Crypto Wallets Explained A Complete Beginner's Guide

Let's clear up a common misunderstanding right away: a crypto wallet doesn't actually "store" your coins like a physical wallet holds cash. That's not how it works at all.

Think of it more like a super-secure digital keychain. This keychain holds the secret codes—your private keys—that give you access to your funds on the blockchain. Without that specific key, you can't prove you own the crypto, and you definitely can't spend it.

What Is A Crypto Wallet And Why Is It Essential?

Your cryptocurrency—whether it's Bitcoin, Ethereum, or anything else—never actually leaves its blockchain. The blockchain is just a massive, shared public ledger, and your coins are simply entries on it. A wallet's real job is to protect the cryptographic keys that prove you own a specific piece of that ledger.

This is a huge shift from how traditional banking works. With a crypto wallet, you are your own bank. You have full control and total responsibility for your assets. This is a powerful concept known as self-custody. There's no middleman, no central company, and no customer service line to call if you forget your password.

Public Address Versus Private Key

To really get a handle on this, an email analogy works perfectly. Every crypto wallet manages two key pieces of data for you:

- Public Address: This is like your email address. It's perfectly safe to share it with anyone who wants to send you crypto. It’s just a long string of letters and numbers that points to your spot on the blockchain. Getting familiar with your crypto wallet address format is essential for receiving payments.

- Private Key: This is your password. It’s the secret code that unlocks your funds, allowing you to sign transactions and send crypto to others. You must never, ever share your private key. Guard it with your life.

When someone sends crypto to your public address, the transaction gets recorded on the blockchain. The funds are now linked to your address, but only the corresponding private key can authorize moving them again. This pairing is the bedrock of crypto security.

To help break it down, here’s a quick summary of the core ideas we've covered.

Core Wallet Concepts At A Glance

| Concept | Analogy | Primary Function |

|---|---|---|

| Crypto Wallet | Digital Keychain | Securely manages your keys to access and control your crypto on the blockchain. |

| Public Address | Email Address / Bank Account Number | A shareable identifier used to receive cryptocurrency from others. |

| Private Key | Password / Safe Combination | The secret code that proves ownership and authorizes spending of your funds. |

Seeing these concepts laid out makes it easier to understand how each piece of the puzzle fits together to give you control over your digital assets.

The Growing Importance of Secure Wallets

As more people and businesses jump into crypto, the need for secure wallets has skyrocketed. The global crypto wallet market was valued at USD 12.59 billion this year and is on track to hit an incredible USD 56.74 billion by 2035. This explosive growth shows just how fundamental wallets are to the entire ecosystem.

A crypto wallet gives you direct access to the decentralized financial system. It's the primary tool that empowers you to interact with the blockchain, manage your assets, and participate in the digital economy on your own terms.

In the end, your wallet is your personal gateway to the crypto world. It puts you in complete control, offering both the freedom to manage your own money and the responsibility to keep it safe. This is decentralization in action.

Custodial Vs Non-Custodial: Who Really Controls Your Keys?

When you’re ready to pick a crypto wallet, you'll run into one question that shapes everything else: who actually holds the private keys? This is the fundamental choice that decides who has the final say over your digital assets. It splits wallets into two main camps—custodial and non-custodial—and they couldn't be more different in how they handle security, convenience, and control.

Getting this part right is probably the most important step you'll take in your crypto journey. Let's break down what each option really means with a simple analogy.

The Bank Vault Analogy Explained

Think of your crypto as gold. You’ve got two basic ways to store it.

A custodial wallet is like putting your gold in a bank's safety deposit box. You’re trusting the bank (the custodian) to keep it safe. They’ve got the heavy-duty security, and if you happen to lose your key, you can go through a process to prove who you are and get access again. It’s convenient, but at the end of the day, the bank holds the master key and controls access.

A non-custodial wallet is more like a personal safe you install in your own home. You—and only you—know the combination. You have complete, undeniable control over your gold. No one else can touch it. But this also means you carry 100% of the responsibility. If you forget that combination, there’s no one to call for help.

This classic trade-off between convenience and control is at the very heart of the custodial versus non-custodial debate.

Understanding Custodial Wallets

A custodial wallet is one managed by a third party, usually a crypto exchange or a dedicated wallet service. When you sign up, they create and look after your private keys for you. All you have to do is log in with a familiar username and password.

This approach is incredibly easy to get started with, especially if you're new to crypto. The platform takes care of all the technical stuff, and most will help you recover your account if you get locked out. The catch? It requires a huge amount of trust. You're trusting that company to have top-notch security, to not suddenly freeze your account, and to not get hacked. The old crypto saying, "not your keys, not your coins," comes directly from this reality.

The Power Of Non-Custodial Wallets

Non-custodial wallets, often called self-custody wallets, put you firmly in the driver's seat. When you set one up, the private keys are generated and stored right on your device, whether that's your phone, computer, or a specialized hardware device. You are the one and only owner of those keys.

This arrangement gives you total financial sovereignty. No third party can freeze your funds, block a transaction, or get to your assets without your direct permission. This is what decentralization is all about. The flip side is that the responsibility is immense. You have to back up your seed phrase somewhere safe, because losing it means your crypto is gone for good. You can dive deeper into the specifics in our guide to non-custodial crypto wallets.

A non-custodial wallet embodies the core principle of cryptocurrency: to be your own bank. It grants you unparalleled freedom but demands absolute personal responsibility for your security.

To help you see the differences more clearly, here's a side-by-side comparison.

Custodial Vs Non-Custodial: A Direct Comparison

Choosing between these two models comes down to your personal priorities—convenience versus control. This table breaks down the key distinctions.

| Feature | Custodial Wallet (e.g., Exchange Wallet) | Non-Custodial Wallet (e.g., MetaMask, Ledger) |

|---|---|---|

| Key Control | A third party holds and manages your private keys. | You hold and manage your private keys. |

| Security | You trust the provider's security measures. | You are responsible for securing your own keys. |

| Convenience | High; easy login and account recovery. | Lower; requires you to manage your seed phrase. |

| Accessibility | Access funds through the provider's platform. | Direct access to your funds on the blockchain. |

| Best For | Beginners, traders, and those prioritizing convenience. | Long-term holders and users who value sovereignty. |

Ultimately, the right choice depends on your comfort level with technology and how much responsibility you're willing to take on for your assets.

Understanding Hot Wallets And Cold Wallets

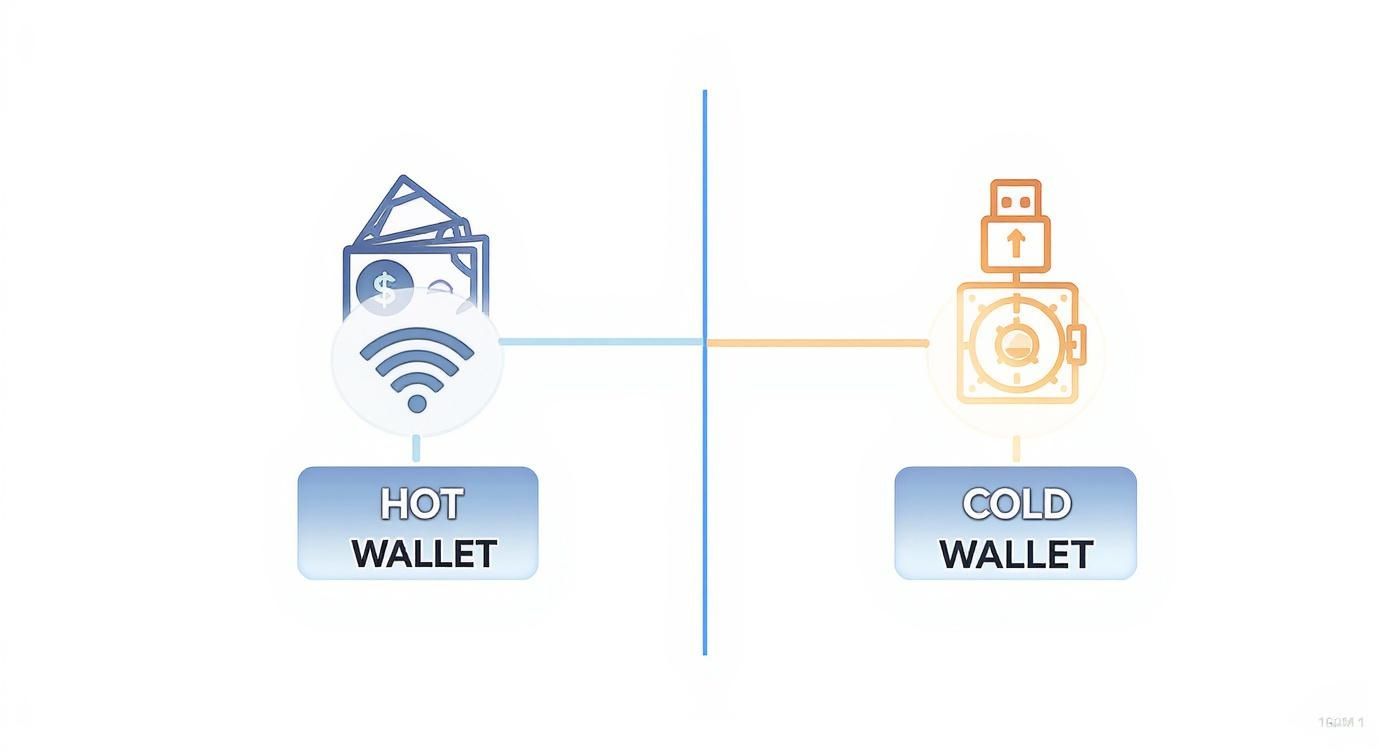

Now that we've covered who holds the keys to your crypto, let's talk about another fundamental concept: where your wallet lives. The difference between a hot wallet and a cold wallet boils down to a single, crucial detail—its connection to the internet. This one factor completely changes the balance between everyday convenience and long-term security.

Let's use a real-world analogy. A hot wallet is like the cash you carry in your pocket. It’s right there when you need it, perfect for buying coffee or making other small, daily purchases. You wouldn't walk around with your entire life savings in your pocket, though. That would be asking for trouble.

A cold wallet, on the other hand, is your personal bank vault or a high-security safe at home. It’s where you lock away your most valuable assets, completely disconnected from the outside world. Getting to it takes more effort, but for storing significant wealth, nothing is safer.

The Convenience Of Hot Wallets

A hot wallet is any crypto wallet that's connected to the internet. This includes the mobile apps, desktop software, and browser extensions you see everywhere. Their online nature makes them incredibly fast and easy to use, which is why they’re the go-to choice for frequent traders, active users, and anyone making regular payments.

This ease of use has made hot wallets incredibly popular. It’s estimated that around 65% of digital asset users use crypto wallets for secure transactions, and software wallets—the most common type of hot wallet—are leading the charge. They represent roughly 60% of the entire crypto wallet market, highlighting just how much people value accessibility for their day-to-day crypto activities. For a deeper dive, you can explore this in-depth crypto wallet market report.

You've probably come across some of these well-known examples:

- MetaMask: The ubiquitous browser extension and mobile app for anyone interacting with the Ethereum world.

- Exodus: A sleek desktop and mobile wallet loved for its beautiful interface and broad support for different coins.

- Trust Wallet: A simple, mobile-first wallet that makes managing assets on your phone a breeze.

The biggest trade-off with hot wallets is their constant online presence. Being connected to the internet inherently exposes them to risks like hacking, malware, and phishing scams. While reputable wallets have robust security, they can never fully replicate the isolated fortress of an offline device.

The Unmatched Security Of Cold Wallets

A cold wallet, also known as cold storage, takes your private keys completely offline. The most common type is a hardware wallet—a small physical device, often looking like a USB stick, that stores your keys on a secure, isolated chip.

Here's how it works: when you need to sign a transaction, you connect the device to your computer. The critical step—the signing—happens inside the hardware wallet itself. Your private key never, ever touches your internet-connected machine. It stays safely locked away on the device.

A cold wallet creates an "air gap" between your private keys and the online world. This physical separation is the gold standard for protecting large amounts of cryptocurrency from digital threats like hacking and malware.

Industry leaders like Ledger and Trezor have built their entire reputation on creating these digital fortresses. Because they offer such powerful protection, they're the top choice for long-term investors ("hodlers") and anyone storing crypto they don't plan on touching for a while. To get a better sense of how these gadgets work, take a look at our guide on what hardware wallets are and how they work.

Creating A Hybrid Strategy For The Best Results

You don't have to pick just one. In fact, the smartest and most common approach is a hybrid one, using both hot and cold wallets for what they do best. It truly gives you the best of both worlds.

Here’s a practical way to set it up:

- Use a Hot Wallet for Daily Use: Keep a smaller, spendable amount of crypto in a mobile or web wallet. This is your "checking account" for quick trades, online shopping, or interacting with decentralized apps (dApps).

- Use a Cold Wallet for Long-Term Savings: Store the vast majority of your assets—your "savings account"—on a secure hardware wallet. Tuck it away somewhere safe, just as you would with any other valuable.

By splitting your funds this way, you dramatically limit your risk. In a worst-case scenario where your hot wallet gets compromised, the bulk of your portfolio remains untouched and completely secure in offline storage. This balanced approach gives you both the flexibility you need for today and the peace of mind you deserve for tomorrow.

Choosing The Right Type Of Crypto Wallet For You

Now that we’ve covered the big picture—custodial vs. non-custodial and hot vs. cold—let's get into the specifics. Picking the right wallet isn't just about technology; it's about matching the tool to your habits and how much risk you're comfortable with. Each wallet type is built for a different purpose, whether you're trading daily or holding for the long haul.

Think of this as a tour through the different options out there. We’ll look at what each one does best and who it's really for, so you can find the perfect fit for your personal crypto or business needs.

Software Wallets For Everyday Access

Software wallets are exactly what they sound like: applications you run on your computer or phone. Because they're always connected to the internet, they fall squarely in the hot wallet category, making them the perfect choice for quick, convenient access to your funds.

Desktop Wallets: These programs are installed right on your PC or Mac. They strike a great balance between easy-to-use features and solid security, often giving you a deeper level of control than other software options. They’re a fantastic choice if you do most of your crypto management from a single, trusted computer.

Mobile Wallets: These are smartphone apps designed for life on the move. Features like QR code scanning make them ideal for paying for things in person. If you envision using crypto like you use a debit card, a mobile wallet is pretty much essential.

Web Wallets (Browser Extensions): Living right inside your web browser, these wallets are your gateway to the world of decentralized applications (dApps) and DeFi. They make interacting with blockchain platforms incredibly smooth, removing a ton of friction.

This simple breakdown helps visualize the trade-off you're making.

It really boils down to this: hot wallets are for spending and active use, while cold wallets are for saving and securing.

Hardware Wallets: The Ultimate Security Fortress

If you’re serious about protecting a significant amount of crypto, a hardware wallet is a must-have. These are small physical devices that keep your private keys completely offline, building a virtual fortress that’s safe from online threats like malware or phishing attacks.

Here’s how it works: when you want to send crypto, you plug the device into your computer. The transaction itself is signed inside the hardware wallet's secure chip. This is the critical part—your private key never actually touches your internet-connected computer. It's the highest level of security you can get without being a security professional.

A hardware wallet is like a digital vault. It creates an "air gap"—a physical barrier—between your keys and the online world, shutting down the most common ways thieves try to steal crypto from software wallets.

This push for stronger security isn't just a niche idea; it’s a major industry trend. In fact, roughly 45% of new crypto wallet releases have incorporated advanced security features modeled after hardware wallets. This shows a clear demand for solutions that are both safer and easier to use. You can even explore the latest crypto wallet market trends to see how the space is evolving.

Multisig Wallets For Shared Control

A multisignature—or "multisig"—wallet takes security a step further by requiring more than one key to sign off on a transaction. Think of it as a joint bank account that needs both partners' signatures, or a high-security safe that needs two separate keys to be turned at the same time.

For example, a common setup is a "2-of-3" multisig wallet. This wallet is controlled by three different private keys, but you only need any two of them to approve a transaction. This is incredibly powerful for a few reasons:

- Businesses: A company can give keys to different partners or executives. This prevents any single person from running off with the company's funds.

- Personal Security: You can store your keys in separate, secure locations. If a thief finds one, it's useless without the second key, keeping your assets safe.

Paper Wallets: The Original Cold Storage

A paper wallet is one of the first and simplest forms of cold storage. It’s a physical piece of paper with your public and private keys printed on it, often as QR codes that can be scanned. Because it’s just paper, it's completely offline and immune to digital hacking.

But that simplicity comes with its own set of dangers. Paper wallets are fragile; they can be destroyed by fire or water, fade over time, or simply be thrown away by accident. If you lose that piece of paper, your funds are gone for good. While they had their moment in the early days of crypto, today's hardware wallets are a far more reliable and recommended standard for offline security.

Essential Best Practices For Wallet Security

Knowing the difference between wallet types is one thing, but truly protecting your assets comes down to how you secure them. It helps to think of your crypto wallet less like a traditional wallet and more like a digital safe. You hold the only keys, which means you are 100% responsible for its security. This is the core principle of self-custody.

As crypto goes mainstream, this responsibility becomes more critical than ever. Around 28% of American adults—that's roughly 65 million people—now own some form of cryptocurrency. With such a massive user base, solid security habits are the only thing standing between you and a potential loss. If you're interested, you can dive deeper into the latest cryptocurrency consumer trends to see just how fast this space is growing.

Guard Your Seed Phrase Like Buried Treasure

The absolute cornerstone of your wallet's security is its seed phrase, sometimes called a recovery phrase. This is just a list of 12 to 24 words that acts as the master key to everything in your wallet. If your phone gets destroyed or your hardware wallet goes missing, this phrase is the only way you'll ever see your funds again.

Protecting it should be your number one priority. No excuses.

- Write It Down On Paper: The moment you get your phrase, write it down with a pen on a physical piece of paper. Don't even think about typing it into a computer.

- Store It Offline And Securely: Hide that piece of paper somewhere safe and private. Think fireproof safes or bank deposit boxes.

- Never Make a Digital Copy: This is a hard and fast rule. Do not take a photo of it, save it in a notes app, or store it in a password manager. Digital copies are a hacker's dream.

- Create Multiple Backups: Make two or three physical copies and store them in completely different secure locations. This protects you if one location is compromised by something like a fire or flood.

Your seed phrase is the ultimate failsafe for your crypto assets. Anyone who gets access to it can clone your wallet and steal everything. Treat it with the same level of seriousness as you would the deed to your house.

Bolster Your Everyday Digital Defenses

Beyond the seed phrase, your daily digital habits are your next line of defense. Scammers are always cooking up new ways to trick people, so building strong security layers is vital for keeping your funds safe from day-to-day threats.

Here's a quick checklist to keep you on the right track:

- Use Strong, Unique Passwords: Your wallet app needs its own complex password that you don't use anywhere else. Mix uppercase and lowercase letters, numbers, and symbols to make it tough to crack.

- Enable Two-Factor Authentication (2FA): If your wallet or exchange offers 2FA, turn it on immediately. It adds a crucial second layer of security by requiring a code from your phone to approve actions.

- Beware of Phishing Scams: Get used to being skeptical. Don't trust unsolicited emails, DMs, or links that promise free crypto or ask for your wallet details. Scammers are masters at creating fake websites that look just like the real thing.

- Verify Everything: Before you hit "send" on a transaction, triple-check the recipient's wallet address. Blockchain transactions are final. One wrong character can send your funds into a digital black hole forever.

- Upgrade to Hardware for Large Holdings: If you're holding an amount of crypto you couldn't stand to lose, a hardware wallet is a non-negotiable upgrade. It keeps your private keys completely offline, making them virtually immune to online hacks.

How Businesses Are Using Crypto Wallets for Real-World Payments

When most people think of crypto wallets, they picture individual investors. But that’s just one side of the story. For businesses, crypto wallets are a gateway to a fundamentally better way of managing money.

By setting up a wallet infrastructure, companies can break free from the slow, expensive, and often frustrating world of traditional banking. It's about unlocking a truly global and efficient way to handle payments.

Think about e-commerce. A merchant can accept a payment from a customer on the other side of the world without worrying about currency conversions, painful card processing fees, or cross-border settlement delays. A shopper in Japan can pay a business in Brazil as easily as if they lived next door. The funds arrive in minutes, not days, opening up entirely new markets.

But it's not just about getting paid. Businesses are also using crypto wallets to fix their own internal financial headaches, especially when it comes to paying a global workforce.

Streamlining Global Payouts and Operations

Paying international contractors, freelancers, and suppliers has always been a logistical nightmare. Traditional wire transfers are sluggish, costly, and force you to navigate a maze of banking rules for every single country. This is where a business-focused crypto wallet system completely changes the game.

Instead of processing payments one by one, a company can execute mass payouts to hundreds of people worldwide in a single, automated batch. These transactions settle quickly, have tiny fees, and completely bypass the slow-moving banks in the middle. The result? A massive reduction in administrative work and happy contractors who get paid on time, every time.

Here's what that looks like in practice:

- Drastically Lower Costs: Say goodbye to the high fees that come with international wires and currency exchange.

- Lightning-Fast Settlement: Payments are confirmed on the blockchain in minutes, a world away from the 3-5 business days of the old system.

- Effortless Global Reach: You can pay people in any country with an internet connection, effectively removing banking borders.

The Critical Role of Stablecoins for Business

The benefits are obvious, but one major hurdle has always been crypto's notorious price swings. No company wants to accept a payment only to see its value drop 10% an hour later. This is precisely the problem that stablecoins were created to solve.

Stablecoins are a special type of cryptocurrency pegged to a stable asset, usually the U.S. dollar. They give you the best of both worlds: the speed and low cost of crypto, with the familiar stability of traditional money. For businesses, they are an absolute necessity.

Stablecoins have become the backbone of business transactions on the blockchain. They allow merchants to benefit from crypto's efficiency without being exposed to its price volatility, making digital currency a practical tool for everyday commerce.

You just have to look at the numbers to see their impact. Stablecoins now make up a staggering 30% of all on-chain crypto transaction volume. In a single recent month, USD 772 billion in stablecoin transactions were settled on the Ethereum and Tron blockchains alone. This shows just how dominant they've become in driving real-world economic activity. You can dig into more data on this trend in the latest stablecoin usage report from TRM Labs.

Integrating Wallets with Payment Gateways

Let's be realistic—most businesses don't have the time or resources to build a secure crypto payment system from scratch. That's where crypto payment gateways like BlockBee come in. These platforms provide all the necessary infrastructure, including secure wallet management, and offer simple plugins for popular e-commerce platforms like WooCommerce and Magento.

By integrating a gateway, a merchant can start accepting crypto payments almost instantly, without needing a deep understanding of blockchain technology. The gateway handles all the heavy lifting—detecting payments, confirming transactions, and routing the funds securely—so businesses can stay focused on what they do best. It’s the essential bridge connecting a traditional online store to the new digital economy.

Your Top Questions About Crypto Wallets, Answered

Once you get the hang of the basics, you'll naturally start having more specific questions. Let's tackle some of the most common ones to help you handle your crypto with more confidence.

Can I Have More Than One Crypto Wallet?

Absolutely. In fact, it’s a smart move. Think of it like having both a checking account and a savings account.

Many seasoned crypto users keep a "hot" software wallet on their phone for small, everyday spending and a separate "cold" hardware wallet tucked away for their long-term investments. This strategy is great for managing risk—if something happens to your "spending" wallet, your main stash remains untouched and secure.

What if I Lose My Hardware Wallet or Someone Steals It?

Don't panic—your crypto is safe! This is a common fear, but it's based on a misunderstanding. Your assets aren't actually on the physical device; they live on the blockchain.

The hardware wallet is just the key. As long as you have your secret recovery phrase written down and stored securely, you can simply get a new hardware wallet, enter your phrase, and regain full access to all of your funds. This is why we can't stress it enough: guard that recovery phrase with your life.

Getting these concepts down is a huge step. If you want to dive deeper into the terminology of the wider crypto space, a good Web3 Dictionary can be a fantastic resource for building out your knowledge.

Who Actually Decides the Transaction Fees?

This is a great question. Your wallet provider doesn't set the transaction fees, often called "gas fees" on networks like Ethereum.

Those fees go directly to the people (miners or validators) who run the computers that process and confirm your transaction on the blockchain. The fee amount fluctuates based on pure supply and demand—the busier the network, the higher the fee. Most wallets today will suggest a competitive fee and usually give you options: pay less and wait a bit longer, or pay a little more to have your transaction confirmed faster.

Ready to bring secure, multi-currency payments to your business? BlockBee offers a non-custodial payment gateway that makes crypto easy, from customer checkouts to mass payouts. Best of all, you always stay in complete control of your funds. Learn more and get started at https://blockbee.io.