How to Convert Crypto to Cash A Practical Guide

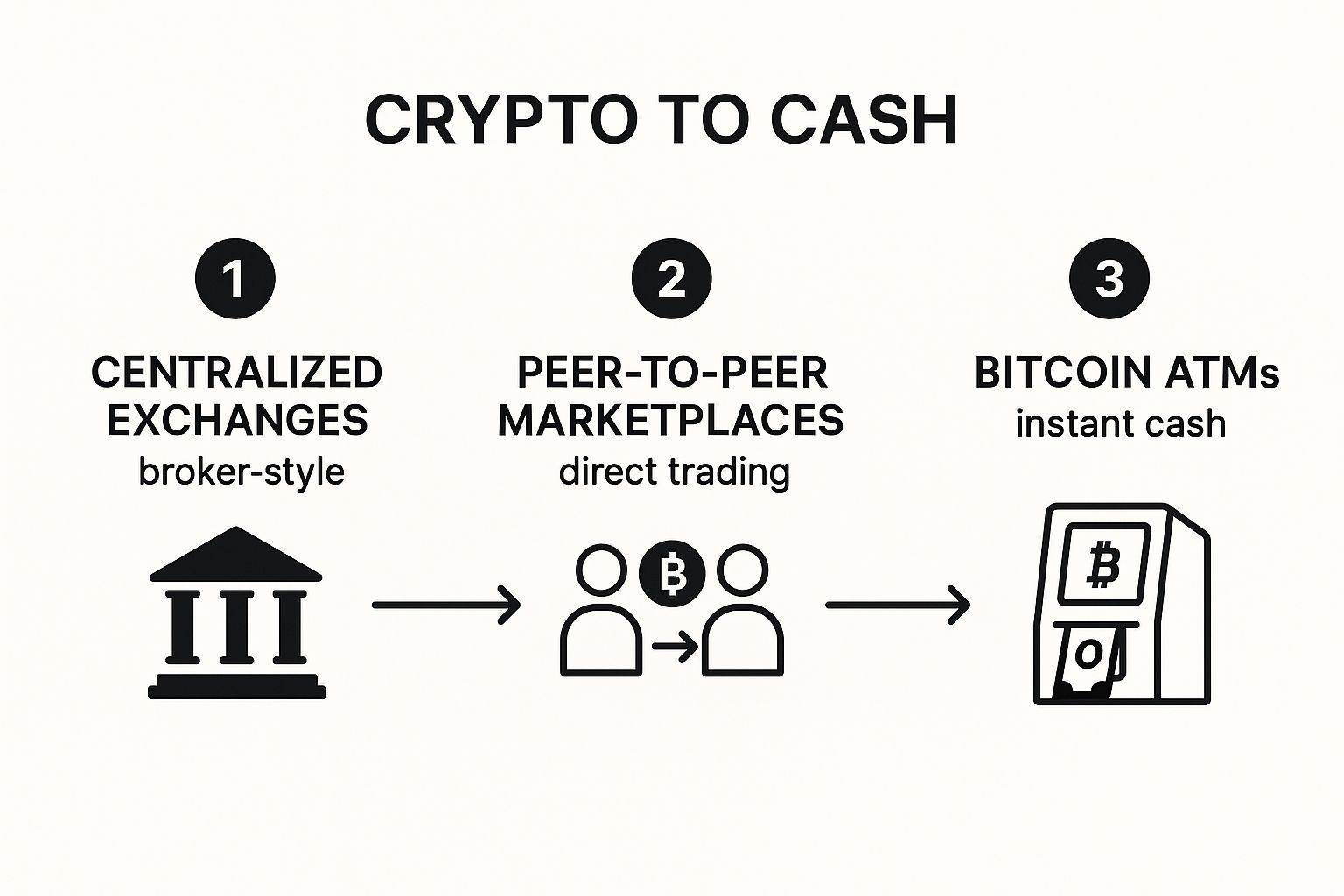

So, you have some crypto and you're ready to turn it into cash. It's a common goal, but the path you take can make a big difference. The two most well-trodden routes are using a centralized exchange (CEX), like Coinbase or Kraken, or going through a peer-to-peer (P2P) marketplace.

One is like a traditional brokerage—fast, straightforward, but with more rules. The other is more like a direct marketplace, offering flexibility but requiring a bit more hands-on effort.

Your Options for Cashing Out Crypto

Before you can cash out, you need to know where to go. Every method comes with its own trade-offs between speed, cost, and convenience. What works for a quick, small withdrawal might not be the best for a larger sum, so understanding your options is the first real step.

Centralized Exchanges vs. Peer-to-Peer Platforms

For most people dipping their toes into cashing out, a centralized exchange is the default choice. Think of it as a one-stop shop where you sell your crypto at the going market rate, and the exchange handles the conversion to dollars, euros, or whatever your local currency is. It's a simple, guided process that’s great for newcomers.

Peer-to-peer (P2P) platforms, however, operate differently. They’re essentially a classifieds board for crypto, connecting you directly with someone who wants to buy what you’re selling. This direct connection often opens up a wider world of payment methods—think bank transfers, PayPal, or even meeting up for a cash-in-hand exchange. You might even snag a better exchange rate if you're patient.

The core difference really boils down to control. With a CEX, you're trusting the platform to handle the transaction for you. On a P2P platform, you're in the driver's seat, setting the terms and dealing directly with another person.

To make the choice clearer, here’s a quick look at the most popular ways to turn your crypto into cash.

Crypto Conversion Methods at a Glance

This table gives you a high-level view of the most common methods, so you can quickly see which one might fit your needs best.

| Method | Best For | Typical Speed | Anonymity Level |

|---|---|---|---|

| Centralized Exchanges | Beginners and large amounts | 1-5 business days | Low (KYC required) |

| Peer-to-Peer (P2P) | Flexibility and payment options | Varies (minutes to hours) | Medium to High |

| Bitcoin ATMs | Quick, small cash withdrawals | Instant | High |

| Crypto Debit Cards | Spending crypto directly | Instant | Low (KYC required) |

Each of these avenues has its place. A Bitcoin ATM is fantastic for grabbing $100 on the go, but a CEX is probably your best bet for cashing out a larger portfolio. It all depends on what you're trying to accomplish.

Choosing the Right Crypto Conversion Method

So, you're ready to turn some of your crypto into cash. The good news is you have options. The path you choose really comes down to what you value most—is it speed, convenience, or having total control over the deal?

Most people, especially when they're starting out, head straight for a Centralized Exchange (CEX). These platforms act a lot like the online stockbrokers you're already familiar with. They create a straightforward, regulated space where you can sell your crypto for cash at the going market rate. They take care of the heavy lifting, which makes them a really popular way to "off-ramp."

Centralized Exchanges: The Main Highway to Cash

Platforms like Coinbase or Kraken are the primary on-ramps and off-ramps for a reason. The process is simple: you send your crypto to your exchange wallet, sell it on the open market, and then withdraw the cash directly to your bank account. It’s a well-trodden path that millions of people trust because it's secure and predictable.

The data backs this up. Just look at Bitcoin—between July 2024 and June 2025, it was the gateway for over $4.6 trillion in fiat inflows. This number absolutely towers over other coins and shows just how critical it is as a bridge between crypto and traditional finance. If you're a data nerd, you can dig deeper into global crypto trends with reports from firms like Chainalysis.

Peer-to-Peer Marketplaces: More Control, More Options

If the structured world of a CEX feels a bit restrictive, you might want to check out a Peer-to-Peer (P2P) marketplace. These services connect you directly with another person who wants to buy what you're selling. Instead of dealing with a corporation, you're trading with an individual, which unlocks a much wider range of payment methods.

Need the money sent to a specific digital wallet? Or maybe you want to arrange a face-to-face cash exchange? P2P platforms make that happen. You can scroll through buy offers, comparing rates and payment types to find the perfect match for your situation. It puts you in the driver's seat.

Key Takeaway: Centralized exchanges are fantastic for their simplicity and direct-to-bank withdrawals. Peer-to-Peer marketplaces, on the other hand, offer incredible flexibility, letting you pick your payment method and negotiate terms directly with buyers.

For anyone just getting their feet wet, it's a good idea to compare the best crypto converter platforms to figure out which one fits your goals.

Beyond these two main routes, a couple of other methods are worth knowing about:

- Bitcoin ATMs: These are great for quickly swapping a small amount of Bitcoin for physical cash. Just be prepared for the convenience fees, which can be pretty steep.

- Crypto Debit Cards: These let you skip the conversion process altogether. You can spend your crypto just like cash at any store that accepts major credit cards, both online and in person.

Your Practical Guide to Cashing Out

So, you're ready to turn your crypto gains into actual cash. Moving funds from a digital wallet to your bank account might seem complicated, but it's a pretty straightforward process when you break it down.

First things first: you need to get your crypto onto an exchange. This means finding the "deposit" address on the exchange for the specific coin you want to sell. A word of caution from experience: triple-check that you're sending your assets on the correct blockchain network. If you accidentally send ETH on the BSC network, for instance, your funds could be lost forever. It's a costly mistake I've seen happen too many times.

Once the crypto lands in your exchange account, it's time to sell. You'll generally have two choices: market orders or limit orders.

A market order is the "sell it now" button. It offloads your crypto at the best price available at that exact moment, which is great if you're in a hurry. A limit order, on the other hand, gives you more control. You set the price you want to sell at, and the order only goes through when the market hits that price.

I've learned the hard way that using a market order during a volatile price swing can be a recipe for disappointment. You might end up with way less cash than you anticipated. If speed isn't your top priority, a limit order almost always gives you a more predictable outcome.

The exact steps for converting your crypto to cash will change a bit depending on whether you're using an exchange, a P2P platform, or a crypto ATM. This visual gives a great overview of how each path works.

As you can see, exchanges offer a structured, almost traditional process, while P2P and ATMs provide more direct and flexible options. If you need a more granular walkthrough, especially for major assets, this guide on how to sell Bitcoin is a fantastic resource.

Completing the Withdrawal

After the sale, your crypto is now fiat currency sitting in your exchange account. The final step is getting that money into your personal bank account. You'll need to link your bank by providing your account and routing numbers. Once that's set up, you can start the withdrawal.

Just keep a couple of things in mind here:

- Processing Times: This isn't an instant process. Depending on the withdrawal method you choose (like ACH or a wire transfer), it can take anywhere from 1 to 5 business days for the money to actually show up in your bank.

- Withdrawal Limits: Nearly every exchange imposes daily or monthly limits on how much cash you can pull out. If you're moving a significant sum, you might need to plan your withdrawals over a few days or weeks to stay within those limits.

Navigating Security and Compliance

When you're ready to turn your crypto into cash, you’re stepping into a regulated world. It might feel like a hassle when a platform asks for your ID, but those checks are there for a reason. Reputable exchanges are following global rules to protect everyone involved.

These standards are known as Know Your Customer (KYC) and Anti-Money Laundering (AML), and they're your first line of defense against fraud. By making sure everyone is who they say they are, exchanges make it incredibly difficult for bad actors to use their services for shady purposes. This ultimately makes the entire system safer for legitimate users like you. Getting familiar with what KYC in crypto entails is a smart move before you start the off-ramping process.

These rules aren't just for show. They're a direct response to real financial crime. For instance, in the first half of 2025, centralized exchanges saw inflows from illicit sources get close to $7 billion. The good news is that direct transfers from these sources are dropping—down from over 40% in 2021-2022 to about 15% in 2025—as exchanges get better at spotting them. You can learn more about this by exploring the landscape of seizable crypto assets in 2025.

Fortifying Your Accounts

While exchanges do their part, your personal security habits are what really keep your crypto safe. A strong password just doesn't cut it anymore.

Here are a few security measures I never skip:

- Two-Factor Authentication (2FA) is a must. Use an authenticator app like Google Authenticator or, even better, a physical hardware key. While SMS codes are an option, they're vulnerable to SIM-swapping attacks, so I'd avoid them if you can.

- Whitelist your withdrawal addresses. This brilliant feature lets you lock withdrawals to a list of pre-approved addresses. So even if a hacker somehow gets into your account, they can't send your funds to their own wallet.

- Watch out for phishing. Always, always double-check the URL before you enter your login details. Scammers are experts at creating fake sites that look identical to the real thing. My advice? Bookmark the exchanges you use and only access them that way.

Think of your account security like layers of an onion. A password is the outer layer, but 2FA and address whitelisting add critical inner layers that make it exponentially harder for anyone to access your funds.

Automating Crypto Payouts for Your Business

If you run a business or work as a freelancer, you know that turning crypto into cash can be a real headache. The whole manual process—sending crypto from a wallet to an exchange, trying to sell at a good price, then waiting for a bank withdrawal—eats up time and leaves you exposed to the market's wild swings.

This is exactly where automated payout tools come into play. They completely change the game. Instead of juggling a half-dozen steps, you can use a service that does all the heavy lifting for you. Picture this: a client pays you in ETH, and that payment is instantly converted and sent to your bank account as USD or EUR. No manual intervention required.

Making Your Crypto-to-Fiat Workflow Effortless

An automated system like this cuts out the tedious manual work that can easily consume hours of your week. More importantly, it’s a brilliant way to manage risk. By converting crypto to fiat almost immediately, you shield your business from the sudden price drops that can wipe out your profits.

This also makes global operations so much simpler. Need to pay a contractor in London? No problem. You can pay them in their local currency, even if your revenue came in as Bitcoin. The system just handles the conversion behind the scenes.

The BlockBee Payouts dashboard gives you a clean, simple overview of everything, so you can track all your conversions without breaking a sweat.

Having a central hub like this means you always know exactly what’s happening with your money, from the moment a payment comes in to when it hits your bank.

The real win here is transforming a complicated financial chore into a simple, "set it and forget it" workflow. It frees you up to focus on your business, slashes your risk, and makes crypto a genuinely practical tool for day-to-day operations.

This kind of automation is perfect for everything from running payroll to paying suppliers. To see how it works in detail, check out our guide on automated payouts for BlockBee users. It’s about making crypto work for you, not making you work for your crypto.

The Shrinking Gap Between Crypto and Cash

It wasn't that long ago that cashing out your crypto felt like a complicated, back-alley deal. Today, the wall between digital assets and traditional banking is crumbling, and turning your crypto into cash is becoming surprisingly straightforward.

This shift isn't happening in a vacuum. Major moves, like the approval of Bitcoin ETFs, are pulling crypto into the mainstream investment world. At the same time, we're seeing real-world assets—everything from real estate to art—being tokenized and traded on the blockchain.

What this all means is that the entire crypto ecosystem is growing up. As the rules of the road (regulation) become clearer and big financial institutions jump in, cashing out is no longer a niche skill for tech wizards. It’s becoming just another financial transaction, with the added security and efficiency you'd expect.

Mainstream Is Closer Than You Think

The numbers really tell the story here. In 2024 alone, the total crypto transaction volume shot past $10.6 trillion. Even more telling is that shady dealings dropped to just 0.4% of that total, a significant decrease from 0.9% the year before. The industry is cleaning up its act. For a deeper dive into these trends, check out the 2025 crypto forecast on Mastercard's official insights page.

Think about it: we're fast approaching a time where converting your crypto to cash will feel as normal as moving money from your savings to your checking account.

Ultimately, we're building a new financial world where digital money and regular old cash live side-by-side. This integration promises faster, more secure, and more accessible ways for everyone to manage their wealth. The future of off-ramping isn't just coming; it's practically here.

Got Questions? We've Got Answers

When it comes to cashing out your crypto, a few common questions always surface. Let's tackle the big ones head-on so you know exactly what to expect.

How Do Taxes Work When I Cash Out?

This is the big one. In most places, selling your crypto for cash is a taxable event. Think of it like selling stocks—if you made a profit on the sale, you'll likely owe capital gains tax. The rules can get complicated, so it's always a smart move to chat with a tax professional who understands the crypto space. They can help you stay compliant and avoid any nasty surprises later on.

How Long Until I See the Money in My Bank?

The actual sale of your crypto on an exchange happens almost instantly. The part that takes time is getting the cash from the exchange into your bank account.

You can generally expect this to take anywhere from 1-5 business days. The exact timing really depends on the exchange you're using, your bank's processing times, and the withdrawal method you choose (like an ACH transfer versus a wire).

Is It Safe to Link My Bank Account to an Exchange?

It's a valid concern, and the short answer is yes, it's generally safe—if you stick with reputable, well-established exchanges. These platforms invest heavily in security to protect your information.

That said, you have a role to play too. The single most important thing you can do is enable two-factor authentication (2FA) on your account. It adds a crucial layer of protection that makes it much harder for anyone to gain unauthorized access.

Ready to make your business's crypto-to-fiat process seamless? BlockBee automates payouts, which saves you a ton of time and cuts down on risk.

Find out how it works and get started over at BlockBee's official website.