Choosing the Best Payment Gateway for WooCommerce

Deciding on the best payment gateway for WooCommerce really boils down to what your store needs most. If you want total control and a slick, on-site checkout, Stripe is a fantastic choice. For sheer global trust and ease of use, PayPal is a powerhouse. But if you’re after a modern solution with tiny fees and no borders, BlockBee brings crypto payments into the mix.

This isn't just a technical decision; it directly impacts your conversion rates, security, and how much you keep from each sale.

Why Your Payment Gateway Choice Matters

Picking how customers pay you is one of the most critical decisions you'll make for your store. It goes way beyond just accepting credit cards. You're crafting the final step of the customer journey—it has to be seamless, secure, and inspire trust. Get it right, and you’ll see more completed sales. Get it wrong, and you're looking at a mountain of abandoned carts.

WooCommerce is a giant in the e-commerce world, powering a staggering 20.1% of all online stores. We're talking over 3.5 million active shops, a testament to its incredible flexibility. This popularity means you have a ton of payment options, from the old guard to new crypto players. You can dig into the numbers yourself with these WooCommerce market share statistics on Mobiloud.com.

To cut through the noise, you need to compare your options with a few key things in mind:

- Transaction Fees: What's the real cost of each sale?

- User Experience: Does the customer stay on your site or get redirected?

- Security: How well are you and your customers protected from fraud?

- Integration: How much of a headache is it to set up?

This guide will break down the top contenders to help you find the perfect fit. If you want to jump ahead and see how to get a gateway running, our guide on the WooCommerce payment gateway from BlockBee walks you through it.

Here’s a quick look at how our top three stack up.

| Feature | Stripe | PayPal | BlockBee (Crypto) |

|---|---|---|---|

| Best For | Customization & Control | Global Trust & Simplicity | Low Fees & Global Reach |

| Checkout Type | On-site | Off-site (Redirect) | On-site |

| Avg. Fee | 2.9% + $0.30 | 2.99% + fixed fee | 0.25% + network fee |

Core Factors for Evaluating Payment Gateways

Picking the right payment gateway for WooCommerce isn't just about grabbing the most popular option. To really get it right, you need to dig into the details that affect your bottom line, your customers' happiness, and your store's security.

Knowing what to look for will help you find a partner that genuinely fits how you do business, not just one that processes payments.

Decoding Transaction Fees and Hidden Costs

The first thing everyone notices is the transaction fee, and for good reason—it can take a serious bite out of your profits. These fees aren't one-size-fits-all, so you need to understand the different models to see what works for you.

Many gateways, especially those popular with new stores, use a flat-rate pricing model. You’ll see this structured as 2.9% + $0.30 per transaction. It’s predictable and easy to budget for, which is a huge plus when you're starting out. But as your sales volume grows, those seemingly small percentages can really add up.

The other common model is interchange-plus pricing. This one is a bit more complex but can be much cheaper for high-volume sellers. It separates the non-negotiable interchange fee (charged by Visa, Mastercard, etc.) from the processor's fixed markup. It’s less predictable month-to-month but gives you a clearer picture of what you’re actually paying for.

Don't get fixated on the advertised rate. The real cost often lies in the hidden fees. Look out for monthly account charges, steep chargeback penalties, or extra fees for international sales. A "cheap" gateway can quickly become your most expensive headache.

Security and Checkout Experience

When it comes to payments, security is everything. Any gateway you consider must be PCI compliant. This is the gold standard for protecting credit card information, and it's your best defense against data breaches that could not only cost you a fortune but also destroy your customers' trust.

Just as important is the actual experience of paying. A clunky checkout is one of the fastest ways to lose a sale. Gateways typically handle this in two ways:

- On-site Checkout: Your customer never leaves your website. They enter their card details right there on your checkout page. This creates a smooth, professional experience that keeps your brand front and center and is proven to reduce cart abandonment.

- Off-site Checkout: The customer is redirected to a third-party site like PayPal to complete the transaction. While the familiar name can add a layer of trust, that extra step can sometimes be just enough of a disruption to make a buyer think twice.

It's also worth looking into how a gateway manages failed payments. A system that offers clear guidance and easy retries can make a huge difference. Check out our post on choosing a https://blockbee.io/blog/post/payment-gateway-for-small-business for more on this. Good tools for handling payment failures are a must-have for keeping customers happy.

Comparing Stripe vs PayPal for WooCommerce

When you're setting up a WooCommerce store, the first big payment decision usually boils down to two names: Stripe and PayPal. They’re both fantastic options, but they excel in different areas. The best choice isn't about which one is better overall, but which one fits your brand's game plan for checkout experience, technical control, and building customer trust.

Stripe has quickly become the go-to for merchants who want total control over their checkout flow. Its biggest draw is a powerful API that lets you process payments directly on your site. This means customers never get redirected—they simply enter their card details and click "buy," creating a smooth, professional journey from start to finish.

This is especially critical for businesses built on recurring revenue, like subscription boxes or membership sites. Stripe’s recurring billing system is a beast, handling complex payment schedules, managing failed payments, and giving you detailed analytics without ever pushing your customers off-site.

The Power of Control vs Instant Trust

Over in the other corner, you have PayPal, a titan built on a global reputation for security and trust. If you're launching a new store, that little PayPal button can be a massive conversion driver. Many shoppers are still wary of typing their credit card info into a website they don't know, but they’ll happily log into their PayPal account.

That instant trust is pure gold for a new artisan shop or a niche retailer trying to win over a wider, less tech-savvy audience. Offering PayPal can remove a huge psychological roadblock at checkout. The trade-off? PayPal's standard checkout sends customers to its own site to finish the transaction, which can break the flow of your carefully designed user experience.

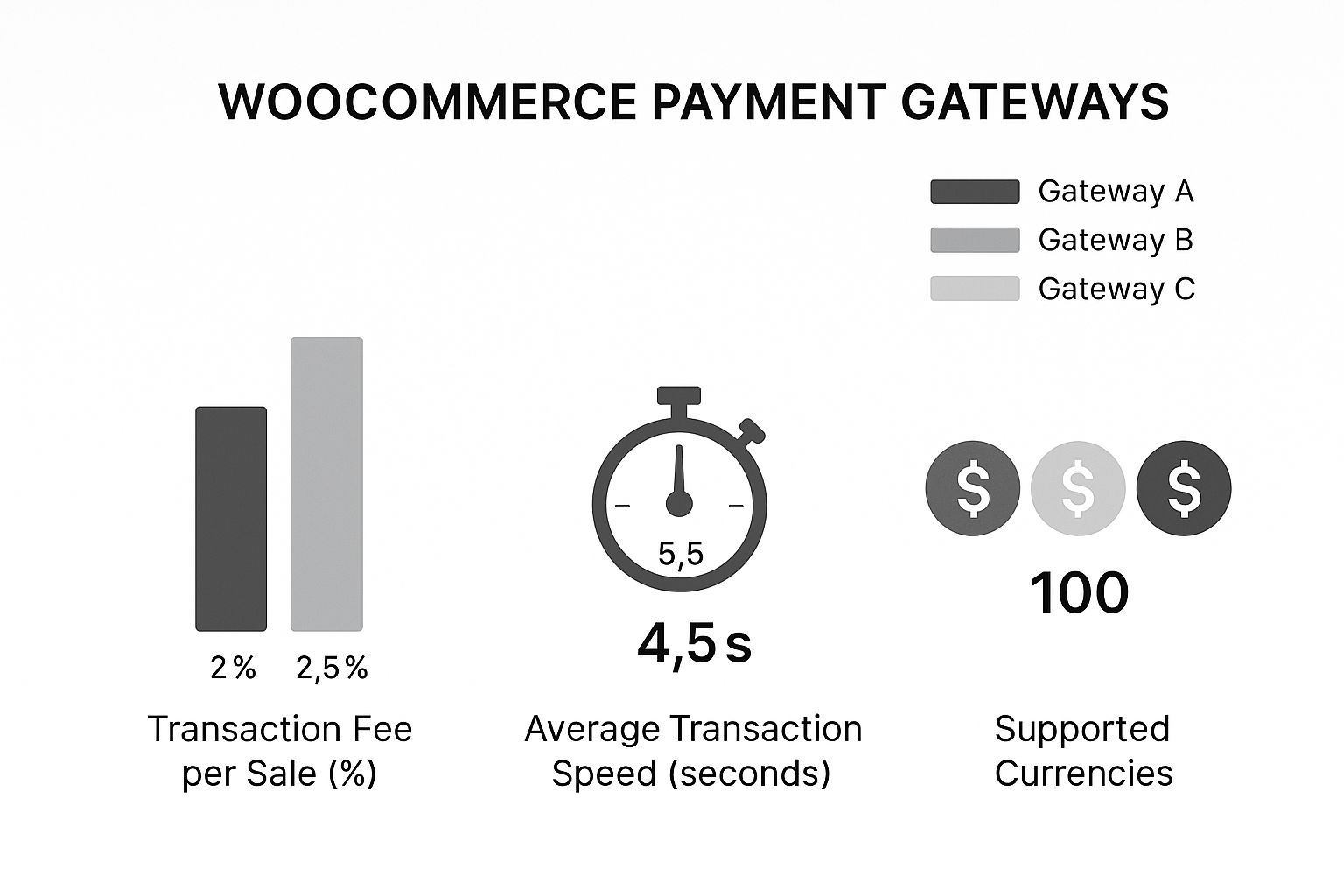

This infographic breaks down some of the key metrics you should be looking at when comparing payment gateways, showing how fees, speed, and currency options stack up.

Looking at it this way, you can see how tiny differences in transaction fees or processing times really start to add up, impacting both your bottom line and your customer's happiness over thousands of sales.

A Deeper Look at Fees and Integration

Let's talk about fees. Both platforms use a similar flat-rate pricing model, but the details are what count. Stripe’s standard fee is a very transparent 2.9% + $0.30 per transaction. PayPal comes in just a bit higher at 2.99% + a fixed fee, which can change depending on the currency. These fractions of a percent might seem insignificant, but they can make a real dent in your profits as your sales grow.

For a store doing $10,000 in monthly sales, that tiny difference in transaction fees can mean hundreds of dollars lost over a year. You have to run the numbers, factoring in everything from chargebacks to international sales and currency conversion fees.

Getting them hooked up to WooCommerce is pretty simple for both, but again, their philosophies differ. Stripe’s official extension is built for deep customization. If you have a developer on hand, you can tweak every single pixel of the payment process, making it the clear winner for brands with unique technical needs.

PayPal, on the other hand, is all about ease of use. Its integration is designed to get you up and running in minutes, which is a huge plus for store owners who just want to start selling without getting bogged down in code.

The market data shows a clear preference. As of December 2024, Stripe is the top dog, used by about 48% of WooCommerce stores, while PayPal powers around 28%. This trend points to a growing desire among merchants for the flexibility and control that Stripe delivers.

To help you see the differences at a glance, here’s a quick breakdown.

Stripe vs PayPal Feature Comparison for WooCommerce

| Feature | Stripe | PayPal |

|---|---|---|

| On-Site Checkout | Yes, customers stay on your site. | No, redirects to PayPal (for standard checkout). |

| Transaction Fees (US) | 2.9% + $0.30 | 2.99% + fixed fee |

| Recurring Billing | Excellent, highly customizable. | Good, but less flexible. |

| Customization | Extensive API for full control. | Limited customization options. |

| Customer Trust | Strong, but newer to some consumers. | Extremely high global recognition. |

| Best For | Subscription services, custom checkouts, tech-savvy brands. | New stores, international sales, building quick trust. |

So, what's the verdict? If a seamless, branded experience and complete control are your top priorities, Stripe is almost certainly your best bet. But if you need to build trust fast and appeal to a massive global audience that values convenience, PayPal is an unbeatable choice.

Of course, these two aren't the only players. As the world of e-commerce evolves, it's worth checking out modern alternatives. Our guide on the best cryptocurrency payment gateway for WooCommerce explores some of the next-generation solutions gaining traction.

Exploring Crypto Payment Gateways for Your Store

Beyond the usual credit card processors, there’s a compelling alternative that's quickly moving from the fringes to the mainstream: cryptocurrency. Accepting crypto is no longer just for niche tech stores; it’s a smart move for any business looking to reach a global, tech-savvy audience and sidestep some of the oldest headaches in eCommerce.

If you’re tired of steep transaction fees or the constant threat of fraudulent chargebacks, crypto payment gateways offer a secure and surprisingly cost-effective solution.

The Strategic Edge of Crypto Payments

At its core, accepting crypto is about improving your bottom line and tightening up your operational security. Traditional payment systems rely on a chain of intermediaries, each taking a cut. Crypto transactions, on the other hand, are peer-to-peer, which strips out a ton of that overhead.

Let's break down the main perks:

- Dramatically Lower Fees: While a standard gateway might hit you with 2.9% + $0.30 on every sale, crypto gateways like BlockBee can offer fees as low as 0.25%. That's a huge difference.

- No More Chargeback Fraud: Crypto payments are final. Once a transaction is confirmed on the blockchain, it's irreversible. This single feature completely wipes out the costly and time-consuming problem of fraudulent chargebacks.

- Instant Global Payouts: Forget waiting days for international payments to clear. Crypto settles in minutes, eliminating cross-border delays and expensive currency conversion fees.

This is a massive opportunity within the WooCommerce world. With over 6 million active stores and 211 million plugin downloads, the platform is a giant. Offering modern payment options is a surefire way to stand out. You can dig into more WooCommerce statistics and trends on Magecomp.com to see just how big the ecosystem is.

Introducing BlockBee for WooCommerce

One of the top players making this possible is BlockBee, a non-custodial crypto payment gateway. The term "non-custodial" is key here—it means you, and only you, have control over your money. Payments go directly from the customer to your personal wallet, cutting out any third-party risk.

By using a non-custodial gateway, you're not just a user—you're the bank. This model provides unparalleled security and autonomy, ensuring your revenue is always under your control without waiting for settlement periods.

BlockBee makes the whole thing surprisingly easy with its dedicated WooCommerce plugin. It supports over 70 cryptocurrencies, so you can cater to a wide net of customers worldwide. The setup process is designed to be quick, meaning you don't need to be a blockchain expert to get started.

This screenshot shows just how clean and simple the BlockBee checkout experience is for your customers.

The interface is built for clarity, guiding customers through the payment process without any confusion, which helps keep cart abandonment low. By adding this option, you're signaling that your store is modern, secure, and ready for a global audience.

How to Choose the Right Gateway for Your Business

Alright, we've walked through the top contenders. Now comes the hard part: making the final call. The truth is, there's no single "best" payment gateway for every WooCommerce store. It all comes down to finding the right fit for your business, your customers, and where you plan to take things next.

Let's cut through the noise with a few real-world situations. I find this is the best way to see which gateway actually solves the problems you're facing today.

Scenario-Based Recommendations

1. The Brand-Focused, High-Volume Store

Picture this: you're running a thriving online store, pushing serious monthly sales. Your number one priority is a buttery-smooth, branded checkout that never sends customers off-site. You know every click counts, and you have the resources to fine-tune the user experience because it's directly tied to your bottom line.

In this case, Stripe is pretty much a no-brainer. Its rock-solid API gives you total control to build a custom checkout flow that feels like a natural extension of your brand. Keeping customers on your site is key to minimizing cart abandonment, especially when you're dealing with high traffic.

2. The Startup Prioritizing Speed and Trust

Now, let’s flip the script. You're launching a new artisan shop or a small side hustle. The goal is simple: get online fast and earn trust from day one. You don't have a developer on standby, so you need something that just works, but you can't risk losing early sales because your checkout looks sketchy.

Here, PayPal is your best bet. That little blue button is recognized and trusted across the globe, giving new buyers the confidence to pull the trigger. For a brand-new store, that built-in credibility is priceless. Plus, the setup is incredibly straightforward, so you can go from zero to selling in no time.

3. The Global Business Getting Crushed by Fees

Finally, imagine you're selling to customers all over the world. You’re constantly getting hammered by currency conversion fees, waiting on cross-border payments to clear, and dealing with the headache of fraudulent chargebacks. These costs are a real drag on your profit margins and make it tough to scale.

This is exactly where a crypto gateway like BlockBee comes into its own. Accepting crypto payments practically wipes out chargeback fraud overnight. Better yet, you can slash transaction fees to a tiny fraction of what traditional processors charge—often as low as 0.25%. Settlements happen in minutes, not days, no matter where your customer is. It’s a game-changer for international operations.

Choosing your gateway is like picking a business partner. Your decision should be based on a deep understanding of your customers and a clear vision for your store's future. The right partner will support your growth, not hinder it.

Your Final Decision Checklist

Before you pull the trigger, run through these last few questions. Your answers should point you directly to the perfect payment solution for your WooCommerce store.

- Who are my customers? Are they tech-forward global shoppers, or a local crowd that sticks with brands they know and trust?

- What’s my biggest headache right now? Is it sky-high fees, abandoned carts, or the constant threat of fraud?

- How much control do I really need? Am I looking for a simple plug-and-play setup, or do I need a powerful API for full customization?

- What's the five-year plan? Are you planning to expand internationally, add subscriptions, or even open a physical storefront?

Thinking through these points will help you move beyond a simple feature list. It allows you to pick a gateway that’s truly aligned with your business goals and ready to help you succeed for the long haul.

Frequently Asked Questions

Choosing a payment processor often brings up a few last-minute questions. Let's tackle some of the most common ones so you can feel confident in your decision and manage your WooCommerce store like a pro.

Can I Use Multiple Payment Gateways?

Yes, you absolutely can—and in many cases, you should. WooCommerce is designed to handle multiple payment options right out of the box. Offering a few different ways to pay is a proven way to boost conversions, as it lets shoppers pick the method they already know and trust.

Think of it this way: you could have Stripe for standard credit card payments, PayPal for its enormous user base, and BlockBee for the growing number of customers who want to pay with crypto. This multi-pronged approach covers all your bases and removes friction at the most important part of the sale. It's all easily managed right from your WooCommerce dashboard.

What Is PCI Compliance and Why Does It Matter?

PCI DSS (Payment Card Industry Data Security Standard) is the security rulebook for anyone who handles credit card information. It's a set of strict standards created to ensure that companies accepting, processing, or storing card details maintain a totally secure environment. Simply put, it's how you keep your customers' payment info safe.

This is non-negotiable. If you don't comply, you're looking at serious fines, the risk of losing your ability to accept card payments, and a major blow to your store's reputation.

The smartest way to handle PCI compliance is to use a hosted payment gateway like Stripe, PayPal, or BlockBee. These services process sensitive data on their own secure servers, which means the burden of storing and protecting cardholder information is on them, not you.

How Difficult Is It to Switch Gateways Later?

Switching your main payment gateway is definitely doable, but the difficulty really depends on your current setup. For most stores using a standard plugin, the technical part is often just a matter of deactivating one and installing another. The real work is usually more operational than technical.

The biggest hurdle is often migrating saved customer data, especially if you run a subscription service. Some gateways are much more helpful with this than others. Stripe, for example, has dedicated services to help you move payment details securely. If you think you might need to switch things up later as your business grows, picking a provider known for its flexibility and strong support from day one will save you a world of pain.

Ready to slash your transaction fees and eliminate chargebacks? BlockBee offers a secure, non-custodial crypto payment solution that integrates seamlessly with WooCommerce. Start accepting crypto payments today.