On Ramp Definition: How Fiat-to-Crypto Gateways Work (on ramp definition)

Think of a crypto on-ramp as the digital equivalent of a currency exchange booth at the airport. It’s the service that lets you swap your everyday money, like US dollars or Euros, for cryptocurrencies like Bitcoin or Ethereum. It's your entry point into the world of digital assets.

What Exactly Is a Crypto On Ramp?

At its heart, a crypto on-ramp is any service that handles the conversion of fiat currency (the government-issued money in your bank account) into cryptocurrency. It's the essential link between the traditional financial system we all use daily—banks, credit cards, and wire transfers—and the new, decentralized world of the blockchain.

Without these on-ramps, getting into crypto would be a confusing mess for most people, reserved only for a small group of tech experts. They solve the very first and most important problem for any newcomer: "How do I buy this stuff?" Whether you're a first-time investor or a global company, the on-ramp is the highway entrance you need to get onto the blockchain superhighway.

The Key Players in an On Ramp Transaction

A successful on-ramp transaction isn't a one-step process. It’s more like a well-coordinated play involving a few key participants to make sure everything is smooth and secure.

- The User: This is you—or any person or business—looking to buy crypto with traditional money.

- The On-Ramp Provider: This is the company providing the actual service. They build the interface, handle the tech, and manage the compliance checks.

- The Payment Processor: This is the financial middleman that securely handles the fiat part of the deal, like processing your credit card payment or bank transfer.

The Gateway to Mass Adoption

You really can't overstate the importance of on-ramps. They are the single biggest driver of crypto adoption around the globe. The simpler it is for people to turn their local currency into crypto, the more people will join the digital economy.

The numbers don't lie. As of January 2025, global crypto ownership has swelled to 580 million people worldwide. This massive growth is happening because on-ramps are making it easier than ever to get started. In fact, 55% of new crypto users are now jumping in through mobile banking apps and user-friendly fintech platforms, not complex crypto exchanges.

A seamless on-ramp experience is no longer just a nice-to-have feature—it's the foundation of attracting and keeping users in the crypto world. If the front door is locked or hard to open, people will just walk away.

For businesses, this isn't just a trend; it's a huge opportunity. By integrating a reliable cryptocurrency payment gateway, merchants can start accepting payments from this massive, tech-savvy global audience, often with lower fees and faster settlement times than traditional methods.

How a Crypto On-Ramp Transaction Unfolds

To really get what an on-ramp does, it helps to walk through a typical transaction from start to finish. From the user's perspective, it feels simple—a few clicks and you're done. But behind the curtain, there's a well-oiled machine at work, designed to move your money from the traditional banking world to the blockchain securely and, most importantly, legally.

It all starts when you decide to buy some crypto. You're on a platform, you pick a coin like Bitcoin or Ethereum, and you type in how much you want to spend in your local currency. This is the initiation—the very first step on the bridge.

Verification and Payment Processing

If you're a new user, the system will immediately prompt you for a Know Your Customer (KYC) check. This is a non-negotiable step where you'll have to upload some ID. It might feel like a bit of a hassle, but it's absolutely crucial for preventing fraud and complying with financial regulations. Thankfully, most modern on-ramps have gotten this down to a science, often getting you verified in just a few minutes.

Once you’ve got the green light, it's time to pay. You'll see familiar options like a credit/debit card or a bank transfer. At this point, the on-ramp’s payment partners jump in to handle the fiat transaction, just as they would for any other online purchase. This is where the magic really happens—the handshake between the old financial system and the new.

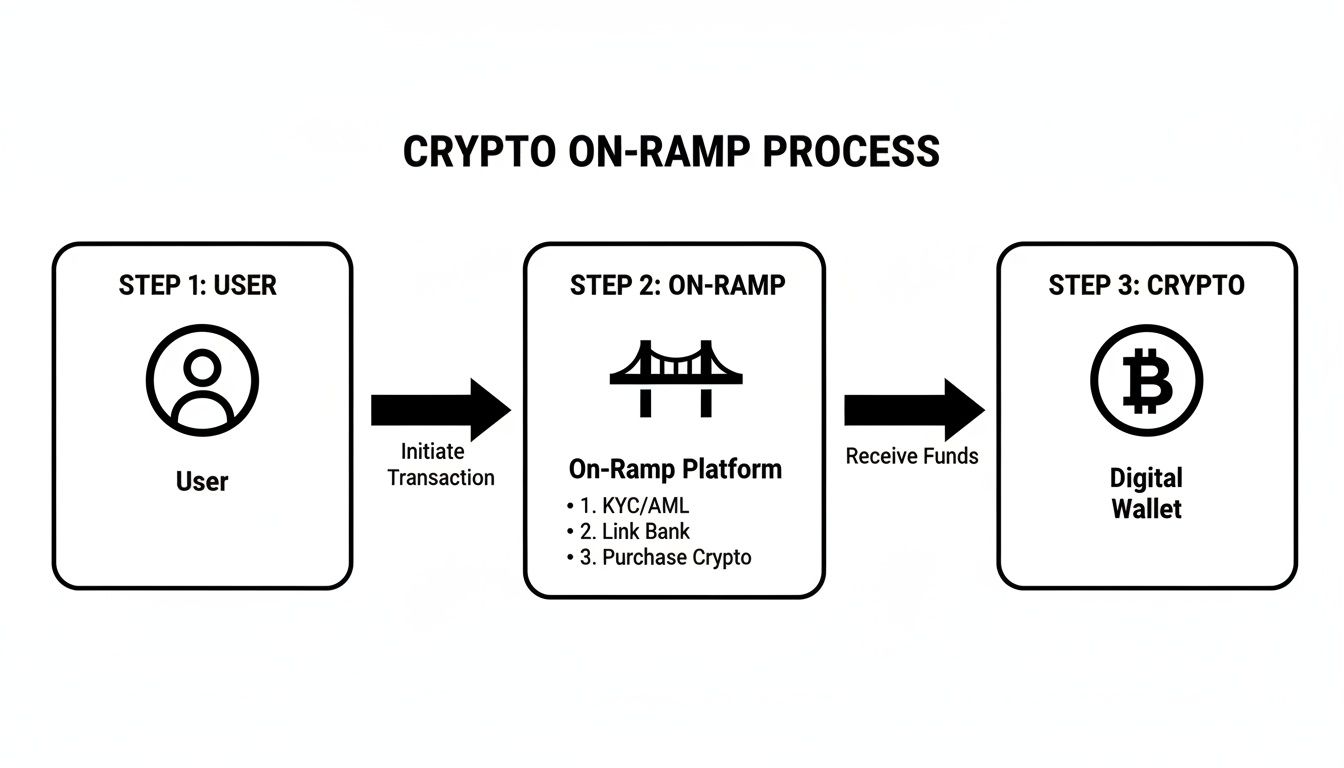

This flowchart gives you a bird's-eye view of the entire journey.

As you can see, the on-ramp acts as the central hub, smoothly connecting your bank account to your digital wallet.

Locking the Price and Final Settlement

Crypto prices can swing wildly, even in the space of a few minutes. To deal with this, the on-ramp gives you a locked price quote. This quote is usually good for a minute or so, protecting both you and the provider from any sudden market shifts. You see the rate, you agree to it, and you lock it in.

With the price locked and your payment approved, the final piece of the puzzle is the settlement. The on-ramp service purchases the exact amount of crypto you requested and sends it directly to the wallet address you provided.

And that’s it. The transaction is complete. You’ve successfully turned your cash into crypto. For developers aiming to integrate this functionality, getting familiar with how a crypto payment gateway API works is the key to building a seamless and trustworthy experience for their users. The entire process shows just how elegantly an on-ramp merges two very different financial universes.

Why On Ramps Are Powering the Future of Finance

Crypto on-ramps have come a long way from being simple gateways for hobbyists and retail investors. They've grown into a piece of critical infrastructure, forming the bedrock for what many see as the future of finance.

Think of them less as a simple exchange and more as the sophisticated logistics network connecting traditional finance with the on-chain economy. This isn't just about buying Bitcoin anymore; it’s about enabling large-scale, complex financial operations that are finally catching the eye of institutional players.

Enabling Advanced Financial Use Cases

The role of an on-ramp is expanding at a breakneck pace. Instead of just handling one-off individual purchases, they are now being woven into complex systems that need a reliable, high-volume bridge between fiat and crypto.

Here are a few ways they're shaping what's possible:

- Tokenized Real-World Assets (RWAs): On-ramps give investors a straightforward way to use traditional currency to buy tokens representing real-world things like property or fine art, bringing liquidity to otherwise static assets.

- On-Chain Collateral Management: Financial institutions can use on-ramps to instantly convert cash into stablecoins, which can then be used as collateral in DeFi protocols. This happens in moments, not days.

- Mass Crypto Payouts: Global companies can now manage payroll and pay contractors in crypto. On-ramps are what allow them to efficiently fund these massive payout operations directly from their corporate bank accounts.

This shift is a massive vote of confidence in the underlying technology. When major financial firms start building their products on this infrastructure, it helps create a more secure and stable ecosystem for everyone involved.

For a FinTech building a next-generation payment solution or an enterprise managing global payouts, a robust on-ramp is no longer a feature—it's the engine.

The Institutional Stamp of Approval

This evolution hasn't gone unnoticed. The biggest names in traditional finance are now paying close attention, with institutional interest in on-ramps skyrocketing. Giants like JPMorgan are already building out infrastructure to help major players get into the digital asset space safely and compliantly.

This isn't just talk. As 2026 gets closer, JPMorgan’s own analysts are forecasting Bitcoin hitting $170,000 within 12 months, a prediction fueled by new ETF approvals and increasing regulatory clarity. You can read more about JPMorgan's strategic shift on Ainvest.com.

When institutions with that kind of influence signal their confidence, it’s a clear sign that on-ramps are truly central to the future financial landscape. For any business looking to innovate in this space, having a well-defined on-ramp strategy is essential. It’s the foundational layer that makes participating in the digital economy not just possible, but practical and scalable.

Choosing the Right On-Ramp Service for Your Business

Let's be clear: not all on-ramps are created equal. When you're picking a provider for your business, it’s not just a technical box to tick. This is a strategic move that directly shapes your customer's experience, your ability to operate globally, and ultimately, your bottom line. Think of it less like picking a utility provider and more like choosing a foundational partner for your venture into the world of digital assets.

Making the right call means looking past the slick marketing and digging into the core features that actually matter. The quality of your on-ramp can mean the difference between a customer sailing through checkout and one who gets frustrated and leaves, abandoning their cart and costing you revenue.

Key Features to Evaluate

As you start comparing your options, there are a few non-negotiable areas to focus on. Get a clear on-ramp definition of your own business needs first, as that will be your guide.

Global Payment Methods: Your customers want to pay with what they know. A great on-ramp needs to support a wide range of payment options—from major credit cards to local bank transfers and popular regional e-wallets. That kind of flexibility is what drives conversion rates, especially when you're selling internationally.

Transparent Fee Structures: Nothing kills trust faster than hidden fees. Look for providers that are upfront about their costs, giving you a clear breakdown of everything from processing fees and network gas fees to any spreads they take. Transparency builds loyalty.

Transaction Speed and Reliability: In digital payments, speed is the name of the game. A good on-ramp should finalize transactions in minutes, not hours. Always check a provider's average settlement times and uptime history to make sure your users get a consistently smooth experience.

Ironclad Security and Compliance: This is the big one. Your partner absolutely must follow the highest security standards and stay on top of global regulations. There’s no room for compromise here.

Security and Compliance Deep Dive

A provider's dedication to security is everything. They are handling sensitive financial information and become a critical link in your own operational security chain.

When evaluating potential on-ramp service providers, it's crucial to consider their security certifications. For a deeper understanding of this process, explore resources on effective SOC 2 vendor management to learn how to vet your partners properly.

On top of that, rock-solid compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) rules isn't optional—it's essential. These procedures are your first line of defense against fraud and ensure your business stays on the right side of the law. To get a better handle on this, you can learn more about the specifics of KYC in crypto and see why it’s the bedrock of any legitimate on-ramp service.

Picking a compliant partner doesn't just protect your business from risk. It builds a foundation of trust with your customers right from their very first transaction.

Bringing an On-Ramp Into Your Platform

Alright, you understand what an on-ramp is. Now, how do you actually get one working inside your own app or website? Getting from theory to practice means picking an integration path.

For any business looking to connect the worlds of traditional money and crypto, there are really two main ways to go about it. Each has its own set of trade-offs when it comes to time, effort, and technical skill. The right choice for you will come down to your team's resources, how fast you want to move, and just how much control you need over the final user experience.

The Quick-and-Easy Route: Ready-Made Plugins

The fastest way to get up and running is to use a third-party on-ramp provider that offers pre-built plugins. These are essentially off-the-shelf solutions built for the big names in e-commerce and web development.

- Platforms: You’ll find these for systems like WooCommerce, Magento, PrestaShop, and even no-code platforms like Bubble.

- Speed: You can often be live in a few hours. Seriously. It’s a massive time-saver compared to building from scratch.

- Simplicity: This approach is designed for people who aren't developers. If you don’t have a big engineering team, this is your best bet.

This is the perfect path for merchants who just want to start accepting crypto payments without a massive technical project.

The Custom-Fit Approach: Direct API Integration

If you need total control and a completely seamless look and feel, then a direct API integration is the way to go. This path lets you weave the on-ramp directly into your platform's DNA.

With a direct API, you can embed the entire on-ramp process into your existing user journey. It feels less like a bolted-on feature and more like a core part of your application.

This level of customization is powerful, but it's also much more demanding. You’ll need developers who are comfortable working with APIs. The success of this approach really depends on the quality of the on-ramp provider's developer tools—think clear documentation, software development kits (SDKs), and a support team that actually answers your questions. To get a feel for how these integrations work under the hood, it’s helpful to look at how developers connect with traditional payment processing solutions like Stripe.

In the end, it doesn't matter if you choose a simple plugin or a full-blown API integration. The goal is the same: give your users a simple, secure, and reliable way to buy crypto on your platform. A smooth on-ramp experience is one of the best ways to get people engaged and keep them coming back.

7. Frequently Asked Questions About Crypto On Ramps

Even after getting the hang of what an on ramp is, you'll probably have a few practical questions when it comes to actually using one for your business. It's totally normal. Let's tackle some of the most common ones we hear from merchants and developers to clear up any lingering confusion.

What’s the Difference Between an On Ramp and a Crypto Exchange?

This is a great question, and it gets to the heart of why on ramps exist in the first place. While both get you into crypto, they're built for completely different jobs and people.

Think of a crypto exchange like the New York Stock Exchange. It's a bustling marketplace designed for traders, packed with order books, complex charts, and advanced trading tools. It’s powerful, but it can be overwhelming if all you want to do is buy some crypto.

An on ramp, on the other hand, is more like a currency exchange booth at the airport. Its one and only job is to swap your everyday money for crypto, quickly and simply. The entire experience is designed to be a straightforward purchase, not a trading session.

In short: an exchange is a trading floor for seasoned traders, while an on ramp is the express checkout for anyone who just wants to buy.

How Long Does an On Ramp Transaction Usually Take?

One of the biggest wins for modern on ramps is speed. While the exact timing can shift depending on your payment method and how busy the blockchain network is, you'll likely be surprised by how fast it is.

- Credit/Debit Card: This is usually the fastest route. Once your payment goes through, the crypto often lands in your wallet within 2 to 10 minutes.

- Bank Transfers (ACH/SEPA): These rely on traditional banking rails, so they take a bit longer. You can expect the transaction to clear in a few hours, but it might take up to 1-3 business days.

The best on ramp providers have engineered their systems to make this process feel almost instant from the user's side. They do all the heavy lifting in the background, which is crucial for keeping customers happy and preventing them from abandoning their carts.

Are Crypto On Ramps Safe and Regulated?

Absolutely—or at least, any legitimate one is. Safety and compliance aren't just features; they're the foundation of a trustworthy on ramp. Since these services bridge the gap between traditional finance and crypto, they have to play by some very strict rules.

This means they’re legally required to have robust security and follow global financial regulations. Here's what that looks like in practice:

- Know Your Customer (KYC): Every user has to verify their identity. This isn't just a company policy; it's a legal mandate to prevent fraud and money laundering.

- Anti-Money Laundering (AML): On ramps actively monitor transactions for suspicious activity to comply with international AML laws.

- Data Security: Just like your bank, they use top-tier encryption and security protocols to keep your sensitive personal and financial data locked down.

For any business, choosing a provider that is upfront and transparent about its compliance and security measures is non-negotiable.

What Are the Typical Fees for Using a Crypto On Ramp?

Fees are a big deal, and they can really vary from one provider to another. A good on ramp will always lay out its fee structure clearly so there are no surprises.

You’ll typically see a few different costs bundled into the final price:

| Fee Type | Description |

|---|---|

| Processing Fee | A small percentage of the total transaction charged by the on ramp provider for its service. |

| Payment Method Fee | A fee passed on from the payment processor, like for using a credit card. |

| Network Fee | Often called a "gas fee," this is what you pay to the blockchain miners or validators who process and confirm your transaction. |

| Spread | The small difference between the crypto’s market price and the price the on ramp quotes you. |

It's easy to get fixated on finding the absolute lowest fee, but it's often smarter to pick a provider that strikes a good balance between fair costs, rock-solid reliability, and great customer support.

How Are On Ramps Shaping Modern Finance?

On ramps are quickly becoming more than just a simple tool for buying crypto—they are evolving into the core infrastructure for the next generation of finance. They are now the main entry point for stablecoins and tokenized Real-World Assets (RWAs), opening the door to finance at a scale we've never seen before.

Last year, stablecoins processed an astounding $46 trillion in transaction volume. To put that in perspective, that’s 20x more than PayPal’s volume and is rapidly closing the gap on Visa (3x over). This explosion is fueled by on ramps, which are shifting the entry point for new users away from exchanges and toward fintech platforms. This is a massive trend that experts predict will become the norm by 2026. You can dive deeper into these insights by reading about the big ideas shaping crypto on a16zcrypto.com.

Ready to integrate a powerful, secure, and developer-friendly crypto payment solution? BlockBee offers a seamless on-ramp experience with easy-to-use plugins and robust API support, helping you tap into the global crypto economy effortlessly. Start accepting crypto payments today at https://blockbee.io.