How to Convert Cryptocurrency to Cash A Practical Guide

So, you’ve made some gains or just need to turn your digital assets back into dollars, euros, or another fiat currency. The good news is that cashing out your crypto is a well-trodden path. It really just boils down to selling your crypto on a platform that can talk to the traditional banking system.

The whole process has gotten much easier as more people have jumped into crypto. In mid-2024, it's estimated that over 560 million people—or about 6.8% of everyone on the planet—hold some form of cryptocurrency. You can read more about the scale of global crypto adoption and see why reliable cash-out options are so important.

This explosion in ownership has fueled the creation of different services to bridge the gap between your crypto wallet and your bank account. Your best bet will depend on what matters most to you: speed, cost, or privacy.

The Three Main Cash-Out Methods

Most people land on one of three main routes:

Centralized Crypto Exchanges (CEX): Think of platforms like Coinbase or Kraken. They act as a trusted intermediary. You sell your crypto on their market, and then you can withdraw the cash straight to a bank account you've linked. It's usually the most direct and often the cheapest method.

Peer-to-Peer (P2P) Platforms: This is more like a direct sale. You connect with another person who wants to buy what you're selling. You both agree on a price and a payment method—like a bank transfer, PayPal, or another digital wallet. To keep things safe, an escrow service usually holds onto your crypto until you confirm you've received the payment.

Crypto ATMs: If you need physical cash in your hand right now, a crypto ATM is your fastest option. They function a bit like a regular ATM in reverse. You send crypto from your wallet to the machine's QR code and it spits out cash. Just be prepared for the convenience to come at a price—the fees are typically much higher.

Key Takeaway: There's no one-size-fits-all answer here. The "best" method really depends on your goal. For large amounts where fees matter, an exchange is probably your go-to. If you value flexibility and more payment options, P2P is great. And for sheer speed to get physical cash, ATMs win.

Crypto-to-Cash Conversion Methods at a Glance

Choosing the right method can feel tricky, so here’s a quick breakdown to help you compare your options at a glance.

| Method | Best For | Typical Speed | Fee Structure |

|---|---|---|---|

| Centralized Exchanges | Large transactions and lowest fees | 1-5 business days | Low trading fees (0.1% - 1%) + withdrawal fees |

| Peer-to-Peer (P2P) | Flexibility, privacy, and varied payment options | Minutes to hours | Low to zero, but exchange rates may be less favorable |

| Crypto ATMs | Immediate access to physical cash | Instant | Very high (often 7% - 20% or more) |

As you can see, the trade-off between speed, cost, and convenience is pretty clear.

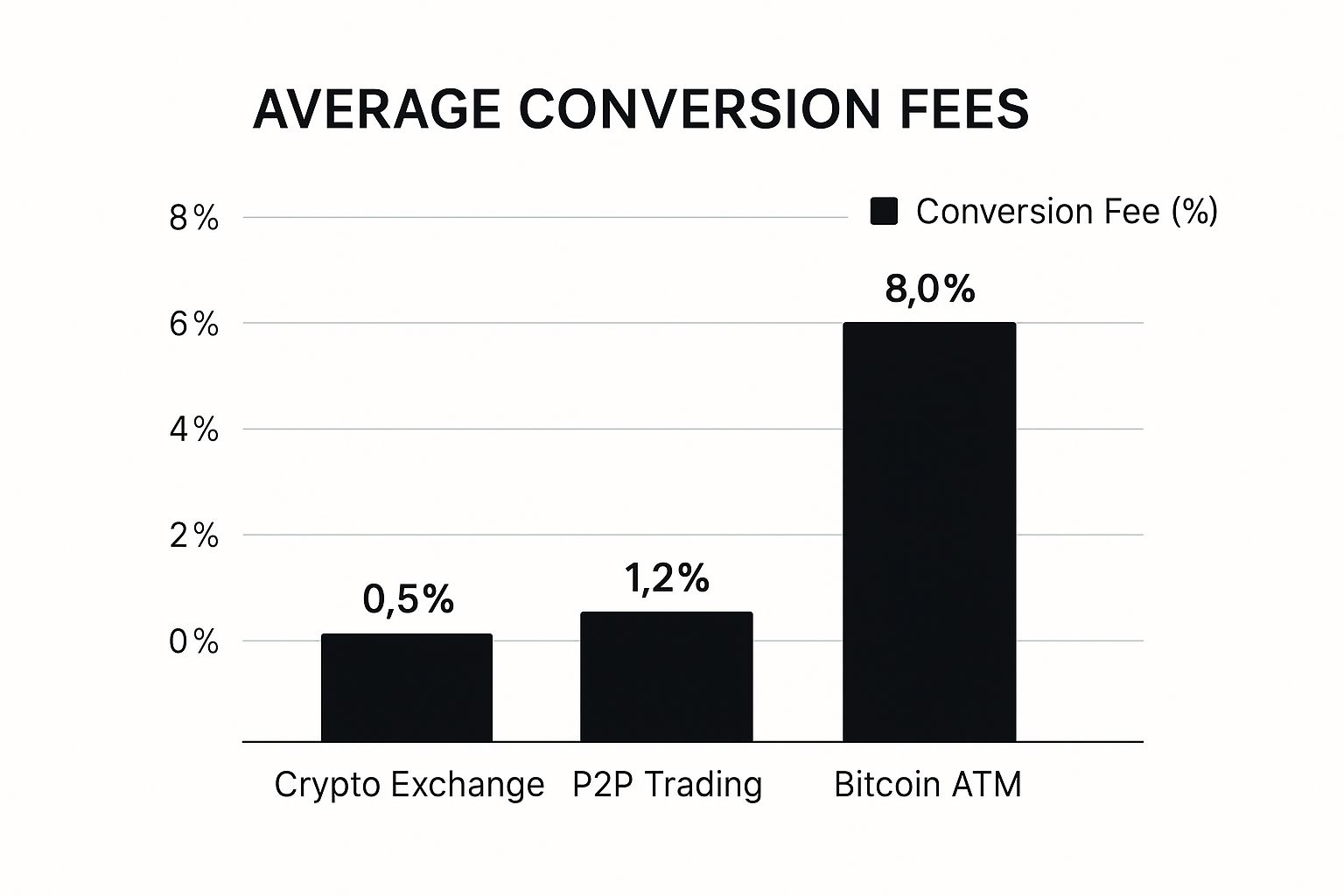

The numbers don't lie. Crypto ATMs are easily the priciest way to cash out, making centralized exchanges the most budget-friendly choice for most people looking to convert their digital holdings back into traditional currency.

Choosing the Right Crypto-to-Cash Method for You

Figuring out the best way to turn your crypto into cash isn’t a one-size-fits-all deal. It’s about matching the right tool to your specific situation. Cashing out a large investment for a down payment is a completely different ballgame than grabbing a few hundred bucks for an unexpected expense. Let's dig into the practical scenarios where each of these methods really makes sense.

When to Use a Centralized Exchange

Think of centralized exchanges (CEX) like Coinbase, Kraken, or Binance as the established, heavy-duty workhorses of the crypto world. They are your best bet when you’re dealing with larger sums and your main priorities are low fees and solid security.

Because they’re regulated, you'll have to go through a Know Your Customer (KYC) process, which usually means uploading an ID. It’s an extra step, for sure, but that layer of verification is what gives you peace of mind during a major transaction.

Let's say you’ve been holding onto some Ethereum for a while and now you want to sell $10,000 of it to buy a car. A CEX is the perfect place for this. Trading fees are generally pretty low—often well under 1%—and the process of withdrawing to your bank account is straightforward and reliable, even if it takes a few business days. It’s the most direct and cost-effective route for turning a significant crypto position into fiat.

The Peer-to-Peer Advantage

Peer-to-peer (P2P) platforms bring a level of flexibility and privacy that you just don't get with standard exchanges. On a P2P marketplace, you're not dealing with a big corporation; you're trading directly with another person. This opens up a huge menu of payment options that go way beyond bank transfers, like PayPal, Venmo, or even meeting up for a cash-in-hand exchange.

Imagine you need $500 in a hurry to fix a leaky pipe, and for whatever reason, you’d rather not have the transaction hit your main bank account. A P2P platform lets you find a buyer who is willing to send the money straight to your digital wallet of choice. To keep everyone safe, these platforms use an escrow service that holds your crypto until you confirm you've received the payment. It's an ideal setup for smaller, more urgent needs where you want more control over the terms.

Pro Tip: Your reputation is everything on P2P platforms, and so is the other person's. Always check the trade history and feedback of anyone you're considering trading with. Someone with hundreds of positive reviews is a much safer bet than a new account with zero history. I always recommend starting with a small test transaction to get comfortable.

The Speed of Crypto ATMs

Sometimes, you just need cold, hard cash in your hand, and you need it right now. This is where crypto ATMs shine. They are, without a doubt, the fastest way to swap digital assets for paper money. The process couldn't be simpler: scan a QR code at the machine, send your crypto, and the ATM spits out cash.

Picture this: you're traveling, your debit card mysteriously stops working, and you need $200 for dinner. If you have Bitcoin on your phone, a nearby crypto ATM is your lifeline. You can have cash in your pocket within minutes, completely bypassing the need for a bank.

But—and it's a big but—this convenience comes at a very high price. Crypto ATM fees are notoriously steep, often ranging from 7% to a staggering 20% or more. They're a fantastic tool for emergencies, but they are not an economical way to off-ramp large amounts or something you'd want to use regularly. Think of them as a financial escape hatch, not your primary exit strategy.

Navigating Fees, Security, and Tax Implications

Successfully turning your crypto into cash involves more than just hitting the "sell" button. To do it right, you need to navigate a minefield of fees, security risks, and tax rules. If you’re not careful, what looked like a great profit on paper can shrink dramatically by the time it hits your bank account.

Let's break down the three biggest hurdles you'll face: the fees you'll pay, the security you'll need, and the taxes you'll owe.

Unpacking the Common Fees

Every time you move or sell your crypto, someone wants a cut. These costs can vary wildly depending on the method you choose, so knowing what to look for is the first step to keeping more of your money.

Here are the usual suspects:

- Exchange Fees: Platforms like Coinbase or Kraken charge for their service. This often comes in two parts: a "spread" (a small difference in the buy/sell price) and a transaction fee. These can change based on how much you're trading.

- Network Fees: Ever heard of "gas fees"? That's what these are. You pay them to the blockchain network itself—not the exchange—to process your transaction. They can be cheap or painfully expensive, depending on how busy the network is at that moment.

- Withdrawal Fees: Once you've sold your crypto for fiat on an exchange, you’ll probably get hit with another fee just to move that cash to your bank. It could be a flat fee or a percentage of the total.

- ATM Surcharges: Crypto ATMs are convenient, but that convenience comes at a steep price. They are notorious for high commissions—sometimes over 15%—and they often give you a less-than-favorable exchange rate on top of that.

Staying Secure in a High-Stakes Environment

When you're dealing with crypto, security isn't just a suggestion; it's a necessity. Because blockchain transactions can't be reversed, they're a magnet for scammers and hackers, especially on peer-to-peer (P2P) platforms where you're dealing directly with another person.

The numbers are staggering. In the first half of 2023 alone, a reported $2.17 billion was stolen from various crypto services. This constant threat is why legitimate platforms are always tightening their security, which can sometimes mean stricter withdrawal limits or longer verification times for users.

Key Security Takeaway: Stick to platforms with solid security measures, like two-factor authentication (2FA). If you're using a P2P service, only use one with an escrow system. And remember the golden rule: if a deal looks too good to be true, it is. Never, ever share your private keys or recovery phrases.

Addressing Your Tax Obligations

And now for everyone's favorite topic: taxes. In most places, crypto is treated as property, which means any profit you make from selling it is likely considered a capital gain—and it's taxable. Ignoring this can bring a world of financial pain from the tax authorities later on.

It's pretty simple math: you take the price you sold your crypto for and subtract the price you originally paid for it (your "cost basis"). The difference is your profit, or capital gain.

This is why keeping detailed records of every single transaction is absolutely critical. You need to log the dates, amounts, and the fiat value at the time of each trade. It might feel tedious, but it will save you a massive headache come tax season.

The rules are always changing, so it's a good idea to stay informed. Resources for understanding cryptocurrency laws can offer some much-needed clarity. With good records and a little planning, you can make sure your crypto profits are fully above board.

Cashing Out on an Exchange: A Step-by-Step Walkthrough

For most people, a centralized exchange (CEX) is the go-to on-ramp and off-ramp for crypto. Think of platforms like Coinbase or Kraken. They act as a trusted bridge connecting your digital assets to the traditional banking system you use every day.

Let's run through a real-world scenario. Say you have $1,000 worth of Ethereum (ETH) sitting in a personal wallet like MetaMask, and you need that money as US dollars in your bank account. The entire process on an exchange boils down to a few distinct phases.

Moving Your Crypto to the Exchange

First things first, you have to get your ETH from your private wallet onto the exchange. It's a straightforward transfer, but you need to be careful.

Inside your exchange account, you'll find a unique deposit address for every cryptocurrency they support.

- Go to your exchange’s wallet or deposit area.

- Select Ethereum (ETH) and copy the deposit address they provide. It's a long string of characters—double-check it!

- Open your MetaMask wallet, start a "Send" transaction, and paste that exchange address into the recipient field.

- Confirm the transaction and wait. Depending on how busy the Ethereum network is, this could take a few minutes or a bit longer.

Once the blockchain confirms the transfer, the ETH will pop up in your exchange's spot wallet. Now you're ready to sell.

The trading dashboard on an exchange can look a little overwhelming at first, but don't let it scare you.

This is the control center. You'll see the price chart, the order book of buyers and sellers, and the simple buy/sell options you'll be using.

Selling Your Crypto for Fiat

With your ETH now on the exchange, it's time to trade it for dollars. You've got two main ways to do this: a market order or a limit order.

A market order is all about speed. It sells your crypto immediately at the best price available right that second. A limit order, on the other hand, gives you control. You set the exact price you want to sell at, but there's no guarantee the trade will happen if the market never reaches your price.

For our $1,000 ETH sale, a market order is the simplest path. You just select "Sell," input the amount of ETH, and hit confirm. The exchange executes the trade instantly. Your account will then show the new USD balance, minus a small trading fee.

Pro Tip: Timing is everything in crypto. These markets can swing wildly. If you sell during a sudden price crash, you could end up with significantly less cash than you expected. I always recommend watching the market for a bit of stability before pulling the trigger on a large sale.

Initiating the Final Bank Withdrawal

This is the last leg of the journey: getting the money from the exchange into your bank account. To do this, you'll need to have your bank account linked and verified with the exchange. It's a one-time setup that's crucial for security.

Just head to the withdrawal section for your fiat wallet, pick US Dollars, select your linked bank account, and type in how much you want to pull out. Keep in mind that exchanges often have daily withdrawal limits.

After you confirm, the transfer is set in motion. While selling your crypto was instantaneous, the actual bank transfer isn't. You can typically expect the funds to land in your account within 1-5 business days.

For businesses that need a more streamlined way to handle crypto payments and payouts, exploring the best crypto payment gateway can automate and simplify this entire workflow.

Automating Crypto Payouts for Businesses with BlockBee

When you're running a business or working as a freelancer, the methods for cashing out crypto have to be smarter and more efficient than personal one-off trades. Manually converting every single crypto payment into cash just doesn't scale—it’s a massive time-sink and leaves your revenue dangerously exposed to market swings.

A Smarter Workflow for Professionals

Let's put this into a real-world context. Imagine you’re a freelance web developer based in Portugal, but your clients are scattered across the globe. Accepting Bitcoin is fantastic for landing international projects, but at the end of the month, your landlord wants Euros, not BTC.

The old way involves sending each payment to an exchange, placing a sell order, and then initiating a bank withdrawal. It’s a tedious, multi-step process you have to repeat over and over. This is exactly the problem a crypto payment gateway like BlockBee solves. It can automate that entire chain of events, taking a client's crypto payment and landing fiat directly in your bank account without you lifting a finger.

Key Insight: Automating the conversion from crypto to fiat is your best defense against volatility. By instantly converting a payment the moment it arrives, you lock in its value and protect your hard-earned revenue from a sudden market dip.

This is more relevant than ever. As crypto becomes more mainstream—with 28% of American adults now owning some—more customers will expect to pay with it. Yet, the process isn't always smooth. An annual consumer report on digital security found that about one in five users have hit roadblocks when trying to withdraw cash from crypto platforms.

The Real-World Benefits of Automated Payouts

Setting up an automated system to convert cryptocurrency to cash is about more than just clawing back a few hours a week. It fundamentally makes your business operations more stable and predictable.

Here’s what that looks like in practice:

- Minimized Volatility Risk: Automatic conversion is like an insurance policy against price drops. Your crypto is swapped for fiat almost instantly, so you’re not left watching the charts, hoping a market swing doesn't wipe out your profits overnight.

- Simplified Accounting: Your books become much cleaner. Instead of a messy ledger filled with dozens of separate crypto-to-fiat trades, you just have a simple record of fiat deposits. This makes bookkeeping and tax time infinitely less painful.

- Seamless Global Payments: You can confidently accept payments from clients anywhere in the world, bypassing the usual headaches of international bank transfers. The funds arrive in your local currency, ready to use.

This hands-off approach transforms the entire payment cycle. If you're curious about how this feature can make a real difference for your business, take a look at our deep dive into BlockBee's automated payouts for all users.

Got Questions About Cashing Out Crypto? We’ve Got Answers.

Even once you know the basic methods, a lot of practical questions come up the first time you actually go to turn your crypto into cash. Getting these details right can be the difference between a quick, easy conversion and a headache-inducing delay. Let's dig into some of the most common things people ask.

The big one is always about timing. How long does this really take? The honest answer is: it depends.

Crypto ATMs are the clear winner for speed—you can have physical cash in your hand in just a few minutes. Centralized exchanges are on the other end of the spectrum. Once you sell your crypto on the platform, you're still looking at a bank transfer that can take anywhere from 1 to 5 business days to actually show up in your account. P2P platforms are the wild card, landing somewhere in the middle. A transaction can be done in minutes or take a few hours, depending entirely on how fast the other trader is.

So, How Long Does the Conversion Really Take?

Here’s a quick breakdown of what to expect from each method:

- Crypto ATMs: The closest you'll get to instant. Perfect for when you need physical cash right away.

- Centralized Exchanges (CEX): The slowest of the bunch. Expect to wait 1-5 business days for the bank transfer to clear.

- Peer-to-Peer (P2P) Platforms: Highly variable. It could be over in minutes if you find a responsive trader, but it can also drag on if they're slow to act.

Another question I hear all the time is about anonymity and ID. Can you cash out without showing your driver's license? While there are a few niche ways to do it, they're often risky and not worth the trouble for most people.

Major exchanges are legally required to perform Know Your Customer (KYC) checks. This isn't just a policy; it's the law in most places. That means you’ll have to upload a government-issued ID to get your money out.

A Word of Caution: Trying to sidestep ID verification usually pushes you toward unregulated platforms where the risk of getting scammed is significantly higher. For any amount that matters to you, sticking with a verified, compliant service is always the smartest move.

Are There Limits on How Much I Can Cash Out?

Yes, and this is a big one. Withdrawal limits are set by each platform and are almost always tied to how much you've verified your identity.

A standard, fully-verified account on a platform like Coinbase or Kraken might let you pull out $5,000-$10,000 per day. If you're a high-volume trader and go through enhanced verification, those limits can shoot up to $100,000 or more. Crypto ATMs, on the other hand, have the strictest limits, typically capping withdrawals somewhere between $1,000 and $10,000 daily.

For businesses that regularly receive crypto, manually cashing out and bumping up against these limits just isn't practical. If you’re a merchant, check out our guide on how to accept cryptocurrency payments for your business for a much smoother solution.

Ready to simplify your crypto transactions? With BlockBee, you can automate payouts, minimize volatility, and streamline your entire payment workflow. Explore our features today and see how easy managing crypto can be.