Litecoin vs Bitcoin Which Is Best for Your Business

When merchants weigh Litecoin against Bitcoin, the choice often comes down to a classic trade-off: speed and low costs versus unmatched security and brand recognition. Think of Bitcoin as the 'digital gold'—it's the established standard, trusted for large, significant transactions. Litecoin, on the other hand, is the 'digital silver,' designed specifically for fast, everyday purchases where keeping fees low is a top priority.

Litecoin vs. Bitcoin: An Executive Summary for Merchants

Choosing between Bitcoin and Litecoin isn't about finding a single "winner." It's about picking the right tool for the job. For any business, this decision has a direct impact on the customer experience, your transaction costs, and how smoothly your operations run. While both are built on secure, decentralized technology, their core designs give them very different strengths.

Bitcoin's massive brand recognition and rock-solid security make it the go-to for high-value payments. Customers feel confident using it for big-ticket items. Its slower confirmation times and higher fees are often seen as a fair price to pay for the security of its network.

In contrast, Litecoin was built from the ground up to be a quicker, lighter alternative to Bitcoin. It shines in situations where speed and low fees are essential, like in retail, for selling digital downloads, or managing subscription payments. Getting a handle on these differences is the first step for any merchant looking to accept crypto payments for their business.

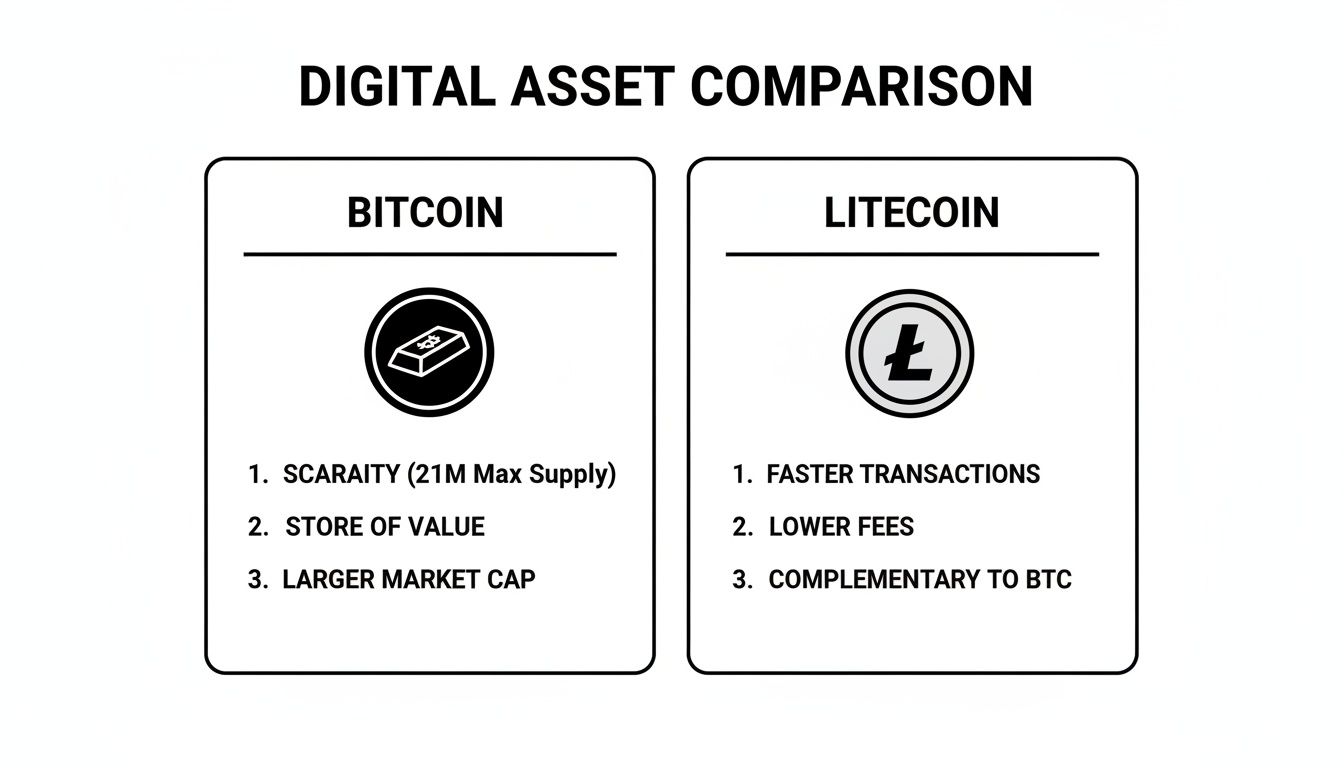

This visual summary drives home the key distinctions between Bitcoin as "digital gold" and Litecoin as "digital silver."

The image really reinforces the idea that while Bitcoin acts as a heavyweight store of value, Litecoin brings the agility needed for day-to-day commerce.

Key Distinctions for E-commerce

To make this decision easier, let's look at each crypto through the lens of what matters most to a merchant: how quickly a sale is finalized, what it costs the customer, and how the market perceives it.

- Brand Trust and Adoption: Bitcoin was first, and for many people, it is cryptocurrency. That gives it a level of trust and name recognition that Litecoin, despite its own long history, just can't match yet.

- Transaction Profile: Litecoin’s average 2.5-minute block time is a full four times faster than Bitcoin's 10 minutes. This means payments are confirmed much quicker, which can reduce abandoned carts and make for a much smoother checkout, especially for small-to-medium sized purchases.

- Cost-Effectiveness: Litecoin's transaction fees are consistently just a fraction of Bitcoin's. This makes it a much more practical and economical choice if you're processing a high volume of smaller payments.

For a quick side-by-side view, this table lays out the most critical metrics for an online business.

Quick Comparison: Bitcoin vs. Litecoin for E-commerce

| Metric | Bitcoin (BTC) | Litecoin (LTC) |

|---|---|---|

| Primary Use Case | Store of Value, Large Transactions | Medium of Exchange, Daily Payments |

| Average Block Time | ~10 Minutes | ~2.5 Minutes |

| Transaction Fees | Higher, can spike with network congestion | Consistently Low |

| Total Supply | 21 Million | 84 Million |

| Merchant Benefit | High Security, Brand Recognition | Speed, Low Cost, Efficiency |

In the end, why choose? The best strategy is often to offer both. Using a flexible payment gateway like BlockBee lets you serve both the customer who trusts Bitcoin for a large purchase and the one who prefers Litecoin's speed and low fees for everyday items. You get to maximize your market reach without making any compromises.

Analyzing the Core Technical Differences

To really get to the heart of the Litecoin vs. Bitcoin debate, you have to look under the hood at the core engineering. These aren't just minor tweaks; they're fundamental design choices that explain why one is built for speed and low-cost payments, while the other stands as a fortress of value. Their differences are entirely intentional, shaping how each one fits into the broader crypto market.

It all starts with their hashing algorithms—the cryptographic engines miners use to solve puzzles, validate transactions, and bring new coins into existence. Bitcoin relies on the legendary SHA-256 algorithm, a heavyweight champion in the Proof-of-Work world known for its raw power and security.

Hashing Algorithms: SHA-256 vs. Scrypt

Bitcoin’s SHA-256 is incredibly demanding from a computational standpoint. Over time, this led to the rise of hyper-specialized mining hardware called Application-Specific Integrated Circuits (ASICs). These machines are phenomenal at mining Bitcoin, but their steep price tag means only large, well-funded operations can truly compete. This has naturally sparked conversations about mining centralization.

When Litecoin forked from Bitcoin back in 2011, it deliberately took a different route. It adopted the Scrypt algorithm, which was engineered to be memory-intensive. The idea was to resist ASIC dominance and keep mining feasible for everyday people using standard CPUs and GPUs, hopefully fostering a more decentralized network from the get-go.

While Scrypt-specific ASICs were eventually developed, Litecoin's initial choice gave it a running start in building a more distributed mining ecosystem. This decision has a direct ripple effect on network security and decentralization.

Ultimately, Bitcoin's approach has forged an unbelievably powerful and secure network. Litecoin’s, on the other hand, prioritized broader participation, especially in its formative years.

Block Time and Transaction Finality

Another game-changing difference is the block time, which is simply how long it takes the network to generate a new block of transactions. This number directly dictates how quickly your payments get confirmed.

Bitcoin operates on a deliberate 10-minute block time. This slow, steady pace gives transactions plenty of time to travel across its massive global network, which is a key ingredient in its unmatched security. When you're moving significant value, that 10-minute wait is a small price to pay for absolute certainty.

Litecoin, built with payments in mind, slashed that time down to just 2.5 minutes—a full four times faster. For a merchant, this means the first confirmation pops up much quicker. For a customer at checkout, it feels a lot more like a modern, seamless retail experience.

Here’s what that looks like in the real world:

- Bitcoin Transaction: The first confirmation takes about 10 minutes. For the transaction to be considered iron-clad, most wait for six confirmations, which is about 60 minutes.

- Litecoin Transaction: The first confirmation lands in roughly 2.5 minutes. After six confirmations, or about 15 minutes, the transaction is widely considered secure.

This speed advantage makes Litecoin a much more practical tool for everyday e-commerce, where you need to confirm payments quickly to ship goods or grant access to digital products.

Total Supply and Economic Scarcity

Finally, let’s talk about supply. Each coin's total circulation is hard-coded into its DNA, creating a predictable scarcity that defines its economic role. Bitcoin is famous for its 21 million coin hard cap. This finite supply is the bedrock of its "digital gold" narrative—a secure place to store value for the long haul.

Litecoin’s supply is precisely four times larger, topping out at 84 million coins. This was a conscious choice to position it as the "digital silver" to Bitcoin's gold. It's more abundant, easily divisible, and better suited for smaller, day-to-day transactions.

The math here isn't an accident. With blocks produced four times faster, a supply that's four times larger just makes sense. This difference in scarcity is a critical point in the Litecoin vs Bitcoin comparison, especially for businesses deciding which asset's economic model best fits their goals.

Comparing Transaction Speed and Cost for Online Payments

For any online business, a smooth checkout is non-negotiable. When you put Litecoin and Bitcoin side-by-side, the most striking differences for merchants are speed and cost. These two factors hit your business right where it counts: customer experience and the bottom line.

Bitcoin operates on a deliberate, secure rhythm, with an average block time of 10 minutes. While this methodical pace is a feature of its security, it can feel like an eternity in a retail environment. Customers today expect things to happen instantly.

Litecoin, on the other hand, was built from the ground up for speed. Its blocks are generated every 2.5 minutes on average. That’s four times faster, meaning a customer's payment gets a confirmation nod much quicker, leading to a far more responsive checkout process.

Real-World Scenarios: High-Volume vs. High-Value Sales

Let's make this practical. Say you sell digital goods—software, e-books, or design assets. A customer making a small purchase wants their download now. Forcing them to wait up to an hour for multiple Bitcoin confirmations is a recipe for frustrated emails and abandoned carts.

In this scenario, Litecoin is the hands-down winner. Its quick confirmations are a perfect match for high-volume, low-value sales. The transaction clears fast, your system can automatically deliver the product, and everyone is happy.

Now, flip the script. Imagine you sell high-ticket items like luxury watches or bespoke art. When a transaction is worth thousands of dollars, absolute security becomes the top priority for both you and your customer.

Here, Bitcoin's higher fees and longer waits are a reasonable trade-off. The network's staggering hashrate provides a level of security that is simply unmatched. That extra cost is the price of ensuring a large, irreversible payment is locked down and protected.

The core takeaway is situational: Litecoin excels in the fast-paced world of daily retail and digital sales, while Bitcoin provides the Fort Knox-level security required for significant, infrequent transactions.

Figuring out how these pieces fit into your business is key. For a wider look at how different payment systems connect, this guide on fintech payment integration strategies offers some valuable context.

A Closer Look at Transaction Fees

Transaction fees, often called "gas," are another major point of difference. You pay these fees to miners to process your transaction, and their cost is driven by network demand. When the Bitcoin network gets busy, it gets congested, and fees can spike from a few dollars to levels that make small purchases completely impractical.

Litecoin almost always has much, much lower fees—often just a few cents. This is thanks to its greater block capacity and less congested network. If you're a business processing hundreds or thousands of transactions a day, the savings from using Litecoin can add up to a significant amount over time.

For a deeper dive into managing transactions, you can learn more about effective Bitcoin payment processing and apply the same logic to other cryptocurrencies.

The Evolution with Layer-2 Solutions

It’s important to remember that neither network is standing still. Both Bitcoin and Litecoin are getting upgrades through Layer-2 solutions, most notably the Lightning Network. This technology moves transactions "off-chain" to make them nearly instant and incredibly cheap, only settling the final balance on the main blockchain later.

- For Bitcoin: The Lightning Network is its answer to becoming practical for everyday purchases and micropayments, tackling its speed and cost issues head-on.

- For Litecoin: Lightning simply supercharges what Litecoin already does well, cementing its position as a highly efficient and low-cost payment method.

By choosing a payment processor that already supports these Layer-2 solutions, you're setting your business up for the future. You can offer customers the robust security of the main network combined with the speed and low fees of the second layer, keeping you ahead of the curve.

Understanding Market Performance and Volatility

When you decide to accept cryptocurrency, you're doing more than just adding another payment button at checkout. You're plugging your business directly into the financial markets. For any merchant, getting a handle on the volatility and market behavior of Litecoin versus Bitcoin is absolutely critical for managing risk. Both are known for their price swings, but the way they interact with each other reveals a lot about how you should manage your assets.

Historically, Bitcoin has been the undisputed leader, the one that sets the market's tempo. Its price movements tend to send ripples across the entire crypto space, and Litecoin is no exception. In fact, Litecoin often behaves as what traders call a high-beta asset relative to Bitcoin. Put simply, it tends to magnify Bitcoin’s moves—when Bitcoin goes up, Litecoin often goes up even more, and when Bitcoin drops, Litecoin can drop harder.

This dynamic creates both opportunities and risks for a business holding crypto. A big rally in Litecoin's price could be a nice boost to your bottom line, but a downturn could also mean a much deeper cut to your assets than if you were holding Bitcoin.

Navigating Price Fluctuations

This amplified volatility is something you have to factor in. For example, recent market data showed Litecoin gaining an impressive 21.60% against Bitcoin in a single month, even as the broader market was sliding. But zoom out to a three-month view, and you'll see its decline of -31.34% was sharper than Bitcoin's -27.18%. This perfectly illustrates its tendency to exaggerate trends, both good and bad. You can dig into these performance metrics in this Litecoin to BTC market analysis.

This kind of behavior brings up a crucial question for any merchant: do we hold the crypto we receive and hope it appreciates, or do we convert it to fiat immediately to lock in the sale price?

For most businesses, predictable cash flow is the name of the game—not market speculation. The volatility in both coins, especially the supercharged swings of Litecoin, makes holding them a real financial risk.

Thankfully, you don't have to choose between accepting crypto and managing risk. Modern payment solutions are built to solve this exact problem. A payment gateway like BlockBee can be set up for instant conversion, letting you offer customers the choice to pay in crypto while you receive the exact sale amount in your own currency. It effectively shields your business from the market's ups and downs.

The Strategic Choice for Merchants

By automating the conversion, you really get the best of both worlds. You can appeal to a wider, more tech-forward customer base by accepting both Litecoin and Bitcoin, all without having to become a part-time crypto trader. It lets you stay focused on what you do best: running your business.

Think about the two main ways to handle crypto revenue:

- Holding Crypto: This path exposes your business directly to market volatility. A sudden price drop could wipe out the profit on a sale. It demands constant monitoring and a stomach for risk.

- Instant Fiat Conversion: This approach completely removes price risk from the equation. You get paid the exact amount of the sale in your local currency, guaranteeing stable and predictable revenue.

For the overwhelming majority of e-commerce businesses, the second option is the only one that makes sense. It lets you tap into the benefits of crypto payments—like lower fees, fast global transactions, and zero chargebacks—without any of the financial headaches. This practical strategy makes the Litecoin vs Bitcoin debate less about which one is a better investment and more about which one works best as a simple, efficient tool for your business.

How Secure Are These Networks, Really?

When you’re taking payments, security isn't just a feature; it's the foundation of trust. Both Bitcoin and Litecoin have rock-solid security, but they operate on completely different scales. This isn't a simple case of "one is secure, the other isn't." Instead, it’s about understanding how their design and size contribute to their resilience.

The key to security for any Proof-of-Work network is its hashrate. Think of hashrate as the total computing power all miners are dedicating to securing the network and validating transactions. The higher the hashrate, the more impossibly difficult and expensive it becomes for anyone to attack the network.

Bitcoin: The Gold Standard of Security

Bitcoin’s hashrate is nothing short of colossal. It’s the single largest, most powerful computing network in the world, making its ledger the most secure public record ever created. Because of this sheer scale, a theoretical 51% attack—where a bad actor tries to control over half the network's mining power—is practically impossible.

This is exactly why Bitcoin is trusted for transferring immense value. The cost to even try to attack the network would climb into the billions of dollars. That economic barrier is so high that it effectively guarantees the integrity of every transaction. If you're a merchant processing big-ticket sales, this is the ultimate peace of mind.

Bitcoin's security isn't just strong; it's an economic fortress. The cost and coordination required to threaten the network are so prohibitive that it has achieved a level of security that other digital assets can only aspire to.

This security is the result of over a decade of non-stop operation and the powerful economic incentives that reward miners for protecting the network, not attacking it.

Litecoin: Battle-Tested for Business

Litecoin’s network is smaller, so its hashrate is naturally lower than Bitcoin’s. But don't mistake that for weakness. Litecoin has been running reliably since 2011, and its Scrypt mining algorithm has proven to be incredibly resilient.

For the vast majority of commercial payments—from selling digital downloads to handling daily cafe sales—Litecoin’s security is more than enough. It has securely processed billions of dollars in value over its lifespan without any major disruptions. The "less secure" label only makes sense when you're making a purely academic comparison to Bitcoin's unprecedented power.

What This Means for You as a Merchant:

- For High-Value Transactions: If you’re selling luxury cars or fine art, Bitcoin’s unmatched hashrate offers the strongest possible guarantee that a payment is final and irreversible.

- For Everyday E-commerce: For typical online store purchases, Litecoin is exceptionally secure. A 51% attack is still incredibly expensive and highly unlikely, making it a perfectly safe bet for handling lots of smaller payments.

Both networks are also highly decentralized, with nodes and miners scattered all over the world. While Bitcoin mining has become dominated by large pools with specialized ASIC hardware, Litecoin’s Scrypt algorithm was originally designed to be more accessible. Today, both are decentralized enough to avoid any single point of failure.

At the end of the day, you can feel confident accepting payments on either network. The choice in the litecoin vs bitcoin security debate really comes down to matching the security level to the transaction value. For most e-commerce businesses, both offer a security model that is light-years ahead of traditional payment systems plagued by chargebacks and fraud.

Choosing the Right Crypto for Your E-commerce Strategy

When it comes to the Litecoin vs. Bitcoin debate, there’s no single winner. The right crypto for your business really boils down to your sales model, what your customers expect, and the average price of your products. A one-size-fits-all strategy just doesn't apply here; you need to think about what aligns best with your actual business goals.

Let's move beyond the technical specs and look at how these coins work in the real world. Your decision should be shaped by the kinds of transactions you process every single day.

Aligning Crypto Choice with Business Model

If your store is built around high-volume, low-value sales, Litecoin has a serious practical advantage. Think about businesses selling digital downloads, processing monthly subscriptions, or even running an online coffee shop. For these models, speed and low fees are everything.

Litecoin’s faster block times and reliably cheap transaction costs mean a much smoother checkout for your customers. It helps you keep your profit margins from getting eaten up by fees, and more importantly, it avoids that awkward moment where a customer has to pay a hefty fee for a small purchase. That’s a quick way to get an abandoned cart.

On the other hand, if you're in the business of selling high-ticket items, Bitcoin’s rock-solid security and brand recognition provide a level of trust that’s hard to beat. For luxury goods, custom-built equipment, or high-value B2B services, Bitcoin’s powerful network essentially guarantees that the payment is final and secure.

The best strategy isn't about picking a winner. It's about seeing that each cryptocurrency serves a different kind of customer. Offering both is often the smartest way to appeal to everyone.

Choosing a cryptocurrency is also about evaluating its long-term viability and role in the market, a key part of understanding competitive advantage for any payment option you offer.

The Hybrid Approach: A Unified Solution

For most e-commerce businesses, the most effective strategy is a hybrid one. By accepting both Bitcoin and Litecoin, you can cater to two completely different customer preferences without making any compromises. You’ll be ready for the customer who trusts Bitcoin for a major purchase and the one who loves Litecoin’s speed for everyday buys.

And you don't need to overcomplicate things to make this happen. The trick is to use a payment gateway that can manage multiple cryptocurrencies from a single, unified system. This approach simplifies your backend, keeps the checkout flow clean, and gives customers a consistent experience, no matter which coin they choose. You can learn more about how to set this up in our guide on finding the https://blockbee.io/blog/post/best-payment-gateway-for-ecommerce.

Litecoin’s lower price point also makes it feel more approachable for everyday retail purchases. Plus, its quicker block confirmations—around 2.5 minutes compared to Bitcoin's 10 minutes—mean you see the money settle faster. This mix of accessibility and speed is a huge plus for any merchant looking to diversify their payment options.

Ultimately, supporting both currencies through a flexible platform like BlockBee helps future-proof your business. It opens you up to a wider customer base, cuts down on operational headaches, and shows that your brand is ready for what's next in digital commerce.

Frequently Asked Questions

As you weigh the differences between Litecoin and Bitcoin, a few practical questions likely come to mind. Let's tackle some of the most common ones that merchants ask when deciding on their crypto payment strategy.

Is Litecoin as Secure as Bitcoin for Payments?

It's true that Bitcoin’s network has a much higher hashrate, which technically makes it the most secure public blockchain on the planet. But this doesn't make Litecoin insecure. For the vast majority of e-commerce transactions, Litecoin's security is more than enough. The network has been running smoothly since 2011, proving its reliability for over a decade.

Think of it this way: you match the security to the transaction's value. Bitcoin’s fortress-like security is perfect for high-value sales where you need absolute certainty. For everyday purchases, however, Litecoin offers ample protection for both you and your customers, making it a perfectly safe and practical option.

Which Is a Better Long-Term Choice for a Business?

The smartest long-term play isn't picking one over the other; it's understanding their different jobs. Bitcoin is often called "digital gold"—it's a store of value with massive brand recognition. Litecoin, on the other hand, is the "digital silver," built to be a faster, cheaper medium of exchange.

A forward-thinking business should offer both. This approach lets you serve two distinct types of customers: those who trust Bitcoin for its established reputation and those who prefer Litecoin for its speed and efficiency on smaller buys. Supporting both coins makes your business more flexible and opens you up to a wider market.

How Do I Handle the Price Volatility of Both Coins?

Price swings are a legitimate concern for any business getting into crypto. The best way to handle this risk is to sidestep it completely. Instead of holding onto the crypto you receive and guessing which way the market will go, use a payment gateway that offers instant conversion to fiat.

By automatically converting crypto payments into your local currency at the moment of sale, you lock in the exact purchase amount every time. This lets you get all the benefits of crypto—lower fees, no chargebacks—without any of the price risk.

This simple move turns Bitcoin and Litecoin from volatile assets into straightforward, efficient payment methods. Historical data confirms that while Bitcoin holds its ground as the top store of value, Litecoin consistently delivers faster processing with solid security. Supporting both lets payment platforms cater to merchants who want security and those who need speed and low fees. You can dig into these historical comparisons of Litecoin and Bitcoin yourself.

Ready to offer both Litecoin and Bitcoin payments without the volatility risk? BlockBee provides a secure, non-custodial payment gateway with instant conversion, easy integration, and support for over 70 cryptocurrencies. Start accepting crypto today.