Your Guide to White Label Payment Platforms

Think of a white label payment platform as getting the keys to a brand new, fully-equipped professional kitchen. Instead of spending years and a small fortune building one from the ground up, you just put your restaurant's name on the door, design your menu, and start serving customers. That's exactly what a white label payment platform does for your business—it gives you a ready-made payment processing engine that you can rebrand and offer as your very own.

This model lets you provide sophisticated payment services without the immense cost, time, and headaches of developing the technology yourself.

Unlocking New Revenue with Branded Payments

For SaaS companies, online marketplaces, and software vendors, processing payments is a critical, yet often clunky, part of the operation. The old way usually meant sending your customers away from your site to a third-party processor like PayPal or Stripe. This works, but it can break the flow and feel disjointed for the user.

A white label payment platform completely flips that script. It embeds payment processing directly into your own app or website, all under your brand. Suddenly, payments aren't just a background utility; they become a core, integrated feature of your product. It’s no longer a cost center, but a powerful way to build stronger customer relationships and open up entirely new revenue streams.

The Two Key Roles Explained

It’s pretty simple to see how this works once you understand the two main players involved:

- The Platform Provider: This is the tech company that builds and maintains the core payment infrastructure. They're the ones in the background managing all the complex stuff—the backend processing, security protocols, and regulatory compliance. They deliver a powerful, unbranded engine ready for you to use.

- Your Business (The Reseller): You’re the one who takes this pre-built engine and puts your own spin on it. You add your logo, your brand colors, and your user interface. Then, you offer these payment services directly to your own customers, giving you complete control over their experience.

This partnership lets you become a payment provider almost overnight, without spending millions of dollars and years in development. You get to market faster, keep your branding consistent, and own the customer relationship from end to end. It's no surprise the market for these solutions is booming. The global white label payment gateway software market, valued at around $3.2 billion, is expected to hit an estimated $8.1 billion by 2033. That explosive growth shows just how many businesses are catching on.

When you adopt a white label solution, you’re doing more than just adding a feature. You're strategically positioning your business as the all-in-one solution your clients need, which is a massive driver for customer loyalty and lifetime value.

This approach is particularly powerful for platforms catering to specific niche industries, allowing them to offer payment processing that’s perfectly suited to their clients' unique needs. It’s a flexible model that works for traditional money and is easily adapted for digital currencies, too. For more on simplifying transactions in that space, check out this article on how BlockBee makes cryptocurrency payments simple for businesses.

Key Benefits of a White Label Payment Solution

When you switch to a white label payment platform, you're doing more than just processing transactions. You're taking strategic ownership of the entire payment experience. The benefits go far beyond the nuts and bolts of moving money; they fundamentally change how you interact with customers and position your business for growth.

The most immediate win? You get to market incredibly fast.

Building a payment system from scratch is a massive project. We're talking years of development, endless testing, and a nightmare of financial regulations. A white label solution hands you a pre-built, road-tested infrastructure, letting you launch a fully branded payment service in a few weeks, not a few years.

Drastically Reduce Development Costs

The cost of building an in-house payment gateway is enough to make your eyes water. You need specialized developers, security pros, and compliance officers—all of whom command high salaries. Then you have to factor in server infrastructure, ongoing maintenance, and constant security audits. It's easy to sink millions into the project before you ever process a single dollar.

A white label payment platform sidesteps the bulk of those upfront costs. Instead of a huge capital investment, you’ll typically have a setup fee and then predictable licensing or transaction fees. This turns a high-risk financial gamble into a manageable operational expense, freeing up cash for what really matters: growing your business.

Think about it: by using a ready-made solution, you skip the most expensive and time-consuming parts of the process. This lets you pour resources into marketing, finding new customers, and innovating your actual product—the things that truly drive growth.

Strengthen Your Brand and Boost Customer Trust

Let's be honest, sending customers to a third-party site to pay feels clunky. That break in the experience can make customers hesitate, question your credibility, and even abandon their cart. A seamless, branded checkout keeps them right where you want them: within your ecosystem, reinforcing your brand from start to finish.

This consistency is key to earning long-term loyalty. When the payment process looks and feels like a natural part of your platform, customers feel safer and more confident. In fact, research shows that a consistent brand presentation can lift revenue by as much as 33%. This trust isn't just a nice-to-have; it leads directly to better conversion rates and happier, more loyal customers.

A white label payment platform gives you full control over the user interface. From the look of the checkout page to the wording in transaction emails, every touchpoint can reflect your brand's commitment to quality. You're no longer just another business using Stripe or PayPal; you're the company that handles payments perfectly.

Turn Payments Into a Profit Center

This might be the most exciting benefit of all: the chance to turn a necessary expense into a new source of revenue. Instead of just paying fees to a payment processor, you can actually start earning money from the transactions flowing through your platform.

This is a strategy that vertical SaaS companies have mastered. Imagine a software platform for yoga studios. It can offer its clients a branded way to handle class bookings and memberships. For every transaction it processes, the SaaS provider earns a small cut.

This approach delivers a few powerful advantages:

- New Revenue Stream: You can add a small markup to transaction fees, creating a profitable new part of your business.

- Increased Stickiness: When payments are woven directly into your platform, it becomes essential to your customers' day-to-day operations. They’ll be far less likely to leave for a competitor.

- Higher Customer Lifetime Value (LTV): By monetizing payments, you increase the total amount of revenue you earn from each customer.

This model is flexible enough to work with all kinds of payment methods. Whether you're dealing with credit cards or looking to add newer options, the logic holds. As digital currencies gain traction, you can apply the same strategy, which is covered in our guide on accepting cryptocurrency payments for your business. Ultimately, you transform a simple utility into a core part of your growth engine.

What to Look for in a Modern Payment Platform

Choosing a white label payment platform is a lot like picking the engine for a race car. The right one gives you the power and reliability to win, but the wrong choice will leave you stalled on the starting line. It's easy to get lost in a sea of feature lists, but the truth is, not all platforms are built the same.

Let's cut through the marketing fluff. We're going to break down the non-negotiable features that separate a basic, off-the-shelf solution from a genuine growth partner. This is about understanding what really matters for your business.

H3: Deep Branding and UI Customization

The whole point of a white label solution is to make it look and feel like yours. This goes way beyond just sticking your logo on someone else's template. A top-tier platform gives you surgical control over the user interface (UI) to create a seamless, completely on-brand experience.

Every touchpoint matters. From the moment a customer decides to pay, the journey should feel like an extension of your brand.

- Checkout Pages: The colors, fonts, and form fields should perfectly match your app or website's design.

- Transaction Emails: Receipts, refund notices, and payment confirmations need to carry your branding and tone of voice.

- Merchant Dashboards: If you're providing payment services to other businesses, their backend portals must reflect your brand, solidifying your position as their trusted partner.

If the experience feels clunky or disjointed, you risk eroding customer trust. A generic checkout page screams "third party" and can be a major cause of cart abandonment. Total brand control is about building confidence from start to finish.

H3: Ironclad Security and Effortless Compliance

In the world of payments, security isn’t a feature—it’s the foundation everything is built on. A single data breach can torpedo your reputation and result in devastating financial penalties. Your chosen white label payment platform absolutely must come with robust, multi-layered security.

Here are the essentials you can't compromise on:

- PCI DSS Compliance: The Payment Card Industry Data Security Standard is the gold standard, and it's non-negotiable. Your provider needs to handle the heavy lifting of Level 1 PCI compliance, the highest and most rigorous level available. This shields sensitive cardholder data and drastically shrinks your own compliance headache.

- Advanced Fraud Detection: Forget simple rule-based systems. Modern platforms use AI and machine learning to spot suspicious transaction patterns in real-time, stopping fraud before it ever impacts you or your customers.

- Tokenization and Encryption: These technologies are crucial. They work together to ensure sensitive payment details are never stored in a readable format, protecting them whether they're being transmitted or just sitting on a server.

Compliance isn’t a one-time checklist; it’s a constant, evolving responsibility. A great provider takes this off your plate by managing complex regulations like KYC (Know Your Customer) and AML (Anti-Money Laundering), saving you from getting bogged down in legal complexities.

This intense focus on security is a major reason the market is growing so quickly. In fact, the white label payment gateway market is projected to reach $3.42 billion, with North America leading the charge. As you can learn from the research on the white label payment gateway market, enhanced security and compliance are becoming the key differentiators that build trust and meet global standards.

H3: Global Reach with Multi-Currency Support

Your business ambitions shouldn't be fenced in by borders. If you have any plans to operate internationally—or if your clients do—then multi-currency support is a must-have. This feature is about more than just accepting different currencies.

A truly global platform handles the messy parts of international business, like cross-border settlements and dynamic currency conversion. This gives your international customers a much better experience because they see prices in a currency they actually recognize and understand. It's a simple change that has been proven to dramatically boost conversion rates in foreign markets.

H3: Streamlined Merchant Onboarding

So, you’ve got this beautifully branded payment platform. Now what? You need to get your clients signed up and using it, and a clunky, manual onboarding process is a dead end. The best platforms automate this, providing digital tools that make it incredibly fast and simple for your clients to get started.

Look for a smooth, self-service online application, instant identity verification, and rapid underwriting decisions. The faster you can get a new merchant approved and processing payments, the faster you start making money. It’s that simple.

H3: Insightful Analytics and Reporting

You can't improve what you don't measure. A powerful analytics dashboard is your mission control, giving you a clear, bird's-eye view of your entire revenue operation. It needs to go beyond simple transaction logs to deliver insights you can actually act on.

A good dashboard will let you track key performance indicators (KPIs) like:

- Total payment volume (TPV)

- Transaction success and failure rates

- Chargeback ratios

- Customer lifetime value

This data is gold. It empowers you to make smart business decisions, spot emerging trends, and fine-tune your payment flows for maximum profitability. Without it, you're just flying blind.

Choosing a platform means looking beyond the surface. To help you evaluate your options, we've put together a checklist of the core features and their direct impact on your business.

Essential Platform Feature Checklist

| Feature Category | Key Capabilities | Business Impact |

|---|---|---|

| Branding & UI | Full control over checkout pages, emails, and dashboards. | Builds customer trust, increases conversions, and reinforces your brand identity. |

| Security & Compliance | Level 1 PCI DSS, AI fraud detection, tokenization, KYC/AML. | Protects your business from catastrophic breaches and reduces your legal/regulatory burden. |

| Global Payments | Multi-currency acceptance, international settlement, dynamic conversion. | Unlocks new markets, improves international customer experience, and boosts global sales. |

| Merchant Onboarding | Automated digital applications, instant verification, fast underwriting. | Reduces friction, accelerates time-to-revenue, and improves client satisfaction. |

| Analytics & Reporting | Real-time KPI dashboards, trend analysis, detailed transaction data. | Enables data-driven decisions, helps optimize for profitability, and provides operational clarity. |

Think of this checklist as your guide. A platform that ticks all these boxes isn't just a tool; it's a strategic asset that will support and accelerate your growth for years to come.

Choosing Your Path: Build vs. Buy vs. White Label

When it's time to handle payments, you're faced with a classic strategic fork in the road. Do you build your own system from scratch, buy an off-the-shelf solution, or partner with a white-label provider? Each path has its own set of rewards and hurdles, and the decision you make will have a lasting impact on your budget, your timeline, and—most importantly—your customer's experience.

Let’s walk through these three options to see which one truly fits your business.

Comparing Payment Solution Models

Deciding on a payment strategy involves weighing factors like cost, speed, and brand control. To make it clearer, here’s a direct comparison of the three primary approaches across the issues that matter most to your business.

| Factor | White Label Platform | Build In-House | Standard Payment API |

|---|---|---|---|

| Brand Control | High (fully customizable front-end) | Complete (100% proprietary) | Low (co-branded or third-party UI) |

| Time to Market | Fast (weeks to a few months) | Very Slow (many months to years) | Very Fast (days to weeks) |

| Initial Cost | Moderate (setup and licensing fees) | Extremely High (development, infrastructure) | Low (minimal to no setup fees) |

| Ongoing Costs | Predictable (licensing/transaction fees) | Very High (maintenance, staff, compliance) | Transaction-based (fees per payment) |

| Technical Resources | Low (minimal development needed) | Extremely High (dedicated expert team) | Low (basic integration skills) |

| Compliance Burden | Low (handled by the provider) | Very High (you own all PCI DSS, etc.) | Low (handled by the provider) |

| Flexibility | High (customizable features/flows) | Complete (total control over everything) | Low (limited to API capabilities) |

As the table shows, there are significant trade-offs with each model. The best choice really depends on your specific priorities and resources.

The In-House Build: The High-Cost Path to Total Control

Building your own payment infrastructure is, without a doubt, the most ambitious route. The ultimate prize? 100% customization. Every workflow, every feature, every single line of code is built to your exact specifications. You own it all, giving you absolute control.

But that control comes with a hefty price tag. The initial development costs can easily climb into the hundreds of thousands, if not millions, of dollars. And that’s just the start. You'll need a permanent, dedicated team of specialized engineers, security pros, and compliance officers. The project timeline can drag on for months or even years, and the burdens of maintenance, security patches, and navigating the shifting maze of regulations like PCI DSS are yours forever.

This path is really only for massive enterprises with incredibly deep pockets and a unique strategic need that no existing solution can possibly meet.

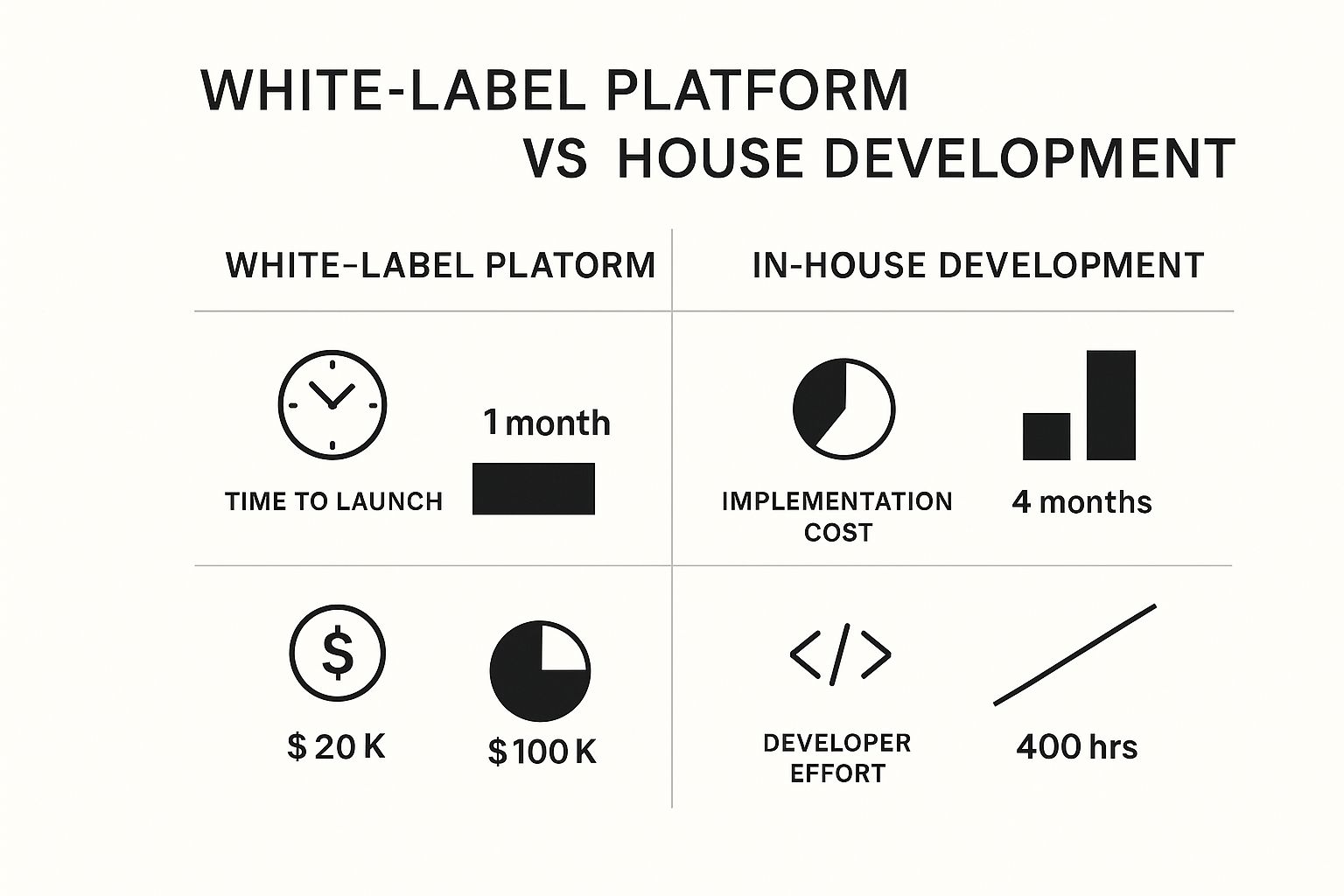

The data here really tells the story. A white-label platform can slash launch times by 75% and cut initial costs and developer hours by a staggering 80%. It’s simply a much more efficient way to get to market.

Standard Payment APIs: The Quick but Impersonal Option

On the other end of the spectrum, you have the standard, off-the-shelf payment API from a processor like Stripe or Adyen. It's the plug-and-play choice. It’s incredibly fast to implement, requires very little money upfront, and gets you up and running almost overnight. For a lot of small businesses or early-stage startups, this is a perfectly sensible way to start accepting payments.

The big trade-off here is brand control. When your customer goes to pay, they’re often whisked away to a checkout page that looks and feels like the payment processor—not you. This can be jarring, chip away at trust, and lead to more people abandoning their carts. While these APIs are powerful, they offer very little room for customization. You're forced to fit your business into their box. You get speed, but you sacrifice a seamless, branded experience.

Looking at Shopify's native payment solution, Shop Pay, helps illustrate how a branded checkout can work, but it’s within a closed ecosystem that you don’t control.

White-Label Platforms: The Strategic Middle Ground

This is where white-label payment platforms come in. They sit right in that sweet spot between the two extremes, offering a brilliant combination of the best of both worlds. You get the speed and cost-efficiency of a ready-made solution, but with the branding and control you’d expect from a custom build.

A white-label partner essentially hands you the keys to a state-of-the-art payment engine. You get to put your logo on it, style the user interface to perfectly match your brand, and offer a completely seamless payment flow to your customers.

This strategic move sidesteps the huge development costs and regulatory nightmares of building in-house. At the same time, it solves the branding problem you get with standard APIs. You can launch a sophisticated, fully branded payment service in a fraction of the time and for a fraction of the cost, turning payments from a necessary evil into a core part of your product's value.

For any business that wants to strengthen its brand, own the customer journey, and maybe even open up new revenue streams, the white-label model is often the smartest path forward. This model is also incredibly adaptable, a key advantage when you're looking to add modern payment options. For a closer look, you can explore our guide on integrating cryptocurrency into your business with BlockBee's approach.

Your Roadmap to a Successful Integration

Bringing a white-label payment platform into your business is a significant move, but it doesn't have to be overwhelming. When you have a clear plan, you can navigate the process smoothly and set yourself up for a successful launch. Think of it as a journey with distinct, manageable stages, each one getting you closer to your own branded, revenue-generating payment solution.

This roadmap breaks down the entire integration into five clear phases. Following these steps gives you the structure and best practices you need to launch with confidence. Of course, the foundation for all of this is building a winning software project development plan that spells out your goals, timelines, and who's doing what.

Phase 1: Strategic Vendor Selection

Your first—and most important—step is picking the right partner. The provider you choose is essentially an extension of your business, so you have to vet them carefully. Your evaluation should really boil down to three things: technology, support, and pricing.

Look past the flashy marketing and dig into their actual technical capabilities. Does their platform have the specific features your customers will actually use? How good is their API documentation? A solid partner will have a proven track record, a reliable infrastructure, and the ability to scale right alongside you.

And don't forget the human side of the equation. What's their support model like? Because when technical hiccups happen—and they will—you need a responsive, expert team ready to help. Finally, get a complete picture of their pricing. Insist on total transparency for setup fees, monthly licenses, and transaction costs to make sure there are no nasty surprises waiting for you later.

Phase 2: Technical Integration and Customization

With a provider selected, it’s time for the tech team to get to work. This is where your developers collaborate with the provider to plug the payment engine into your existing software or website. The main tools for the job are Application Programming Interfaces (APIs).

A good white-label platform will give you comprehensive API documentation and a developer sandbox. This is a safe, secure testing environment where your engineers can play around with the integration without breaking anything in your live system. This is also the stage where you customize the user interface (UI), making sure every checkout page, email receipt, and dashboard perfectly reflects your brand.

Phase 3: Navigating Compliance Together

Payment regulations like PCI DSS, KYC (Know Your Customer), and AML (Anti-Money Laundering) are notoriously complex, but they aren't optional. A huge benefit of using a white-label platform is that the provider shoulders most of the heavy compliance burden for you.

It's crucial to understand that compliance is a shared responsibility. Your provider manages the core infrastructure's security and PCI DSS Level 1 certification, but you are still responsible for ensuring your own systems and processes are secure.

Think of your provider as your compliance guide. They should help you understand exactly what you're responsible for. This partnership model drastically cuts down on your risk and the resources you’d otherwise spend on compliance, freeing you up to focus on your customers.

Phase 4: Rigorous Pre-Launch Testing

Before you even think about going live, you have to test every single part of the payment flow. The sandbox environment is your best friend here. The goal is to run through every possible real-world scenario to find bugs or friction points before your customers do.

Your testing checklist should cover:

- Successful Transactions: Run payments with different card types from various locations.

- Failed Transactions: Intentionally cause declines to see how the system reacts and what messages the user sees.

- Refunds and Voids: Test the full transaction lifecycle, including giving money back.

- User Experience: Go through the entire checkout process as if you were a customer. Is it simple? Is it fast?

This intense testing is the best insurance policy you can have against a messy launch. A flawless rollout builds trust with your users from day one.

Phase 5: Go-Live and Merchant Onboarding

Once testing is complete, it's time for the main event. A successful launch is more than just flipping a switch; you need a solid strategy for rolling the new service out to your clients. A smart approach is to start with a small group of beta testers before making it available to everyone.

Your launch plan also needs a smooth process for merchant onboarding. The best platforms offer digital tools that make it incredibly easy for your clients to sign up, get approved, and start taking payments. Clear communication and excellent support during this initial phase are absolutely essential for driving adoption and making your new platform a massive success.

The Future of Embedded Payments and Your Business

If you look at the horizon, you'll see the line between software and financial services is practically disappearing. The future is all about embedded finance, a world where payments aren't a separate, clunky step but a smooth, almost invisible part of the experience. A white-label payment platform is your ticket into this new reality.

Think about it this way: your customers will no longer have to stop what they're doing to "go pay." They'll just... do the thing. Whether that's booking a service, wrapping up a project, or upgrading a subscription, the payment will happen right there, in the moment, as a natural part of the flow. This shift is powerful—it makes your platform stickier and far more valuable to your clients' day-to-day work.

Riding the Waves of Innovation

To keep your edge, your platform has to be ready for what's coming. Two huge trends are reshaping the payments world as we know it: intelligent automation and the need to handle more complex money movements.

AI-Powered Personalization and Security: Artificial intelligence is already doing much more than just flagging suspicious transactions. The platforms of tomorrow will use AI to personalize the entire payment experience, offering up a user's preferred payment methods or even creating tailored installment plans on the fly. This kind of intelligence creates a smarter, safer, and incredibly responsive ecosystem.

Complex Transaction Flows: Business isn't just about simple A-to-B payments anymore. Marketplaces have to split a single payment between multiple sellers. SaaS companies are moving to sophisticated usage-based billing. Platforms have to manage intricate commission structures. A solid white-label solution gives you the architecture to handle all these complex money flows without having to build a massive, costly system from scratch.

The real beauty of a white-label model is its agility. As payment technology moves forward, your provider takes care of all the heavy lifting on the backend. This lets you roll out new features under your own brand and stay ahead of the curve.

This forward-thinking approach is precisely why the market is booming. The white-label payment gateway market is projected to jump from USD 2.29 billion to a staggering USD 6.87 billion by 2033, growing at a 14.5% CAGR. This shows just how hungry businesses are for payment solutions they can own, customize, and trust for the future. You can dig deeper into these market projections and their drivers.

Picking a white-label payment platform isn't just about fixing a problem you have today. It's an investment in a flexible foundation that will help your business not just survive, but thrive in the embedded finance future.

Frequently Asked Questions

It's natural to have questions when you're exploring a new way to handle payments. Let's walk through some of the most common ones that pop up when businesses consider a white-label payment platform.

How Does Pricing For These Platforms Work?

The pricing for a white-label payment solution is designed to be manageable, avoiding the six-figure-plus investment you'd need to build your own from scratch. While every provider is a bit different, you'll generally see a predictable, multi-part structure.

You can usually expect a mix of these three costs:

- Setup Fee: This is a one-time charge to get everything up and running. It covers configuring the system, applying your branding, and integrating it with your existing software.

- Monthly License Fee: Think of this as a subscription. It pays for access to the core technology, customer support, and all the behind-the-scenes maintenance and updates.

- Per-Transaction Costs: For every payment you process, the provider takes a small fee. The great part is that you can typically add your own markup to this, turning your payment system into a new revenue stream.

This model flips a potentially massive capital expense into a predictable operational cost, making advanced payment processing accessible to far more companies.

Who Is Responsible For PCI Compliance?

This is one of the most important questions to ask, and the answer is shared responsibility. A huge advantage of a white-label solution is that you get to offload the most intense compliance headaches, but you're not entirely hands-off.

Your white-label provider takes on the heavy lifting: achieving and maintaining the highest level of security, PCI DSS Level 1, for their core platform. However, your business is still responsible for securing your own side of the equation—things like your website, your app, and your internal procedures.

Essentially, your provider becomes a compliance partner. They handle the complex technical security and protect cardholder data within their system, which massively shrinks your risk. But at the end of the day, security is a team sport.

Can I Migrate My Existing Customers?

Yes, in most cases you can. Bringing your current merchants over from another payment processor to your new branded platform is a common goal, but it requires a well-thought-out plan. The process and its difficulty really depend on your old provider and the migration tools your new partner offers.

Typically, this involves securely transferring tokenized payment details, so sensitive customer data is never exposed. A quality provider will give you dedicated support and clear instructions to make the transition as smooth as possible for you and your clients.

Ready to take control of your payment experience and unlock new revenue? BlockBee offers a secure, developer-friendly cryptocurrency payment platform that you can make your own. Start processing crypto payments under your brand today.