Crypto Bank Account Guide Your Key to Modern Digital Finance

So, what exactly is a “crypto bank account”?

It’s not quite a bank account in the traditional sense. Instead, think of it as a financial hub that merges the world of digital wallets with the familiar services you’d expect from a bank. It’s like a universal travel adapter for your money, letting you connect your everyday currency (like US Dollars) with digital currencies (like Bitcoin). This setup allows you to hold, send, and receive assets all over the world, making it much easier for businesses to plug into the blockchain economy.

Bridging Two Financial Worlds

A crypto bank account serves as that crucial bridge between government-issued fiat currency and decentralized digital assets. It offers an interface that feels a lot like your standard online banking portal but is powered by the speed and borderless nature of crypto.

The best way to get a handle on this is to see how different it is from the traditional bank account opening process. Instead of just holding dollars or euros, these accounts are built to manage a whole portfolio of digital assets. They take complicated blockchain interactions and make them simple, so businesses can accept crypto payments, manage their funds, and send payouts without needing a team of blockchain experts. This ease of use is a huge reason they’re catching on.

At its core, a crypto bank account changes the way businesses deal with money. It tears down the old walls of geography and time, enabling instant, 24/7 value transfer across borders with far less hassle than the old-school financial system.

To give you a clearer picture, let's compare the two side-by-side.

Crypto Bank Account vs Traditional Bank Account

This table breaks down the key differences and similarities between traditional and crypto banking services.

| Feature | Traditional Bank Account | Crypto Bank Account |

|---|---|---|

| Asset Types | Holds government-issued fiat currency (USD, EUR, etc.). | Holds both fiat currency and digital assets (BTC, ETH, stablecoins). |

| Accessibility | Typically restricted by geography and banking hours. | Global, 24/7 access. Transactions are borderless. |

| Transaction Speed | Cross-border payments can take several business days to settle. | Transactions often settle in minutes, regardless of location. |

| Intermediaries | Relies on a network of correspondent banks for international transfers. | Uses decentralized blockchain networks, often with fewer intermediaries. |

| Fees | Can have high fees for wire transfers, currency conversion, and maintenance. | Generally lower transaction fees, especially for cross-border payments. |

| Security | Protected by government insurance (e.g., FDIC) up to a certain limit. | Security relies on cryptography and user responsibility (private keys). Custodial services may offer insurance. |

| Account Control | The bank has ultimate control over your funds and can freeze assets. | Varies: Non-custodial accounts give you full control. Custodial accounts are managed by a third party. |

While they serve different purposes, the goal of a crypto bank account is to offer the best of both worlds: the reliability and familiarity of banking with the efficiency and global reach of crypto.

Why Are These Accounts Gaining Traction?

The rise of the crypto bank account is a direct result of the incredible growth in digital asset adoption. As more people and companies start using cryptocurrencies for everything from investing to everyday transactions, the need for better financial tools has skyrocketed.

The numbers tell the story. Around 6.8% of the world's population now owns some form of cryptocurrency. In the past year alone, North America and Europe saw massive transaction volumes, hitting over $2.2 trillion and $2.6 trillion, respectively. That kind of capital movement requires a whole new financial backbone to support it.

For a business, this is about more than just adding another payment option. It's about tapping into a new, fast-growing global market. Here’s what these accounts bring to the table:

- Global Reach: Do business with customers, suppliers, and partners anywhere on the planet, instantly.

- Reduced Fees: Skip the steep intermediary fees that come with traditional international payments.

- Faster Settlement: Get your money in minutes, not days. This dramatically improves cash flow and keeps your business moving fast.

- Asset Diversification: Hold and manage both fiat and crypto in one place—a must-have for modern treasury management.

Custodial vs. Non-Custodial: The Great Divide

When you start exploring crypto bank accounts, you’ll quickly run into a critical decision that defines who actually controls your money. It all comes down to a single concept: custody. Getting your head around the difference between custodial and non-custodial solutions is the most important step you can take, as it shapes your control, your responsibilities, and your security.

Think of it like this: a custodial account is like keeping your valuables in a safe deposit box at a bank. The bank holds everything for you, and they have the master key. It's convenient, sure, and you don't have to worry about losing the key. But it means you have to place 100% trust in that bank's security measures and its ethical conduct.

On the other hand, a non-custodial solution is like having a high-security safe installed in your own home. You—and only you—have the combination. This gives you total control over your assets. The flip side? You're completely responsible for that combination. If you lose it, there’s no locksmith who can get you back in.

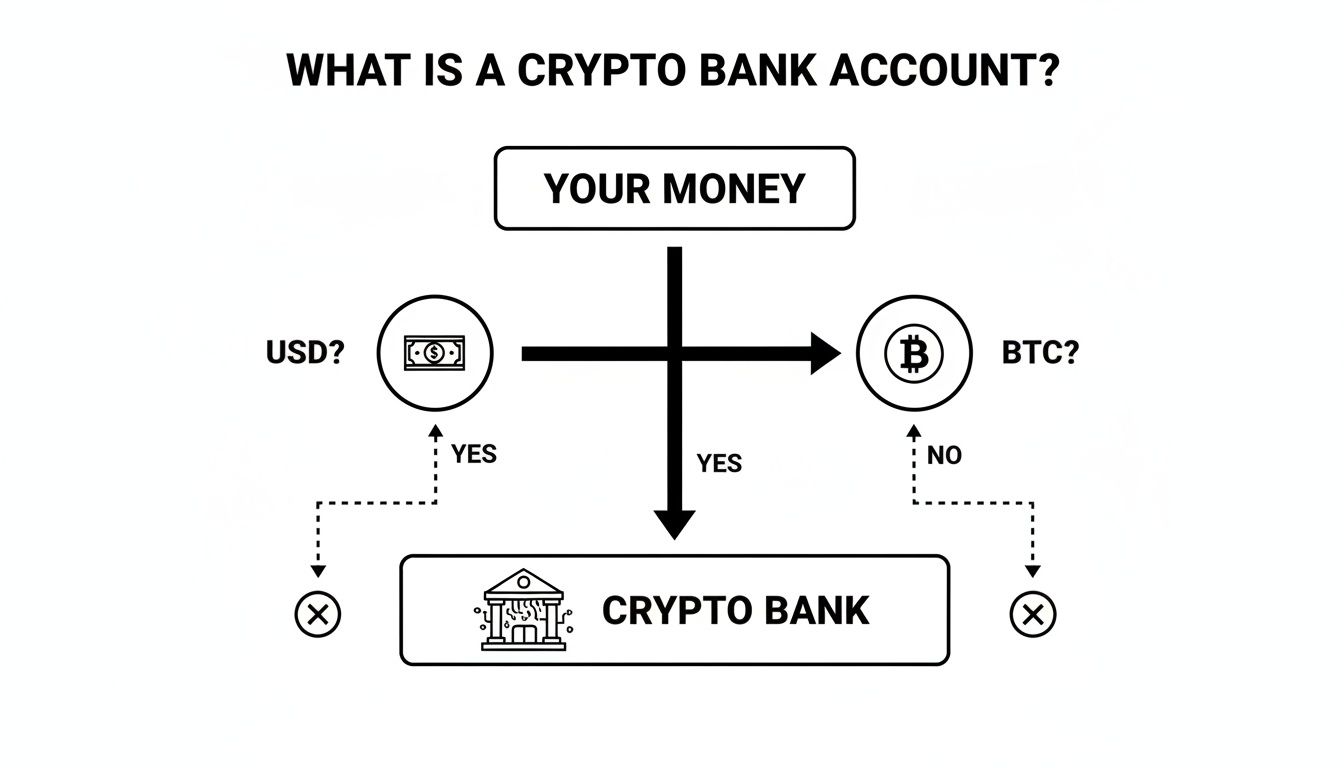

This diagram helps visualize how a crypto-friendly bank often acts as a bridge between traditional money and digital assets.

The image shows that while a bank might handle your US dollars, the way it interacts with something like Bitcoin hinges entirely on the custody model you choose.

The Custodial Model: Convenience and Trust

Custodial crypto accounts are the go-to for most newcomers and even many large institutions. They're what you typically get from big, centralized exchanges and crypto neobanks. Their main draw is simplicity. You log in with a familiar username and password, and if you forget it, there's usually a "Forgot Password" link to save the day.

But that convenience comes at a steep price. You aren't actually holding your own crypto. Instead, the provider is holding the private keys for you. This means you're trusting them to:

- Protect your funds from hackers, scammers, and internal fraud.

- Stay in business and not dip into customer funds.

- Let you withdraw your money anytime you ask, without excuses or delays.

While many reputable platforms do a great job, history is littered with cautionary tales. The sudden collapse of major exchanges has left customers with billions of dollars in funds either lost forever or tied up in years-long bankruptcy proceedings.

The Non-Custodial Model: Control and Responsibility

Non-custodial solutions put you firmly in control. You hold and manage your own private keys—the string of cryptographic code that proves you own your assets on the blockchain. This model is the heart and soul of decentralization, captured perfectly by the crypto mantra: "not your keys, not your coins."

With a non-custodial setup, no third party can freeze your account, seize your funds, or lose them in a hack. This absolute ownership, or sovereignty, is a game-changer for businesses needing full command over their treasury and payment systems. It completely removes counterparty risk, which is a constant worry with custodial services.

The real power of non-custodial finance is asset sovereignty. When a business uses a non-custodial payment gateway like BlockBee, every single payment from a customer lands directly in a wallet that only the business controls. No middleman ever touches the funds.

Of course, this level of control demands an equal level of responsibility. If you lose your private keys or the recovery phrase that backs them up, your funds are gone for good. There's no customer service number to call and ask for a reset. For a much deeper dive, you can learn more about the nuances of different crypto custody solutions and what they mean for a business.

Making the Right Choice for Your Business

The custodial vs. non-custodial debate isn't about which one is universally "better." It's about which one is the right fit for your business's specific needs, risk appetite, and technical capabilities.

- A custodial account might work if: You need convenience above all else, want a simple interface for frequent trading, and are comfortable entrusting a well-regulated third party with your security.

- A non-custodial solution is often best if: You demand absolute control, want to eliminate any risk from a third-party failure, and have solid internal procedures for managing keys securely.

Many businesses find a hybrid approach is the most practical solution. They might use custodial services for short-term trading while relying on non-custodial wallets for long-term treasury storage and direct, peer-to-peer payment processing.

Finding Your Fit: A Guide to Crypto Banking Solutions

Once you get your head around the difference between custodial and non-custodial options, the whole world of crypto finance starts to click. The term "crypto bank account" isn't a single thing; it’s an umbrella for a whole range of services, each built for a specific purpose.

Think of it like choosing a car. You wouldn't take a Formula 1 car on a family road trip, and you wouldn't enter a minivan in a Grand Prix. The right financial tool depends entirely on what you want to achieve. The crypto ecosystem has three main flavors, ranging from the very centralized and familiar to the completely decentralized and self-managed. Let's break them down.

Centralized Crypto Exchanges

For most people, a centralized exchange like Coinbase or Binance is their first taste of crypto. These platforms work a lot like a stock brokerage. You sign up, fund your account, and can start buying, selling, or trading all sorts of digital currencies. They're designed to be intuitive, which makes them a great starting point for beginners or active traders.

For a business, they offer a straightforward, custodial way to accept crypto and swap it for cash.

- Simple to Use: The user interface hides all the complicated blockchain stuff, making it feel just like any other online service.

- Deep Liquidity: These are the biggest players in the market, so it’s easy to cash out large amounts of crypto into traditional currency without a fuss.

- All-in-One Services: Many bundle in extra features like staking, lending, and even debit cards, turning them into a one-stop shop for your crypto needs.

Of course, the big trade-off is the custodial risk we talked about. You’re handing over control of your funds to the exchange, and these platforms are a massive, tempting target for hackers.

Dedicated Crypto Neobanks

The next step up from a basic exchange is the crypto neobank. These are digital-first financial institutions that try to merge the best of traditional banking with crypto-native features. Their goal is to be the bridge between the old and new financial systems, offering things you just can't get at a normal bank or a simple exchange.

Crypto neobanks are really pushing what a crypto bank account can be. You'll often find FDIC-insured cash accounts sitting right alongside crypto wallets, crypto-backed loans, and high-yield savings products powered by digital assets.

These are a solid choice for businesses that want to weave crypto deeper into their finances but don’t want the headache of managing their own keys. The catch? They are almost always custodial, which means you're still trusting their security and hoping they stay in business.

Non-Custodial Wallets and DeFi Protocols

On the other end of the spectrum, you have the world of true self-sovereign finance. With non-custodial wallets (think MetaMask or Trust Wallet) and Decentralized Finance (DeFi) protocols, you have absolute control over your assets. You are your own bank. No middlemen, no single point of failure, and no one can ever freeze your funds.

This approach offers the ultimate in financial freedom and security, but it comes with a much steeper learning curve and total responsibility for your assets. The rise of stablecoins has been a game-changer here, making blockchain payments a practical tool for everyday business. Just look at the numbers: the stablecoin supply exploded from a mere $5 billion five years ago to over $305 billion, with recent transaction volumes soaring past $32 trillion globally. This growth has turned non-custodial payment flows into a real competitor for traditional payment rails.

Thinking through these different financial solutions shares some common ground with a process like opening an offshore company and bank account, as both require a deep dive into regulatory rules and asset control. For a business, using a non-custodial gateway means every single payment lands directly in a wallet you control, completely eliminating counterparty risk.

Putting Your Crypto Bank Account to Work

Alright, let's move past the theory. A crypto bank account is so much more than just a digital vault for your coins. For any business operating today, it's a powerful tool that can sharpen your competitive edge, unlock new markets, and seriously boost efficiency.

We're going to walk through three of the most impactful ways real companies are using these accounts to fundamentally change how they do business.

Each of these examples tackles a major headache from the old-school financial world, from painfully slow international payments to treasury strategies that just don't cut it anymore.

Accept Global Payments Without the Friction

Picture this: you run an e-commerce store, and a potential customer in Japan tries to buy your product. Their card gets declined for some vague cross-border reason. Another customer in Brazil sees the price jump after hefty currency conversion fees and abandons their cart. Sound familiar? These are the kinds of everyday problems that silently kill sales.

A crypto bank account, especially one hooked up to a non-custodial payment gateway, cuts right through that mess. The moment you start accepting currencies like Bitcoin, Ethereum, or stablecoins, you’ve effectively opened your doors to anyone on the planet with an internet connection.

Here’s what that looks like in the real world:

- Truly Borderless Sales: Payments fly directly from your customer’s wallet to yours. No more navigating the slow, tangled web of correspondent banks.

- Lower Fees, Higher Margins: Forget the typical 2-4% credit card processing fees, not to mention currency exchange markups. Crypto transaction costs are a different ballgame—often much, much lower.

- Money in Your Pocket, Faster: Funds settle on the blockchain within minutes, not the 3-5 business days it takes for a standard bank transfer. This is a game-changer for your cash flow.

This isn’t just a futuristic idea. Smart businesses are already adding crypto payment options to tap into a huge global market that traditional finance often leaves behind.

Streamline Global Payouts and Payroll

Now, let's flip the script. Your company depends on a global team of freelancers—developers, designers, and marketers scattered across different continents. Paying them every month is a logistical nightmare of wire transfers, endless bank detail forms, high fees, and frustrating delays.

This is exactly where a crypto bank account shines, particularly when you use stablecoins like USDC or USDT. These are digital currencies pegged 1:1 to something like the U.S. dollar, giving you the best of both worlds: the stability of fiat money with the speed of crypto.

Using stablecoins for payouts is like sending a digital dollar bill straight to someone's inbox. The value doesn't fluctuate wildly, the transfer is almost instant, and the cost is a tiny fraction of a wire transfer.

Think about it. A company can process payroll for dozens of international contractors in one go. Every single person gets paid in minutes, no matter where they are or what their local banking system is like. It's a massive boost for morale and it radically simplifies your accounting. The same logic applies to paying international suppliers, making your supply chain faster and more reliable.

Modernize Your Corporate Treasury

Finally, let's talk about managing your company's cash reserves. The traditional playbook is to let your funds sit in a corporate bank account, earning next to nothing while inflation slowly eats away at their value. Digital assets open up a whole new set of strategies.

A more modern approach to treasury could involve:

- Hedging Against Inflation: Some companies are allocating a small portion of their reserves to assets like Bitcoin, viewing it as a long-term digital store of value.

- Putting Idle Cash to Work: You can convert idle cash into stablecoins and lend them through regulated DeFi protocols, often earning yields that make traditional savings accounts look like a joke.

- Unlocking 24/7 Liquidity: Funds held as digital assets are always accessible. This means you can move capital instantly to jump on an opportunity or cover an unexpected cost, without ever having to wait for the bank to open.

This definitely requires a smart approach to risk management, but it marks a huge shift in how businesses can actively grow their financial resources. Of course, a crucial part of this strategy is knowing how to bridge the gap back to the traditional world. For businesses integrating these systems, figuring out how to easily move funds from a crypto wallet back to a bank account is the final piece of the puzzle.

How to Choose the Right Crypto Banking Solution

Picking the right partner to handle your company's digital assets is a huge decision. There’s no single "best" crypto bank account—the right choice really depends on how your business operates, what level of risk you're comfortable with, and how much technical heavy lifting you can handle. Getting this right means carefully weighing a few key factors that separate the solid providers from the shaky ones.

To help you out, I've put together a practical framework. Think of it as your checklist for making a smart, informed decision.

Walking through these points will give you the confidence that you're choosing a service that not only works for you today but can also grow with you tomorrow.

Security and Custody Standards

First things first: security is everything. Before you even think about features, you need to dig into how a provider actually protects your funds. This is especially true for custodial services, where you're handing over control to someone else.

- Custody Technology: Are they using the right tools for the job? Look for things like multi-signature wallets and cold storage for the bulk of their assets. These are the industry standards for preventing hacks.

- Insurance Coverage: What happens if the worst-case scenario occurs and they get breached? Ask if they have an insurance policy that covers theft. Make sure you understand the fine print—what’s covered, and more importantly, what isn't.

- Audit History: Have they had their security checked by reputable third-party firms? Regular, transparent security audits are a great sign that they take protecting your money seriously.

If you’re leaning towards a non-custodial solution, your focus shifts a bit. The main advantage is that you're in charge of your own keys, which cuts out that third-party risk. Here, the security of the software itself is what matters most.

Regulatory Compliance and Licensing

The Wild West days of crypto are fading. The regulatory landscape is getting more defined, and you absolutely want a partner who plays by the rules. Sticking with a compliant provider protects your business from sudden shutdowns and legal messes down the road.

As the rules of the road have become clearer, big institutions have jumped in. A recent global review found that financial institutions in roughly 80% of countries have started digital asset projects—a massive change from just a few years ago. This just goes to show how important compliance has become. You can dig deeper into this trend in the TRM Labs Global Crypto Policy Review.

When you're sizing up a provider, check their licenses and how seriously they take Know Your Customer (KYC) and Anti-Money Laundering (AML) rules. Any platform that seems to be cutting corners on compliance is a major red flag.

Fees and Integration Capabilities

Finally, let's get practical. A solution can be secure and compliant, but if it costs a fortune or is a pain to use, it's not the right fit. You need to look at the bottom line and how easily it will plug into your current workflow.

Get a clear picture of the entire fee structure:

- Transaction Fees: How much does it cost to send and receive payments?

- Withdrawal Fees: Are there fees for cashing out to fiat currency or moving crypto off the platform?

- Network Fees: How do they handle blockchain gas fees? Are they passed directly to you, or are they baked into other charges?

Beyond the costs, check out their integration options. A good crypto payment solution should play nicely with the systems you already use. Look for clear API documentation, pre-built plugins for e-commerce platforms like WooCommerce or Magento, and a support team that can actually help your developers get everything hooked up.

Setting Up Non-Custodial Payments for Your Business

For businesses that put a premium on financial self-reliance, going non-custodial isn't just a feature—it's a core operating principle. This approach guarantees that you, and only you, control your funds the moment a customer pays. It completely sidesteps the risk of a third-party freezing your account or a platform going under with your money.

Making the switch to a non-custodial model is a lot more straightforward than you might think. With a crypto payment gateway like BlockBee, you can plug this secure payment flow right into your e-commerce store or custom app. It essentially creates a direct, private bridge between your customer's wallet and yours, cutting out the middlemen.

The Non-Custodial Payment Workflow

The entire process is built for simplicity and security. It gives merchants total command over their revenue without needing to be a blockchain expert.

Here’s a quick look at how a typical transaction unfolds:

- Customer Chooses Crypto: At your checkout, the customer picks their preferred crypto from the list you offer.

- Invoice Generation: The gateway instantly generates a unique invoice with a one-time wallet address for that specific payment.

- Blockchain Verification: Once the customer sends the funds, the gateway watches the blockchain for the necessary confirmations to validate the transaction.

- Direct Deposit: After confirmation, the payment lands directly in your company’s non-custodial wallet. The funds never touch a third-party account.

This direct-to-wallet model is the whole point. Think of it as the digital version of a customer handing you cash. There are no settlement delays and no intermediary holding your revenue, which dramatically improves your cash flow and kills counterparty risk.

This dashboard view gives you a clear picture of how these direct transactions are tracked.

The key takeaway here is the real-time visibility and control this gives you over your incoming crypto.

Tangible Benefits of Taking Control

When you implement a system where you hold your own keys, you gain some serious operational advantages. It’s a shift away from depending on custodial platforms and toward a much more robust financial setup.

First and foremost, you get complete asset sovereignty. Your funds are yours. Full stop. This is a game-changer for treasury management and protecting your business from external threats. To get a better handle on the mechanics behind this, our guide on non-custodial crypto wallets breaks it all down.

Second, the fees are significantly lower. By cutting out the layers of intermediaries who all want a piece of the action, transaction costs are often just a fraction of what you’d pay with traditional processors. That savings goes straight to your bottom line, making every single sale more profitable. This blend of security, control, and savings makes setting up direct crypto payments a smart and accessible move for any modern business.

Got Questions About Crypto Bank Accounts? We've Got Answers.

Jumping into the world of crypto finance can feel like learning a new language. You're not alone. Here, we'll tackle some of the most common questions that pop up when businesses start thinking about using a crypto bank account.

Is My Money Actually Safe in a Crypto Bank Account?

That’s the big question, and the answer comes down to one thing: who holds the keys?

With a custodial account, you’re trusting the provider to keep your funds secure, just like you trust a traditional bank. The best ones have robust security systems, insurance policies, and a proven track record of protecting their users' assets. You're essentially outsourcing your security to them.

On the other hand, non-custodial accounts put you in the driver's seat. You control the private keys. This can be incredibly secure—no one can access your funds without them. But it comes with a huge responsibility: lose those keys, and your money is gone forever. There's no "forgot my password" link to click.

Are These Accounts Regulated Like Normal Banks?

Not exactly. The regulatory landscape for crypto is still a patchwork that changes from one country to the next.

Most custodial platforms are regulated as money service businesses, which means they have to follow strict Know Your Customer (KYC) and Anti-Money Laundering (AML) rules. But they almost never have the kind of government deposit insurance (like the FDIC in the U.S.) that backs your traditional bank account.

Non-custodial solutions are a different beast entirely. Since you're acting as your own bank, they fall outside that specific regulatory structure. No matter which route you take, it’s on you to check a provider’s licensing and compliance in your area.

The bottom line is this: while the crypto industry is growing up fast, the regulatory safety nets you're used to with traditional banking just aren't the same. Doing your own homework isn't just a good idea—it's essential.

Can I Actually Use This for Day-to-Day Business Expenses?

Absolutely, and it's getting easier all the time. Many crypto financial platforms now issue crypto debit cards.

Here’s how they work: when you swipe the card or make an online purchase, the platform instantly converts the right amount of your crypto into the local currency—dollars, euros, you name it.

This little piece of plastic bridges the gap between your digital assets and the real world, letting you spend your crypto at any merchant that accepts standard debit or credit cards. It makes your crypto holdings genuinely useful for everyday transactions.

What Happens If I Lose My Private Keys?

This is where the difference between custodial and non-custodial becomes crystal clear.

If you’re using a non-custodial wallet, losing your private keys or your seed phrase is a catastrophic event. It means your funds are permanently and irreversibly lost. There is no recovery process, no customer support to call, and no one who can help you get them back.

With a custodial account, you don't even have the private keys to lose. The provider manages them for you. If you get locked out of your account, you just follow their standard recovery procedure, much like you would with your email or any other online service.

Ready to take full control of your business's crypto payments? With BlockBee, you can set up a secure, non-custodial payment system that sends funds directly to your wallet, eliminating middlemen and reducing fees. Explore BlockBee's features today.