A Guide to Crypto Transaction Tracking for Businesses

At its heart, crypto transaction tracking is the process of watching a digital payment as it travels from a customer's wallet to yours. Think of it as a public, digital receipt system for every single transaction, allowing you to confirm payments, balance your books, and keep your operations running smoothly.

Unpacking the Digital Ledger

Picture a massive, shared accounting book that everyone can see but no single person can alter. That’s the core concept of a blockchain. While crypto wallets offer a layer of pseudonymity—your name isn't directly stamped on your wallet address—every single transaction is permanently recorded on this public ledger. This creates an incredibly powerful system for verifying payments.

For any business, tracking crypto payments isn't just a nice-to-have feature; it's the foundation of financial integrity. It’s the mechanism that proves a customer’s payment actually arrived, a vendor was paid, and your accounts are accurate. Trying to accept crypto without it would be like taking cash payments with your eyes closed—a risky and unmanageable approach.

To really get how tracking works, it helps to understand blockchain technology's inherent transparency and accountability. This built-in transparency is precisely what makes every transaction verifiable and trustworthy.

Why Every Business Needs to Track Crypto

The need for solid crypto transaction tracking has exploded, driven by both practical business needs and mounting regulatory pressure. As digital currencies go mainstream, financial authorities are paying much closer attention, and for good reason.

This scrutiny isn't misplaced. In 2021 alone, criminals managed to launder an estimated $8.6 billion in cryptocurrency. That staggering number highlights why oversight is so crucial. For businesses, ignoring Anti-Money Laundering (AML) and transaction monitoring rules can lead to crippling fines and serious legal trouble.

So, tracking becomes a non-negotiable for any legitimate business. It's essential for daily operations, long-term stability, and staying on the right side of the law.

At its core, crypto transaction tracking transforms the abstract movement of digital funds into concrete, actionable business data. It provides the proof of payment necessary for everything from shipping a product to closing your books at the end of the month.

Core Business Benefits of Tracking Crypto Transactions

For any business that deals with cryptocurrencies, setting up a proper tracking system delivers immediate and obvious wins. It shifts the entire process from a tedious, mistake-prone manual task to a streamlined and dependable automated workflow.

The table below breaks down the key benefits across different business functions.

| Business Function | Benefit of Transaction Tracking |

|---|---|

| Payment Verification | Gives you undeniable proof that a specific customer payment was received and confirmed. |

| Inventory Management | Triggers automated order fulfillment and inventory updates the moment a payment is verified. |

| Financial Reconciliation | Makes it simple to match incoming funds to outstanding invoices, drastically reducing errors. |

| Security and Fraud | Helps you spot and flag suspicious transactions before they can cause financial damage. |

| Compliance and Auditing | Creates a permanent, auditable trail of all transactions to satisfy regulatory requirements. |

Ultimately, great transaction tracking is about building trust and efficiency. It ensures every digital dollar is accounted for, giving both you and your customers peace of mind. This verifiable system is what makes it possible for businesses to confidently embrace cryptocurrencies, paving the way for faster, more secure digital commerce.

How On-Chain Crypto Tracking Works, Step by Step

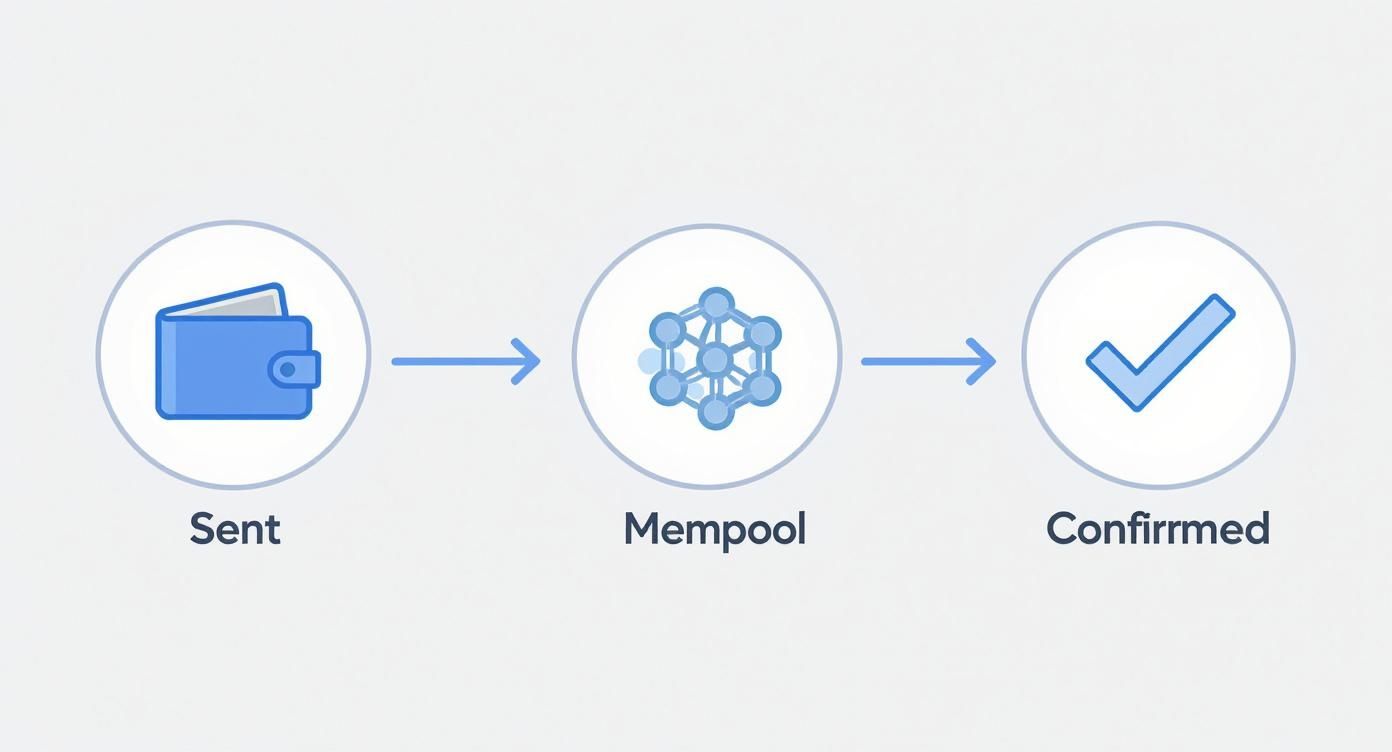

Ever wonder what really happens after you hit "send" on a crypto transaction? It’s a lot like tracking a package. Every single step, from the moment it leaves your wallet to the second it arrives, is publicly visible and verifiable. This isn't just a cool feature; it's the core of what makes crypto so transparent and secure.

Let's walk through the life of a single transaction to see how it works. When you send crypto, you’re not physically moving digital coins. Instead, you're broadcasting a signed message to the network that basically says, "I authorize the transfer of X amount from my address to this other address."

But that broadcasted message doesn't instantly get carved into the blockchain. First, it makes a stop in a digital waiting room.

The Mempool: A Digital Sorting Facility

Your transaction’s first stop is the mempool (short for memory pool). The best way to picture it is as a massive, chaotic sorting facility for unconfirmed transactions. Yours arrives alongside thousands of others from all over the world, all waiting for miners to pick them up and pack them into the next "shipment," which is a block.

Miners are the postal workers of the blockchain. They grab transactions from this pool—often prioritizing the ones with higher "postage" (transaction fees)—bundle them together, and then race to solve a complex puzzle to add that bundle to the blockchain.

Transaction Hash: The Universal Tracking Number

The instant your transaction is created, it's given a unique string of letters and numbers called a transaction hash (or TxID). This is your universal tracking number. It’s a one-of-a-kind identifier that lets you, the recipient, or anyone else look up its exact status in real-time.

You can copy this TxID and paste it into a blockchain explorer—think of it as a public tracking website for a specific blockchain, like Etherscan for Ethereum or Blockchain.com for Bitcoin. These sites show you everything.

Key Takeaway: The transaction hash (TxID) is the cornerstone of crypto tracking. It gives everyone a public, verifiable way to watch a payment’s journey from the mempool to its final destination, leaving no room for doubt.

Confirmations: The Delivery Milestones

When a miner finally includes your transaction in a newly solved block, it gets its first confirmation. This is a huge milestone. It means your payment is officially on the blockchain ledger. It’s like getting that first notification that your package has been picked up and is officially in transit.

But for businesses, one confirmation often isn't enough, especially for high-value payments. Blockchains are built as a chain of blocks, with new ones constantly being added on top of old ones. Each new block added after the one containing your transaction counts as another confirmation.

- 1 Confirmation: Your transaction is in a block. It's on the record, but in a very rare network event (like a re-organization), it could theoretically be reversed.

- 3-6 Confirmations: Now we're talking. Your transaction is buried under several new blocks, making it exponentially harder and more expensive to tamper with. Most businesses consider this the gold standard for security.

- 10+ Confirmations: At this point, the transaction is effectively permanent. It’s set in stone and considered completely irreversible.

This brings us to the crucial difference between confirmation and finality. A single confirmation makes a transaction official, but getting multiple confirmations is what makes it final. For a merchant, waiting for a set number of confirmations is just like waiting for a check to clear—it’s a non-negotiable step to prevent fraud and be absolutely sure the funds are secure before shipping a product or providing a service. Of course, this entire tracking process starts with a unique crypto wallet address, which acts as the specific "mailing address" for the funds you're watching.

Why Tracking Crypto Transactions is a Business-Critical Skill

Knowing the how of crypto transaction tracking is one thing, but understanding the why is where it really clicks for businesses. For any company that accepts digital currencies, a solid tracking system isn't just a nice-to-have tech tool. It's a core asset that directly impacts your efficiency, security, and bottom line. It’s how you turn raw, public blockchain data into smart business decisions.

Think of a transaction's journey as a simple flow: a customer sends crypto, it hits the network, and eventually, it's confirmed.

Each step in that path is a critical moment where you need visibility. Let’s break down the essential business functions that rely on getting this right.

Automated Payment Reconciliation

Imagine trying to manually match dozens, or even hundreds, of incoming crypto payments to specific customer invoices. It’s a complete nightmare—slow, full of errors, and impossible to manage as you grow. This is where automated crypto transaction tracking comes in.

When a customer pays, a good tracking system instantly sees the funds arrive at the designated address. It confirms the amount is correct, marks the invoice as paid in your books, and can even kick off your shipping process. This simple automation saves countless hours of tedious admin work and keeps your financial records perfectly accurate.

Proactive Fraud Detection

The pseudo-anonymous nature of crypto can, unfortunately, attract fraudsters. A reliable tracking system acts as your front-line defense. By automatically monitoring where incoming funds are coming from, you can spot and flag payments from wallets known for shady activities.

For instance, your system can check the sender's address against public blacklists or official sanctions lists in real-time. If a payment comes from a flagged source, it can be automatically frozen for review. This stops you from accidentally getting involved with funds from scams or hacks, protecting your cash and your reputation.

By turning the blockchain's transparent ledger into a security tool, businesses can effectively screen incoming payments, identifying high-risk transactions in real-time before they can cause damage.

Streamlined Refund and Return Processing

Handling refunds in crypto can get messy fast if you don't have a crystal-clear record of the original payment. A proper tracking system gives you that immutable audit trail, making the whole process simple and secure.

When a customer needs a refund, you can pull up the original transaction instantly—the exact amount, the sender’s address, everything. This lets you send the right amount back to the right person without any guesswork, building trust and making the customer experience feel just as smooth on the way out as it was on the way in.

Reliable Mass Payouts

Does your business pay out to multiple people at once? Think affiliates, contractors, or suppliers. Crypto transaction tracking is absolutely essential here to verify that every single one of those payments actually went through and was confirmed.

Without it, you have no real proof of payment when a vendor claims they never received their funds. A good system monitors each outgoing transaction and gives you a definitive "delivered" receipt once it's locked in on the blockchain. This keeps your partners happy and provides a clean, auditable record of all your expenses.

Simplified Compliance and Audits

With regulators paying more and more attention to crypto, keeping meticulous records is no longer optional. A robust tracking system is your best friend for compliance, creating a permanent, organized archive of all your crypto financial activity.

This detailed log is exactly what you need for audits and for meeting Anti-Money Laundering (AML) and Know Your Customer (KYC) rules. When regulators come asking, you can hand over a clear, time-stamped record of every transaction. For a closer look at this, check out our guide on anti-money laundering transaction monitoring. Being prepared like this makes compliance a breeze and shows you’re running a tight, legitimate ship.

How Do You Actually Track a Crypto Transaction?

Now that we know why tracking crypto transactions is so important, let's get into the how. There are a few different ways to get this done, and the best method for you really boils down to your business needs, technical skills, and how many transactions you're handling.

You don't want to bring a sledgehammer to crack a nut, but you also don't want to be caught unprepared when sales start rolling in. Let’s look at the main options, from the simplest to the most sophisticated.

Manually Watching with Blockchain Explorers

The most basic way to track a payment is to do it by hand. You simply take your receiving address, paste it into a public blockchain explorer like Etherscan for Ethereum or Blockchain.com for Bitcoin, and hit refresh until you see the funds arrive.

This approach is completely free and requires zero technical setup. If you're a hobbyist or a small merchant doing just one or two sales a day, it can work. But let's be honest—it's not a real business solution. It’s slow, prone to human error, and becomes a massive headache the second your volume picks up.

Running Your Own Blockchain Node

For those who want ultimate control and don't want to trust anyone else, there's the option of running your own dedicated node for each cryptocurrency you accept. A node is a computer that downloads and maintains a full copy of the entire blockchain, validating every single transaction on its own. It gives you a direct, unfiltered pipeline to on-chain data.

This path offers maximum decentralization and security—you are your own source of truth. However, the trade-off is huge. The technical and financial burden is immense, requiring powerful hardware, constant maintenance, and specialized DevOps knowledge to keep it running smoothly. For most small and medium-sized businesses, the cost and complexity just don't add up.

Key Insight: Running a full node gives you complete control, but the high operational costs and technical expertise required mean it's typically only feasible for large enterprises or crypto infrastructure companies with dedicated engineering teams.

Integrating a Third-Party API

This is the sweet spot for the vast majority of businesses. Using a third-party API service like BlockBee means you let someone else handle all the heavy lifting. These platforms run and maintain the nodes, monitor the blockchains, and package all that complexity into a simple, reliable service.

You just need to integrate their API into your website or application. With a few lines of code, you can generate payment addresses and let the service do the watching for you. It’s the perfect balance of power and simplicity, giving you robust crypto transaction tracking without the nightmare of managing your own infrastructure.

- Scalable: Easily handles anything from a few transactions to thousands per day.

- Cost-Effective: Significantly cheaper and more predictable than running your own nodes.

- Developer-Friendly: Turns a highly complex process into a few straightforward API calls.

- Multi-Currency Support: Add dozens of different cryptocurrencies through one single integration.

Using Webhooks for Real-Time Automation

Webhooks are a game-changer for anyone using an API. Think of them as automatic notifications. Instead of your system constantly having to poll the API and ask, "Is the payment here yet? How about now?", a webhook proactively tells your system the moment something happens.

When a payment is first detected or when it hits the right number of confirmations, the tracking service sends a webhook—a notification—to your application. This event-driven approach is incredibly efficient. It allows you to instantly trigger your business logic—like marking an order as paid, delivering a digital download, or sending out a shipping confirmation. This is what creates a truly seamless, automated experience for your customers. BlockBee, for instance, uses webhooks to send instant payment updates right to your e-commerce store.

Comparison of Crypto Transaction Tracking Methods

Choosing the right tool for the job is crucial. While manual tracking might seem appealingly simple at first, a solution that can't grow with your business will quickly become a liability. The table below breaks down the pros, cons, and best use cases for each method to help you decide.

| Method | Pros | Cons | Best For |

|---|---|---|---|

| Blockchain Explorers | Free, no setup required. | Not scalable, completely manual, prone to human error. | Hobbyists or merchants with extremely low transaction volume. |

| Dedicated Nodes | Complete control, trustless, maximum security. | Extremely expensive, technically complex, requires constant maintenance. | Large enterprises and infrastructure providers with dedicated tech teams. |

| Third-Party APIs | Scalable, cost-effective, developer-friendly, easy to implement. | Reliance on an external service provider. | Most e-commerce stores, SMBs, and online businesses. |

| Webhooks | Real-time notifications, highly efficient, enables full automation. | Requires an API integration and a server to receive notifications. | Any business looking to automate its payment and fulfillment workflows. |

Ultimately, for any business serious about accepting crypto, an API-driven approach with webhooks offers the most practical, scalable, and cost-effective path forward. It lets you focus on your business, not on blockchain infrastructure.

Best Practices for Implementing a Tracking System

Setting up a crypto transaction tracking system is far more than a simple technical checkbox. It's a critical business decision that can make or break your operations. Get it right, and you have a smooth, reliable way to collect revenue. Get it wrong, and you're staring down the barrel of lost funds, chaotic accounting, and unhappy customers.

And this isn't just about tracking Bitcoin anymore. Stablecoins are a huge piece of the puzzle, accounting for roughly $9 trillion in transaction volume over a recent 12-month period. That colossal figure shows just how vital a bulletproof tracking system is for the assets that businesses depend on every day.

Never Reuse Payment Addresses

If there's one golden rule, it's this: generate a unique payment address for every single invoice or order. Seriously. Reusing the same address for multiple customers is a guaranteed path to an accounting nightmare. It makes it practically impossible to figure out who paid what.

Think about it. You ask two different customers to send $100 to the same address. A payment for $100 comes in. Which customer was it? What if $200 arrives? Did they both pay, or did one person accidentally send double? This confusion stops any automated order fulfillment process dead in its tracks.

A few things happen when you use unique addresses:

- Clarity: One payment is tied directly to one order. Clean and simple.

- Privacy: Customers can't just look up your address on a block explorer and see your entire transaction history.

- Automation: Your system knows exactly which invoice to mark as "paid" the second the funds hit its dedicated address.

Set Smart Confirmation Thresholds

A transaction with just one confirmation isn't necessarily final. Deciding on the right number of confirmations to wait for is a balancing act between security and speed.

For small, everyday purchases, waiting for just one or two confirmations is probably fine. It keeps the customer experience snappy. But for a high-value transaction, you need to be more cautious. Waiting for six or more confirmations makes a payment virtually irreversible, protecting you from potential fraud or chain reorganizations. The ideal number really depends on your risk appetite and the specific crypto involved.

A well-defined confirmation policy is your primary defense against payment reversal risks. It ensures you only consider a payment final when it is securely embedded in the blockchain, protecting your revenue before you ship goods or provide services.

Design for Resilience and Accuracy

Your tracking system has to be built for the real world, where network glitches and human errors happen. This is where two key concepts come into play: idempotency and resilient retry logic. To manage this level of complexity, many businesses rely on automated data processing to keep things running smoothly.

Idempotency is a fancy way of saying your system can handle the same notification multiple times without messing things up. Let's say a network hiccup causes a payment webhook to be sent twice. An idempotent system will simply recognize the duplicate and won't, for example, credit a customer's account a second time.

Your system also needs robust retry logic. If your server is down for a minute when a notification arrives, the sender should be able to try again later. This prevents you from missing payments and keeps your internal records perfectly synced with the blockchain.

Finally, you need a plan for exceptions. What happens when a customer sends too little or too much? Your system should automatically flag these situations and alert your support team. They can then reach out to the customer and fix the problem, saving you from a mountain of manual reconciliation work later on.

If you want to dig deeper into how these systems work under the hood, check out our guide on what transaction monitoring involves.

Frequently Asked Questions About Crypto Tracking

Even after you've got the basics down, crypto transaction tracking can throw some curveballs. Let's tackle some of the most common questions and tricky situations that businesses and developers run into. Think of this as the go-to guide for clearing up those last few bits of confusion.

Can You Really Track Transactions on Privacy Coins?

For the most part, no—and that's the whole point. Privacy-focused coins like Monero (XMR) are built from the ground up to be opaque to outsiders. They're specifically engineered to prevent the kind of public tracking that's standard on Bitcoin or Ethereum.

Monero uses some clever cryptography, like ring signatures and stealth addresses, to scramble the details. The sender, receiver, and amount for every transaction are intentionally hidden from public view. The only people who can see the real details are the ones actually involved in the transaction, using their private keys.

What does this mean for a business? Your usual tracking tools won't work. You can't just plug a transaction ID into a public block explorer to see what happened. If you want to accept privacy coins, you'll need to use a specialized payment gateway that can confirm payments privately without broadcasting anything on the public blockchain.

On-Chain vs. Off-Chain Tracking: What's the Difference?

Understanding the line between on-chain and off-chain is key to knowing where your money actually is.

On-chain tracking is looking at transactions recorded directly on the blockchain itself. This is the ultimate source of truth—it's public, decentralized, and can be verified by anyone. When a customer pays you from their personal wallet, this is the method you'll use to confirm the funds have truly arrived and settled.

Off-chain tracking, on the other hand, deals with activity that happens outside the main blockchain. The classic example is trading on a centralized crypto exchange. When you buy and sell on a platform like Coinbase or Binance, you're usually just seeing numbers change in their internal database. It only becomes a real on-chain transaction when you withdraw those funds to an external wallet you control.

Think of it this way: on-chain is the public record, while off-chain is a private ledger. For any business accepting payments directly from customers, on-chain tracking is the only game in town. It’s your final, undeniable proof of payment.

How Do APIs Make Crypto Tracking Easier?

Honestly, they're a lifesaver. Instead of building and maintaining a mountain of complex infrastructure yourself, an API from a service like BlockBee handles all the heavy lifting for you. Forget about the headache of running your own nodes for a dozen different cryptocurrencies or coding a bulletproof notification system from scratch.

With an API, you can do things like:

- Generate a unique payment address for every single customer invoice.

- Watch multiple blockchains at once for payments to those addresses.

- Get instant webhook notifications the second a payment is confirmed.

This completely automates your payment workflow, from the moment a customer clicks "pay" all the way to marking an order as complete. For developers, this translates to saving hundreds of hours of work, slashing maintenance costs, and getting a reliable system that can grow with your business.

What Exactly Is a "Pump and Dump" Scheme?

A "pump and dump" is a classic form of market fraud, just adapted for the crypto world. Scammers pick an obscure, low-value coin and "pump" its price by spreading hype and misleading positive news. Once a flood of unsuspecting buyers drives the price way up, the original scammers "dump" all of their holdings at the peak.

The result? The price plummets, and everyone who bought into the hype is left holding a virtually worthless asset. According to the US Commodities Futures Trading Commission, these schemes are often orchestrated anonymously and can be over in minutes. This is where good crypto transaction tracking can be a powerful investigative tool, helping to spot the on-chain fingerprints of these schemes, like a huge chunk of tokens being sent to insiders right before the "pump" begins.

Is It Legal to Track Crypto Transactions?

Absolutely. Tracking transactions on public blockchains like Bitcoin is perfectly legal. These networks were designed to be public and transparent. All the data is out there for anyone to see and analyze—it's a fundamental feature, not a bug.

The legal questions pop up not with the tracking itself, but with what you do with the information. Financial regulations like Anti-Money Laundering (AML) and Know Your Customer (KYC) laws actually require many businesses to monitor transactions. They're looking for suspicious patterns that could signal illegal activity.

So, for many businesses in the financial space, transaction monitoring isn't just legal; it's a legal requirement. Ignoring these rules can lead to massive fines. The whole point is to help prevent things like money laundering and terrorist financing, which ultimately makes the entire crypto ecosystem safer for everyone.

Ready to stop wrestling with the complexities of crypto payments and get back to growing your business? BlockBee offers a powerful, developer-first API that automates crypto transaction tracking from start to finish. Get instant payment alerts, support over 70+ coins, and integrate seamlessly with the tools you already use.