Cold storage crypto: Master Safe, Offline Wallet Security

When we talk about cold storage crypto, we're talking about the practice of keeping your cryptocurrency's private keys completely and totally offline. Think of it less like a wallet in your pocket and more like a high-security vault. It’s the ultimate defense against online threats like hacks and phishing scams.

Why Cold Storage Is the Gold Standard for Crypto Security

Let's use a simple analogy. A retail store keeps a small amount of cash in the register for daily business. That’s a “hot wallet”—it’s online, connected, and ready to transact, but it’s also exposed. The bulk of the store's money, however, is locked away in a safe overnight. That safe is your cold storage crypto.

This simple separation is the most critical principle in managing digital assets. Any funds with private keys stored on an internet-connected device are constantly at risk. For a business handling significant crypto balances—whether an online store accepting payments or a platform managing user funds—leaving everything in a hot wallet is like leaving the vault door wide open.

Building Your Digital Fortress

Securing your company’s treasury isn't just an IT problem; it's a core business function. By adopting an offline-first strategy for your main reserves, you shrink the potential "attack surface" for hackers down to almost nothing. Keeping the vast majority of your funds in cold storage creates a powerful firewall between your day-to-day operational funds and your long-term capital.

This strategy pays off immediately in several ways:

- Massively Reduces Hacking Risk: If private keys never touch the internet, they can't be stolen by a remote attacker. It's that simple.

- Gives You Full Control: You have complete sovereignty over your crypto, without relying on the security of a third-party exchange or custodian.

- Strengthens Corporate Governance: Having a formal cold storage policy isn't just good practice; it builds immense trust with your customers, partners, and investors.

The concept is beautifully straightforward: an online thief cannot steal a key that isn't online. This is the bedrock principle that institutional-grade crypto security is built upon.

A Non-Negotiable for Modern Business

For any merchant, developer, or finance team in the crypto space, cold storage isn't just a "nice-to-have." It’s your primary defense against a catastrophic, company-ending loss. As your business and transaction volumes grow, so does the pot of gold at the end of the rainbow for potential attackers.

A well-designed cold storage strategy allows your business to function smoothly without putting its core financial assets on the front line. This guide will walk you through it all, from the different types of cold wallets to the nitty-gritty of integrating them into your payment and treasury workflows. You'll learn how to build a secure, self-custodial system that protects your digital assets for the long haul.

Understanding the Fundamentals of Cold Storage

At its heart, cold storage crypto is built on one incredibly simple yet powerful idea: your private keys never, ever touch the internet. This isn't about some fancy software. It's about creating a physical air gap—an unbreakable barrier between your most valuable assets and the online world.

Let's cut through the jargon with an analogy.

Think of a hot wallet like the debit card you keep in your pocket. It’s perfect for grabbing coffee and making daily purchases—convenient, but you wouldn’t keep your life savings tied to it. If you lose it, you’re in trouble.

A cold storage wallet is like the original deed to your house. It’s the ultimate proof of ownership, tucked away in a bank's safe deposit box. You’d never carry it around town. You only access it when you absolutely have to, for the most important transactions, like selling the property. That’s the fundamental difference.

Shrinking Your Digital Attack Surface

In security, the term "attack surface" refers to all the different points a hacker could use to break into a system. For a hot wallet, this surface is huge. It includes the phone or computer it’s on, the Wi-Fi network you’re using, and the wallet software itself. A single weak link in that chain can mean a total loss of funds.

Cold storage shrinks this attack surface down to almost nothing.

By taking the private keys completely offline, you eliminate all remote entry points. A thief on the other side of the world simply can't hack a piece of hardware locked in a physical vault. This is why offline isolation is the bedrock of any serious crypto security plan.

The industry learned this the hard way. Cold storage wasn't just a clever idea; it was a necessary reaction to catastrophic losses. Analysts estimate that between 2011 and 2020, over $10 billion was stolen from online wallets and exchanges. Hacks like the infamous Mt. Gox collapse and the $500 million Coincheck heist proved that leaving large sums online was a recipe for disaster. As the crypto market grew, so did the risks, cementing offline security as an absolute must. You can learn more about the evolution of crypto wallets to see how these events shaped today's best practices.

Comparing Hot, Warm, and Cold Storage

So, how do you choose the right setup for your business? It helps to see how the different storage types stack up. We’ve covered hot and cold, but there's also a middle ground called "warm storage." Think of this as a wallet on a dedicated, internet-connected computer—more secure than your phone, but not fully offline.

This table breaks down the trade-offs at a glance.

Hot vs Warm vs Cold Storage: A Quick Comparison

| Attribute | Hot Storage (e.g., Exchange Wallet) | Warm Storage (e.g., Desktop Wallet) | Cold Storage (e.g., Hardware Wallet) |

|---|---|---|---|

| Connectivity | Always online and connected | Online when the device is on | Completely offline |

| Security Level | Low (most vulnerable) | Medium (safer than hot) | Highest (most secure) |

| Accessibility | Instant access for fast trades | Quick access from a specific device | Slower access, requires physical device |

| Primary Use Case | Daily spending, frequent trading | Regular but infrequent transactions | Long-term holding, large reserves |

| Example for a Business | A small float for instant customer refunds | A desktop wallet for weekly payroll | The main corporate treasury account |

The key takeaway is that you don't have to choose just one. A sophisticated treasury strategy uses a mix of all three, allocating funds based on their operational purpose and security requirements.

By understanding these core differences, you can start building a crypto management strategy that balances day-to-day needs with the long-term safety of your assets. This layered, "defense-in-depth" approach is the hallmark of a mature and resilient digital asset operation.

Exploring Your Cold Storage Options

Once you’ve grasped why cold storage is so critical, the next step is figuring out how to do it right. Putting an offline strategy into practice means picking the right tool for the job. Not all cold storage solutions are built the same; each one strikes a different balance between security, ease of use, and day-to-day complexity. It's all about finding the perfect fit for your business.

Hardware Wallets: The Go-To Starting Point

For most businesses, the most common and practical entry point is a hardware wallet. Think of devices from companies like Ledger or Trezor as highly specialized USB drives with a single, crucial purpose: to lock down your private keys and sign transactions securely. Your keys live inside a fortified, isolated chip, completely walled off from your internet-connected computer.

When it’s time to send funds, you plug in the device, check the transaction details on its little screen, and physically press a button to give it the green light. This hands-on approval step is the magic—it means that even if your main computer is riddled with malware, a hacker can’t authorize a transaction without physically holding your device. To get a better feel for how they work, check out our guide on what is a hardware wallet.

Air-Gapped Computers: Fort Knox Security

For organizations that need to take security up another notch, an air-gapped computer is the answer. This is simply a dedicated machine—usually a laptop—that has never, and will never, connect to the internet. Some people even go as far as physically ripping out the Wi-Fi and network cards to make an online connection impossible.

Signing a transaction becomes a two-step dance. You create the unsigned transaction on an online computer, move it to the air-gapped machine with a USB drive or QR code, sign it there, and then carry the signed transaction back to the online machine to broadcast it. This process creates a literal "air gap" between your keys and the online world, slamming the door on remote attacks.

Paper Wallets: The Old-School Original

Back in the day, one of the first forms of cold storage was the paper wallet. It's exactly what it sounds like: a piece of paper with your public and private keys printed on it, usually with corresponding QR codes for easy scanning. It’s the definition of simple—no electronics, no firmware, just a physical document.

But for an active business, paper wallets are frankly a nightmare. They're fragile, easily destroyed by fire or water, and a real pain to use for regular transactions. They're better suited for a "deep freeze" scenario, where you’re locking away assets you don’t intend to touch for years, not for managing your company’s working capital.

The growing demand for robust offline solutions is reshaping the market. As organizations re-evaluate the risks of online exposure, budgets are shifting towards more secure, cold-environment hardware.

This isn't just a feeling; the numbers back it up. A global hardware wallet study projects the market will surge from around USD 0.72 billion in 2026 to USD 2.58 billion by 2031. While software wallets have been the default for a long time, cold-environment hardware is expected to grow at an incredible 29.85% CAGR through 2031, showing a massive shift in security priorities. You can dig into the full report on the cryptocurrency hardware wallet market for a closer look.

Multi-Signature Wallets: The Corporate Standard

For any serious business, the gold standard for a cold storage strategy involves multi-signature (multisig) wallets. Think of a multisig setup like a corporate bank vault that needs two different keyholders to open it. It's a single wallet that requires a specific number of signatures (say, 2-of-3 or 3-of-5) before any funds can be moved.

This structure is a game-changer because it eliminates single points of failure.

- Heightened Security: A thief would have to steal multiple keys, often held by different people in different places, to get to your funds.

- Shared Control: No one person has the power to unilaterally move company assets, which is a must-have for good corporate governance.

- Built-in Redundancy: If one key gets lost or compromised, the funds are still safe and accessible because the other keyholders can still authorize transactions.

When you combine multisig technology with hardware wallets or air-gapped computers, you create an institutional-grade security fortress that protects your treasury from both external hackers and internal threats.

Integrating Cold Storage into Your Business Workflow

Making the leap from understanding cold storage theory to actually using it in your business can feel like a big step. But with a clear treasury management policy, it’s a lot more straightforward than you might think. The goal isn’t to lock up every last satoshi and grind your operations to a halt; it’s to be smart about separating your assets based on how you use them. This creates a powerful, layered defense that protects your capital without killing your agility.

The core principle is simple: keep the vast majority of your funds—think 95% or more—safely tucked away in an offline cold storage solution. The small chunk that's left over stays in a hot wallet, acting as your "working capital" for day-to-day needs like customer refunds, operational bills, or small supplier payments. This two-wallet system is the foundation of a truly resilient business workflow.

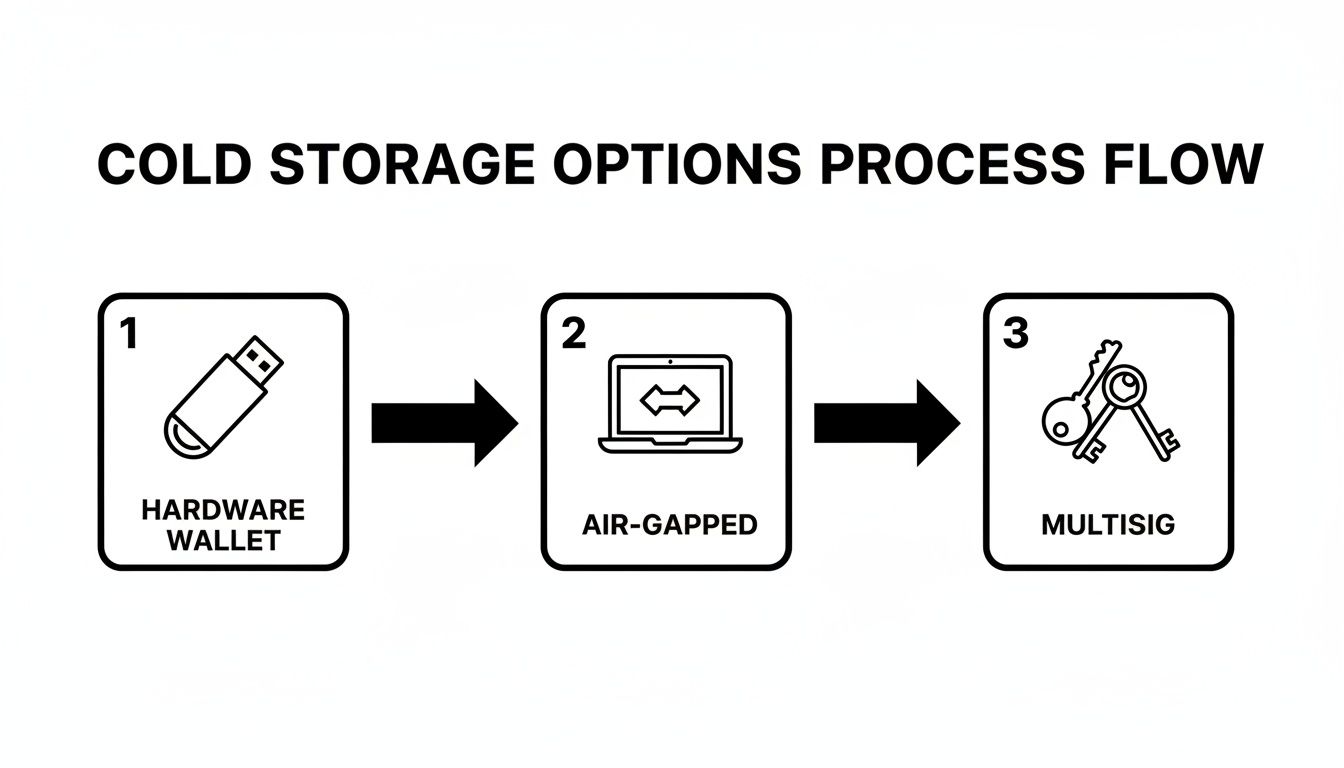

This diagram lays out the typical path businesses take, starting with basic hardware wallets and moving toward more robust setups like multisig.

As you can see, the journey to greater security naturally leads from single-device solutions to distributed-control systems. For any serious business, something like multisig isn't a luxury—it's essential.

Establishing a Secure Treasury Policy

Your treasury policy should be a formal, written document that spells out exactly how your company handles its crypto assets. This is your operational playbook. It removes guesswork and makes sure everyone on your team is following the same secure procedures, every single time.

A good policy should nail down these key areas:

- Fund Segregation Rules: Get specific about the percentage of funds held in cold versus hot storage. For example, your policy might state that any amount over a certain threshold (say, $10,000) in the hot wallet must be swept to the cold storage address at the end of each business day.

- Access Control Protocols: Detail who has the keys to the kingdom. A multi-signature (multisig) wallet is the gold standard for businesses, as it requires multiple keyholders (like the CEO, CFO, and Head of Engineering) to sign off on any transaction leaving cold storage.

- Transaction Authorization Procedures: Map out the step-by-step process for moving funds out of cold storage. This should cover everything: how the transaction is generated on an online machine, how it's signed on an offline, air-gapped device, and how the required multisig approvals are gathered before it's broadcast to the network.

Handling Mass Payouts Securely

One of the biggest operational headaches is managing large-scale payments—like payroll or affiliate commissions—without creating a massive security hole. A classic mistake is moving a huge chunk of funds into a hot wallet just to process these payouts, which temporarily puts your entire payroll at risk. There's a much better way that keeps your keys offline through the entire process.

The trick is to prepare your transaction batches offline. Your team can generate a file with all the payout details (recipient addresses and amounts) on a standard online computer. Then, that unsigned transaction data is moved—via a secure USB drive or QR code—to the offline machine where your cold storage private keys live.

Your private keys sign the entire batch of transactions in a completely isolated environment. Only the signed, secure transaction data is brought back to an online device to be broadcast to the network. Your cold storage keys never, ever touch the internet.

This method lets you execute hundreds of payments efficiently while maintaining the highest security standards. For businesses looking to streamline this, it's worth understanding how a self-custodial wallet can handle automated payouts without ever exposing your core treasury.

Creating Bulletproof Backup and Recovery Protocols

Your cold storage is only as safe as its backup. A hardware wallet can get lost, stolen, or simply stop working. If you don't have a rock-solid recovery plan, those funds are gone for good. The key to that plan is your seed phrase (or recovery phrase)—a list of 12 or 24 words that can restore your entire wallet.

Protecting this seed phrase is your single most important job. Never, ever store it digitally. Don't take a picture of it with your phone, and don't save it in a password manager or a text file on your computer. It needs to exist only in the physical world.

Here are a few industry-standard methods for keeping that phrase safe:

- Use Steel Plates: Paper is fragile; it burns and gets ruined by water. Instead, etch or stamp your seed phrase into a steel plate. This makes it practically indestructible.

- Geographically Distribute Backups: Make several physical copies of your seed phrase and store them in different, highly secure locations. Think bank safe deposit boxes in different cities or with different trusted custodians.

- Implement Shamir's Secret Sharing (SSS): This is a more advanced technique that splits your seed phrase into multiple "shards." You can set it up so that a certain number of shards (e.g., 3-out-of-5) are needed to put the full phrase back together. This way, if one shard is lost or stolen, it's completely useless on its own.

How Cold Storage Impacts Compliance and Insurance

Think of cold storage as more than just a security tactic. It's a strategic move that fundamentally changes how insurers, regulators, and investors see your business. For these groups, how you handle your private keys is the ultimate litmus test for your operational maturity and risk management. A loose, "we'll figure it out later" approach is a massive red flag. A formal cold storage policy, on the other hand, signals that you're a serious, disciplined operation.

When you can prove that your keys are managed offline with strict, auditable controls, it answers the toughest due diligence questions before they're even asked. Potential partners and investors want to see this level of security as a baseline. It also tells regulators you're a responsible custodian of funds, which can make a world of difference when seeking licenses or approvals.

Lowering Premiums and Building Trust

When you're looking to insure digital assets, the underwriters will want to know everything about your security setup. A well-documented cold storage crypto strategy, especially one using multi-signature schemes, can directly lower your insurance premiums. It makes perfect sense—you're actively neutralizing the single biggest risk they're covering: a catastrophic hack.

This proactive stance on security does more than just save you money; it builds a bedrock of trust. To see how this plays out beyond just crypto, you can explore the general security compliance benefits that extend to all parts of a business. Strong compliance isn't just about dodging fines; it’s about crafting a reputation for dependability that attracts top-tier clients and partners.

The message you send to insurers and investors becomes incredibly powerful: "Our most critical assets are physically isolated from online threats, governed by strict internal controls, and require multi-person authorization to be moved." That sentence alone can completely reframe your risk profile.

Meeting a New Industry Standard

The move to cold storage isn't some niche trend; it's the professionalization of the entire crypto industry happening in real time. The market for crypto cold storage wallets was valued at around USD 1,634.5 million in 2024, with Europe making up over 30% of that figure. And it's not slowing down. The Asia-Pacific region is projected to grow at an 11.8% CAGR through 2031. This isn't just a fad—it shows that serious offline security is quickly becoming the default expectation.

What this explosive growth means is that clients, regulators, and insurers now simply assume any legitimate business will have a sophisticated cold storage plan. Not having one is no longer a neutral choice; it’s a competitive liability and a glaring operational risk. It can stall your growth and leave your business exposed. Simply put, cold storage is the new baseline for corporate governance in the world of digital assets.

Achieving Secure Self-Custody with the Right Tools

Many businesses think they have to choose between fortress-like security for their crypto and the operational speed they need to run their company. It feels like a classic tradeoff, but it doesn't have to be. You can absolutely have both. With a smart, layered strategy, you can protect your core treasury while keeping the payment workflows humming.

The path to real self-custody isn't complicated; it just relies on a few solid best practices. The first principle is simple: segregate your funds. Keep the vast majority of your capital completely offline in what's known as an air-gapped environment. For any serious operation, this should always be paired with a multi-signature (multisig) setup, which is just a fancy way of saying you require multiple approvals to move funds. This instantly gets rid of single points of failure and builds corporate governance right into your treasury.

Unifying Security and Usability

Once your main vault is secure, the next step is building safe and efficient workflows for things like payouts and managing your working capital. This means getting into the habit of preparing transaction batches offline, signing them in that secure, isolated environment, and only then bringing the signed transaction online to be broadcast. This simple process ensures your private keys never touch the internet, completely neutralizing online threats even when you're running large-scale operations like a payroll or mass payouts to suppliers.

The real magic happens when you pair a rock-solid internal cold storage policy with a flexible, non-custodial payment platform. This combination gives you the best of both worlds: complete, sovereign control over your funds and the tools to run your payment operations smoothly.

Suddenly, security is no longer a roadblock—it's a competitive edge. Instead of just locking your assets away where they can't be used, you create a system where they are both deeply protected and still productive. Your cold storage is the impenetrable vault, while a non-custodial tool like BlockBee acts as the secure, armored car for daily commerce. You get full control from end to end.

Of course, none of this works without meticulous key management. Protecting your backup is everything. That’s why getting a handle on the specifics of seed phrase security is an absolute must for anyone truly serious about taking control of their assets. Get this right, and a well-planned cold storage strategy will give your business the confidence to operate knowing its digital foundation is fundamentally secure.

Common Questions About Crypto Cold Storage

Even with the best-laid plans, putting a cold storage policy into practice always brings up a few questions. Let's walk through some of the most common ones we hear from businesses, so you can get the operational details right.

Can We Still Get Paid if Our Funds Are in Cold Storage?

Yes, absolutely. This is a big point of confusion for a lot of people. The great thing about cold storage is that you can keep receiving payments 24/7 without ever plugging in your device.

Here's how it works: non-custodial payment platforms can generate new receiving addresses that are linked to your offline wallet. When a customer pays you, the funds are sent to that address on the blockchain and credited to your keys. Your hardware wallet can stay tucked away safely in a vault. You only need to bring it out when you’re ready to actually spend or move those funds.

What's the Single Biggest Mistake Companies Make?

By far, the most critical mistake is fumbling the recovery seed phrase. It's easy to get hyper-focused on protecting the physical hardware device, but the 12 or 24-word phrase that backs it all up is what truly matters.

Think of it this way: if your hardware wallet gets lost, stolen, or broken, it’s a pain, but you can recover. If you lose the seed phrase, the funds are gone for good. There's no customer support line to call.

Never, ever create a digital copy of this phrase. Don't take a picture of it, don't email it to yourself, don't save it in a text file. The best practice is to store it physically—ideally etched into a steel plate that can survive a fire or flood. For top-tier physical security for the devices themselves, you can even look into specialized smart lockers for hardware wallets. To take security a step further, some businesses split the phrase into pieces and store them in different secure locations.

How Often Should We Move Funds From Our Hot Wallet to Cold Storage?

There isn't a one-size-fits-all answer here; it really depends on your transaction volume and how much risk you're comfortable with. The key is to define this in a formal treasury policy and stick to it.

A smart, common approach is to set a ceiling for your operational hot wallet. Once the balance hits that number, the excess gets moved.

For example, your policy might look like this:

- Daily Sweeps: Any balance over $5,000 in the hot wallet gets "swept" to the main cold storage address at the end of every business day.

- Weekly Rebalancing: If your transaction volume is lower, a once-a-week transfer might be perfectly fine.

The goal is to build a consistent, documented routine. This turns security from a one-off task into a daily habit, systematically minimizing the amount of capital you have exposed online.

At BlockBee, we help you build these secure payment workflows without the headache. Our non-custodial platform integrates perfectly with your cold storage strategy, giving you enterprise-level security that doesn't slow you down. Learn more about how BlockBee can secure your crypto payments.