How to Set Up Recurring Payments for Your Business

Before we get into the nuts and bolts of setting up recurring payments, let's talk about why this is such a game-changer. This isn't just a minor operational tweak; it's a fundamental shift in how you do business. Adopting a subscription model creates predictable revenue, forges stronger customer relationships, and ultimately builds a much more resilient company. It’s about turning sporadic sales into a steady, reliable income stream you can actually count on.

Why Recurring Payments Are a Must-Have for Growth

Switching from one-off purchases to a subscription-based model is one of the most powerful levers you can pull for growth. The most obvious win? Your cash flow becomes incredibly stable. Say goodbye to the nerve-wracking rollercoaster of sales peaks and valleys. Instead, you get a dependable monthly recurring revenue (MRR), which makes everything from budgeting to forecasting a whole lot easier.

That kind of predictability gives you the confidence to reinvest in your business, whether that’s hiring new people, scaling your marketing, or building out your next big product feature.

Building a Stable Foundation

The benefits run deeper than just the balance sheet. When customers subscribe, they're not just buying a product; they're investing in an ongoing relationship with your brand. This commitment naturally leads to better engagement and less churn. It's not just a theory—by 2023, churn rates for subscription services had already dropped to a lean 5.4%, proving that customers really do stick around when the value is consistent.

This model is the engine behind the entire subscription economy, which has astonishingly grown 4.6 times faster than the S&P 500 in the last decade. On average, a subscriber brings in three to five times more revenue over their lifetime than a one-time buyer. That's a massive difference.

A predictable revenue stream is the bedrock of a scalable business. It allows you to shift focus from chasing the next sale to improving your product and nurturing the customer base you already have.

Key Benefits of an Automated System

Putting an automated recurring payment system in place also frees you from a world of administrative headaches. Just think about it: no more manual invoicing, no more awkward follow-ups on late payments, and no more processing every single transaction by hand. A good system does all that heavy lifting for you, freeing up your team to focus on what really matters.

This automation delivers some serious advantages:

- Reduced Payment Failures: Automated retries and smart dunning management can rescue revenue from declined transactions or expired cards without you lifting a finger.

- Improved Customer Experience: For subscribers, it’s a seamless "set it and forget it" experience. They don’t have to remember to repurchase, which removes a major point of friction.

- Enhanced Lifetime Value: Beyond the initial sale, recurring payments are crucial for increasing customer lifetime value, which is the cornerstone of any truly sustainable business.

At the end of the day, learning how to set up recurring payments is less about the technical steps and more about embracing a new, more stable business mindset. To see how BlockBee makes this happen, you can explore our tools right here: https://blockbee.io/subscriptions/

Choosing Your Recurring Payment Setup Method

When it comes to setting up recurring payments, you're at a crossroads. The path you choose will shape your day-to-day operations and how easily your business can grow. There's no one-size-fits-all answer here; the right choice boils down to your business model, your team's technical skills, and where you see yourself in a few years.

Essentially, you have two main options: using a straightforward dashboard or getting your hands dirty with a direct API integration.

The No-Code Dashboard Approach

Think of the dashboard as the express lane. It's designed for speed and simplicity, letting you create subscription plans, manage your customers, and check reports all through a visual, point-and-click interface. It's a fantastic starting point if your billing is fairly standard—say, a simple monthly fee for a service or access to a product.

With a dashboard, you can be up and running in a matter of hours, not weeks. This approach slashes the need for upfront technical investment, so you can test out your subscription model and start bringing in revenue right away. For a deeper dive into the practicalities, especially for freelancers and small businesses, this guide on setting up automated payments and recurring billing systems is a great resource.

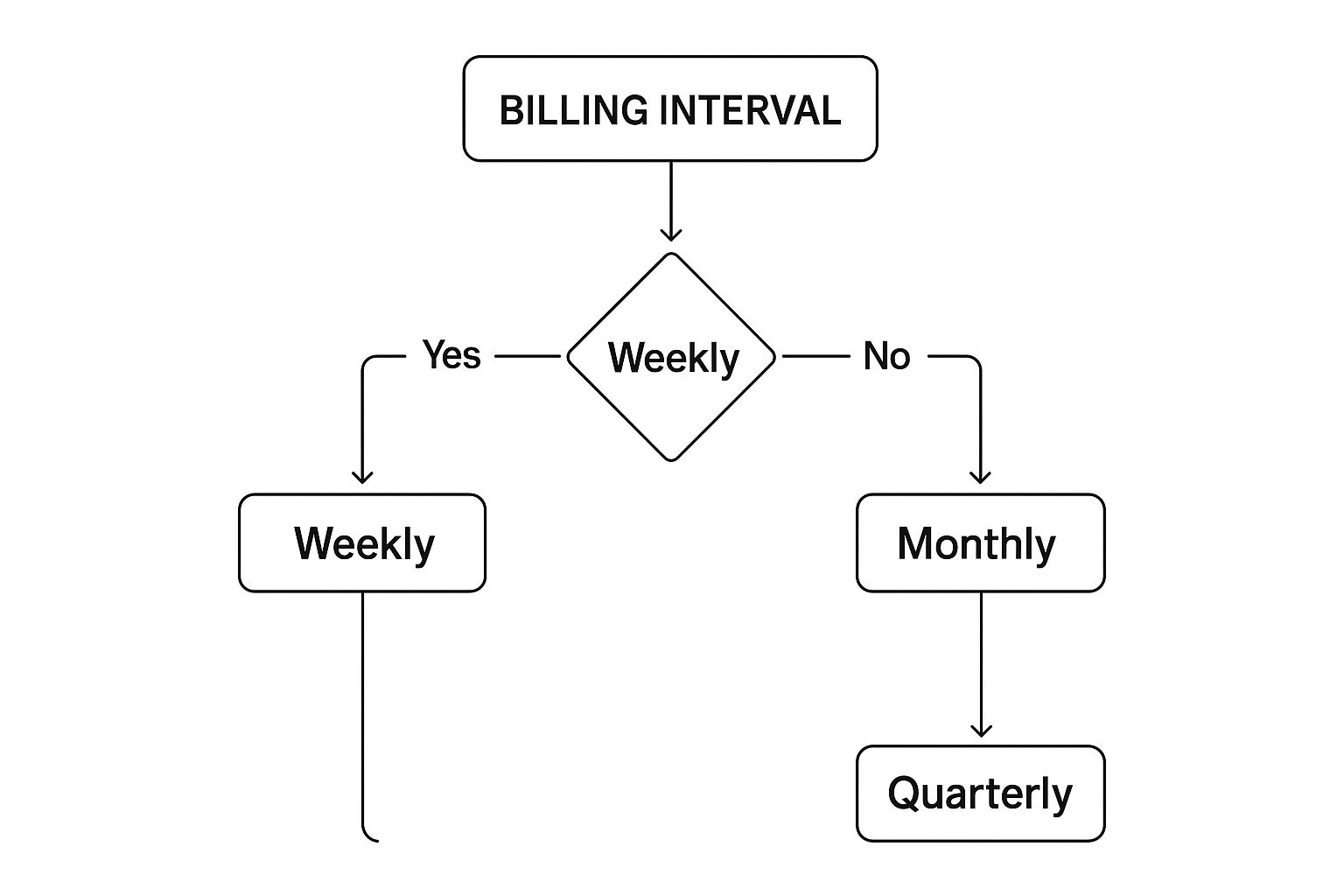

The visual below gives you a sense of how intuitive it is to configure something as critical as the billing interval right from the dashboard.

As you can see, defining how often your customers are billed is just a matter of making a few simple, direct choices. This is the core of what makes the dashboard so powerful for getting started quickly.

The API Integration Path

On the other side of the coin, you have the API. This is your custom-tailored suit. It's for businesses that need to weave the payment process directly into their own platform, website, or app for a truly seamless customer experience. Yes, it requires a developer, but the flexibility you get in return is unmatched.

An API lets you build billing logic that's as unique as your business itself. You can handle things like:

- Usage-Based Billing: Charge customers for exactly what they use, not a flat fee.

- Tiered Pricing with Upgrades: Let users move between subscription plans without any friction.

- Custom Checkout Flows: Design a checkout process that looks and feels like your brand, not someone else's.

Dashboard vs API Integration for Recurring Payments

Still on the fence? This table breaks down the key differences to help you decide which path makes the most sense for your business right now.

| Feature | Dashboard (No-Code) | API Integration (Developer-Led) |

|---|---|---|

| Technical Skill | None needed. Designed for business owners and non-technical staff. | Requires a developer or a team with API integration experience. |

| Speed to Market | Very fast. You can set up and launch in a single afternoon. | Slower. Implementation can take from days to weeks. |

| Customization | Limited. You work within the features and flows provided. | Highly flexible. Build any billing logic or UX you can imagine. |

| Upfront Cost | Low. No development costs, just the platform fees. | Higher. You have to factor in developer time and resources. |

| Best For | Startups, small businesses, and anyone testing a new model. | Scaling businesses, SaaS platforms, and companies with unique needs. |

Ultimately, your decision hinges on a classic trade-off: speed versus control. If you need to get moving now with minimal hassle, the dashboard is your best friend. But if your business has complex requirements or you're building for massive scale, investing in an API integration will pay dividends for years to come.

Remember, this isn't a permanent choice. Many successful companies start with a dashboard to validate their idea and then migrate to an API as they grow and their needs evolve.

Setting Up Recurring Payments Through Your Dashboard

If you want to get a subscription model up and running without writing a single line of code, the dashboard is your command center. It’s a visual, hands-on way to turn what feels like a complex process into a few simple clicks. Honestly, it’s designed to get you from zero to your first paying subscriber as quickly as possible.

The recurring payment market is absolutely massive, and it's not slowing down. It’s expected to jump from $166.7 billion in 2024 to $182.1 billion in 2025. This growth is all about convenience—both for businesses and customers who love predictable, automated billing. A good dashboard lets you tap into this trend right away. If you're curious, you can read more about the global market for recurring payments to see just how big the opportunity is.

Defining Your Subscription Plans

First things first, you need to actually create the subscription plans people will buy. Think of this as building out the product catalog for your recurring services. Just log into your dashboard and look for a section labeled something like "Products" or "Plans."

This is where you'll nail down the specifics of what you're offering:

- Plan Name: Keep it simple and clear. Something like "Basic Monthly" or "Premium Annual" works perfectly.

- Pricing: Set the cost and choose the currency.

- Billing Cycle: This one’s critical. Decide how often you'll bill the customer—monthly, quarterly, or annually. A great tip here is to offer an annual plan with a slight discount. It’s a classic, proven way to improve your cash flow and lock in customer loyalty.

For example, a software-as-a-service (SaaS) company might set up a "$29/month Pro Plan" alongside a "$290/year Pro Plan." That annual option gives the customer two months free, which is a powerful incentive to commit for the long haul. You can build this entire structure in minutes, no developer needed.

The real goal here is to make your pricing totally intuitive. A potential customer should glance at it and immediately get what they’re paying for, how much it costs, and when they’ll be charged. A dashboard makes achieving that transparency a breeze.

The BlockBee dashboard, for example, gives you a really clean interface to manage all of this.

As you can see, everything from generating payment addresses to managing payouts is laid out clearly. That kind of clarity is a lifesaver when you're juggling multiple subscription tiers and customer payments.

Customizing the Customer Experience

With your plans locked in, it's time to think about the checkout process. A generic, unbranded payment page can feel jarring to a customer and might even make them second-guess their purchase. Thankfully, most modern dashboards let you customize the look and feel to create a smooth, trustworthy experience.

You can usually upload your company logo, tweak the colors to match your brand, and even add custom fields to gather any extra information you need. But it goes beyond just looks. You can also automate your email notifications, which is a game-changer for communication.

Here are the essentials you'll want to set up:

- Payment Confirmations: Send a receipt the moment a payment goes through.

- Failed Payment Alerts: If a card is declined, an automated email can let the customer know and give them a link to update their payment info. This saves you from having to chase them down manually.

- Upcoming Renewal Reminders: Give customers a friendly heads-up before a big annual subscription renews. It’s just good customer service.

By taking a few minutes to configure these settings, you’re not just accepting payments. You're building a professional, automated subscription machine that practically runs itself.

A Developer's Guide to Integrating Payments with the API

While a dashboard is great for getting started, there comes a point when you need to go deeper. For developers, that’s where the API becomes your best friend. Integrating recurring payments directly into your application isn’t just about moving money around; it’s about crafting a billing engine that fits your business logic like a glove. This is how you build truly custom experiences, from unique checkout flows to complex, usage-based pricing models.

Taking an API-first approach gives you complete control over the entire subscription lifecycle. It’s a must-have for SaaS platforms, marketplaces, or any business where payments are a core part of the product. You’re no longer stuck in a predefined workflow, which means you can build a system that scales and flexes as your company evolves.

Core API Actions for Subscription Management

When you’re setting up recurring payments through an API, you’ll be working with a handful of key endpoints. Think of these as the fundamental Lego bricks for your subscription logic. The exact names might differ between providers, but the core ideas are always the same.

You'll primarily be focused on a few key tasks:

- Creating Customer Objects: You can't bill a ghost. The first step is always to create a customer profile via an API call. This will give you a unique ID that you’ll use for everything else related to that customer.

- Defining Subscription Plans: Create and manage your pricing tiers programmatically. This lets you add, update, or even retire plans without ever having to log into a dashboard.

- Initiating Subscriptions: This is the main event. You’ll make an API call to link a customer ID with a plan ID, which officially kicks off their billing cycle.

For example, starting a subscription usually means sending a POST request to an endpoint like /subscriptions. The body of your request would include the customer_id and plan_id, and a successful response confirms the subscription is live. To see the specific endpoints and parameters you'll need, dive into the BlockBee API documentation.

The real magic of using an API is automating complex billing scenarios. Picture a customer upgrading their plan mid-month. Your code can instantly calculate the prorated amount, credit them for unused time on the old plan, and switch them to the new one without a hitch.

Putting It Into Practice: Tips and Best Practices

First things first: security. Your API keys are the literal keys to your revenue, so you have to protect them. Always store them as environment variables on your server—never, ever expose them in your frontend code. Treat them with the same caution you would any other critical password or credential.

Next up, you’ll want to use webhooks for real-time updates. Constantly polling the API to check if a payment went through is inefficient. Instead, a webhook system will automatically push notifications to your server as events happen. This is the professional standard for handling things like:

- Successful Payment: Your system gets the ping, and you can immediately trigger a receipt email and grant the user access to your service.

- Payment Failure: The webhook alerts your dunning process to kick in and start the retry logic.

- Subscription Cancellation: Your app is notified to update the user's account status and schedule when their access should end.

A truly solid system is built to handle failure. Network glitches and gateway errors are inevitable. That’s why you should implement idempotent requests to prevent accidentally charging a customer twice if a network call has to be retried. Your logic should also handle failed payments gracefully, maybe by waiting a few days before the next retry, rather than immediately marking the subscription as delinquent. This kind of thoughtful planning is what makes for a robust and reliable payment system.

Getting the Most Out of Your Subscription System

Getting your subscription model live is a fantastic first step, but that's really where the journey begins. To build a truly successful business, you need to actively manage and fine-tune your recurring payment setup. This is how you turn a functional system into a powerful engine for customer retention and revenue growth.

A huge piece of this puzzle is dunning management. This is just a technical term for the automated process of recovering failed payments. Instead of your team manually chasing down every declined transaction, a good system can retry the charge and gently nudge customers to update their payment info, preventing a ton of preventable churn.

Polishing the Customer Journey

Beyond just catching failed payments, real optimization is about making the entire subscriber experience feel effortless. Flexibility is your secret weapon here—it attracts new customers and, more importantly, keeps them around. Think about what you can offer that adds real value and removes any friction from the process.

Here are a few tactics I've seen work incredibly well:

- Free Trials: Let people kick the tires and experience your service risk-free. It's the ultimate confidence-booster.

- Coupons and Discounts: Promotional codes are perfect for giving marketing campaigns that extra push to get people to sign up.

- Effortless Plan Upgrades: When a customer's needs grow, make it incredibly simple for them to move to a higher-tier plan.

These strategies aren't just about getting that initial conversion. They build genuine goodwill and show customers you're invested in their success. As you think about long-term growth, it’s worth exploring different mobile app monetization strategies that can work alongside your core subscription model.

The best subscription systems are practically invisible to the customer. Payments just work, plan changes are a click away, and communication is always clear and timely. That’s how you build the trust needed for real, long-term loyalty.

There's a reason the subscription billing market is booming—it's estimated to be worth $7.32 billion in 2024. A lot of that growth is fueled by new tech. AI, for example, is now helping automate everything from revenue forecasting to fraud detection, which significantly cuts down on operational headaches.

Why Transparent Communication is Non-Negotiable

Finally, don't ever underestimate the power of clear, consistent communication. Your customers should never be left wondering about their subscription status.

Being proactive is the name of the game. This means sending automated reminders for upcoming renewals, giving a heads-up about an expiring card, and providing clean, easy-to-read invoices after every charge. This level of transparency does more than just prevent billing surprises; it constantly reinforces the value you provide, helping turn a simple transaction into a lasting relationship.

Answering Your Top Questions About Recurring Payments

Even with the best tools in hand, setting up recurring payments often brings up a few questions. Let's walk through some of the most common ones we hear from businesses just like yours, so you can build out your subscription model with confidence.

What Happens When a Customer's Payment Fails?

This is probably the number one concern, but thankfully, modern payment platforms have it figured out. When a payment doesn't go through, a process known as dunning management springs into action automatically.

The system doesn’t just give up. It will intelligently retry the charge a few times over the next several days. At the same time, it sends out automated, friendly emails to your customer letting them know what happened and prompting them to update their payment info. If all attempts fail, the subscription can be set to pause or cancel, protecting your revenue while giving the customer plenty of chances to fix the issue.

How Should I Store Customer Payment Information Securely?

Here's the simple answer: you don't. You should never, ever store sensitive details like a full credit card number on your own servers. The security and compliance headache is immense.

Instead, you’ll want to lean on a payment gateway that is fully PCI DSS compliant. These platforms use a brilliant technology called tokenization. When a customer first pays, their details are sent directly to the gateway, which then gives you back a unique, secure token. You just store that token. For every future charge, you use the token, not the actual card data. This hands off all the heavy security lifting to the experts.

Relying on tokenization is the industry standard for a reason. It allows you to process recurring payments without ever touching the raw, sensitive financial data, dramatically reducing your risk and compliance overhead.

Can I Offer Both Monthly and Annual Billing Cycles?

Not only can you, but you absolutely should! Offering flexible billing cycles is one of the easiest ways to boost conversions and increase customer lifetime value. Any good payment platform makes it simple to create different pricing plans for the same service.

You can set up monthly, quarterly, and annual options with just a little bit of configuration. A classic, high-impact strategy is to offer a nice discount for customers who commit to an annual plan. It’s a win-win: they get a better price, and you get better cash flow and lower churn.

How Do Prorated Charges Work When Someone Changes Their Plan?

Proration can seem complicated, but professional subscription platforms handle all the math for you. It's completely automated.

Let's say a customer upgrades their plan mid-month. The system instantly calculates how much unused time is left on their old plan and credits them for it. Then, it calculates the cost of the new plan for the rest of the billing period and applies that credit. The customer is only charged the difference. This keeps billing fair and transparent, creating a smooth experience for customers as their needs evolve. As businesses look to offer more payment choices, understanding how to accept crypto payments can add even more flexibility.

Ready to build a powerful, flexible subscription system? With BlockBee, you can set up recurring payments in minutes and manage your entire subscription lifecycle with ease. Get started with BlockBee today.