How to Use Cryptocurrency Wallet: A Complete Guide

When you get right down to it, using a crypto wallet involves three main activities: keeping your private keys safe, getting paid using your public address, and signing off on any transactions you send out. Think of it as your own personal digital vault where you have the final say over your assets. The absolute golden rule? Protect your seed phrase like it's the master key to everything—because it is.

What Is a Crypto Wallet and Why Do You Need One

Before we get into the nitty-gritty, let's clear up what a crypto wallet actually is. It’s easy to picture a digital version of a leather wallet, but that’s not quite right. A crypto wallet is much more like a high-tech, encrypted keychain for the blockchain. It doesn’t physically "hold" your coins. Instead, it securely manages the cryptographic keys that prove you own your crypto on the blockchain.

That’s a really important distinction. Owning crypto means you own a private key—a long, secret password that gives you the power to spend the coins linked to it. Your wallet is simply the tool, whether it's software or a physical device, that protects this key while letting you manage your funds. As you get started, you'll run into a lot of new jargon; this Web3 Dictionary is a great resource to keep handy.

The Keys to Your Digital Kingdom

Every non-custodial wallet you set up has two parts that work together:

- Public Key: This is used to generate your public wallet addresses, which you can share with anyone. It works just like your bank account number—people can send money to it, but they can't use it to take money out. You can learn more in our detailed guide on what a crypto wallet address is: https://blockbee.io/blog/post/crypto-wallet-address.

- Private Key: This is the top-secret part. You use it to sign and authorize any transaction you make, proving that you're the true owner of the funds. Never, ever share this key with anyone.

This public-private key setup is the magic behind being your own bank. It puts you in the driver's seat, cutting out the need for traditional financial middlemen.

Custodial vs. Non-Custodial Wallets

The question of who controls the keys leads us to a crucial choice: custodial or non-custodial wallets. A custodial wallet, like the one you get on a crypto exchange, means a third party is holding your private keys for you. It's convenient, sure, but you're fundamentally trusting someone else with your money.

A non-custodial wallet, on the other hand, puts you in sole possession of your private keys. This is what people mean when they talk about self-sovereignty in crypto.

You'll often hear the phrase, "Not your keys, not your coins." This is the core principle of non-custodial wallets. It's more responsibility, but it gives you ultimate security and control over your assets.

This drive for self-custody is a big reason the crypto wallet market is seeing such incredible growth. The global market was valued at USD 12.59 billion in 2024 and is projected to skyrocket to USD 100.77 billion by 2033. This isn't just a niche trend; it shows that knowing your way around a crypto wallet is fast becoming a vital skill in modern finance.

Wallet Types at a Glance

Choosing the right wallet can feel overwhelming, but it really boils down to balancing security with convenience. Here's a quick breakdown to help you figure out what makes the most sense for your needs.

| Wallet Type | Primary Use Case | Security Level | Convenience |

|---|---|---|---|

| Hardware Wallet | Long-term storage, high-value assets ("cold storage") | Very High | Low |

| Software Wallet | Daily transactions, frequent use (desktop & mobile) | High | High |

| Web Wallet | Quick access, interacting with dApps (browser-based) | Medium | Very High |

| Paper Wallet | Deep cold storage (rarely used now) | High (if secured) | Very Low |

Ultimately, many people use a combination—a hardware wallet for their long-term holdings and a software or web wallet for day-to-day spending and DeFi activities.

Choosing and Setting Up Your First Wallet

Getting started with a crypto wallet boils down to one fundamental trade-off: convenience versus security. How you strike that balance will define how you manage your digital assets. It’s a skill more and more people are learning—projections show a staggering 920 million active crypto wallet users by 2025. This isn't just a Western phenomenon, either; the Asia-Pacific region is leading the charge with around 350 million users. If you're curious, you can explore more about these global trends and see just how mainstream this is becoming.

The first, most important question to ask is: what's the game plan for this wallet?

If you're thinking about daily use—making frequent transactions, buying NFTs, or dabbling in DeFi apps—a software wallet is your best bet. Whether it's on your desktop or phone, it gives you that quick, easy access you need for your "spending" crypto.

But if you're in it for the long haul and holding a serious amount, a hardware wallet is the gold standard. These little physical gadgets keep your private keys completely disconnected from the internet, making them virtually untouchable by online hackers and malware.

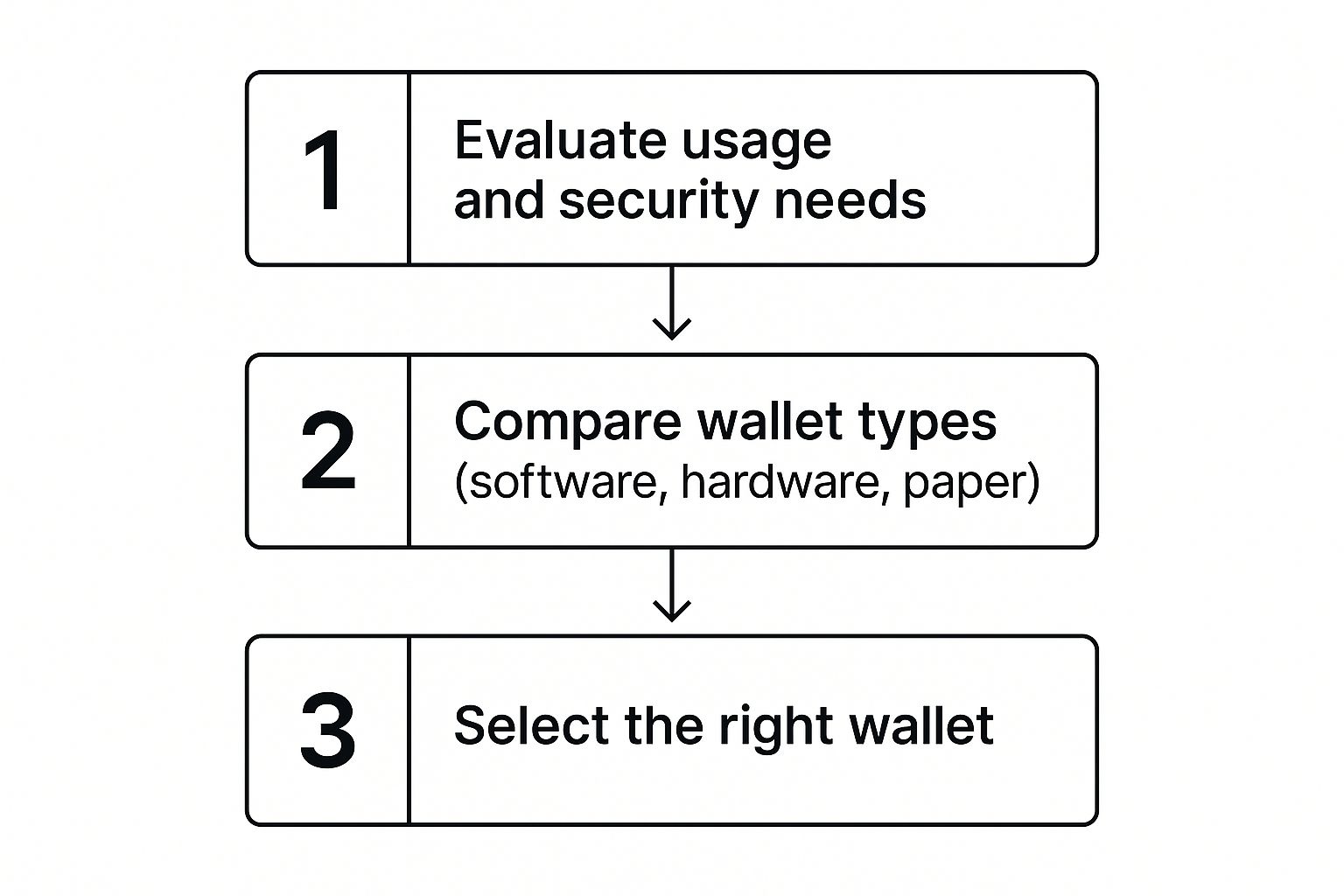

This chart lays out the decision-making process perfectly, starting with your needs and leading you to the right choice.

As you can see, it all begins with a bit of self-reflection. Your comfort with security and how you plan to use your crypto are the two pillars that will support your decision.

Your First Software Wallet Setup

Alright, let's get our hands dirty. We’ll use a popular option like Exodus or Trust Wallet as our example, but the steps are pretty much the same for most non-custodial software wallets. It’s a lot less intimidating than it sounds.

First things first, download the wallet only from the official source. I can't stress this enough. Go directly to their official website or use the official Apple App Store or Google Play Store. Scammers are experts at creating fake sites and apps that look identical to the real thing, designed to drain your funds the moment you use them.

Once you have the app installed, fire it up and choose to create a new wallet. The software will then magically generate all your necessary keys behind the scenes.

Next, you'll need to set a strong password. This password acts as the local key to your wallet, encrypting the file on your device and serving as your final sign-off for sending transactions. Go for something long, unique, and hard to guess.

That initial setup takes just a couple of minutes. But what comes next is, without a doubt, the most crucial part of this whole process.

The Critical Importance of Your Seed Phrase

The wallet will now reveal your seed phrase—sometimes called a recovery phrase. It will be a list of 12 or 24 random words. Think of this phrase as the master key to your entire crypto life.

This seed phrase is your ultimate safety net. If your laptop dies or your phone gets stolen, you can enter these words into a new wallet on any device and get everything back. But remember, anyone who finds these words can do the same and take all your crypto.

There's a right way and a very wrong way to handle this. Let's stick to the right way:

- Write it down. On paper. With a pen. Make sure every word is spelled correctly and in the right order.

- Store it offline and out of sight. Find a secure physical location—a home safe, a safety deposit box, or somewhere nobody would ever think to look.

- Never, ever save it digitally. Don't take a picture of it, don't store it in a note-taking app, and don't email it to yourself. The moment it touches a device connected to the internet, it’s vulnerable.

Sending and Receiving Crypto with Confidence

Alright, your wallet is set up and locked down. Now for the fun part: actually using it. Sending and receiving crypto is what this is all about, and getting comfortable with the process will turn you into a pro in no time. The mechanics are pretty simple, but paying attention to the details is what separates a smooth transaction from a "where did my money go?" moment.

Think of it like sending an email, but with one crucial difference: you're sending real value, and there's no "undo" button.

How to Receive Crypto The Right Way

Receiving crypto is refreshingly straightforward. All you need is your public wallet address. This is the long string of letters and numbers you can share with anyone who wants to send you coins. It’s a lot like giving out your email address—people can send things to it, but they can't use it to access your inbox.

Finding your address is easy:

- Just open your wallet and pick the crypto you’re expecting (like Bitcoin or Ethereum).

- Look for a button that says “Receive” or “Deposit.”

- Your wallet will then show your unique public address for that specific coin, usually alongside a handy QR code for quick scanning.

You just copy that address and give it to the sender. It's that simple. One thing to know is that some wallets generate a new address for every transaction to boost your privacy. Don't let that throw you off; they all point back to your main balance.

Executing Your First Send Transaction

Sending crypto, on the other hand, requires your full attention. Once you hit send, that transaction is out there for good. A single typo in an address can send your funds into the digital void, lost forever. So, precision is everything.

Let's walk through a real-world example. Say you need to pay a contractor 0.05 ETH for a project.

First, you'll get their Ethereum public address. With that in hand, you’ll open your wallet, go to your Ethereum holdings, and hit “Send.” This will bring up a screen with fields for the recipient's address and the amount you want to send.

Pro Tip from Experience: Double, then triple-check the address before you confirm anything. A best practice I always follow is to verify the first four and last four characters of the address. This helps catch any copy-paste errors or sneaky malware trying to switch the address.

You'll also see a field for the network fee, which you’ll often hear called “gas” on networks like Ethereum. This isn't a fee from the wallet; it's what you pay the people running the network to process and confirm your transaction. Most wallets do a good job of suggesting a fee based on how busy the network is, but you can usually adjust it. Paying a bit more can get your transaction confirmed faster, while a lower fee might save you a few cents but could take longer.

We get into the nitty-gritty of this in our guide on how to send crypto.

After you've confirmed the address, amount, and fee are all correct, you’ll authorize the transaction using your password or biometrics. Your wallet then broadcasts it to the blockchain, and you're done.

How to Verify Your Transaction

So, you've sent the crypto. Now what? Your wallet will have a transaction history where you can see its status—usually something like pending, confirmed, or (rarely) failed.

For the ultimate proof, you can use a block explorer. Think of it as a public search engine for the blockchain. For Ethereum, you'd use a site like Etherscan; for Bitcoin, you might use Blockchain.com's explorer. Just find the transaction ID (often called a TXID or hash) in your wallet's history, paste it into the explorer's search bar, and you’ll see the official, permanent record of your transaction.

Advanced Security to Protect Your Assets

Getting your wallet set up is the first step, but real, long-term security is all about building a proactive defense for your crypto. As you get comfortable using your wallet, the habits you form are what will separate you from the crowd and truly protect your investments. It’s all about thinking in layers and creating deliberate hurdles for anyone trying to get at your funds.

For anyone holding a serious amount of crypto, the first big upgrade is pairing your software wallet with a hardware wallet. I like to think of a software wallet as a checking account—it's great for smaller, day-to-day transactions. Your hardware wallet, on the other hand, is your vault. It stores your private keys completely offline, shielding them from online threats like malware and phishing schemes.

Building Your Digital Fortress

A layered security strategy goes beyond just hardware; it's about making unauthorized access as difficult as possible at every single point. Your best defense is a set of simple, consistent habits.

Let's start with the fundamentals:

- Strong, Unique Passwords: Don't ever reuse passwords, especially not the one protecting your wallet. If you're juggling a lot of them, a good password manager is a lifesaver.

- Two-Factor Authentication (2FA): Switch on 2FA for every single account related to your crypto, from your email to your exchange logins. For the best protection, use an app like Google Authenticator instead of SMS-based codes.

If you're managing funds for a business or with family, a multi-signature wallet is a fantastic option. A multisig wallet needs more than one private key to sign off on a transaction. For instance, a 2-of-3 setup requires approval from two out of three keyholders before any crypto can be moved. This is a game-changer for teams, as it prevents any one person from having total control over the assets.

Staying Vigilant Against Evolving Threats

Your digital security is only as good as your awareness of the dangers out there. Scammers are always cooking up new ways to part people from their crypto, and their tactics are evolving from online tricks to real-world intimidation.

A growing and frankly terrifying trend is the "wrench attack," where criminals use physical violence to force victims to hand over their assets. It’s a stark reminder that security isn't just digital. Being discreet about your holdings online is just as crucial as having a strong password.

Learning to spot common scams is an essential skill. Always be on the lookout for:

- Phishing Scams: These are sneaky emails or messages that look like they’re from a legitimate company. They'll prompt you to click a link and enter your seed phrase or password. Never, ever type your seed phrase anywhere except into your wallet software for a recovery.

- Fake Airdrops: Scammers will promise you free tokens, but first, you have to connect your wallet to their malicious website. Once you do, they can drain your funds. If an offer sounds too good to be true, it is.

Ultimately, protecting your crypto is a continuous process, not a one-time setup. It all comes back to understanding how to keep your private keys safe. To really dive deep on this, check out our complete guide on private key security. Staying educated and vigilant are your most powerful allies.

Wallet Integrations for Developers and Business

For a developer or a business owner, a crypto wallet isn't just a place to hold coins—it's the engine for your entire Web3 operation. Whether you're accepting payments or building a dApp, getting your wallet integration right is fundamental. Thankfully, the tools available today make this a whole lot easier than it used to be.

Think about the classic e-commerce problem: managing customer payments. You can't just slap a static wallet address on your checkout page and call it a day. That's a recipe for chaos and lost funds. This is exactly where a payment gateway like BlockBee steps in, offering a powerful API to automate the entire payment lifecycle.

Automating Crypto Payments with an API

A smart integration lets you generate a unique deposit address for every single customer order, programmatically. This one feature solves a massive operational headache. By tying each incoming payment to a specific order, you kill any confusion and make your accounting a breeze.

The benefits here are pretty clear:

- Scalability: You can handle a flood of transactions without needing to manually check anything.

- Security: You stop exposing a single, static business wallet to the public, which is a major security plus.

- Customer Experience: It just looks and feels professional, giving your customers confidence at checkout.

A developer's real goal is to build a completely seamless payment loop. Your API shouldn't just create addresses; it needs to watch the blockchain for payments and then kick off your backend processes once a transaction is confirmed.

This is where the magic happens. You can automate order status updates, trigger shipping notifications, or grant access to a digital product the instant the network confirms the payment. It's about creating a system that truly reacts to on-chain events in real time.

Managing and Tracking Your Operations

Beyond just taking payments, an integrated wallet system gives you a command center for your finances. Forget juggling multiple wallets on different chains. An API-powered solution brings all that data into one place. You can monitor payment statuses, see your balances across different cryptos, and verify confirmations without leaving your dashboard.

Many platforms, including BlockBee, use callbacks (or webhooks) to send your server real-time alerts. For instance, once a customer's payment has enough blockchain confirmations, the gateway pings your system. This means your application can react immediately—no more constantly hitting the API to ask, "Is it there yet?"

This is how you learn to use a crypto wallet not as a static vault, but as a dynamic tool that powers your business.

Answering Your Crypto Wallet Questions

As you start using a crypto wallet, you're bound to run into a few questions. It happens to everyone. Getting straight answers is the best way to feel confident managing your digital assets, so let's break down some of the most common things people ask.

What Happens if I Lose My Device?

It’s a heart-stopping moment: your phone vanishes or your laptop gives up the ghost. But here’s the good news—your crypto isn't actually on that device. It exists on the blockchain.

As long as you have that recovery seed phrase you wrote down, your funds are perfectly safe. Just grab a new device, download your wallet software, and choose the "restore" or "import" option. When you enter your 12 or 24-word phrase, you'll get full access back. This is exactly why keeping a physical, offline copy of your phrase is the most important rule in crypto.

Can I Use One Wallet for Everything?

For the most part, yes. Many modern software wallets are multi-currency, meaning they can handle Bitcoin, Ethereum, and thousands of other tokens all in one place. This makes life a lot easier for most people.

That said, not every wallet supports every single coin out there. Always check the wallet's list of supported assets before sending anything to it. You wouldn't want to send Ethereum to a wallet that can only handle Bitcoin—it would simply be lost.

Think of it like this: Your public wallet address is your email address, which is safe to share so people can send you things. Your private key is the password to that email account—you never share it. The seed phrase is the master key that can reset everything, making it the one secret you must guard above all else.

Are Mobile Wallets Safe for Large Amounts?

Mobile wallets are incredibly convenient for day-to-day transactions, but they are what we call "hot wallets." This just means they're always connected to the internet. While that connection makes them easy to use, it also exposes them to a tiny bit of risk from online threats like malware.

They're perfect for holding smaller amounts of crypto you plan to spend or trade. For any significant, long-term holdings—your "savings"—the undisputed best practice is to use a "cold wallet." This is typically a physical hardware device that keeps your private keys completely offline, shielding them from any online vulnerabilities. And as you manage your assets, don't forget about taxes; this crypto tax software comparison is a great resource for finding tools to help you stay on top of things.

Ready to integrate seamless, secure crypto payments into your business? BlockBee provides the tools you need to automate transactions, manage multiple currencies, and grow with confidence. Explore our developer-friendly API and e-commerce plugins at https://blockbee.io.