Discover Your ecommerce merchant account: The Complete Guide

An ecommerce merchant account is a special kind of bank account that gives your online business the green light to accept credit and debit card payments. It’s not your everyday business checking account; instead, it acts as a secure holding pen for customer funds before they officially land in your pocket.

Think of it as the digital version of a cash drawer.

The Digital Vault Your Online Store Can't Live Without

At its heart, an ecommerce merchant account is the financial engine of your online store. It's a formal agreement you make with an acquiring bank, specifically so you can process what are known as "card-not-present" transactions—the bread and butter of online retail.

When a customer clicks "buy" on your site, the money doesn't just teleport into your business account. It has to travel through a secure, multi-step process first. The merchant account is the final stop on that journey, a place where the funds are verified and held safely before being released to you. It's the system that ensures the money is real and the transaction is legitimate.

Your Account's Role in the Payment Journey

This whole dance happens in the blink of an eye, but there are a few key players working behind the scenes. Your ecommerce merchant account is right in the middle of it all, acting as a crucial intermediary. Without one, the entire flow of money from customer to company simply grinds to a halt.

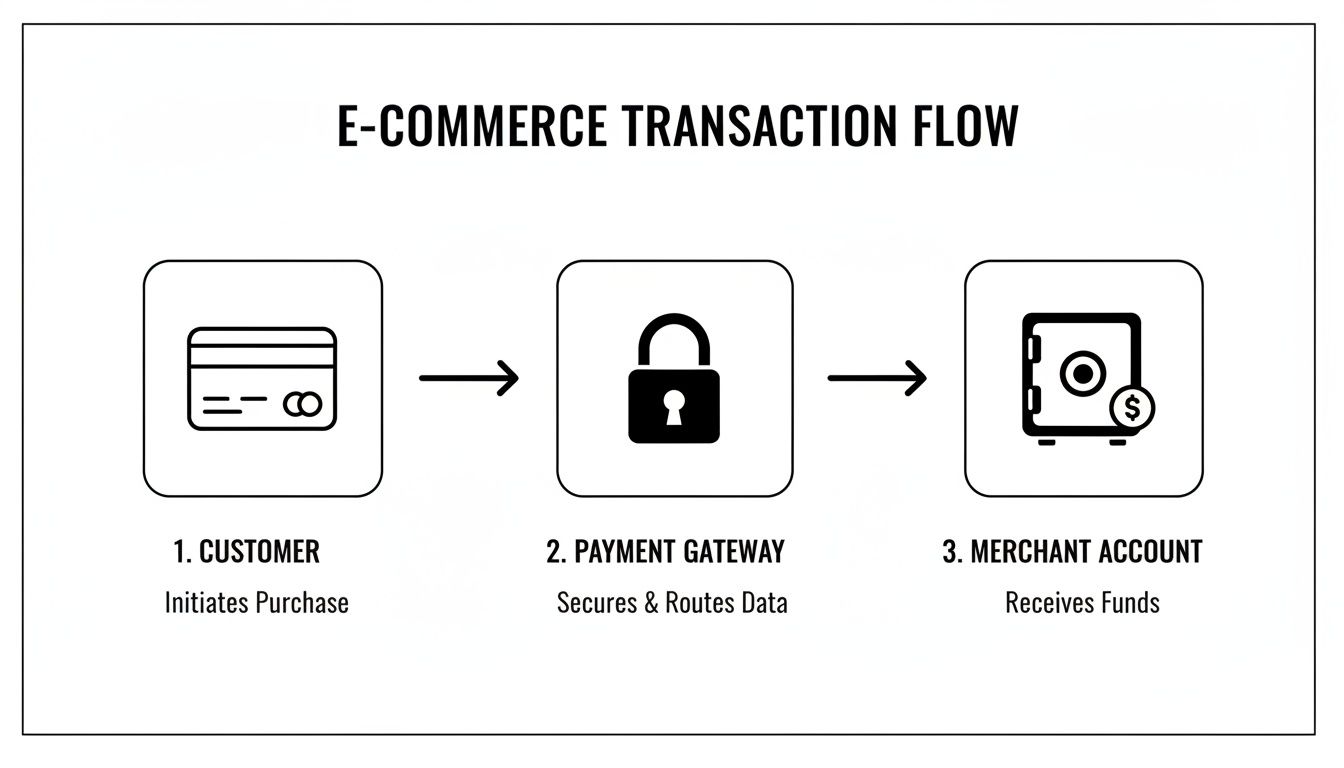

This flowchart breaks down the journey a payment takes from the customer’s checkout to your account.

As you can see, the merchant account is the secure vault where the money collects after the payment gateway gives the initial thumbs-up.

This kind of digital plumbing has never been more important. With global ecommerce sales expected to rocket to $6.86 trillion in 2025, this system has become the engine of modern retail. That means nearly 21% of all retail sales will soon be happening online, highlighting just how essential a solid payment setup is. Understanding the wider context of the e-commerce landscape in New Zealand, for example, shows just how vital these secure payment solutions are in markets all over the world.

A common point of confusion is the difference between a merchant account and a payment gateway. The gateway is the secure messenger that encrypts and transmits card data, while the merchant account is the vault that actually holds the money.

To make this crystal clear, let's break down their distinct roles.

Merchant Account vs Payment Gateway at a Glance

This quick comparison should clear up any confusion about who does what during an online transaction. They work together, but they are not the same thing.

| Feature | Merchant Account | Payment Gateway |

|---|---|---|

| Primary Role | Holds funds from transactions | Securely transmits payment data |

| Analogy | A secure bank vault | An armored truck |

| Main Function | Authorizes and settles payments | Encrypts and validates card info |

| Provider | An acquiring bank or provider | A technology service provider |

| When It's Used | Throughout the entire transaction | At the very beginning of the checkout |

In short, the payment gateway is the bouncer at the door checking IDs, and the merchant account is the secure room inside where the cash is counted and held. You need both to run a successful online store.

Decoding Merchant Account Costs and Fees

Let's be honest: trying to understand the financial side of a merchant account can feel like decoding a secret language. The fee structures often seem complex on purpose, but getting a firm grip on them is absolutely critical for your store's profitability.

When it comes down to it, every transaction fee you pay is a mix of three distinct parts. Think of them like ingredients in a recipe—each one has a specific role, and the final price tag depends on how much of each is in the mix.

The Three Core Fee Components

Every single time a customer swipes, taps, or types in their card details, three main charges get bundled together. Once you know what they are, your monthly statement starts to make a lot more sense.

Interchange Fees: This is the big one. Interchange makes up the largest chunk of your processing costs and is paid directly to the customer’s bank (like Chase or Bank of America). It's essentially their cut for taking on the risk and fronting the money. These rates are set by the card networks (Visa, Mastercard, etc.) and are completely non-negotiable.

Assessment Fees: This is a much smaller fee that goes straight to the card networks themselves—Visa, Mastercard, Discover, and Amex—just for using their payment systems. Just like interchange, this fee is fixed and non-negotiable.

Processor Markup: Here’s where you have some wiggle room. This is the fee your merchant account provider tacks on top of the other two for providing their technology, customer support, and other services. It's their profit margin, and it's the one part of the cost you can actually negotiate.

These three components are then packaged and sold to you through a few different pricing models. Your business's sales volume and average ticket size will play a huge role in which model works best for you.

Common Pricing Models Explained

Providers rarely show you all three fees separately. Instead, they use pricing models to simplify—or sometimes, to obscure—the costs.

For most established businesses, the Interchange-Plus model is the gold standard. It’s the most transparent because it clearly separates the wholesale costs from the processor's markup, so you always know exactly what you’re paying for.

Here’s a quick rundown of what you’ll encounter:

Flat-Rate Pricing: Simple and predictable. You pay one consistent percentage plus a fixed transaction fee, no matter what kind of card is used. This is the model made famous by platforms like Stripe and PayPal. It's fantastic for startups that need predictability, but it can become the most expensive option as your sales grow.

Interchange-Plus Pricing: Often called "cost-plus," this model is all about transparency. The provider passes the true interchange and assessment fees directly to you and adds their own clear, pre-negotiated markup (e.g., "Interchange + 0.20% + $0.10"). While it’s incredibly fair, the fluctuating interchange rates can make forecasting your exact monthly costs a bit tricky.

Tiered Pricing: This model tries to simplify things by bucketing hundreds of different interchange rates into three or four tiers, usually called "Qualified," "Mid-Qualified," and "Non-Qualified." It looks simple at first glance, but it’s often the least transparent model, as the processor gets to decide which transactions get bumped into the more expensive tiers.

Watch Out for Hidden Fees

The per-transaction cost is only part of the story. Many providers load up their monthly statements with a variety of other charges. Spotting these "hidden" fees is essential to understanding the true cost of your ecommerce merchant account. For a more detailed look, check out our payment processing fees comparison guide.

Keep an eye out for these common line items:

- Monthly Fees: A recurring charge just for keeping the account open.

- PCI Compliance Fees: A fee to cover the cost of ensuring you meet the Payment Card Industry’s security standards.

- Chargeback Fees: A penalty you’re charged every time a customer disputes a transaction.

- Early Termination Fees (ETF): A hefty fine if you decide to leave your contract before it's up.

- Monthly Minimums: A fee that kicks in if your processing volume dips below a certain threshold.

Passing the Underwriting and Approval Process

Getting approved for an ecommerce merchant account isn't like opening a checking account. It's a full-blown risk assessment. Providers are essentially placing a bet on your business's stability, and their underwriting process is how they calculate the odds.

They’re really just trying to answer one crucial question: "How likely is this business to cause us headaches with costly chargebacks or fraud?"

This deep dive is called underwriting. Think of it as a financial background check for your company. The provider pores over your business model, financial history, and even your website to decide if you're a safe bet. Your goal is to give them a complete, trustworthy picture that puts any of their potential worries to rest.

What Underwriters Are Looking For

Underwriters are trained to spot red flags. They’ll scrutinize everything from your personal credit score to the fine print in your website's return policy. They use this info to build a risk profile that determines not only if you get approved, but also what fees you'll pay and the terms of your agreement.

A history of too many chargebacks, a fuzzy business model, or missing legal documents can bring an application to a screeching halt. What they want to see is a stable, predictable business that handles customer money professionally and transparently.

The best way to sail through this is to anticipate their questions and have all your paperwork ready before you even start the application.

The underwriting team’s main job is to protect the acquiring bank from losing money. When you provide clear, comprehensive documents, you make their job easier and send a strong signal that your business is a low-risk, reliable partner.

Assembling Your Application Toolkit

Being prepared is the single most important thing you can do to speed up your approval. It’s just like getting your documents in order before applying for a mortgage. Having everything ready to go shows you’re serious and helps the underwriter move your file along without delays.

Here’s a checklist of the essential documents you’ll almost certainly need:

- Business License and Formation Documents: This is the proof that your business is a legitimate, registered entity. Think Articles of Incorporation or your LLC formation papers.

- Federal Tax ID Number (EIN): Your company's unique tax identifier. If you're a sole proprietor, you might use your Social Security Number instead.

- Business Bank Account Statements: You'll likely need three to six months of statements to show your business is financially stable with consistent cash flow.

- A Functional and Compliant Website: Your site must be live and secure (look for that SSL certificate). It also needs to clearly display your products, pricing, and contact information.

- Clearly Stated Policies: Your return, shipping, and privacy policies need to be easy for both customers and underwriters to find and understand. No burying the details!

Why Some Industries Are Considered High-Risk

Certain types of businesses naturally come with more risk, which can make it tougher to get a standard ecommerce merchant account. Providers label these industries as "high-risk" not because they're shady, but because they have a statistically higher chance of facing chargebacks and fraud.

This label usually means you'll face tougher scrutiny during underwriting, pay higher processing fees, and may even be required to keep a cash reserve with the provider.

Common high-risk categories include:

- Subscription Services: Recurring billing can lead to more customer disputes, especially if canceling a subscription isn't straightforward.

- Digital Goods and Services: With no physical product to track, it can be tough to prove delivery if a chargeback claim arises.

- Nutraceuticals and Supplements: These businesses often deal with chargebacks from customers unhappy with the product's effectiveness.

- Travel and Ticketing: Customers buy these large-ticket items far in advance, increasing the risk of cancellations and disputes down the road.

If your business falls into one of these categories, don't panic. Many providers actually specialize in high-risk merchant accounts and get the unique challenges you face. The trick is to be upfront about your business model and show that you have solid systems in place to manage risk. When you address potential red flags head-on, you stand a much better chance of navigating the approval process successfully.

Managing Chargebacks and Preventing Fraud

Getting your ecommerce merchant account approved is just the first step. Now, the real work begins: protecting it. The two biggest headaches for any online seller are chargebacks and fraud, which are really two sides of the same coin. Learning to handle them isn't just good business—it's crucial for staying in business.

So, what is a chargeback? It all starts when a customer calls their bank to dispute a charge you made. This isn't a simple refund. It kicks off a messy, expensive process that can seriously strain your relationship with your payment processor if it happens too often.

The Anatomy of a Chargeback

Think of a chargeback as a formal complaint lodged against your store, triggering a formal investigation. Suddenly, you're tangled in a web that includes the customer, their bank, the card network (like Visa or Mastercard), and your own bank. Every single dispute comes with a penalty fee, usually somewhere between $20 to $100, and you pay that whether you win or lose.

But the visible fees are just the tip of the iceberg. You also lose the revenue from the sale, you're out the product you shipped, and you'll waste precious hours digging up evidence to fight the claim. If your chargeback ratio gets too high, you risk having your merchant account shut down completely.

It's always better to be proactive than reactive. The easiest way to win a chargeback is to stop it from ever happening in the first place. Your best weapons are crystal-clear communication and top-notch customer service.

Proactive Strategies to Minimize Disputes

The best defense against chargebacks is built right into your customer's shopping experience, long before they'd ever think to file a dispute. It all comes down to building trust and being transparent.

- Use Clear Billing Descriptors: Make sure the name that shows up on a customer's credit card statement is obviously you. A vague descriptor like "SRVCS-WEB*LLC" is a classic trigger for what’s known as "friendly fraud"—when a legitimate customer disputes a charge simply because they don't recognize it.

- Provide Stellar Customer Service: Don't hide your contact info. When customers can easily find your phone number or email, they're far more likely to come to you for a simple refund instead of going straight to their bank.

- Set Realistic Expectations: Write detailed product descriptions and use high-quality photos. Be upfront and clear about your shipping and return policies. When a customer knows exactly what to expect and when, there are far fewer reasons for them to be unhappy.

Leveraging Technology to Combat Fraud

Great service can stop honest customers from filing disputes, but you need solid technology to block outright criminals. Think of modern fraud prevention tools as your digital security team, working behind the scenes to vet every transaction.

This is more critical than ever. Fraud and payment challenges are completely reshaping ecommerce. Recent studies show that over 80% of merchants are adopting real-time payment systems, and 6 in 10 now use tokenization to keep up with growing threats. With fraud involving digital goods alone expected to soar to $27 billion globally by 2030, you can't afford to be unprepared. You can dive deeper into these trends in the 2025 Global Fraud and Payments Report.

Here are the key tools you should have in your arsenal:

- Address Verification Service (AVS): This tool checks the customer's billing address against the one their bank has on file. If they don't match, it's a huge red flag.

- Card Verification Value (CVV): Always require the three or four-digit security code on the card. It's a simple way to prove the customer actually has the physical card in their possession.

- Tokenization: This is a game-changer. Tokenization swaps sensitive card data for a unique, unbreakable code (a "token"). You can use this token for things like recurring billing without ever storing the actual card number, which dramatically cuts down your risk in a data breach.

By pairing clear, honest communication with powerful fraud-fighting technology, you can protect your ecommerce merchant account, hold onto your revenue, and build a business that customers trust.

Choosing and Integrating Your Payment Provider

Picking the right payment provider is one of the most critical decisions you'll make for your online business. It's not just about getting paid; this choice shapes your store's profitability, how smoothly your operations run, and what kind of checkout experience your customers have. Think of it as finding a partner, not just a processor.

Don't get fixated on transaction fees alone. You need to dig deeper. What are the terms of the contract? Are you about to get locked into a multi-year deal with hefty cancellation fees? And what about their customer support? When a payment issue pops up, you need a real expert on the phone right away, not a ticket number in an automated email.

Plugins vs. Custom APIs

The next big question is a technical one: how will this provider actually connect to your website? Generally, you’re looking at two main options: a pre-built plugin or a custom API integration.

Pre-Built Plugins: These are off-the-shelf extensions designed for popular platforms like Shopify, WooCommerce, or Magento. They're the "plug-and-play" solution, letting you start accepting payments in minutes with minimal fuss. For instance, BlockBee offers officially supported plugins for most major ecommerce platforms, which guarantees a smooth connection without needing to write a single line of code.

Custom API Integration: An API (Application Programming Interface) hands the keys over to your developers, giving them total freedom to design a checkout experience from scratch. This path offers incredible control but comes with a much heavier lift in terms of technical resources and ongoing maintenance. This is a common consideration when building an ecommerce app where a unique user flow is essential.

For a more detailed breakdown, our guide on ecommerce payment gateway integration is a great place to start.

Key Questions for Potential Providers

Before you sign on the dotted line for an ecommerce merchant account, you need to ask some hard questions. Getting clear answers upfront will save you a world of headaches down the road.

Choosing a payment partner is like hiring a key employee. You need to vet them thoroughly to ensure they align with your business goals, technical capabilities, and most importantly, your budget. A bad fit can cost you more than just money; it can cost you customers.

Here are the non-negotiable questions you should ask:

- What is your complete fee structure? Demand a full schedule of fees. Go beyond the basic transaction rate and ask about monthly minimums, chargeback fees, and PCI compliance costs.

- What integration options do you support? Do they offer a reliable, well-maintained plugin for your ecommerce platform, or are you on the hook for custom development?

- What does your customer and technical support look like? Is it available 24/7? Will you be talking to a real person who can actually solve your problem?

- How does your system scale? Can it handle a massive traffic spike during a Black Friday sale? What happens to your pricing as your business grows?

This level of scrutiny is especially important in the booming B2B space. While it doesn't get all the headlines, B2B ecommerce is on track to hit a staggering $32.11 trillion in 2025, making the consumer market look small in comparison. With user penetration expected to reach 54.3%, merchants who adopt efficient, developer-friendly payment tools will be in the best position to claim their share of this massive market.

Exploring Crypto as a Modern Payment Solution

While traditional merchant accounts have their place, there’s another path that sidesteps the common headaches of the old-school system. Cryptocurrency payments directly tackle the biggest pain points for online sellers: sky-high fees, chargeback fraud, and glacial cross-border settlements.

If you run an online store, you've likely felt the sting of a suddenly frozen account, a delayed payout, or a fraudulent dispute clawing back your hard-earned revenue. Crypto-native platforms were built to solve these exact problems, creating a much more direct and secure way to get paid.

A Radically Different Approach to Payments

The magic is in the model. A crypto payment gateway like BlockBee operates on a non-custodial basis. In simple terms, this means you are always in complete control of your money. Customer payments go directly into your own crypto wallet, cutting out the middleman who would normally hold your funds.

This one change neuters the biggest risks tied to a standard ecommerce merchant account:

- No More Account Freezes: Since the funds are in your wallet, no third party can lock you out of your own revenue. The money is yours, period.

- Irreversible Transactions: Crypto payments are final. This design makes chargeback fraud impossible, a persistent issue that bleeds merchants of billions annually.

The non-custodial model puts the power back where it belongs: with the merchant. It turns payments from a source of anxiety into a simple, secure transfer of value from your customer directly to you.

Turning Payments into a Competitive Advantage

Accepting crypto isn't just about dodging problems—it's about gaining an edge. It unlocks new efficiencies and opens your business to a truly global customer base. Platforms like BlockBee are packed with features that help ecommerce businesses leapfrog competitors still wrestling with outdated payment rails.

For starters, transaction fees are a world apart, often just a tiny fraction of what credit card processors charge. Better yet, payments settle almost instantly, whether the customer is next door or on the other side of the planet. Gone are the multi-day waiting periods for international bank wires to clear.

This speed and savings are becoming essential. Global transaction volumes are expected to hit 440 billion by 2030—a massive 60% increase from 2025. As this growth explodes, especially in emerging markets, friction-free payment systems will be a necessity. You can see more data on this trend with this ecommerce market transaction growth report on juniperresearch.com.

Practical Tools for Today's Merchants

A modern payment solution needs to be more than just a checkout button. It has to give you tools that simplify your financial operations. For example, BlockBee's Mass Payouts feature lets you securely send funds to many recipients at once—perfect for paying affiliates, running payroll, or settling up with suppliers, all from your self-custodial wallet.

Features like these show that crypto is no longer a niche experiment. It’s a practical, powerful tool for any business that wants to slash costs, protect its revenue, and operate without borders. Our guide to cryptocurrency merchant services dives even deeper into these advantages. This isn't just a new payment option; it's a fundamental upgrade to how we do business online.

Frequently Asked Questions About Merchant Accounts

Diving into payment processing for the first time? It's natural to have questions. Let's tackle some of the most common ones business owners ask when setting up their ecommerce merchant account, giving you the clear, straightforward answers you need.

Can I Get an Ecommerce Merchant Account with Bad Credit?

Yes, you absolutely can, but you should expect a few extra hurdles. A provider might require you to keep more money in a security reserve or simply charge higher fees to balance out what they see as a higher risk.

Your best move is to look for providers that specialize in high-risk merchant accounts. These companies know the landscape inside and out and have underwriting processes built to handle businesses with less-than-perfect credit.

How Long Does Approval Usually Take?

This is a classic "it depends" scenario. You could be approved in a few hours or find yourself waiting for a few weeks. The timeline really hinges on the type of provider you’re working with.

- All-in-one platforms like Stripe or PayPal are known for their speed, often granting near-instant approval.

- Traditional providers take a much deeper look. Their full underwriting review can take anywhere from a few days to two weeks, especially if you're in what's considered a high-risk industry.

The trade-off between a quick setup and a more thorough one often comes down to the aggregator vs. dedicated account model. Getting a handle on this difference is key to picking the right long-term partner for your business.

What Is an Aggregator vs. a Dedicated Account?

Think of an aggregator like PayPal or Stripe as a giant umbrella. They have one massive merchant account and let thousands of smaller merchants operate underneath it. This makes signing up incredibly fast, but it’s a double-edged sword—their automated systems can be quick to freeze funds or suspend your account if your activity raises a red flag.

A dedicated merchant account, on the other hand, is all yours. It’s an account issued by an acquiring bank directly to your business. The application and underwriting are more intense, but the payoff is significant: more stability, better rates (especially as you grow), and direct control. You're not just a number in a massive pool.

As the world of online payments evolves, so do the dangers. Fraud targeting digital goods is on track to cost merchants a staggering $27 billion by 2030, fueled by sophisticated AI-powered attacks. This reality makes having a secure and adaptable payment solution non-negotiable.

Merchants need accounts that can localize for different regions, because a one-size-fits-all approach just doesn't work anymore. With over 80% of businesses reporting a sharp increase in real-time payments, flexible and secure platforms are now a fundamental requirement. Learn more about these ecommerce market findings.

Ready to escape high fees and the risk of frozen funds? BlockBee offers a secure, non-custodial crypto payment gateway that puts you in complete control of your revenue. Accept global payments instantly with ultra-low fees and zero chargeback fraud. Get started with BlockBee today.