Blockchain to Bank: A Practical Guide for Crypto to Fiat

For any business that accepts crypto, the real magic happens when those digital earnings land in your bank account. This "off-ramping" process—converting assets like Bitcoin or stablecoins into dollars or euros—is the final, crucial step. It’s what turns blockchain revenue into tangible capital you can actually use to pay salaries, cover rent, or reinvest in the business.

From On-Chain Earnings to Off-Chain Capital

Let's be honest: for a business, getting paid in crypto is only half the battle. The real challenge is navigating the journey from a customer's crypto wallet to usable funds in your company's bank account. This path is often riddled with friction because, frankly, traditional banking wasn't built for the world of decentralized ledgers.

This gap forces businesses to find a middle ground, but the early solutions were far from perfect. We're talking slow, expensive, and clunky systems that just weren't cut out for serious commercial use. When you're trying to manage daily cash flow, waiting days for a wire transfer or losing a chunk of your revenue to fees just doesn't work.

The Old Way Was a Headache

In the early days, off-ramping was a frustrating mess. You’d face a whole set of hurdles that made you question if accepting crypto was even worth it.

Settlement times were a big one. It wasn't uncommon to wait three to five days before funds were actually accessible in your account—an eternity when markets are moving fast. Then came the costs. High transaction fees, a combination of network gas, exchange commissions, and wire charges, would slowly chip away at your bottom line.

On top of that, the whole process was painfully manual. Someone on your team had to track payments, initiate conversions, and then try to reconcile everything across multiple platforms. It was inefficient, prone to human error, and made it nearly impossible to scale your crypto operations.

The real challenge was never just about moving money. It was about moving it with the speed, low cost, and reliability a modern business needs to survive. A clunky off-ramp process is a direct drag on growth.

A Modern Fix for a Modern Problem

Thankfully, things have changed. A new wave of B2B crypto payment processors has stepped in to fix this exact problem. These platforms are designed from the ground up to automate the entire blockchain to bank workflow, offering a genuinely seamless alternative.

Tools like BlockBee give merchants exactly what they need to eliminate the old pain points:

- Speed: You get near-instant conversion from volatile crypto into stablecoins, which slashes your risk. From there, settlement to your bank account is fast.

- Efficiency: Automated workflows take care of everything, from confirming the initial payment to converting the funds. This frees up your team to focus on work that actually grows the business.

- Lower Costs: Instead of a patchwork of unpredictable fees, you get a clear, competitive fee structure that lets you keep more of your hard-earned revenue.

By plugging one of these modern solutions into your financial operations, you can finally turn a complicated, manual chore into a smooth, automated process. It ensures your digital revenue isn't just sitting on the blockchain but is ready to be put to work in the real world.

Choosing Your Crypto Off-Ramp Strategy

Figuring out the best way to get your crypto from the blockchain into your bank account isn’t a one-size-fits-all deal. The right move really depends on your business model, how many transactions you handle, and what your day-to-day operations look like. An e-commerce store juggling hundreds of small daily sales needs something entirely different from a trading firm liquidating a seven-figure crypto position.

So, let's walk through the three main strategies you'll encounter: Centralized Exchanges (CEXs), Over-the-Counter (OTC) Desks, and B2B Crypto Payment Processors. I'll use some real-world scenarios to help you see which one fits your business, comparing them on volume, fees, speed, and security.

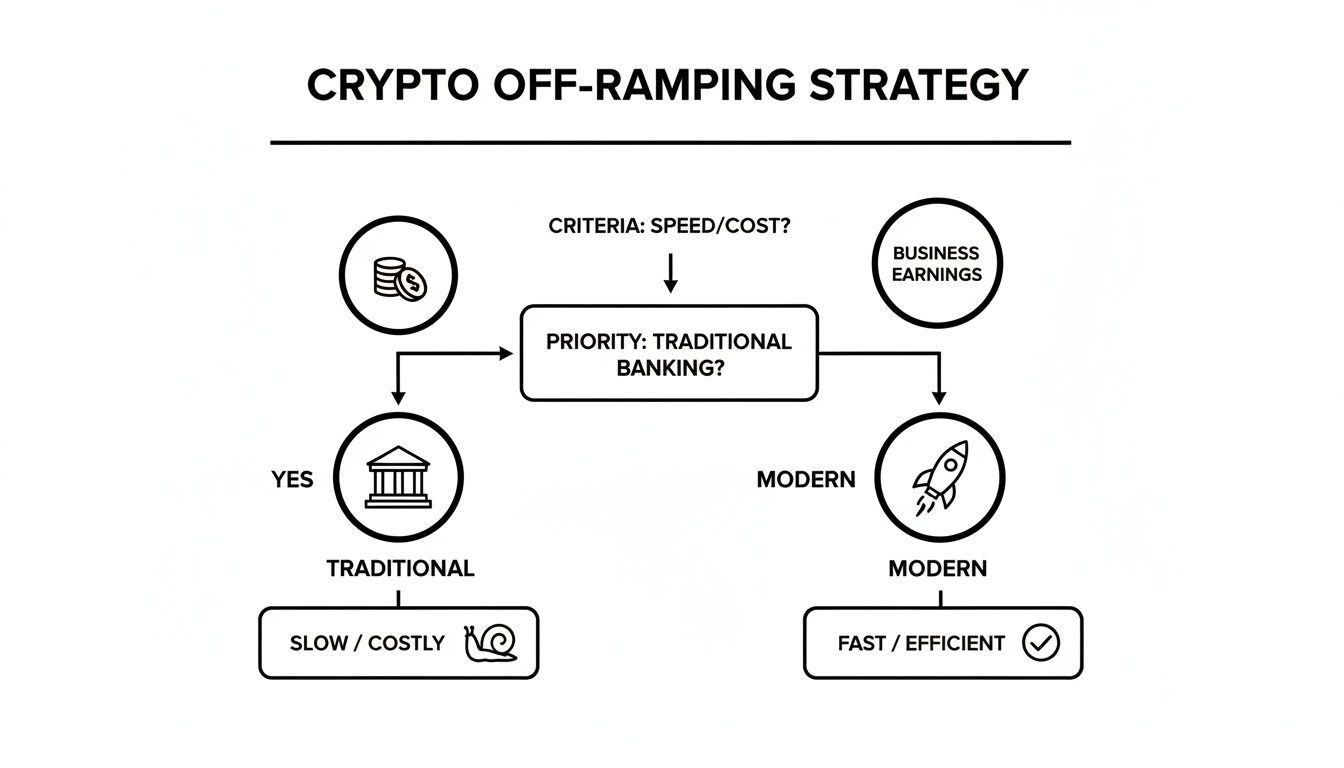

This flowchart gives you a great visual on the core choice businesses face when it's time to cash out their crypto earnings.

As you can see, there’s a clear fork in the road between the slow, expensive old-school methods and the faster, more efficient solutions available today for converting crypto to fiat.

To make this even clearer, here's a quick side-by-side look at how these methods stack up.

Crypto Off-Ramp Methods Compared For Businesses

| Method | Best For | Typical Fees | Settlement Speed | Security Level |

|---|---|---|---|---|

| Centralized Exchanges | Low-volume, infrequent, or one-off transactions. | 0.5% - 2% + withdrawal fees | 1-5 business days | High (custodial risk) |

| OTC Desks | Large block trades (typically $100k+). | Varies (0.1% - 0.5%), often negotiable. | Same day to 3 business days | Very High (personalized) |

| B2B Processors | High-volume, daily online transactions (e.g., e-commerce). | 0.25% - 1%, often tiered by volume. | Instant (to stablecoin), scheduled fiat payouts | High (non-custodial options) |

This table should give you a solid baseline for thinking about your own needs. Now, let’s dig into the specifics of each one.

Centralized Exchanges for Occasional Conversions

For businesses just dipping their toes into crypto, centralized exchanges like Coinbase or Kraken are the usual first stop. They offer a familiar, user-friendly interface for buying, selling, and converting digital assets into cash. They feel a lot like an online banking portal.

If you have low or infrequent transaction volumes, a CEX is a perfectly practical starting point. A crucial first step is choosing from reliable South Africa Cryptocurrency Exchange Platforms or others in your region. But be warned: their fee structures, which often include a mix of maker-taker fees, withdrawal charges, and network costs, can really add up as your volume grows.

Picture a freelance graphic designer who gets a one-time payment of $5,000 in ETH. For them, using a CEX is a straightforward way to turn that crypto into USD and send it to their bank. It's a manual process, but for a single transaction, it’s completely manageable.

Over-the-Counter Desks for High-Volume Trades

Now, when your business needs to move a serious amount of crypto—think $100,000 or more—an OTC desk is a much better tool for the job. These services offer a personalized, high-touch experience for large block trades by connecting buyers and sellers directly, away from the public order books.

The biggest win with an OTC desk is minimizing slippage. That’s the nasty difference between the price you expect to get and the price you actually get. If you dump a huge sell order on a public exchange, you can single-handedly tank the price, which means less cash in your pocket. OTC desks prevent this by locking in a pre-agreed price for the entire trade.

For instance, a venture capital fund looking to liquidate $2 million in BTC would never do it on a public exchange. They'd go straight to an OTC desk to secure a competitive, fixed rate without spooking the market and eroding the value of their own assets during the sale.

B2B Payment Processors for Automated Operations

For most online businesses that handle daily transactions—like e-commerce stores, SaaS companies, and digital platforms—a B2B crypto payment processor is the most efficient and scalable solution by far. These services are built to automate the entire workflow, from accepting the payment to off-ramping the funds.

Instead of you or your team manually converting every single payment, a processor like BlockBee can instantly swap incoming crypto for a stablecoin. This move alone shields you from price volatility. From there, the funds can be automatically sent to your bank account on a schedule you set.

The key advantage here is scalability. As your business grows from ten sales a day to a thousand, the system handles the volume without you lifting a finger. That's a huge deal for keeping your operations lean.

The United States has emerged as the world's biggest crypto market, with activity jumping as major banks like JPMorgan and Citigroup start exploring blockchain. This growth is heavily driven by stablecoins, which have hit over $4 trillion in annual volume and now make up 30% of all on-chain activity.

Platforms like BlockBee are built for this reality, processing over $30 million for merchants with fees as low as 0.25%. They offer instant payouts that are lightyears ahead of slow, traditional banking.

For any merchant, this shift means faster, cheaper transactions, especially across borders. If you’re handling frequent payments, understanding how to convert cryptocurrency to fiat is no longer a "nice-to-have"—it's fundamental to managing your cash flow. This approach turns a complex financial chore into a simple, automated process that just runs in the background, freeing you up to focus on growing your business.

Navigating Compliance And Security In Crypto Transfers

Moving funds from the blockchain to your bank isn't just a technical puzzle—it's a regulatory one, too. Every off-ramp provider, whether it's a huge exchange or a specialized payment processor, has to play by a strict set of rules designed to stop financial crime. For any business, this means getting a handle on compliance isn't optional; it's a core part of your financial operations.

At the heart of it all are two acronyms you’ll see everywhere: KYC (Know Your Customer) and AML (Anti-Money Laundering). These aren't just red tape. They're global standards that financial institutions are legally bound to follow to verify identities and flag suspicious transactions.

For your business, this translates into providing specific documentation to prove you are who you say you are before you can cash out your crypto.

The Essentials of Business Verification

When you partner with an off-ramp service, they’re legally required to know who they're doing business with. This process, often called Know Your Business (KYB), is naturally more involved for a company than for an individual. Expect to submit a standard package of documents to verify your business's identity and who owns it.

You’ll need to have things like this ready:

- Business Formation Documents: This means your articles of incorporation or other registration paperwork that proves your company is a legitimate legal entity.

- Proof of Address: A recent utility bill or bank statement with your registered business address usually does the trick.

- Ownership Information: You’ll have to identify anyone who owns 25% or more of the company. These key people often have to go through their own personal KYC checks.

- Tax Identification Number: Your company's EIN or equivalent tax ID is a must for reporting.

While digging up these documents can feel like a bit of a grind, there’s no way around it. Reputable providers simply won't process your funds without this verification. You can take a deeper dive into our guide explaining why KYC in crypto is so critical for building a trustworthy financial ecosystem.

Think of KYC and AML not as roadblocks, but as the security protocols that protect the entire financial system—and that includes your business. A platform that takes compliance seriously is one you can trust.

Fortifying Your Digital Treasury

Compliance protects you from regulatory headaches, but you still need to guard your assets against direct threats. A rock-solid security posture is absolutely vital when you're managing funds moving between the blockchain and your bank. This comes down to both the tools you use and the habits you build.

One of the single most effective security upgrades you can make is switching to a multi-signature (multi-sig) wallet. Instead of a single private key having total control, a multi-sig setup requires multiple approvals (say, 2-of-3 or 3-of-5) before any transaction can go through. This simple change drastically cuts the risk of internal theft or a single point of failure if one key gets compromised.

For instance, you could set it up so that a transaction needs a green light from the CEO, CFO, and Head of Operations. If one person's login gets stolen, the funds are still safe because the attacker can't get enough signatures.

It's also worth noting that the wider financial world is paying close attention. As a recent headline pointed out, Regulators Urge Banks To Address Crypto Liquidity Risks, which underscores the importance of choosing stable, well-vetted partners for your off-ramping needs.

Vetting Your Third-Party Partners

Your security is only as strong as your weakest link, and that often means the third-party platforms you depend on. Before you integrate with any payment processor or exchange, you have to do your homework. Look for providers who are completely transparent about how they handle security.

- Security Audits: Have they been independently audited by a reputable cybersecurity firm? Ask to see the report.

- Insurance: Do they carry insurance to cover the assets they hold in custody?

- Custody Model: Do they give you a choice? A non-custodial solution means you keep full control of your private keys, which is always the safest option.

By making both regulatory compliance and proactive security your top priorities, you'll build an operational workflow that not only gets the job done but gives you peace of mind with every single transaction.

How to Integrate a Crypto Off-Ramp Solution

Alright, let's get into the nuts and bolts. This is where we connect the dots and build an automated pipeline to move your crypto earnings from the blockchain to bank. I'll walk you through the hands-on process of integrating a payment processor, using BlockBee's platform as our real-world example. You'll see just how fast you can get this up and running.

Whether you're a developer who's comfortable with APIs or a merchant who'd rather use a simple plugin, the goal is the same. You need a reliable, set-it-and-forget-it workflow that handles crypto payments and off-ramping without any daily hand-holding.

The Developer Route Using Direct API Calls

If you have a custom-built platform or just need a deeper level of control, going the API route is your best bet. It gives you total command over the payment experience, from generating unique addresses for each transaction to getting real-time updates through webhooks.

Your first move is always to generate an API key. This is the unique credential that authenticates your system's requests. Treat it like a password for your application—keep it secure on your server and never, ever expose it in your front-end code.

With your key in hand, you can start making calls. The two most critical interactions you'll have with the API are:

- Requesting a Payment Address: Your application pings the processor to get a fresh crypto address for a customer's specific order.

- Handling Notifications: You'll provide a webhook (basically a URL on your server) that the processor uses to instantly notify you when a payment is received, confirmed, or settled.

As you can see from BlockBee's documentation, modern crypto APIs are designed to be developer-friendly, often providing libraries for popular languages to get you started quickly.

The main takeaway here is that you don't have to build everything from scratch. These tools are built for speed and simplicity.

For instance, here’s a quick Python snippet showing how you’d generate a payment address. It's surprisingly straightforward.

import requests

api_key = "YOUR_API_KEY"

my_address = "YOUR_BTC_WALLET_ADDRESS"

callback_url = "https://yourstore.com/callback"

params = {

'apikey': api_key,

'address': my_address,

'callback': callback_url,

'coin': 'btc'

}

response = requests.get('https://api.blockbee.io/api/v1/payment/create/', params=params)

if response.status_code == 200:

data = response.json()

print(f"Payment address: {data['address_in']}")

else:

print("Error creating address")

See? With just a few lines of code, your system can request a new address and automatically link it to your backend via the callback URL for processing.

The Merchant Route Using No-Code Plugins

Running your store on a major e-commerce platform? Good news: you don't need to write a single line of code. Solutions like BlockBee provide pre-built plugins that turn a potentially complex integration into a simple copy-and-paste job.

This is a massive advantage for merchants using platforms like:

- WooCommerce: The go-to choice for WordPress e-commerce sites.

- Magento: A robust platform favored by larger online stores.

- OpenCart: A popular open-source shopping cart solution.

- PrestaShop: Another widely used and flexible e-commerce system.

Getting set up is usually as simple as finding the plugin in your platform's marketplace, installing it, and then pasting your API key into the settings page. That’s often all it takes to enable crypto payments on your site.

The real power of plugins is the speed to market. You can go from deciding to accept crypto to actually doing it in under an hour, without needing to hire a developer or divert your technical resources.

Configuring Your Payout and Address Settings

Once you're connected, either through the API or a plugin, the final piece is dialing in your settings to fit your business's cash flow. This is where you put the "auto" in automation.

A key setting to configure is the payout threshold. This tells the system the minimum balance your account must reach before funds are automatically converted and sent to your bank. For example, you could set it to $500. Every time your processed crypto value crosses that mark, a payout is triggered. This helps you bundle transactions, manage fees, and simplify your accounting.

Another great feature is the ability to use reusable addresses. Instead of creating a new address for every single payment, you can assign a static address to a specific customer or recurring invoice. This is perfect for subscription services, as it makes tracking payments a breeze and keeps the blockchain history cleaner for both you and your customer.

By thoughtfully configuring these options, you create a seamless blockchain to bank pipeline that works quietly in the background, letting you get back to what you do best—running your business.

Mastering Mass Payouts For Global Teams

Moving funds from the blockchain to bank accounts isn't just about getting paid—it's also about paying out. If you're running a business with a global network of freelancers, affiliates, or suppliers, you already know the headache of managing payouts. It can quickly become a complex and costly mess.

This is exactly where blockchain technology steps in, offering a much smarter alternative to old-school payment methods.

Think about a SaaS company with an affiliate program that stretches across dozens of countries. Every month, they owe commissions to 100 different partners. The traditional route means grappling with international bank wires, each hit with high fees, terrible exchange rates, and settlement times that can drag on for days. It's not just slow and expensive; it's a massive drain on your team's time.

The Advantage Of Crypto Payouts

By switching to a crypto-based mass payout system, that same company can completely overhaul its workflow. Forget initiating 100 separate wire transfers. Now, they can just prep a single payout list—often a simple CSV file with wallet addresses and amounts—and send out the entire batch in minutes.

The benefits are huge and immediate:

- Drastic Cost Reduction: International wires can easily set you back $25 to $50 per transaction. Paying 100 affiliates could mean flushing $5,000 down the drain on fees alone. With crypto, the transaction costs are a tiny fraction of that, often just a few dollars for the entire batch.

- Near-Instant Settlement: Blockchain transactions don't wait for business hours. They confirm in minutes, not days. Your partners worldwide get their funds almost instantly, which does wonders for morale and strengthens your business relationships.

- Simplified Operations: You're swapping out a tangled web of different banking systems and regional payment rules for one clean, unified process.

This one change can turn an operational nightmare into a simple, efficient task.

The core value of crypto mass payouts is the removal of intermediaries. By bypassing the traditional correspondent banking system, you eliminate the friction, delays, and costs that have defined cross-border payments for decades.

A Real-World Payout Scenario

Let's make this more concrete. Picture a digital marketplace that needs to pay out earnings to its creators in North America, Europe, and Southeast Asia. Using a platform with a mass payout feature, the finance team can get this done quickly.

First, they compile a list with each creator's crypto wallet address and the amount they're owed, usually in a stablecoin like USDC to sidestep price volatility. Next, they upload this file to their payment provider's dashboard, give it a final review, and authorize the whole batch with a single click.

Within minutes, every single creator has their payment. The marketplace saves thousands in fees, the finance team gets hours of their week back, and the creators receive their money faster than they ever would through a bank. It’s a win-win-win.

For any business ready to make this switch, the first step is understanding the available mass payout solutions to modernize their payment operations.

Security Through Self-Custody

One of the most important aspects of a modern payout system is keeping control of your funds. The most secure solutions are non-custodial, which is just a fancy way of saying you hold your own money in your own wallet right up until the moment of payment.

This is a huge deal. With custodial services, you have to deposit your funds onto their platform, making you vulnerable if they ever have a security breach. A non-custodial model means your assets are never at risk.

This self-custody approach gives you complete authority. You simply connect your wallet, trigger the payouts through an API or a dashboard, and the funds move directly from your wallet to your recipients. It’s the perfect blend of operational efficiency and top-tier security, letting you scale global payments with total confidence.

Common Questions About Cashing Out Crypto

Getting your crypto from the blockchain into your business bank account can feel a bit daunting. You're not alone. Here are some of the most frequent questions we hear from business owners, along with straightforward answers to help you navigate the process like a pro.

How Do We Protect Our Business From Crypto Price Volatility?

This is the big one, isn't it? You sell a product for $100, and an hour later, the crypto you accepted is only worth $90. That's a direct hit to your bottom line.

The smartest move is to sidestep volatility altogether. A quality crypto payment processor will offer instant conversion to a stablecoin like USDC or USDT. The moment a customer’s payment hits your wallet, it’s automatically swapped for a stable asset pegged to the US dollar. This locks in the sale price immediately, so you don't have to sweat the market's ups and downs while waiting to off-ramp.

What Are The Tax Implications Of Converting Crypto To Fiat?

Treat every crypto-to-fiat conversion as a taxable event. In most places, it's viewed the same as selling a stock or any other capital asset. That means you’re on the hook for tracking and reporting any gains or losses.

Meticulous record-keeping is non-negotiable. For every single off-ramp transaction, you need to log:

- The exact date and time of the conversion.

- How much crypto you sold (e.g., 0.5 ETH).

- The cash value you received in your local currency.

- Any fees you paid for the transaction.

Look for a platform that gives you detailed, exportable transaction histories—it makes life so much easier. But remember, this is crucial: always talk to a tax advisor who knows the digital asset space. They'll ensure you're staying compliant with your local laws.

Think of your transaction history as your business's financial ledger for crypto. Meticulous record-keeping isn't just good practice—it's your best defense against tax-related headaches and potential audits down the road.

How Difficult Is It To Integrate A Crypto Payment API?

It's probably much easier than you think. The days of needing a dedicated developer for weeks on end are long gone. Modern crypto payment solutions are built for everyone, not just coders.

If you're using a popular e-commerce platform like WooCommerce, Magento (now Adobe Commerce), or OpenCart, you can usually find a pre-built plugin. Installation is often a simple, no-code affair—just copy and paste an API key, and you're good to go. For custom applications, a well-documented REST API lets a developer get a basic payment system up and running in a matter of hours.

Can I Off-Ramp Crypto To Any Bank Account Globally?

Not quite. It really depends on two things: your off-ramp provider and your bank.

First, you need to make sure the service you’re using actually operates in your country. That's the easy part. The more critical step is confirming that your own bank is comfortable with funds coming from crypto exchanges. Some banks are still wary and have strict internal policies that can cause delays or even freeze your funds.

A quick phone call to your bank to explain your situation can save you a world of trouble. As the regulatory picture gets clearer, more banks are becoming crypto-friendly, but it's always better to check first.

Ready to create a seamless blockchain to bank workflow for your business? With BlockBee, you can automate crypto payments, instantly convert funds to stablecoins, and manage mass payouts with ease. Get started with BlockBee today and take control of your digital revenue.