A Guide to White Label Payment Solutions

Ever wondered how some companies offer such a smooth, branded payment experience without being a massive payment processor themselves? The secret is often a white label payment solution.

In simple terms, it allows you to offer payment services under your own company name, but the technology is actually powered by a third-party expert. This means you can give your customers a seamless checkout experience that feels 100% yours, all without the headache of building a complex payment system from the ground up.

It’s a smart way to keep your customer’s trust and stay in control of the user experience while letting someone else handle the heavy lifting of security and compliance.

What's Really Happening Behind the Scenes?

Picture this: you run a thriving online marketplace or a software-as-a-service (SaaS) platform. Your customer is ready to buy, but at the final step, they're whisked away to an unfamiliar, third-party website to enter their credit card details. That jarring transition can kill trust and wreck the customer's journey at the most crucial moment.

A white label solution completely prevents this. It works silently in the background, totally invisible to your user.

Think of it like a fantastic local bakery that uses a premium, unbranded flour to make its amazing bread. The bakery gets to create its signature products with top-quality ingredients but doesn’t have to go through the trouble of building and running its own flour mill. In the same way, your business gets to offer a secure, reliable payment experience that looks and feels like it was built by you.

Why This is a Game-Changer for Your Brand

The biggest win here is maintaining total brand control. When a customer pays you, they see your logo, your colors, and your messaging from start to finish. That kind of consistency is absolutely essential for building a strong brand identity and earning long-term customer loyalty.

This model is especially effective for businesses like:

- SaaS Platforms looking to embed payment processing as a core feature of their software.

- Marketplaces that need to juggle complex payouts to multiple sellers or vendors without a hitch.

- Digital Agencies building e-commerce stores for clients and wanting to offer a branded payment option as part of their service package.

By keeping the entire payment process inside your own environment, you reinforce your brand’s credibility and professionalism. It prevents the brand confusion that can happen when customers are bounced over to external payment processors.

The Smart Business Case Behind the Tech

Beyond just looking good, choosing a white label payment solution is a solid financial and operational move. Trying to build your own payment gateway from scratch is a massive undertaking. We're talking huge upfront costs, often between $30,000 to over $300,000, and a development timeline of anywhere from four to eighteen months.

That path also demands you become an expert in navigating incredibly complex regulations, like PCI DSS compliance. By working with a white label provider, you get to skip all those massive hurdles. You can launch much faster, keep your resources focused on what you do best, and leave the payment infrastructure to the specialists. For a closer look, you can explore the nuances of white label payment processing in our detailed guide.

This practical approach is fueling some serious growth. The global white label payment gateway market is on track to hit $2.7 billion this year and is projected to reach $4.7 billion by 2033. This boom is happening because more and more businesses realize they can maintain their brand identity while outsourcing the nuts and bolts of payments.

Why Businesses Choose a White Label Payment Model

So, we know what a white label solution is. But the real question is, why are so many smart businesses going this route? It’s not just a technical decision; it's a strategic one that shapes everything from how customers see your brand to how efficiently your business runs.

At its core, it’s all about owning the customer experience from start to finish. Think about it: the moment a customer pulls out their credit card is a peak moment of trust. If you suddenly bounce them to a third-party site with a different logo and URL, you’re introducing a moment of doubt. That hesitation is all it takes to lose a sale.

A white label payment solution gets rid of that risk completely. By keeping the entire transaction inside your own branded environment, you’re constantly reinforcing your credibility. Your logo, your colors, your domain—it's a seamless journey that tells the customer they’re in the right place, building real loyalty over time.

Accelerate Your Go-to-Market Strategy

One of the biggest wins with a white label payment solution is speed. Building a payment gateway from the ground up isn't a weekend project. It’s a massive undertaking that demands deep expertise in finance, security, and a labyrinth of global regulations.

Realistically, developing an in-house system can take anywhere from four to eighteen months. In a fast-paced market, that's an eternity. It also means pulling your best engineers off your core product—the thing that actually makes you money—to work on payment plumbing.

A white label solution completely flips the script. You can launch a fully functional, branded payment service in a tiny fraction of that time. The technology is already built, tested, and certified. Your job is integration, not invention. This agility is a huge competitive advantage, letting you meet market demands and start bringing in revenue while others are still in development.

Achieve Significant Cost Savings

Beyond the time sink, building a payment system from scratch is incredibly expensive. Just the initial development for a secure and compliant app—say, for medical billing—can run anywhere from $30,000 to over $300,000. And that's just to get started. It doesn't include the relentless ongoing costs for maintenance, security patches, and staying compliant with standards like PCI DSS.

For most companies, the ROI on building a payment gateway just isn't there. The multi-million dollar price tag and years of work are far better spent on improving the core product that your customers are actually paying for.

White label solutions turn a massive capital expense into a predictable operational one. Instead of a huge upfront investment, you pay manageable provider fees. This frees up your cash and your team to focus on what they do best: building great products and serving your customers.

Maintain Brand Control and Customer Trust

Ultimately, you want your platform to be essential to your users. The more you can integrate into a single, smooth experience, the less reason they have to go anywhere else. This is especially true for businesses like Direct-to-Consumer (DTC) brands, which live and die by the quality of their customer journey.

When you embed payments directly into your platform, it stops being a separate, clunky step and becomes just another valuable feature of your service. This deepens the customer relationship and boosts retention in a few key ways:

- Brand Consistency: Your payment flow looks and feels exactly like the rest of your platform, reinforcing your brand identity right at the point of sale.

- Enhanced User Experience: No more jarring redirects. You give users a faster, smoother, and more trustworthy checkout process.

- Increased Retention: An all-in-one solution makes your platform stickier. You're solving more of your customers' problems, which gives them fewer reasons to ever leave.

How to Choose the Right Payment Integration Model

Picking the right way to handle payments is a huge decision for any business. It’s not just about moving money from point A to point B; it’s about what your customer experiences, how you present your brand, and how much complexity you’re willing to take on. To get it right, you first need to understand the three main paths you can take.

Each option—building it yourself, using a co-branded service, or going with a white label payment solution—comes with its own set of pros and cons. The best choice really boils down to what matters most to you right now: speed, brand control, or long-term cost.

Comparing the Three Core Models

Let's unpack what these three approaches actually mean for your business.

Building a payment gateway from the ground up gives you total control, but it's a massive undertaking. You're not just building software; you're essentially becoming a payments company, which requires an enormous amount of time, money, and expertise.

On the other hand, co-branded solutions like Stripe Connect get you up and running fast. The trade-off? Your customers will see the provider's logo right at the checkout, which can dilute your brand at a critical moment in their journey.

White label payment solutions offer a powerful strategic balance. They give you the seamless brand experience of an in-house system without the crippling development costs and regulatory headaches. This makes it an incredibly smart move for businesses focused on growth and a polished customer experience.

As you weigh your options, it's helpful to see what the market looks like beyond the big names. For a broader perspective, you might find value in resources about Exploring payment gateway alternatives like Stripe.

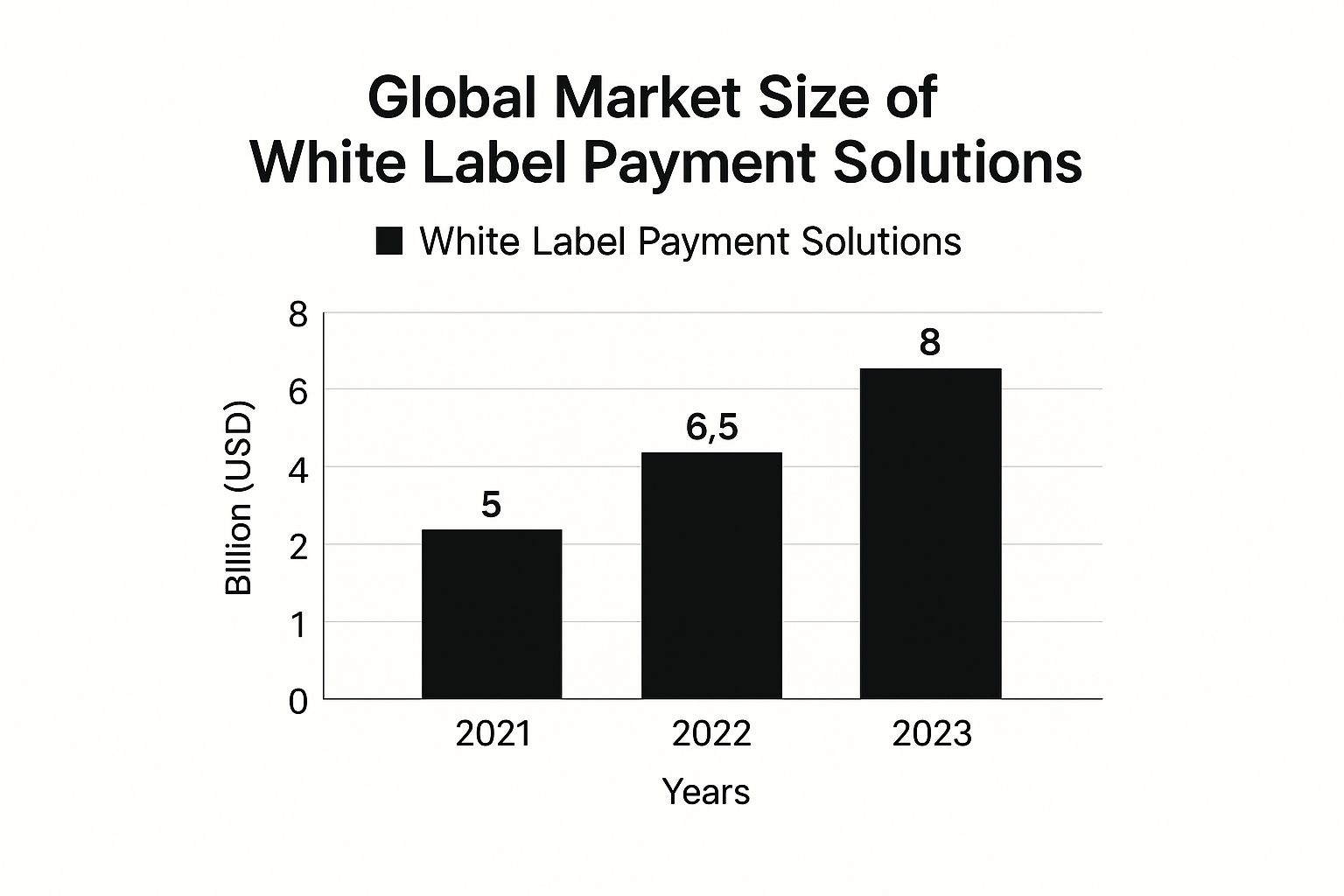

The image below gives you a clear visual of just how popular white label solutions have become.

That steady climb from $5 billion to $8 billion in market size over just three years tells a story: more and more companies are realizing they can own their payment experience without the pain of building it from scratch.

Payment Solution Models A Side-by-Side Comparison

To really see how these models differ in practice, let's put them head-to-head. This table breaks down the crucial differences in cost, branding, speed, and the compliance burden you'll have to carry.

| Feature | Build In-House | Co-Branded Solution (e.g., Stripe) | White Label Solution |

|---|---|---|---|

| Upfront Cost | Extremely High ($$$$) | Low ($) | Moderate ($$) |

| Time to Market | Very Slow (12-24+ months) | Very Fast (Days/Weeks) | Fast (Weeks/Months) |

| Brand Control | 100% Complete Control | Limited (Provider branding is visible) | 100% Complete Control |

| User Experience | Fully Customizable | Standardized by Provider | Fully Customizable |

| Compliance Burden | Entirely Your Responsibility | Mostly Handled by Provider | Mostly Handled by Provider |

| Revenue Potential | High (Keep all fees) | Moderate (Revenue sharing) | High (Set your own rates) |

As you can see, the "right" answer truly depends on your business stage and goals.

If you’re a startup that needs to launch yesterday with as little cash burn as possible, a co-branded solution is a perfectly logical place to start. But be warned, it often feels like a temporary fix once your brand identity becomes a top priority.

At the opposite extreme, only the biggest, most deep-pocketed enterprises can even entertain the idea of building a payment system in-house. The operational overhead and regulatory hoops are just too much for most.

This is where white label payment solutions hit the sweet spot, especially for scaling businesses, SaaS platforms, and marketplaces. You get to offer a professional, fully branded payment flow that builds trust and keeps customers in your ecosystem. It's the best of both worlds: you look like you built it yourself, but you get the speed and reduced burden of a great partnership.

Finding the Right White Label Payment Partner

Choosing a provider for your white label payment solutions isn't just another vendor search. Think of it more like hiring a foundational partner for your entire revenue operation. This one decision touches everything—customer experience, how smoothly your business runs, and your ability to grow. Getting it right is non-negotiable.

The best partner works silently in the background, an invisible extension of your team that lets your brand take all the credit. But the wrong one? That path leads to technical nightmares, angry customers, and revenue slipping through your fingers.

To make sure you end up on the right side of that equation, you need a clear game plan. It all starts by popping the hood and looking at the technology itself. A slick, flexible API isn't just a perk; it's the engine that will power your entire payment system.

Evaluating the Technical Fundamentals

Before you even get to a conversation about pricing, you have to be certain the technology can actually do the job. A great sales pitch is worthless if the platform is clunky or unreliable. This is where you need to get rigorous.

Your first stop is the API. Is it well-documented? Does it make sense? Can your developers work with it without pulling their hair out? A confusing API will blow up your timeline and your budget before you even get started.

Here’s what to zero in on from a technical perspective:

- API Flexibility and Documentation: The API needs to handle what you need today and what you'll need tomorrow. The documentation should be so clear and complete that it empowers your developers, not frustrates them.

- Seamless Integration Capabilities: The solution has to play nicely with your existing platform. Don't just take their word for it—ask for case studies or examples of integrations similar to yours.

- Robust Security and Compliance: This one is a deal-breaker. The partner must be fully compliant with global standards like PCI DSS. Their security is your security.

A provider’s commitment to security is a direct reflection of their reliability. They should be able to walk you through their compliance, data encryption, and fraud prevention systems without hesitation.

Once you’re confident in the tech, it's time to shift gears and look at the business relationship. For a deeper dive on the technology, our guide on choosing a white label payment gateway is a great resource.

Assessing the Business and Support Side

Even the most amazing technology can be ruined by terrible support or shady business practices. Your partner should be as committed to your success as you are, and you can see that commitment in how they structure their pricing and how they show up when you need help.

Hidden fees and confusing pricing are giant red flags. You want a partner with a transparent model that makes sense for a growing business. If you can’t easily figure out what you’ll be paying, it's time to walk away.

And when something inevitably goes wrong, you need to know an expert is there to help, right away. Ask about their support channels, average response times, and whether you'll get a dedicated person to call.

Keep these critical business factors in mind:

- Transparent Pricing Models: Make sure you see the whole picture. Get a clear breakdown of transaction fees, setup costs, and any other monthly charges. No surprises.

- Quality of Technical Support: How good is their support, really? Is it available 24/7? What are their guaranteed response times? Slow support during an outage means lost sales.

- Proven Ability to Scale: You need a provider that can grow with you. Ask for hard numbers on their transaction volume capacity and system uptime.

In the end, this is about finding a true partner—one whose technology, business ethics, and vision for the future match your own. This relationship is the bedrock of your payment operations, so take the time to choose wisely.

The Future of Branded and Integrated Payments

The way we pay for things is changing. It's no longer just the last step in a sale; it's a huge part of the entire customer experience. In a world with endless online competition, simply being able to accept money isn't good enough anymore. The winners will be the businesses that create a checkout process that's smart, smooth, and feels like a natural part of their brand.

This is where white label payment solutions really start to shine. Instead of a clunky, third-party form, payments are becoming woven directly into products and services. Taking control of that experience with a white label partner is quickly becoming a major advantage for companies that want to lead their market. It lets them keep up with new trends without having to become payment experts themselves.

The numbers back this up. The market for white label payment gateways was recently valued at $2.29 billion and is expected to skyrocket to $6.87 billion by 2033. That’s a growth rate of about 14.5% every year, a clear sign that businesses are serious about controlling their brand and payment flow. You can dig deeper into this market growth on Business Research Insights.

Key Trends Shaping Tomorrow's Payments

A few powerful trends are pushing this evolution forward, and white label providers have to keep innovating to stay relevant. Smart businesses are already getting ready for a world where payments are more flexible, intelligent, and tailored to each customer.

Here are three big shifts to watch:

- Smarter Fraud Detection: AI and machine learning are finally living up to the hype. These tools are becoming critical for spotting and stopping fraud as it happens, all without creating annoying roadblocks for real customers.

- Expansion of Payment Methods: Credit cards are no longer the only game in town. People now expect to pay with digital wallets like Apple Pay, use Buy Now, Pay Later (BNPL) options, or even pay with cryptocurrency. Offering these alternative payment methods is fast becoming table stakes.

- Hyper-Personalized Checkouts: The one-size-fits-all payment page is on its way out. The future lies in dynamic checkouts that remember a customer's preferences and present them with the easiest, fastest way to pay.

Adapting to a New Era of Commerce

As these changes become the new normal, white label providers will act as strategic partners. They are the engine that allows businesses to offer modern features without the massive expense and headache of building it all from scratch. This includes helping merchants navigate new and sometimes complex assets, a topic we cover in our guide on the future of crypto payments.

The ultimate goal is to make the payment process invisible. The best checkout is one the customer barely notices—it's fast, intuitive, and builds trust by feeling like a natural extension of the brand they are interacting with.

At the end of the day, as commerce becomes more connected, owning your payment experience is a necessity, not a luxury. White label solutions give you the tools to protect your brand, build customer loyalty, and create a payment system that’s ready for whatever comes next.

Got Questions About White Label Payments? We've Got Answers.

Even after seeing all the benefits, it's natural to have a few questions rolling around in your head. When you're considering a big move like this, you need straight answers to make a smart decision. Let's tackle the most common questions that pop up, so you can clear up any confusion and feel confident about how it all works.

We'll get into the nitty-gritty of how white label services differ from a standard API integration, just how much control you really get, and touch on the big topics: security and compliance. Think of this as your final Q&A before you take the next step.

How Is This Different From Just Using an API From a Company Like Stripe?

This is a great question, because while both involve an API, they’re worlds apart in terms of your brand experience. When you use a standard integration with a provider like Stripe, your customers will likely see the Stripe logo and branding during checkout. They might even get redirected to a Stripe-hosted page to complete their payment, which can feel a little disconnected from your site.

A white label payment solution, on the other hand, is built to be a silent partner. It works completely behind the scenes. The provider's powerful technology is all there, but it's completely invisible to your customer. This lets you process payments under your own banner, giving you full command of the checkout journey and making the whole experience feel like a natural part of your platform.

How Much Control Do I Really Get Over the User Experience?

You get total control. That's the main event and one of the biggest draws of going white label. Since the provider's tech is hidden from view, you have a blank canvas to design and build the entire payment flow and user interface exactly how you want it.

This means you can dial in every last detail to match your brand's unique style. You're in the driver's seat for:

- The visual design and layout of your checkout page.

- Every word of the messaging and instructions your customers read.

- The entire step-by-step process, from inputting payment details to seeing that "Thank You" screen.

Are These Solutions Secure and PCI Compliant?

Absolutely. Any legitimate white label provider shoulders the heavy burden of security and PCI DSS compliance. Their entire infrastructure is built on a secure, certified foundation designed to guard sensitive payment data. This dramatically shrinks your own compliance workload and risk.

But remember, security is a team sport. While your provider locks down their systems and the payment processing itself, you're still on the hook for securing your own website or application and the customer data you handle. The partnership makes compliance much easier, but it doesn't take you completely out of the game.

What Kind of Businesses Get the Most Out of This Model?

While just about any business can find a reason to use a white label model, it’s a game-changer for a few specific types. If your goal is to weave payments directly into the fabric of your service—making it a core feature—you’re a perfect fit. Doing this not only strengthens your brand but can open up entirely new ways to generate revenue.

The businesses that see the biggest wins are usually:

- SaaS Platforms looking to embed payment acceptance directly into their software.

- Vertical Software Companies (ISVs) who are building complete, all-in-one platforms for niche industries.

- Online Marketplaces that need to seamlessly handle transactions between many different buyers and sellers.

- Digital Agencies that create e-commerce websites and experiences for a roster of clients.

Ready to offer seamless, branded cryptocurrency payments without the complexity? At BlockBee, we provide a secure, non-custodial solution that puts you in control. Integrate quickly, support over 70 cryptocurrencies, and keep your customers within your ecosystem. Get started with BlockBee today.