what is an ipn: your quick guide to payment notifications

At its core, an Instant Payment Notification (IPN) is an automated message a payment gateway sends to your server the moment a transaction's status changes. Think of it as a tap on the shoulder from your payment processor, letting your system know that a customer's payment went through, failed, or was refunded.

This behind-the-scenes communication is the secret sauce that makes modern e-commerce automation possible.

The Foundation of Automated E-commerce

An IPN isn't just a simple alert; it's a vital, machine-to-machine conversation. When someone buys a product from your store, a third-party gateway like BlockBee handles the transaction. Once that process is complete, the gateway needs to tell your website what happened so it can take the next step.

Instead of you having to manually check your payment dashboard for new orders, the gateway immediately sends a data-packed IPN to a specific URL on your server—a designated endpoint often called an "IPN listener." This listener is always waiting for these crucial updates.

Why This Matters for Your Business

This automated notification system is what powers the seamless, instant experiences your customers now expect. It's the invisible engine that kicks off critical business operations right after a payment is made.

For example, a single successful IPN can trigger your system to:

- Update inventory levels: The moment a sale is confirmed, the item is removed from your available stock count.

- Grant access to digital goods: Instantly unlock a user’s access to a course, a software license, or a downloadable file.

- Send order confirmations: Fire off a customized "Thank You" email with all the order details.

- Kickstart fulfillment: Automatically notify your warehouse or shipping department that an order is ready to be packed.

Without IPNs, you’d be stuck in a manual loop of checking payments and fulfilling orders. It would be slow, riddled with human error, and completely impossible to scale. IPNs are what turn a simple transaction into a slick, automated workflow.

To really get a handle on what makes an IPN tick, it helps to break down its core components. These are the pieces that work together to ensure reliable and secure communication between the payment gateway and your application.

Here’s a quick look at the key elements involved.

Key Components of an Instant Payment Notification

A breakdown of the core elements that make a typical IPN system function effectively.

| Component | Role and Function |

|---|---|

| Payment Gateway | The service (e.g., BlockBee) that processes the payment and originates the IPN message. |

| Merchant Server | Your web server, which hosts your e-commerce platform or application. |

| IPN Listener | A dedicated script or URL on your server designed to receive and process incoming IPN data. |

| IPN Message (Payload) | The data sent by the gateway, containing transaction details like status, amount, and customer info. |

| Verification Mechanism | A security step where your listener confirms the IPN's authenticity with the gateway to prevent fraud. |

| HTTP POST Request | The technical method used by the gateway to send the IPN message to your listener. |

Understanding these parts is the first step toward building a resilient system that can handle payments automatically.

As e-commerce continues to grow, reliable notification systems like IPN are absolutely essential, no matter what payment type you accept. For businesses looking ahead, understanding the mechanics of integrating diverse payment methods into e-commerce platforms, like stablecoins, provides great insight into where the industry is headed.

How an Instant Payment Notification Works Step by Step

To really get a feel for what an IPN is, let's walk through a typical online purchase from beginning to end. Think of it as a silent, automated conversation happening in the background between a few different systems, all designed to keep your business running without you having to lift a finger.

Let's say a customer lands on your website and decides to buy one of your digital products. They pop it in their cart, head to checkout, and choose their payment option—we'll use BlockBee in this example. That single click is the starting pistol for the entire automated process.

The Initial Transaction and Gateway Communication

The second your customer hits "Pay," your site bundles up all the transaction details and securely passes them over to the payment gateway. The gateway then takes the baton, managing the heavy lifting of the financial processing. It's the gateway's job to confirm the payment with whatever financial network is involved, whether that's a standard credit card company or a crypto blockchain.

But once the gateway gets an answer—success, failure, or still pending—its work isn't done. Now it needs to tell your system what happened. This is where the "notification" part of IPN comes in. The gateway sends an asynchronous message, which just means it happens in the background, completely separate from what the customer is doing in their browser.

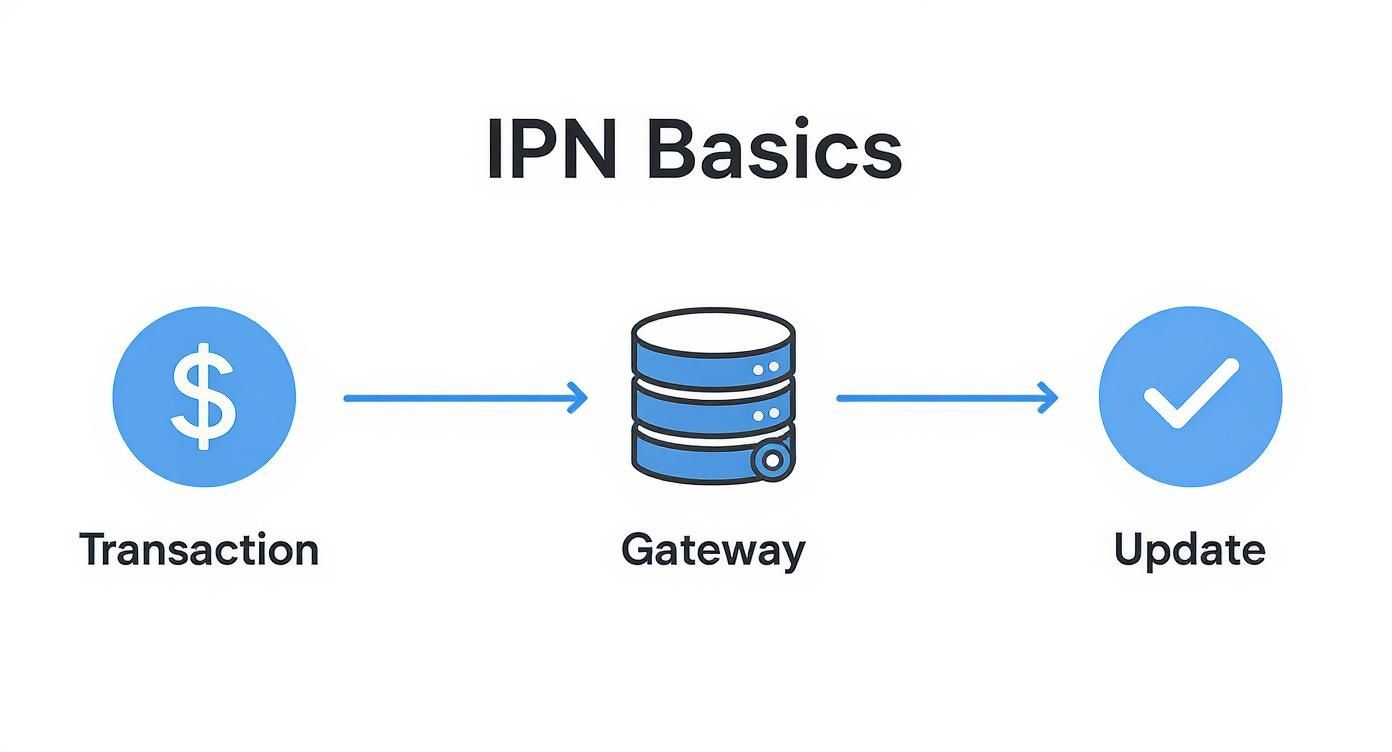

This simple but effective three-step flow is easy to see in action.

As you can see, the gateway is the middleman, confirming the payment and then telling your server to update its records.

The Server Handshake and Verification

So, how does the gateway talk to your server? It sends the IPN message using an HTTP POST request to a specific URL you've set up—this is often called your "IPN listener." This listener is just a script on your server, always on and waiting for these pings. The message it receives, the "payload," is packed with all the important details: transaction ID, payment amount, status, and customer info.

The very first thing your server must do when it gets an IPN is check if it's legitimate. This is a critical security step. It verifies the message by sending the data it just received straight back to the payment gateway. This quick "handshake" confirms the message really came from the gateway and wasn't sent by a scammer trying to trick your system into giving away a product for free.

This need for secure, automated financial systems is huge. The Interbank Payment Networks market, currently valued at around $14.3 billion, is on track to nearly double. This boom is driven by the growing demand for solid risk management in digital payments. You can dig into the numbers yourself and read more about the growth of interbank payment networks to see how big this trend really is.

Fulfilling the Order and Responding

Only after the IPN has been verified should your system actually do anything. Once it's confirmed the message is authentic, it can finally act on the information inside.

Here’s a breakdown of what happens next:

- Parse the Data: Your listener script pulls out the key details from the IPN payload.

- Execute Business Logic: If the payment status is "completed," your system can now do its thing. It might update your database to mark the order as paid, trigger an email, adjust your inventory, or grant the customer access to their digital download.

- Send a Confirmation: Lastly, your listener needs to send an "HTTP 200 OK" response back to the gateway. This is just a simple, standardized way of saying, "Got it, thanks!" It lets the gateway know the message was received successfully so it doesn't try to send it again.

IPNs vs. Webhooks and APIs: Understanding the Key Differences

When you first dive into IPNs, it’s easy to get tangled up in a web of similar-sounding tech terms like webhooks and APIs. They all help different software systems talk to each other, but the way they communicate is fundamentally different. Getting these distinctions right is the key to understanding the specific, crucial role an Instant Payment Notification plays.

Let's use a restaurant analogy. An API (Application Programming Interface) is like a restaurant menu. You, the customer, have to ask the waiter for what you want (that's a pull request), and the kitchen (the server) responds by bringing you that specific item. You have to initiate the conversation every single time you need something.

The "Push" Model: How Webhooks and IPNs Work

A webhook, on the other hand, flips that script. It operates on a “push” model. Imagine you’ve placed your order and are waiting at your table. Instead of you repeatedly asking the waiter, "Is my food ready yet?", the kitchen sends a notification directly to you the moment it’s plated. The server proactively pushes information to you when a specific event happens.

This "push" approach is way more efficient for getting real-time updates because your system doesn't have to constantly poll for new information.

So, where does an IPN fit in? An Instant Payment Notification (IPN) is simply a highly specialized type of webhook. It’s a webhook built for one job and one job only: to push notifications about payment events. All IPNs are webhooks, but not all webhooks are IPNs. A generic webhook might tell you about a new comment on social media, but an IPN is laser-focused on transactions—confirming payments, flagging failures, and processing refunds.

Comparing the Three Technologies

To make it crystal clear, let's lay out the core differences. Each of these tools has its own communication style and is best suited for different jobs.

A simple way to remember it: With an API, you ask for data. With a webhook or IPN, data asks for you—by showing up at your digital doorstep the moment something happens.

This table breaks down how they stack up against each other.

| Technology | Communication Model | Primary Use Case |

|---|---|---|

| API | Pull: Your application requests data from a server when it needs it. | General-purpose data retrieval and interaction, like fetching user data. |

| Webhook | Push: A server sends data to your application when a specific event happens. | Real-time notifications for a wide range of events (e.g., code commits, new sign-ups). |

| IPN | Push: A specialized webhook where a payment gateway sends transaction data. | Exclusively for payment-related events like completions, failures, or refunds. |

Mastering how these digital conversations work is a huge advantage. If you want to get even better at structuring these interactions, checking out some API documentation best practices is a great next step.

Dissecting a Real-World IPN Message Payload

To really get what an Instant Payment Notification does, you have to look under the hood at the data it carries. This chunk of data, often called a "payload," is a structured message that gets sent to your server. It’s not just a simple "payment complete!" ping; it’s a full-blown, detailed report.

Think of it like a digital receipt that’s automatically delivered and filed away by your system. This payload has everything your application needs to know about a transaction, empowering it to take immediate, automated action. Most of the time, this data comes formatted as JSON (JavaScript Object Notation) or simple key-value pairs, which are super easy for your code to read.

A Sample BlockBee IPN Payload

Let's pull apart a real-world IPN payload from a service like BlockBee. While the exact fields can differ a bit from one payment gateway to another, the essential information is almost always the same. This is the raw data your server's listener would receive.

{ "status": "completed", "txid_in": "abc123def456...", "txid_out": "ghi789jkl012...", "address_in": "your_deposit_address", "address_out": "customer_refund_address", "amount_coin": "0.0025", "amount_fiat": "150.00", "coin": "BTC", "fiat_coin": "USD", "order_id": "ORDER-5544", "customer_email": "[email protected]" }

This block of code might look a little intimidating at first, but each line tells a critical part of the transaction's story. It's the "what is an IPN" question answered in a very practical way.

An IPN payload is the source of truth for your automated systems. Every field is a specific instruction or piece of data that can kick off a different workflow—from fulfilling an order to flagging a potential issue for a human to review.

Translating the Data into Actions

Every key in that payload is a puzzle piece your system uses to make decisions. As soon as your IPN listener gets this message, it parses the data and gets to work.

Let’s translate what some of these key fields mean and the actions they might trigger:

"status": "completed": This is the big one. A "completed" status tells your system the payment went through successfully. It's the green light to ship a product, grant access to a digital course, or credit an account. If it said "failed" or "pending," you’d trigger a totally different process, like sending a payment reminder email."amount_coin": "0.0025"and"amount_fiat": "150.00": These fields confirm the exact amount paid. Your system should cross-reference this with the original order total to make sure the customer paid the right price. This simple check catches any partial payment problems before they cause a headache."order_id": "ORDER-5544": This is the unique tag that connects the payment directly to a specific order in your database. Your system grabs this ID to look up the customer's purchase and instantly mark it as paid."customer_email": "[email protected]": With this, you can link the payment to a specific customer account. It’s also perfect for firing off automated confirmation receipts or "thank you" emails.

By breaking down this payload, you can see how an IPN turns raw transaction data into business logic. It’s the essential bridge between a customer clicking "pay" and your systems automatically doing their thing.

Locking Down Your IPN Handler: Essential Security Measures

When you're dealing with Instant Payment Notifications, you're handling the keys to the kingdom—sensitive financial data. That's why securing your IPN handler isn't just a good idea; it's absolutely critical. An unprotected IPN endpoint is like an open door for fraudsters, who can send fake notifications to trick your system into shipping products that were never paid for.

Think of it this way: you have to treat every single IPN message that arrives as suspicious until you can prove it's legitimate. Verification is your top priority, always.

The All-Important Verification Handshake

The single most powerful defense you have against a spoofed IPN is what I call the "verification handshake." It's a simple but brilliant security check.

The process is straightforward: your server receives an IPN and, instead of immediately acting on it, it sends that same data straight back to the payment gateway to ask, "Hey, is this for real?" The gateway will reply with a clear VERIFIED or INVALID.

Only after you get that VERIFIED confirmation should your system even think about fulfilling the order. This one step will shut down the overwhelming majority of fraudulent attempts right in their tracks. But don't stop there. For a truly hardened system, you need to layer your defenses.

Here are a few more non-negotiables:

- HTTPS is a Must: Your IPN listener URL has to use HTTPS. This encrypts the data as it travels from the gateway to your server, preventing anyone from snooping on the transaction details along the way.

- Whitelist IP Addresses: A great way to add another layer of security is to tell your server to only listen to IPNs coming from the payment gateway's specific IP addresses. It’s like having a bouncer at the door who only lets in pre-approved guests. You can learn more about how to do this in our guide on upgrading BlockBee callback IPs.

- Double-Check the Details: Before you mark an order as complete, your script should do a quick sanity check. Does the payment amount in the IPN match the order total in your database? Is the currency correct? This simple cross-reference catches any discrepancies and ensures the customer paid what they were supposed to.

Handling Duplicates and Why Idempotency Matters

It's not uncommon to receive the same IPN more than once. A temporary network glitch or a gateway's own retry logic can cause duplicate notifications to be sent. If your system isn't ready for this, you could end up shipping the same product twice or giving a customer duplicate access to a digital file.

This is where the concept of idempotency comes in.

Idempotency is a fancy word for a simple idea: processing the same request multiple times should have the exact same result as processing it just once. Your code should check the unique transaction ID from every IPN against your database. If you've already seen that ID, you simply ignore the new request.

This prevents those accidental duplicate fulfillments and keeps your operations running smoothly.

Alright, let's get our hands dirty and move from theory to a working integration. Setting up your first Instant Payment Notification (IPN) is surprisingly straightforward, and it's the critical first step to automating your payment workflows. The whole process boils down to creating a listener on your end and then telling BlockBee where to send its updates.

First things first, you need to create a "listener" script on your server. Think of this as a digital receptionist. It’s a piece of code, maybe in PHP, Python, or Node.js, that lives at a public URL. Its only job is to patiently wait for incoming data from BlockBee and know exactly what to do with it when it arrives.

Once that script is up and running, you just need to pop over to your payment gateway's dashboard. You'll find a field where you can paste the URL to your listener. This simple action tells the gateway, "Hey, every time a transaction status changes, send the details to this address."

The Importance of Sandbox Testing

Before you let your integration handle real money, you absolutely must test it. This isn't just a suggestion—it's non-negotiable. This is where a sandbox environment becomes your best friend. A sandbox is a secure playground that perfectly mirrors the live system, letting you simulate all kinds of transactions without any actual crypto changing hands.

Using the sandbox, you can throw different scenarios at your listener to see how it behaves. The goal is to make sure your code is solid enough to handle anything that comes its way.

- Successful Payments: Does your system correctly mark an order as paid and deliver the goods or services?

- Failed Transactions: What happens when a payment fails? Does your script log the error and flag the order appropriately?

- Refunds and Disputes: Can your listener handle a refund notification and update your records without breaking a sweat?

A thorough testing phase is your best insurance against costly errors and customer frustration. It ensures your entire automated workflow is flawless before it ever touches a real customer order, giving you complete confidence in your integration.

We know testing can sometimes be a pain, which is why we built tools to make it easier. For a streamlined approach, check out our guide on the BlockBee Callback Tester. Properly simulating these events is the key to building a system you can truly rely on.

Got Questions About IPNs? Let's Clear Things Up.

Once you start thinking about using Instant Payment Notifications, a few practical questions always pop up. It's totally normal. Let's tackle some of the most common ones I hear from developers so you can feel confident moving forward.

What if My Server Goes Down When the IPN Arrives?

This is probably the number one concern, and for good reason. But don't worry, any well-designed payment system has a plan for this. Services like BlockBee don't just send the notification once and hope for the best.

If your server is offline or doesn't send back a "success" response (like an HTTP 200 OK), the system automatically tries again. It will keep resending the IPN several times, usually with a bit more time between each attempt. This gives your server a chance to come back online without you losing that crucial payment data.

Isn't an IPN Just a Fancy Payment Confirmation Email?

Not at all. They're built for completely different audiences. A payment confirmation email is for your customer—it's friendly, human-readable, and tells them their order is complete.

An IPN, on the other hand, is a coded message sent from one computer to another—specifically, from the payment gateway's server to your application's server.

Think of the IPN as the backstage crew cue. Your system gets the IPN cue, verifies it's legit, and then triggers all the important actions, like sending that confirmation email to the customer. The IPN is the cause; the email is the effect.

So, Can I Fulfill the Order Before the IPN Gets Here?

I can't stress this enough: absolutely not. A customer seeing a "Thank You" page after checkout is not proof of payment. That happens on their browser and can be easily faked.

The only signal you can trust is the verified IPN that comes directly from the payment gateway to your server. It's your single source of truth. Waiting for it is the most critical step you can take to prevent fraud and ensure you only deliver goods or services for payments that have actually gone through.

Ready to automate your crypto payments with a reliable IPN system? With BlockBee, you can integrate a secure and efficient payment gateway in minutes. Get started for free today!