What Is APY in Crypto and How Does It Work?

In the simplest terms, Annual Percentage Yield (APY) in crypto is the actual rate of return you can expect on your digital assets over a year, once the powerful effect of compounding is factored in. Think of it as a supercharged savings account, but for your cryptocurrency.

Understanding Crypto APY With a Simple Analogy

If you’ve ever used a traditional savings account, you’re already familiar with the basic concept. You put your money to work, and it generates interest. Crypto APY follows the same principle, but the mechanics behind the returns—and their potential—are often much more dynamic.

The secret sauce is compounding interest. This is where APY truly shines. Instead of your earned rewards sitting on the sidelines, they’re rolled back into your original investment. From that point on, you start earning rewards on that new, larger total. It’s a cycle of growth.

The Snowball Effect of Compounding

Imagine you’re rolling a small snowball down a snowy hill. As it rolls, it picks up more snow, getting bigger and gathering even more snow at an ever-increasing pace. That’s exactly how compounding works with your crypto.

- Your Initial Stake: This is your starting "snowball."

- Rewards Earned: The first layer of snow is added, making it slightly bigger.

- Compounded Growth: The next round of rewards is now calculated on the larger snowball, not the original one.

This is precisely why APY is such a vital metric for any crypto investor. It gives you a much more realistic forecast of your potential earnings than a simple interest rate ever could.

APY isn't just another financial term; it’s a measurement of your crypto's potential to grow exponentially. It reveals the true power of your investment when your earnings begin to generate their own earnings.

While APY tells you about compounded growth, you'll often see another term: APR. Understanding the distinction is crucial.

Crypto APY vs APR at a Glance

When you’re looking at crypto earning opportunities, you’ll see both APY and APR. They sound similar, but they tell very different stories about your potential returns. APR is the simple, non-compounded interest rate, while APY shows you the bigger picture, including the magic of compounding.

This table breaks down the core differences.

| Feature | APY (Annual Percentage Yield) | APR (Annual Percentage Rate) |

|---|---|---|

| Compounding Interest | Includes the effect of compounding. | Does not include the effect of compounding. |

| Calculation | Reflects earnings on both principal and accumulated interest. | Calculated only on the original principal amount. |

| What It Represents | The true annual rate of return on your investment. | The simple annual interest rate without growth. |

| Investor Takeaway | Shows the full growth potential of your assets. | A baseline interest figure; requires manual compounding. |

For a more detailed look into this, understanding the difference between APR and APY in traditional finance provides a great foundation, as the core concepts are the same.

How APY Works in the Real World of Crypto

In the fast-moving world of decentralized finance (DeFi), APY is the return you see quoted for activities like staking your coins, lending them out on a protocol, or providing liquidity in what's known as "yield farming."

It's important to know that these APY figures aren't set in stone. They can fluctuate based on the specific crypto asset, the DeFi protocol you're using, and the general sentiment of the market. Platforms often show how these yields can shift with market performance. For instance, you can see how yields are tracked for various assets on sites like APY.Finance via CoinGecko. Getting a handle on APY is your first step to making smarter decisions in the world of crypto yields.

How Compounding Supercharges Your Crypto Earnings

The real magic behind APY isn't just the interest rate; it’s the power of compounding. This is where your investment earnings are rolled back into your principal, so they start generating their own earnings. It’s what turns a simple interest rate (APR) into a powerful growth engine for your crypto.

Think of it like this: Imagine you stake 10 ETH in a pool. If there's no compounding, you just earn rewards on that initial 10 ETH over and over. But with compounding, the rewards you earn in the first month get added to your stake. So, in the second month, you're earning rewards on a bigger pot—your original 10 ETH plus the rewards from month one.

This creates a snowball effect. Your crypto holdings start to grow at an accelerating rate because each new earning period builds on the last. It makes your initial investment work much harder for you over time.

At its heart, compounding is just earning interest on your interest. It’s a simple concept, but it's what can transform small, steady rewards into significant gains, especially if you’re in it for the long haul.

The APY Calculation in Action

How often your earnings are compounded makes a huge difference. The more frequently it happens—daily, weekly, or monthly—the higher your effective APY will be. A daily compound will always beat a monthly one, even if the base interest rate (APR) is exactly the same.

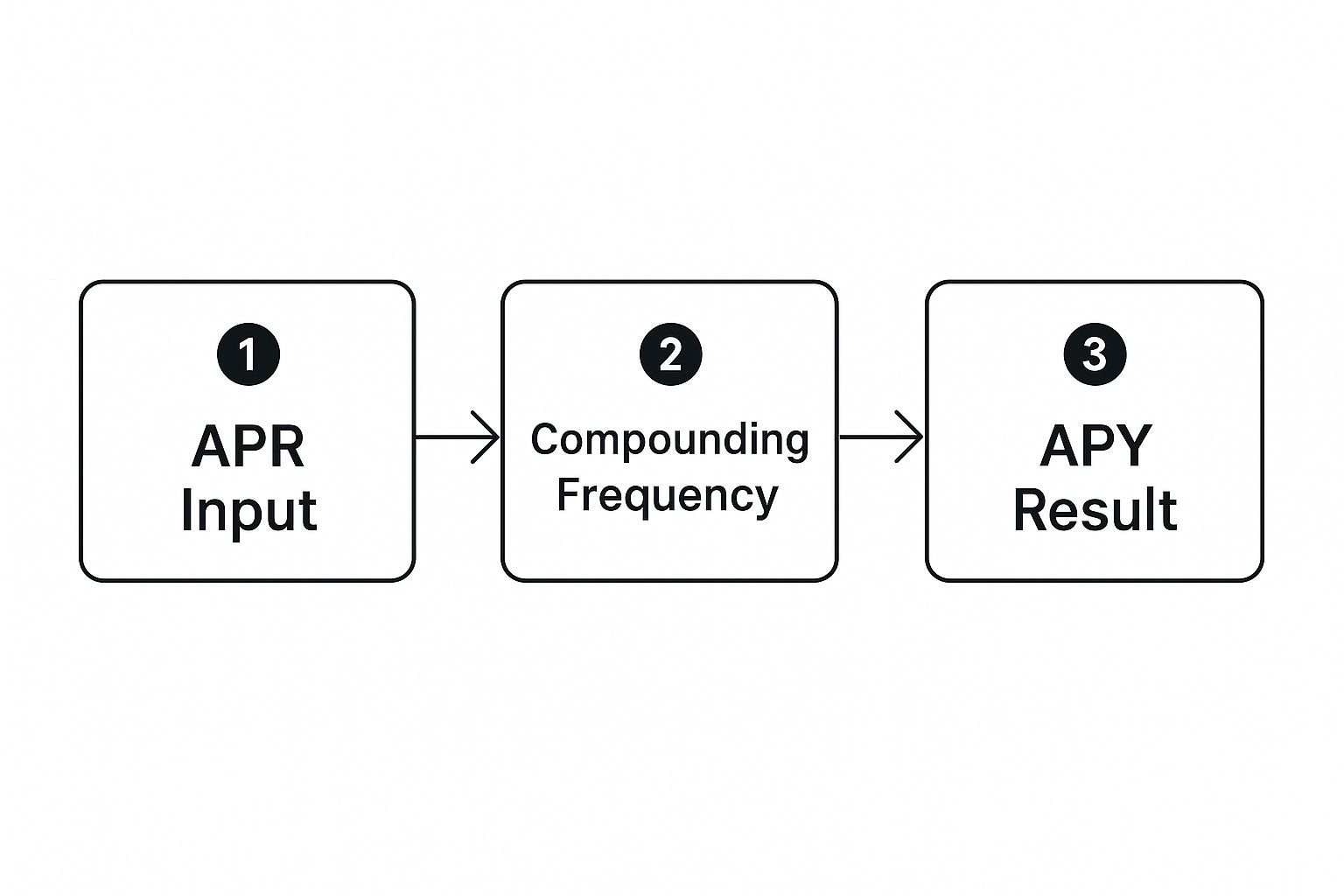

This visual really breaks down how a starting APR, when combined with the frequency of compounding, determines your final APY.

The takeaway here is that APY isn't just a static number. It's the result of an active growth strategy where your earnings are constantly being put back to work.

Getting a handle on these mechanics is crucial, not just for earning yield but for engaging with the crypto economy as a whole. As more businesses begin accepting crypto, understanding its growth potential becomes even more important. If you’re just getting started, our guide on demystifying crypto processing is a fantastic next read.

Exploring Popular Ways to Earn Crypto APY

So, you understand what APY in crypto is. Now for the exciting part: where can you actually earn it? The world of decentralized finance (DeFi) has opened up some fantastic ways to put your digital assets to work. Each method has its own quirks, risks, and is suited for different types of people.

Let's dive into the three most common ways people are generating yield right now.

Staking: Earning Rewards by Securing a Network

Staking is one of the most fundamental ways to earn crypto APY. At its core, it means you're helping run a Proof-of-Stake (PoS) blockchain by "locking up" some of your crypto.

When you stake your assets, you’re helping to validate transactions and keep the network secure. As a thank you for your contribution, the network pays you rewards in the form of more tokens—and that's where your APY comes from.

- Who It's For: Staking is a great fit for long-term holders (HODLers) who believe in a project and want to earn passive income without the stress of active trading.

- Typical Risk Level: Generally considered low to moderate. The main risk isn't from the staking itself but from the price of your staked crypto going up or down.

Crypto Lending: Be the Bank

Another popular route is crypto lending. You can think of it like a decentralized, peer-to-peer savings account. You deposit your crypto into a lending platform, and that platform loans your assets out to borrowers who need them.

The borrowers pay interest on the loan, and the platform passes a cut of that interest back to you as your APY. It's a simple, effective way to earn a return on crypto that would otherwise just be sitting in your wallet.

Lending platforms act as the bridge between those who have assets and those who need them, creating a market for interest rates determined by supply and demand.

Yield Farming: Chasing the Highest Returns

Yield farming is where things get more advanced—and potentially a lot more profitable. This strategy involves actively moving your crypto between different DeFi protocols and liquidity pools, always hunting for the best APY available. A yield farmer might lend on one platform, then use the token they receive as collateral to borrow on another, and so on.

This approach often requires interacting with many different kinds of crypto assets. If you're just getting started, it really helps to have a firm grasp of the basics. Our guide on what a cryptocurrency token is is a great place to build that foundation.

- Who It's For: This is definitely for the more seasoned DeFi user who is comfortable managing complex positions and understands the higher risks involved.

- Typical Risk Level: Yield farming carries high risk. You're exposed to potential smart contract bugs, impermanent loss, and the sheer complexity of the strategies themselves.

These three methods are the bread and butter of earning APY in crypto. If you want to look beyond these, check out these 9 proven ways to earn passive income with crypto for even more ideas. Ultimately, the right path for you will come down to your personal risk tolerance and what you hope to achieve with your investments.

Navigating the Risks of High APY Promises

When you see a crypto project promising an APY in the triple, or even quadruple, digits, it’s easy to get excited. Who wouldn't want those kinds of returns? But before you jump in, it's critical to understand that those eye-popping numbers often signal equally massive risks lurking just beneath the surface.

Think of it this way: high APY is almost always a sign of high risk. It's a classic investment principle that holds true in crypto as much as anywhere else—the bigger the potential reward, the greater the danger. For a deeper dive into protecting your portfolio beyond just crypto, exploring general investment risk management strategies is a smart move.

Common Dangers Behind the Numbers

It's tempting to focus only on that big, flashy APY percentage, but the real story is in how that yield is generated. Here are three of the most common risks you absolutely need to be aware of:

Smart Contract Bugs: DeFi protocols are built on smart contracts, which are just lines of code running on a blockchain. If a hacker finds a single bug or an oversight in that code, they can drain the entire protocol. Your funds could vanish in an instant.

Impermanent Loss: When you provide liquidity to a decentralized exchange, the value of your two paired tokens can drift apart. This can leave you with less money than if you had just held onto the original assets in your wallet. It's a strange-sounding risk, but a very real one.

Reward Token Volatility: Many of these incredibly high APYs are paid out in the platform's own native token. The problem? These tokens are often new, unproven, and extremely volatile. If the token's price crashes—which happens all the time—your impressive APY can quickly become worthless.

The rule of thumb in DeFi is simple: If an APY seems too good to be true, it probably is. The highest yields are often used to attract liquidity to the newest and riskiest protocols.

History shows us that crypto APYs swing wildly with the market. Back in the 2017 bull run, some of the first DeFi projects offered yields over 20%, only to see them evaporate when the 2018 bear market arrived. As asset prices tanked, liquidity dried up, and the APYs went with it. This cycle repeats itself, and you can see the evidence for yourself by looking at historical data on platforms like CoinMarketCap to see these trends for yourself.

Why APY Is a Key Pillar of Modern Crypto Investing

It wasn't that long ago when the main crypto strategy was simple: buy low, sell high. Timing the market was the name of the game, and the entire space felt like one big speculative bet. But things have changed. As the crypto world matures, it's starting to adopt the same kind of smart, wealth-building strategies you see in traditional finance.

At the very heart of this change is APY. It signals a major shift away from chasing short-term price swings and toward building sustainable, long-term value. This isn't just a minor update; it shows crypto is growing up into a more sophisticated financial ecosystem.

The Shift From Speculation To Utility

The explosion of APY-generating opportunities, like crypto staking and lending, is proof that the industry is building real-world use cases. Instead of your assets just sitting idly in a wallet, you can now put them to work.

This is a game-changer. It allows you to earn passive income, turning your digital holdings into active, productive tools. We've moved from simply owning crypto to actually participating in its economy. Grasping the reasons to invest in cryptocurrency is key to understanding this new era of financial utility.

And this isn't some niche trend; it's a worldwide movement.

APY is more than just a number. It's the bridge from crypto's speculative past to a future built on real financial services and sustainable wealth for everyday users.

The incredible growth in crypto adoption has poured fuel on the fire, creating massive demand for reliable ways to earn a yield. By early 2024, the number of crypto owners worldwide surged past 560 million. This huge, and still growing, user base is actively looking for more than just trading. You can explore more cryptocurrency ownership data to get a sense of just how big this global trend has become.

These millions of people want to do more with their assets, and the market is responding. The expansion of products offering an APY reflects this fundamental shift toward generating real, consistent returns from digital assets.

Frequently Asked Questions About Crypto APY

Even after getting the hang of the basics, you probably still have a few questions about how crypto APY works in the real world. That’s completely normal. Diving into crypto yields means looking at both the exciting returns and the details hidden in the fine print.

This FAQ is designed to give you straightforward answers to the questions we hear most often. We’ll cut through the noise and address the practical side of crypto APY, clearing up any lingering doubts so you can approach these opportunities with your eyes wide open.

Is the APY Offered on Crypto Guaranteed?

Almost never. If there's one thing to remember about crypto APY, it's that it is highly variable. This isn't like a traditional bank savings account with a locked-in rate. Crypto APYs can, and often do, swing wildly based on market sentiment, demand for borrowing, and the specific reward rules of a protocol.

A juicy APY you see today isn't a guarantee for tomorrow. These rates are dynamic, so it's smart to keep an eye on them instead of assuming they're set in stone.

How Often Are Crypto APY Rewards Paid Out?

This really depends on the platform or protocol you're using. Payout schedules are all over the map, which directly impacts how quickly your investment can grow.

Your earnings might be paid out:

- Daily: Many decentralized finance (DeFi) platforms and crypto exchanges pay out every day. This is great for maximizing the power of compounding.

- Weekly: Some services choose to distribute rewards on a simple weekly schedule.

- Per Epoch: With staking, rewards are often tied to an "epoch," which is just a set period of time on the blockchain. An epoch could last a few hours or several days.

As a rule of thumb, the more frequent the payout, the harder your APY works for you, because your earnings start generating their own earnings sooner.

Can I Lose My Initial Investment When Earning APY?

Yes, absolutely. This is probably the single most important risk to understand. While you’re earning yield, the actual crypto you put up—your principal—is still subject to the wild price swings of the market.

If the price of the coin you're earning on suddenly plummets, that loss in value can easily cancel out—and even exceed—any APY gains you've made. It's entirely possible for your total investment to be worth less than when you started, even as you're collecting rewards.

And market volatility isn't the only threat. Things like smart contract bugs, platform hacks, or the infamous "impermanent loss" in liquidity pools can also put your initial capital at risk.

Ready to integrate seamless crypto payments into your business? BlockBee offers a secure, non-custodial gateway for over 70 cryptocurrencies, featuring instant payouts and low fees. Discover how BlockBee can streamline your transactions today.