A Guide to Cryptocurrency to Fiat Conversion

So, you've got crypto and you need cash. The process of turning your digital assets—like Bitcoin or Ethereum—into government-issued money, like US Dollars or Euros, is what we call "off-ramping." Think of it as the bridge connecting the crypto world back to the traditional financial system. It's the final, crucial step that lets you spend your crypto earnings in the real world.

Why You Need a Solid Fiat Conversion Strategy

For any business dealing with digital assets, having a plan to convert crypto to fiat isn't just a good idea; it's a core part of managing your money. If you can't reliably turn that crypto into cash, your assets are effectively stuck online, limiting what you can actually do with them.

This process is absolutely vital for covering day-to-day operational costs—think payroll, rent, and paying suppliers. It's also how you lock in your investment profits. A smart off-ramping strategy gives you predictable cash flow. We all know how volatile the crypto market can be, and a well-timed conversion can protect the value of your earnings from a sudden market dip. It makes your digital revenue real and usable.

The Most Common Ways to Cash Out

When it's time to convert your crypto, you'll find a few main routes to take. Each one has its own pros and cons when it comes to speed, fees, and overall convenience.

- Centralized Exchanges (CEX): These are the big names you've heard of. They act as a middleman, matching buyers and sellers in a trusted environment.

- Peer-to-Peer (P2P) Platforms: These platforms connect you directly with another person to trade crypto for fiat. They usually use an escrow service to keep the transaction safe.

- Specialized Off-Ramp Services: These are platforms built specifically for one thing: turning crypto into cash. They can sometimes offer a smoother process or better rates for certain currencies.

The real challenge isn't just how to convert your assets. It's about doing it quickly, safely, and without getting eaten alive by fees. A smart strategy focuses on minimizing those costs to maximize what actually hits your bank account.

To give you a better sense of these options, let's break them down.

Comparing Common Crypto Off-Ramp Methods

Here's a quick look at the most popular ways to convert crypto assets into cash, highlighting the primary pros and cons of each approach.

| Method | Best For | Typical Speed | Key Consideration |

|---|---|---|---|

| Centralized Exchanges (CEX) | High-volume trading & users who want a familiar, all-in-one platform. | 1-5 business days | Requires identity verification (KYC) and you're trusting a third party with your funds. |

| Peer-to-Peer (P2P) Platforms | Users in regions with limited banking access or those seeking more payment options. | Varies (minutes to hours) | Higher risk of scams; success depends on finding a trustworthy counterparty. |

| Specialized Off-Ramp Services | Businesses needing fast, direct-to-bank settlements for specific currencies. | Near-instant to 24 hours | May support fewer cryptocurrencies and can have higher transaction minimums. |

Choosing the right method really depends on your specific needs—how much you're converting, how fast you need the cash, and your comfort level with different platforms.

By 2025, this whole process has become much more straightforward thanks to major crypto exchanges and dedicated apps. Global players like Binance and Coinbase have become go-to services, along with regional specialists like Nigeria's Breet, for selling assets like Bitcoin or Tether for local currency. Most facilitate withdrawals right to your bank or debit card, making the conversion fast and affordable. It's worth taking some time to explore these evolving exchange services to see which one fits your needs.

Ultimately, getting a handle on these methods is the first step to building a financial workflow that actually works. Whether you're a freelancer getting paid in crypto or a larger company managing a digital treasury, a reliable off-ramping plan is a non-negotiable for staying financially stable and ready for growth.

How to Choose the Right Off-Ramp Platform

Picking the right partner to turn your crypto into cash is one of the most important financial decisions you'll make in this space. The platform you land on will directly affect how fast your transactions clear, how much you pay in fees, and how secure your funds are. They're definitely not all the same, and what works for a high-volume trading desk won't be the best fit for a freelancer getting paid in crypto.

Think about it: a trading firm needs rock-bottom fees and massive liquidity to execute large orders without slippage. But if you're a small business owner just needing to cash out a payment, you probably care more about a simple interface and knowing the money will hit your bank account quickly. Figuring out your own priorities is always the first step.

Evaluate Key Platform Features

When you start digging into different off-ramp providers, a few core features should be at the top of your checklist. These are the make-or-break details that let you compare services properly.

First up, and it might sound obvious, but check the supported currencies. Does the platform actually handle the crypto you hold and the fiat you need? Whether you're dealing in BTC and need USD, or something more exotic, this is the most basic filter.

Next, you have to get granular with the fee structure. Don't just look at the shiny, advertised trading fee. You need to uncover all the potential costs—withdrawal charges, network fees, and any other "hidden" expenses that can eat into your cash-out. For a good real-world example of how these fees are broken down, you can check out Vtrader's fee page.

Finally, security and compliance are non-negotiable. I'd never use a platform that doesn't take this seriously. Look for:

- Two-Factor Authentication (2FA): This should be standard. If it’s not, that’s a huge red flag.

- Withdrawal Address Whitelisting: A fantastic feature that lets you lock withdrawals to only your pre-approved bank accounts or addresses.

- Regulatory Compliance: Make sure the platform is fully compliant with KYC (Know Your Customer) and AML (Anti-Money Laundering) rules for your country. This protects you and the platform.

Comparing Centralized Exchanges and Specialized Services

Your two main options are typically large, centralized exchanges (CEXs) or more focused, specialized off-ramp services.

CEXs are the giants of the industry for a reason. They have massive brand recognition and, more importantly, deep liquidity. These platforms are huge marketplaces for both buying and selling crypto. Between July 2024 and June 2025, centralized exchanges processed enormous fiat inflows, with Bitcoin alone representing over $4.6 trillion in fiat purchases. This sheer volume shows how central they are to the ecosystem, making them a very solid choice for most conversion needs.

On the flip side, dedicated off-ramp providers are specialists. Their entire business is built around getting crypto from a wallet into a bank account. They often offer a more direct, and sometimes faster, settlement process. This is perfect for businesses that have predictable cash flow needs, like making payroll or paying vendors on a strict schedule.

Key Takeaway: Let your transaction volume and frequency be your guide. If you're converting funds daily or in large amounts, the deep liquidity pools on a major exchange are your best friend. For bigger, less frequent withdrawals, a specialized service might offer a smoother, more direct experience.

At the end of the day, you're looking for a reliable financial partner, not just a tool. Do the research, compare the fine print, and go with the service that gives you peace of mind. Getting this choice right from the start will make your entire off-ramping process secure, efficient, and cost-effective.

Using Stablecoins for Smarter Fiat Conversions

If you've spent any time in crypto, you know volatility is the name of the game. That's a huge risk when you're trying to convert your business's crypto earnings into fiat. So, how do you lock in your gains without sleepless nights? The answer, for many of us, is stablecoins.

Think of a stablecoin like USDC or USDT as your financial safe harbor. Instead of jumping directly from a volatile asset like Bitcoin to your bank account, you can make a strategic pit stop. This simple move lets you lock in the value of your assets the moment you decide to sell.

For example, you see a great price for Bitcoin and decide to sell. By immediately swapping it for USDC, you've essentially captured that exact dollar value. Now, that money is shielded from market dips while you wait for the fiat withdrawal to hit your bank, which can often take a few days.

Why a Stablecoin Bridge Makes Sense

This strategy is all about giving you back control over timing and predictability. A direct crypto-to-bank transfer is a waiting game where the market can easily turn against you. By converting to a stablecoin first, you effectively hit the pause button on volatility.

From my experience, this approach brings a few key advantages to the table for any business:

- Dodge the Volatility Bullet: Your profits are secured instantly. It doesn't matter if the market tanks while your fiat settlement is processing.

- Speed Up Global Payments: Stablecoin transactions are lightyears ahead of traditional international bank wires in both speed and cost.

- Sharpen Your Financial Planning: When you know the exact fiat value you’re getting, forecasting and managing your cash flow becomes much more reliable.

The core idea is simple: separate the timing of your market exit from the timing of your bank withdrawal. This small change in workflow can save a significant amount of money and reduce financial stress, especially in a turbulent market.

A Game-Changer for International Transactions

For businesses operating globally, stablecoins aren't just a smart move; they're practically essential for converting crypto to fiat. The real value becomes clear when you look at the sluggish and expensive traditional banking system.

A 2025 report from FXCintel, for instance, highlights how regions like Sub-Saharan Africa stand to gain the most, thanks to notoriously high remittance costs and slow transfers.

This is where stablecoins truly shine. Imagine paying an international contractor. Instead of a costly wire transfer that takes a week, you can send USDC in minutes. They receive it almost instantly and can then convert it to their local fiat currency on their own terms. It simplifies global finance, making your entire operation more agile.

To really dig into how this works, check out our guide on the role of stablecoins in cross-border payments. It's a strategy that can seriously cut down on operational headaches and costs.

Your Secure Crypto Off-Ramping Workflow

Alright, you've picked your platform and have a game plan. Now, let’s get down to the brass tacks of actually turning those digital assets into cash you can use. Having a repeatable, methodical workflow is your best defense against the simple mistakes that can stall a transfer or, worse, cause you to lose funds. The goal is to make every cryptocurrency to fiat conversion a predictable, non-event.

It all starts with locking down your account from day one. Security is never an afterthought—it's the foundation. At a bare minimum, you need two-factor authentication (2FA) enabled. For an even beefier layer of protection, I always recommend using a withdrawal address whitelisting feature if it's available. This locks any outgoing transfers to only your pre-approved bank accounts, a simple move that can thwart a potential disaster if your account is ever compromised.

Initiating the Transfer and Sale

With your account properly secured, it's time to move your crypto from your business wallet to the exchange. This is where you need to be meticulous. Always double—then triple—check the deposit address the exchange gives you. Sending crypto to the wrong address is like putting cash in an envelope with the wrong address on it; it's gone for good.

Just as critical is making sure you've selected the right blockchain network. I've seen it happen: someone sends USDT on the Ethereum network (ERC-20) to a Tron network (TRC-20) address, and those funds are lost forever. Pay close attention to the details here.

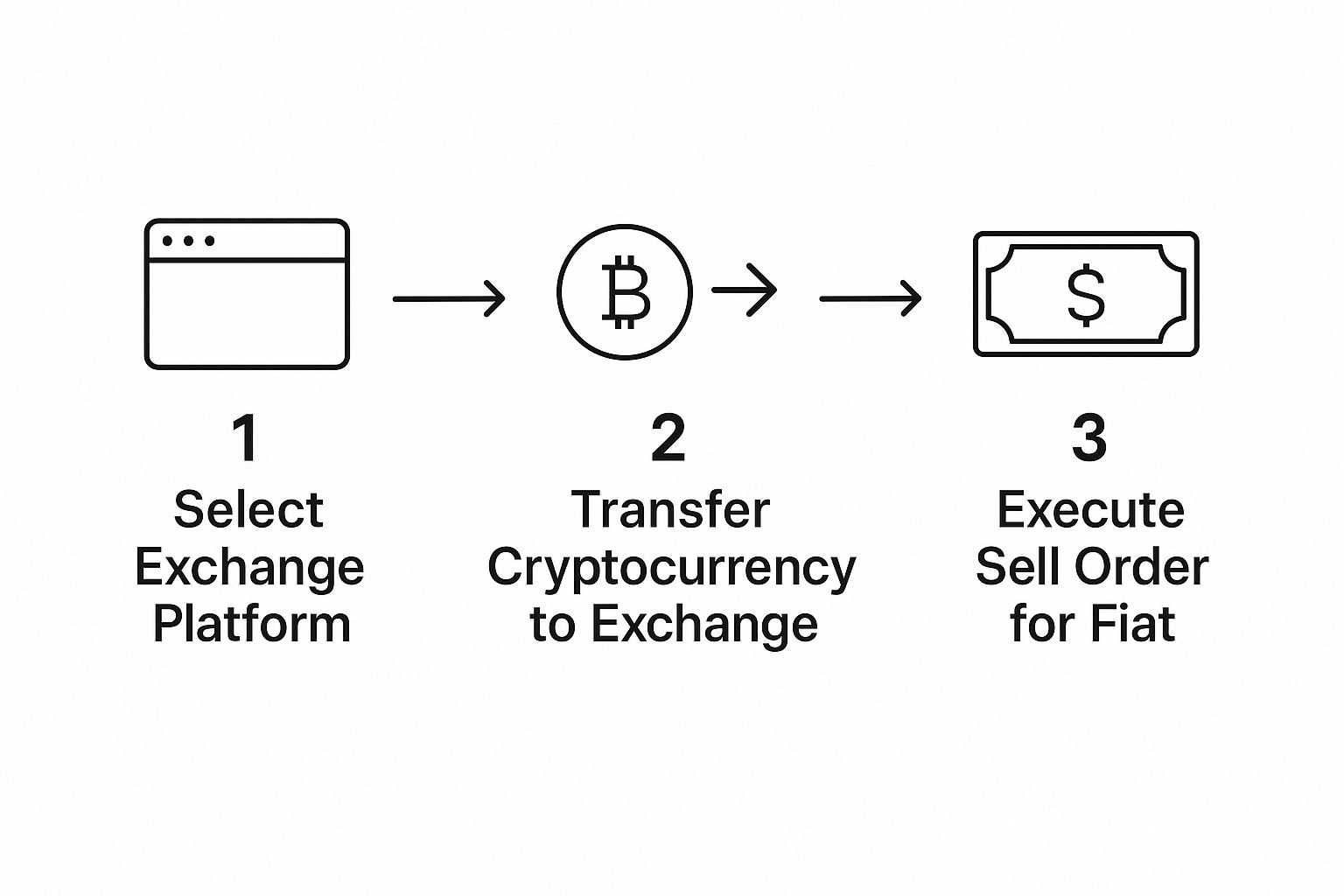

This infographic breaks down the basic flow of the conversion process.

As you can see, it’s a clear three-phase journey, from choosing your tools to getting the final fiat deposit.

Once the crypto lands in your exchange account, you'll place a sell order. You typically have two main options:

- Market Order: This sells your crypto instantly at the best available market price. It's the fastest and most common choice.

- Limit Order: This lets you set a specific price you want to sell at. Your order will only go through if the market hits that price.

For a business that just needs to cash out a payment, a market order is almost always the most direct path to convert cryptocurrency to fiat without playing guessing games with the market.

Finalizing the Fiat Withdrawal

With the crypto sold, the last leg of the journey is withdrawing the cash to your linked bank account. Before you hit that final confirmation button, take a second to review the platform's withdrawal fees and estimated processing times. These can vary quite a bit and will affect the final amount that hits your account.

Be sure to keep clean records of every single transaction. You'll want to log the amount of crypto sold, the exact exchange rate, the date, and any fees involved. This isn't just about good housekeeping; it’s absolutely essential for your accounting and tax reporting later on.

Pro Tip: When using a new platform, I always send a small test amount first. Go through the entire process—from deposit to withdrawal—with a tiny sum. This confirms all your addresses are correct and that the system works as you expect before you move any significant amount of money.

This careful, step-by-step approach is particularly crucial for companies just getting started. If this is all new territory, you might find some helpful context in our article on accepting crypto payments for business. Think of a solid off-ramping workflow as the final, critical piece of that entire operational puzzle.

Navigating Tax and Compliance Requirements

Cashing out your crypto isn't just a simple swap from digital to dollars. It's a regulated financial event that comes with very real tax and legal responsibilities. Trust me, ignoring compliance is a surefire way to create massive headaches for your business later on. Staying on the right side of these rules is non-negotiable for smooth, long-term operations.

Any legitimate off-ramp service you use is bound by strict Know Your Customer (KYC) and Anti-Money Laundering (AML) laws. That’s why they ask for your ID and business verification during setup. These aren't just hoops to jump through; they're essential safeguards to prevent fraud and protect the integrity of the financial system. A platform that takes this seriously is a platform you can trust.

Understanding Your Tax Obligations

Let's get straight to the point: in most places, like the U.S., selling crypto for fiat is a taxable event. The second that conversion happens, you’ve likely triggered a tax liability. This is the single most important concept to get right.

It all comes down to capital gains. If you sell your crypto for more than you bought it for, that profit is a capital gain, and Uncle Sam wants his cut. On the flip side, selling at a loss can sometimes be used to offset other gains, which is a silver lining.

To figure out the numbers, you need to know your cost basis—what you originally paid for the crypto, including any fees. The math is straightforward:

- Capital Gain/Loss = Sale Price - Cost Basis

So, if you bought 1 ETH for $2,000 and sold it for $3,500, your capital gain is $1,500. That's the figure you'll need to report. This is why keeping clean, detailed records of every single transaction isn't just good practice—it's absolutely essential.

Best Practices for Staying Compliant

Crypto taxes can feel like a beast, but you can tame it with the right system. The worst thing you can do is try to piece together a year's worth of trades right before the tax deadline. Get organized from day one.

The best advice I can give is to treat your crypto bookkeeping with the same rigor as your traditional business accounting. This isn't just about April 15th; it's about having a clean, auditable financial trail for your company year-round.

Here are a few practical ways to stay on top of it all:

- Get Crypto Tax Software: Seriously, don't try to do this manually. Tools like Koinly or CoinTracker are lifesavers. They sync with your wallets and exchanges to automatically track your cost basis and calculate gains and losses, saving you countless hours and preventing costly mistakes.

- Log Everything: For every cryptocurrency to fiat conversion, you need a record. Note the date, the crypto sold (e.g., 0.5 BTC), the fiat value you received, and any transaction fees. A simple spreadsheet can work, but the software mentioned above does it better.

- Hire a Pro: Tax laws around digital assets are a moving target and can be incredibly confusing. Find a tax advisor or CPA who genuinely understands crypto. Their expertise is worth every penny to make sure you're compliant and not overpaying.

Got Questions About Cashing Out Crypto? We’ve Got Answers.

Even with a solid plan in place, turning your business's crypto earnings into cash can feel a little murky. It’s natural to have questions, especially when you're dealing with frequent transactions and need to manage your cash flow effectively.

Let’s dive into the questions I hear most often from business owners about the crypto-to-fiat conversion process.

One of the biggest concerns is always speed. How long will it actually take for the money to hit your bank account? The timeline really depends on the path you choose. A standard wire transfer from a large exchange usually takes 1-3 business days, while an ACH transfer can sometimes stretch to 5 days.

On the other hand, specialized crypto off-ramp services are often much faster, with some offering nearly instant settlements. For any business where cash flow is king, that speed can make a world of difference.

What Fees Should I Expect?

Another hot topic is fees. It's never just one simple charge, and if you’re not careful, the costs can eat into your revenue. You need to be aware of the full picture to understand what you’ll actually pocket from a sale.

Typically, you'll run into a few different costs:

- Trading Fees: This is what the platform takes for actually selling your crypto. It's usually a small percentage of the total sale amount.

- Network Fees: Before you can even sell, you have to move your crypto to the exchange. This transaction costs a "gas" fee paid to the blockchain network itself.

- Withdrawal Fees: Once your crypto is sold and you have fiat, the platform will charge you a fee—often a flat rate—to send that cash to your bank.

I can't stress this enough: you have to look at the total cost. A platform might lure you in with super-low trading fees, only to hit you with a massive withdrawal fee. Always calculate the cost of the entire process from your wallet to your bank account.

Then there's the question of limits. How much can you actually cash out? Every platform has daily, weekly, or monthly withdrawal limits. These are almost always tied to your verification level—the more KYC/AML documentation you provide, the higher your limits will be.

If your business handles a high volume of crypto payments, you absolutely must confirm that a platform's limits can accommodate your needs before you commit. Running into a withdrawal cap when you need to make payroll is a nightmare you want to avoid.

For a deeper look into the mechanics of the conversion process, our guide on how you can cash out cryptocurrency is a great resource.

And finally, we have to talk about security. My best piece of advice is simple: don’t treat an exchange like a bank account. Never leave large amounts of crypto sitting on an exchange for long periods. Only move what you plan to sell right away, and make sure you’ve enabled every security feature available, especially two-factor authentication (2FA) and withdrawal address whitelisting.

BlockBee helps you manage your crypto finances without the headache. As a non-custodial payment gateway, we ensure you always have full control over your funds, complete with instant payouts and transparent, low fees. See how we can help your business at https://blockbee.io.