What Is IPN and How Does It Automate Online Payments?

Think of an Instant Payment Notification (IPN) as a digital heads-up for your online store. When a customer pays, instead of you having to log in and manually check your account, the payment processor sends a secure, automatic message straight to your server. That message essentially says, "Hey, Order #123 is paid!" This is the core of what an IPN is—an automated, server-to-server communication system that confirms payment events the moment they happen.

The Foundation of Automated E-Commerce

At its heart, an IPN is a specific type of "push" notification sent from a payment gateway to your system whenever a transaction's status changes. This isn't a simple email or text; it's a direct line of communication between two machines.

Imagine you sell digital products like e-books or software licenses. Without an IPN, you’d be stuck manually verifying each payment before you could email the customer their download link. This approach is slow, prone to mistakes, and simply doesn't work once you start getting more than a few orders a day.

An IPN completely changes the game by creating an automated workflow. The instant a payment is confirmed, your server gets the notification and can immediately kick off the next step, like granting access to a course or sending a license key. This is the engine that powers instant digital downloads and automatic order processing, turning a manual chore into a seamless, hands-off operation.

To better understand this flow, let's break down the key players involved.

Key Roles in an Instant Payment Notification Flow

This table outlines who does what in a typical IPN communication process, making it clear how the information travels from the payment processor back to your business systems.

| Component | Role in the IPN Process |

|---|---|

| Payment Gateway | Initiates the communication. It detects a change in payment status (e.g., successful, failed, refunded) and sends the IPN message. |

| IPN Message | The data packet itself. It contains crucial information like the transaction ID, amount, currency, and customer details, all packaged securely. |

| Your Server | The destination. It has a specific "listener" script waiting at a designated URL to receive and interpret the incoming IPN message. |

| Listener Script | The brain of your operation. This code receives the IPN, validates its authenticity, and then triggers business logic (e.g., update the database, send an email, grant access). |

Each component plays a vital role in ensuring the notification is sent, received, and acted upon correctly, all without any human intervention.

Why Automation Is Critical

To really get why IPNs are so important, it helps to understand the bigger picture of Business Process Automation (BPA). IPNs are a perfect example of BPA in action for e-commerce, taking a repetitive, critical task—payment verification—and handing it over to machines. This switch unlocks some serious advantages:

- Immediate Fulfillment: Customers get what they paid for right away. This drives satisfaction way up and cuts down on "Where's my stuff?" support tickets.

- Reduced Manual Workload: Your team is freed from the mind-numbing task of checking for payments and manually updating order statuses.

- 24/7 Operations: Your business can process orders and deliver products around the clock, even while you sleep.

- Improved Accuracy: Automation gets rid of the human errors that inevitably creep in with manual data entry and order management.

An IPN isn't just a technical feature; it's a strategic tool for scaling an online business. It transforms the payment process from a potential bottleneck into a smooth, reliable, and fully automated part of your operations.

Ultimately, understanding what an IPN is means seeing it for what it is: a silent, efficient worker that ensures your business runs smoothly behind the scenes. It’s the invisible link that connects a customer's payment to the immediate delivery of their purchase, creating the instant gratification that modern online shoppers have come to expect.

How an IPN Transaction Actually Works

So, what does an IPN transaction look like in the wild? Let's follow the digital breadcrumbs of a single online payment to see how it all connects. The whole thing is a carefully choreographed dance between different systems, turning a customer's click into a fulfilled order in seconds.

Think of it as a "push" system. The payment processor actively sends—or pushes—information to you the moment it's available. This is way more efficient than your server having to constantly ask, "Did the payment go through yet? How about now?"

This automated conversation is the backbone of modern e-commerce. Let’s trace the journey from checkout to confirmation.

The Customer Kicks Things Off

It all starts when a customer hits that "Pay Now" button on your site. They're sent over to a secure payment page hosted by your gateway (like BlockBee) to enter their card details or approve a crypto payment.

Once they submit, the gateway takes over. Its first job is to securely process the transaction, talking to the necessary financial networks to make sure the funds are available and authorize the payment. This part happens in the blink of an eye.

The Gateway Sends the IPN Message

As soon as the payment is processed successfully, the gateway’s automation kicks in. It bundles up all the important details into a small, secure data packet—the IPN message.

This little message is packed with everything your system needs to know:

- Transaction ID: A unique fingerprint for this specific payment.

- Payment Status: The crucial detail, like 'Completed', 'Failed', or 'Pending'.

- Amount and Currency: Exactly how much was paid and in what currency.

- Customer Information: The details required to get the order fulfilled.

The gateway then fires this message off to a specific URL you provided during your setup. This URL is your IPN listener, a dedicated digital mailbox on your server waiting to catch these notifications.

The real magic of an IPN is its proactive communication. Instead of your system having to periodically check the payment gateway's API for updates, the gateway pushes real-time information directly to you the second something happens. This is what makes instant, automated actions possible.

Your Server Catches and Verifies

When the IPN message arrives, your listener’s first job is critical: make sure it’s the real deal. It immediately performs a "handshake" by sending the data right back to the payment gateway to ask, "Did you really send this?" This step is an absolute must for security, as it stops scammers from sending fake IPNs to trick your system into giving away products for free.

Once the gateway confirms the message is authentic, your listener knows the data is trustworthy. For developers wanting a deeper look at building these secure interactions, our guide on a crypto payment gateway API offers practical examples.

Your System Springs into Action

With the payment officially validated, your server's own logic takes the wheel. The listener script can now set off a chain reaction of automated tasks based on the payment status:

- Update the Order: The order in your database gets flipped from 'Pending' to 'Completed'.

- Start Fulfillment: An email with a download link is sent for a digital product. For a physical item, the order is flagged for the shipping department.

- Adjust Inventory: Your stock count for that product is automatically reduced.

- Notify the Customer: A confirmation email goes out, letting the customer know everything went through smoothly.

This entire sequence, from the initial click to the final confirmation email, happens automatically and almost instantly. These interconnected payment endpoints form a massive and growing network. In fact, card networks and infrastructure providers report endpoint counts in the billions, which highlights the enormous potential for instant, real-time applications. A report from PwC dives deeper into this interconnected future of payments.

Understanding IPNs Versus Webhooks

When you're dealing with automated system messages, you'll often hear the terms "IPN" and "webhook" thrown around, sometimes even used interchangeably. It's an easy mistake to make, but they aren't quite the same thing.

Here’s the simplest way to think about it: all IPNs are a type of webhook, but not all webhooks are IPNs.

A webhook is a general-purpose messenger. It’s the broader term for an automated message that one app sends to another whenever a certain event happens. For example, a webhook could tell your project management software to create a new task every time a customer submits a support ticket. It's incredibly flexible and can be set up to carry almost any kind of news.

An Instant Payment Notification (IPN), however, is a very specific kind of webhook. Its entire job is to communicate events related to payments. It speaks the language of transactions, carrying precise financial details like payment status, transaction IDs, and amounts.

The Real Difference: Purpose and Structure

The core distinction between the two boils down to their purpose. A general webhook is a blank canvas; you decide what event triggers it and what information it sends. An IPN comes pre-built for the specific, high-stakes job of handling financial data.

This means IPNs usually come with security and validation protocols baked right in—features you’d have to build from scratch for a generic webhook.

Think of it this way: an IPN is a battle-hardened webhook, designed from the ground up for the security-critical world of payments. It gives you a much more robust and reliable framework for handling money than a generic webhook ever could.

This specialization is precisely why payment gateways, including BlockBee, rely on them. The structure is standardized, which makes the integration process much more straightforward and secure for merchants. For a look at how we've recently improved our own systems, check out our post on enhancements to checkout payments and deposits webhooks.

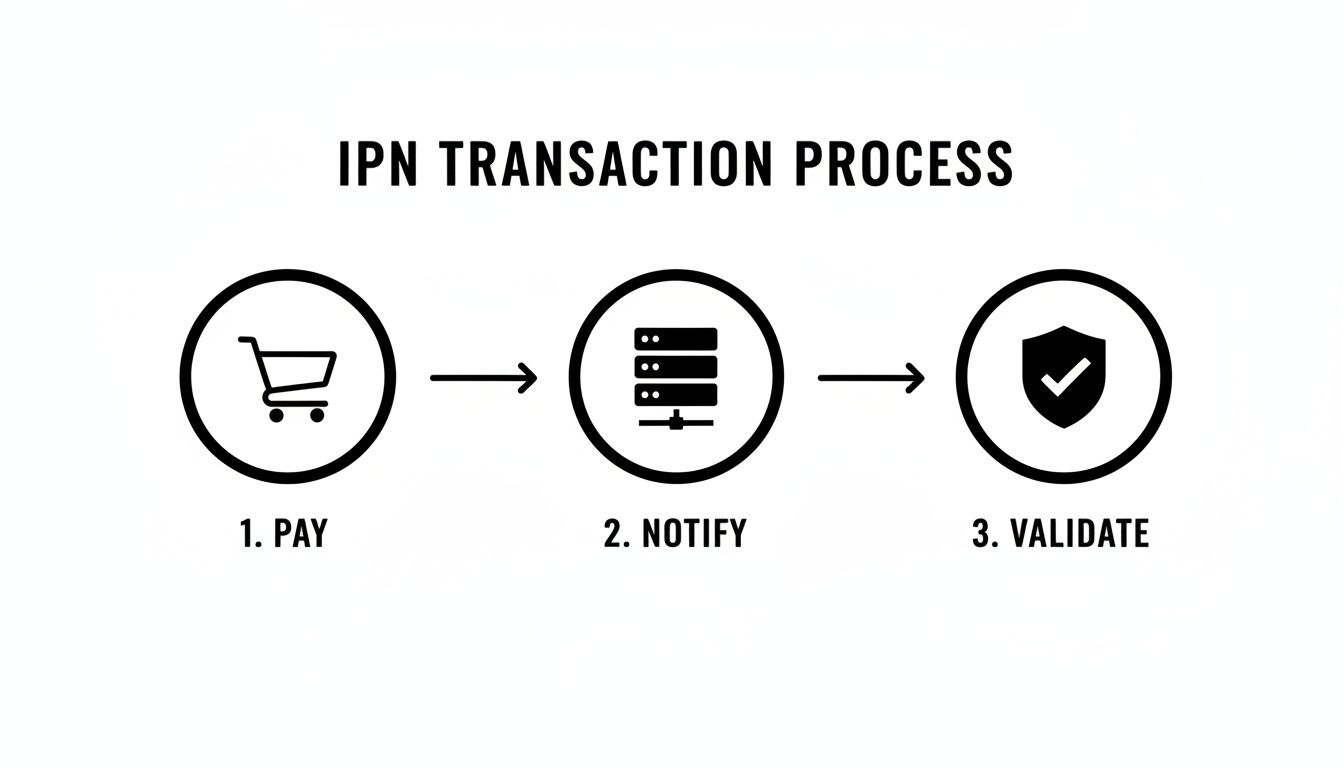

The diagram below breaks down the typical IPN flow, showing the clean, three-step process of payment, notification, and validation.

As you can see, it's a direct and secure handshake. The payment gateway sends a notification, but your system must validate it to confirm it’s legitimate before taking any action, like shipping a product or granting access to a service.

IPN vs General Webhooks A Feature Comparison

To really nail down the differences, let's look at a head-to-head comparison. This table highlights how the specialized nature of IPNs sets them apart from the broader, more general webhook category.

| Feature | Instant Payment Notification (IPN) | General Webhook |

|---|---|---|

| Primary Use Case | Specifically for payment events (e.g., successful transaction, refund, dispute). | Broadly used for any event (e.g., new user signup, code commit, support ticket). |

| Data Structure | Highly structured and standardized to carry specific financial data. | Flexible and customizable; the sender and receiver define the data structure. |

| Built-in Security | Often includes specific security protocols like signature verification to prevent fraud. | Security is entirely dependent on the implementation; may require custom solutions. |

| Reliability | Designed for high reliability with features like retry logic for failed deliveries. | Reliability varies; retry mechanisms often need to be configured manually. |

| Implementation | Simpler to implement for payment processing due to its focused purpose. | Can be more complex to set up for payments, as all logic must be built from scratch. |

In the end, this comparison makes the choice clear. While a general webhook could be configured to handle payments, an IPN is the tool purpose-built for the job, bringing an essential layer of security and reliability right out of the box.

So, when do you choose one over the other? For anything related to payments, the focused security and structure of an IPN are almost always the right answer. For more technical insights into building similar real-time systems, this guide on integrating webhook sources with real-time data pipelines is a great resource. Understanding this key difference helps you build smarter, more secure automated workflows.

Why IPNs Are a Must-Have for Crypto Payments

When you start accepting crypto, you quickly realize it’s a different beast than traditional finance. A credit card transaction gets a thumbs-up or thumbs-down almost instantly. But a crypto payment needs to be confirmed on the blockchain, and that can take several minutes—creating a clunky, uncertain pause for you and your customer.

This is exactly why understanding what an IPN is matters so much in the crypto world. Here, automation isn't just a nice-to-have; it's the core of a functioning payment system. The Instant Payment Notification is the perfect solution to bridge that confirmation gap, acting as the operational backbone for any serious crypto payment gateway.

Handling Blockchain Confirmations on Autopilot

Instead of having someone on your team manually refresh a block explorer to see if a payment went through, a solid IPN system does the watching for you. The payment gateway patiently waits for the transaction to gather enough blockchain confirmations—a vital step to make sure the payment is final and can't be reversed or double-spent.

Only when that security benchmark is hit does the gateway fire off the IPN. This message is the definitive green light for your system to release the product or activate the service. It takes the tedious, error-prone task of manual verification completely off your plate.

Turning Messy Blockchain Events into Simple Instructions

Crypto transactions aren't always a straight "success" or "failure." Sometimes a customer accidentally sends too little (an underpayment). Other times, they might not send anything before the payment window closes. A good IPN system translates all these messy, on-chain possibilities into simple, actionable messages your store can actually understand and act on.

For instance, your system can get specific IPNs for different scenarios:

- Payment Confirmed: The transaction is locked in. Go ahead and ship the order.

- Underpayment Detected: The system can automatically ping the customer with instructions to pay the rest.

- Transaction Timed Out: The order is automatically cancelled, and the item is put back in stock.

You can think of a well-built crypto IPN as a skilled interpreter. It stands between the complex, sometimes chaotic world of the blockchain and the clean, orderly logic of your business, ensuring every outcome is handled without you lifting a finger.

This automated communication is what makes for a smooth customer experience. It’s conceptually similar to the massive messaging networks that underpin traditional finance. The SWIFT network, for example, connects over 11,500 institutions and 4 billion accounts worldwide, all using standardized messages to keep money flowing. As you can see in this report on interbank payment systems, these systems are all about creating order. In much the same way, IPNs bring that essential structure to the decentralized landscape of crypto commerce.

How to Securely Set Up Your IPN Listener

Putting an IPN system in place is a game-changer for automating your business, but getting it wrong can be costly. A weak IPN listener is like leaving the back door unlocked; it’s an open invitation for fraud and data theft. Building a secure listener isn’t just a nice-to-have, it's absolutely essential for protecting your revenue and your customers' trust.

If you remember only one thing, make it this: always validate every single IPN message you receive. Never trust a notification just because it hit your listener's URL. It's surprisingly easy for a bad actor to send a fake message, trying to trick your system into shipping a product that was never paid for.

So, how do you stop that? You need a verification step. When an IPN comes in, your system should immediately send that data straight back to the payment gateway’s own verification server. The gateway will then reply with a simple "yes, this is real" or "no, we never sent this." This back-and-forth "handshake" is your first and most powerful line of defense against phony transactions.

Your Essential Security Checklist

Validation is critical, but a truly secure setup has multiple layers of defense. Think of it as protecting your business from several different angles at once. Go through this list and treat it as a non-negotiable part of your development process.

HTTPS is a Must: Your listener URL must use HTTPS. No exceptions. This encrypts the data as it travels from the payment gateway to your server, shutting down any "man-in-the-middle" attacks where someone could snoop on or change the information in transit.

Build for Duplicates (Idempotency): Sometimes, network hiccups cause payment gateways to send the same IPN more than once. Your listener needs to be idempotent, which is a fancy way of saying it can handle the exact same message multiple times without messing things up, like creating duplicate orders. The easiest way to do this is to have your system check the transaction ID. If you've already processed it, you can just ignore the duplicate.

Log Absolutely Everything: Keep a detailed record of every IPN that comes in. This means logging the full message data, the result of your validation check, and whatever action your system took in response. When something goes wrong—and it eventually will—these logs will be your best friend for troubleshooting, spotting suspicious patterns, and balancing your books.

Think of your security measures like a medieval castle's defenses. The validation handshake is the guard at the main gate. HTTPS is the secret, encrypted tunnel for messages. Idempotency prevents chaos if the same messenger arrives twice. And your logs? They're the watchmen in the tower, recording everything that happens.

Practical Tips for BlockBee Users

If you're working with BlockBee, we give you an extra layer of security right out of the box. Every IPN we send includes a callback signature, which is a unique code generated using your secret API key.

Your listener script can quickly create its own version of this signature and compare it to the one we sent. If the two signatures match perfectly, you have cryptographic proof that the message genuinely came from BlockBee and hasn't been tampered with. It's a fast, reliable, and incredibly secure way to verify notifications, letting you tap into the full power of IPN automation with total peace of mind.

Troubleshooting Common IPN Problems

Even the best automated systems hit a snag now and then. When an Instant Payment Notification doesn't work as expected, it can bring your order fulfillment to a grinding halt and throw your accounting into chaos. The good news? Most IPN problems are old classics, and once you know what to look for, they're surprisingly easy to fix.

The most common culprit is also the simplest: the IPN message just never shows up. Before you start digging through lines of code, always check the basics. Is your listener URL spelled correctly in your payment gateway’s settings? A single typo is all it takes to send those crucial notifications into the digital ether. Overly aggressive firewalls or server security rules can also be the villain, mistakenly blocking the incoming pings from the gateway’s IP addresses.

Diagnosing Validation Failures

Another frequent headache is the validation failure. This is when your listener gets the IPN message just fine, but the security check fails. More often than not, this points to a problem in how your own script is handling the data it receives.

For instance, some web frameworks have a habit of "cleaning" or altering incoming data automatically. If this happens, it can corrupt the message before your validation logic even gets a chance to look at it. This creates a mismatch, the security handshake fails, and your system correctly rejects the notification as untrustworthy.

To get to the bottom of these issues, you need to see what’s actually going on under the hood.

Here’s a solid, step-by-step approach to debugging:

Check Gateway Logs: Your payment processor’s dashboard is your first stop. It should have a log of every IPN it sent, along with the response your server gave back. An HTTP error code like a 404 (Not Found) or a 500 (Server Error) is a massive clue that points you right to the problem.

Implement Detailed Logging: Your listener script needs its own logbook. Make sure it records every single incoming IPN message before it does any processing. This gives you the raw, untouched data, allowing you to see exactly what the gateway sent and compare it to what your script is trying to validate.

Use a Testing Tool: Firing off test notifications manually is a slow, painful process. A dedicated tool changes the game entirely. For example, developers can find an easy way for callback testing to simulate all kinds of payment scenarios, which helps you find and crush bugs in your code in a fraction of the time.

A failed IPN is a symptom, not the disease. By methodically checking the entire path—from the gateway’s logs to your server’s firewall and your own script’s internal records—you can quickly find the root cause and get your automated workflows back on track.

Common Questions About IPN

Getting into the nitty-gritty of payment automation can feel a bit overwhelming, so let's tackle some of the most common questions that pop up. These answers should clear things up and show you just how valuable IPNs can be for a growing business.

Why Bother with IPN When I Already Get Email Notifications?

That’s a great question, and it really gets to the core of what automation is all about. Think of it this way: emails are for humans, but IPNs are for your systems.

When a payment email hits your inbox, you have to stop what you're doing, log in, find the order, and manually mark it as paid. An IPN, on the other hand, is a message sent directly to your website, triggering it to update the order status instantly, automatically, 24/7. No human intervention needed.

For any business that wants to grow, that kind of hands-off automation is essential. It means customers get their digital downloads immediately, and you aren't stuck with a mountain of manual, error-prone tasks that slow everything down.

What Exactly Is an IPN Listener?

An IPN listener is a piece of code—usually a script—that lives on your server at a specific URL. Its entire purpose is to wait and "listen" for those incoming payment messages from a payment gateway like BlockBee.

When a notification finally arrives, the listener springs into action with two critical jobs:

- Verify the Message: First, it checks to make sure the message is the real deal and not a fake one sent by a bad actor.

- Take Action: Once verified, it reads the payment details and kicks off the next step in your process, like updating an order in your database from 'Pending' to 'Complete'.

Are IPNs 100% Reliable?

While IPNs are incredibly reliable, no system that depends on the internet can promise 100% perfect delivery every single time. A temporary network hiccup or server downtime (on either your end or the payment processor's) could cause a message to get lost.

This is why it's always smart to have a backup plan. Best practice involves occasionally using the payment processor's API to pull a list of recent transactions. You can then cross-reference this list with your own records to catch any payments that might have slipped through the cracks.

Ready to automate your crypto payments with a secure and reliable IPN system? BlockBee provides an easy-to-integrate solution with robust security features, ensuring your business runs smoothly around the clock. Explore our developer-friendly platform and see how simple it is to get started.