Payment gateway for developers: A Practical Guide to Integration

A payment gateway built for developers is less of a tool and more of a universal translator for money. It takes all the messy, disconnected financial networks and turns them into clean, predictable code you can actually work with.

Think of it as a powerful API-first platform. This gives you fine-grained control over how money moves through your application, making payments a core feature instead of just a tacked-on final step. For anyone building a modern digital product, that shift in thinking is a game-changer.

Beyond The Black Box: Understanding The Developer-First Gateway

Not too long ago, payment gateways were rigid, "black box" systems. As a developer, you had to wrestle with clunky interfaces and frustrating limitations. Integrating payments was a necessary evil, something you dreaded at the end of a project.

Thankfully, that’s all changed. Today's gateways are built from the ground up with the needs of engineers in mind.

A modern payment gateway for developers is all about flexibility and control. It works like a sophisticated power adapter. You don't need to know the intricate wiring of every global electrical grid—whether it's Visa, Mastercard, or a crypto network. You just need a reliable adapter that lets your app plug in and work everywhere, seamlessly.

A developer-centric gateway hides the immense complexity of financial protocols. It gives you a clean, well-documented API, so you can focus on building a fantastic user experience instead of battling ancient banking standards.

This isn’t just a nice-to-have. It’s a competitive advantage. As commerce becomes more immediate and digital, your ability to quickly build, test, and tweak payment flows is what makes your product stand out.

To see the difference clearly, let's compare the old way with the new.

Traditional Vs Developer-First Payment Gateways

| Feature | Traditional Gateway | Developer-First Gateway |

|---|---|---|

| Primary Interface | Web-based dashboard, often clunky. | Clean, well-documented API. |

| Customization | Very limited; "one-size-fits-all" checkout. | Highly customizable via code. |

| Integration | Complex, often requires specialized help. | Straightforward with SDKs and libraries. |

| Automation | Minimal; requires manual intervention. | Built for automation (payouts, refunds). |

| Developer Experience | Low priority; documentation is often poor. | Top priority; excellent docs and sandboxes. |

This table shows a clear shift: the focus has moved from providing a simple service to empowering developers to build sophisticated financial features directly into their products.

The Rise Of API-Driven Commerce

The explosive growth of the internet economy is directly linked to this developer-centric mindset. A decade ago, the global gateway market was just a fraction of its current size. By 2023, it hit USD 26.84 billion in annual revenue and is expected to soar to USD 159.52 billion by 2032.

This growth isn't just about more people shopping online; it's fueled by API-driven commerce, where payments become a programmable, integral part of the application itself.

At the heart of this revolution is the REST API, which allows your application to talk to the payment processor smoothly. This API-first design gives you some serious firepower:

- Granular Control: Manage every single step of a transaction's life directly in your code.

- Custom User Experiences: Build checkout flows that feel like a natural part of your brand, not a clunky third-party page.

- Faster Innovation: Want to add a new cryptocurrency? You can do it with a few API calls, not a full system re-architecture.

- Automation: Set up programmatic rules for handling refunds, subscriptions, and payouts to slash your manual workload.

Ultimately, a payment gateway for developers is an empowerment tool. It hands you the building blocks to create robust, secure, and flexible financial features that help your business grow and keep your users happy.

What's in a Modern Developer's Payment Toolkit?

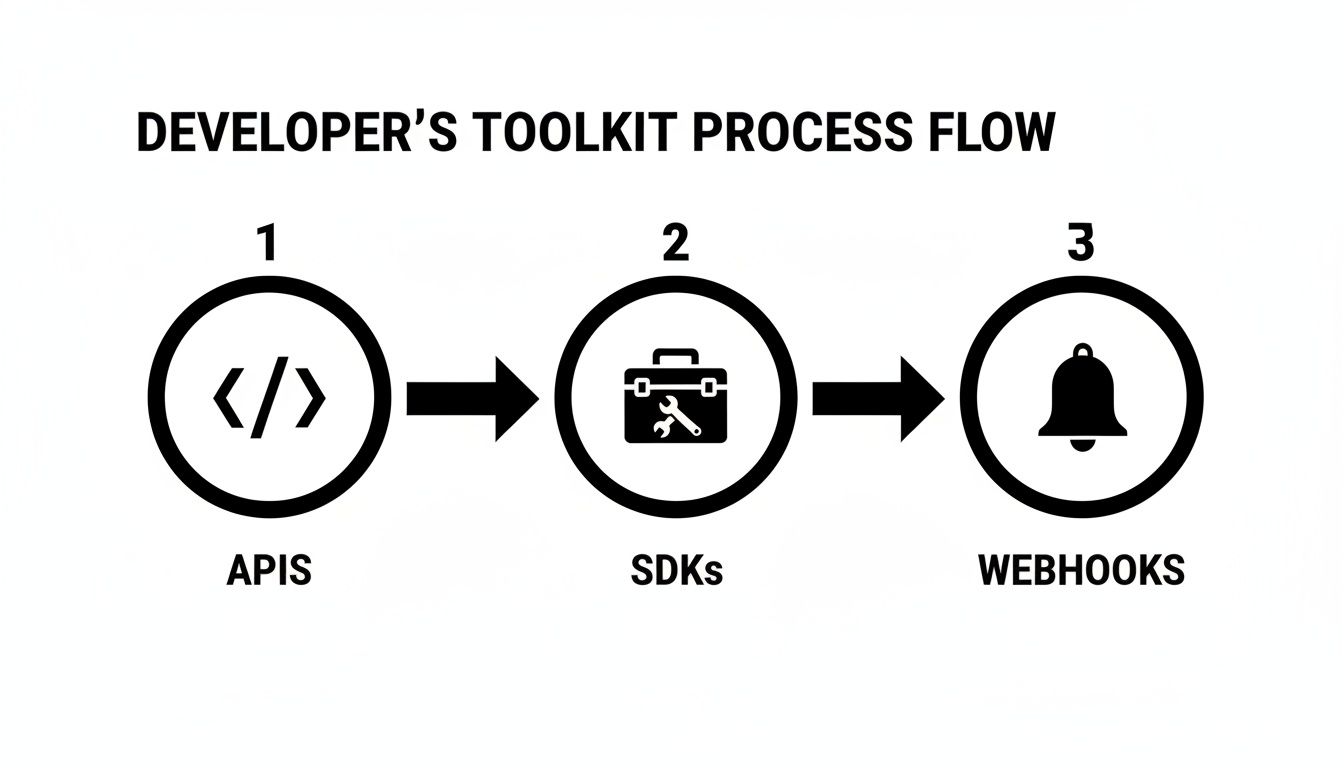

Let's get practical. A modern payment gateway for developers isn’t just one thing; it’s a whole toolkit. Each tool has a specific job, and knowing how to use them is the key to building payment systems that are efficient, secure, and don't break when you need them most. Think of it like this: you understand the concept of an engine, but now it's time to learn how to use the wrench, the screwdriver, and the diagnostic computer.

These components are built to work together, creating a seamless development process that slashes your integration time and helps you squash bugs long before they ever impact a real customer. Let's open up this toolkit and see what's inside.

APIs: The Direct Line to Your Money

The Application Programming Interface (API) is the heart and soul of any developer-focused gateway. It’s the language you use to give the payment system direct commands. Forget clicking buttons on a dashboard—you're writing code that sends precise, secure instructions.

For instance, one simple API call can kick off a payment, another can issue a refund, and a third can pull up a customer's entire transaction history. This level of control through code is what makes true automation and deep customization possible.

- Create a Payment Request: Your code sends the payment details—like the amount and currency—straight to the gateway's API.

- Check a Transaction's Status: You can programmatically ping the API to find out if a payment is still pending, has gone through, or failed.

- Manage Payouts: Need to pay vendors or users? You can automate sending money directly from your application's backend.

This direct line of communication is what separates a simple payment button from a fully baked financial feature inside your product.

A well-documented API is basically your contract with the gateway. It's a guarantee that if you send a specific, properly formatted request, you'll get a predictable response. This is what allows you to build solid error handling and a reliable experience for your users.

SDKs: The Pre-Built Construction Kits

Sure, you can always talk to an API directly, but Software Development Kits (SDKs) make the job a whole lot faster and less prone to silly mistakes. Think of an SDK as a "pre-built construction kit." Instead of building every piece from scratch, the SDK gives you ready-to-go code libraries for your language of choice, whether that's Python, JavaScript, PHP, or something else.

This is a massive time-saver. An SDK takes care of all the boring, repetitive code for things like authentication, formatting requests, and handling errors. For example, creating a new payment might become a single line of code like gateway.create_payment(), instead of you having to manually build a whole HTTP request with the right headers and JSON body. It not only gets you moving faster but also shrinks the chances of making common slip-ups.

Webhooks: The Instant Notification System

If the API is how you talk to the gateway, webhooks are how the gateway talks back to you—and it does it instantly. A webhook is just an automated message the gateway sends to your application the moment something important happens. It’s like an instant messaging system for your server.

This is a huge deal because so many payment events don't happen in real-time. A customer might close their browser before a payment is fully confirmed, or a crypto transaction might need a few minutes to get validated on the blockchain. Without webhooks, you’d be stuck constantly asking the gateway, "Is it done yet? How about now?"

With webhooks, the gateway just lets you know the second an event happens:

- Payment Received: Your app gets a webhook and can immediately flip the order status to "Paid."

- Payment Failed: The webhook pings your system, which can then trigger an automated email to the customer to try again.

- Dispute Opened: Your backend gets notified instantly, allowing you to flag the transaction for a human to review.

This event-driven approach is just way more efficient and scales much better.

Sandbox Environment: The Risk-Free Laboratory

Finally, every good toolkit needs a "risk-free laboratory"—the sandbox environment. It’s a perfect copy of the live payment gateway that uses fake data instead of real money. This is your playground to build, test, and break things without any real-world financial consequences.

A solid sandbox lets you simulate every scenario you can think of: successful payments, declined cards, network timeouts, and even complicated refund flows. It's absolutely essential for making sure your integration is rock-solid before a single real dollar ever changes hands. Developers who are disciplined about testing in a sandbox can ship new features with confidence, knowing they’ve already worked out the kinks in a safe, controlled space.

How a Real Payment Flow Actually Works

So, we've talked about the tools, but what does a payment flow actually look like from a developer's standpoint? Let's walk through the entire lifecycle of a transaction, from the moment a customer hits "Buy Now" to the point where the money is sitting in your account. It’s a surprisingly elegant dance of automated steps.

Let's use a classic e-commerce example: someone is buying a pair of sneakers from your online shop. They’ve added them to the cart, plugged in their payment details, and are ready to go. This is where your integration takes over and the real work begins.

The whole process is orchestrated by the very tools we've been discussing—APIs, SDKs, and Webhooks—all working together. This diagram gives a great visual overview of how they pass the baton from one to the next.

As you can see, each tool has a specific job. APIs issue direct commands, SDKs make those commands easier to write, and Webhooks listen for events to report back to your system.

Stage 1: Authorization – The Initial Handshake

First up is Authorization. Think of this as the initial "handshake" between your store, the payment gateway, and the customer's bank or crypto wallet. Your application makes a direct API call to the gateway, essentially asking, "Hey, does this person actually have the funds to cover this purchase?"

The gateway securely forwards that request to the financial network, which checks the customer's account balance or credit limit. It then sends back a simple yes or no. If it's a "yes," the funds are put on hold—they haven't been transferred yet, just reserved. This is a critical distinction.

From a developer's perspective, this means your code needs to be ready for either outcome. An approval moves the customer forward to a confirmation page. A decline should trigger a clear, helpful error message without ever revealing sensitive payment information.

Stage 2: Capture – The Point of No Return

With the funds authorized, the next step is the Capture. This is the point of no return. It’s where you send another API call telling the gateway, "Everything looks good. Go ahead and take the money." This is usually triggered when you ship the physical product or grant access to a digital service.

Why the separation? Flexibility. Imagine an item is suddenly out of stock after an order is placed. You can simply void the authorization without any money ever changing hands. This completely sidesteps the headache of processing a refund. For digital goods or instant services, the capture can happen almost immediately after authorization.

Authorization is a promise of payment, but Capture is the action that finalizes it. This two-step process gives you a crucial control point, cutting down on the operational overhead of managing refunds for unfulfilled orders.

Stage 3: Settlement – The Final Delivery

The final stage is Settlement. Once a transaction is captured, the payment gateway bundles it with others and sends it off for processing in a batch. The money then moves from the customer's bank, through all the intermediary networks, and finally lands in your merchant account.

This part isn't instantaneous. It can take anywhere from a few minutes for crypto payments to a few business days for traditional credit card transactions. You don’t directly interact with this stage via API calls; it’s a background process handled by the gateway.

However, your system still needs to know when the money has officially arrived. This is where webhooks—often called Instant Payment Notifications (IPNs)—are indispensable. The gateway sends an automated IPN to your server to confirm that a payment has been settled. If you want to dig deeper, our guide on what is an IPN explains why these notifications are a developer's best friend.

Getting a handle on these three stages—Authorization, Capture, and Settlement—gives you a solid mental map of how a developer-focused payment gateway turns a customer's click into actual revenue.

Choosing the Right Integration Strategy

Deciding how to plug a payment gateway into your application is more than just a technical choice—it's a foundational one. This decision will directly shape your customer's checkout experience, define your security workload, and influence how easily you can adapt and grow in the future.

There are three main paths you can take, each with its own benefits and drawbacks. Think of it like building a house: you can buy a pre-fab home that's fast and reliable, design a completely custom dream house from the ground up, or use a modular kit that snaps neatly into your existing structure.

Let's figure out which one is the right blueprint for your project.

Hosted Checkout Pages: The Simple and Secure Path

The most straightforward way to get paid is by using a hosted checkout page. With this approach, when your customer is ready to buy, you simply redirect them to a secure page hosted entirely by the payment gateway. They enter their card details there, and once the payment is done, the gateway sends them right back to your site.

This method is incredibly popular, and for good reason. It offloads almost all the heavy lifting for security and compliance. Because sensitive payment information never even grazes your servers, your PCI DSS compliance burden shrinks dramatically. It's the path of least resistance.

- Pros: Top-tier security, minimal compliance headaches, and the fastest implementation time.

- Cons: You sacrifice control over the look and feel, and the user experience can feel a bit disjointed when they leave your site.

- Best for: Startups, small businesses, or any project where getting to market quickly and securely is more important than a fully branded checkout.

Direct API Integration: The Path of Maximum Control

If you need total command over every pixel of the payment process, then a Direct API Integration is what you're looking for. This is the "custom-built" route. You design, build, and host the entire checkout form on your website, and your backend communicates directly with the gateway’s API to handle the transaction.

This gives you the power to create a perfectly seamless, on-brand experience that keeps the customer on your site from start to finish. But with great power comes great responsibility. You're now handling highly sensitive payment data, which pulls your entire application into the full scope of PCI DSS compliance. This isn't something to take lightly. To dive deeper, our guide on payment gateway API integration unpacks the technical nitty-gritty.

Direct API integration offers the ultimate flexibility but demands a serious commitment to security. Your code becomes the first and last line of defense for customer data, making things like meticulous error handling and ironclad key management absolutely non-negotiable.

Pre-Built Plugins: The Quick-Start Solution

What if you're building on a popular platform like WooCommerce, Magento, or OpenCart? This is where pre-built plugins shine. They offer a fantastic middle ground. These are essentially ready-made connectors that handle all the complex integration work for you. Just install the plugin, pop in your API keys, and you're good to go.

This approach blends the speed of a hosted page with the integrated feel of a direct API. The plugin usually renders the payment form right on your checkout page—often using iframes or other clever tricks—to keep the user journey smooth while still isolating sensitive data from your servers. For example, the BlockBee plugin for WooCommerce lets you accept crypto payments instantly without writing a single line of code.

Common Pitfalls to Avoid

No matter which path you take, some common mistakes trip up even experienced developers. Knowing what they are ahead of time can save you days of debugging and prevent major security holes. Once you've settled on a strategy, the real work of implementation begins. For a practical walkthrough, this resource explains how to integrate a payment gateway from start to finish.

Here are the classic blunders to steer clear of:

- Insecure API Key Management: Never, ever put your secret API keys in your frontend code (like JavaScript). They belong on your server, safely tucked away as environment variables.

- Ignoring Idempotency: Networks are unreliable. A glitch could cause you to send the same payment request twice. An idempotency key is a unique identifier you send with each request to guarantee the customer is only charged once, no matter what.

- Poor Error Handling: Don't just show a vague "Payment Failed" message. The gateway’s API will send back specific error codes. Use them to give your users clear, helpful feedback so they can fix the problem and try again.

- Forgetting Webhook Verification: Webhooks are essential for getting real-time updates, but you have to be sure they're legitimate. Always verify the cryptographic signature on incoming webhooks to confirm they actually came from your payment gateway and not a fraudster.

How BlockBee Delivers a Superior Developer Experience

Theory and toolkits are one thing, but the real test of a payment gateway is how it performs in the wild. A great gateway should feel less like a hurdle and more like a force multiplier—it should solve problems, not create them. This is exactly where BlockBee shines, moving beyond basic transaction processing to offer a genuinely better experience for developers.

By focusing on clean architecture and practical tools, BlockBee directly tackles the common frustrations that bog down development and overcomplicate payment logic. It’s built to help you integrate faster, maintain less code, and gain real control over your financial operations.

A Clean API and Extensive SDKs

At the heart of the BlockBee experience is a powerful, yet refreshingly simple, API. Forget about convoluted endpoints and inconsistent data structures; what you get is a clean, RESTful interface that’s predictable and easy to work with. This design philosophy dramatically flattens the learning curve and cuts down integration time.

To get you up and running even faster, BlockBee provides a solid set of SDKs for popular programming languages. These kits handle all the boilerplate code for authentication, request formatting, and error handling, letting you focus on what actually matters: your application’s business logic. This means you can add complex features with just a few lines of code—a principle you can see for yourself in the BlockBee API documentation.

Pre-Built Plugins That Eliminate Custom Builds

For many of us, the goal is to get a solid payment system running on a standard platform without reinventing the wheel. BlockBee's library of pre-built plugins for platforms like WooCommerce, Magento, OpenCart, and Odoo makes this possible. These aren't just simple payment buttons; they are full-featured integrations that can save you hundreds of hours of development.

Instead of spending weeks building a custom connector from scratch, you can install a plugin, punch in your settings, and start accepting cryptocurrency payments in minutes. This frees up your development cycles for the features that actually differentiate your product in the market.

A great developer tool doesn't just provide raw power; it offers intelligent shortcuts. BlockBee’s plugins are the ultimate shortcut, delivering enterprise-grade crypto payment functionality without the enterprise-level development effort.

This approach reflects a major shift in the industry. Developers are increasingly choosing gateways that give them deeper control over both the flow of funds and the user experience. Market analysts even forecast that self‑hosted payment gateways will grow at a 16.46% CAGR through 2031, outpacing the broader market. This trend favors gateways that offer rich APIs while letting merchants keep control of their own wallets—a model BlockBee was built on.

Self-Custody and Programmatic Mass Payouts

One of BlockBee’s most powerful features is its self-custodial model, which is paired with API-driven Mass Payouts. Unlike custodial gateways that hold your funds hostage, BlockBee ensures payments go directly to your wallet. You always retain full control over your assets, which is a huge advantage for both security and operations.

The Mass Payouts feature builds on this foundation, giving you a robust tool for programmatic control over outgoing funds. Whether you're paying affiliates, processing user withdrawals, or managing supplier payments, you can automate the entire process through the API.

This combination lets you build incredibly efficient and flexible financial workflows:

- Automate Payouts: Trigger payments to thousands of recipients with a single API call.

- Retain Control: Funds are sent directly from your own wallet, eliminating third-party risk.

- Simplify Operations: Slash the manual workload and the potential for human error in your payment processes.

By connecting these tangible features to the real-world challenges developers face every day, BlockBee offers more than just a payment gateway—it offers a smarter, more efficient way to build.

Your Technical Checklist for Choosing a Payment Gateway

Picking a payment gateway is a lot more than just comparing transaction fees. For a developer, it's a major architectural decision. The choice you make will directly affect how fast your team can ship features, how well your product performs, and whether you can scale when you hit that next growth spurt. This checklist is designed to cut through the marketing fluff and zero in on what really matters to an engineering team.

Think of this less as a list and more as a blueprint for evaluation. By methodically checking each potential gateway against these criteria, you can make a clear-headed decision that fits your tech stack and business goals. The goal is to find a partner that genuinely helps your code, not one that holds it back.

API Quality and Developer Experience

You can tell a lot about a company's engineering culture by looking at its API. A clunky, poorly designed API will become a constant source of headaches for your team. On the other hand, a great one makes the integration process feel almost effortless. So, skip the glossy marketing pages and get your hands dirty in the actual documentation.

- Is the API RESTful and predictable? A clean, logical API with consistent naming and data structures is the bare minimum. You shouldn't have to guess what an endpoint does.

- Is the documentation clear and interactive? The best docs have code samples in languages you actually use, interactive API explorers, and straightforward explanations for every single endpoint and error code.

- Does it have a functional sandbox? A solid sandbox environment is non-negotiable. It's your playground to test everything—from happy-path payments to weird edge-case failures—without touching real money.

- Are there SDKs for your stack? Good, well-kept SDKs for your main programming language can save you a ton of time by handling the tedious stuff like authentication and request signing.

Scalability and Reliability

Let's be clear: your payment gateway is a critical piece of your infrastructure. If it goes down, your revenue literally stops. Reliability isn’t just a nice-to-have feature; it’s the bedrock of your entire payment system. Don't just take their word for it—look for hard proof of their performance.

A gateway's uptime Service Level Agreement (SLA) is more than just a number; it's a contractual promise of reliability. Look for a gateway that offers 99.9% uptime or higher and has a transparent status page to prove it.

Dig into how the platform handles high-volume traffic. Ask them directly about their architecture and what happens during massive sales events like Black Friday. A gateway that chokes under pressure will become a massive bottleneck, stunting your growth just when you're starting to succeed. The payment gateway for developers you choose has to be as resilient and dependable as the application you’re building.

Frequently Asked Questions

When you're knee-deep in code, integrating a payment gateway can throw a few curveballs your way. Getting straight answers to common questions is the key to building a solid, reliable system and avoiding those late-night debugging sessions. Let's tackle some of the things developers ask most.

How Do I Handle Security and Compliance?

Think of security as a two-front war: what happens on the user's device (client-side) and what happens on your server. When dealing with traditional card payments, your main goal is to reduce your PCI DSS compliance burden. The easiest way to do this is by letting the gateway handle the sensitive data directly through hosted payment pages or tokenization.

The biggest rule? Never store raw API keys in your frontend code. Ever. They belong on your server, safely stored as environment variables. It’s also absolutely critical to validate every single webhook you receive. Always check the cryptographic signature to confirm the message is actually from the gateway and hasn't been messed with in transit.

What Is the Difference Between a Gateway and a Processor?

It helps to think of them as different players on the same team.

The payment gateway is like the secure messenger—it’s the tech that connects your app to the payment network, capturing and encrypting the payment details. The payment processor is the financial middleman that actually talks to the banks and card networks (like Visa or Mastercard) to get the money moving.

These days, many modern providers bundle both roles. Services from Stripe to crypto platforms like BlockBee act as both the gateway and processor, which dramatically simplifies things for developers. You get one API, one point of contact, and a lot less complexity.

Can I Use Multiple Payment Gateways?

Absolutely. In fact, it’s a pretty savvy move often called payment orchestration. Juggling multiple gateways gives you a safety net if one provider has an outage. It also lets you be strategic, routing payments to whichever gateway offers the best fees for a specific transaction or currency.

A common setup is using one gateway for traditional credit cards and another, like BlockBee, to handle all your cryptocurrency payments. The only real downside is the extra layer of logic you'll need to build and maintain to manage the routing and pull all your reporting data into one place.

Ready to build with a payment gateway that was actually designed for developers? BlockBee gives you a clean API, ready-to-go plugins, and a self-custodial model for total control and flexibility. Start integrating today.