A Guide to Accept Crypto Payments Online for Your Business

If you've been on the fence about accepting crypto payments, it's time to look past the headlines and focus on the real-world advantages for your business. This isn't just about tapping into a new market; it's a strategic move that can directly impact your cash flow, reduce overhead, and protect you from common e-commerce headaches.

The Real Benefits of Accepting Crypto Payments

Let's break down the tangible, bottom-line reasons why adding a crypto payment option makes solid business sense. We're talking about optimizing your financial operations in a way that traditional systems simply can't match.

Think about a freelancer in Asia working with a client in North America. A standard bank transfer can get stuck for days, chipped away by correspondent banking fees and currency exchange rates. With crypto, that payment lands in their wallet in minutes, with a fraction of the cost. That’s the kind of efficiency we're talking about.

Slash Transaction Fees and Boost Margins

Anyone who runs an online store knows the sting of credit card fees. You're typically handing over 2.5% to 3.5% of every single sale to a mix of banks and processors. Those fees eat directly into your profit margins.

Crypto flips that model on its head. Most payment processors charge a simple, flat fee, often hovering between 0.5% and 1.0%. If your business does $50,000 in monthly sales, switching could put an extra $1,000 back in your pocket every month. That’s money you can reinvest in marketing, new products, or even just better pricing for your customers.

By dramatically cutting down on transaction overhead, accepting crypto gives your net revenue an immediate lift. It turns a necessary evil into a competitive edge.

Accelerate Cash Flow with Near-Instant Settlements

This is where crypto really shines. Forget waiting 2–5 business days for a batch of credit card payments to settle. Crypto transactions are confirmed on the blockchain and available in your wallet in minutes.

This speed changes everything for your working capital.

- Pay Your Bills Faster: Get immediate access to your funds to pay suppliers or run payroll without waiting on the bank.

- Reduce Financial Risk: The shorter the settlement time, the less exposure you have to market swings or payment holds.

- Be More Agile: With cash on hand, you can jump on new opportunities or handle unexpected expenses without delay.

Eliminate Chargeback Fraud for Good

Chargeback fraud is a nightmare for merchants. A customer can dispute a perfectly valid charge weeks later, and the funds are automatically pulled from your account while you're left to fight a long, often losing battle. It's a system that costs businesses billions.

Cryptocurrency transactions are final. Once confirmed on the blockchain, they are irreversible. This simple fact completely eliminates the risk of fraudulent chargebacks. If you're in a high-risk industry or just tired of dealing with "friendly fraud," this feature alone is a game-changer. You can get a deeper dive into the essentials of Bitcoin payment processing in our dedicated guide.

This puts the control back where it belongs—with you. Once you’ve delivered your product or service, you can be confident that the payment is secure.

Traditional Payments vs. Crypto Payments: A Quick Comparison

To put it all into perspective, here’s a high-level look at how the two systems stack up side-by-side.

| Feature | Traditional Payments (e.g., Credit Cards) | Cryptocurrency Payments |

|---|---|---|

| Transaction Fees | High, typically 2.5% - 3.5%, plus various other hidden fees. | Low, often a flat 0.5% - 1.0%. |

| Settlement Speed | Slow, taking 2-5 business days for funds to become available. | Fast, with funds settling in minutes. |

| Chargeback Risk | High. Customers can dispute charges weeks or months later. | Virtually zero. Transactions are final and irreversible. |

| Global Access | Limited by banking infrastructure, currency conversions, and high FX fees. | Borderless. Anyone with an internet connection can pay. |

| Account Freezes | Accounts can be frozen or terminated by banks/processors without warning. | Self-custodial. You have full control over your funds. |

| Customer Privacy | Requires extensive sharing of sensitive personal and financial information. | Enhanced privacy. Customers don't need to share sensitive data. |

As you can see, the advantages are clear and compelling. From pure cost savings to operational security, crypto offers a modern alternative designed for the speed of digital commerce.

How to Choose the Right Crypto Payment Provider

Picking the right partner to handle your crypto payments is easily the most critical decision you'll make. This choice directly shapes everything from who controls your funds and your customers' checkout experience to your daily workflow. It's less of a technical decision and more of a fundamental business one.

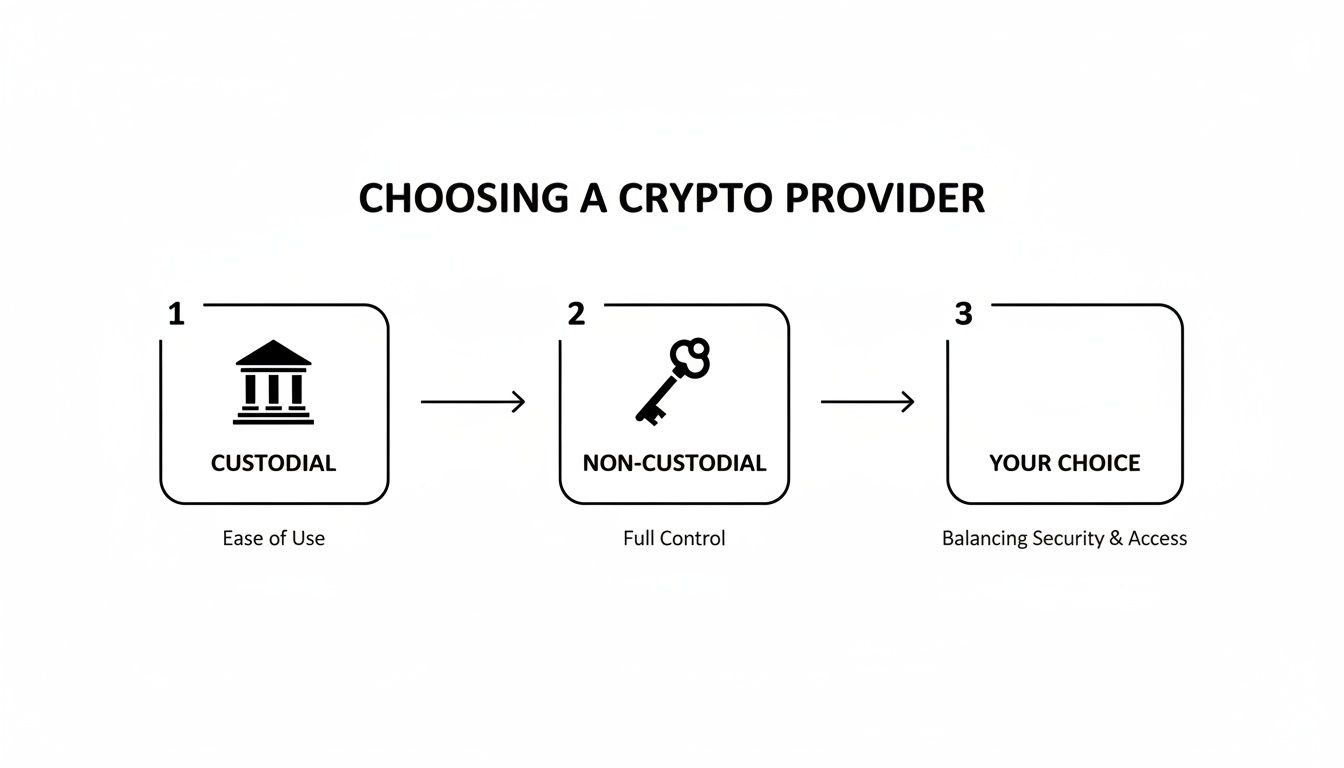

The entire market really boils down to two distinct models: custodial and non-custodial providers. Getting a handle on what makes them different is the key to figuring out which path is right for your business.

Custodial Providers: The "Bank" Approach

Think of a custodial provider as being a lot like PayPal or your traditional bank account. When a customer pays you in crypto, the money goes into an account that the provider manages and secures on your behalf. They deal with all the messy blockchain details, confirm the transaction, and drop the funds into your account with them.

This "hands-off" approach is incredibly popular because it’s just so simple. A small e-commerce shop running on WooCommerce, for example, can install a plugin and be ready to go in minutes. There's no need to learn about private keys or the inner workings of a blockchain. The provider handles security, custody, and usually offers simple tools for converting your crypto back into dollars or euros.

The trade-off for all this convenience? You don't have direct control over your funds. You’re placing your trust in a third party to keep your money safe, just like you do with a bank. For many businesses, this is a perfectly fine—and often preferred—way to operate.

Non-Custodial Providers: Being Your Own Bank

Non-custodial solutions are the complete opposite. When a customer pays you, the crypto is sent directly to a wallet that you, and only you, control. The provider's software helps make the transaction happen, but it never actually touches or holds your money. You hold the private keys, which gives you absolute ownership.

This model is a favorite for businesses that put a premium on security, decentralization, and total autonomy. If you're comfortable managing your own digital assets, a non-custodial provider cuts out the middleman risk. No one can freeze your account or block you from accessing your funds. You are in charge.

As you can see, today's providers focus on making the merchant experience as clean as possible, regardless of the custody model.

Of course, with this freedom comes greater responsibility. You are the only one responsible for keeping your private keys safe. If you lose them, you lose your money—permanently. There’s no 1-800 number to call for a password reset.

The market for this kind of crypto payment infrastructure is booming. Projections show the industry growing from over $1.5 billion toward $3.5 billion by 2030, which tells you just how much merchant demand is out there. This growth means you need a partner who can scale with you and support the coins your customers want to use.

Custodial vs. Non-Custodial Providers: Key Differences

To make this choice clearer, it helps to see a direct comparison. This table breaks down the core differences between the two models, helping you weigh the trade-offs based on what matters most to your business.

| Attribute | Custodial Provider (e.g., BlockBee) | Non-Custodial Solution |

|---|---|---|

| Control of Funds | The provider holds your funds in a managed account. | You have 100% control; funds go directly to your wallet. |

| Ease of Use | Extremely simple. Ideal for beginners and non-technical users. | Requires a basic understanding of crypto wallets and security. |

| Security | You trust the provider's security infrastructure. | You are fully responsible for securing your own private keys. |

| Third-Party Risk | Higher. Your funds could be at risk if the provider is compromised or freezes your account. | Minimal. No third party can access or freeze your funds. |

| Best For | Businesses prioritizing convenience and ease of integration. | Businesses prioritizing security, control, and decentralization. |

Ultimately, both paths will get you to the same destination: accepting crypto online. The key is picking the route that best aligns with your company's philosophy on risk and responsibility.

So, How Do You Decide?

There's no single "best" answer here—only what’s best for you. Your decision really comes down to your business model, how comfortable you are with the tech, and your appetite for risk.

Your choice between custodial and non-custodial isn't just about technology; it's about defining who holds the ultimate responsibility for your revenue. Do you prefer the safety net of a managed service or the complete sovereignty of self-custody?

For a much deeper dive into the specific companies out there, check out our guide on the 12 best crypto payment processors. It's a great resource for comparing features head-to-head to find the perfect match.

Getting Crypto Payments Live On Your Website

Alright, let's get down to the brass tacks: turning the idea of accepting crypto into a working checkout option on your site. This is where you actually connect your website to a payment gateway, and honestly, it's a lot less intimidating than it sounds. I'll walk you through the most common ways to do this, using BlockBee as our real-world example, from simple plugins to powerful APIs.

If you're new to the space and want to peek under the hood, it can be helpful to have a basic grasp of the technology making all this possible. For anyone curious about the mechanics, a good place to start is understanding blockchain technology and its core concepts. It's not required, but it definitely gives you some valuable context for what's happening behind the scenes.

This decision between a custodial (managed, bank-like) and non-custodial (you hold the keys) provider is the first major fork in the road and will shape how you integrate.

The Easiest Route: E-Commerce Plugins

For the vast majority of online stores, the quickest way to get started is with a pre-built plugin. If your site runs on a major platform like WooCommerce, Magento, or PrestaShop, you can be up and running in minutes without touching a single line of code.

Think of these plugins as a simple bridge connecting your store directly to the payment gateway. You install it, plug in a few details from your provider account, and a new crypto payment option instantly appears for your customers at checkout. It really is that simple.

Here’s the typical play-by-play using a service like BlockBee:

- Sign up for an account with your chosen payment provider.

- Find your platform's plugin in their integrations section and download it.

- Install and activate the plugin in your website’s admin panel, just like you would with any other extension.

- Copy your API Key from your provider's dashboard and paste it into the plugin's settings on your site. This is what securely links your store to your account.

And that's it. Your store is now ready to accept crypto. The plugin takes care of everything else—generating unique payment addresses for each order, watching the blockchain for confirmations, and automatically updating your order statuses.

For Custom Setups: The API Integration

But what if you've got a custom-built website, a SaaS application, or a business model that doesn't fit into a standard e-commerce box? This is where a direct API (Application Programming Interface) integration is your best friend. It gives you complete freedom to build a payment experience from the ground up.

While this path does require some developer time, modern payment APIs are built to be straightforward and come with excellent documentation. The core idea is the same: your system just needs to talk to the payment provider to create and check on payments.

The workflow usually breaks down like this:

- Generate an API Key: This is your secret password for talking to the provider's system. Keep it safe.

- Request a Payment Address: When a customer wants to pay, your server makes an API call to the provider to get a fresh, unique crypto address for that specific transaction.

- Set Up Callbacks (Webhooks): This is the most important piece. A callback is a URL on your server that the payment provider pings with updates. When a customer's payment is confirmed, the provider sends a notification to your callback URL, telling your system to mark the order as paid.

An API gives you total creative control over the checkout flow. You can design every single element the customer sees, from the payment instructions to the confirmation screen, making sure it all fits perfectly with your brand's look and feel.

A solid API integration is not rocket science for a good developer, especially with clear documentation. For a deeper technical dive, you can explore how a crypto payment gateway API really works and how to implement one from start to finish.

For More Advanced Needs: Mass Payouts

Accepting crypto isn't just about getting paid; it can also completely change how you pay others. A Mass Payouts feature lets you send crypto to hundreds or thousands of recipients at once, right from your business wallet.

This is a game-changer for a few common business operations:

- Affiliate & Commission Payments: Pay your global affiliates in their preferred crypto instantly, sidestepping international bank fees and frustrating delays.

- Paying Contractors & Freelancers: Settle invoices with international talent in minutes, not days. They get paid faster and you have less administrative headache.

- Platform & Gaming Rewards: Distribute winnings or user rewards on your platform automatically and efficiently.

The process is usually handled through the API or even a simple file upload (like a CSV) with wallet addresses and amounts. You kick off the batch payment, and the system handles the rest, firing off individual transactions to everyone on your list. This one feature can transform your payment gateway from a simple checkout tool into a full-blown financial hub for your business.

Managing Crypto Taxes and Regulations

Dipping your toes into crypto payments means you've got to learn the rules of the road. While digital currencies offer some incredible freedoms, they don’t exist in a legal vacuum. For your business to thrive long-term, you have to get a handle on your legal and financial obligations right from the start.

This isn't about turning you into a tax lawyer overnight. It’s about knowing just enough to make smart decisions and keep your business on the right side of the law.

Why Payment Providers Need Your Details

If you've ever signed up for a payment processor, you've been asked for identity verification. It’s a standard—and necessary—part of the process. This all comes down to two key compliance areas: Know Your Customer (KYC) and Anti-Money Laundering (AML).

- KYC (Know Your Customer): This is just what it sounds like—a provider verifying your identity. As a business, you'll likely submit things like your articles of incorporation or business license. It's a fundamental step to ensure anonymous or fraudulent entities aren't using the platform.

- AML (Anti-Money Laundering): These regulations are broader, designed to stop the illegal flow of money. Payment providers use AML checks to spot suspicious transaction patterns and report them to the authorities when necessary.

These aren't just hoops to jump through; they protect the entire financial system, your business included. When a provider takes this stuff seriously, it's a great sign they're a stable, compliant partner you can trust.

Getting a Handle on Crypto Taxes

For most merchants, this is where things get a bit fuzzy. But the core concept is actually pretty simple. Most tax authorities, like the IRS in the US, don't see cryptocurrency as currency. They treat it as property.

That single distinction changes everything.

It means that every single time you accept a crypto payment for a product or service, you’ve triggered a taxable event. You're required to record the fair market value of that crypto in your local currency (like USD or EUR) at the exact moment of the transaction. That dollar value is what counts as your revenue for that sale.

Your tax isn't based on the amount of crypto you hold, but on its cash value the instant you received it. Ignoring this simple rule can create massive accounting headaches and lead to you under-reporting your income.

Trying to track the fluctuating value of every crypto payment by hand would be an absolute nightmare. Luckily, you don't have to. There are two smart ways to handle this.

- Use Crypto Accounting Software: Specialized platforms can sync with your wallets and automatically pull in transaction data, calculating the fiat value at the time and generating the reports your accountant will thank you for.

- Lean on Auto-Conversion: This is the easiest method by far. Payment gateways like BlockBee can instantly convert incoming crypto into a stablecoin or your local fiat currency. This locks in the value immediately, so you receive the exact amount you charged. It makes your bookkeeping as simple as a standard credit card sale and completely protects you from crypto's price swings.

The regulatory world is always shifting, so it pays to stay current. This a complete guide to tax on crypto in Australia is a good example of a detailed regional resource. But no matter where you are, it's always best to chat with a qualified tax professional in your area to make sure all your bases are covered.

Security and Customer Experience Best Practices

Getting your payment gateway up and running is a great feeling, but the real work starts now. To truly succeed with crypto payments, you need a setup that’s rock-solid for your business and dead-simple for your customers. Nailing this balance is what separates a neat tech feature from a genuine competitive edge.

Let's dive into the practical habits that build trust and keep those sales coming in, starting with locking down your side of the equation.

Fortifying Your Business Security

Think of your payment gateway as the digital equivalent of your cash register and back-office safe, all rolled into one. It demands that same level of respect and protection. Honestly, just a few non-negotiable security habits will shield you from the vast majority of potential headaches.

First, treat your API keys like they're the keys to your entire business. Never, ever share them publicly, embed them in your website's front-end code, or accidentally commit them to a public GitHub repository. If you even suspect a key has been exposed, revoke it immediately and generate a new one. Don't hesitate.

Next up: enable two-factor authentication (2FA) on your provider account. This is your single best defense against someone trying to force their way in. Even if a scammer gets ahold of your password, 2FA acts as a digital deadbolt, stopping them from accessing your funds or messing with your settings.

Finally, stay sharp against phishing scams. You’ll inevitably get official-looking emails asking you to log in or "verify" your account details. Always be skeptical. Check the sender’s email address carefully and get in the habit of navigating directly to your provider’s website yourself instead of clicking links in an email.

A proactive security posture isn't about being paranoid; it's just good business. Simple, consistent habits are what protect your revenue and your reputation.

Crafting a Seamless Customer Checkout Experience

Once your security is tight, you can shift your focus to making the payment process as smooth as possible for your customers. A clunky, confusing checkout is the fastest way to lose a sale you worked hard to get.

The name of the game is eliminating friction. Start by making it obvious you even accept crypto. Put the logos of the coins you support right on your homepage, product pages, and in the website footer. This simple visual cue signals to crypto-savvy shoppers that you're ready for their business.

When it comes to the checkout page itself, clarity is everything.

- Provide Clear Instructions: Don't assume your customer is a crypto pro. Use simple, direct language to walk them through the payment steps.

- Use QR Codes: Displaying a QR code next to the wallet address is a must-have for mobile users. They can scan it with their wallet app, which pre-fills all the transaction details and eliminates the risk of costly typos.

- Show Real-Time Status Updates: Your checkout page should give instant feedback. Let the customer see messages like "Waiting for payment," "Confirming on the network," and "Payment complete." This reassures them that everything is working correctly.

Offering the right mix of coins is also a huge part of the user experience. While Bitcoin might seem like the obvious choice, real-world data paints a broader picture. Bitcoin often accounts for about 23.3% of checkout volume, but stablecoins like USDT and USDC frequently match or even surpass that share. To appeal to the widest audience, a smart starting point is supporting Bitcoin plus at least one major stablecoin. You can dive deeper into these crypto payment trends on Coingate.com.

Handling Common Payment Hiccups

Even with a flawless checkout flow, things can sometimes go sideways. The key is to handle these moments professionally, so you keep your customer happy.

A common issue is an underpayment or overpayment. This happens when a customer sends a slightly wrong amount, usually due to a manual error or a miscalculation of network fees. Any good payment gateway will automatically flag this mismatch and put the order on hold.

Your system should then notify both you and the customer. If they underpaid, provide a simple way for them to send the remaining balance. If they overpaid, you can coordinate a refund for the difference. Having a clear, helpful support process for these cases turns a potential frustration into an opportunity to show off your great customer service.

Got Questions About Crypto Payments? We've Got Answers.

Jumping into crypto payments for the first time? You're bound to have a few questions. From dealing with wild price swings to figuring out the actual costs, getting straight answers is the first step. Let's tackle the things merchants ask us most often when they're ready to accept crypto payments online.

How Do I Protect My Business From Crypto's Price Volatility?

This is usually the first question on everyone's mind, and for good reason. Crypto prices can swing wildly, and you can't have your revenue changing by the minute.

The best way to handle this is by using a payment processor that offers instant auto-conversion. It's a simple but powerful feature. When a customer pays you in something like Bitcoin, the service instantly swaps it for a stablecoin (like USDC) or your local currency (USD, EUR, etc.). This locks in the value of the sale right then and there.

You get the exact amount you charged, less a tiny fee. Just like that, you've sidestepped the volatility and turned a fluctuating asset into stable, predictable revenue.

What Are The Real Fees For Accepting Crypto?

One of crypto's biggest selling points for merchants is the potential for significant cost savings. The fees are almost always lower than what you’re used to with credit cards.

Most crypto payment gateways keep it simple with a flat-rate model, typically charging between 0.5% and 1.0% per transaction. You're not going to run into the monthly fees, setup charges, or all the other hidden costs that plague the traditional card processing world.

Think about it: that's a huge drop from the 2.5% to 3.5% (plus a mess of interchange fees) you’re likely paying for card transactions. That difference goes straight back to your bottom line.

Of course, always double-check the pricing page of any provider you're considering. You'll want a clear breakdown of their transaction fees and any network (gas) fees you might encounter when you move your funds.

Do I Need To Be a Crypto Guru to Set This Up?

Not at all. The great thing about modern crypto payment platforms is that they're built for business owners, not blockchain developers. If you've ever set up Stripe or PayPal, you've got all the skills you need.

Especially if you use a provider with e-commerce plugins, you won't ever have to touch the blockchain directly. The whole technical side is handled for you behind the scenes:

- It creates a unique payment address for every single order.

- It watches the network to confirm the payment has gone through.

- It automatically updates the order status in your store.

From your perspective, it's seamless. A payment comes in, and the funds show up in your account. The complex stuff is taken care of, so you can just focus on running your business.

What If a Customer Sends The Wrong Amount?

It's a fair question—mistakes happen. Any good payment gateway has systems in place to handle these hiccups without causing a headache.

If a customer sends too little (an underpayment), the system will flag it and let both you and the customer know. The payment is put on hold until the remaining balance is paid, which means you don't accidentally ship an order that hasn't been fully paid for.

If they send too much (an overpayment), the extra funds can typically be refunded. But honestly, this rarely happens. Well-designed checkout pages with QR codes and copy-paste buttons make it incredibly difficult for customers to send the wrong amount in the first place.

Ready to unlock global customers and lower your fees? With BlockBee, you can accept crypto payments online securely and effortlessly. Get started for free today!