How to Trade in Coinbase: Your Complete Guide

Before you can even think about buying your first Bitcoin or Ethereum on Coinbase, you’ve got to get your account set up and squared away. This isn't just a formality; it's the foundation for securing your funds and ensuring you can trade without a hitch. Getting this right from the start saves you from headaches and potential delays down the line.

Setting Up Your Coinbase Trading Account

Think of setting up your account as building your personal trading headquarters. You wouldn't build a house on a shaky foundation, and the same principle applies here. The first order of business is creating your account with a strong, unique password and immediately enabling Two-Factor Authentication (2FA). Honestly, this is non-negotiable in the crypto world.

From there, you'll tackle identity verification. It's a standard process for any reputable financial platform, and it’s there to protect everyone.

To help you keep track, here's a quick checklist of what you'll need to do to get your account ready for action.

Coinbase Account Setup Checklist

This table breaks down the essentials for getting your Coinbase account from zero to trade-ready.

| Step | What You Need | Key Action |

|---|---|---|

| Account Creation | A valid email address & a strong password | Sign up on the Coinbase website and create a unique password you don't use anywhere else. |

| Security Setup | Your mobile phone | Enable Two-Factor Authentication (2FA) using an authenticator app for the best security. |

| Identity Verification | Government-issued photo ID (driver's license or passport) | Follow the on-screen prompts to upload a clear picture of your ID and confirm your personal details. |

| Funding Source | Bank account details or a debit card | Connect your preferred payment method to deposit funds into your account. |

Once these steps are complete, you're officially on the platform and ready to explore.

Getting Your Identity Verified

Coinbase, like all regulated exchanges, has to verify who you are to comply with financial laws and prevent fraud. This is the "Know Your Customer" or KYC process. It might seem like a bit of a pain, but it's a crucial security layer for you and the entire platform.

You'll need to have a few things handy:

- Your full legal name and date of birth

- Your current physical address

- A government-issued photo ID, like a driver's license or passport

This process confirms you are who you say you are, which is fundamental to maintaining a secure trading environment.

Connecting a Payment Method

With your identity confirmed, it's time to link a payment source. This is how you'll move cash into your Coinbase wallet to actually buy crypto. You've got a couple of solid options, and each has its pros and cons.

Connecting a bank account using an ACH transfer is great for larger deposits, but be prepared to wait a few days before those funds are fully cleared and available to withdraw. If you want to move fast, linking a debit card is your best bet. It lets you buy crypto almost instantly.

My Two Cents: I almost always use a debit card for quick buys when I see a market opportunity I want to jump on. The slightly higher fee is worth it for the speed. For planned, larger investments, I'll use a bank transfer to save on fees, knowing I have to wait a bit.

Getting to Know the Coinbase Dashboard

Once you're verified and have a way to fund your account, take a few minutes to just click around the dashboard. This is your command center. You'll see real-time asset prices, your portfolio balance, and the straightforward interface for buying and selling.

Don't skip this step. Familiarity is your best friend when money is on the line. Knowing exactly where everything is helps you avoid fumbling around and making mistakes when you're ready to pull the trigger on a trade.

It also helps to understand the sheer scale of the platform you're on. Coinbase, which has been around since 2012, is a behemoth in the industry. By early 2025, it was reporting a staggering $312 billion in quarterly trading volume. What's really telling is that institutional trading now makes up over 82% of that volume, a huge vote of confidence from professional investors. If you're curious, you can find more Coinbase growth statistics on Backlinko.com. This context should give you peace of mind about the security and reliability of the platform.

Making Your First Crypto Trade on Coinbase

Alright, your account is funded and you're ready to go. This is where the rubber meets the road—time to actually buy some cryptocurrency. It might feel a bit intimidating, but trust me, the basic process is surprisingly simple. We'll start with a straightforward purchase before touching on some of the more advanced tools Coinbase offers.

First things first, find the "Buy / Sell" button on your dashboard. It's usually pretty prominent. Clicking that opens up the main trading menu. This is your command center. You'll see the big names like Bitcoin (BTC) and Ethereum (ETH) listed right away, but you can also search for any other crypto available on the platform.

How to Place a Simple One-Time Purchase

Let's walk through a practical example. Say you've decided to dip your toes in with a $100 investment in Bitcoin.

You'll start by selecting Bitcoin from the list of cryptocurrencies. Then, in the amount field, you just type in $100. The interface will immediately show you the corresponding amount of BTC you'll get at the current market price. Don't rush this part—Coinbase gives you a preview screen before you commit.

My Advice: Never skip the preview screen. Seriously. It’s your chance to see a full breakdown: the Coinbase fee, which payment method is being used, the exact quantity of crypto you're getting, and the total charge. This step is all about transparency, so you know exactly what you’re paying before you pull the trigger.

If everything on the preview screen looks correct, go ahead and hit the "Buy now" button. The transaction is usually almost instant, especially with a debit card. Just like that, the Bitcoin you bought will show up in your portfolio. You've officially made your first trade. This is a classic example of what's known as spot trading, where you're buying the asset on the spot for immediate delivery.

Thinking About a Recurring Buy Strategy

Once you're comfortable with a single purchase, you might want to explore one of Coinbase’s most useful features for long-term thinkers: the recurring buy. This is a great way to invest without trying to "time the market," which is a game even seasoned pros struggle with.

Instead of making one-off buys, you can set up a schedule. For instance, you could automate a $25 purchase of Ethereum every single Friday. This method is called Dollar-Cost Averaging (DCA), and it's popular for a few good reasons:

- Takes Emotion Out of the Equation: By automating your buys, you sidestep the panic-selling or FOMO-buying that can wreck a portfolio. It's a set-it-and-forget-it approach.

- Smooths Out Your Entry Price: You naturally buy more coins when the price is low and fewer when it's high. Over time, this can give you a much better average cost per coin.

- Builds Good Habits: It makes investing a consistent, disciplined part of your financial routine, helping you grow your holdings steadily over the long haul.

Setting up a recurring buy is just as simple as a one-time purchase. Just toggle the option, pick your frequency (like daily, weekly, or on the 1st and 15th of the month), and set your amount. For anyone new to crypto, this is a fantastic, low-stress way to start building a position methodically.

Trading Smarter with Advanced Orders

If you want to move beyond simply buying and holding, you need to graduate from that big, friendly “Buy” button on the main Coinbase screen. That interface is fantastic for getting started, but Coinbase Advanced is where you'll find the tools that give you real precision and control. This is the difference between being a passive investor and an active trader.

When you just hit "buy," you’re placing a Market Order. It’s the simplest order type, telling the exchange, "Get me this coin right now at whatever the best price is." It’s quick and easy, but you sacrifice control. In a volatile market, the price you actually pay can be surprisingly different from the one you saw a second ago.

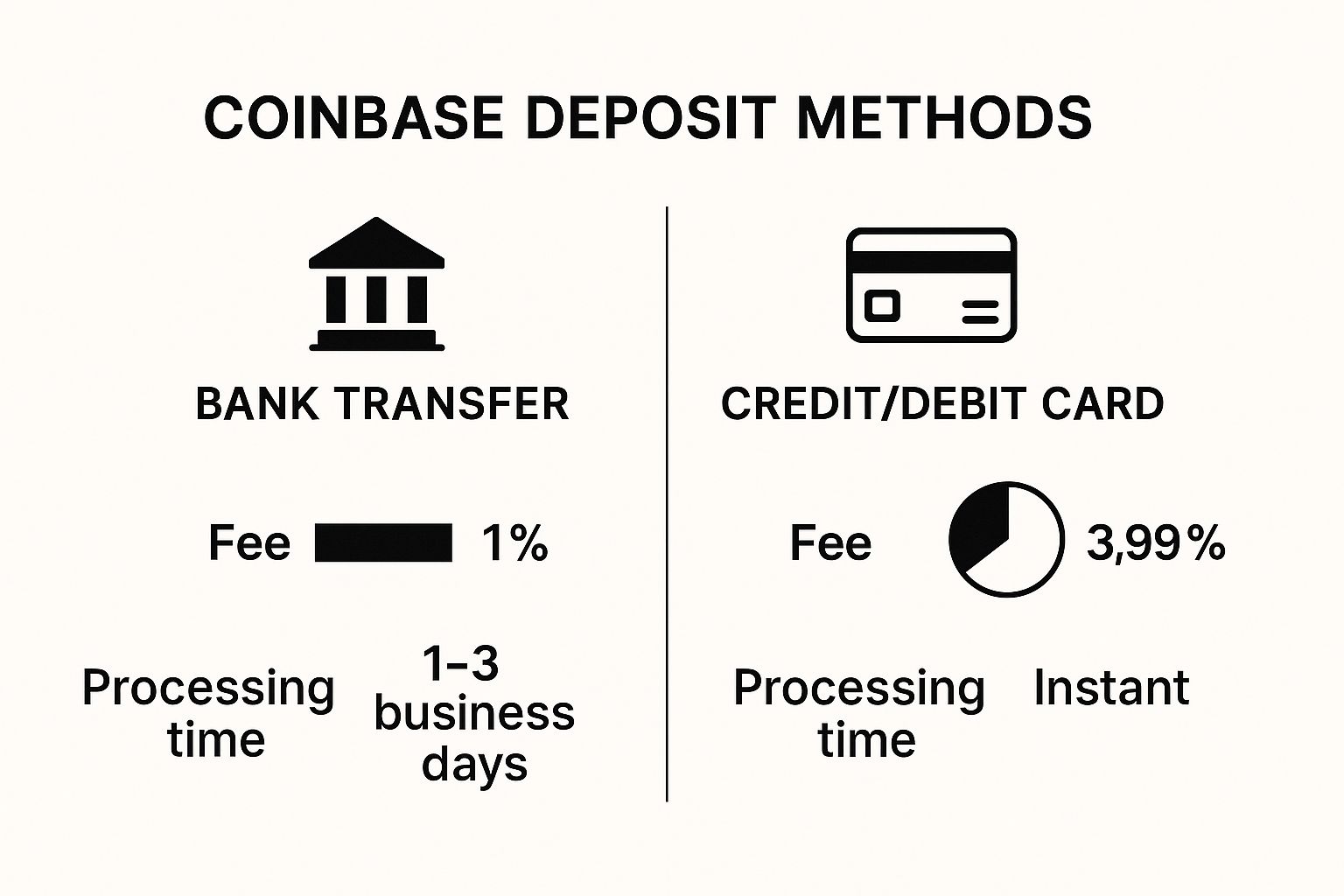

Before you can even place a trade, though, you need funds in your account. How you deposit money involves its own strategy, as there's always a trade-off between speed and cost.

As you can see, getting money into your account quickly might cost more, which is something you have to weigh when trying to catch a fast-moving opportunity.

Taking Control with Limit Orders

This is where you really start trading with intention. A Limit Order lets you tell the market the exact price you're willing to pay for an asset (or the exact price you're willing to sell it for). Your order sits on the books and will only get filled if the market price hits your target—or a better one.

Let's say Bitcoin is trading around $68,000, but your gut and your research tell you a small dip is coming before the next rally. Instead of buying at the current price, you could place a limit buy order for $66,500.

- If the price drops to $66,500 or lower, your order triggers automatically, and you get your BTC at the price you wanted.

- If the price never falls that low and instead climbs higher, your order just sits there, unfilled. You might miss out on the trade, but you also avoided buying at a price you weren't comfortable with.

This single tool is invaluable. It forces you to be disciplined and lets you wait for the market to come to your price, not the other way around.

Protecting Your Capital with Stop-Loss Orders

Winning at trading isn't just about how much you make; it’s about how much you don't lose. Your number one risk management tool is the Stop-Loss Order. This is an order you set up in advance to automatically sell your crypto if the price drops to a specific level (your "stop price").

Key Takeaway: Think of a stop-loss as your automated safety net. It’s designed to get you out of a bad trade before a small, manageable loss snowballs into a devastating one.

For example, imagine you bought Ethereum at $3,500 per coin. You could immediately place a stop-loss order at $3,250. If the price of ETH suddenly tumbles, your position is automatically sold as soon as it hits that $3,250 mark, capping your potential loss at around 7%. Without it, you’re just hoping the price will recover.

To help you decide which order to use, here's a quick comparison of the most common types you'll encounter on Coinbase.

Coinbase Order Types Compared

This table breaks down the key differences to help you align your trading action with your specific goal.

| Order Type | Best For | Key Characteristic |

|---|---|---|

| Market Order | Speed and guaranteed execution | Buys or sells immediately at the best available current market price. |

| Limit Order | Price control and entering/exiting at specific targets | Only executes if the market reaches your specified price or a better one. |

| Stop-Loss Order | Risk management and protecting capital | Triggers a market sell order if the price falls to your specified stop price, limiting losses. |

Each order type serves a different purpose. A market order is for getting in or out now, a limit order is for getting the price you want, and a stop-loss is your insurance policy.

Learning to use these orders fluidly is what separates casual buying from strategic trading. They are the building blocks for executing a real plan, helping you trade with discipline instead of emotion.

How to Analyze Crypto Assets on Coinbase

Successful trading is more than just hitting the “buy” and “sell” buttons. It’s about making calculated decisions, and that means you’ve got to do your homework on the assets you’re eyeing. Fortunately, Coinbase packs a lot of analytical tools right into its platform, helping you move past guesswork and toward a more informed strategy.

When you click on any crypto, whether it’s a major player like Solana or a smaller altcoin, you land on its dedicated asset page. This is your command center for analysis. You’ll instantly see the current price and the 24-hour percentage change, along with a simple line chart showing recent price movement.

That first glance is great for a quick health check, but the real insights come from digging a bit deeper.

Interpreting Price Charts and Historical Data

The chart is your single most important tool on the page. Coinbase lets you toggle the time frame, from a tight one-hour view all the way out to the asset’s entire trading history. I always start by looking at the one-year or "All" chart to get a feel for the asset's personality. Is it a slow and steady climber, or is it prone to wild, dramatic swings?

For a more granular look, you’ll want to switch from the default line chart to the candlestick view. Understanding candlestick patterns is a fundamental skill for any trader. If you’re new to this, our guide on how to read cryptocurrency charts is the perfect place to start; it breaks down exactly what each candle reveals about price action.

Just below the chart, you'll find a few crucial metrics:

- Market Cap: The total value of all the coins currently in circulation.

- Volume (24h): The total value of the asset traded in the last day. A surge in volume often points to growing interest.

- Circulating Supply: How many coins are actually available on the market for trading.

These numbers give the price chart essential context. A large market cap might signal a more mature, established project, while a sudden spike in trading volume could mean a big news story is making waves.

Understanding Market Dynamics and Influences

Here’s something every experienced trader knows: no crypto exists in a bubble. The performance of Bitcoin, in particular, tends to create ripples that affect the entire market. When Bitcoin is on a tear, it often lifts other altcoins up with it—what many call an "altseason." On the flip side, a sudden Bitcoin crash can drag almost everything else down.

Key Insight: Before you trade a smaller altcoin, take a quick look at what Bitcoin is doing. Its momentum is often a powerful sign of the market’s overall mood.

These broader market trends have a huge impact on trading activity. For example, during Q1 2025, Bitcoin and Ethereum trading made up 38% of Coinbase's massive $393 billion quarterly trading volume. This highlights just how connected asset performance and platform activity are. In that same quarter, while transaction revenues varied, assets in stablecoins like USDC jumped 39%, showing that many traders were also seeking stability. You can dig into these numbers yourself in this Coinbase financial performance analysis.

By combining solid chart analysis with a keen awareness of these market forces, you can start making much smarter, more strategic trades on Coinbase.

Don't Skip This: How to Actually Secure Your Coinbase Account

Getting started on Coinbase is exciting, but let's be real—the most important move you'll ever make has nothing to do with buying low and selling high. It's about locking down your account. In crypto, you are your own bank, and that means security is 100% your responsibility. Treating it as an afterthought is like leaving a pile of cash on a park bench.

The first thing you absolutely must do is set up Two-Factor Authentication (2FA). While a text message (SMS) for 2FA is better than nothing, it's a known weak point that's vulnerable to "SIM swap" attacks. I strongly recommend using an authenticator app like Google Authenticator or Authy instead. It’s a massive security upgrade that stops most brute-force login attempts cold.

And of course, this all starts with your password. A strong, unique password is your frontline defense. Don't even think about using your pet's name or "Password123." Get a password manager to create and store ridiculously complex passwords for you. It's a game-changer for all your online accounts, but especially for the ones holding your money.

Taking Your Security from Good to Great

Once you've got a solid password and app-based 2FA, it's time to add more layers to your defense. If you're serious about protecting your assets, a physical Security Key (like a YubiKey) is the gold standard. This is a small USB device that you have to physically plug in and touch to approve logins or withdrawals. For a remote hacker, it’s a brick wall.

Another powerful, yet often overlooked, feature is address whitelisting. This tool lets you create an "approved" list of crypto addresses that you can send funds to. If a wallet address isn't on your whitelist, no withdrawals can go there. Period. So even if a thief somehow gets into your account, they can't just send your crypto to their own wallet. It’s a simple, brilliant safeguard.

Expert Insight: I always tell people to think of security in layers. Your password is a fence, 2FA is a locked door, and whitelisting is a security guard inside. The more obstacles you put in an attacker's way, the safer you'll be. No single method is perfect, but stacking them together makes your account a much, much harder target.

Staying Sharp and Avoiding Scams

You also have to be your own security analyst. Phishing scams are everywhere, and scammers have gotten incredibly good at creating fake emails, texts, and websites that look identical to the real Coinbase. They want to panic you into giving up your login details.

Here’s how I personally avoid falling for these tricks:

- Become a URL detective. I always glance at the address bar to confirm I'm on the official

coinbase.combefore I even think about typing anything. - Treat urgency with suspicion. Phishers love creating fake emergencies—"Your account is locked!" or "Suspicious activity detected!"—to make you act without thinking. I just take a breath and slow down.

- Never trust, always verify. If I get an unexpected email from "Coinbase," I never click the link. Instead, I open a new browser tab and manually type in the Coinbase URL myself to log in and check.

By being proactive with these security settings, you build a fortress around your account. If you want a deeper dive, you can learn more about enhancing security with new two-factor authentication options in our guide. Mastering these habits is a non-negotiable part of learning how to trade on Coinbase safely.

Frequently Asked Questions About Coinbase Trading

As you get your feet wet with trading on Coinbase, you're bound to have questions. It's one thing to navigate the platform, but it's another to really understand the fees, tools, and best practices that separate a novice from a confident trader. Let's break down a few of the most common things people ask.

What Is the Difference Between Coinbase and Coinbase Advanced?

This is a big one, and it causes a lot of confusion for newcomers. Think of the standard Coinbase platform as the on-ramp. It’s designed for simplicity, making it perfect for your first few buys or for setting up recurring purchases. The interface is clean and straightforward, but that ease of use comes at the cost of higher, less transparent fees.

Coinbase Advanced, however, is the full-blown trading engine. This is where you’ll find:

- Lower, volume-based trading fees

- Powerful charting tools for technical analysis

- Advanced order types like limit and stop-loss orders

The great part is your account gives you access to both, and you can move funds between them instantly and for free.

The Bottom Line: I tell most beginners to start with the simple Coinbase interface for their first buy. But once you want to start analyzing charts and taking control of your entry and exit points, you should immediately switch over to using Coinbase Advanced.

How Are Coinbase Trading Fees Calculated?

Understanding fees is absolutely critical—they eat directly into your profits.

On the simple Coinbase platform, the fee structure can be a bit confusing. You’re essentially paying a spread (a small margin they build into the price) plus a Coinbase Fee. This fee is the greater of either a flat rate (for small transactions) or a variable percentage (for larger ones).

Coinbase Advanced is much more transparent, using a standard maker-taker fee model that's common on professional exchanges.

- Taker Fee: You pay a taker fee when your order is filled immediately (like a market order). You are "taking" liquidity from the order book.

- Maker Fee: You pay a lower maker fee when you place an order that doesn't fill instantly (like a limit order away from the current price). By doing this, you're "making" a market and adding liquidity for others.

This structure actually incentivizes you to use limit orders, which is a key habit for more strategic trading.

Should I Keep My Crypto on Coinbase or Use a Private Wallet?

This is one of the most important security decisions you'll make, and the answer really depends on what you’re doing with your crypto.

Keeping funds on Coinbase is incredibly convenient for active trading. Your capital is ready to go at a moment's notice, and Coinbase has robust security measures, including insurance for the cash portion of your USD wallet. The major trade-off? You don't actually control the private keys to your crypto. Remember the saying: "Not your keys, not your coins."

For long-term holding—what the community calls "HODLing"—the gold standard is moving your assets to a private, non-custodial wallet. A hardware wallet from a company like Ledger or Trezor gives you full control over your private keys, making it the most secure way to store your investments.

A common strategy is to keep a smaller "trading stack" on the exchange and move the rest of your long-term holdings into cold storage. You get the best of both worlds: liquidity for trading and maximum security for your core position.

Are you a business looking to accept cryptocurrency payments securely and efficiently? BlockBee offers a non-custodial payment gateway with low fees, instant payouts, and seamless integrations for platforms like WooCommerce and Magento. Take control of your crypto revenue and simplify your transactions by visiting https://blockbee.io to learn more.