Your Guide to Using a Bitcoin Transaction Accelerator

It’s a feeling every Bitcoin user dreads: you send a payment, and then... nothing. Hours go by, and it’s still sitting there, unconfirmed. More often than not, the reason your Bitcoin transaction is stuck is surprisingly simple: the transaction fee was too low for the current network conditions.

Think of the Bitcoin mempool—the waiting room for all unconfirmed transactions—as a packed concert venue with limited seating. Miners are the bouncers, and they’re only letting in the people who offer the biggest tip. If your fee is too low, you’ll be left waiting outside until the crowd thins out.

Understanding Why Your Bitcoin Transaction Is Stuck

The Bitcoin network is a competitive marketplace for block space. A new block is mined roughly every ten minutes, but it can only hold a finite number of transactions. When the network gets busy, a queue forms in the mempool.

Miners are driven by profit. They’ll always prioritize transactions that pay them the highest fees. If your transaction’s fee is outbid by others, it gets pushed to the back of the line, time and time again. This is the exact scenario a bitcoin transaction accelerator is built to fix.

The Impact of Network Congestion

The crypto world never sleeps, and network traffic can swing wildly. A sudden price rally, a popular new Ordinals mint, or a breaking news story can trigger a flood of new transactions. On an average day, the Bitcoin network might process nearly 500,000 transactions, but during peak times, that number has shot past 724,000.

This kind of surge can clog the mempool for hours, sometimes even days. A fee that would have gotten you a quick confirmation just last week might be completely ignored today.

So, why does this happen? A few common culprits are usually at play:

- Low Fee Rate: The most common reason. You simply set a fee (measured in satoshis per virtual byte, or sat/vB) that wasn't competitive enough for the current demand.

- Sudden Traffic Spike: You sent your transaction right before a wave of high-fee transactions hit the mempool, instantly pushing yours down the priority list.

- Outdated Wallet Software: Older wallets often rely on poor fee estimation algorithms, suggesting rates that are far too low for the modern network.

Key Takeaway: A stuck transaction isn't lost—it's just unconfirmed. Miners haven’t included it in a block because its fee is too low to compete with other, more profitable transactions waiting in the mempool.

To help you quickly figure out what's going on, here's a simple table that matches common symptoms with their likely causes and solutions.

Quick Diagnosis for Stuck Bitcoin Transactions

| Symptom | Common Cause | Primary Solution |

|---|---|---|

| Transaction unconfirmed for 1-2 hours | Mild network congestion, slightly low fee. | Wait a bit longer, or use an accelerator for urgency. |

| Unconfirmed for 6+ hours | High network congestion, significantly low fee. | Fee-bumping (RBF or CPFP) is recommended. |

| Status shows "dropped" or disappears | Node mempools have timed out and discarded it. | The funds are safe. Simply resend the transaction. |

| Wallet error during sending | Outdated wallet or a bug. | Update your wallet software and try again. |

Understanding these patterns is the first step. The good news is that you almost always have a way to fix the problem.

How Fee Estimation Works

The best defense is a good offense. To avoid getting stuck in the first place, you need to use a reliable, up-to-date fee estimator. These tools constantly analyze the mempool and predict what fee rate will get your transaction confirmed in the next block, the next hour, or beyond.

For a live look at what miners are currently accepting, you can check out our real-time fee estimator. Getting the fee right from the start is the easiest way to ensure your Bitcoin gets where it’s going without any unnecessary stress or delays.

How Bitcoin Transaction Accelerators Actually Work

So, what really happens when you hand over your Transaction ID (TXID) to one of these accelerator services? It’s not some dark art; it’s just a clever way of gaming the Bitcoin network’s own rules. These services are essentially giving your stuck transaction a nudge, but how they do it can be worlds apart.

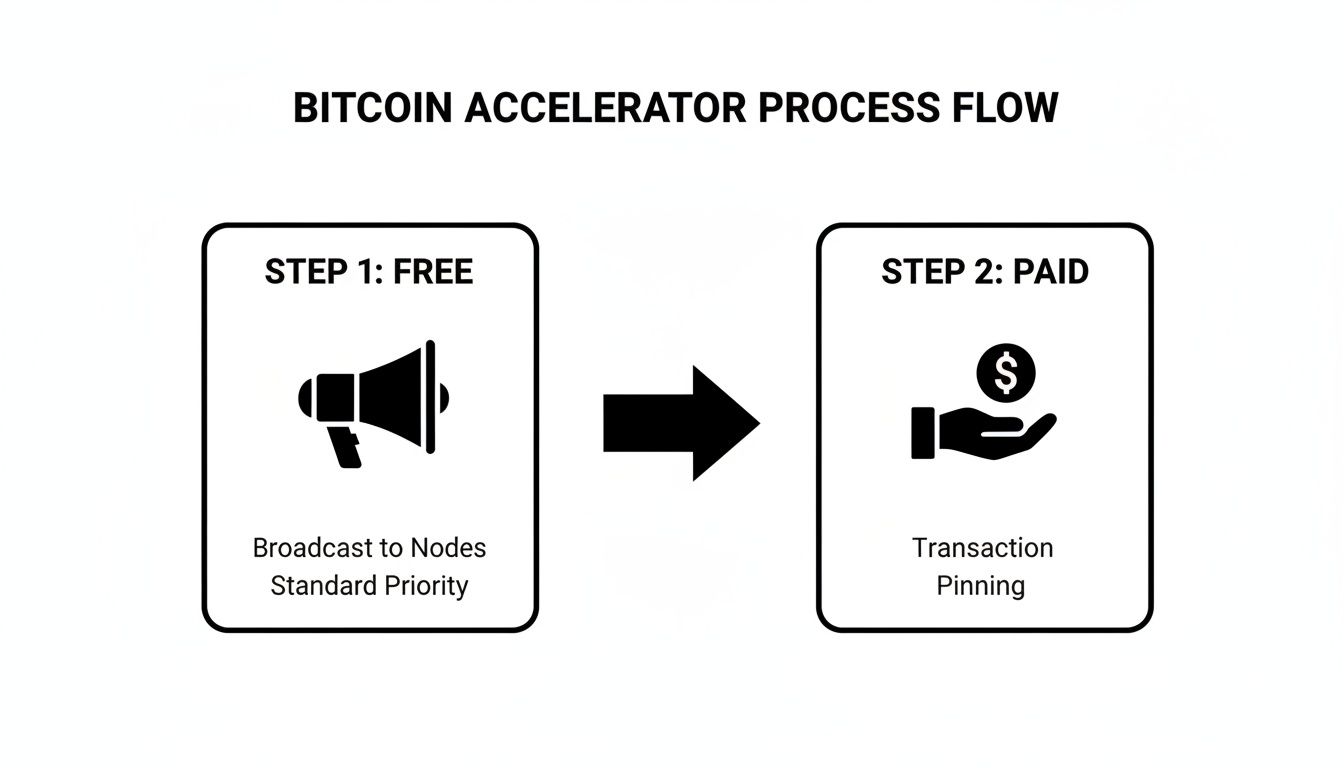

At the end of the day, an accelerator's job is to make sure miners see and care about your transaction. They come at this problem from a couple of different angles, which neatly sorts them into two camps: the free rebroadcasters and the paid, direct-to-miner services.

The Rebroadcasting Method of Free Accelerators

Most free accelerators rely on the simplest trick in the book: rebroadcasting. When you submit your TXID, their system just starts shouting your transaction data out to all the Bitcoin nodes it knows. The idea is to make sure your transaction is floating around in as many mempools as possible, just in case some nodes dropped it or never saw it in the first place.

Think of it like this: your transaction is a flyer for a local concert that got lost in the mail. A rebroadcasting service is like printing thousands of extra copies and plastering them all over town. It definitely increases the odds that someone important (a miner) will see it.

This can sometimes be enough to get a transaction over the line, especially if it just needs a tiny push. But let's be realistic—it offers zero guarantees. If your fee is just plain too low for how busy the network is, showing it to more miners won't convince them to pick it up over transactions that will actually make them money.

The Direct-to-Miner Approach of Paid Services

This is where things get serious. Paid accelerators don't just hope for the best; they take your transaction and hand-deliver it to the people in charge. These services have direct lines of communication and often financial partnerships with major mining pools.

When you pay their fee, the accelerator sends your TXID straight to their partner pools. The pool operator then shuffles your transaction into a high-priority list, essentially letting you jump the massive queue in the public mempool.

Here's a better way to picture it:

- The Mempool: The chaotic general admission line at a sold-out festival.

- Your Low-Fee Transaction: You're stuck way at the back, maybe not even getting in.

- A Paid Accelerator: Your friend who works backstage gets you a VIP pass, letting you walk right in.

This is exactly why paid services can confidently promise a confirmation in the next block or so. They aren't just broadcasting into the ether; they're talking directly to the bouncers at the front door. For a merchant waiting on a payment to clear before shipping an order, that kind of certainty is everything.

A legitimate bitcoin transaction accelerator will only ever ask for your Transaction ID (TXID). If a service requests your private keys, seed phrase, or any other wallet information, it's a scam. Full stop. Your TXID is public information, and it's all they need.

Are They Safe to Use?

It’s completely normal to feel a bit uneasy about giving your transaction info to a third party, so let's clear this up. The security of your Bitcoin hinges entirely on your private keys. As long as those keys never leave your wallet, your funds are safe.

An accelerator works with the public data of your transaction, which is already visible to the entire world on the blockchain. They can't change the transaction—it's already been signed by your private key. All they can do is act as a messenger service, delivering that signed, unalterable transaction to miners with a little extra encouragement.

Of course, you should always stick with reputable services. But the core process itself is safe and doesn't expose your wallet to any risk. Understanding this difference is key to using these tools without losing any sleep.

Manual Methods for Unsticking a Transaction

While accelerator services are handy, you don't always need to pay a third party to get your transaction moving. If you’re comfortable getting your hands a little dirty, there are a couple of powerful, built-in methods you can use to rescue a stuck transaction yourself.

Think of it like knowing how to change a flat tire—a skill that can get you out of a jam without having to call for help. The two most common techniques are Replace-by-Fee (RBF) and Child-Pays-for-Parent (CPFP). They are part of the Bitcoin protocol and give you a way to signal to miners that your transaction is worth their time.

Using Replace-by-Fee to Bump Priority

Replace-by-Fee is as straightforward as it sounds. You essentially create a new transaction that’s a carbon copy of the stuck one—same sender, same recipient, same amount—but with one crucial difference: a higher fee. Once you broadcast this new, more attractive version, it kicks the old one out of the mempool.

There's one catch, though. This only works if the original transaction was flagged as "RBF-enabled" when you first sent it. Many modern wallets, like Electrum, do this by default, but it’s always worth checking your wallet’s settings.

Let’s walk through a real-world example:

- You send 0.01 BTC to a merchant, but an hour later, it’s still sitting unconfirmed.

- You check your wallet, confirm the transaction was sent with RBF enabled.

- In your wallet's transaction details, you’ll likely see an option like "Bump Fee" or "Increase Fee."

- Clicking this creates the new transaction for you. All you have to do is approve the higher fee, and the wallet broadcasts it to the network.

Miners are financially motivated. They'll spot the new transaction with its juicier fee and prioritize it. Once they include your new transaction in a block, the original one is automatically invalidated and forgotten. Problem solved.

How Child-Pays-for-Parent Works

So, what happens if your transaction wasn't marked for RBF? Or what if you're the one receiving a payment that's stuck in limbo? This is where Child-Pays-for-Parent (CPFP) comes to the rescue.

The idea here is to create a new "child" transaction that spends the unconfirmed funds from the stuck "parent" transaction.

The real genius is in the fee. You attach a very high fee to this new child transaction, making it incredibly appealing to a miner. But here’s the key: a miner can't process the child without first processing the parent.

By creating a high-fee child transaction, you're essentially stapling the two together. You're making miners an offer they can't refuse: "If you want this big fee from my new transaction, you have to confirm the stuck parent first." It creates a powerful financial incentive for them to grab both.

Imagine someone pays you, but the transaction gets stuck. You need those funds. With CPFP, you can take those unconfirmed coins and immediately create a new transaction—maybe just sending them to another wallet address you own—but you attach a fee large enough to cover the cost of confirming both transactions.

This flow diagram illustrates the different paths to getting a transaction confirmed, from simple rebroadcasting to using a paid service.

As you can see, while free options exist, the manual and paid methods give you a more direct line to a miner's attention.

Practical Steps with a Wallet

The good news is that many wallets have integrated these features directly into their interface. In a wallet like Electrum, performing an RBF is often as simple as right-clicking the unconfirmed transaction in your history and looking for the option to increase the fee.

For CPFP, the process is a bit different but still straightforward. You’d find the unconfirmed incoming transaction, select it, and choose to "spend" from it. The wallet then walks you through creating the child transaction and setting an appropriate fee to push both through.

Throughout this process, keeping a close watch on your transaction's status is key. To get a better handle on this, our guide on how crypto transaction tracking works explains how you can monitor its journey from the mempool to the blockchain.

Ultimately, both RBF and CPFP put you back in control. They are fundamental network features designed precisely for moments when the mempool gets crowded. Once you get the hang of them, you’ll find you rarely need to rely on a third-party service again.

When the do-it-yourself methods like RBF or CPFP seem a bit too technical, or you just need to get a transaction confirmed now, a bitcoin transaction accelerator is your most straightforward option. These services are built for one purpose: to get your stuck transaction pushed through the network, and they only need a single piece of public information to do it.

The whole process is refreshingly simple. You find your transaction's unique ID, hand it over to the service, and they use their connections and resources to get it prioritized by miners.

First, Grab Your Transaction ID (TXID)

Before you can accelerate anything, you need to find your Transaction ID, also known as a TXID or transaction hash. Think of this long string of characters as the public tracking number for your payment on the blockchain.

You'll almost always find the TXID in your wallet's transaction history. Just open up the details of the unconfirmed transaction, and it should be right there. If you can't find it, you can also search your public wallet address on a block explorer like Blockchain.com or mempool.space to locate the transaction details.

Once you’ve found it, copy the entire TXID. That’s the only "key" an accelerator needs to get to work.

A Critical Word on Security: A legitimate accelerator service will never ask for your private keys, seed phrase, or any wallet login credentials. The TXID is public information. Any platform that requests sensitive data is a scam trying to steal your funds, so steer clear.

Next, Submit Your TXID to an Accelerator

With your TXID copied, you just need to pick a service. Most of them operate in one of two ways.

Free Accelerators: These services are usually pretty simple. They take your TXID and rebroadcast it to a bunch of different nodes across the Bitcoin network. It’s a “best effort” shot in the dark, but sometimes, that’s all a transaction with a slightly-too-low fee needs to get noticed by a miner.

Paid Accelerators: This is the high-certainty option. For a small fee, these services use their direct relationships with mining pools to get your transaction included in an upcoming block. They essentially let you pay to jump the queue.

The steps are basically the same for both: go to the accelerator's website, paste your TXID into their form, and hit submit. If you're using a paid service, you'll be given a Bitcoin address to send a small payment to, which activates the acceleration process.

So, Which Type of Service Should You Use?

Choosing between a free and paid accelerator really comes down to one thing: urgency.

If the transaction isn't time-sensitive, give a free service a try first. You have nothing to lose, and it might just do the trick. If you don't see a confirmation after a few hours, you can always move on to a paid option.

For anything urgent—like a customer waiting for an order to be fulfilled—a paid service is the way to go. The cost is typically just a few dollars, which is a small price to pay for the near-guarantee of a quick confirmation. When the network is busy, with daily transactions often soaring past 470,000, this becomes an essential tool for any merchant. You can see the constant demand for block space by checking out Bitcoin's daily transaction volume.

Some businesses even build accelerator APIs into their systems. This allows them to automatically detect and speed up stuck customer payments, fixing potential issues before the customer even notices. It's a smart way to handle the unpredictable nature of network congestion. After you submit your TXID, you can pop it into any block explorer and watch its status flip from "unconfirmed" to confirmed.

How to Avoid Stuck Transactions Entirely

While it's smart to know how to use a bitcoin transaction accelerator, it’s even smarter to never need one. A few proactive steps can save you a ton of time, money, and the headache of a delayed payment. For merchants and businesses, where every transaction counts, this isn't just a convenience—it's essential.

The root of most stuck transactions is simple: the fee was too low. Instead of taking a wild guess, it's always better to rely on real-time data from the network.

Adopt Dynamic Fee Estimation

Picking a transaction fee manually is like trying to guess rush-hour traffic without a map. A much better approach is to use a wallet or payment gateway that offers dynamic fee estimation. This feature looks at the current chaos in the Bitcoin mempool and calculates the right fee to get your transaction confirmed in a reasonable time.

This is a complete game-changer for businesses. A platform like BlockBee builds this right in, making sure every payment—whether it's from a customer or a payout to a supplier—is sent with a competitive fee. This simple automation removes the guesswork and makes it far less likely that your payments will ever get stuck.

If you're new to this, getting the basics right is a great place to start. You can learn more in our guide on how to transfer Bitcoins.

Pro Tip: Think about how quickly you need the transaction to go through. Most good wallets let you pick a fee level: low priority if you're not in a rush, medium for regular timing, and high priority for when it absolutely has to be in the next block. Choose the one that fits your situation.

Diversify Your Payment Options

Relying only on Bitcoin means you're at the mercy of its network congestion and high fees. A solid payment system should always have a plan B, giving you a fallback when the Bitcoin network is swamped.

Offer Multiple Cryptocurrencies: The easiest way to do this is to use a payment gateway that accepts a bunch of different digital currencies. If Bitcoin fees are through the roof, your customers can just pay with something faster and cheaper, like Litecoin or Tron.

Embrace Layer-2 Solutions: The Lightning Network is the perfect example. It's a second layer built on Bitcoin specifically for instant, super-low-cost payments. For small, frequent transactions, it's a fantastic way to skip the mempool congestion entirely.

By giving your customers these options, you create a much smoother experience and keep your business running, no matter what's happening on a single blockchain. That kind of flexibility is what builds a truly resilient payment system.

Leverage a Modern Payment Gateway

For any merchant, the checkout and payout process is where reliability is make-or-break. A modern, non-custodial payment gateway is your best defense against delays, offering features built for real-world business.

Here’s what a platform like BlockBee can do for you:

- Instant Payment Detection: The system spots payments right away, often before they're even confirmed on the blockchain. This means you can update order statuses immediately.

- Reliable Payouts: Features like Mass Payouts are designed with fee optimization in mind, helping you send funds efficiently without overpaying.

- Seamless Integration: With plugins for e-commerce platforms like WooCommerce and Magento, you get all these advanced features working inside the setup you already use.

To really get ahead of this problem, it helps to understand where Bitcoin is headed. As block rewards decrease, transaction fees will become the main reason miners keep processing transactions. This article on the evolving role of Bitcoin transaction fees gives great insight into these changes and shows why setting the right fee is only going to get more important. In the end, avoiding stuck transactions isn't about a single trick; it's about building a smarter, more flexible payment strategy from the ground up.

Frequently Asked Questions

It's easy to get lost in the weeds of Bitcoin transactions, especially when one gets stuck. Let's clear up some of the most common questions people have about transaction accelerators and what to do when a payment is taking forever.

Are Bitcoin Transaction Accelerators Safe to Use?

Generally, yes—but only if you stick with reputable services. The reason they're safe is simple: they only need your Transaction ID (TXID) to do their job. Nothing more.

Your TXID is already public information on the blockchain, so sharing it doesn't expose you to any risk. A legitimate accelerator just uses that ID to find your transaction and push it to their mining partners. Think of it like a public tracking number for a package; anyone can look it up, but no one can touch what's inside.

A Critical Word of Warning: If any site or service asks for your private keys or seed phrase, run. It’s a scam, 100% of the time. Your private keys are the only thing that gives someone control over your Bitcoin, and you should never, ever share them.

How Long Does a Bitcoin Accelerator Actually Take?

That really depends on the type of service you're using and, more importantly, how swamped the Bitcoin network is at that moment.

- Free Accelerators: These are a bit of a gamble. They usually just rebroadcast your transaction across the network, hoping a node that missed it will pick it up. Sometimes it works and you'll get a confirmation in a few hours. Other times, it does nothing at all.

- Paid Accelerators: This is where you get reliability. These services have direct connections to mining pools. By paying them, you're essentially paying the miners to prioritize your transaction. This often results in a confirmation within the next block or two, usually in just 10-20 minutes.

Even paid services can see small delays during major network congestion, but they are by far your best bet when time is a factor.

What Happens If a Transaction Is Stuck Forever?

It won't be stuck forever. Bitcoin nodes have a built-in cleanup mechanism. If a transaction sits unconfirmed in the mempool for too long—typically around 14 days—nodes will eventually drop it to save space.

Once dropped, it’s like the transaction never happened. The Bitcoin was never truly spent, and the funds will simply become available again in the sender's wallet.

Of course, waiting two weeks is almost never the right move. It's far better to take control of the situation yourself using RBF, CPFP, or a paid accelerator service. Don't leave it to chance.

Can I Speed Up a Transaction Someone Else Sent Me?

Absolutely. This is a common problem, and you have a great tool at your disposal: Child-Pays-for-Parent (CPFP).

Here's the idea: you take the unconfirmed Bitcoin you're about to receive and immediately create a new "child" transaction to spend it (even sending it back to yourself works). The key is to attach a very generous fee to this new child transaction—high enough to cover both its own confirmation and that of the "parent" transaction it depends on.

Miners are driven by profit. They see your high-fee child transaction and want that reward. But they can't claim it without also processing the original parent transaction first. This gives them a powerful financial incentive to grab both transactions and confirm them together in the next block. It’s an incredibly clever way to "pay" to accelerate a payment coming to you.

Here at BlockBee, we build our tools to help you avoid these headaches in the first place. Our non-custodial payment gateway uses smart fee estimation to make sure your payments go through smoothly from the start. Get started with BlockBee today and experience crypto payments without the friction.