A Guide to Cryptocurrency Algorithmic Trading

Imagine having an expert trader working on your behalf around the clock, executing every move with perfect, emotionless precision. That's the essence of cryptocurrency algorithmic trading. It’s simply the practice of using computer programs to automatically buy and sell digital assets based on a set of rules you define. In a market that never sleeps, it’s become an incredibly powerful tool.

The Advantage of Automated Crypto Trading

Let's be honest: trading crypto manually is tough. The market is volatile and runs 24/7, but human traders aren't. We get tired, we get emotional, and we simply can't process market data fast enough to keep up. It's all too easy for fear or greed to drive impulsive decisions, and great opportunities often vanish while we're asleep or just living our lives.

This is exactly where algorithmic trading gives you a serious competitive edge. Instead of relying on gut feelings and manually clicking "buy" or "sell," you deploy sophisticated software—commonly called trading bots—to carry out your strategy with mechanical precision.

A trading bot doesn't get tired, emotional, or distracted. It just follows its programming, analyzing market data and executing orders faster than any human possibly could. This takes the psychological stress out of trading, which is often the biggest source of costly mistakes.

This kind of automation isn't just a niche tool for tech wizards anymore; it's rapidly becoming a mainstream necessity. The global algorithmic trading market, which includes crypto, is booming. It grew from $12.35 billion in 2023 to an estimated $13.72 billion in 2024, with projections showing it could surpass $26 billion by 2030. This explosive growth is a direct result of better AI and more traders embracing automated systems.

Why Automation Is Essential

The shift from manual to algorithmic trading offers some clear, game-changing benefits. These systems are built to exploit market dynamics that are just too fast for people to see, let alone act on.

- Speed and Efficiency: An algorithm can scan dozens of indicators and fire off an order in a fraction of a second. This allows it to capture tiny price movements that a human trader would never even notice.

- Emotional Discipline: Bots are immune to fear and greed. They stick to the plan no matter what, preventing the kind of emotional blunders that can destroy a trading account.

- 24/7 Market Coverage: The crypto market never closes its doors. An automated system can trade for you around the clock, making sure you don't miss a move.

- Backtesting Capabilities: This is a big one. Before you risk a single dollar, you can run your strategy against historical market data to see how it would have performed. This lets you find flaws and fine-tune your approach without losing money.

At its core, algorithmic trading is about replacing human weaknesses with technological strengths. It turns trading from a gut-wrenching, reactive guessing game into a proactive, data-driven discipline. To build a strong base in these concepts, resources like the vTrader Academy provide excellent educational material to help you understand how to use these tools the right way.

How Trading Bots Execute Trades

To really get what's happening with cryptocurrency algorithmic trading, we need to pop the hood and see how these bots actually work. I like to think of a trading bot as a master chef in a high-tech kitchen. It takes raw ingredients (market data), follows a very precise recipe (your strategy), and serves up a perfectly executed trade, all without any human fuss.

This whole operation boils down to a continuous, three-step cycle. It’s this loop that lets the bot run 24/7, tirelessly hunting for opportunities. Let's break down this process, starting with how the bot gets its hands on the "ingredients."

The Data Collection Phase

First things first, a trading bot is a data vacuum. Its entire existence depends on a constant, real-time stream of market information to make smart moves. And it's not just looking at the current price of Bitcoin. The analysis goes much, much deeper.

This data stream includes a few key components:

- Price Feeds: The most up-to-the-second price info for countless assets, often pulled from multiple exchanges at once.

- Order Book Data: A live view of all the current buy and sell orders. This reveals market depth and where potential price walls (support and resistance) might be forming.

- Trading Volume: A measure of how much of an asset is changing hands. High volume can signal a strong, convincing trend.

- Social Sentiment: Some of the more sophisticated bots even scrape news headlines and social media chatter to get a feel for the market's mood.

So, how does it get all this information? Bots rely on something called an Application Programming Interface, or API.

Think of an API as a secure messenger between your bot and a crypto exchange. It lets your bot ask for market data and send trade orders without ever needing your actual login details.

This API connection is the bot's lifeline. Without it, the bot would be flying completely blind, deaf, and dumb to what's happening in the market.

The Signal Generation Phase

Once the bot has its data, it moves on to step two: following the recipe. This is where the "algorithm" in algorithmic trading really shines. The bot runs the incoming data through its pre-programmed logic to spot a potential trading opportunity.

This logic is basically a set of "if-then" rules. For instance, a simple strategy might look like this:

- IF the 50-day moving average crosses above the 200-day moving average (a classic "golden cross"), THEN generate a 'buy' signal.

- IF the Relative Strength Index (RSI) climbs above 70, THEN generate a 'sell' signal, because the asset might be overbought.

Getting this part right requires a solid grasp of technical indicators. If you're looking to build a better foundation on this, our guide on how to read cryptocurrency charts is a great place to start.

The Trade Execution Phase

When the bot's logic generates a signal, the final step is to act on it. Using that same API connection, the bot instantly fires off a buy or sell order directly to the exchange. This happens in milliseconds—far faster than any human could ever hope to react, click a mouse, and confirm the trade.

The execution is flawless and, most importantly, emotionless. The bot places the order for the exact amount at the exact price dictated by its strategy, no second-guessing involved.

This entire cycle—data in, signal out, trade executed—then repeats itself over and over again. It’s a relentless loop that allows the bot to monitor the markets and trade on your behalf without ever needing a coffee break. This seamless integration of data, logic, and speed is precisely what gives algorithmic trading its power.

Core Algorithmic Trading Strategies Explained

A powerful bot is nothing without a smart strategy. Once you've connected your trading bot to an exchange, its success hinges entirely on the logic it’s programmed to follow. The world of cryptocurrency algorithmic trading is full of different strategic playbooks, and each one is designed to capitalize on specific market behaviors.

Getting a handle on these core strategies is crucial. Think of them as different tools in a toolbox; you wouldn't use a hammer to turn a screw. In the same way, picking the right strategy comes down to the current market conditions, the crypto asset you're trading, and your own appetite for risk.

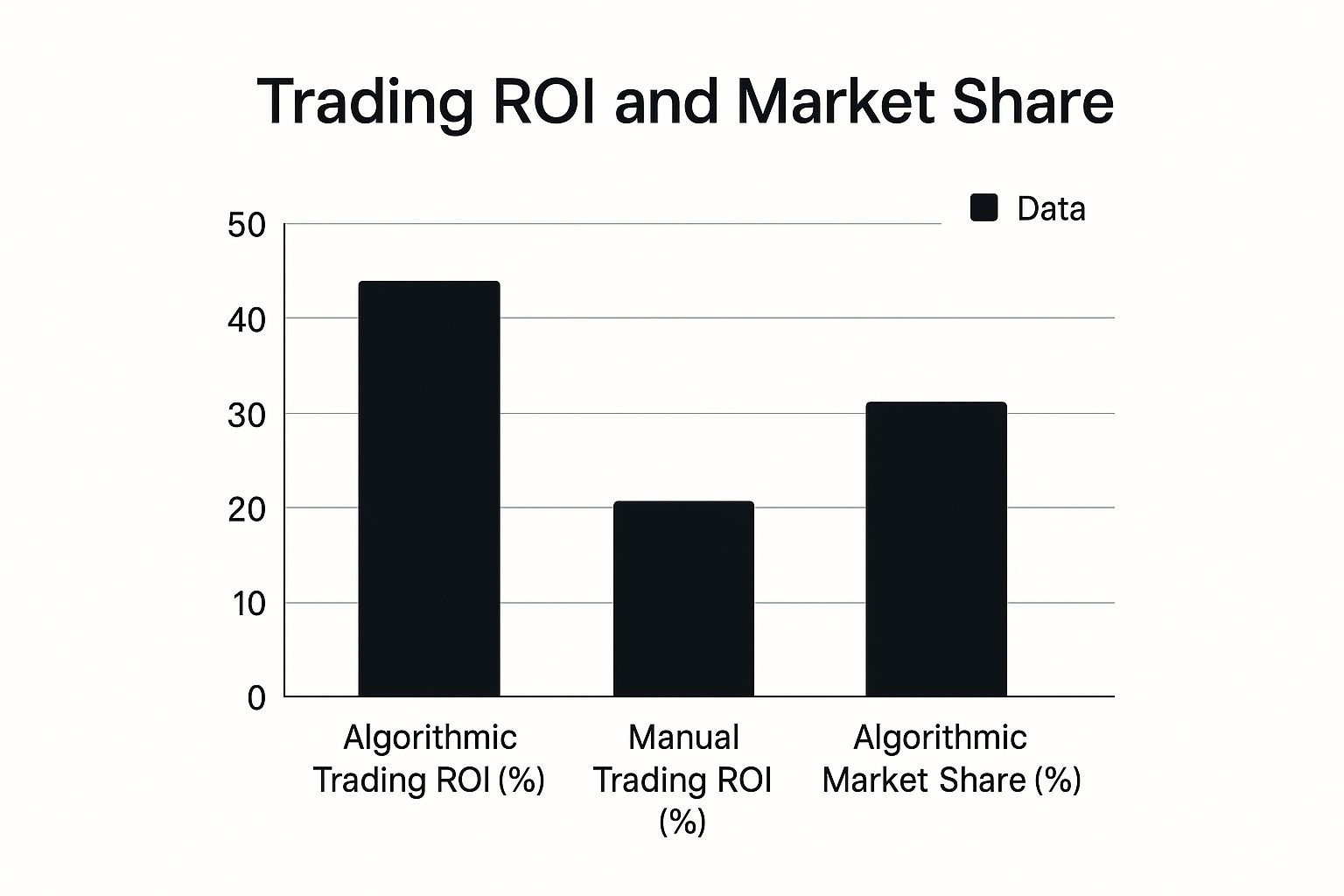

This chart paints a clear picture of how algorithmic trading often stacks up against manual efforts, highlighting the rapid shift toward automated systems.

As you can see, automated strategies frequently deliver stronger returns and are responsible for a huge slice of total market activity, which speaks volumes about their effectiveness.

To help you get started, here's a look at some of the most common strategies you'll encounter.

Common Algorithmic Crypto Trading Strategies Compared

Choosing the right strategy can feel overwhelming at first. This table breaks down the most popular approaches, comparing their underlying logic, the market conditions where they shine, and the typical risk involved.

| Strategy Type | Core Logic | Best For | Typical Risk Level |

|---|---|---|---|

| Arbitrage | Buy low on one exchange and sell high on another, capturing the price difference. | Fragmented markets with frequent price discrepancies between exchanges. | Low |

| Market Making | Place simultaneous buy and sell orders to profit from the bid-ask spread. | Stable, high-volume markets where consistent liquidity is needed. | Low to Medium |

| Momentum Trading | Buy into assets showing strong upward trends and sell when they lose steam. | Volatile, trending markets with clear directional price movements. | High |

| Mean Reversion | Buy assets that have fallen far below their average price and sell those far above it. | Range-bound or choppy markets where prices oscillate around a mean. | Medium |

This comparison should give you a solid foundation for deciding which path aligns best with your goals and the market environment. Now, let's explore each one in more detail.

Arbitrage Trading

Arbitrage is probably the most straightforward concept in algorithmic trading. The idea is simple: buy low and sell high, but do it instantly. An arbitrage bot achieves this by constantly scanning prices for the same coin across multiple exchanges.

Imagine finding a popular book for $5 at one store and seeing it listed for $10 at a shop right across the street. Arbitrage is like having a lightning-fast assistant who can buy the book at the first store and sell it at the second, pocketing the $5 difference before the prices have a chance to sync up.

This strategy thrives on market inefficiency. Since the crypto market is split across hundreds of exchanges, small price gaps pop up all the time—but they often vanish in seconds. A bot can execute these trades fast enough to profit, while a human trader simply doesn't stand a chance.

Market Making

Market making bots are the lifeblood of an exchange, providing the liquidity that keeps trading smooth. They work by placing both buy (bid) and sell (ask) orders for a specific asset at the same time, earning a small profit from the difference between the two prices, known as the bid-ask spread.

A market maker is like a currency exchange booth at an airport. They're always ready to buy or sell a currency, and they make a tiny profit on every single transaction by keeping a gap between their buy price and their sell price.

These bots ensure there are always orders on the book, which makes it easier for everyone else to trade without causing wild price swings. It’s generally a lower-risk strategy that focuses on accumulating a high volume of small, consistent profits.

Momentum Trading

Momentum trading is built on the classic saying, "the trend is your friend." A bot using this logic is designed to spot assets that are making a strong move in one direction—up or down—and ride the wave.

The algorithm sifts through indicators like trading volume and the speed of price changes to measure a trend's strength. If a crypto is rocketing upward with heavy volume, the bot will buy, betting the trend will continue. On the flip side, if an asset is in a nosedive, the bot might place a sell or short order.

- Entry Signal: A common trigger is a price breakout above a key resistance level, especially when paired with a spike in trading volume.

- Exit Signal: The bot gets out of the trade when indicators suggest the momentum is fizzling out, like seeing declining volume or a price reversal pattern.

This approach really shines in volatile markets where powerful trends can develop in the blink of an eye.

Mean Reversion

Mean reversion works on the complete opposite principle of momentum trading. It's based on the statistical idea that asset prices, over time, tend to return to their historical average.

Think of it like a rubber band. If you stretch it too far, it eventually snaps back to its normal state. A mean reversion bot hunts for assets whose prices have stretched too far from their average, betting that they will soon "snap back" toward the middle.

The bot will buy an asset when its price tumbles far below its historical average and sell when it climbs significantly above it. Traders often use technical tools like Bollinger Bands or the Relative Strength Index (RSI) to pinpoint these overextended—or "oversold" and "overbought"—conditions.

Of course, performance varies across these and other algorithmic methods. Research indicates that machine learning models often come out on top, posting average returns around 23% by using historical data to reach prediction accuracies between 53% and 59%. Other strategies, like analyzing social media sentiment, deliver returns closer to 18%, while high-frequency trading brings in about 15%. You can read more about these performance benchmarks to see how different approaches compare.

Choosing the Right Trading Bot Platform

Alright, you've got a handle on the strategies. Now comes the fun part: picking the tools to put those strategies into action. This is a critical decision point in your cryptocurrency algorithmic trading journey, and you’re basically facing a fork in the road.

You can either roll up your sleeves and build a custom trading bot from scratch, or you can subscribe to a ready-made platform. The right choice really boils down to your own unique mix of technical skills, how much time you can commit, and what you’re trying to achieve. One path offers ultimate control, the other offers convenience. Let's dig in.

The Two Main Paths for Automation

Your first option is the classic Do-It-Yourself (DIY) route, which is a great fit if you're comfortable with code and want total command over every detail. The second path is using a commercial Trading-Bot-as-a-Service (TBaaS) platform, perfect for traders who'd rather skip the coding and get straight to deploying strategies.

- Building Your Own Bot: This means you'll be writing your own code, likely in a language like Python, and plugging it directly into an exchange's API. The payoff is a bot that's 100% yours, tailored to your exact specifications.

- Using a Pre-Built Platform: Think of these as bot marketplaces. They are usually web-based services that give you access to a menu of proven bots and user-friendly tools for building strategies without needing to be a developer.

So, which one is for you? Let's break down what each path really entails.

Building a Custom Trading Bot

Going the DIY route is a challenging but incredibly rewarding project. It’s how you bring a truly unique, proprietary trading idea to life—the kind of strategy you won’t find on any public platform. Just be prepared for a serious commitment of time and a steep learning curve.

Most developers in this space lean on the Python programming language. Its powerhouse libraries for data analysis (like Pandas), number crunching (NumPy), and machine learning (Scikit-learn) make it the go-to choice. You'll also need to get intimately familiar with how exchange APIs work for fetching market data and, more importantly, placing orders.

The absolute, non-negotiable first step in building a bot is backtesting. This is where you run your brand-new strategy against months or years of historical market data to see how it would have fared. Skipping this step is like flying blind—you're putting real money on the line with a completely unproven concept.

Selecting a Pre-Built Platform

For most traders, jumping onto an established bot platform is the most sensible and efficient choice. These companies have already done all the heavy lifting: building secure infrastructure, integrating with exchanges, and squashing bugs. All that's left for you is to pick a strategy, tweak the settings, and hit 'go'.

But be warned: not all platforms are created equal. You have to do your homework to protect your capital and give yourself the best shot at success. Here's a quick checklist of what to look for when you're comparing your options:

- Security Features: This is paramount. The platform should never ask for withdrawal permissions on your API keys. Look for fundamentals like two-factor authentication (2FA), data encryption, and a solid reputation for keeping user funds safe.

- Supported Exchanges and Pairs: Does the platform work with the exchanges you already use? Does it support the crypto pairs you want to trade? The more options, the better, especially if you plan on running arbitrage strategies across different markets.

- Strategy Variety: A quality platform won't just offer one or two basic bots. It should provide a whole toolbox of strategies, from simple DCA and Grid bots to more advanced ones built on technical indicators. Crucially, it should also let you customize the parameters.

- Transparent Pricing: Make sure you understand exactly how you'll be charged. Is it a flat monthly fee? A cut of your winning trades? A tiered model based on your trading volume? Watch out for hidden costs that can eat into your profits.

- Community and Support: Don't underestimate the value of good support. An active user community and a responsive help desk can be a lifeline when you're starting out. Check for solid documentation, tutorials, and easy ways to get help.

Ultimately, finding the right platform is a personal decision. It's all about matching its features and philosophy with your trading style and goals. To get a better feel for the technology that makes all of this possible, it can be useful to learn more about how blockchains operate. For a deeper dive, check out our guide to understanding blockchain and its potential with the splitting function.

How to Manage Automated Trading Risks

Handing the keys over to a trading bot gives you incredible power, but it also comes with its own set of very real risks. A tiny flaw in your logic or a sudden, violent market swing can trigger rapid, automated losses. The best way to think about risk management is like installing guardrails on a high-speed racetrack; they don't slow you down, but they’re there to stop a small mistake from becoming a catastrophe.

Without those safety measures, a cryptocurrency algorithmic trading bot can compound errors just as fast as it compounds profits. Smart trading isn't just about chasing wins—it’s about engineering a system that can take a punch and protect your capital when things inevitably go sideways.

Setting Up Your Defenses

Your first line of defense is building risk controls directly into your bot's code. These are the hard-and-fast rules that slam on the brakes, cutting losses before they spiral out of control. It’s where you draw the red lines your bot is never allowed to cross.

One of the most critical of these is the stop-loss. This is simply a price you set ahead of time where your bot automatically exits a losing trade. For example, if you buy Bitcoin at $60,000, you might set a stop-loss at $58,500. If the price drops to that level, the bot sells, capping your loss at 2.5%. This one simple command is arguably the most effective tool you have for preserving your capital.

An automated strategy without a stop-loss is like driving a race car with no brakes. It’s exhilarating right up until the moment it isn't. You absolutely must define your maximum acceptable loss before you ever enter a trade.

You can also zoom out from individual trades and implement broader portfolio-level controls. For instance, you could program a maximum daily drawdown limit—maybe you tell the bot to halt all trading if your account is down 5% on the day. This prevents one bad day from turning into a disaster. Position sizing rules are equally important, ensuring you never bet the farm on a single trade.

Avoiding Common Pitfalls

Even with solid defenses, there are some classic mistakes that trip up even experienced traders. One of the most insidious is overfitting, which usually happens when you're backtesting a strategy. This is when you tweak your algorithm so it performs perfectly on past data. The problem? It becomes so tailored to the past that it can't adapt to the live, unpredictable market. It's like memorizing the answers to last year's exam; you'll ace that specific test but completely bomb the real one.

To get around this, always split your historical data. Use one chunk to build the strategy and a completely separate, "unseen" chunk to test it. If it falls apart on the new data, you've likely overfitted it.

Another huge risk is pure technical failure. What happens if your internet cuts out or the exchange's API goes down? A well-designed bot needs a "heartbeat" check. If it loses connection for a certain amount of time, it should be programmed to pause all activity and send you an alert.

Here are a few essential practices to keep your automated trading sustainable:

- Start Small: Never deploy a new bot with your entire trading stack. Start with an amount of capital you are genuinely prepared to lose. This lets you see how it behaves in the wild without risking your whole portfolio.

- Monitor Continuously: Automation isn't a "set and forget" machine. You need to check in regularly. Review its trade logs and watch its equity curve. Is it performing as you expected? Are the market dynamics shifting away from your strategy's sweet spot?

- Diversify Strategies: Don't put all your eggs in one algorithmic basket. Running several different, uncorrelated strategies can help smooth out your returns. A loss from one bot might be canceled out by a gain in another.

By weaving these risk management techniques into your process, you move from just hoping for the best to building a truly resilient trading operation. This methodical approach is also vital for businesses managing digital assets. For any company in this space, understanding the crypto payments for business can be a guide to growth and greater financial agility.

The Future of AI in Crypto Trading

Crypto algorithmic trading isn't just evolving; it's sprinting toward a future that's more intelligent, autonomous, and frankly, more fascinating than ever before. The bots and strategies we see today are just the warm-up act. The main event is being driven by advanced artificial intelligence, which is completely rewriting the rules for how automated systems engage with crypto markets.

The star of this show is deep reinforcement learning (DRL). Forget the rigid "if this, then that" logic of older algorithms. DRL models are built to learn and adapt entirely on their own. It's like teaching a bot to trade by giving it a market simulator and a simple goal: make a profit. It gets rewarded for smart moves and penalized for bad ones, and after millions of trial-and-error runs, it develops its own unique strategies—often spotting opportunities a human programmer would never think to code.

In other words, the trading bots of tomorrow won't just execute your strategy; they will create and refine their own in the heat of the moment. By constantly analyzing their own performance, they can adapt to bizarre market conditions and find subtle patterns that are invisible to the naked eye.

The Rise of Decentralized Intelligence

We're also seeing a massive shift toward decentralization. As decentralized exchanges (DEXs) become faster and more reliable, trading bots will live and breathe in these trustless environments. This brings a whole new set of puzzles to solve, as bots will need to interact directly with smart contracts and navigate complex on-chain mechanics without a central company holding their hand.

Predictive analytics is also getting a serious upgrade. The next generation of trading intelligence is chugging down a firehose of data that goes way beyond simple price charts. New algorithms are being built to analyze:

- Complex on-chain data: Think tracking whale wallet movements, monitoring smart contract interactions, and even gauging the overall health of a network.

- Decentralized social media: Pulling sentiment from Web3 native platforms to get ahead of market-moving narratives.

- Cross-chain activity: Finding arbitrage opportunities that exist across completely different blockchain ecosystems.

The Human Element in an AI-Driven World

So, where do people fit into this AI-powered future? The role is changing, not disappearing. The demand is shifting away from manual traders and toward the quants, data scientists, and AI specialists who can design, manage, and supervise these sophisticated systems. As AI continues to blend with finance, new career paths are opening up, with a growing number of specialized AI jobs in crypto that didn't even exist a few years ago.

The road ahead for crypto algo trading is incredibly exciting. We're moving beyond simple automation and into the realm of genuine artificial intelligence—creating systems that aren't just faster than humans, but are on a path to becoming smarter. For anyone in this space, keeping up with these innovations isn't just a good idea; it's the key to survival and success in the next chapter of crypto.

Got Questions About Algorithdmic Trading? We’ve Got Answers.

Jumping into crypto algo trading is exciting, but it naturally comes with a lot of questions. We get it. To help you get comfortable and clear up any confusion, here are some straight-up answers to the things we’re asked most often.

Can I Really Start With Just a Small Amount of Money?

Absolutely. One of the biggest myths is that you need a huge bankroll. Many exchanges and bot platforms have incredibly low minimums, so you can dip your toes in the water with a small amount of capital.

In fact, we strongly recommend starting this way. Think of your first deposit as tuition money—an amount you’re okay with losing. It’s the best way to test your strategies and see how your bot behaves in the real world without putting your finances on the line. Starting small isn’t just smart; it’s a core part of responsible trading.

Do I Have to Be a Coder to Use a Trading Bot?

Not these days. A few years ago, the answer was yes. You’d need to be pretty handy with a language like Python to build a bot from the ground up. But the game has changed.

Now, a whole host of platforms are designed for the non-coder. They offer pre-built bots you can deploy in minutes or visual drag-and-drop editors for creating your own custom logic. This has completely opened up the world of automated trading to anyone, regardless of their technical background.

No profitability is ever guaranteed. A bot's success depends entirely on the strategy it executes, the current market conditions, and your risk management. A poorly designed strategy will lose money automatically, just as a well-designed one can generate profits.

How Do I Make Sure My Funds Are Safe With a Trading Bot?

Security is everything, and this is where you need to be vigilant. The golden rule is simple: never, ever give a trading bot withdrawal permissions.

When you create an API key on your exchange to connect the bot, you’ll see options for what it can do. Make sure you only enable trading permissions. This allows the bot to place buy and sell orders for you, but it physically cannot move your crypto off the exchange. Think of it like giving a valet a key that only opens the door and starts the car, but doesn’t open the trunk.

On top of that, always use strong, unique passwords and enable two-factor authentication (2FA) everywhere—on your exchange account and your bot platform. Layering your security like this is the best defense you have.

Ready to integrate secure, automated crypto payments into your business? BlockBee offers a non-custodial solution with low fees, instant payouts, and robust developer tools. Accept over 70 cryptocurrencies with ease and keep full control of your funds. Learn more and get started at BlockBee.