Crypto to bank account: The quickest guide to safe crypto transfers

So, you've got crypto and you need to get it into your bank account.So, you've got crypto and you need to get it into your bank account. There are a few well-trodden paths to get this done. For most people and businesses, the go-to solution is a centralized crypto exchange (CEX) where they can sell their assets for fiat currency and then cash out. But that's not the only game in town—other solid options include peer-to-peer platforms, specialized payment processors, and even over-the-counter desks for those moving serious volume.

Your Options for Moving Crypto to a Bank Account

Figuring out the best way to turn your crypto into cash in the bank means weighing the trade-offs of each method. The right choice really boils down to what you're trying to do. Are you a merchant handling hundreds of crypto payments a day, or are you an individual just looking to make a single transfer? Your needs will dictate the best path.

The most straightforward and popular route is using a major centralized exchange like Coinbase or Kraken. These platforms are the big, trusted players in the space, offering plenty of liquidity and a simple process. You just send your crypto to your exchange wallet, sell it for fiat like USD or EUR on their market, and then withdraw it to your linked bank account. If you want a more detailed breakdown of this process, our guide on how to convert crypto to cash walks through it step-by-step.

Exploring Alternative Off-Ramps

Exchanges are great, but they aren't the only solution. Peer-to-peer (P2P) platforms, for example, cut out the middleman and let you deal directly with another person. This often gives you more flexibility on payment methods, but it also means you have to be extra cautious. You're trading with a stranger, so vetting your counterparty is key to avoiding scams.

For the big players—companies or individuals looking to convert significant sums, usually over $100,000—over-the-counter (OTC) desks are the standard. OTC services offer a white-glove, private trading experience. This is crucial because it keeps your massive order off the public market, preventing it from tanking the price (an effect known as slippage).

Finally, for businesses that accept crypto, a payment processor like BlockBee is a lifesaver. These services automate the conversion and settlement, taking the manual work out of the equation. It's the perfect setup for merchants who need to regularly deposit their crypto earnings into a business bank account without any fuss.

To make the choice a bit clearer, let's break down how these methods stack up against each other.

Comparing Crypto to Bank Account Methods

This table offers a quick comparison of the most common methods for converting cryptocurrency to fiat and transferring it to a bank account, highlighting key differences in speed, fees, and ideal use cases.

| Method | Best For | Typical Speed | Average Fees | Security Level |

|---|---|---|---|---|

| Centralized Exchange (CEX) | Everyday users, small businesses, frequent traders | 1-5 business days | 0.5% - 2.5% | High |

| Peer-to-Peer (P2P) | Users in regions with limited banking access | Varies (minutes to hours) | 0% - 1.0% | Moderate |

| Over-the-Counter (OTC) | High-volume traders, institutions, businesses | 1-3 business days | Varies (negotiated) | Very High |

| Payment Processor | Merchants, e-commerce, automated payouts | Instant to 24 hours | 0.25% - 1.0% | High |

Key Takeaway: There is no single "best" method for every situation. Your transaction volume, urgency, cost sensitivity, and security requirements will determine whether a CEX, P2P platform, OTC desk, or payment processor is the most suitable path for moving crypto to a bank account.

Ultimately, the best off-ramp is the one that aligns with your specific goals. An individual cashing out a small amount has very different needs from a business that needs to process and settle hundreds of crypto payments automatically.

Choosing the Right Crypto Off-Ramp Strategy

So, you have crypto and you need cash in your bank account. Which way do you go? The right path really boils down to your specific needs—how much you’re moving, how often, and how much hands-on effort you're willing to put in.

The good news is that the infrastructure for cashing out has gotten much better over the years. With over 659 million crypto owners globally (that’s 6.8% of the world's population!), the demand for solid off-ramps is huge. We’re seeing this reflected in massive on-chain activity. North America alone saw $1.2 trillion in Bitcoin fiat inflows, and South Asia experienced an 80% surge in regional growth, largely driven by people cashing out to their local bank accounts. You can dig deeper into these trends in the full research on blockchain statistics.

The Go-To Method: Centralized Exchanges

For most people and small businesses, a centralized exchange (CEX) like Coinbase or Kraken is the most familiar route. The process is straightforward: deposit your crypto, sell it for fiat like USD or EUR on the exchange's market, and then withdraw the funds to your linked bank account.

But it’s not as simple as clicking a button and seeing the money instantly appear. You’ll first need to get through the Know Your Customer (KYC) process by providing ID documents. Exchanges also have withdrawal limits that often scale with your verification level. A basic account might let you pull out a few thousand dollars a day, while a fully verified one can handle significantly more.

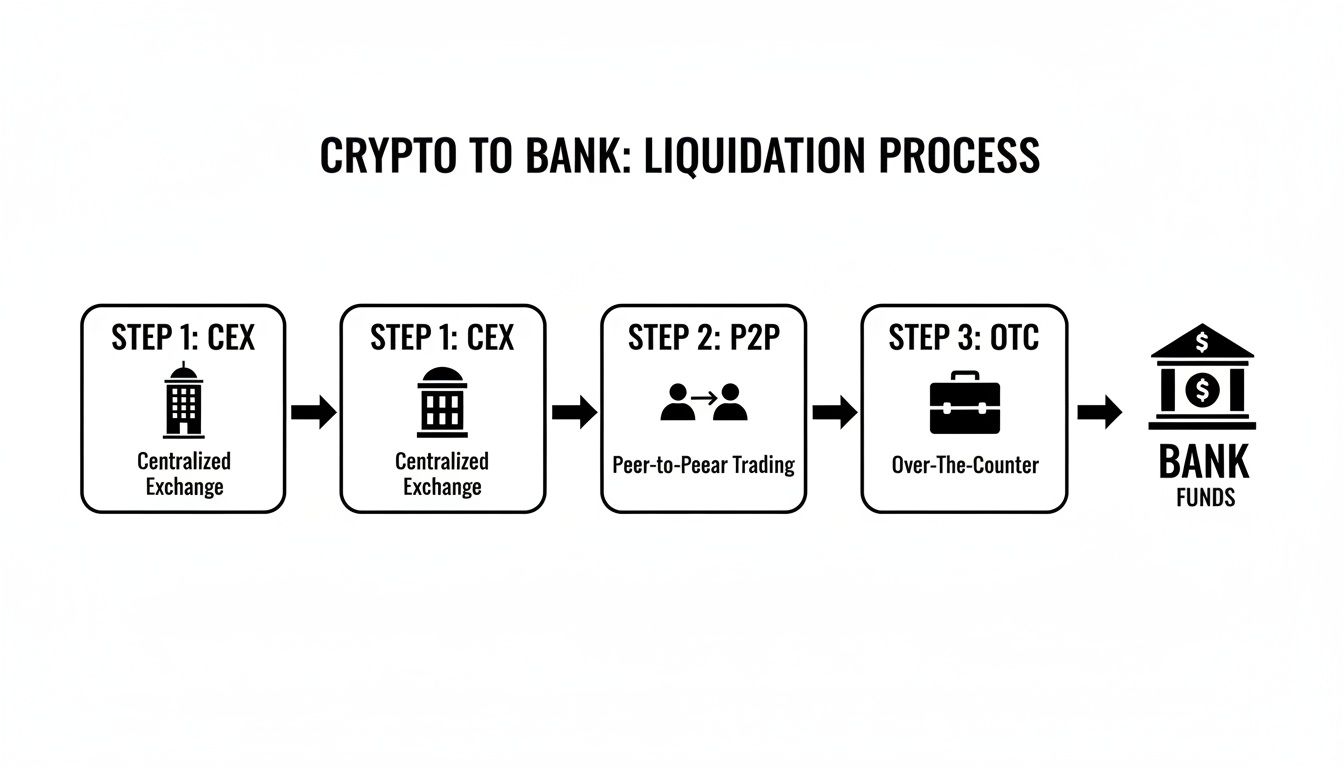

This flowchart lays out the different paths for turning your crypto into cash, whether you're using a CEX, a P2P platform, or an OTC desk.

As you can see, they all get you to the same destination, but the journey and the type of traveler best suited for each route are quite different.

A More Direct Approach: Peer-to-Peer (P2P) Transactions

If you prefer a more direct route and don't mind a bit more work, peer-to-peer (P2P) platforms are a solid alternative. Let's say you want to sell $5,000 worth of USDT. On a P2P marketplace, you'd find a buyer looking to pay with a direct bank transfer.

Here's how that usually plays out:

- You find a buyer with a solid reputation—look for high completion rates and good reviews.

- Once you start the trade, the platform locks your USDT in an escrow account to protect everyone involved.

- The buyer then sends the $5,000 to your bank and marks the payment as sent.

- After you see the money land in your account, you release the USDT from escrow to finalize the deal.

This can often be quicker and cheaper than using a CEX, but it puts the responsibility on you to vet your trading partner and avoid scams.

For the Big Moves: When to Use an OTC Desk

Over-the-Counter (OTC) desks are the private banking of the crypto world. They aren't for cashing out a few hundred dollars. These services are built for high-net-worth individuals and businesses that need to liquidate large sums—think $100,000 or more—without tanking the market price.

If you tried to sell a massive amount of crypto on a public exchange, you'd likely run into slippage, where the price falls as your large sell order eats through the order book. An OTC desk avoids this by arranging a private trade directly with a large buyer at a fixed, pre-agreed price. It's discreet, efficient, and ensures your big move doesn't cause a ripple.

Expert Tip: No matter which method you choose, always run a small test transaction first. Sending a tiny amount before moving the whole sum is a simple way to double-check that your bank details and wallet addresses are correct, potentially saving you from a very costly mistake.

Putting It on Autopilot: Automated Payouts for Businesses

For any business accepting crypto, manually cashing out every payment just isn't scalable. That’s where payment processors like BlockBee come in. These platforms handle the entire crypto-to-fiat workflow for you.

An e-commerce shop, for example, can use BlockBee to automatically convert crypto payments into fiat and have the funds settled in its bank account daily or weekly. This completely removes the manual grind, cuts down on admin headaches, and keeps the cash flowing predictably. Developers can take this a step further, using API-driven flows to build this automated off-ramping right into their own applications, making the whole process an invisible, seamless part of their financial backend.

Getting Right with Compliance and Taxes When You Cash Out

Moving crypto into your bank account is more than just a transfer—it’s a regulated financial event. Every time you turn digital assets into fiat currency, you're stepping into the world of compliance and tax law. Trust me, you don't want to ignore this part. Getting it wrong can lead to some serious headaches, from frozen accounts to unwelcome letters from tax agencies.

The first thing you'll almost always run into is Know Your Customer (KYC). This is the standard identity check where exchanges and payment processors ask for your driver's license, a utility bill, or other documents. It might feel like a hassle, but for any reputable platform, it’s a non-negotiable legal step.

These identity checks are a core part of global Anti-Money Laundering (AML) regulations. Platforms have a legal duty to verify who is moving money through their systems to prevent crime. Ultimately, this process creates a safer environment for everyone involved. To get a better handle on this, you can learn more about the role of KYC in crypto.

Don't Forget About the Tax Man

After clearing the compliance hurdles, your next big consideration is taxes. In most places, like the United States, tax authorities treat cryptocurrency as property, not currency. That small difference has huge implications for how your transactions are handled.

When you sell your crypto for cash to send to your bank, you've just created a taxable event. You're essentially "disposing" of an asset, which triggers either a capital gain or a capital loss. The amount you owe (or can deduct) depends entirely on how much that crypto's value changed while you held it.

Key Insight: The taxable event happens the moment you convert Bitcoin to US dollars. The profit or loss from that sale is what you have to report, even if the cash is still sitting on the exchange and hasn't hit your bank yet.

To figure out your tax obligation, you need to know your cost basis (what you originally paid for the crypto, including any fees) and the sale price (the fiat value you got when you sold it). The difference is your capital gain or loss.

Meticulous Records Are Your Best Friend

Thinking you can fly under the radar is a bad bet. Tax agencies are getting much smarter about tracking blockchain activity, and failing to report can bring on audits, penalties, and hefty interest charges. The best defense is simply keeping good records.

For every single transaction, you should be tracking:

- The date you bought the crypto

- Your cost basis in your local currency

- The date you sold it for fiat

- The sale price you received

This sounds like a ton of work, especially if you trade frequently. Luckily, specialized crypto tax software can connect directly to your exchange accounts and do the heavy lifting for you. Tools like Koinly or CoinTracker are lifesavers here, saving you hours of spreadsheet work while ensuring your numbers are accurate.

A Quick Example of How It Works

Let's walk through a simple scenario. Imagine you bought 0.1 BTC for $3,000 a year ago. Today, you sell that same 0.1 BTC for $7,000 to cash out.

- Cost Basis: $3,000

- Sale Price: $7,000

- Capital Gain: $4,000

You now have a $4,000 long-term capital gain to report on your taxes, since you held the asset for more than a year. The tax rate on long-term gains is typically much more favorable than the rate for short-term gains (assets held less than a year).

Proper compliance is crucial, but if you find yourself in a tricky spot, there are professional services for tax audits that can help you navigate the complexity. By keeping clean records and understanding your obligations from day one, you can make sure your crypto cash-outs are smooth and stress-free.

If your business deals with crypto, you know the drill. Manually converting crypto to cash for every single payout is a massive time-sink. It’s tedious, ripe for human error, and completely unsustainable as you grow. Automating that entire workflow isn't just a nice-to-have; it's a fundamental upgrade for your operations, saving you headaches and reducing risk.

This is exactly where a platform like BlockBee comes in and changes the game. Instead of treating each payout as a manual chore, you can build an automated pipeline. This system moves funds from your company’s crypto balance straight to the right bank accounts, all with barely any hands-on effort. For anyone running a freelance marketplace, an affiliate program, or any business that needs to handle regular payments, this shift is essential.

Streamlining Payments with Mass Payouts

Picture this: you run a global platform and need to pay a few hundred contractors every single Friday. Doing this one by one is a logistical nightmare. You send the crypto, chase down confirmations, and then each person has to figure out how to cash it out themselves. It’s messy.

This is the exact problem BlockBee's Mass Payouts feature was built to solve.

The tool lets you fire off hundreds, or even thousands, of individual transfers from a single crypto balance, all at once. Just upload a list of who to pay and how much, and the system takes care of the rest. It's a game-changer for any business with recurring, high-volume payments.

Here’s how it simplifies things:

- Recipient Management: You can easily create and manage a list of all your payees and their bank details in one place.

- Batch Processing: Forget one-off transactions. You initiate a single batch payment that covers everyone on your list.

- Automated Conversion: The platform automatically converts the right amount of crypto into the correct fiat currency for each person.

- Direct Settlement: The cash lands directly in their individual bank accounts. No extra steps, no hassle for them.

Of course, to receive these funds, you'll need a proper business bank account. Getting this set up correctly is a crucial first step. If you're just starting, a resource like this guide on How to Open a Business Bank Account in Canada can point you in the right direction. By consolidating all your payouts, you’ll slash your administrative workload.

Building Custom Workflows with API Integration

The Mass Payouts feature is fantastic for scheduled payments, but what if your business needs something more custom? This is where an API-driven approach really shines. It allows your developers to programmatically trigger the crypto to bank account process right from your own software.

An API essentially lets your application "talk" directly to BlockBee's system. This gives you granular control over the entire payout process and unlocks some seriously powerful automation.

Real-World Scenario: Imagine an online gaming platform that needs to pay out tournament winnings instantly. As soon as a tournament finishes, the platform’s backend can use an API call to trigger the payout. The system calculates the prize money, initiates the crypto-to-fiat conversion, and sends the cash straight to the winner's bank account—all happening in minutes, without a human lifting a finger.

This level of integration makes for a truly seamless user experience and gets rid of manual payment queues for good. To dive into the technical side of things, check out the https://blockbee.io/payouts.

The Role of Stablecoins in Automation

So, what’s the magic behind this smooth automation? A lot of it comes down to stablecoins. They act as the perfect bridge between the often-volatile world of crypto and the traditional banking system we all use.

The numbers are staggering. The total stablecoin supply has climbed to over $305 billion. In the last year, transaction volumes blew past $32 trillion, with a solid $5.7 trillion of that being for actual payments—putting it in the same league as major credit card networks. This isn’t just speculation; it's being used for real-world stuff like remittances and cross-border payouts, allowing people to cash out crypto to their bank accounts in minutes, not days.

For businesses, this translates to dramatically lower fees, often just a fraction of the 3-7% you’d pay for a traditional wire transfer, plus you get real-time tracking.

By using stablecoins like USDT or USDC as an intermediary currency, platforms like BlockBee can lock in the value during the conversion. This protects both you and your recipient from sudden price swings, making your finances much more predictable. It's this powerful combination of automation tools and the reliability of stablecoins that makes these efficient crypto-to-bank workflows a reality.

Best Practices for Safe and Efficient Crypto Withdrawals

Moving your crypto into a bank account is the final hurdle in the off-ramping process. But getting it right involves more than just hitting the “withdraw” button. You need a solid strategy to protect your assets from security risks and keep fees from eating into your profits. Every transfer needs to land safely and cost-effectively.

The name of the game is minimizing risk. I've seen simple security slip-ups lead to catastrophic losses, so before you even think about initiating a transfer, lock down your accounts. This isn't just a friendly suggestion—it's non-negotiable for operating in this space.

Start with the basics. If your exchange or platform offers two-factor authentication (2FA), turn it on. Period. Use an authenticator app like Google Authenticator or Authy instead of SMS, which is vulnerable to SIM-swapping attacks. This one small step makes it exponentially harder for anyone else to get their hands on your funds.

Securing Your Withdrawal Pathway

With your account secured, the next focus is the withdrawal itself. A surprisingly common and devastating mistake is sending funds to the wrong address. Blockchain transactions are final. One typo, and your money is gone for good.

This is why I always recommend doing a small test transaction before moving a large sum. Send a nominal amount—a few dollars is fine—to confirm the address is correct and that everything arrives as expected. Yes, you'll pay a small transaction fee, but that fee is cheap insurance against losing the entire amount.

Another fantastic security feature to look for is address whitelisting. This lets you create a pre-approved list of crypto addresses that your account can send funds to. Once an address is whitelisted, which often involves a security time-lock, your account can only withdraw to those specific destinations. It’s a great way to neutralize malware that tries to hijack your clipboard and paste in a scammer’s address at the last second.

Pro Tip: Never, ever approve a withdrawal or copy a wallet address while you're distracted or on public Wi-Fi. Take a minute, connect to a secure network, and double-check every single character of the destination address before you hit confirm.

Optimizing for Cost and Speed

Security comes first, but efficiency is a close second. The fees for moving crypto to a bank account can really add up, especially if you’re doing it often. With a bit of smart timing and research, you can cut those costs down significantly.

Withdrawal fees typically break down into two types:

- Network Fees: These go to the blockchain miners or validators who process your transaction. They go up and down based on network traffic.

- Exchange Fees: This is what the platform charges, either as a flat fee or a percentage, to handle the fiat withdrawal to your bank.

While you can't change the exchange fees, you have some control over network fees. On blockchains like Ethereum, gas fees can swing wildly. By using a gas tracker, you can time your transfers for when the network is less busy—often on weekends or late at night—and potentially save a good chunk of change.

Maintaining Flawless Records

Lastly, don't sleep on meticulous record-keeping. Every single time you convert crypto to fiat, you’re creating a taxable event with compliance implications. Keeping a clean log of your activity isn't just good housekeeping; it's essential for staying on the right side of regulators.

For every single withdrawal, make sure you document:

- The date and time

- The type and amount of crypto you sold

- The fiat value you received

- All associated transaction fees

- The blockchain transaction IDs (hashes)

This information is pure gold come tax time, as it lets you accurately calculate your capital gains or losses. It also provides a critical paper trail if you ever need to sort out a dispute or provide proof of funds. By making these steps a habit, you can handle every crypto to bank account transfer with total confidence.

Got Questions? Let's Clear a Few Things Up

Even after you've mapped out your strategy, a few nagging questions can pop up when it's time to actually move your crypto into a bank account. It's totally normal. Things like transfer speeds, withdrawal limits, and what to do if something goes wrong are common concerns.

Let's walk through the most frequent questions I hear, so you can handle the process like a pro.

How Long Will This Actually Take?

The number one question is always about timing. Once you sell your crypto for fiat on an exchange, the money doesn't just instantly appear in your bank. The speed really comes down to the withdrawal method you pick and how quickly your own bank moves.

- Standard Bank Transfers (ACH/SEPA): This is the go-to for most people. You should plan for it to take anywhere from 1-5 business days. Remember, weekends and holidays don't count, so they can slow things down.

- Wire Transfers: If you're moving a larger sum, wires are generally faster, often landing in 1-3 business days. The trade-off is that they almost always cost more.

- Faster Payment Systems: In some places, like the UK with its Faster Payments Service, you might have access to near-instant networks. If your exchange supports it, your funds could show up in minutes or a few hours.

Selling the crypto itself is usually the quick part. It's the old-school banking system that creates the lag. Always build that delay into your timeline, especially if you need the cash by a certain date.

How Do I Handle a Large Withdrawal Without Causing Problems?

Moving a big chunk of money can raise a few eyebrows at both your exchange and your bank. Don't take it personally; it's a standard anti-money laundering (AML) check, not a sign you did something wrong. But you can definitely take steps to make it go smoothly.

First off, check your account's verification level on the exchange. They all have daily or monthly withdrawal limits tied to how much KYC info you've provided. Trying to pull out more than your limit allows is a surefire way to get the transaction flagged or just plain blocked.

A Pro Tip from Experience: If you're moving a really significant amount, say over $100,000, think about splitting it into a few smaller, planned transfers over a couple of days. For really big conversions, your best bet is often an Over-the-Counter (OTC) desk. They're built specifically for handling large, compliant trades and settlements.

It's also a smart move to give your bank a quick heads-up. A simple phone call letting them know to expect a large transfer from a crypto platform can prevent them from freezing your account for "unusual activity."

What If My Transfer Fails or Gets Stuck?

It’s not common, but transfers can hit a snag. If the money hasn't arrived in the expected window, don't panic. Start by checking the transaction status on your exchange. If it says "complete," then the holdup is likely somewhere in the banking network or with your bank itself.

If a transfer flat-out fails, the money will almost always bounce back to your exchange account. This often happens because of a simple typo in the bank details. Seriously, double-check every digit of your account and routing numbers before you hit send again.

If it's just delayed and you're getting antsy:

- Contact Exchange Support: Open a ticket with all your transaction details. They can track the payment from their end.

- Call Your Bank: Ask if they see a pending incoming transfer and if they need anything from you to approve it.

Can I Send Crypto Straight from a Cold Wallet to My Bank?

This is a really common point of confusion. The short answer is no, you can't.

Think of it this way: your bank account only speaks in fiat currency (USD, EUR, etc.), while your cold wallet (like a Ledger or Trezor) holds crypto assets. They speak different languages. To bridge the gap, you have to send your crypto from your cold wallet to a service that can act as a translator—like a centralized exchange or a payment processor.

Once the crypto is on that platform, you can sell it for fiat. Then you can initiate the final withdrawal to your bank account.

At BlockBee, we're all about making this easier for businesses. Our Mass Payouts feature takes the entire crypto-to-bank workflow and automates it. You can pay anyone, anywhere in the world, right from a single crypto balance, without all the manual steps. Discover how BlockBee can streamline your business payouts and take the hassle out of fund settlement.