Best Recurring Billing Software: Top 7 Picks

Subscription and recurring revenue models have become the engine of modern business growth. For SaaS companies, e-commerce brands, and digital service providers, the ability to seamlessly manage recurring payments is critical for predictable cash flow and strong customer retention. However, navigating the crowded market to find the best recurring billing software can be a significant challenge.

Each platform promises automation and simplicity, but the ideal solution hinges on your specific operational needs. Are you a developer-focused team requiring a powerful API for custom integrations? An international business grappling with complex sales tax and VAT compliance? Or perhaps you're a forward-thinking company looking to accept cryptocurrency payments for your subscription services? This guide is designed to cut through the marketing noise and provide clear, actionable insights.

We will deliver an in-depth, comparative analysis of the top recurring billing software solutions available today. You will find a detailed breakdown of each platform's core features, ideal use cases, and transparent pricing structures, complete with screenshots and direct links. We'll examine how established leaders like Stripe and Chargebee serve traditional subscription models while also highlighting how innovative solutions are redefining recurring payments for the digital economy. By the end of this comprehensive roundup, you will have a clear framework for selecting a billing partner that not only automates your revenue collection but also serves as a catalyst for sustainable growth.

1. Stripe Billing: The Developer's Choice for Flexibility

Stripe Billing is a powerful and highly adaptable recurring billing platform built directly on top of Stripe’s renowned global payments infrastructure. It’s designed for businesses, from early-stage startups to large enterprises, that require sophisticated and customizable subscription logic. The platform excels at handling diverse and complex pricing models, making it a top contender for the title of best recurring billing software for companies with evolving needs.

Its core strength lies in its composability and developer-first approach. Stripe provides world-class APIs and extensive documentation, empowering technical teams to build completely custom billing systems tailored to their specific business logic. This flexibility allows for the implementation of nearly any pricing strategy imaginable, from simple flat-rate subscriptions to intricate usage-based models.

Key Features and Use Cases

Stripe Billing offers a comprehensive suite of tools to manage the entire subscription lifecycle.

- Diverse Pricing Models: It supports flat-rate, per-seat, tiered, and metered (usage-based) billing, allowing businesses to charge customers based on consumption, like API calls or data storage.

- Pre-built Components: To accelerate development, Stripe offers embeddable components like Checkout, Payment Links, and a hosted customer portal. This portal lets customers self-manage their subscriptions, update payment details, and view invoices, drastically reducing customer support workload.

- Automated Invoicing & Dunning: The platform automates invoicing and includes smart dunning management to handle failed payments, sending customizable reminders to customers and reducing involuntary churn.

- Global Reach: By leveraging the core Stripe Payments network, it provides access to a vast array of payment methods and supports over 135 currencies, simplifying international expansion.

For businesses looking to integrate a flexible and robust payment system, understanding the nuances of a payment gateway for SaaS is crucial.

Pricing and Accessibility

Stripe Billing's pricing is structured to scale with your business. The "Starter" plan is pay-as-you-go, charging 0.5% on recurring payments, making it highly accessible for new businesses. This fee is in addition to standard Stripe payment processing fees. The "Scale" plan, designed for larger businesses, offers custom pricing and includes premium features like a custom domain for the customer portal and advanced reporting.

| Feature | Description |

|---|---|

| Primary Audience | Developers, Startups, SaaS, Scale-ups |

| Pricing Model | Pay-as-you-go (0.5% per transaction) + Custom "Scale" plan |

| Unique Selling Point | Unmatched API flexibility and developer documentation |

| Customer Support | 24/7 email, chat, and phone support; premium support available |

Pros:

- Extremely powerful and well-documented APIs for deep customization.

- Seamless integration with the global Stripe Payments ecosystem.

- Accessible pay-as-you-go pricing for early-stage companies.

Cons:

- Costs can become significant as transaction fees for both Billing and Payments accumulate.

- Some advanced features require upgrading to the more expensive "Scale" plan.

Website: https://stripe.com/billing

2. Chargebee: The All-in-One Subscription Management Hub

Chargebee is a comprehensive subscription management and recurring billing platform designed to handle the entire customer lifecycle, from acquisition to retention. It caters to a wide range of businesses, especially SaaS and subscription-based companies, by offering a full-stack solution that combines billing automation, dunning management, invoicing, and revenue recognition into a single, cohesive system. This integrated approach makes it a leading choice for businesses looking for one of the best recurring billing software solutions that can scale from startup to enterprise.

Its primary strength is its ability to centralize complex subscription operations. Instead of piecing together different tools for billing, revenue analytics, and retention, Chargebee provides a unified platform. This allows businesses to manage intricate product catalogs with diverse pricing models, automate tax compliance, and integrate with a vast ecosystem of payment gateways, offering flexibility and control over the entire revenue operations workflow.

Key Features and Use Cases

Chargebee offers a robust feature set that simplifies every aspect of subscription management.

- Flexible Product Catalog: It supports a variety of pricing strategies, including subscription, usage-based, and hybrid models. This allows businesses to easily experiment with promotions, trials, and discounts.

- Checkout & Self-Serve Portal: Chargebee provides hosted checkout pages and a self-service customer portal, empowering customers to manage their own subscriptions, update payment information, and download invoices without contacting support.

- Smart Dunning & Invoicing: The platform includes advanced dunning management to automatically recover failed payments and reduce involuntary churn. It also features powerful, customizable invoicing to meet global compliance needs.

- Extensive Integrations: With support for over 35 payment gateways, Chargebee gives businesses the freedom to choose their preferred payment processors and expand into new markets.

- Revenue Recognition & Retention: Optional add-ons provide GAAP-compliant revenue recognition and advanced retention tools, like churn surveys and usage tracking, to provide deeper business insights.

For companies evaluating their options, understanding the landscape of the best SaaS billing software is essential.

Pricing and Accessibility

Chargebee offers a tiered pricing model that accommodates businesses at different growth stages. A generous free "Starter" plan is available for early-stage startups with up to $250K in cumulative revenue, making it highly accessible. The "Performance" and "Enterprise" tiers are designed for scaling businesses and offer more advanced features, with pricing starting at $599/month. It's important to note that overage fees may apply if plan thresholds are exceeded.

| Feature | Description |

|---|---|

| Primary Audience | SaaS, Subscription E-commerce, Startups, Scale-ups |

| Pricing Model | Free Starter tier; Paid plans from $599/month + overages; Custom enterprise plans |

| Unique Selling Point | A single, unified platform for billing, revenue recognition, and retention tools |

| Customer Support | 24/7 email and phone support; Dedicated Customer Success Manager on higher tiers |

Pros:

- Generous free tier makes it accessible for early-stage businesses.

- Strong sandbox environment for thorough testing before going live.

- Combines billing, RevRec, and retention tools into one integrated platform.

Cons:

- Published pricing for mid-tier plans is higher than some competitors.

- Overage fees can apply if usage exceeds the limits of your chosen plan.

Website: https://www.chargebee.com/

3. Recurly: The Subscription Growth Engine

Recurly is an enterprise-grade subscription management platform designed specifically for brands focused on optimizing and scaling their recurring revenue. It distinguishes itself by providing a comprehensive suite of tools that go beyond basic billing to actively manage the entire subscriber lifecycle, from acquisition to retention and expansion. This focus makes it a strong candidate for the best recurring billing software for established B2C and B2B companies looking to reduce churn and maximize customer lifetime value.

The platform's core philosophy centers on revenue optimization. Recurly achieves this through sophisticated payments orchestration, which intelligently routes transactions to the best-fit payment gateway, and an AI-powered revenue recovery engine designed to combat both voluntary and involuntary churn. Its robust infrastructure is built to handle high-volume, complex subscription models, making it a reliable choice for businesses with significant scale.

Key Features and Use Cases

Recurly’s feature set is engineered to drive subscription growth and operational efficiency.

- Advanced Dunning & Churn Mitigation: Recurly uses machine learning to analyze transactions and customize its retry logic, significantly improving payment success rates. This intelligent dunning process helps recover revenue that would otherwise be lost to failed payments.

- Flexible Plan Management: The platform supports a wide array of pricing models, including fixed, quantity-based, hybrid, and usage-based billing. It also offers powerful couponing, add-ons, and trial management capabilities to support marketing and acquisition efforts.

- Payments Orchestration: Instead of locking you into one gateway, Recurly connects to over a dozen gateways, allowing businesses to optimize payment processing based on geography, cost, or success rates, thereby increasing authorization rates and reducing fees.

- Subscriber Portal & Shopify Integration: It offers a hosted subscriber portal for self-service management and a dedicated product, Recurly Commerce, for native Shopify subscriptions, appealing directly to e-commerce brands.

Pricing and Accessibility

Recurly’s pricing is geared towards established businesses and enterprises. The "Core" plan is quote-based and typically requires a minimum monthly transaction volume, making it less accessible for early-stage startups. They also offer a "Professional" and "Elite" plan for larger organizations with more complex needs. While pricing is not publicly listed, Recurly provides a free developer sandbox environment, allowing teams to fully test the platform's capabilities before making a financial commitment.

| Feature | Description |

|---|---|

| Primary Audience | Enterprise B2C/B2B, Mid-market SaaS, E-commerce |

| Pricing Model | Quote-based with TPV minimums; custom plans for larger scale |

| Unique Selling Point | AI-driven revenue recovery and payments orchestration |

| Customer Support | Dedicated support for enterprise clients; standard support available |

Pros:

- Enterprise-grade reliability and scalability with high uptime.

- Advanced, AI-powered tools for churn reduction and revenue recovery.

- Free and fully functional developer sandbox for comprehensive testing.

Cons:

- Quote-based pricing with TPV minimums lacks transparency for smaller businesses.

- Some modules, like advanced revenue recognition, may come at an additional cost.

Website: https://recurly.com/

4. Paddle: The All-in-One Merchant of Record

Paddle offers a fundamentally different approach to recurring billing by acting as a merchant of record (MoR). This all-in-one platform is designed for SaaS and software companies, particularly those selling internationally, who want to offload the complexities of payments, billing, tax compliance, and fraud prevention. By handling these critical functions on behalf of the business, Paddle simplifies global sales operations, making it a powerful contender for the best recurring billing software for businesses prioritizing simplicity and compliance.

Its core strength is its MoR model. Instead of integrating a separate payment gateway, subscription manager, and tax compliance tool, businesses sell through Paddle. Paddle then becomes the reseller on record, taking on the responsibility for every transaction's sales tax (like VAT) calculation, collection, and remittance. This significantly reduces the administrative and legal burden associated with cross-border sales.

Key Features and Use Cases

Paddle provides an integrated suite of tools built to manage and grow a global subscription business.

- Merchant of Record Model: The platform's standout feature automatically handles global sales tax and VAT compliance, removing a major operational headache for companies selling to multiple countries.

- Unified Platform: It combines a global checkout, subscription billing logic, payment processing, and fraud protection into a single integration, reducing the need for multiple vendors.

- Managed Payments & Churn Reduction: Paddle accepts payments via credit cards, PayPal, Apple Pay, and more. Its system includes built-in dunning and payment recovery tools to fight involuntary churn.

- SaaS-focused Reporting: Businesses get access to key SaaS metrics like MRR, churn rate, and customer lifetime value directly within the Paddle dashboard.

Beyond just managing payments, a platform's tools can empower businesses to implement proven customer retention strategies to reduce churn and maximize lifetime value.

Pricing and Accessibility

Paddle’s pricing is famously straightforward. For its standard plan, there are no monthly fees, setup costs, or separate contracts. Instead, it charges a simple, all-inclusive pay-as-you-go rate per transaction (e.g., 5% + $0.50), which covers payment processing, billing features, tax compliance, and fraud protection. For businesses with high volume, custom pricing plans are available.

| Feature | Description |

|---|---|

| Primary Audience | SaaS, Software Companies, International Sellers |

| Pricing Model | Pay-as-you-go (flat fee per transaction) + Custom plans |

| Unique Selling Point | All-in-one Merchant of Record model handles global tax compliance |

| Customer Support | Dedicated support for technical and operational queries |

Pros:

- Dramatically simplifies global tax and VAT compliance.

- Simple, all-inclusive pay-as-you-go pricing covers all core services.

- Reduces the operational burden of managing multiple financial tools.

Cons:

- The flat per-transaction fee can be expensive for businesses with a high average order value.

- Offers less direct control over the payment stack compared to using a separate gateway.

Website: https://www.paddle.com/

5. PayPal Subscriptions / Recurring Payments: The Widely-Trusted Option

PayPal Subscriptions leverages the immense trust and familiarity of the PayPal brand to offer a straightforward recurring payments solution. It's designed for businesses, particularly consumer-facing services, memberships, and nonprofits, that want to offer a recognizable and trusted checkout experience. By tapping into PayPal’s massive global user base, it provides a low-friction way for customers to subscribe using an account they likely already have.

Its primary strength is accessibility and ease of implementation. For businesses already using a PayPal Business account, setting up recurring payments is a natural extension of their existing infrastructure. This makes it an excellent choice for merchants seeking a quick launch without the steep learning curve associated with more complex billing systems, solidifying its place as a contender for the best recurring billing software for direct-to-consumer models.

Key Features and Use Cases

PayPal’s subscription tools are built to manage the core needs of a recurring revenue model simply and effectively.

- Flexible Plan Management: The platform supports a variety of billing cycles, including trials, initial setup fees, and tiered or volume-based pricing. Merchants can also implement plan-wide price updates for all subscribers simultaneously.

- Simple Integration: Businesses can easily add PayPal subscription buttons to their website or integrate with PayPal Checkout, providing a seamless and familiar payment flow for customers.

- Built-in Reporting: The PayPal Business dashboard offers essential reporting features and KPIs, allowing merchants to track subscription revenue, active subscribers, and other vital metrics without needing a separate analytics tool.

- Cross-Border Capabilities: Merchants can define subscription plans in multiple currencies, simplifying the process of selling to an international audience and managing global payments.

For those just starting, it's helpful to understand the fundamentals of how to set up recurring payments.

Pricing and Accessibility

PayPal's pricing model for subscriptions is based entirely on transaction fees, with no monthly or setup costs for the subscription feature itself. This makes it highly accessible for businesses of all sizes. The standard rate for commercial transactions (which includes subscriptions) in the U.S. is typically 3.49% + $0.49 per domestic transaction. While this is straightforward, these fees can be higher than some dedicated payment gateway alternatives.

| Feature | Description |

|---|---|

| Primary Audience | Consumer-facing businesses, Memberships, Nonprofits |

| Pricing Model | Pay-as-you-go (e.g., 3.49% + $0.49 per transaction) |

| Unique Selling Point | High consumer trust and massive existing user base |

| Customer Support | Phone support, resolution center, and extensive help documentation |

Pros:

- Extremely familiar and trusted checkout experience for consumers.

- Low barrier to entry with no monthly fees for the subscription functionality.

- Easy to launch for existing PayPal Business account holders.

Cons:

- Transaction fees can be higher compared to other specialized billing platforms.

- Lacks the advanced catalog complexity and API flexibility of developer-centric solutions.

Website: https://www.paypal.com/business/accept-payments/subscriptions

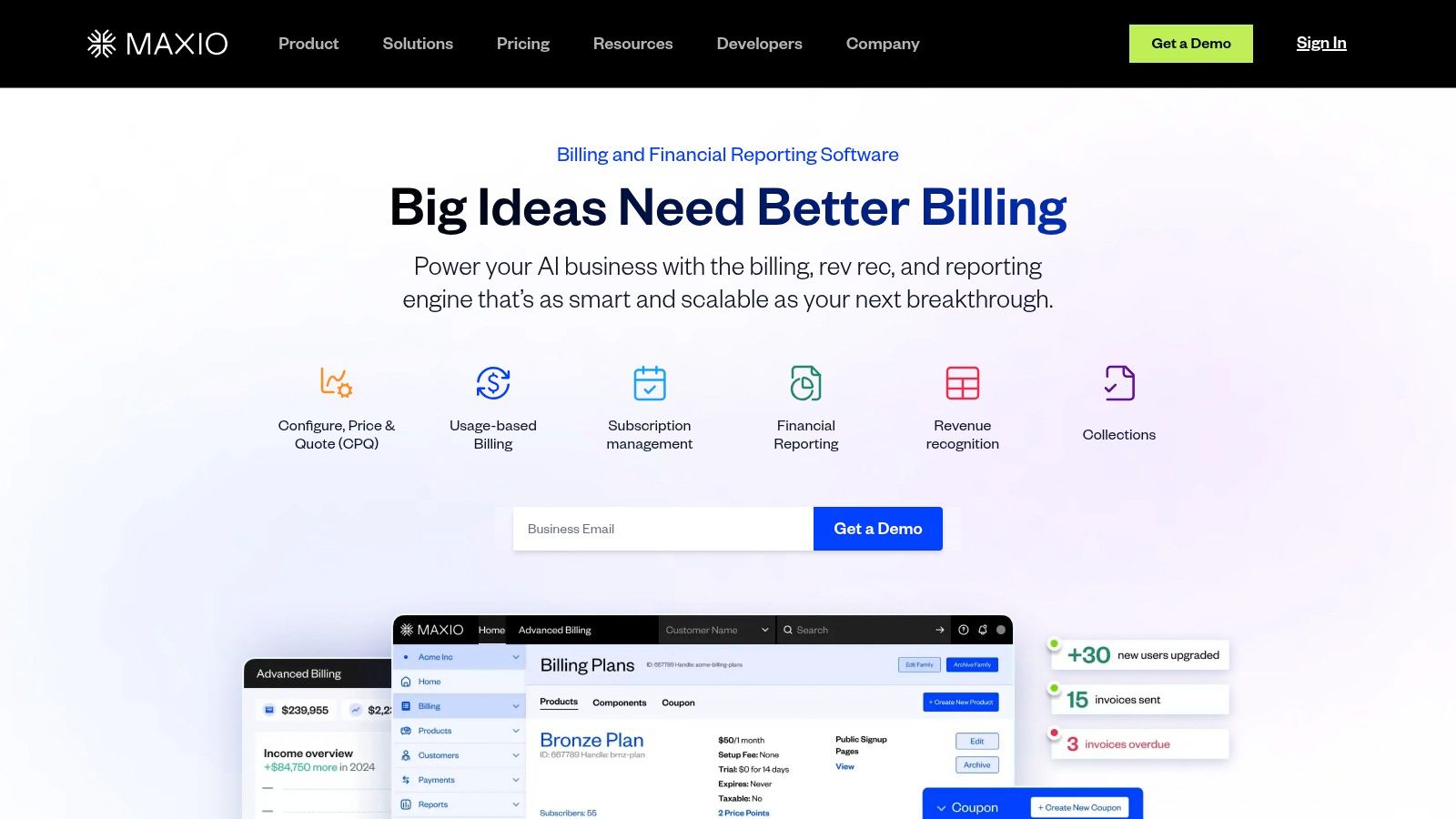

6. Maxio: The B2B SaaS Billing Powerhouse

Maxio, the entity formed from the merger of Chargify and SaaSOptics, is a comprehensive financial operations platform specifically engineered for B2B SaaS companies. It moves beyond simple payment processing to integrate subscription billing, revenue recognition, accounts receivable management, and detailed SaaS analytics into a single source of truth. This makes it a top contender for the best recurring billing software for established SaaS businesses navigating complex financial compliance and growth scaling challenges.

Its core strength lies in its ability to handle intricate B2B billing scenarios, from high-volume usage-based models to complex product catalogs with numerous add-ons and promotions. By uniting billing operations with financial reporting, Maxio provides executives and finance teams with clear, real-time visibility into key metrics like ARR, churn, and LTV, directly from the billing data.

Key Features and Use Cases

Maxio offers a robust feature set designed to manage the entire quote-to-cash lifecycle for B2B SaaS.

- Complex Billing Models: The platform excels at both fixed and usage-based billing, supported by a flexible product catalog that can handle sophisticated pricing structures and customer-specific deals.

- Revenue Recognition & Reporting: It provides one-click financial reports compliant with ASC 606 and IFRS 15 standards, automating a process that is often a major pain point for growing SaaS companies.

- Developer-Focused Tooling: With robust APIs and strong uptime metrics, Maxio is built for reliability, allowing technical teams to integrate billing logic deeply into their products and internal systems.

- Scalable Add-ons: Businesses can extend the platform’s capabilities with advanced modules for A/R management and multi-entity support, which is crucial for companies operating globally or through acquisitions.

Pricing and Accessibility

Maxio's pricing reflects its focus on the B2B SaaS market. The entry-level "Grow" plan starts at $599 per month, which includes unlimited users and is designed for businesses beginning to scale. Unlike many competitors, Maxio publishes its mid-tier pricing, providing transparency for growing companies. More advanced capabilities and enterprise features are available in higher-tier plans with custom pricing.

| Feature | Description |

|---|---|

| Primary Audience | B2B SaaS Companies, Scale-ups, Finance Teams |

| Pricing Model | Tiered plans starting at $599/month, custom enterprise pricing |

| Unique Selling Point | Integrated billing, revenue recognition, and SaaS analytics |

| Customer Support | Dedicated support tiers based on plan level |

Pros:

- Excellent for complex B2B SaaS billing and financial compliance.

- Transparent mid-tier pricing with unlimited users included.

- Strong developer tools and high reliability with published uptime metrics.

Cons:

- The starting price of $599/month may be prohibitive for early-stage startups or SMBs.

- Some advanced capabilities are only available as higher-tier add-ons.

Website: https://www.maxio.com/

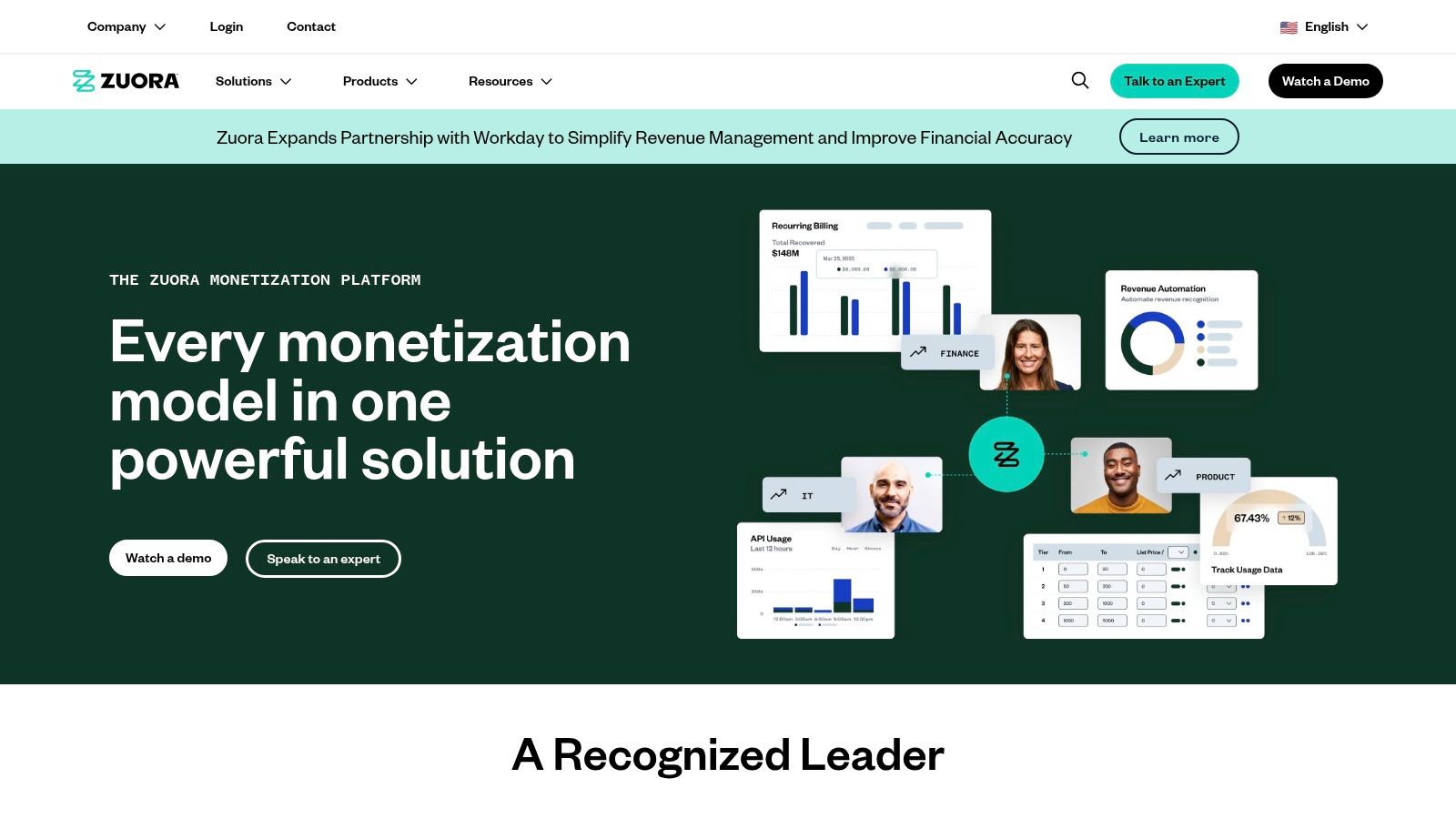

7. Zuora: The Enterprise-Grade Monetization Engine

Zuora is a comprehensive, enterprise-grade monetization platform built to manage the entire quote-to-cash lifecycle for large, complex organizations. It goes far beyond simple recurring payments, offering an integrated suite of tools for subscription billing, revenue recognition, and configure-price-quote (CPQ). Zuora is engineered for global businesses that require sophisticated pricing, intricate product catalogs, and strict compliance, making it a powerful choice for enterprises navigating the subscription economy.

Its primary strength lies in its ability to handle immense complexity and scale. The platform is designed to support hybrid business models that mix one-time sales, recurring subscriptions, and usage-based charges. This makes it one of the best recurring billing software options for established companies that have outgrown simpler solutions and need a centralized system to manage multifaceted revenue streams across different products, regions, and sales channels.

Key Features and Use Cases

Zuora’s platform is built around a "Subscription Order Management" system that provides a single source of truth for all subscription-related activities.

- Advanced Product Catalog: It allows for highly flexible and dynamic product catalogs, enabling attribute-based and location-specific pricing. This is ideal for companies with complex product lines that need to tailor offers to different customer segments or geographies.

- Integrated Quote-to-Cash: Zuora connects the entire customer journey, from the initial sales quote (CPQ) and order orchestration to billing, collections, and revenue recognition. This unified approach eliminates data silos and streamlines financial operations.

- Revenue Recognition Automation: The integrated Zuora Revenue module helps businesses automate complex revenue recognition processes to comply with accounting standards like ASC 606 and IFRS 15, a critical function for public or scaling companies.

- Enterprise-Grade Configuration: The platform offers extensive configuration options and documentation, empowering finance and IT teams to model and manage even the most unique and complex billing scenarios without custom code.

Pricing and Accessibility

Zuora’s pricing is tailored to enterprise needs and is not publicly listed. Access to the platform requires a sales-led procurement process, where pricing is customized based on the specific modules, transaction volume, and support plans required. This model is typical for enterprise software and often involves a significant implementation and onboarding process. Due to its complexity and cost, Zuora is generally not a fit for small teams or startups with straightforward billing needs.

| Feature | Description |

|---|---|

| Primary Audience | Large Enterprises, Global Brands, Companies with complex monetization models |

| Pricing Model | Custom, quote-based; requires sales engagement |

| Unique Selling Point | End-to-end quote-to-cash lifecycle management for enterprise complexity |

| Customer Support | Multiple global support plans, dedicated account management, professional services |

Pros:

- Deep, enterprise-level functionality covering the full quote-to-cash process.

- Highly configurable and flexible to handle extremely complex use cases.

- Large ecosystem and proven track record with major global brands.

Cons:

- Pricing is not transparent and requires a lengthy sales and implementation cycle.

- Likely overkill and too costly for small businesses or startups with simple needs.

Website: https://www.zuora.com/

Top 7 Recurring Billing Platforms — Feature Comparison

| Solution | Implementation 🔄 | Resources ⚡ | Expected outcomes ⭐📊 | Ideal use cases 💡 | Key advantages |

|---|---|---|---|---|---|

| Stripe Billing | Moderate — API-first integration for developers | Low-to-moderate dev effort; pay-as-you-go fees + payment fees | Flexible, scalable subscription models and global payments 📊⭐ | Startups → scale-ups needing custom pricing & global payment methods | Strong APIs & docs; broad payment/currency support; hosted portal |

| Chargebee | Moderate — UI + API with configurable workflows | Moderate; add-ons (RevRec, retention) may increase cost | Comprehensive billing, invoicing and retention automation 📊⭐ | SaaS/hybrid pricing needing robust catalog & retention tooling | All-in-one billing, RevRec & retention; generous starter tier |

| Recurly | Moderate–High — enterprise features and orchestration | Moderate-to-high; modules and add-ons can add complexity | Optimized subscription lifecycle, churn mitigation, analytics 📊⭐ | Brands scaling subscriptions; Shopify-native use cases | Payments orchestration; AI churn tools; enterprise reliability |

| Paddle | Low — merchant-of-record simplifies implementation | Low operational effort; higher per-transaction cost possible | Simplified global compliance, tax/VAT and payments handled 📊⭐ | SaaS selling cross-border that want tax/compliance offloaded | M-of-R model; built-in tax, fraud & chargeback protection |

| PayPal Subscriptions | Low — quick setup via PayPal business account | Minimal dev effort; familiar checkout; transaction fees may be higher | Fast time-to-market with familiar user checkout 📊⭐ | Consumer subscriptions, memberships, nonprofits | Wide consumer adoption; no monthly fee for subscription feature |

| Maxio (Chargify) | Moderate–High — tailored for complex catalogs | Higher baseline cost (Grow tier); add-ons for scale | Strong financial reporting, RevRec and usage billing ⭐📊 | B2B SaaS with complex catalogs and usage-based pricing | Transparent mid-tier pricing; robust APIs and finance tooling |

| Zuora | High — enterprise-grade, sales-led implementation | High (procurement, implementation, ongoing config) | Full quote-to-cash, global compliance and advanced monetization ⭐📊 | Large enterprises with complex pricing, CPQ, and compliance needs | Deep enterprise functionality; extensive customization & ecosystem |

Choosing Your Growth Engine: A Final Recommendation

Navigating the landscape of recurring billing software can feel overwhelming, but the journey to finding the right platform is a critical investment in your company's future. As we've explored, the "best" solution is rarely a one-size-fits-all answer. Instead, it's a strategic choice that must align perfectly with your business model, technical resources, and growth trajectory. The right software isn't just a tool for collecting payments; it's a foundational engine for predictable revenue, customer retention, and operational efficiency.

Making the final decision requires a clear-eyed assessment of your most pressing needs. A simple summary won't suffice; you need to map your specific challenges to the unique strengths of each platform we've reviewed.

A Decision Framework for Your Business

To help you make a final, confident choice, consider your business through these three critical lenses: your business model, your technical maturity, and your target market.

1. Match the Platform to Your Business Model:

- For High-Volume B2C & E-commerce: If your focus is on streamlined, high-velocity subscription management for a broad consumer base, platforms like Stripe Billing and Recurly excel. Their focus on dunning management, self-service portals, and reliable payment processing makes them ideal for minimizing churn and maximizing customer lifetime value.

- For Complex B2B SaaS: If you manage intricate contracts, usage-based billing, and multi-tiered pricing, Maxio (formerly Chargify) and Zuora are built for you. They provide the deep financial reporting and billing logic necessary to handle complex B2B relationships and revenue recognition standards.

- For Global SaaS & Software Sales: If you want to completely offload the headache of international sales tax, VAT, and compliance, Paddle is the definitive choice. Its merchant-of-record model simplifies global expansion by taking on that liability for you.

2. Align with Your Technical Capabilities:

- Developer-First & API-Driven: Teams that thrive on custom workflows and deep integrations will find Stripe Billing offers an unmatched level of flexibility. Its powerful API and extensive documentation allow you to build a completely bespoke billing infrastructure.

- Low-Code & Business-User Friendly: If you need to empower your marketing, finance, and operations teams to manage subscriptions without heavy developer involvement, Chargebee is a standout. Its intuitive interface and out-of-the-box functionality make it accessible to non-technical users.

3. Consider Your Target Market's Future:

This is where a forward-thinking strategy becomes essential. While traditional payment methods are still dominant, the global financial landscape is rapidly evolving. The rise of digital currencies presents a significant, untapped opportunity for growth, particularly for businesses serving a global, tech-savvy audience.

Ignoring this segment means leaving potential revenue on the table. This is the crucial gap that a specialized tool like BlockBee fills. By enabling recurring crypto payments, you can:

- Access a Borderless Market: Attract customers from regions with less stable fiat currencies or limited access to traditional banking.

- Drastically Reduce Fees: Sidestep the high transaction fees associated with credit card networks.

- Eliminate Chargebacks: Crypto transactions are irreversible, protecting your business from fraudulent chargeback disputes.

The most innovative approach is often a hybrid one. You can leverage a platform like Stripe or Chargebee for your fiat currency transactions while seamlessly integrating BlockBee to cater to the growing crypto economy. This dual strategy doesn't just expand your payment options; it future-proofs your revenue streams and positions your brand as a leader at the forefront of financial technology.

Ultimately, the best recurring billing software will empower you to spend less time managing invoices and more time building your product and delighting your customers. Choose wisely, implement thoughtfully, and watch your business thrive.

Ready to tap into the future of recurring revenue? BlockBee makes it simple to accept recurring crypto payments, opening your business to a global market with lower fees and zero chargebacks. Explore how our non-custodial solution can complement your existing billing stack and future-proof your growth at BlockBee.