What Is Spot Trading in Crypto? A Beginner's Guide

Let's get right down to it. Spot trading is the simplest way to buy and sell cryptocurrency. It's a direct, no-fuss transaction where you purchase a digital asset like Bitcoin or Ethereum for immediate delivery.

Think of it like buying a physical item from a store. You see the price, you pay for it, and you walk away with it in your hands. In the crypto world, this means you pay the current market price—known as the spot price—and the coins are instantly transferred to your wallet. No complex contracts, no future dates, just a straightforward exchange.

Spot Trading Compared to Other Crypto Trading Methods

Before we dive deeper, it's helpful to see how spot trading stacks up against other popular methods. Each approach serves a different purpose, and understanding the core differences is key to choosing the right strategy for your goals.

| Trading Method | Ownership of Asset | Settlement Time | Primary Goal |

|---|---|---|---|

| Spot Trading | Yes, you own the actual crypto. | Immediate ("on the spot"). | To buy and hold assets, or profit from price increases by owning the asset. |

| Futures Trading | No, you own a contract to buy/sell at a future date. | At a predetermined future date. | To speculate on future price movements (up or down) without owning the asset. |

| Margin Trading | Yes, but you use borrowed funds to buy more. | Immediate, but the position is leveraged. | To amplify potential gains (and losses) by trading with borrowed capital. |

This table shows that spot trading is unique because it's the only one of these methods that gives you direct, unencumbered ownership of your crypto right away.

So, What's the Point of Spot Trading?

At its heart, spot trading is the bedrock of the crypto market. It’s how most people get their start. When you complete a spot trade, you take full ownership of the cryptocurrency, and that’s a big deal.

This ownership means the assets are truly yours. You can transfer them to a private wallet for long-term safekeeping (a strategy famously known as "HODLing"), use them to buy things, or trade them for other digital currencies. This is a world away from other trading styles where you're often just betting on price changes without ever touching the actual coin.

The Main Goal: Buy Low, Sell High

For most people, the objective is beautifully simple: buy an asset at a low price and sell it when the price goes up. If you purchase one Bitcoin for $60,000 and later sell it when the market price hits $65,000, you’ve just pocketed a $5,000 profit. It’s this straightforward logic that makes spot trading such a popular entry point for newcomers.

The most important thing to remember is that spot trading grants you tangible ownership. You’re not just trading paper contracts; you are acquiring the real digital asset, which gives you total control over how it's stored and used.

In this guide, we’ll walk you through everything you need to know to get comfortable with spot trading. We'll start from square one and build your understanding piece by piece, covering:

- How a trade actually works: We'll look at placing orders and making sense of a trading screen.

- The biggest benefits: Why having direct ownership and keeping things simple are major pluses.

- The risks involved: How to handle market swings and keep your funds safe.

- Where you can trade: Exploring the difference between centralized and decentralized exchanges.

Alright, let's break down how a spot trade actually works. Getting from the theory to your first trade is a lot simpler than you might think. Forget about complex financial dashboards; it's much more like using a specialized online marketplace.

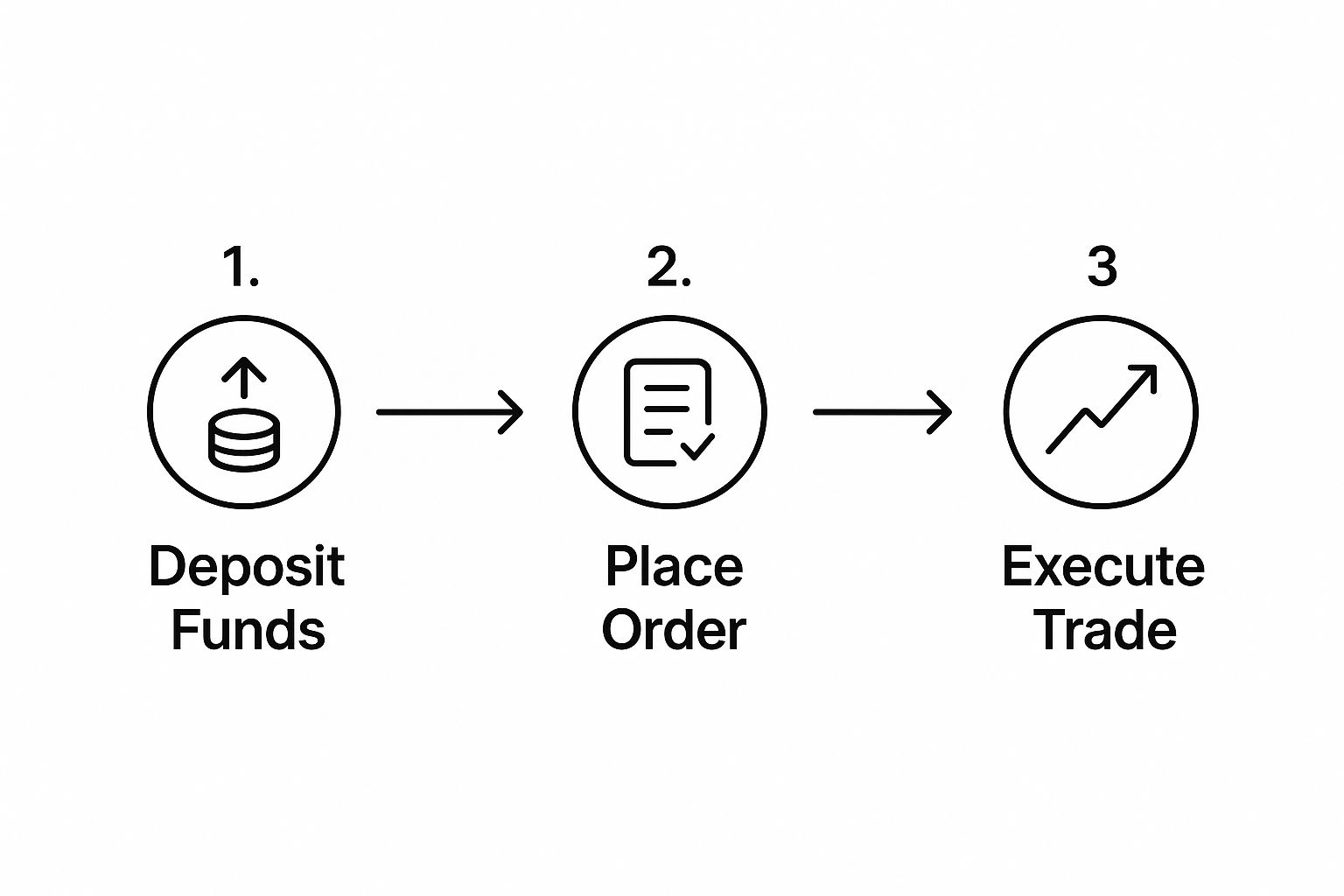

At its heart, the process is just a few simple steps. You put money into your account, pick the crypto you want to trade, and then place an order to buy or sell it. That's really it.

This visual gives you a quick rundown of the entire flow.

As you can see, it's a direct path from funding your account to owning the asset, which is the whole point of spot trading—it's immediate.

Finding Your Way Around the Trading Interface

When you first open up the trading screen on an exchange, you'll see a few key components. The most important one is the order book. This is a live, constantly updating list of all the buy and sell orders for a particular crypto. Think of it as a public ledger showing what other traders are willing to pay (these are the "bids") and what they're willing to sell for (the "asks").

This transparency is what helps you make good decisions. By watching the order book, you can get a feel for the market's mood and spot price levels where a lot of buying or selling is happening. Learning to read this is a fundamental skill, and our guide on how to read cryptocurrency charts is a great place to start building that expertise.

Picking Your Trading Pair

Before you can place a trade, you need to select a trading pair. This just defines the two assets you're swapping. For instance, a common pair is BTC/USD, where you trade Bitcoin for U.S. Dollars. Another is ETH/BTC, for swapping Ethereum and Bitcoin.

The first currency listed is the base currency—that’s what you're actually buying or selling. The second is the quote currency, which is what you're using to price the transaction.

Placing the Order

With your trading pair selected, it's time to place an order. For spot trading, you'll mainly use two types:

Market Order: This is the most straightforward option. You're telling the exchange to buy or sell for you right now, at the best price available on the market. This guarantees your trade goes through quickly, but the final price might fluctuate slightly from what you saw on screen. Speed is the priority here.

Limit Order: This puts you in the driver's seat. You set a specific price you're willing to buy or sell at, and the order will only be filled if the market hits that price or a better one for you. This prioritizes getting the price you want over immediate execution.

A market order is like shouting, "I'll take a coffee now, whatever the price!" A limit order is more like saying, "I'll only buy that coffee if it's $3.00 or less."

Recent events, like the introduction of spot ETFs, have injected a ton of volume and liquidity into the market. When the first U.S. spot Bitcoin ETF was approved in 2024, it helped trigger a massive price jump of around 150% in the early part of the year. It's a perfect example of how major news can bring a flood of new participants into the spot markets.

Key Advantages of Spot Trading

So, why choose spot trading when there are so many ways to get into crypto? The simple answer is that it offers a clarity and control that’s hard to beat. For both seasoned pros and newcomers, the benefits of spot trading make it the bedrock of any solid crypto strategy.

At its core, spot trading is wonderfully simple. You buy crypto at its current market price, and you own it right then and there. There are no complicated expiry dates, no confusing leverage, and no interest payments to worry about like you find in futures or margin trading.

This "what you see is what you get" approach is exactly why it's the go-to starting point for most people. It's an intuitive way to trade, making it much easier to get the hang of from your very first transaction.

The Power of Direct Ownership

Here’s the biggest difference: unlike derivatives where you’re just betting on price changes, spot trading gives you actual ownership of the crypto. This is a huge deal. It means you can do a lot more with your assets than just watch their price go up or down.

Owning your crypto means you can move it, use it, or hold it on your own terms. This control is the essence of why many people get into digital assets in the first place—it's about self-sovereignty over your finances.

Once those coins are yours, a whole world of possibilities opens up. You can:

- HODL for the Long Term: Move your crypto off the exchange and into a secure, private wallet. This gives you full control and is a popular strategy for long-term investing.

- Earn Passive Income: Put your assets to work by participating in staking or lending. This lets you earn rewards on the crypto you're holding.

- Use It for Payments: Spend your crypto directly on goods and services. More and more businesses now accept cryptocurrency payments, turning your digital assets into real-world currency.

This direct ownership turns your investment from just a number on a screen into a tangible, useful asset.

A More Manageable Risk Profile

Let's be clear: all crypto trading has risks. But spot trading keeps those risks more contained and predictable than other methods. Your potential loss is capped at whatever you put in. If you buy $100 worth of an asset, the absolute most you can lose is that $100.

That’s a world away from margin trading, where borrowing money can magnify your losses and a single bad trade could wipe out your entire account. With spot trading, there's no leverage, which means you’re safe from liquidation calls and the nightmare of having your position forcibly sold.

The market backs this up. The total spot trading volume across major exchanges hit a staggering $14.6 trillion in a recent one-year period, proving it's the market's main hub for liquidity. For major cryptocurrencies, this high volume means you can usually buy or sell when you want without the price suddenly slipping. This stability and straightforward risk are why understanding what is spot trading in crypto is the essential first step for anyone entering the market.

Understanding the Risks and How to Manage Them

While spot trading is one of the more direct ways to get into crypto, it's not without its pitfalls. A smart trader is a prepared one. The crypto market is famous for its wild energy, and being ready for the risks is just as crucial as spotting opportunities. Knowing the potential downsides helps you build a strategy that can weather the inevitable storms.

The biggest elephant in the room is market volatility. Prices can rocket up or plummet in the blink of an eye, often driven by a news headline, a shift in market sentiment, or even a single tweet. A coin that's up 20% one day could easily be down 15% the next. That’s just the nature of the beast, but it can be a gut-wrenching experience if you don't have a plan.

Key Risks in Spot Trading

Beyond the general price swings, a few specific risks pop up when you're spot trading. These usually have to do with the assets you pick and the exchanges you use.

Liquidity Risk: Major players like Bitcoin have plenty of buyers and sellers, so you can almost always trade when you want. But with smaller, more obscure altcoins? Not so much. You might find there aren't enough people on the other side of the trade, making it tough to buy or sell at your target price without causing a price slip yourself.

Security Risk: When you leave your crypto on an exchange, you’re placing your trust in their security measures. Hacks and platform failures are real, documented threats. On the other hand, moving your assets to a personal wallet means all the security responsibility lands squarely on your shoulders.

As you look for a place to trade, make sure you're evaluating platforms that follow fundamental website security best practices. A secure exchange should be your first line of defense.

Proactive Risk Management Strategies

Knowing the risks is only half the battle. Actively managing them is what separates traders who last from those who get washed out. Thankfully, there are several solid strategies you can use to protect your capital and trade with more confidence. The goal is to make calculated moves, not emotional ones.

The core of risk management isn't about avoiding every single loss—that's impossible. It's about making sure no single trade can wipe you out. It’s about survival and staying in the game long enough to succeed.

Here are a few actionable steps to get you started:

Set Stop-Loss Orders: This is your most important safety net. A stop-loss is an automatic instruction you give the exchange to sell your asset if it drops to a certain price, effectively capping your potential loss on that trade.

Diversify Your Portfolio: The old saying "don't put all your eggs in one basket" couldn't be more true here. Spreading your funds across different cryptocurrencies helps soften the blow if one of your picks takes a nosedive.

Avoid Emotional Trading: Fear of missing out (FOMO) can cause you to buy at the top, while fear, uncertainty, and doubt (FUD) can scare you into selling at the bottom. Stick to your pre-defined strategy and resist making impulse decisions based on market hype or panic.

Even in a strong market, outside forces can throw a wrench in the works. For example, despite a Bitcoin rally in the first half of 2025, spot trading volumes on centralized exchanges actually dropped by 22% in Q2 because of wider economic anxieties. This is a perfect illustration of how quickly things can change, highlighting why a solid risk plan is non-negotiable. You can dig into the data on these market shifts by reading the full report on crypto trading volumes.

Choosing Where to Trade: CEX vs. DEX

Alright, so you’ve got a handle on what spot trading is. Now for the next big question: where do you actually do it? This choice is a huge deal because the platform you use shapes your entire trading experience. The crypto world gives you two main arenas: Centralized Exchanges (CEXs) and Decentralized Exchanges (DEXs).

Think of a CEX like your familiar, everyday bank. It's a company that acts as a trusted middleman, holding onto your funds and making sure trades go through smoothly. They’re known for being easy to use and having lots of customer support, which makes them a go-to for anyone just starting out.

A DEX, on the other hand, is more like a digital farmers' market. There's no single company in charge. Instead, trades happen directly between people, powered by automated programs called smart contracts. This gives you far more control, but it also means you’re the one in the driver's seat, responsible for everything.

The Centralized Exchange Experience

For the vast majority of people, a CEX is their first taste of crypto. Platforms like these are built to be intuitive, often with simple "buy" and "sell" buttons, slick mobile apps, and plenty of guides to help you find your footing.

Here’s why so many people start with a CEX:

- High Liquidity: CEXs usually have massive order books. This just means there are tons of buyers and sellers at any given time, so you can make large trades without causing the price to swing wildly.

- User-Friendliness: The interfaces are polished and designed for a mainstream audience, not just tech wizards.

- Customer Support: If something goes wrong—a deposit is missing or a trade seems stuck—there's an actual support team you can reach out to for help.

But this convenience comes with a major catch. When you keep your crypto on a CEX, you don't really own it in the purest sense. The exchange holds it for you. This creates what’s known as counterparty risk. If the exchange gets hacked, goes bankrupt, or runs into regulatory trouble, your funds could be frozen or lost. This is a critical point for any business managing digital assets, a topic we dive into deeper in our guide on crypto payments for business.

The Decentralized Exchange Advantage

DEXs are built on the core crypto principle of self-custody. You—and only you—control your private keys, which means your funds are always yours. Your crypto stays in your personal wallet right up until the moment a trade is finalized, eliminating the risk of a massive exchange hack wiping out your holdings.

On a DEX, you are your own bank. This offers incredible security and freedom, but it demands a bit more technical know-how and a whole lot of personal responsibility.

Why are traders flocking to DEXs?

- Self-Custody: Your funds are your funds. Period. They never leave your personal wallet until you approve a trade.

- Privacy: Most DEXs don't require you to submit personal documents or go through a lengthy verification (KYC) process, offering greater anonymity.

- Access to New Tokens: The hottest new tokens and experimental projects almost always appear on DEXs long before they get the nod from a major CEX.

Recent market data shows a fascinating shift in trader behavior. While top CEXs saw their Q2 2025 spot trading volume drop by 27.7% to $3.9 trillion, DEXs were booming. Their trading volume actually jumped by 25.3% to $876.3 billion in the same period. One platform, PancakeSwap, saw its volume explode by an incredible 539.2%. This trend strongly suggests that a growing number of traders are choosing the control and autonomy that decentralized platforms offer.

Frequently Asked Questions About Spot Trading

Even after getting the basics down, you probably still have some questions about how crypto spot trading actually works day-to-day. Let's tackle some of the most common ones to help clear things up and get you more comfortable.

Think of this as the final piece of the puzzle to understanding what is spot trading in crypto before you dive in.

Is Spot Trading the Best Choice for Beginners?

For most newcomers, the answer is a resounding yes. Spot trading is the most direct and intuitive way to get started with crypto. You're simply buying an asset at its current market price. It’s clean and simple.

You don't have to worry about the complexities of leverage or the pressure of expiry dates that come with futures or options trading. Because of this, your risk is capped at the amount you invest. This makes it a much less intimidating way to learn the ropes of the crypto market without the higher stakes of more advanced strategies.

How Is Spot Trading Different from Futures Trading?

The main distinction boils down to two things: ownership and timing.

- Spot Trading: You're buying the actual cryptocurrency. The moment the trade is complete, you own the coins. They're yours to hold, send to another wallet, or sell whenever you want.

- Futures Trading: You aren't buying the crypto itself. Instead, you're buying a contract that obligates you to buy or sell a cryptocurrency at a set price on a specific date in the future. It’s all about betting on where the price is headed.

Here’s an analogy: Spot trading is like walking into a store, buying a bar of gold, and taking it home with you. Futures trading is like signing a paper today that locks you into buying that same gold bar in three months at a price agreed upon now.

The bottom line is this: spot trading is about owning the asset right now. Futures trading is about making a deal based on where you think the price will be later.

How Are Profits from Spot Trading Taxed?

This is a big one, and the rules change dramatically depending on where you live. It is absolutely essential to speak with a qualified tax advisor in your country.

That said, in many places like the United States, crypto is treated as property for tax purposes. This generally means that when you sell a crypto asset for more than you paid for it on a spot market, you’ll have to pay a capital gains tax. The tax rate often depends on how long you held the asset. Gains from assets held for less than a year (short-term) are typically taxed at a higher rate than those held for over a year (long-term). Keeping meticulous records of your trades—dates, prices, and amounts—is non-negotiable for staying compliant.

What Does All the Jargon Mean?

The crypto world has its own language, and it can feel like a lot at first. You'll constantly run into terms like "HODL," "FUD," "gas fees," and "DeFi."

Don't let it scare you off. Having a good place to look these up makes all the difference. For a fantastic, all-in-one glossary covering terms you’ll see in crypto and beyond, check out this Web3 Dictionary.

Ready to streamline your business's digital currency operations? BlockBee provides a secure, non-custodial crypto payment gateway that makes it easy to accept payments and manage payouts. Take full control of your assets with our developer-friendly tools and dedicated support.