How to Set Up Online Payments A Practical Guide

So you're ready to start accepting payments online. The first thing you'll need is a way to securely grab customer card details—that's your payment gateway. Then you need something to actually talk to the banks and move the money, which is where a payment processor comes in.

Thankfully, you don't always have to juggle separate services. Modern solutions like BlockBee often roll all of this into one package, making setup as simple as installing a plugin or connecting an API to your site.

What's Running Under the Hood?

Before we get into the nuts and bolts of the setup, it helps to understand what’s actually happening behind the scenes. Think of it like looking at a map before a road trip. Knowing how the pieces fit together will help you make smarter choices for your business and troubleshoot any issues down the line.

The whole magic of an online transaction relies on a few key players working together seamlessly to get money from your customer’s wallet into your bank account.

The Key Players in Every Transaction

At its core, every online sale involves a few essential components. While some providers bundle them together, knowing what each one does is crucial.

Payment Gateway: This is your digital cash register. It’s the secure storefront technology that captures a customer’s payment info, encrypts it, and sends it on its way.

Payment Processor: Think of the processor as the middleman. It takes the encrypted data from the gateway and does the heavy lifting, talking to the customer's bank and your bank to get the transaction approved.

Merchant Account: This isn't your standard business bank account. It's a special holding account where funds from card transactions sit until they're cleared and ready to be transferred to you.

It really boils down to this: the gateway is the secure messenger, the processor is the financial go-between, and the merchant account is the temporary vault for your money.

To make this even clearer, let's break down these essential services.

| Component | Primary Function | Why It's Important |

|---|---|---|

| Payment Gateway | Securely captures and encrypts customer payment data at checkout. | Protects sensitive information, preventing fraud and building customer trust. |

| Payment Processor | Communicates with the customer's and merchant's banks to authorize the transaction. | Facilitates the actual fund transfer and ensures the payment is valid. |

| Merchant Account | A special bank account that holds funds from card payments before settlement. | Acts as a necessary intermediary between the processor and your business bank account. |

Having a solid grasp of these components is the first step. They form the foundation of any online payment system, whether you're selling a physical product or a digital service.

Digital Wallets Are No Longer Optional

The game has changed. It's not just about accepting Visa or Mastercard anymore. The explosion of digital wallets like Apple Pay, Google Pay, and PayPal has completely reshaped what customers expect when they hit "buy." These wallets offer a one-click experience that's both faster and more secure.

This isn't just a small trend—it's a massive shift in consumer behavior. Back in 2014, digital payments were part of just 34% of e-commerce sales. By 2028, that number is expected to hit a staggering 79%.

What's driving this? The sheer number of people using digital wallets. We're looking at a jump from 3.7 billion users in 2023 to 5.4 billion by 2028. That’s 60% of the world's population. If you're not offering these options, you're putting a roadblock in front of a huge portion of your potential customers. Digging into the latest online payment statistics really puts this into perspective.

Choosing the Right Online Payment Solution

Picking a payment provider can feel overwhelming, but it really just comes down to finding the right partner for your specific business. It’s easy to get fixated on transaction fees, but the best way to figure out how to set up online payments is to think about how each option will work for you day in and day out.

For example, an all-in-one solution like Stripe or PayPal is incredibly convenient. They package the gateway, processor, and merchant account all together, which is a lifesaver for new businesses or anyone who just wants to get up and running fast.

On the flip side, a traditional merchant account can make a lot more sense financially if you’re processing a high volume of sales. Sure, there’s more paperwork and you have to juggle a few different services, but those lower per-transaction rates really add up. You're essentially trading a bit of simplicity for significant long-term savings.

Comparing Payment Solution Types

To help you decide, here’s a quick overview of the main payment provider models and who they're best suited for.

| Solution Type | Best For | Key Advantage | Potential Drawback |

|---|---|---|---|

| Payment Aggregator (e.g., Stripe, PayPal) | Startups, small businesses, and those who prioritize simplicity. | Fast setup, all-in-one convenience, and no complex underwriting. | Higher per-transaction fees, less control over funds. |

| Traditional Merchant Account | High-volume sellers, established businesses, high-risk industries. | Lower transaction rates, more direct control over your funds. | Longer application process, requires separate gateway. |

| Payment Gateway Only (e.g., Authorize.net) | Businesses that already have a merchant account and need a secure way to connect. | Flexibility to choose your own merchant account provider. | Adds another layer of management and potential cost. |

Ultimately, this choice depends on your sales volume, risk profile, and how much hands-on management you’re willing to do.

Evaluating Your Core Needs

Before you sign on the dotted line, you need to be brutally honest about what you absolutely need. Forget the bells and whistles for a moment and focus on the fundamentals that will make or break your daily operations.

- Integration Ease: How easily will this thing actually connect to your website? If you’re not a developer, look for ready-made plugins for platforms like Shopify or WooCommerce. A painful integration can cost you a lot of time and money.

- Supported Currencies: Planning to sell globally? Make sure the provider can handle payments from your key international markets. The last thing you want is a checkout process that alienates potential customers.

- Customer Support: This is a big one. When a payment fails during a major sale, you need a real person you can talk to, not just a chatbot. Think of good support as an insurance policy for your revenue.

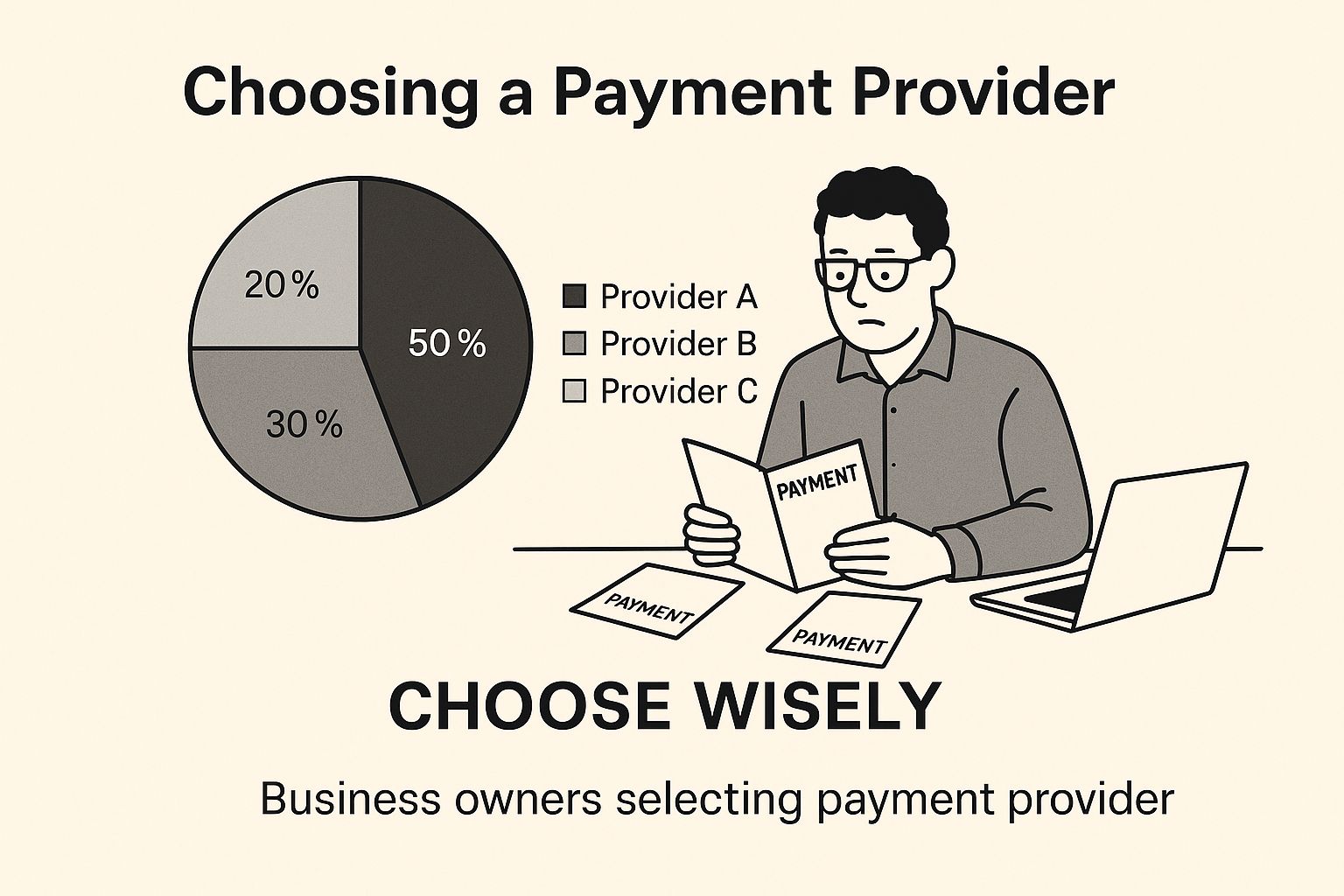

This infographic is a great visual reminder of why you need to weigh your options carefully before jumping in.

It really drives home the point that your payment provider is a foundational piece of your business. Don't just skim the surface.

Matching the Solution to Your Business Model

There is no "best" provider—only the best provider for you. A one-size-fits-all approach is a recipe for frustration.

Think about a subscription box service. Their needs are completely different from a typical e-commerce store. They need bulletproof recurring billing, smart dunning management for failed payments, and a simple way for customers to tweak their own plans. A provider that’s weak in these areas would be a constant headache.

Likewise, a business selling high-ticket items might find that offering "buy now, pay later" (BNPL) options from services like Klarna or Afterpay is a game-changer for conversions. Also, merchants in certain industries often need to look specifically at the top high-risk merchant account providers to find a partner who understands their unique challenges.

Key Takeaway: Your business model should drive your decision. Don't get swayed by popularity; pick the solution that solves your real-world problems.

If you want to dig deeper into specific options, our guide on choosing the https://blockbee.io/blog/post/best-payment-gateway-for-ecommerce is a great next step. Taking the time now to match a provider's strengths to your business needs will save you a world of trouble and lost sales down the road.

Getting Payments Plugged Into Your Website

Alright, this is where the rubber meets the road. You’ve picked your payment provider, and now it's time to actually connect it to your online store. How you handle this part of the setup has a huge impact on everything from your site's security to how many customers actually complete their purchase.

The good news is, you've got a few different ways to tackle this. Each one is built for different technical comfort levels and business needs. The end goal is always the same: create a smooth, mobile-friendly, and secure checkout that makes customers feel confident handing over their payment info.

Picking Your Integration Path

The right method really boils down to your website platform, your team's technical skills, and how much you want to customize the checkout experience. Let's walk through the main options you'll encounter.

- Plugins and Extensions: If you're on a popular platform like Shopify, WooCommerce, or Magento, this is your express lane. Plugins are essentially pre-built connectors that you can install in a few clicks to link your store directly to the payment gateway.

- Hosted Payment Pages: This is a fantastic choice if you want to bolster security without needing a developer on standby. When a customer is ready to pay, they're sent to a secure page hosted by your payment provider. This keeps sensitive card data completely off your servers and makes your life a lot easier when it comes to PCI compliance.

- API Integration: For anyone who wants total control over the checkout process, a direct API integration is the gold standard. It gives your developers the power to build a fully custom payment flow that looks and feels exactly like the rest of your brand, keeping customers on your site the entire time.

For most businesses running on something like WordPress with WooCommerce, grabbing a plugin is a no-brainer. It's an incredibly simple and effective way to start accepting payments, often in less than an hour.

The Easy Route: Setting Up With Plugins

If your store is on a major e-commerce platform, your first stop should be its app or plugin marketplace. Just search for your payment provider—for example, BlockBee has official plugins for all the big players—and follow the prompts.

The process almost always looks something like this:

- Install the plugin right from your platform’s dashboard.

- Find the plugin’s settings page.

- Copy and paste your API keys, which you'll find in your payment provider's account.

Once you save those settings, the new payment options should pop up on your checkout page automatically. It’s a method built for merchants who want to spend their time selling products, not writing code.

Pro Tip: Never skip testing. Always use a "sandbox" or "test mode" before you go live. This lets you run a bunch of fake transactions to make sure every part of the process works perfectly without actually charging a real credit card.

The Power-User Path: Custom API Integration

While plugins are all about speed and simplicity, a direct API integration is about total control and flexibility. This is the path for custom-built websites or businesses with unique needs, like complex subscription models or splitting payments in a marketplace. An API gives your developers the building blocks to weave the payment process directly into your user experience.

This approach definitely requires more technical know-how, but the payoff is huge. You can design a completely seamless, on-brand checkout that builds maximum trust with your customers.

If this sounds like the right direction for you, our guide on payment gateway API integration is a great next step. It gets into the nitty-gritty of the technical side and the benefits you can expect. By weighing these options, you can confidently choose the integration path that fits your goals and gets you to a secure, efficient payment setup.

Mastering Global Commerce and Cross-Border Payments

Taking your business international is a huge step. It opens up a world of new customers, but it also throws a wrench into the simple online payments you're used to. To really succeed at selling across borders, you have to get comfortable with the unique challenges of global commerce.

This is about way more than just accepting a credit card from another country. You're suddenly dealing with currency conversions, confusing international transaction fees, and wildly different local payment habits. These are the details that can make or break a sale when a customer is thousands of miles away.

Why You Can't Ignore Local Payment Methods

Let's put this into perspective. A customer in Germany is ready to buy from your store. They get to the checkout page, and they're looking for Giropay or SOFORT—popular bank transfer methods they use every day. If they don't see those options, there's a good chance they'll just leave. Gone.

Offering payment methods that people already know and trust is one of the most powerful things you can do to boost conversion rates. It’s a clear signal to international shoppers that you're serious about their business. That small bit of familiarity builds instant trust and can have a massive impact on your global sales figures.

The entire cross-border payment world is exploding. We're talking about a market that hit $194.6 trillion in 2024 and is on track to reach an incredible $320 trillion by 2032. This isn't just a slow trickle; it's a flood, driven by customers who want fast, reliable payments. More than 70 countries have already rolled out real-time payment systems, and that network is spreading globally. You can get a more detailed breakdown from these cross-border payment insights from J.P. Morgan.

Tackling Currency and Conversion Head-On

One of the quickest ways to lose an international sale is to show prices only in your home currency. It forces the customer to do mental math and guess the final cost, creating a moment of hesitation that often ends with an abandoned cart.

The fix? Show prices in their local currency. A modern payment solution can handle all the conversions in the background, giving your customers a clear, simple price from start to finish. This small change completely avoids the nasty surprises—like currency mismatches or unexpected bank fees—that cause so many international transactions to fail.

The goal is to make a purchase from another country feel just as simple and secure as buying from a local shop. Transparency in pricing and currency is non-negotiable for building that trust.

If you're looking to get this right, digging into the mechanics of multi-currency payment processing is your next step. It's the technical foundation you need to build a checkout experience that makes international customers feel right at home. Nail these details, and you’ll be ready to expand into new markets with confidence, turning global opportunities into real, tangible revenue.

Keeping Your Payments and Customers Safe

When you're dealing with online payments, customer trust is everything. Each time someone clicks "buy," they're not just purchasing a product; they're trusting you with their sensitive financial details. This makes security more than just a box to tick—it's the bedrock of your reputation.

One small mistake can shatter that trust instantly. That’s why it’s so important to understand your security responsibilities from the get-go.

Understanding PCI Compliance

You've probably heard of the Payment Card Industry Data Security Standard (PCI DSS). It’s the set of rules every merchant has to follow when accepting credit cards. It can sound pretty daunting, but the good news is that your choice of payment provider can make a world of difference.

By using a solution like BlockBee, which often employs hosted payment pages, you ensure sensitive card data never even passes through your servers. Your provider shoulders the major PCI compliance burden, which is a huge weight off your shoulders. They maintain the necessary certifications, leaving you with a much simpler, more manageable list of responsibilities.

Your Toolkit for Fighting Fraud

Beyond basic compliance, you need a proactive strategy to prevent fraud. These tools act like a vigilant security team, verifying that every transaction is legitimate and protecting both you and your customers from bad actors.

Here are a few essential tools you should be familiar with:

- Address Verification Service (AVS): This is a simple but effective check. It compares the billing address the customer enters with the one their card issuer has on file.

- Card Verification Value (CVV): You know that little three or four-digit code on the back of a credit card? Requiring it proves that the customer physically possesses the card.

- SSL Certificates: Understanding the importance of an SSL Certificate is crucial. It encrypts the connection between your customer's browser and your website, keeping their data private and secure.

Many modern payment gateways go a step further, using AI to detect unusual transaction patterns in real time. This kind of intelligent monitoring can catch sophisticated fraud that older, manual checks might miss, stopping problems before they start.

The digital payments market is absolutely massive and continues to grow. Projections estimate it could reach nearly US$20.09 trillion by 2025, a boom fueled by the relentless expansion of e-commerce.

This explosive growth is precisely why ironclad security isn't just an option—it's a necessity. Building a secure payment environment is how you build a brand that people trust.

Common Questions About Setting Up Online Payments

Jumping into online payments for the first time? It's totally normal to have a few questions. Getting a handle on the basics is the first step to making a smart decision for your business. Let's walk through some of the things that come up most often when merchants are getting started.

What Is the Difference Between a Payment Gateway and a Payment Processor?

It’s easy to see why people get these two mixed up, but the distinction is pretty simple when you break it down.

Think of the payment gateway as the virtual equivalent of a credit card terminal you'd see in a physical store. It’s the secure tech on your website that encrypts a customer's payment details the moment they hit "Buy Now" and sends them on their way.

The payment processor is the one doing the financial legwork behind the scenes. It takes that encrypted information from the gateway and communicates with the customer's bank and your bank to make sure the funds are available and the transaction is approved.

Thankfully, many modern services like Stripe or PayPal bundle these two functions together. This makes life a whole lot easier, especially if you’re just starting out and don’t want to juggle multiple vendors.

How Much Does It Really Cost to Accept Online Payments?

This is the big one, and the answer is... it depends. The most common pricing model you'll run into is a per-transaction fee, often something like 2.9% + $0.30 for every payment you process. On top of that, some providers might charge a monthly subscription fee.

All-in-one platforms are usually very transparent with their pricing, which is great for predictability. On the other hand, you might see traditional merchant accounts advertising lower rates. While that can be tempting for businesses with huge sales volumes, be careful. They often come with a more complicated fee structure, including setup costs, monthly minimums, and sometimes long-term contracts you can't easily get out of.

The key takeaway here is to look past the advertised rate. You have to factor in every single potential fee—monthly charges, chargeback penalties, and anything else hiding in the fine print—to get a real picture of what it will cost your business.

Do I Have to Worry About PCI Compliance?

In a word, yes. If you accept credit card payments, you have to be PCI compliant. But don't panic—it doesn't have to be a nightmare. The smartest move for most online businesses is to choose a payment provider that takes on most of this responsibility for you.

When you use a solution with a hosted payment page, like what we offer at BlockBee, the customer's sensitive card data never actually passes through your website's servers. Your provider handles all the heavy lifting of securing that information. This dramatically shrinks your PCI compliance scope and saves you a ton of headaches. It's a proven way to stay secure without needing an in-house security expert.

Can I Accept Payments from Other Countries?

Absolutely! Going global is easier than ever. Most payment platforms today are built to handle international sales, but you need to check a few specific things before you commit.

- Supported currencies: Make sure they can process payments in the currencies your international customers actually use.

- Conversion fees: Find out exactly what it will cost you to convert that foreign currency back into your own. These fees can add up quickly.

- Local payment methods: This is a big one. Does the provider support payment options that are popular in specific countries? Think about things like iDEAL in the Netherlands or Giropay in Germany.

Letting customers pay in their own currency with a method they trust is a huge conversion booster. It builds confidence and can make all the difference in a competitive global market.

Ready to simplify your payment process with a secure, non-custodial solution? BlockBee offers lightning-fast confirmations, easy integration, and support for over 70 cryptocurrencies. Start accepting payments today.