What Is an IPN and How Does It Actually Work?

An Instant Payment Notification (IPN) is a message sent directly from a payment processor's server to your own system. Think of it as an automated heads-up, a digital tap on the shoulder letting your website know the instant a transaction's status changes.

Decoding the Digital Handshake

Let's break down what's really happening. At its core, an IPN’s job is simple but absolutely critical: it tells your application, "Hey, that order was just paid for!" This server-to-server communication is the secret sauce that makes modern e-commerce work so smoothly, allowing you to fulfill orders the moment a payment goes through.

Instead of you having to manually check your payment account, the IPN triggers actions automatically. This "digital handshake" confirms that a transaction happened, kicking off the entire fulfillment process. The practical applications are huge, especially for managing e-commerce on platforms like Wix or any online store.

IPN Characteristics at a Glance

To give you a clearer picture, here’s a quick summary of what makes an IPN system tick.

| Attribute | Description | Primary Benefit |

|---|---|---|

| Automation | Actions are triggered programmatically without manual intervention. | Saves time, eliminates human error, and enables 24/7 operations. |

| Asynchronous | The notification is sent independently of the user's browser session. | Ensures transaction updates are received even if the customer closes the page. |

| Server-to-Server | Direct communication between the payment gateway and the merchant's server. | Provides a secure and reliable channel for sensitive transaction data. |

| Real-Time | Notifications are sent almost instantly after a transaction event occurs. | Enables immediate order fulfillment and a better customer experience. |

These characteristics work together to create a system that’s fast, reliable, and essential for scaling any online business.

Why Automation Matters

What would happen without an IPN? You'd be stuck logging into your payment gateway, hunting down the transaction, confirming it was successful, and then manually updating your own database. It’s slow, tedious, and a recipe for mistakes. An IPN completely removes that friction.

Here’s why it's a game-changer:

- Immediate Order Fulfillment: You can grant access to digital downloads or kick off the shipping process the moment a payment is confirmed.

- Accurate Record-Keeping: Your website’s database updates automatically, keeping inventory and sales records perfectly in sync.

- Enhanced Customer Experience: Buyers get what they paid for right away, which is exactly what they expect.

This server-to-server communication is the essential automated process that allows a business to scale. It ensures that fulfillment happens reliably, 24/7, without requiring constant manual oversight.

Just a quick clarification: this IPN is different from the similarly named Interbank Payment Network, which handles large-scale transactions between banks. That market was valued at $14.3 billion and is projected to hit $29.8 billion by 2033, showing just how massive digital payment infrastructures are becoming. You can find more insights on this growing market at htfmarketinsights.com.

For an online merchant, however, the IPN we're talking about is the immediate, actionable message that powers your day-to-day business.

How the Automated Handshake Actually Works

So, what’s really going on when a customer pays? Think of it as a secure, automated conversation happening behind the scenes. The second a customer completes a purchase, their details zip over to the payment gateway, which handles the transaction.

Once the payment is confirmed, the gateway doesn't just sit on that information. It immediately dispatches a secure message—the Instant Payment Notification (IPN)—to a specific URL you've set up on your server. This URL is basically a dedicated listener, waiting to catch these incoming payment updates.

The beauty of this whole system is that it’s asynchronous. It runs completely separate from what the customer is doing on their screen. Even if they close their browser the instant they pay, the IPN makes sure your system gets the memo and can start processing the order.

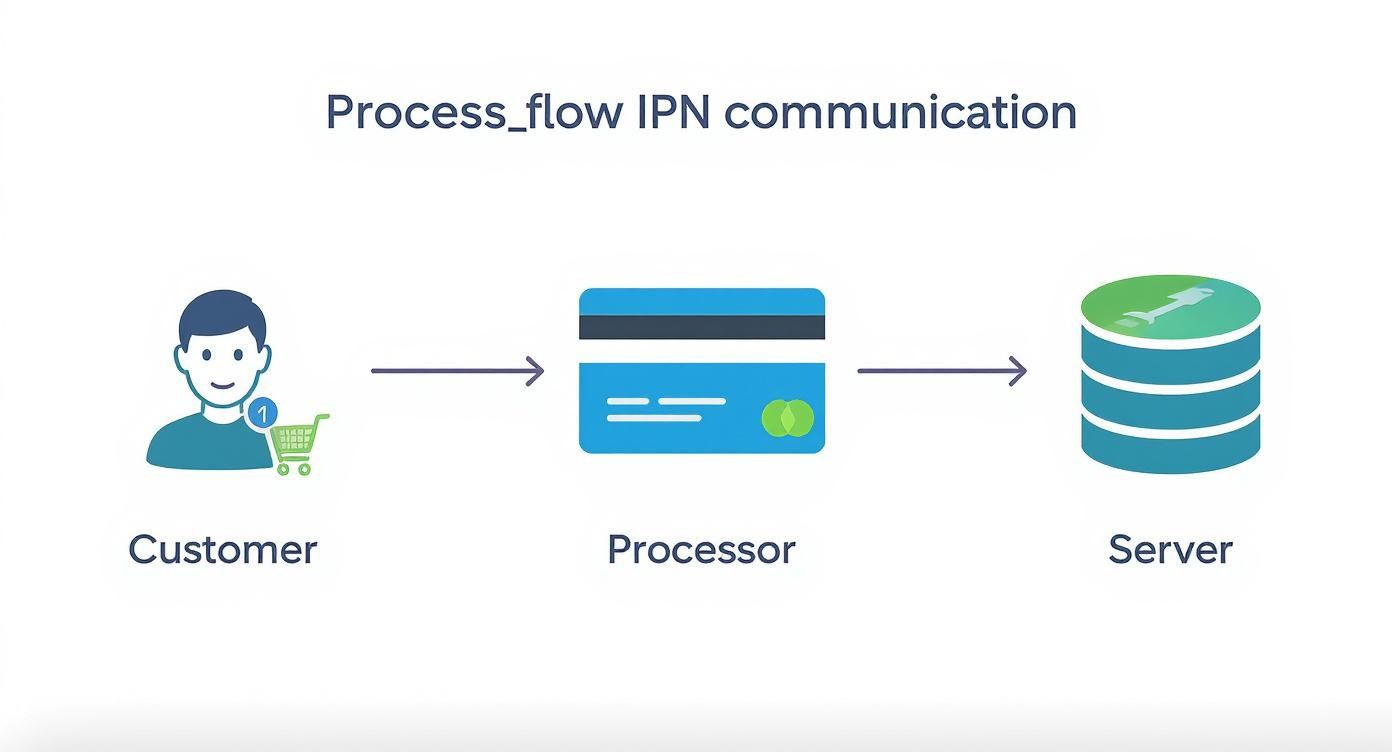

The IPN Communication Flow

This sequence of events is often called a "digital handshake." When your server's listener catches the IPN, its first job is to send a simple reply back to the gateway, usually an HTTP 200 OK response. This is just a quick "Got it, thanks!" to confirm the message arrived safely.

This diagram helps visualize how the information flows, from the customer all the way to your server's database.

The real takeaway here is the efficiency. The IPN triggers all your backend tasks instantly, no human intervention required, making for a perfectly smooth customer experience.

What if the gateway doesn't get that acknowledgment back? It assumes something went wrong—maybe a temporary network hiccup—and tries sending the IPN again. This built-in redundancy is a lifesaver, ensuring you don't lose orders just because of a momentary glitch.

Triggering Automated Actions

Once that handshake is complete, your server gets to work. The listener script cracks open the IPN to read the transaction details and then kicks off a series of pre-programmed actions based on what it finds.

Here’s a typical play-by-play of what happens next:

- Database Update: The system finds the customer's invoice in your database and marks it as 'Paid'.

- Inventory Adjustment: Stock levels for the purchased item are automatically updated.

- Fulfillment Initiation: If it's a physical product, a notification might go out to the shipping team. For digital goods, the customer gets instant access to their download, service, or subscription.

- Customer Notification: An automated email is fired off to the customer, letting them know their order is good to go.

This seamless, automated process is the backbone of modern e-commerce. It ensures your business can operate and fulfill orders 24/7, keeping operations running smoothly in real-time without requiring a single manual check.

This kind of automation isn't just a nice-to-have anymore; it's essential. Global cashless payment volumes are on track to jump by over 80% between 2020 and 2025, climbing from about 1 trillion transactions to nearly 1.9 trillion. You can discover more insights about these payment trends from PwC and see exactly why automated systems like IPNs have become so critical.

IPN vs Webhooks vs API Polling

It's easy to get these terms tangled up, but knowing the difference is key to building a smart, efficient payment system. When you need to check the status of a transaction, you really have three main options: API polling, webhooks, and Instant Payment Notifications (IPNs). Each one handles communication in a totally different way.

Let’s start with the old-school method: API polling. This is the most basic but also the least efficient approach. Think of it like a kid in the back of a car on a long road trip, constantly asking, "Are we there yet?" Your server has to repeatedly send requests to the payment gateway's API, asking over and over, "Is this order paid yet?" This creates a ton of needless server traffic and can slow down your order processing.

Why Push Notifications Are a Smarter Choice

A much better way to handle this is with "push" notifications, which brings us to webhooks. A webhook is a more general-purpose tool that lets one system notify another when a specific event happens. Instead of your server constantly begging for updates, you simply give the payment gateway a URL and it promises to send you a message as soon as something changes.

This is like giving a restaurant your phone number and asking them to text you when your table is ready. It's an efficient, event-driven model that saves resources and delivers information the moment it's available. At BlockBee, we're always refining our system, which includes ongoing enhancements to checkout payments and deposits webhooks to give our merchants the most reliable data possible.

So, where does an IPN fit in?

An Instant Payment Notification (IPN) is simply a highly specialized type of webhook. While a generic webhook might tell you about all sorts of different events, an IPN is laser-focused on one thing: communicating a change in payment status.

If a webhook is the restaurant texting you that your table is ready, an IPN is the hostess calling to confirm not just your table, but your exact order details and payment confirmation. It's a purpose-built tool for payment automation, delivering a standardized package of data that your system can immediately understand and act upon. This specialization is what makes IPNs so powerful for e-commerce.

Comparing IPN, Webhooks, and API Polling

To make it even clearer, let's break down the key differences between these communication methods. The table below shows how each one stacks up in terms of its communication style and overall efficiency.

| Method | Communication Type | Efficiency | Best For |

|---|---|---|---|

| API Polling | Pull (Your server asks for data) | Low | Scenarios where real-time updates aren't critical. |

| Webhooks | Push (Gateway sends data on event) | High | General-purpose, real-time event notifications. |

| IPN | Push (Specialized webhook for payments) | Very High | Automated, real-time payment and order processing. |

When it comes down to it, the event-driven "push" model of IPNs is vastly superior for payment automation. It saves your server from doing unnecessary work and provides the instant, accurate data you need to run a modern online business smoothly.

Securing Your IPN Listener From Day One

Think of an unsecured IPN listener as leaving the back door of your shop unlocked. Anyone can wander in. Just because a message arrives at your endpoint doesn't mean it's friendly. You have to treat every single IPN as suspicious until you've proven it's the real deal. If you don't, you're opening yourself up to fake orders, messed-up inventory, and real financial losses.

The name of the game in IPN security is verification. Before your system updates a single database entry or marks an item for shipping, you absolutely must confirm the notification is authentic. It's surprisingly easy for a bad actor to send a crafted, fake IPN to your listener, trying to trick you into fulfilling an order that was never paid for. Your system needs a bouncer at the door, checking every ID.

Your Security Checklist

To bulletproof your system, you need more than just one lock on the door. A layered security approach is best, ensuring that if one check fails or is bypassed, another one will catch the fraud.

Here’s a practical, must-do checklist for handling every IPN that comes your way:

Check the IP Address: Your payment gateway will always send notifications from a specific list of IP addresses. Your first step should be to check if the incoming request is coming from one of those approved IPs. If it’s not, drop it immediately. For BlockBee users, we make sure to keep you in the loop on these addresses. You can learn more by reading our guide on upgrading the BlockBee callback IPs.

Perform a Verification "Handshake": This is the most important step. Your listener needs to take the transaction details from the IPN it just received and immediately make a direct API call back to the payment gateway's own verification server. This is like calling the bank to confirm a check is real before you deposit it. It validates the data straight from the source.

Prevent Duplicates: Every IPN has a unique transaction ID. Your system should log these IDs and check to make sure you haven't already processed that specific transaction. Gateways sometimes resend notifications, and this simple check prevents you from, say, shipping the same product twice for one payment.

Never, ever trust the data in an IPN payload on its own. The single most important thing you can do to prevent fraud is to verify its authenticity by making a separate, direct API call back to the payment gateway. This is your number one defense.

The need for this kind of rigorous security is obvious when you look at the scale of global payment systems. Take the China International Payment System (CIPS), for example. It saw its participant numbers grow by 10% in just one year and now handles an annual volume of around $24.45 trillion, as detailed in this analysis from fxcintel.com. With that much money moving around, you can see why securing every single transaction is non-negotiable. By putting these checks in place, you’re building a firewall that ensures only legitimate payment notifications get through, protecting your business from expensive mistakes.

Putting Your IPN Integration Into Practice

Alright, let's move from theory to action. This is where you build your IPN listener—a script on your server ready to catch and process payment data from your gateway. Think of it as your system's digital receptionist, waiting to handle every notification that comes in.

Your first move is to set up a simple script, maybe in PHP or Python, that can listen for an HTTP POST request. This script will need to grab the incoming data (usually in a common format like JSON) and save it to a log file or database. Logging everything at the start is a lifesaver for debugging and seeing exactly what the gateway is sending you.

Testing in a Safe Environment

I can't stress this enough: never test your IPN listener with live customer transactions. That’s what a sandbox environment is for. Almost every payment processor worth its salt provides a sandbox, which is a dedicated testing area that mirrors the real thing. When you're choosing the best payment gateway, take a hard look at their sandbox features and documentation—it will make your life much easier.

Inside the sandbox, you can throw every imaginable scenario at your system without a single real dollar changing hands. It’s your playground to see how your code holds up under pressure.

The golden rule of development is to test everything in a sandbox first. This isn't just a suggestion; it's a critical practice that prevents costly errors, protects your customers' data, and ensures your system is resilient before it goes live.

Simulating Real-World Scenarios

A solid testing plan goes way beyond just checking for a single successful payment. You need to prepare your IPN handler for the messy reality of online transactions. Make sure you run through these scenarios:

- Successful Payments: This is the happy path. Does your system correctly update the order status to "paid" and kick off the fulfillment process?

- Failed Transactions: What happens when a card is declined? Your listener should catch this status and handle it gracefully, maybe by sending an automated email to the customer.

- Refunds and Disputes: Don't forget about money going the other way. Test how your system handles refunds, ensuring it updates inventory and financial records correctly.

This screenshot from BlockBee's documentation gives you a peek at the kind of data your listener will be working with.

See those clear key-value pairs like status and txid_in? That's the information your script will parse to understand and verify the transaction. To make this whole process less of a headache, BlockBee has a handy tool. Check out our guide on introducing the callback tester for easy callback testing to speed up your development and debugging. By running these simulations, you'll build a tough, reliable IPN handler you can trust to run your business on autopilot.

Handling Real-World IPN Issues

In a perfect world, every IPN would show up instantly and only once. But we don't live in a perfect world. Real-world systems have to deal with network timeouts, server hiccups, and all sorts of unexpected glitches. If you want to build a truly resilient IPN listener, you have to plan for what happens when things go wrong.

To get this right, you absolutely need to master two concepts: smart error handling and something called idempotency.

Surviving Temporary Downtime

So, what happens if your server has a brief outage and misses an IPN? The good news is that most payment gateways are built for this. If a gateway sends a notification and doesn't get a successful "200 OK" response from your listener, it assumes something went wrong and will try sending it again later.

This retry logic is a fantastic safety net. But it also creates a new problem: your system could get the same exact notification more than once. This is where idempotency becomes your best friend.

Idempotency is a fancy word for a simple idea: your system can receive the same IPN multiple times but will only process the order once. It's what stops you from accidentally shipping a product twice or double-charging a customer.

The Power of Idempotency

Let's walk through a scenario. A customer pays, the gateway fires off an IPN, and your system marks the order as paid to kick off the shipping process. Great. But a tiny network delay causes the confirmation to fail, so the gateway resends the same IPN 30 minutes later.

Without an idempotent setup, your system might see that second notification and treat it as a brand-new order. Chaos.

To prevent this, your IPN listener needs to perform a simple, critical check every single time it receives a notification:

- Find a Unique ID: Pull the unique transaction ID from the IPN payload. Every legitimate payment notification will have one.

- Check Your Database: Before doing anything else, query your database. Have you already processed an order with this specific transaction ID?

- Process or Ignore: If the ID is new, go ahead and process the order. If you find the ID already in your records, your system should simply ignore the duplicate and send back another success confirmation to the gateway.

Building your listener to recognize and toss out these duplicate messages is what separates a fragile integration from a rock-solid, reliable one. It's a simple check that prevents temporary network issues from becoming permanent, expensive problems for your business.

Got Questions About IPNs? We've Got Answers

Even after you get the hang of how IPNs work, a few common questions always seem to pop up. Think of this as the "what if" section where we tackle those practical, real-world scenarios you're bound to run into. Let's clear up any lingering doubts.

What Happens if My Server Is Down When an IPN Is Sent?

This is a classic concern, and thankfully, most payment gateways have a built-in safety net for it. If a gateway sends an IPN and doesn't get the expected "all good" signal back (an HTTP 200 OK response), it won't just give up. It assumes something went wrong and will try again.

The gateway will then resend the exact same notification on a schedule, maybe a few times over the next 24 hours, until it gets a successful response. This is precisely why your system needs to be idempotent—a fancy word that just means it's smart enough to recognize a notification it's already seen and processed. This prevents you from, say, shipping the same product twice just because the IPN arrived more than once.

Is an IPN the Same as a Payment Confirmation Email?

Not at all. They're built for completely different audiences and jobs. A payment confirmation email is for your customer. It's written for a human to read, offering peace of mind that their order went through.

An IPN, on the other hand, is a message sent from one computer to another—specifically, to your application's backend. It’s not meant to be pretty; it's a raw data payload designed to kick off automated actions. Think of it as your system getting a direct order to update its records, unlock a digital download, or start the shipping process. One is for people, the other is for your code.

The core difference is the audience and function. An email informs the human user, while an IPN instructs the backend system to take immediate, automated action based on the transaction's status.

Can I Process an Order Based Only on the IPN Data?

Absolutely not. This is a critical security point. You should never trust the data in an IPN without verifying it first. Why? Because anyone on the internet can find your IPN listener URL and send a fake notification, trying to trick your system into giving away products or services for free.

Always treat an IPN as a simple heads-up, not as the gospel truth. The right way to handle it is to use the transaction ID from the notification to make a secure, direct API call back to the payment gateway. This round-trip verification confirms that the payment is real and that the details match what the gateway has on file. Only then should you fulfill the order.

Ready to build a secure and automated payment system? With BlockBee, you get a developer-friendly platform with robust tools, clear documentation, and dedicated support to make your integration seamless. Start accepting crypto payments today at https://blockbee.io.