How to Create Wallet Address From Scratch

First things first, getting a crypto wallet address usually means downloading a trusted software wallet—think something like Exodus or Trust Wallet. You’ll go through a quick setup, and the most critical step will be backing up a 12 or 24-word recovery phrase. Treat this phrase like gold; it's the master key to every address your wallet ever creates. Keeping it safe and offline is non-negotiable.

What Is a Crypto Wallet Address and Why Does It Matter?

Before we get into the nitty-gritty of making one, let’s be clear on what a wallet address actually is. The simplest analogy is to think of it as your unique digital mailbox for crypto. It's just a string of letters and numbers that you can hand out to anyone who needs to send you assets like Bitcoin or Ethereum.

But here’s where it gets more interesting. Unlike a physical mailbox, this address is born from complex cryptography. It’s fundamentally tied to two other critical pieces of the puzzle: a public key and a private key. Understanding this trio is the bedrock of keeping your crypto secure.

The Core Components: Public and Private Keys

At the heart of every wallet address lies a pair of cryptographic keys. These two keys are mathematically linked, but they have completely opposite jobs. One is meant for sharing, the other for hoarding.

- Private Key: This is it—the most important piece of information in your crypto life. It’s a secret, randomly generated string of characters that gives you the power to spend your funds. When you send crypto, you use this key to "sign" the transaction, proving you’re the rightful owner.

- Public Key: This key is generated directly from your private key. Its job is to be converted into a shareable wallet address so people can send you funds. It lets the world pay you without ever laying eyes on your precious private key.

Think of it like your bank account. The public key is your account number—you can share it freely to receive money. The private key, on the other hand, is your PIN or password. If someone gets it, they can drain your account. This is exactly why you constantly hear the mantra "not your keys, not your coins" in the crypto world. If someone else holds your private keys, you're just trusting them not to run off with your money.

Key Takeaway: Your private key is your ultimate proof of ownership. Never, ever share it. If you lose it, your crypto is gone for good. There's no "forgot password" link to click.

From Keys to a Usable Address

So, how do you get from a long, clunky public key to a clean-looking wallet address? The public key itself isn't very user-friendly. To fix that, it’s put through a one-way cryptographic function called hashing, which shortens and converts it into the familiar address format you see in your wallet. If you want to go deeper into the technical mechanics, our detailed guide on the crypto wallet address breaks it all down.

This conversion process is also why addresses look so different from one blockchain to another. A classic Bitcoin address, for example, often starts with a 1, 3, or bc1, while every Ethereum address kicks off with 0x. Each network has its own unique recipe for turning public keys into addresses.

Hot Wallets vs. Cold Wallets

As you start exploring how to create a wallet address, you'll quickly run into two main types of wallets. The difference all comes down to how they store your private keys.

- Hot Wallets (Software): These are wallets that live on a device connected to the internet. We're talking mobile apps (Trust Wallet), desktop programs (Exodus), and browser extensions (MetaMask). They're super convenient for making frequent transactions but are inherently riskier because being online makes them a target for digital thieves.

- Cold Wallets (Hardware): These are physical devices, like a Ledger or Trezor, that keep your private keys completely offline. To authorize a transaction, you sign it inside the secure hardware, so your keys never touch your internet-connected computer. This is the gold standard for securing large amounts of crypto for the long haul.

Ultimately, the choice is a classic trade-off: convenience versus security. A hot wallet is great for your "spending" cash, but for your "savings," a cold wallet is an absolute must for real peace of mind.

Creating Your First Address with a Software Wallet

For most people just getting into crypto, a software wallet is the best place to start. They hit that sweet spot between being easy to use and secure enough for everyday transactions. You can literally have a new wallet address up and running in a few minutes, right from your phone or computer. Let’s walk through how it’s done using a couple of well-regarded wallets, like Trust Wallet or Exodus.

First thing’s first, and this is non-negotiable: only download the official app. The crypto space is full of scammers who build convincing fake apps designed to drain your funds the second you send them. Don't just search the app store. Go straight to the source—the official website like trustwallet.com or exodus.com—and use their links to the Apple App Store or Google Play Store. It’s the only way to be sure.

Once the app is installed, you'll see a pretty standard choice: "Create a new wallet" or "I already have a wallet." We're starting fresh, so you'll want to create a new one. The moment you tap that button, the wallet gets to work, generating your unique private keys behind the scenes.

Here’s a look at what you’ll find on the official Trust Wallet site. It’s a popular choice, especially for mobile, and their homepage makes it clear where to go.

They point you directly to the correct app for your device, which is exactly the kind of secure first step you want to see.

Securing Your Recovery Phrase The Right Way

The screen that comes next is easily the most important one you'll encounter. The wallet will show you your 12 or 24-word recovery phrase, often called a seed phrase. Think of this as the master key to your entire crypto life. Every address and private key your wallet ever creates will stem from this single phrase.

This is critical: Your recovery phrase is your only backup. If your phone gets destroyed or you forget your password, these words are the only thing that will let you get your funds back. There's no "forgot my password" link. No customer support line. You are the bank.

Your wallet will plaster warnings all over the screen, telling you to store this phrase securely and never share it. Take this advice seriously.

- Never take a screenshot. If your phone or cloud account gets hacked, you’ve just handed over the keys to the kingdom.

- Don't save it in a password manager or a text file. Malware is specifically designed to hunt for these kinds of files.

- Do write it down on paper—maybe even two copies—and store it somewhere safe and private. A fireproof safe or a safety deposit box are great options.

I’ve even seen people engrave their phrase onto a small metal plate to make it fire and waterproof. It might sound a little extreme, but if we're talking about a significant amount of money, it’s a smart move.

Generating Your First Bitcoin or Ethereum Address

After you've confirmed you wrote down your recovery phrase (most apps have a little test to make sure you did), your wallet is ready to go. The software will automatically generate your first addresses for major coins like Bitcoin (BTC) and Ethereum (ETH).

This is a neat feature of modern wallets, especially Hierarchical Deterministic (HD) wallets. From that one seed phrase, the wallet can create a practically endless number of addresses across different blockchains. That means you don’t need one phrase for Bitcoin, another for Ethereum, and a third for Solana. They all trace back to that one master key you just wrote down.

Finding your address to receive funds is simple:

- Pick the crypto you want to receive (like Ethereum).

- Tap the button that says "Receive" or "Deposit."

- The app will show your unique address, usually as both a long string of characters and a scannable QR code.

You'll notice an Ethereum address starts with 0x, while a modern Bitcoin address often begins with bc1. This is your public address. It's completely safe to share with anyone who wants to send you crypto. When they do, the transaction gets logged on the blockchain, and you'll see your balance update in the wallet.

And that’s it! You've just created your first crypto wallet address and, more importantly, taken full control of your own digital assets. By protecting that recovery phrase, you've ensured that only you can access your funds. This is the whole point of self-custody—the real power of crypto.

Generating Wallet Addresses Programmatically for Developers

If you're a developer or a business building an application on a blockchain, creating wallet addresses one by one through some software interface is a non-starter. You need automation to scale. This is where programmatic wallet generation comes in, allowing your application to create thousands—or even millions—of unique addresses on demand.

This approach is the backbone of crypto exchanges, merchant payment gateways, and pretty much any service that handles user deposits. By using cryptographic libraries, you can build a system that automatically gives a fresh address to every user or transaction, ensuring both security and efficiency.

The Technical Nuts and Bolts of Address Creation

Under the hood, generating a wallet address with code follows the same cryptographic recipe as doing it manually in a wallet app. You start with a source of randomness to create a private key, use that to derive a public key, and then hash the public key to get the final, shareable address.

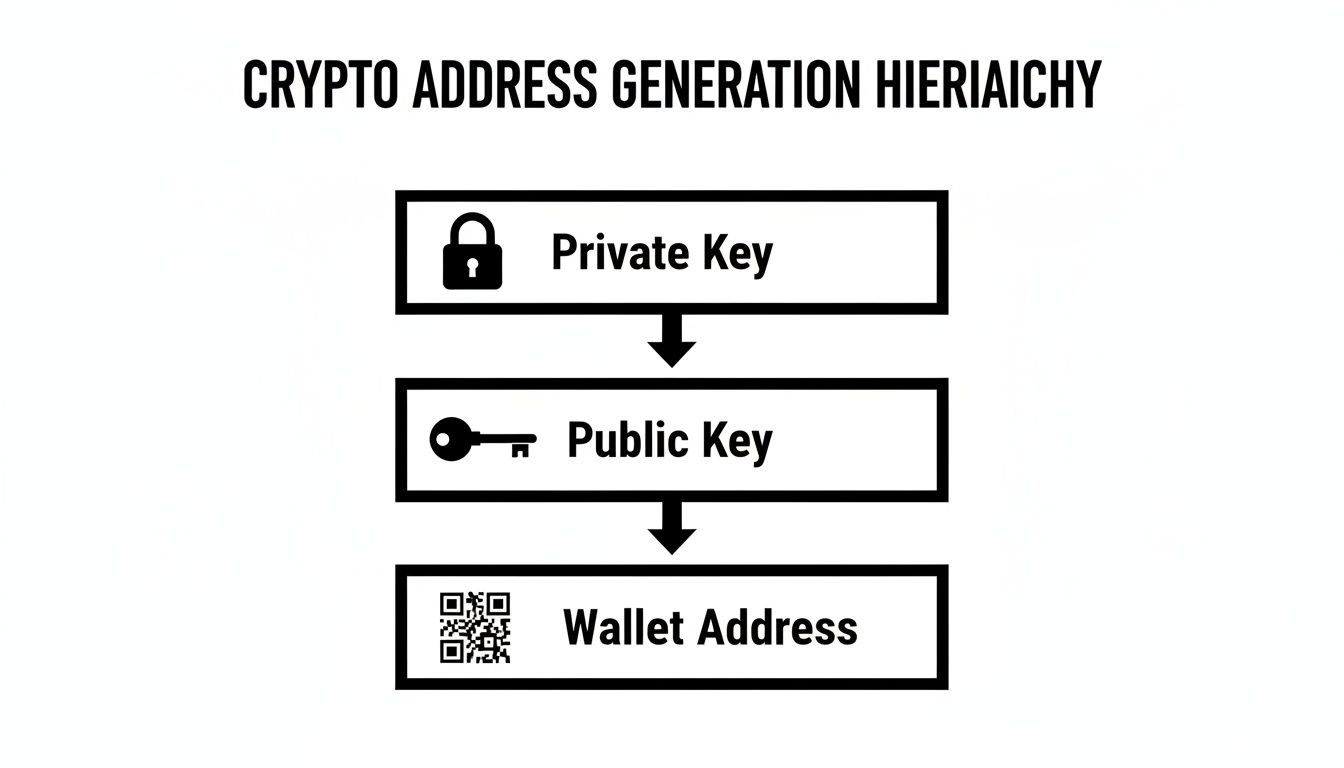

This entire process is a one-way street, which is what makes it so secure. You can easily go from a private key to an address, but nobody can reverse the process to figure out your private key. This diagram breaks it down visually.

As you can see, the private key is the secret sauce—everything else is derived from it. To make this happen in your code, you'll need to lean on specialized libraries built for specific blockchains. These tools handle all the heavy lifting with the complex math, freeing you up to focus on your app's logic.

When you're building systems that interact with different services, it's critical to follow established guidelines. Resources like these API Development Best Practices are invaluable for creating secure and reliable integrations.

For developers looking for the right tools, here's a quick rundown of some popular libraries for the major chains.

Popular Libraries for Wallet Address Generation

| Blockchain | Popular Library | Primary Language |

|---|---|---|

| Ethereum | ethers.js, web3.js |

JavaScript/TypeScript |

| Bitcoin | bitcoinjs-lib |

JavaScript/TypeScript |

| Solana | @solana/web3.js |

JavaScript/TypeScript |

| Multi-Chain | bip39 |

JavaScript/TypeScript |

These libraries are well-maintained and widely trusted in the developer community, making them a solid starting point for any project.

An Example With Ethers.js for an Ethereum Address

Let's walk through a real example using ethers.js, the go-to library for most Ethereum developers. The code is surprisingly simple.

First, you just need to create a new, random wallet instance. This wallet object will hold everything you need: the private key, public key, and the final Ethereum address.

// Import the Wallet class from the ethers library

const { ethers } = require("ethers");

// Create a new random wallet

const wallet = ethers.Wallet.createRandom();

console.log("Address:", wallet.address);

// Example Output: 0x...

console.log("Private Key:", wallet.privateKey);

// Example Output: 0x...

console.log("Mnemonic Phrase:", wallet.mnemonic.phrase);

// Example Output: twelve random words...

That tiny snippet just generated a complete, self-contained wallet. The wallet.address is what you'd show a user for a deposit. The wallet.privateKey and the wallet.mnemonic.phrase? Those need to be stored like the crown jewels—safely and securely.

The Power of Hierarchical Deterministic (HD) Wallets

While you could generate single, random addresses like the one above, you'd quickly create a management nightmare. Each address comes with its own private key that you have to back up. Imagine doing that for a thousand users.

This is exactly why Hierarchical Deterministic (HD) wallets, defined by the BIP-32 standard, are a complete game-changer.

HD wallets let you create one master seed—that familiar 12 or 24-word phrase—and then derive a nearly infinite, tree-like structure of child keys and addresses from it. The benefits for any application at scale are enormous.

Key Advantage: With an HD wallet, you only ever need to back up one single master seed. From that one seed, you can regenerate every single address and private key your application has ever used. It radically simplifies key management and disaster recovery.

This structure is perfect for assigning a unique address to every user or deposit without the headache of managing thousands of individual private keys. It also boosts user privacy by making it harder to link transactions back to a single person.

For businesses aiming for a smooth payment experience, it's worth digging into how a well-designed crypto payment gateway API can help manage these programmatic flows, tying each address neatly to a specific payment or user for easy accounting.

Choosing an Address Strategy for Your Business

When you decide to accept crypto payments, one of the first forks in the road you'll hit is how to handle wallet addresses for customers. It sounds like a minor technical detail, but this decision has a huge impact on your accounting, your customers' privacy, and your overall security. You're really choosing between two fundamentally different approaches.

The first path is all about simplicity: you use a single, static address for every single deposit. The second, more sophisticated path involves generating a brand-new, unique address for every transaction. Let's break down what that actually means for your business.

The Static Address: Simple, But Full of Traps

It’s easy to see why using one static address for all incoming payments is so tempting. You generate one address, paste it on your checkout page or invoices, and you're good to go. The setup is dead simple and requires basically zero technical work, which can feel like a godsend when you're just starting out.

But that initial simplicity is deceptive. As your business grows, this approach can quickly unravel into a massive headache. The biggest problem by far is attribution. Imagine two different customers need to pay you 0.001 BTC for two separate orders. Both payments hit your wallet. Now what? You have no immediate way of knowing which payment belongs to which order.

You're left scrambling to manually match things up, probably by asking customers to send you their transaction IDs. It's a clumsy, time-consuming process that completely undermines the efficiency crypto is supposed to offer.

Why Reusing Addresses Is a Privacy Nightmare

On top of the accounting mess, plastering a single address everywhere creates serious privacy issues for both you and your customers. Remember, blockchains are public ledgers. Anyone with an internet connection can pop your address into a block explorer and see its entire history—every payment you've ever received and your total balance.

This leads to some pretty uncomfortable situations:

- Customer Exposure: Your customers can see what other people are paying you. A savvy competitor could even analyze your transaction flow to get a surprisingly accurate estimate of your revenue.

- Balance on Display: Your company's entire crypto holdings at that address are public. This paints a massive target on your back for hackers and sophisticated scammers.

- Linked Activity: Every payment is publicly tied together, making it trivial for outsiders to map out your financial movements.

My Take: Reusing a single address is like doing all your company's banking inside a glass box. Sure, it's straightforward, but it exposes financial details that any smart business owner would rather keep under wraps.

The Superior Strategy: Unique Addresses for Every Transaction

The professional way to handle this is by generating a new, unique address for every single invoice. When a customer gets to your checkout, your system creates a fresh address just for them, for that one specific purchase. As soon as the payment comes through, that address is retired and never used again.

This approach immediately solves the attribution problem. Because each address is tied to a single order, the moment the funds arrive, you know exactly who paid, how much they sent, and for what. Your reconciliation process can be completely automated and 100% accurate.

The privacy benefits are just as crucial. With each payment going to a different address, it becomes incredibly difficult for an outsider to link transactions or figure out your total balance. Your customers' privacy is respected, and your business's financial operations stay confidential. This is exactly how major crypto exchanges and serious merchants do it.

The Automation Challenge—And How to Solve It

So if unique addresses are so much better, why isn't everyone doing it? The main barrier has always been the technical lift. To pull this off, you need a backend system that can programmatically generate, monitor, and manage potentially thousands of addresses. You need to hook into an API to create them, watch the blockchain for payments, and then securely sweep the funds into a central cold wallet.

This is where a crypto payment gateway like BlockBee comes into the picture. Building this kind of infrastructure from scratch is a massive undertaking—it's complex, expensive, and if you get the security wrong, catastrophic. A payment gateway does all that heavy lifting for you.

Here’s a look at how it streamlines everything:

- A customer hits "Pay with Crypto" on your site.

- Your store pings the BlockBee API.

- BlockBee instantly generates a unique address for that order and shows it to the customer.

- It then watches the blockchain for the payment to land in that specific address.

- Once confirmed, BlockBee sends a notification back to your store, and the order is marked as paid.

The whole thing is automated, secure, and non-custodial, meaning the funds go straight to your wallet. You get all the benefits of a professional setup—privacy, security, and automated accounting—without needing a team of blockchain engineers. For any business that's serious about accepting crypto, this is the only way to fly.

How to Secure Your Private Keys and Seed Phrase

So, you know how to create a wallet address. That’s the easy part. The real work—and what will ultimately protect your assets—is mastering the security of your private keys and that all-important seed phrase. It's a heavy responsibility, but it gets to the very heart of the crypto ethos: "Not your keys, not your coins."

If someone gets their hands on your private key, they have total control. Your wallet address becomes a glass box they can reach into and empty at will. There's no bank to call, no fraud department, and no reversing the transaction. In crypto, you are the bank.

The Siren Song of Digital Convenience

In a world where everything is synced to the cloud, our first instinct is to save important information digitally. You might be tempted to screenshot your seed phrase, drop it into a notes app, or even email it to yourself. Don’t do it. This is probably the single most devastating mistake a new crypto user can make.

Any file on a device connected to the internet is a target. Malware is constantly evolving, with many strains designed specifically to hunt for text strings that look like private keys or seed phrases. Storing this information online is the digital equivalent of taping your house key to the front door.

Key Takeaway: Your seed phrase must never, ever touch the internet. Treat it like a physical-only artifact. The instant it becomes a digital file, you've introduced a vulnerability that is almost impossible to fully scrub from existence.

The Gold Standard: Hardware Wallets

For anyone serious about crypto, a hardware wallet isn't a luxury—it's essential. These are small physical devices designed to keep your private keys in a completely offline environment, a practice known as "cold storage."

Here’s how they work: when you need to send funds, you connect the device, and the transaction is "signed" internally using the key stored on the device's secure chip. Your private key never actually leaves the hardware, meaning it’s never exposed to your potentially malware-infected computer or phone.

- Offline by Design: Your keys are generated and stored away from the prying eyes of the internet.

- Physical Confirmation: You verify and approve transactions directly on the device's screen, which prevents malicious websites from tricking you into signing something you didn't intend to.

- Unmatched Peace of Mind: For holding crypto long-term, nothing beats the security of a top-tier hardware wallet.

Best Practices for Physical Storage

Once you’ve correctly written down your seed phrase (on paper or a more durable material like steel), the next question is where to put it. You have to protect it from both prying eyes and physical threats like fire, floods, or just plain decay.

Think about these battle-tested storage options:

- A Fireproof Safe: A solid, straightforward solution to guard against fire and casual theft in your home.

- Bank Safety Deposit Box: Offers institutional-grade security, but it does mean placing trust in a third party for access.

- Split Locations: For the truly paranoid (and the truly secure), you can split your seed phrase into multiple parts and store each piece in a different, highly secure location.

No matter which route you take, the mission is the same: make it incredibly difficult for anyone but you to get access. If you want to dive deeper into advanced security measures, check out our guide on private key security. And for developers, using tools for GitHub Secret Scanning is a non-negotiable step to prevent accidentally committing keys to a public repository.

It’s a big ecosystem out there. By late 2018, an estimated 460 million Bitcoin addresses had been created. This sheer volume underscores the need to secure the keys for the addresses you actually use, as many are created for temporary purposes and then abandoned.

A Few Lingering Questions About Wallet Addresses

Once you get the hang of creating wallet addresses, a few common questions almost always surface. It’s a new world with its own quirks, so let's clear up some of the usual points of confusion to help you move forward confidently.

Can I Change My Wallet Address?

The short answer is no. A crypto address is permanent, mathematically derived from your public key, and can't be changed after it’s created.

But here’s the good news: you can—and absolutely should—generate brand-new addresses for different transactions. This is a huge win for your privacy. Thankfully, modern wallets make this a breeze, often creating a fresh address every time you hit the "Receive" button.

What if I Send Bitcoin to an Ethereum Address?

This is a scenario you want to avoid at all costs. Sending crypto to an address on a different, incompatible blockchain is one of the easiest ways to lose your funds for good. Think of it like trying to send a letter to a non-existent postal code—it just gets lost.

A Tip from Experience: Always, always double-check the address format. It’s a simple habit that can save you a world of hurt. For instance, an Ethereum address will always start with

0x, while a modern Bitcoin address often starts withbc1. Mismatched prefixes are a major red flag.

Does One Wallet Work for Multiple Cryptocurrencies?

Yes, and this is a lifesaver. Most modern software and hardware wallets are multi-currency by design. They can securely hold assets from different blockchains—like Bitcoin, Ethereum, and Solana—all managed by a single recovery phrase.

This is all thanks to a technology called Hierarchical Deterministic (HD) wallets. They use one master key to derive all your individual addresses across different coins, which dramatically simplifies your backup and recovery process. No need to juggle dozens of separate wallets.

I Just Received Some Crypto I Didn't Ask For. What's Going On?

Seeing a tiny, random deposit show up in your wallet can be unsettling. This is usually a "dusting attack" or a more recent scam called "address poisoning." Scammers blast out minuscule amounts of crypto to thousands of addresses for a couple of reasons:

- Trying to uncover your identity: They watch where the "dust" moves next, hoping to link multiple addresses together and eventually tie them to a single person.

- Tricking you with a lookalike address: They send the dust from an address that looks very similar to one you've used before. Their hope is that when you go to make your next payment, you'll accidentally copy their address from your transaction history instead of the correct one.

The best response is the easiest one: do absolutely nothing. Just ignore it. Don't touch the funds, don't try to send them back. Just leave the dust sitting there and be extra vigilant about verifying addresses before you send anything.

Ready to put this into practice for your business? BlockBee offers a powerful, non-custodial payment gateway that takes the complexity out of the equation. You can generate unique, secure addresses for every transaction automatically and focus on what you do best.