Automated Accounts Payable Solutions | Streamline Payments

Think of an automated accounts payable (AP) solution as a digital command center for all your supplier invoices. It’s a software platform built to take the entire invoice-to-payment workflow online, wiping out tedious manual tasks like data entry and hunting down approvals. Essentially, it centralizes everything, cutting down on mistakes and freeing up your finance team's valuable time.

Moving Beyond Manual Accounts Payable

If your current AP process feels like a traffic jam, you're not alone. Stacks of paper invoices, endless keyboard tapping for data entry, and the constant back-and-forth for approvals create a major gridlock. This is the reality for countless businesses stuck with old-school AP methods, and it leads to costly errors, late payments, and a fuzzy view of company finances.

This manual slog isn't just an operational nuisance; it's a genuine strategic handicap. When your sharpest finance pros are bogged down keying in invoice data or chasing signatures, they can't focus on what really matters—analyzing financial trends, optimizing cash flow, or contributing to big-picture strategy. The entire department gets stuck in a reactive loop.

The Problem with Manual Processes

The fundamental flaw of a manual AP system is that it's slow, clumsy, and wide open to human error. Every single step, from opening the mail to cutting a check, is a chance for a mistake that can hit your bottom line. It's a bit surprising how many companies still operate this way. One recent study found that around 68% of businesses were still manually typing invoice data into their systems. That number is dropping, but it shows how ingrained the old ways are.

This dependence on manual work creates a familiar list of headaches for finance teams:

- Mind-Numbing Data Entry: Typing in every line item from an invoice is painfully slow work that creates a bottleneck from the very start.

- High Risk of Errors: A simple typo in an invoice number or a misplaced decimal point can easily lead to overpayments, duplicate payments, or even compliance headaches.

- Zero Visibility: When invoices are just pieces of paper or attachments in an email, it's impossible to know where anything stands. Good luck trying to forecast cash flow or give a supplier a quick status update.

- Approval Delays: Chasing down managers for a signature—whether on paper or via email—is a massive time-sink that often results in missing out on early payment discounts.

An inefficient accounts payable system doesn't just cost money in errors and missed discounts; it costs your team their most valuable asset: time. It traps them in a cycle of administrative work, preventing them from contributing to the company's strategic financial health.

This is exactly the gridlock that AP automation is designed to clear. It creates a smooth, digital superhighway where every invoice flows through a centralized system. If you want to see how this concept applies beyond just finance, take a look at these key business process automation examples. At the end of the day, automation isn't a luxury anymore; it's a core requirement for any modern finance department looking to stay ahead.

How AP Automation Overhauls Your Invoice Processing

Let's walk through what actually happens when an invoice hits an automated accounts payable system. Forget the old-school paper shuffle from one desk to another. Think of it more like a high-tech digital assembly line, fine-tuned for speed and accuracy. Every manual bottleneck is replaced by a smart, seamless step.

The whole thing kicks off the second an invoice arrives. It doesn't matter if it's a PDF in an email, a paper copy that gets scanned, or a digital file from a supplier's portal. This is where the first bit of magic happens, moving from manual sorting to intelligent data intake.

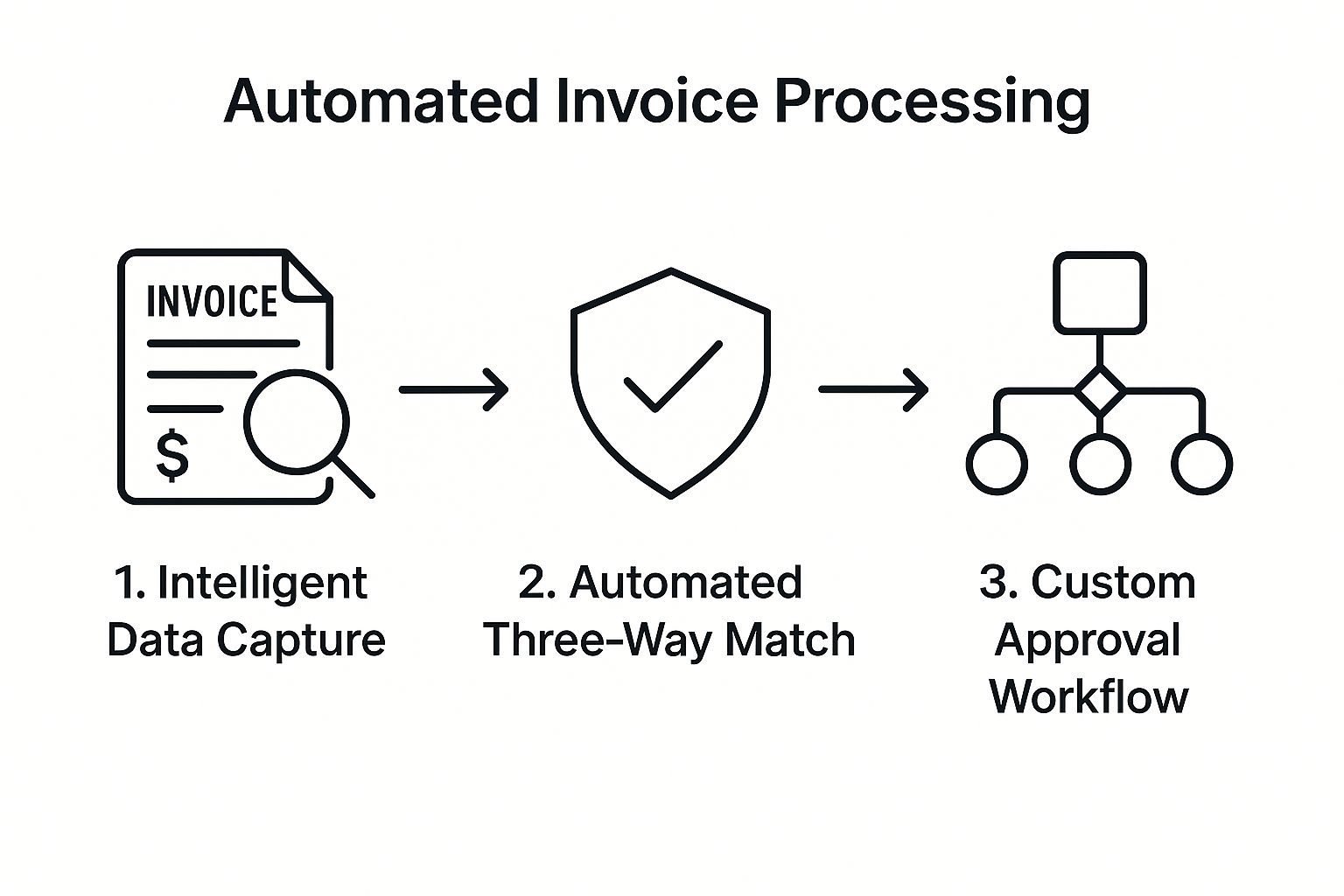

Step 1: Intelligent Data Capture

The most tedious, soul-crushing part of manual AP has always been data entry. Automated accounts payable solutions get rid of it completely with something called intelligent data capture. Using technology like Optical Character Recognition (OCR), the system literally "reads" the invoice, no matter what it looks like.

But it’s much smarter than just pulling text. AI algorithms then sift through that text to figure out what it all means. The system identifies the vendor's name, the invoice number, the due date, what was purchased, and the total amount, then plugs all that information right where it needs to go. This one step stops the typos and mix-ups that plague manual entry, making sure your data is clean from the very start.

This infographic breaks down the core stages of this automated journey, from capture to final payment approval.

As you can see, each step builds on the last. It creates a transparent, structured process that replaces human guesswork with automated checks and balances.

Step 2: Automated Three-Way Matching

Once the invoice data is in the system, it’s time for a critical check-up: the three-way match. This is a core accounting control to confirm a bill is legitimate before any money leaves your account. Doing this by hand means someone has to dig through files to find all the related paperwork. It’s a huge time sink.

Automation makes it happen in a flash. The system instantly cross-references the invoice against two other crucial documents:

- The Purchase Order (PO): This confirms your company actually ordered the goods or services listed on the invoice.

- The Goods Receipt: This verifies that what you were billed for was actually delivered in the right quantity and condition.

If everything lines up—prices, quantities, terms—the invoice gets a green light and moves to the next stage. If something’s off, the system flags the exception and pings the right person to take a look. This simple step prevents overpayments, paying the same bill twice, and even potential fraud, all without a human having to touch routine transactions.

By automating the three-way match, you fundamentally change your approach. Instead of a "trust but verify" model, you move to a "verify then trust" one. The system enforces the rules, letting your AP team focus only on the tricky exceptions that need a human brain.

Step 3: Custom Approval Workflows

After an invoice is verified, it needs to be approved. In a manual world, this is where things often go wrong. Invoices get buried under piles of paper or lost in someone’s inbox for weeks. An automated accounts payable solution replaces that chaos with crystal-clear digital workflows you can customize.

You can set up rules that mirror your company's internal policies. For example, maybe invoices under $500 from the marketing department get approved automatically. But an invoice over $10,000? That could be routed to a department head and then to the CFO for a final signature.

The system automatically notifies approvers, who can review and sign off on invoices with a single click, right from their email or a mobile app. This gets the right invoices in front of the right people at the right time. Better yet, it creates a bulletproof digital audit trail, showing exactly who approved what and when. Once it gets the final nod, the invoice syncs seamlessly with your accounting software or ERP, queued up and ready for payment.

What Are The Must-Have Features in an AP Automation Platform?

When you start digging into automated accounts payable solutions, it's easy to get lost in a sea of features. Every platform seems to have its own special set of bells and whistles. But if you strip it all away, there are a handful of core functions that are absolutely non-negotiable. These are the workhorses that truly solve the biggest headaches of manual AP.

Think of it like buying a new car. A panoramic sunroof is a nice perk, but you wouldn't even consider a vehicle without an engine, brakes, and a steering wheel. It's the same with AP software; some features are foundational, and they're what you should be looking for first.

AI-Powered Data Capture

The first and most critical feature is intelligent data capture. This tackles the biggest time-sink and error source in any AP department: manual data entry. The best platforms use a powerful combination of Optical Character Recognition (OCR) and Artificial Intelligence (AI) to automatically read and—more importantly—understand invoices, no matter what format they arrive in.

This is much more than just converting a PDF into text. The AI is the secret sauce; it learns to identify key information like the vendor's name, invoice number, due date, line-item details, and totals. This technology immediately stops your team from having to waste hours on tedious typing, which drastically cuts down on costly human errors right from the start.

Customizable Approval Workflows

Every business has its own unique approval process, so a rigid, one-size-fits-all workflow is a non-starter. A top-tier automated accounts payable solution needs to offer flexible and highly customizable approval routing. This lets you build rules that perfectly mirror your company's internal policies.

For example, you can create multi-step approval chains based on all sorts of criteria:

- Invoice Amount: Bills under $1,000 might just need a department manager's nod, while anything over $20,000 has to go to the CFO.

- Vendor or Department: Invoices from key suppliers or for specific departments can be automatically sent straight to the right person.

- GL Code: You can even route invoices for approval based on the general ledger code assigned to the expense.

Automating these workflows means invoices never get stuck on someone's desk or lost in a long email thread. It speeds up the entire payment cycle while enforcing your internal controls and creating a crystal-clear digital audit trail for every single bill.

The goal of a smart workflow isn't just to move an invoice from point A to point B. It's to enforce your business rules automatically, ensuring compliance and freeing your team from playing the role of administrative traffic cop.

This level of control is a huge reason why companies are ditching manual processes. The numbers are pretty telling: enterprises report that automation allows a single AP employee to process over 23,000 invoices a year, a massive leap from the 6,000 they could handle manually. With roughly 20% of AP teams already fully automated and another 41% planning to make the switch soon, the momentum is clear.

Automated Three-Way Matching

For any business that relies on purchase orders (POs), automated three-way matching is an absolute game-changer. It's your best defense against paying incorrect or even fraudulent invoices. This feature digitally cross-references three key documents in seconds: the purchase order, the goods receipt note, and the vendor invoice.

If the quantities, prices, and terms on all three documents are a perfect match, the invoice sails through and is approved for payment without anyone needing to lift a finger. But if there’s a discrepancy—say, the invoice amount is higher than what was on the PO—the system instantly flags it and routes it to the right person for review. It's a powerful shield against overpayments and duplicate bills.

Real-Time Analytics and Dashboards

You can't manage what you can't measure. Old-school manual AP processes often leave finance leaders flying blind, with very little insight into spending until after the month has already closed. A modern automation platform changes that by providing real-time analytics and customizable dashboards, turning your AP data from a historical record into a strategic asset.

With just a few clicks, you can track critical key performance indicators (KPIs) like:

- Invoice processing cycle time

- Current accrual liabilities

- Early payment discount capture rates

- Team productivity and workload metrics

This instant visibility helps you forecast cash flow more accurately, spot bottlenecks in your process before they become major problems, and make smarter financial decisions. It elevates the AP department from a back-office cost center into a source of valuable business intelligence. Plus, having that clear view of payment statuses is crucial for financial health. To learn more, check out our guide on what payment reconciliation is and why it matters.

To really see the difference, it helps to put the two approaches side-by-side.

Manual AP vs Automated AP: A Feature Comparison

This table breaks down how a modern automated system transforms each step of the accounts payable process.

| Feature | Manual AP Process | Automated AP Solution |

|---|---|---|

| Invoice Entry | Manual keying of data from PDFs or paper. High risk of human error. | AI-powered OCR automatically extracts and populates data. 99%+ accuracy. |

| Approval Routing | Relies on email chains, interoffice mail, or physically walking papers around. | Pre-set, customizable workflows automatically route invoices to the right approvers. |

| PO Matching | A person must manually compare the PO, invoice, and receipt line by line. | The system automatically performs a three-way match and flags any discrepancies. |

| Payment Execution | Requires manual setup of payments in banking portals or check printing. | Integrated payment execution across multiple methods (ACH, card, check). |

| Visibility | Limited to non-existent. Status is unknown until an invoice is fully processed. | Real-time dashboards show invoice status, cash flow, and team performance. |

| Audit Trail | Paper trail is difficult to track and easy to misplace. | A complete, unchangeable digital audit trail is created for every action. |

As you can see, the contrast is stark. Automation doesn't just speed things up; it adds layers of control, accuracy, and strategic insight that are simply impossible to achieve with a manual system.

Unlocking the Strategic Value of AP Automation

Bringing in an automated AP solution is much more than a simple operational tweak—it's a serious business decision that pays for itself, and then some. The benefits don't just stay within the finance department; they ripple across the entire company, turning accounts payable from a cost center into a genuine value driver.

The most obvious win? A steep drop in costs.

When you take manual labor and human error out of the equation, the cost to process every single invoice plummets. This isn't just about saving a few bucks here and there; it’s about fundamentally changing the financial mechanics of your business.

It’s no surprise that automated accounts payable solutions are catching on. The market for these platforms was already at USD 3.07 billion in 2023 and is expected to more than double to USD 7.1 billion by 2030. That's a 12.8% annual growth rate, a clear signal that businesses get it: financial efficiency is key to staying competitive. You can dig deeper into these trends over at Grand View Research.

Beyond Cost Savings: Better Cash Flow Management

While saving money is a great start, the real strategic wins come from how automation changes the way you manage cash. Automated systems can slash invoice processing times from weeks down to days, sometimes even hours.

This speed gives you an incredibly precise, real-time picture of your financial liabilities. Suddenly, you can forecast your cash flow with pinpoint accuracy. No more waiting until the end of the month to figure out where you stand.

This newfound agility also gives you access to a powerful financial tool: early payment discounts. A lot of suppliers will knock off 2% or so if you pay within 10 days instead of the usual 30. With a manual system, that's almost impossible to pull off consistently. With automation, you can grab those discounts every time, effectively turning your AP department into a profit center.

An automated AP system changes the conversation from "Can we pay this on time?" to "Should we pay this early to save money?" It transforms payables from a reactive chore into a proactive tool for financial optimization.

Stronger Security and Supplier Relationships

Security is another huge piece of the puzzle. Manual processes are wide open to fraud, from doctored invoices to payments going to the wrong place. Automated systems build a fortress of control around your payables.

Features like automated three-way matching and digital audit trails mean the system instantly flags anything that looks off. In fact, according to PYMNTS, companies with fully automated AP were 63% more likely to feel confident about their fraud prevention.

This level of reliability also does wonders for your supplier relationships. Getting paid faster and more predictably helps their cash flow and builds a ton of trust. Many systems include a vendor portal where suppliers can check invoice statuses on their own, which cuts down on endless email chains and makes for a much smoother partnership. As you build out your financial infrastructure, understanding what a payment platform is can provide the foundation for these kinds of improvements.

Empowering Your Finance Team for Strategic Work

Maybe the most important benefit of all is the human one. When you free your finance team from the mind-numbing work of data entry and chasing down approvals, you unlock their real talent. Their time shifts from low-value busywork to high-impact projects.

Instead of just keying in numbers, they can finally focus on:

- Analyzing spending patterns to find new ways to save money.

- Optimizing working capital by timing payments strategically.

- Negotiating better terms with key suppliers, backed by solid payment data.

- Supporting financial planning and analysis (FP&A) with clean, real-time information.

This shift empowers your team to become true strategic partners, delivering insights that lead to smarter decisions and directly boost the bottom line. That's the real ROI of automation—turning an administrative function into a powerhouse of financial intelligence.

Your Roadmap for Implementing an AP Solution

Making the move to an automated system can feel like a massive undertaking. The key is to break it down into manageable steps, turning a mountain into a series of small, conquerable hills. A solid roadmap is the best tool you have for a smooth transition.

The journey doesn't start with looking at software demos. It starts with a hard look at your own processes. Think of it like creating a blueprint before construction begins—you need to map the terrain, find the weak spots in your foundation, and know exactly what you want the final result to look like. A clear plan keeps you from getting lost and ensures the solution you choose actually fits your business.

Begin with a Thorough AP Audit

Before you can fix a problem, you have to understand it inside and out. The first step is to map your current accounts payable workflow, from the moment an invoice hits your inbox to the second a payment goes out the door. Don't skip anything. Document every person, every manual touchpoint, and every piece of software involved.

This audit is your diagnostic tool. As you chart the course of an invoice, you'll start to see the bottlenecks. Where do things get stuck? How many hours are people spending just keying in data? What’s your real cost-per-invoice? Answering these questions gives you a baseline to measure against and helps you define what a "win" actually looks like.

With this data, you can set specific, measurable goals for your new automated accounts payable solution. Your targets might look something like this:

- Slash the invoice processing cycle from 20 days down to 5 days.

- Cut the cost per invoice by 60%.

- Wipe out 95% of manual data entry mistakes.

- Capture at least 80% of available early payment discounts.

This initial audit is easily the most important step. If you don't have a crystal-clear picture of your current pain points and what you need to achieve, you risk picking a solution that solves the wrong problems or just doesn't deliver a real return on your investment.

Choosing the Right Vendor Partner

Once you know your goals, you can start evaluating potential vendors. This is about more than just comparing feature lists; it's about finding a genuine partner whose technology aligns with your business, both for today and for the long haul.

Come prepared with a list of critical questions for every provider you talk to. The answers will quickly separate the real contenders from the rest.

Key questions to ask vendors:

- Integration Capabilities: How well does your platform connect with our existing accounting software or ERP? A clunky integration just trades one manual task for another.

- Scalability: Can your system grow with us? You need to know the solution can handle a much higher volume of invoices and users down the line without slowing to a crawl.

- Security Protocols: What specific measures do you have in place to protect our sensitive financial data from cyber threats and unauthorized access?

- Onboarding and Support: What does your implementation process actually involve? What kind of training and ongoing support can my team expect to receive?

It's also worth noting that growing regulatory pressure worldwide is pushing more companies toward automation to create precise, auditable records. While North America is currently the biggest market for these solutions, adoption is accelerating globally as businesses see the benefits. You can get more details on this trend in this market analysis by Grand View Research.

Managing Change and Driving Adoption

The best software in the world is completely useless if your team refuses to use it. A successful rollout really comes down to good change management. You have to get your people on board from the very beginning by explaining the "why" behind the new system.

Frame the automated accounts payable solution as a tool that gets rid of their most boring, repetitive tasks—not as a replacement for their jobs. Show them how it will free them up to focus on more strategic work that adds real value. Once you have their buy-in, a clear training plan is non-negotiable.

Appoint a project champion from within the AP team, someone who can help guide their colleagues through the transition. Run hands-on training sessions for different roles so everyone feels confident with the new tools. This focus on your people is what will ultimately guarantee a successful launch. For businesses that handle a high volume of outgoing payments, looking into efficient mass payout solutions can be a great next step to further optimize financial workflows.

Got Questions About AP Automation? We’ve Got Answers.

Making the leap to an automated accounts payable system is a big decision, and it’s smart to have questions. This isn't just about getting new software; it's about changing how a fundamental part of your business operates. To help cut through the noise, we've tackled the most common questions we hear from business owners and finance teams.

Let's get straight to the practical, no-fluff answers. We'll cover the big ones: security, how the new tech gets along with your old tech, and what kind of payback you can actually expect.

Is My Financial Data Actually Secure on These Platforms?

This is usually the first question out of the gate, and for good reason. You’re trusting a new system with highly sensitive financial information, and that trust has to be earned. The good news is that reputable automated accounts payable solutions are built with bank-grade security at their core—it's not just an add-on.

These platforms deploy a multi-layered defense to keep your data locked down:

- Data Encryption: All your information is scrambled, both when it's stored (at rest) and when it's being sent (in transit). This makes it completely unreadable to anyone without authorization.

- Strict Access Controls: You're in the driver's seat. You decide who can see what and who can do what by setting up custom user roles and permissions. This ensures your team members only access what they absolutely need to do their jobs.

- Regular Audits: Top providers don't just say they're secure; they prove it. They undergo regular third-party security audits to maintain certifications like SOC 2, which confirms their security practices meet tough industry standards.

Think of it as a digital Fort Knox. The system is designed from the ground up with multiple locks, alarms, and strict access protocols to guard what’s inside.

Will It Play Nice with My Current Accounting Software?

Nobody wants a new tool that creates more work by refusing to talk to their existing systems. A huge selling point for modern automated accounts payable solutions is their ability to connect smoothly with the accounting software or ERP you already rely on, whether it's QuickBooks, NetSuite, Xero, or SAP.

This integration is everything. It creates a two-way flow of information where the automation tool pulls vendor details and POs from your ERP, and once an invoice is paid, it sends all the payment data right back. This completely kills the need for manual double-entry and guarantees your financial records stay in sync and error-free.

A great integration doesn’t just link two systems—it fuses them into one seamless workflow. The tech should feel invisible, letting your team focus on the process, not the software.

What’s the Real Return on Investment Here?

Okay, let's talk money. Beyond the features and security, what’s the actual ROI of bringing in an automated accounts payable solution? The payback comes from a few key areas that, together, make a serious financial impact.

The most obvious win is in direct cost savings. It might be surprising, but around 37% of companies are still wrestling with paper receipts, a notoriously slow and expensive habit. Simply moving from paper to e-invoicing can slash processing costs. For perspective, wider adoption of e-invoicing in the US could save businesses a mind-boggling $450 million every year by cutting those costs in half. You can get more eye-opening details from these accounts payable trends and statistics.

But the ROI goes way beyond the cost-per-invoice.

- Strategic Savings: Automation makes it easy to capture early payment discounts every single time. For many businesses, this alone can add up to tens of thousands of dollars in savings each year.

- Productivity Jumps: Imagine your team not having to spend hours on mind-numbing data entry or chasing down approvals. They get that time back to focus on work that actually moves the needle, like cash flow analysis and financial planning.

- Fewer Costly Mistakes: By taking human error out of the equation, you eliminate expensive overpayments, duplicate bills, and the headache of fixing mistakes long after they've happened.

When you add up the hard cost savings, the new strategic opportunities, and the massive boost in your team's productivity, the case for automation becomes crystal clear. It's an investment that quickly pays for itself by building a smarter, faster, and more strategic finance operation.

Ready to see how a streamlined, secure payment system can benefit your business? At BlockBee, we provide a robust cryptocurrency payment platform designed for secure B2B transactions. Explore how our solutions can simplify your financial operations at https://blockbee.io.