what is an ipn: A Quick Guide to Instant Payments

An IPN, which stands for Instant Payment Notification, is essentially a message your payment processor sends to your server whenever a transaction's status changes. Think of it as a tap on the shoulder from your payment system, saying, “Hey, that payment for Order #123 just came through!” This immediate, server-to-server communication is what makes modern e-commerce automation possible.

What Is an IPN and Why Does It Matter?

Let's imagine you sell digital products—maybe e-books or software. When a customer buys something, you want to deliver it instantly. Without automation, you’d have to constantly check your account for new payments, match them to orders, and then manually send the download link. That's slow, tedious, and just doesn't work once you start getting more than a few orders.

This is the exact problem IPNs were designed to solve. An IPN creates a direct, automated link between a payment gateway (like BlockBee) and your own server. As soon as a payment is confirmed, the gateway pings a special URL on your site with all the necessary details.

The Engine of E-commerce Automation

Your server is set up to "listen" for these pings. When it receives an IPN, it can kick off a whole series of actions you've defined ahead of time, all without anyone lifting a finger. This automation is absolutely critical for creating a slick customer experience and keeping your business running smoothly.

A single IPN can trigger a cascade of useful tasks:

- Granting Access: Instantly unlock a customer's access to their digital download, online course, or subscription features.

- Updating Inventory: For physical goods, the system can automatically decrease the stock count the moment a sale is confirmed.

- Sending Confirmations: Fire off an automated order confirmation email or a shipping notification to the customer.

- Updating Records: Mark an invoice as "paid" in your accounting software, keeping your books tidy and accurate.

At its heart, an IPN is the digital handshake that turns a successful payment into a fulfilled order. It’s the invisible but essential glue that lets online businesses run 24/7, giving customers what they want immediately and saving you from a mountain of manual work.

This drive for faster, more reliable transaction systems is a huge reason for the explosive growth in payment technology. In fact, the global interbank payment networks market is expected to grow dramatically between 2020 and 2033, all thanks to these kinds of advancements. You can find more insights about this market growth on rnceus.com. By getting a handle on IPNs, you're learning about one of the core concepts that powers this global move toward fully automated, real-time commerce.

How an IPN Delivers Transaction Data

So, how does an IPN actually get the payment information from point A to point B? It’s not just a single ping; think of it as a carefully choreographed conversation happening behind the scenes between the payment gateway and your website.

Let's say a customer lands on your site and decides to buy your new e-book. The moment they click "Buy Now," a series of automated handshakes begins. This entire exchange is over in a matter of seconds, but it’s what powers your automated sales and fulfillment system.

The Step-by-Step Transaction Flow

The customer kicks things off, but the real magic happens in the background. A successful IPN ensures your system gets the news about the payment instantly, so it can do its job without you lifting a finger.

Here's a breakdown of the typical journey an IPN takes:

- Customer Makes a Payment: Your customer finishes the checkout and enters their payment details. This information goes directly to the payment gateway, like BlockBee, not your server. This is a huge security benefit.

- Gateway Processes the Transaction: The gateway does the heavy lifting, connecting with the crypto network to confirm the payment. Once it gets the green light, the transaction status flips from "pending" to "successful."

- IPN Message is Sent: This is the critical step. The payment gateway’s server packages up all the transaction details into a message (the "payload") and sends it as an HTTP POST request to a specific URL you've designated. This URL points to your IPN "listener" script.

- Your Server Receives the Message: Your listener—a script on your server—catches this incoming message. It now knows something happened, but it doesn’t automatically trust the information.

- Server Validates the Message: Here’s where security gets serious. Your script immediately sends the data right back to the payment gateway with a simple question: "Did you actually send this?" This handshake is a crucial step to verify the message is legitimate and not a scammer trying to get a free product.

- Gateway Confirms Authenticity: The gateway server checks the data it receives back and replies with a definitive "VERIFIED" or "INVALID."

- Action is Taken: Only when your script gets that "VERIFIED" confirmation does it spring into action. It then reads the transaction details—like the order ID and amount—and triggers whatever you've told it to do. It might email the customer a download link for the e-book, update your inventory, and mark the order as "complete" in your database.

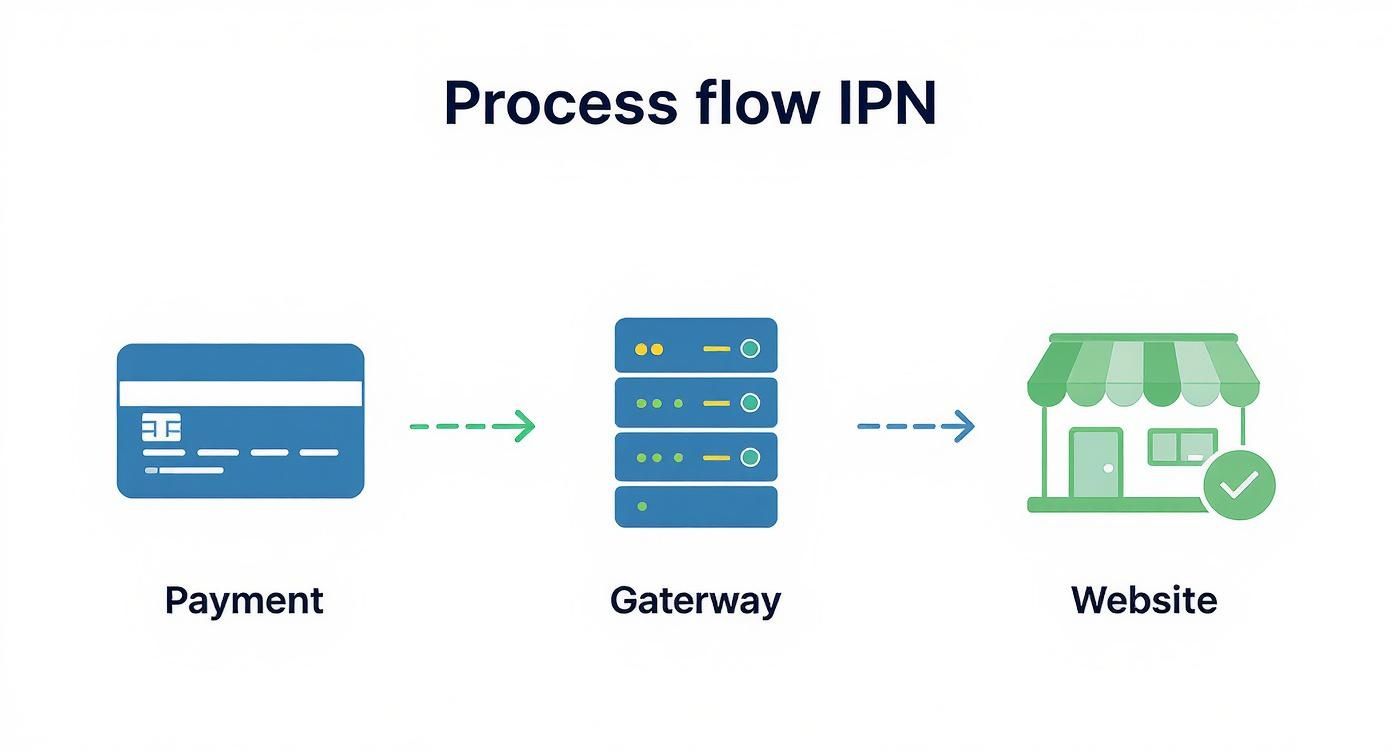

This diagram helps visualize the communication path from the customer's initial payment all the way to your website's final action.

As you can see, the IPN is a direct, server-to-server communication channel. It runs in parallel to what the customer sees on their screen, making the whole process seamless for them.

Key Takeaway: The IPN process is an asynchronous, background operation. While your customer is looking at a "Thank You" page, your server and the payment gateway are having a private, secure conversation to fulfill the order automatically. This separation is what makes the system so efficient and reliable.

Unpacking the IPN Message Payload

So, what does an IPN message actually look like? It’s essentially a small, structured bundle of data that we call a payload. Think of it as a digital memo that arrives at your server's doorstep, carrying all the details you need to know about a specific transaction.

When your server’s listener script catches an IPN, it's not just getting a generic "payment received" ping. It’s receiving a neat package of key-value pairs—a list where every piece of data has a clear label. This information is typically sent in a web-friendly format like x-www-form-urlencoded, making it easy for your application to read and process.

Core Components of a Standard Payload

While the exact data fields can change from one payment processor to another, almost every IPN payload includes a few non-negotiable pieces of information. Your backend code needs to be able to pull apart this data to figure out what happened and update your system accordingly.

Here are some of the most common fields you’ll run into:

transaction_id: This is the unique reference for this specific payment. It's absolutely critical for your records and for making sure you don't process the same order twice.payment_status: Tells you the current state of the transaction. You'll see values likeCompleted,Pending,Failed, orRefunded.mc_gross: The total amount the customer paid.mc_currency: The currency used, likeUSDorEUR.custom: A handy field you can use to pass your own internal identifiers—like an order ID or customer number—through the checkout flow and get it back with the IPN.

By parsing these fields, your script can automatically check if the amount paid matches the order total and then find and update the correct order in your database. Getting this right is a fundamental part of a secure setup.

A Look at a BlockBee Crypto Payload

Cryptocurrency payments, naturally, come with their own unique set of data. A BlockBee IPN payload, for example, will include fields directly related to the blockchain. Getting familiar with these is the key to a successful crypto integration, a concept we dive deeper into in our guide on payment gateway API integration.

Let's compare a standard payload with a crypto one to see the difference:

| Field Name | Standard (Fiat) Example | BlockBee (Crypto) Example | Purpose in Crypto |

|---|---|---|---|

| Status | Completed |

confirmed |

Means the transaction has enough blockchain confirmations. |

| Amount | 19.99 |

0.0005 |

Shows the amount paid in the specific crypto (e.g., BTC). |

| Confirmations | N/A | 6 |

The number of new blocks mined since the transaction was included. |

| Coin | N/A | btc |

Tells you which cryptocurrency was used. |

The inclusion of fields like

blockchain_confirmationsis vital. Your system can use this number to decide when a payment is truly secure and irreversible before you fulfill the order. This little piece of data is what allows your business to automate crypto payments with real confidence.

IPN vs Webhooks vs API Polling

To really get what an IPN does, it helps to see how it stacks up against other ways systems talk to each other. You'll often hear terms like "webhooks" and "API polling" thrown around, and while they're all in the same family, they work very differently. Knowing the difference is crucial for building a system that’s both fast and reliable.

Think of it like this: a webhook is a general term for any automated message sent from one app to another when something happens. It’s a versatile notification system. An IPN, however, is a very specific type of webhook, purpose-built and fine-tuned for one thing: payment events.

An IPN is to a webhook what a surgical scalpel is to a kitchen knife. Both cut, but one is crafted for a very precise, critical task—handling your money.

Push vs Pull The Core Difference

The biggest difference comes down to how your server gets the news. Both IPNs and webhooks use a "push" model. The payment gateway actively pushes information to your server the second an event happens, like a payment being confirmed. This is super efficient—your server only has to do work when there's actually something to do.

On the other hand, API polling is a "pull" model. This is the digital equivalent of your server constantly calling the payment gateway's API and asking, "Anything new? How about now? Is it done yet?" This endless checking burns through resources, creates a ton of unnecessary server traffic, and often means you're late to find out about important updates. If you want to dive deeper into the mechanics, it helps to understand what constitutes a REST API in the first place.

This comparison table lays out the key differences between these methods.

IPN vs Webhooks vs API Polling A Head-to-Head Comparison

This table contrasts the three primary methods for retrieving transaction data, highlighting their differences in mechanism, efficiency, and ideal use cases.

| Attribute | IPN | General Webhook | API Polling |

|---|---|---|---|

| Mechanism | Event-driven; your server is notified automatically about payment events. | Event-driven; your server is notified about a wide range of predefined events. | Time-driven; your server must repeatedly ask if there are any updates. |

| Efficiency | Very high; minimal server load as it only acts on incoming data. | High; only active when an event occurs, making it efficient for many tasks. | Very low; creates constant, often unnecessary, traffic and server load. |

| Real-Time | Instantaneous; perfect for immediate order fulfillment and updates. | Near-instant; great for general notifications like a new user signing up. | Delayed; updates are only as fast as your polling interval. |

| Use Case | Specifically for payment transaction status updates. | Broadly used for any event (e.g., new user sign-up, file upload). | For when real-time updates are not critical, or a push model isn't available. |

As you can see, the "push" model used by IPNs and webhooks is clearly the winner for any system that needs to react quickly.

The entire financial world is moving toward more efficient, real-time systems. Experts at Deloitte predict that by 2030, 25% of large international transfers will settle on tokenized currency networks—a shift built on instant data exchange. By choosing an event-driven method like an IPN, you're aligning your business with that same forward-thinking efficiency. At BlockBee, we're all-in on this approach, which is why we've made significant enhancements to our webhooks for checkouts and deposits.

Securing Your IPN Implementation

When you're dealing with payments, security isn't just a nice-to-have feature; it's the bedrock of your entire operation. A wide-open, unsecured IPN listener is like leaving your back door unlocked—it’s an open invitation for trouble.

Attackers can and will try to fool your system into thinking a payment was completed when, in reality, it never happened. This puts you at serious risk of fulfilling fraudulent orders and giving away your products or services for free. That’s why you have to treat every single IPN message as suspicious until you’ve proven it’s legitimate.

The Critical Validation Handshake

Here’s the thing: you can't ever trust an incoming IPN message at face value. A skilled attacker can easily cook up a fake POST request that looks identical to a real one from your payment gateway. If your system just accepts it without asking questions, you've just been had.

So, how do you know if a message is real? You send it right back where it came from and ask.

The Golden Rule of IPN Security: Always take the complete, untouched IPN payload you receive and send it directly back to the payment gateway's verification URL. Don't process the order until you get a "VERIFIED" response. Anything else is a red flag.

This simple back-and-forth is your handshake. It's how you confirm the message is authentic, originated from the payment provider, and wasn't messed with along the way. Consider this a non-negotiable step in your setup.

Essential Security Checklist

The handshake is your first line of defense, but it shouldn't be your only one. A truly robust system has multiple layers of security, with each one designed to catch a different kind of problem.

Make sure your IPN script runs these checks every single time:

- Check the Receiver: Does the

receiver_emailormerchant_idin the message actually match your account? This is a simple but crucial check to ensure you aren't processing a payment meant for someone else. - Validate Payment Details: Compare the payment

amountandcurrencyfrom the IPN with the original order details stored in your database. A common trick is for an attacker to send a verified IPN for $1.00 on an order that should have been $100.00. - Prevent Duplicate Processing: Look up the

transaction_idin your records. Have you already processed this payment? This stopgap is absolutely essential to prevent fulfilling the same order twice.

Protecting the endpoint that listens for these IPNs is just as important. For a deeper dive into protecting your site, this guide on how to secure your WordPress site offers some great, comprehensive strategies. By layering all these security checks, you build a system that’s much harder to fool, protecting both your revenue and your customers' trust.

Bringing Your BlockBee IPN Handler to Life

Alright, let's move from theory to action. This is where we roll up our sleeves and get a real Instant Payment Notification (IPN) handler working, using BlockBee to automate your crypto payment updates.

First things first, you need to give BlockBee an address to send its updates. You'll generate a unique callback URL in your BlockBee dashboard. Think of this URL as a dedicated mailbox on your server where BlockBee will drop off notifications the moment a payment status changes.

Building Your Listener Script

Now that you have your address, you need to build what's waiting at that address: your listener script. This script is the core of your automation. Its job is to catch the IPN data BlockBee sends, make sure it's legitimate, and then trigger your business logic.

Your script needs to be smart enough to understand the different payment stages. You’ll be looking for statuses like:

- pending: The transaction is visible on the blockchain but is still waiting for the required number of confirmations.

- confirmed: Success! The payment has enough confirmations and is now considered complete and secure.

- failed: Something went wrong, and the payment couldn't be completed.

Testing is absolutely essential here. You don't want to experiment with live customer payments. Set up a test environment to run simulated transactions, making sure your script handles pending and confirmed statuses exactly as you expect. To make your life easier, we built a tool for this exact purpose. Check out our Callback Tester for stress-free testing.

Here's a pro-tip that will save you headaches later: Log everything. Every single IPN request that comes in and every response your script sends out should be recorded. When something eventually breaks (and it will), these detailed logs will be invaluable for figuring out what went wrong.

The idea of a secure, automated payment network isn't unique to crypto; it’s the backbone of global finance. Take, for example, an Interbank Payment Network (IPN), the infrastructure that lets banks send money to each other. A great real-world example is China's Cross-border Interbank Payment System (CIPS), which was built to handle international transactions in yuan. You can even dig into the data and learn more about CIPS growth trends on fxcintel.com. It just goes to show how vital these automated, secure messaging systems are for any kind of commerce, big or small.

IPN Frequently Asked Questions

Even when you've got the basics down, a few practical questions always pop up when it's time to actually implement an IPN system. Let's tackle some of the most common ones that developers run into.

What Happens if My Server Goes Down?

This is a classic concern, and for good reason. The good news is that most payment gateways, including BlockBee, are built with this in mind. They have a retry mechanism.

If your listener URL is offline and doesn't send back a success code (like an HTTP 200 OK), the gateway won’t just throw its hands up. It will try sending the IPN again, usually several times over a specific period. This gives your server a few chances to catch the notification once it's back online.

But don't get too comfortable relying on retries. Consistent server uptime is non-negotiable. If your server misses the final retry attempt, that notification is gone for good, and you could be left with an order that’s paid for but never fulfilled.

Can I Use One IPN Listener for Multiple Websites?

Absolutely. In fact, it's a very efficient way to manage things, as long as you plan for it in your code. The key is to build your script so it can tell which transaction belongs to which site.

A smart way to do this is to include a unique identifier every time you create a payment request. Think of it like adding a label, such as a site_id or another custom parameter.

When your IPN listener gets a notification, it can then:

- Look for that unique identifier in the data it receives.

- Use that ID to figure out which website the payment is for.

- Run the right logic—like updating the correct customer's order in the right database.

With this setup, a single, robust script can act as the central brain for all your payments, even if you're running a dozen different online stores.

Ready to automate your crypto payments with a reliable and secure IPN system? With BlockBee, you get an easy-to-integrate platform with robust tools and dedicated support to ensure your payment automation works flawlessly. Start accepting crypto today!