Your Guide to White Label Payment Solutions

Imagine this: you want to offer your customers a smooth, branded payment experience—one that feels like it’s 100% yours—but you don’t have the years and millions of dollars it takes to build a payment system from the ground up. This is where white label payment solutions come in. They let you take a powerful, pre-built payment infrastructure and put your own brand name on it.

Build Your Brand on Your Own Payment System

Think of it like this: a world-class kitchen gives you the recipes, ingredients, and professional-grade tools. All you have to do is put on your chef's hat, cook the meal, and serve it to your customers under your restaurant’s banner. You get all the credit without having to design the kitchen, source the equipment, and hire the staff yourself.

That’s exactly what a white label payment solution does. It lets you bypass the staggering cost, complexity, and regulatory maze that comes with creating a payment system from scratch.

Building payment infrastructure is a huge undertaking. It demands massive investment in technology, deep knowledge of ever-changing financial regulations, and constant maintenance just to keep things secure and running. For most businesses, it’s a distraction that pulls precious resources away from what they actually do best.

Why Businesses Choose This Model

The real appeal boils down to two things: speed and focus. Instead of getting bogged down in a 12-18 month development cycle that can cost hundreds of thousands of dollars, you can launch a reliable, secure payment system in a fraction of the time. This frees you up to concentrate on serving your customers and growing your business.

This model is a game-changer for several types of businesses:

- SaaS Platforms: Embedding payments directly into your software creates a stickier product, reduces customer churn, and opens up a whole new revenue stream.

- Marketplaces: Making it simple to pay sellers and vendors builds trust and makes your operations far more efficient.

- Software Vendors: Adding a branded payment option makes your core product more valuable and indispensable to your clients.

A white label solution gives you something unique: total brand control. Instead of redirecting customers to a clunky, third-party page to pay, the entire experience stays within your ecosystem. It looks like you, feels like you, and builds serious customer trust.

A Market Driven by Demand

You don’t have to take my word for it—the numbers tell the story. The market for white label payment solutions was recently valued at $2.26 billion and is projected to hit $2.7 billion by next year. Looking ahead, it's expected to reach an incredible $4.7 billion in the next decade.

This explosive growth is a direct result of more and more businesses wanting to own their payment experience. Find out more about the growth of MSP payments on getflexpoint.com.

To give you a clearer picture, here’s a quick breakdown of what these solutions offer.

White Label Payments At a Glance

| Core Feature | Business Benefit |

|---|---|

| Branded User Interface | Reinforces brand identity and builds customer trust. |

| Pre-Built Infrastructure | Dramatically reduces time-to-market and development costs. |

| Managed Compliance & Security | Offloads complex regulatory burdens like PCI DSS compliance. |

| Revenue Sharing Models | Creates a new, profitable income stream from payment processing. |

Ultimately, this model gives you the best of both worlds: a top-tier payment system without the headaches of building one yourself.

This guide is designed to walk you through the whole process. We’ll break down how it all works, what to look for in a partner, and how to get started. By the end, you’ll have everything you need to make the right call for your business.

How White Label Payment Solutions Work

Ever wondered what happens behind the scenes when a customer hits "pay" on your site? With a white label solution, the experience feels like it's 100% yours, but a powerful, specialized engine is running the show in the background. The real magic is that your business gets all the credit, while your provider handles the heavy lifting.

Think of it like being a franchisee. You run your business under your own banner and create a unique customer experience. The parent company—in this case, the white label provider—gives you the operational blueprint, the backend technology, and the complex regulatory framework needed to make it all work. You get a world-class system without the headache of building it from scratch.

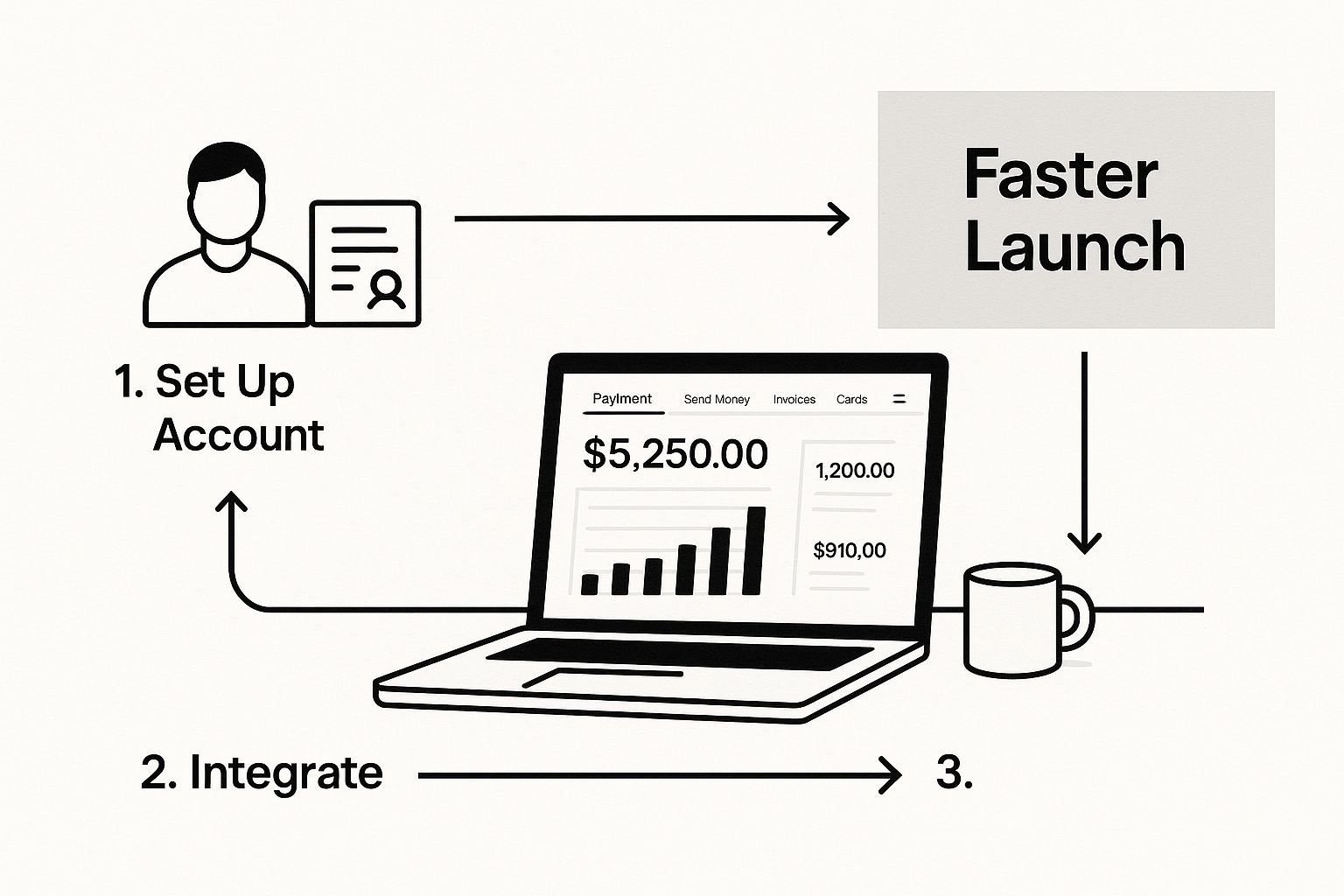

This is what makes a much faster launch possible—you're not starting from zero. You're building on an established, proven infrastructure.

As the visual shows, tapping into a provider’s existing tech stack frees up an enormous amount of development time and internal resources.

Tracing a Single Transaction

When a customer buys something, they see a checkout page with your logo, your colors, your brand. That interface is just the tip of the iceberg. Here’s a quick look at the journey that payment takes, all in a matter of seconds.

Initiation: The customer types their credit card details into your branded checkout form. This form is a secure element supplied by your white label partner, but it's styled to blend perfectly with your website.

Authorization: That data is securely whisked away to the provider's payment gateway. The gateway is like a digital armored truck, encrypting the information and sending it down the right financial channels.

Verification: From there, the provider's system pings the card networks (think Visa or Mastercard) and the customer's bank to make sure the funds are available and the card is valid.

Confirmation: Once approved, a confirmation zips back through the gateway to your site, and the customer gets the "payment successful" message.

Settlement: In the background, the provider manages the transfer of funds from the customer’s bank to your merchant account.

This whole dance is choreographed by your white label partner, but from your customer's perspective, they never left your world.

The Core Technology Components

Three key pieces of tech work together to make this happen, all managed by your provider. Knowing what they are helps clarify how everything stays so secure and efficient.

Payment Gateway: This is the digital version of a card reader in a store. It securely captures payment information from your site and passes it on. In a white label setup, its most important job is making sure this first point of contact is fully branded as yours.

Payment Processor: This is the engine room. It connects to all the different banks and card networks, handling the authorization requests and managing the actual money movement.

Tokenization: This is a crucial security feature. Instead of storing sensitive credit card numbers on your servers (a huge liability), the data is replaced with a unique, unbreakable code called a token. This token can be used for things like subscriptions or repeat purchases without ever exposing the original card details, which dramatically simplifies your PCI compliance requirements.

By taking care of these moving parts, your white label provider shields you from massive technical debt and regulatory hurdles. You're free to focus on your business while they make sure every transaction is secure, compliant, and fast.

This is a game-changer for software and SaaS companies. Building a payment system from the ground up can easily take up to 18 months and cost a fortune. A white label partnership gets you a market-ready solution in a fraction of the time. It’s not just about adding a feature; it’s about creating a new revenue stream and boosting customer loyalty by keeping everything under one roof—yours.

The Business Case for a White Label Payment Model

It’s one thing to understand the nuts and bolts of white label payments, but it’s another to see the massive impact they can have on your business. Choosing this model isn't just a technical decision; it's a strategic move that can seriously boost growth, build stronger customer relationships, and open up entirely new ways to make money. The benefits reach far beyond just handling payments—they touch every part of your brand and your bottom line.

This isn't just a fleeting trend. It’s a direct response to what the market is demanding: financial tools that feel like a natural part of a brand's experience. The numbers back this up, with the global white label payment gateway market—currently valued at $2.29 billion—projected to explode to $6.87 billion. That’s a compound annual growth rate of 14.5%, which clearly shows a massive shift toward ready-made payment systems that businesses can make their own. You can dive deeper into this expanding market on businessresearchinsights.com.

Solidify Your Brand Consistency

Let's be honest, few things are more jarring than getting to a checkout page only to be redirected to a third-party site with completely different branding. That friction can sow seeds of doubt right at the most critical moment of a purchase, chipping away at the trust you've worked so hard to build.

White label solutions completely solve this. The entire payment flow—from the checkout form to the confirmation email—is wrapped in your company's logo, colors, and voice. This creates a smooth, professional journey that keeps the customer grounded in your world, making them feel more secure and loyal to your brand.

Turn a Cost Center into a Profit Center

Payment processing has always been seen as a line item on the expense sheet—a necessary cost of doing business. But what if you could flip that on its head? A white label model does just that, turning a cost center into a genuine revenue stream.

By partnering with a provider, you can get a cut of the transaction fees. Every single time a customer pays, you earn a piece of the pie. For businesses that handle a lot of transactions, like SaaS platforms or online marketplaces, this can become a pretty significant and reliable source of income. You're no longer just paying for a service; you're monetizing a fundamental part of your operations. Our comprehensive guide to white label payment processing explores this in more detail.

Accelerate Your Speed to Market

Trying to build your own payment system from scratch is a massive undertaking. We're talking huge investments in developers, technology, and time—often 12 to 18 months, if not longer, before you can even think about launching. In that time, your competitors have already moved on.

White label payment solutions offer a powerful shortcut. You're essentially plugging into a pre-built, battle-tested infrastructure, which means you can roll out a sophisticated payment system in a tiny fraction of the time.

This speed lets you jump on market opportunities as they arise. It also frees up your team to stay focused on what they do best: improving your core product and growing the business, instead of getting bogged down in the complexities of payment engineering.

Reduce Your Compliance and Security Burden

The world of payment security and regulations is a minefield. Standards like PCI DSS (Payment Card Industry Data Security Standard) are incredibly strict, demanding constant monitoring, expensive audits, and relentless updates just to stay compliant. One misstep can be catastrophic.

Here's the beauty of a white label partnership: the provider carries most of that weight for you. They’re the ones responsible for maintaining the certifications and ensuring the platform's security is always airtight.

This offloads a huge amount of risk and administrative headache from your shoulders. Your provider handles all the tricky security protocols, like tokenization and encryption, so you can operate with the confidence that your customers' sensitive data is being protected by experts.

Choosing The Right White Label Payment Partner

Picking a provider for your white label payment solution is one of those make-or-break business decisions. This isn’t about just signing up for a service; it’s about finding a long-term partner whose tech becomes a core part of your brand, your customer experience, and ultimately, your revenue.

Get this right, and a great partner can feel like a growth engine. Get it wrong, and you're in for a world of technical headaches, frustrated customers, and a business that’s stuck in neutral. You need to look past the slick sales presentations and really dig into their technology, support, and business model to find a partner that can grow with you.

Assess The Depth Of Customization

The whole point of a white label solution is to keep your brand front and center. So, the first thing you need to figure out is how much you can actually customize. A true white label platform lets you control every single touchpoint, creating an experience so smooth your customers will never know another company is involved.

Get specific when you talk to potential partners. Ask them:

- User Interface (UI): Can we completely reskin the checkout pages, payment forms, and customer portals with our own CSS and branding? We need total control over the look and feel.

- Communication: Can we customize the invoices, email alerts, and payment receipts so they sound like they’re coming from us?

- Payment Flows: Can the system handle our specific workflows, like recurring subscriptions or tricky marketplace payouts?

The goal is simple: the user should never feel like they’ve been passed off to a third party. The entire payment process should feel like a natural part of your platform.

Scrutinize Security And Compliance

When it comes to payments, security isn't just a feature—it's everything. Your partner will be handling incredibly sensitive customer data, and if there’s a breach, it’s your brand that takes the hit. You absolutely must choose a provider with a fortress-like security posture and all the right compliance certifications.

The gold standard here is PCI DSS (Payment Card Industry Data Security Standard) Level 1 compliance. This is the highest level of validation, proving that the provider follows the most rigorous security protocols for handling cardholder data.

But don't stop at PCI DSS. Ask about their other security measures. Are they using advanced tokenization to keep raw card numbers off their systems? Do they run regular security audits and penetration tests to find and fix vulnerabilities? A transparent partner will be happy to show you their security documentation.

Choosing a secure partner is a massive win, as it dramatically reduces your own compliance burden. For a deeper dive into how this works, check out our guide on a white label payment gateway.

Evaluate Scalability And Performance

You're building a business to grow, so your payment partner has to be ready for the ride. A system that works perfectly for 100 transactions a day might completely fall apart when you hit 1,000. You need a solution built on an infrastructure that can handle massive transaction volumes without breaking a sweat.

Ask about their tech stack. Is it built on modern, cloud-native architecture that can scale automatically? What’s their uptime guarantee, and can you see a public status page? A truly reliable partner will have built-in redundancy and failover systems to ensure their service stays online, even when you're having your biggest sales day ever.

Understand The Fee Structure And Support

A partnership is only as good as the business model that supports it. White label payment fees can get complicated, so it's crucial to understand every potential cost before you sign anything.

A solid comparison of different payment models can help put the white label option into perspective. While a gateway reseller is a simple entry point and a PayFac model offers more control, the white label solution truly shines for businesses seeking complete brand ownership and customization.

Here's a breakdown of how these models stack up:

Feature Comparison White Label vs Payment Facilitator vs Gateway Reseller

| Feature | White Label Solution | Payment Facilitator (PayFac) | Gateway Reseller |

|---|---|---|---|

| Branding | Fully branded under your name. Seamless user experience. | Co-branded or provider-branded. Less control for you. | Provider-branded. Your name is not on the product. |

| Control | High. You manage the customer relationship and experience. | Medium. You manage sub-merchants under the PayFac's umbrella. | Low. You are essentially a sales agent for the provider. |

| Onboarding | You control the merchant onboarding process. | You are responsible for sub-merchant underwriting and onboarding. | The gateway provider handles all merchant onboarding. |

| Revenue | High potential. You set your own pricing and keep the margin. | Good potential. You earn a share of the transaction fees. | Lower potential. You earn a commission or referral fee. |

| Liability | High. You are responsible for fraud and chargebacks. | High. You assume the risk for your sub-merchants. | Low. The gateway provider assumes most of the risk. |

| Technical Lift | Medium to High. Requires significant integration work. | High. Requires extensive technical and compliance setup. | Low. Usually involves simple API keys or referral links. |

This comparison makes it clear that while white label solutions require a greater investment in integration and risk management, they offer unparalleled control and revenue potential.

Finally, don't forget to evaluate their support system. A great partnership is built on top of excellent API documentation, accessible developer support when you're integrating, and a responsive team that can help when things go wrong. A partner who invests in quality support is a partner who's invested in seeing you succeed.

White Label Payments in the Real World

It’s one thing to talk about white label payment solutions in theory, but where the rubber really meets the road is seeing how they perform in practice. Businesses across all sorts of industries are using this model to untangle complex problems, open up new revenue streams, and build much stronger brands. These real-world examples show just how flexible and powerful this approach can be.

From highly specialized software platforms to massive online marketplaces, the applications are everywhere. Each use case puts a spotlight on a different strength of the white label model, whether that’s making life easier for niche clients or handling complicated payout schedules for thousands of sellers. These stories don't just prove the model's value; they provide a clear blueprint for success.

This trend is only getting bigger. The white label payment gateway market is on track to hit a valuation of around $2.41 billion, growing at a steady clip of about 5.1% each year. This growth is driven by a simple fact: more and more businesses want flexible, brand-first payment options. You can read more about this market growth on archivemarketresearch.com.

SaaS Platforms Boosting Retention and Revenue

Let's take a Software-as-a-Service (SaaS) platform that sells project management tools to creative agencies. In the beginning, they sent customers to third-party payment links for billing. The experience was disjointed and clunky, which contributed to customers leaving.

By bringing in a white label payment solution, they completely overhauled their billing. Now, customers manage subscriptions, upgrade their plans, and pay invoices right inside the platform's dashboard. It's a seamless experience that reinforces the SaaS company's brand and makes the tool feel essential. Even better, the company now earns a small cut of every transaction, creating a brand-new revenue stream on top of its subscription fees.

Vertical Software for Fitness Studios

Now, picture a software company that builds management tools just for fitness and yoga studios. Their clients needed a dead-simple way to manage class bookings, memberships, and walk-in payments. Before, studios often had to juggle separate systems—one for their schedule and another for processing payments, creating a real administrative headache.

By embedding a white label payment solution, the software provider created an all-in-one package. Studios could suddenly take payments through a branded interface that felt like a natural part of their scheduling software. This simplified everything for the studio owners, made the software far more valuable, and locked in customers who couldn't imagine going back to wrangling multiple systems.

These examples reveal a core truth: integrating payments isn't just a feature. It’s a strategic move that turns your platform into the central hub for your customers' operations, making your product stickier and more valuable.

Marketplaces Managing Complex Payouts

Online marketplaces have their own unique beast to tame: they have to collect payments from thousands of buyers while also sending payouts to countless sellers. A marketplace for handmade crafts, for instance, needs to make sure every seller—from a solo artisan to a small business—gets paid accurately and on time.

A white label solution lets the marketplace put this entire process on autopilot.

- Seller Onboarding: New sellers can connect their bank accounts through a portal that carries the marketplace's branding.

- Automated Payouts: The system automatically figures out commissions and sends funds to sellers on a regular schedule.

- Enhanced Trust: A reliable, professionally branded payment system builds confidence and makes sellers more loyal to the platform.

This move didn't just make operations more efficient; it became a major selling point for attracting new vendors to the platform. Giving sellers more options, like the ability to receive different types of payments, can set a marketplace even further apart. To learn more about this, check out our guide on how to accept crypto payments for your business.

Your Roadmap from Selection to Launch

Alright, you've picked your white label partner. Now for the exciting part: bringing your very own branded payment system to life. Getting this right isn't about luck; it's about following a clear, structured roadmap. Think of it as a journey with distinct phases, each one building on the last to ensure a smooth and successful launch.

This whole process is about turning your vision into a secure, functional, and beautifully branded reality. It's a true collaboration between your team and your chosen provider, with clear milestones to keep everyone on track.

Phase 1: Technical Integration and Testing

First things first, let's get under the hood. This is the technical integration phase, where your developers use the provider's API (Application Programming Interface) to connect their payment infrastructure directly to your platform. This is a critical step, and having clear, comprehensive API documentation from your partner is an absolute game-changer. It can mean the difference between a quick integration and a month of headaches.

Your team will start out in a sandbox environment. This is essentially a secure playground that mirrors the live payment system but doesn't touch real money. It’s here that your team can run every test imaginable, making sure the entire transaction flow—from checkout to settlement—works flawlessly.

Think of the sandbox as a flight simulator for your payment system. It lets your team practice every maneuver, handle simulated turbulence, and ensure everything is perfect before you take off with actual customer money. Catching bugs here is infinitely better than finding them post-launch.

Phase 2: Branding and UX Customization

With the technical foundation in place, it’s time to focus on what your customers will actually see and feel. This is where you infuse your brand's personality into the provider's technology, making it look and feel like it was built by you, for you. Your design team will take the lead, applying your logo, color scheme, and fonts to every customer touchpoint.

Key areas you'll want to customize include:

- Checkout Pages: The payment forms should blend seamlessly with your website's design.

- Customer Emails: Your receipts, notifications, and alerts need to speak in your brand's voice.

- Merchant Portals: If you're serving other businesses, their dashboard should carry your branding.

The end goal? To create an experience so cohesive that your users have no idea there's a third-party provider powering it all.

Phase 3: Merchant Onboarding and Compliance

Before you can start processing payments, you need a streamlined way to get your users or sub-merchants signed up. This process needs to be both user-friendly and fully compliant with all the necessary financial regulations. Your provider will be your guide here, helping you navigate the requirements for Know Your Customer (KYC) and Anti-Money Laundering (AML) checks.

Your job is to design an onboarding flow that feels effortless. This usually means simple online forms that gather the required information without scaring users away. A clunky onboarding experience is a major roadblock, so making it smooth is essential for getting your clients up and running quickly. By thinking through each of these phases, you can tackle the implementation with confidence and set yourself up for a killer launch.

Got Questions About White Label Payments? We've Got Answers.

Jumping into the world of white label payments always brings up a few big questions. It's smart to get straight answers before you pick a partner and weave their tech into your platform. Let’s tackle some of the most common ones to clear things up.

Making a good call here means really understanding the differences between payment models, what the costs look like, and who's on the hook for crucial things like security and compliance.

White Label Gateway vs. PayFac Model

One of the first things people get stuck on is the difference between a white label gateway and becoming a full-blown Payment Facilitator (PayFac). Both give you way more control than just reselling someone else's service, but they're worlds apart in terms of responsibility and risk.

Here’s a simple way to think about it:

A white label solution is like getting a custom-branded car from a top-tier manufacturer. You get to put your logo on it and decide where it goes, but the experts who built it are still handling the engine, the maintenance, and all the safety checks.

The PayFac model, on the other hand, is like getting the keys to the entire dealership. You're not just driving the car; you're responsible for vetting every single person you sell a car to and are liable if they get into trouble.

The main differences really come down to:

- Liability: As a PayFac, you're on the hook for all the financial risk your sub-merchants bring, from fraud to chargebacks. With a white label partner, they typically absorb most of that risk for you.

- Control: A PayFac has the final say on underwriting and onboarding, but that control comes with a mountain of compliance work. White label solutions handle that messy compliance layer, making your life much easier.

What's the Typical Cost Structure?

When you invest in a white label payment solution, the pricing usually breaks down into a few standard buckets. Every provider is different, but you can generally expect to see some combination of these:

- Setup Fees: A one-time charge to get you integrated and set up on their platform.

- Monthly Fees: A recurring fee that covers platform access, ongoing maintenance, and customer support.

- Per-Transaction Fees: This is the small percentage or flat fee taken from each payment you process. It's also where you'll often find opportunities for revenue sharing.

The real win isn’t just about the features you get—it's about the massive costs you don't have to pay. Partnering with a provider helps you dodge the $30,000 to $300,000 price tag and the 4-18 month development timeline it would take to build a comparable system from the ground up.

Who's in Charge of PCI Compliance?

This is a big one. PCI DSS compliance is notoriously complex, and getting it wrong isn't an option. The good news is that with a solid white label partner, you work under a shared responsibility model where they do almost all of the heavy lifting.

Your provider maintains their own strict PCI Level 1 compliance, which covers their entire payment infrastructure, from the gateway to the data storage vaults. This dramatically shrinks your own compliance burden. Your main job is to make sure your website and integration points handle customer data securely before it's passed off to the provider’s system.

It's a true partnership—you get to offer world-class security without having to become a security expert yourself.

Ready to offer a seamless, branded payment experience without the development overhead? With BlockBee, you can integrate secure crypto payments directly into your platform, maintaining full brand control while we handle the complex backend. Explore our developer-friendly API and start building today.