The Best Way to Buy Ripple (XRP) A Complete Guide

If you're looking to buy Ripple (XRP), your best bet is almost always a major, centralized cryptocurrency exchange. I've found through years of experience that these platforms offer the best blend of security, ease of use, and liquidity. This makes buying XRP with traditional money, like US dollars or euros, incredibly straightforward.

Your Quick Guide to Buying Ripple (XRP)

Jumping into the world of crypto doesn't have to be a headache. While there are decentralized ways to get your hands on XRP, sticking with a well-known, regulated exchange is the path of least resistance, especially for your first purchase. Think of these platforms as a secure bridge from your bank account to the crypto market.

But not all exchanges are created equal. Finding the right fit means looking at a few key things:

- Security: How are they protecting your money and information? Always look for essentials like two-factor authentication (2FA) and find out if they keep the majority of assets in offline "cold storage."

- Fees: Get a clear picture of the costs. Trading fees, deposit fees, and withdrawal fees can add up and vary wildly from one platform to another.

- Ease of Use: A confusing interface is a recipe for disaster. You want a platform that feels intuitive, not one where you're second-guessing every click.

- Payment Methods: Does the exchange let you deposit money the way you want to? Whether it's a simple bank transfer, a debit card purchase, or a wire, make sure your preferred method is supported.

Why Liquidity Is a Big Deal

One of the most overlooked, yet critical, advantages of using a major exchange is liquidity. High liquidity simply means there are plenty of buyers and sellers available at all times. This is huge. It ensures you can complete your trade quickly and at a price that reflects the true market value.

For an asset as popular as XRP, this is non-negotiable. Ripple consistently ranks among the top cryptocurrencies, and its trading volume is massive. For instance, in August 2025, XRP's market cap was sitting around $177.29 billion, with a daily trading volume of $5.67 billion. This kind of market depth, which you'll find on giants like Coinbase or Kraken, means you can buy or sell without causing a massive price swing. It's a sign of a healthy, stable market. You can track these metrics and learn more about XRP's market performance.

My Two Cents: Don't underestimate the importance of high trading volume. It's your assurance that you can get in and out of a position efficiently. That peace of mind is what makes using a major exchange the best way to buy Ripple, in my book.

Comparing Top Platforms to Buy Ripple (XRP)

To help you get started, here's a quick comparison of some leading exchanges where you can buy XRP. I've focused on what matters most: fees, usability, security, and payment options. This should give you a good starting point for finding the platform that best suits your needs.

| Exchange | Best For | Typical Fees | Supported Fiat Currencies |

|---|---|---|---|

| Coinbase | Beginners & Ease of Use | 0.5% - 3.84% | USD, EUR, GBP, and more |

| Kraken | Advanced Traders & Security | 0.16% - 0.26% | USD, EUR, CAD, JPY, GBP, CHF, AUD |

| Uphold | Simplicity & Multi-Asset Support | Spread-based (0.9% - 1.8%) | USD, EUR, GBP, and 20+ others |

| Binance | Low Fees & Global Access | 0.1% spot trading | Over 50 fiat currencies supported |

Ultimately, choosing a reputable, high-volume exchange just makes sense. It takes the guesswork out of the process, giving you a secure place to set up and verify your account, fund it easily, and buy your XRP with confidence. It's the smartest first step you can take.

Choosing the Right Platform for Your Needs

When you're ready to buy Ripple, the first question isn't "where's the best place?" but "what's the best place for me?" It's a personal decision. The platform that a seasoned trader uses to scalp tiny profits might be a confusing mess for someone just making their first crypto purchase.

Let's break down the main avenues for buying XRP. They each serve a different purpose, and knowing the difference is the key to getting started on the right foot.

Centralized Exchanges (CEXs)

For most people dipping their toes into crypto, a centralized exchange (CEX) is the way to go. Think of familiar names like Coinbase or Kraken. These platforms operate a lot like a stock brokerage, where they act as a trusted middleman, matching buyers with sellers.

The main draw here is convenience. They’re built to be user-friendly, with simple interfaces and straightforward ways to connect your bank account or use a debit card. Honestly, a new user can often go from zero to owning XRP in less than an hour. It’s a smooth on-ramp.

The catch? You’re trusting them with your crypto. On a CEX, the exchange holds the private keys, not you. It's a trade-off between ease of use and ultimate control.

Decentralized Exchanges (DEXs)

Then you have decentralized exchanges (DEXs). These are a different beast entirely. They run on smart contracts, letting you trade directly from your own wallet without ever giving up your funds to a third party.

This peer-to-peer approach gives you total control and enhances your privacy. But that freedom comes with responsibility. You'll need your own non-custodial wallet (like MetaMask or Trust Wallet) and a basic grasp of how things like liquidity pools and gas fees work. There's no customer support hotline to call if you send funds to the wrong address. DEXs are for those who've been around the block and value self-custody above all else.

Key Takeaway: The whole CEX vs. DEX debate boils down to one word: custody. With a CEX, you trust them. With a DEX, you trust yourself.

Peer-to-Peer (P2P) Platforms

Finally, there are peer-to-peer (P2P) marketplaces. Imagine a Craigslist for crypto. These platforms connect you directly with other individuals who want to buy or sell. You can browse listings, negotiate terms, and use a huge variety of payment methods, from bank transfers to cash.

P2P offers incredible flexibility but also carries a higher risk of running into a scammer. While they use escrow and reputation systems to protect users, the burden of checking out your trading partner is ultimately on you. This path is often best for people in countries with limited exchange access or for those who need to use a very specific, less common payment method.

Understanding these models is also crucial for businesses. If you're thinking about how your company might one day use digital assets, check out our guide on how to accept cryptocurrency payments for your business. It dives into the practical side of integrating these payment methods.

Setting Up and Securing Your Account

Alright, you've picked your exchange. Now comes the part that's more than just paperwork—it’s about building a digital fortress for your funds right from the get-go. This is where a security-first mindset really begins to pay off.

The moment you start signing up, you'll run into Know Your Customer (KYC). This means you'll need to hand over some personal info like your name, address, and a government-issued ID. It can feel a bit invasive, but this is a non-negotiable for any legitimate, regulated exchange. They're required to do this to comply with anti-money laundering (AML) laws. Frankly, if a platform doesn't ask for this, you should see it as a massive red flag and head for the hills.

Fortifying Your New Account

Once your basic details are submitted and verified, the real security work starts. Don't just click "next" and accept the default settings. Your absolute first priority should be to enable Two-Factor Authentication (2FA).

But here's a crucial tip: not all 2FA is created equal. I strongly advise against using SMS-based 2FA. Hackers have gotten frighteningly good at a technique called SIM-swapping, where they convince your mobile provider to switch your number to a new SIM card. Once they do that, they get your text codes and can waltz right into your account.

Always, always opt for an authenticator app instead.

- Google Authenticator: This is the old standby. It’s reliable, widely supported, and does its job well.

- Authy: A great alternative that offers cloud backups. This is a lifesaver if you ever lose or break your phone.

Using one of these apps generates a temporary, time-sensitive code on your device that is completely independent of your phone number. It adds a powerful layer of security that makes unauthorized access significantly more difficult.

Next up is your password. A simple word with a number and a symbol just isn't enough anymore. You need something long, complex, and completely unique to that one exchange. I highly recommend using a password manager to generate and store a truly random string of characters, something like Jk9!zP$vR7@qT*eF. You'll never remember it, but that's the point—your password manager will handle it for you.

Expert Tip: Treat your crypto exchange account with the same seriousness you give your online bank account. Reusing passwords or settling for weak authentication is like leaving your front door wide open. A few extra minutes of setup now can prevent a complete disaster later.

Understanding the Regulatory Landscape

Picking the right place to buy XRP also means choosing a platform that takes compliance seriously. From a legal perspective, regulatory adherence and security are two sides of the same coin. For instance, Ripple Labs secured a U.S. patent for a cross-border payment system, which has drawn a lot of interest from major banks and financial institutions. This has helped boost XRP's adoption on compliant exchanges in key markets.

Despite the well-known legal battle between Ripple and the SEC, most global exchanges have adapted. They've built strong KYC and compliance systems that allow them to offer XRP trading both legally and securely. By sticking to these regulated platforms, you get better protection against fraud and clearer terms on who holds your assets, making them the smartest choice for buying XRP. You can always stay updated on XRP's market performance and regulatory news on TradingView.

Making Your First Ripple Purchase Like a Pro

Alright, your account is set up and secure. Now for the exciting part—actually buying your first bit of Ripple. This step isn't so much about clicking the right buttons as it is about making smart, deliberate moves to get the most out of your money.

First things first, you need to get some cash into your exchange account. Most platforms give you a few ways to do this, and each one is a trade-off between speed and cost.

- Bank Transfers (ACH): This is usually your cheapest route. The downside? It's slow. You might have to wait a few business days for the funds to clear, which can be frustrating if you're trying to jump on a price dip.

- Debit Cards: Need to buy XRP right now? A debit card is your best bet. The purchase is instant. That convenience, however, comes at a price—debit card fees are typically higher, making this option better for smaller, time-sensitive buys.

- Wire Transfers: If you're moving a larger sum of money, a wire transfer is a solid middle ground. It's faster than a standard bank transfer but costs more. It's the go-to for serious investors who need to move significant capital without the multi-day wait of an ACH.

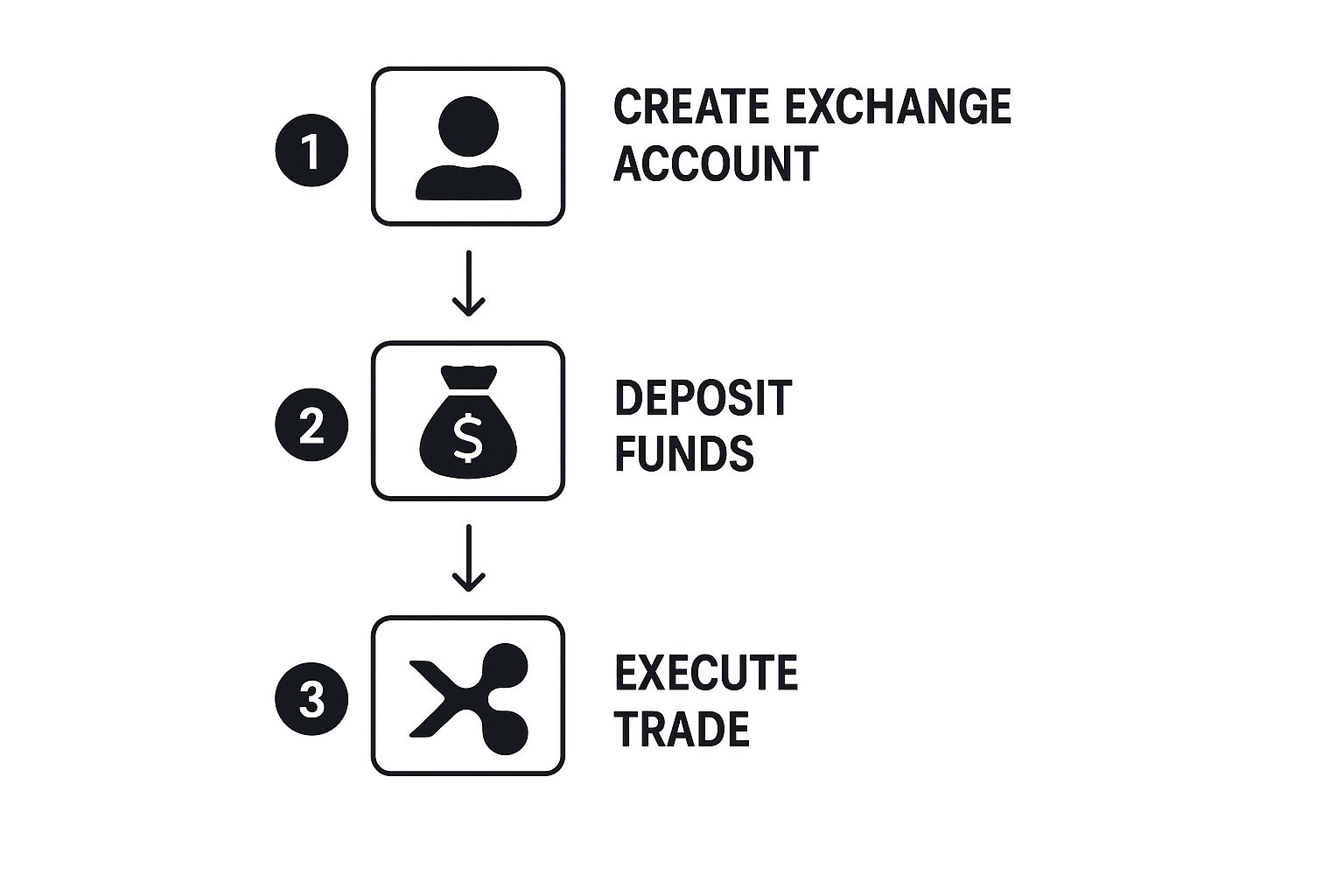

This simple graphic lays out the entire journey, from getting set up to making the trade.

As you can see, buying Ripple is a straightforward process that begins with a secure setup and culminates in executing the actual purchase.

Understanding Your Order Types

With money in your account, you generally have two main ways to buy XRP: a market order or a limit order. Knowing the difference is key.

A market order is the "just get it done" option. You're essentially telling the exchange, "Buy XRP for me immediately at whatever the current best price is." It's fast and guarantees your order gets filled, but you sacrifice control over the exact price you pay.

A limit order, on the other hand, puts you in the driver's seat. You set the exact price you’re willing to pay. For instance, if XRP is currently trading at $0.60, you could place a limit order to buy only if the price drops to $0.58. Your order will sit there and only execute if the market hits your target. It's a fantastic tool for strategic buying, but be warned: if the price never drops to your specified level, your order will never be filled.

Pro Tip: For your very first purchase, a market order is perfectly fine. It gets the job done. As you gain experience, however, learning to use limit orders to enter the market at precise points is a much smarter, more disciplined way to invest.

Navigating Volatility with Smart Strategies

Let's be honest: crypto markets are famous for their wild price swings. A quick look at historical data shows just how dramatic these shifts can be. Back in the 2017 bull run, XRP saw quarterly returns blast past 1000%, only to crash by more than 77% in 2018. More recently, XRP's price has shown renewed strength with a remarkable increase of approximately 438% in the past year, and it's not uncommon to see daily trading volumes exceed $5 billion. This is exactly why choosing a reliable platform is so important. If you want to dive deeper into the numbers, you can explore historical price and volume data on CryptoRank.

So, how do you deal with this? One of the most effective strategies I’ve seen is Dollar-Cost Averaging (DCA).

Instead of pouring all your money in at once and trying to "time the market" (a fool's errand, most of the time), you invest a fixed amount of money at regular intervals. Think $50 every Friday, rain or shine. This simple technique averages out your purchase price over time, which smooths out the bumps from volatility and, maybe most importantly, takes the emotion out of your investment decisions.

How to Properly Secure Your XRP After Purchase

So, you've bought your XRP. That’s a huge first step, but the real work starts now: making sure your investment is safe. Leaving your XRP on the exchange where you bought it is easy, but for anything other than short-term trading, it's a gamble you really shouldn't take.

Think of an exchange like a busy bank lobby. It's great for making transactions, but you wouldn't leave a pile of cash on the counter overnight. Exchanges hold your assets in what we call a hot wallet—a wallet that's always connected to the internet. This constant connection makes it a juicy target for hackers.

In the crypto world, there's a saying that's practically law: "Not your keys, not your crypto." It means that if you don't personally control the private keys (the secret password to your funds), you don't actually own your assets. The only way to fix this is to move your XRP into a personal wallet where you, and only you, hold the keys.

Understanding Your Wallet Options

When it comes to choosing a wallet, you're essentially trading off between security and convenience. There are a few different types, and picking the right one is crucial for protecting your XRP.

Software Wallets (Hot Wallets)

These are apps you can install right on your computer or phone—think wallets like Exodus or Trust Wallet. They're a definite step up in security from an exchange because you control your own private keys.

The catch? They still run on devices that are connected to the internet, leaving them open to things like malware or clever phishing schemes. They're a solid choice for managing smaller amounts you might want to access more frequently.

Hardware Wallets (Cold Storage)

If you're holding a significant amount of XRP, a hardware wallet is the undisputed champion of security. These are small, physical devices made by companies like Ledger or Trezor that store your private keys completely offline.

When you make a transaction, you sign it directly on the device itself. This means your keys are never exposed to your computer or the internet. For a long-term investor, this is the highest level of security you can get.

My Two Cents: The best strategy for buying Ripple and holding it for the long haul is to move it into cold storage. While software wallets are better than exchanges, the peace of mind that comes with the offline protection of a hardware wallet is unbeatable.

The Secure Transfer Process

Moving your XRP from an exchange to your personal wallet is a process that demands your full attention. It's not complicated, but one small slip-up could mean your funds are gone for good. It's a simple operation with very high stakes.

Here’s a safe way to handle the transfer:

- Start the Withdrawal: First, log into your exchange account and navigate to the withdrawal page for XRP.

- Get Your Wallet Address: Open your personal wallet (whether it's software or hardware) and generate a new receiving address for XRP. Carefully copy this long string of letters and numbers.

- The All-Important Double-Check: Paste the address into the withdrawal field on the exchange. Now, meticulously compare the first and last few characters of the address you pasted with the address displayed in your wallet. This simple check protects you from clipboard-hijacking malware that secretly swaps out addresses.

- Don't Forget the Destination Tag (If Needed): XRP transactions sometimes require a Destination Tag. If your receiving wallet gives you one, you must include it.

- Send a Small Test Amount: Before you move your entire stack, send a tiny amount of XRP first—just enough to test the connection. Wait for it to show up safely in your personal wallet before you even think about sending the rest.

If you're new to this, the process can feel a bit nerve-wracking. To get more comfortable, you can learn more about how to send crypto with our detailed guide.

One final, critical point. When you set up your new wallet, you'll be given a recovery seed phrase, which is usually a list of 12 or 24 words. This is the master key to your funds. Write it down on paper—not on your computer—and store it in a couple of secure, offline places. If you lose this phrase, you lose your crypto. Period.

Common Questions About Buying Ripple

Diving into crypto for the first time always stirs up a few questions. Even with a solid plan, you'll probably run into some practical details once you're actually ready to buy. Let's walk through some of the most common questions new investors have when figuring out the best way to buy Ripple.

Can I Buy Ripple With a Credit Card?

Absolutely. Most major exchanges let you buy Ripple (XRP) directly with a credit or debit card. Honestly, it's the fastest way to get your hands on some XRP, often wrapping up the whole transaction in minutes.

But that convenience comes with a trade-off. Credit card purchases almost always have higher fees than a standard bank transfer. You also need to be careful, because some credit card companies treat crypto purchases as a cash advance. If that happens, you could get hit with extra fees and sky-high interest rates right away. It's always a good idea to check the fee schedule on both the exchange and with your card provider before hitting "buy."

What Is the Minimum Amount of Ripple I Can Buy?

One of the best things about XRP is how easy it is to get started. The minimum purchase amount is usually tiny—often just $1 to $10, depending on the exchange you're using. This makes it perfect for anyone who wants to dip their toes in the water without committing a lot of money upfront.

Key Insight: You don’t need a fortune to start investing in crypto. The low minimums on most platforms mean you can begin your journey with an amount that feels comfortable for you, without any major financial pressure.

Of course, every exchange sets its own rules. Before you commit, take a quick look at the platform’s terms to find their specific minimum trade size for XRP. That way, there are no surprises when you’re ready to make your first move.

Is It Safe to Leave My XRP on the Exchange?

This is a big one. While top-tier exchanges have robust security, the golden rule in crypto is to avoid storing large amounts of your assets on an exchange long-term. Think of it this way: exchanges are centralized businesses, which makes them a juicy target for hackers.

The safest move by far is to transfer your XRP to a personal wallet where you—and only you—control the private keys. This is called self-custody, and it’s the whole point behind the famous crypto saying, "not your keys, not your crypto." If you're holding a significant amount, a hardware wallet (also called cold storage) is the ultimate in security.

For active traders, keeping a small amount on an exchange can be practical. Just be fully aware of the risks involved. If you're still exploring why people are drawn to this space, our article on the compelling reasons to invest in cryptocurrency offers a great overview.

At BlockBee, we offer a secure, non-custodial B2B crypto payment platform that gives you full control. You can simplify all your transactions with our easy-to-integrate API, enjoy low fees, and get support for over 70 cryptocurrencies. Get started with BlockBee today!