Turn Bitcoins to Cash A Merchant's Guide

So, you've started accepting Bitcoin. That’s a fantastic move for attracting a whole new wave of customers, but let's be real—those digital coins won't pay your suppliers or cover the rent. The real trick for any business is finding a dependable, automated way to turn bitcoins to cash without getting caught in the crossfire of market volatility.

Why Merchants Need a Smart Crypto-to-Cash Strategy

For a growing online business, taking crypto payments can feel like a double-edged sword. On one hand, you're opening your doors to a global, tech-savvy audience. On the other, your hard-earned revenue is sitting in a fluctuating digital asset, which can make managing day-to-day operations a real headache.

Imagine you run an e-commerce store. A customer places a large order and pays with Bitcoin. Great! The payment is confirmed on the blockchain, but those funds aren't exactly ready to use. You still need traditional cash to:

- Pay your suppliers for new inventory.

- Cover monthly overhead like rent and utilities.

- Run payroll for your team.

This delay between receiving crypto and having usable cash can throw a major wrench in your operations. The journey from a niche digital asset to a mainstream financial tool has been a long one, and the market reflects that. In Q1 2025, Bitcoin's daily trading volume averaged a staggering $96 billion, a 20% jump from the same time in 2024. You can discover more insights on Bitcoin's market development, and that surge shows just how much liquidity is out there.

Common Merchant Pains and How BlockBee Solves Them

Every merchant accepting crypto runs into similar hurdles. Here’s a quick look at those everyday challenges and how a platform like BlockBee is built to solve them directly.

| Merchant Challenge | The BlockBee Solution |

|---|---|

| Price Volatility Risk | Revenue tied up in a fluctuating asset can lose value overnight. |

| Manual Conversion Hassles | Moving funds to an exchange and cashing out is slow and tedious. |

| Operational Cash Gaps | Crypto sits in a wallet while fiat bills are due. |

| High Transaction Fees | Multiple steps (wallet to exchange, exchange to bank) add up. |

Ultimately, a good payment system isn't just about accepting crypto; it's about making that crypto work for your business in the real world.

Bridging the Gap From Crypto to Cash Flow

This is exactly why a dedicated payment platform becomes an essential business tool, not just a flashy feature. Instead of manually sending crypto to an exchange, waiting for it to clear, and then initiating a bank withdrawal, an automated system does all the heavy lifting for you.

A smart conversion strategy isn't about trying to time the market; it's about creating predictable, stable cash flow. For any business owner, that kind of stability is worth far more than chasing speculative gains.

Platforms like BlockBee act as that crucial bridge, instantly converting your crypto revenue into the stable fiat currency you actually need. This completely removes your exposure to price swings and ensures the money from your sales is ready to go, helping you run your business without a hitch.

Alright, before you can start turning that Bitcoin into cash, there are a few essential things you need to get squared away. Think of this as laying the groundwork. Getting these basics right from the get-go will save you a world of trouble later and make the whole process a lot smoother.

First things first, you'll need a BlockBee account. This is your command center for everything related to your crypto payments and payouts.

Once you're signed up, the next crucial step is to generate an API key. This key is basically the secure handshake between your website or app and BlockBee's system, letting them talk to each other without any security hiccups.

Nailing Down Your Payout Details

With your account and API key in hand, it's time to think about where the money is going.

- Choose Your Currency: Are you cashing out to USD, EUR, or something else? Your best bet is to pick the currency that matches your main business bank account. This simple choice helps you dodge extra conversion fees your bank might otherwise tack on.

- Connect Your Bank: This is the final piece of the puzzle. You’ll need to link your business bank account so BlockBee knows exactly where to send your funds. Double-check that all the details are spot-on to avoid any delays.

Making smart decisions here is a big part of learning how to properly accept crypto payments for business. It's not just about the tech, but about the financial strategy behind it.

A solid setup isn't just about ticking boxes; it's a strategic move. By taking a few minutes to configure your account, API, and bank details correctly, you're building a reliable pipeline that turns unpredictable crypto into stable cash flow for your business.

Once this foundation is set, you're officially ready to tackle the integration. You can move forward with confidence, knowing your system is primed for seamless, automated conversions.

Hooking BlockBee into Your Store for Automatic Payments

With your account settings dialed in, it's time for the fun part: connecting BlockBee directly to your e-commerce platform. This is the magic that lets you automatically turn bitcoins to cash without lifting a finger. Don't worry, this isn't about heavy-duty coding; it's more about setting up a smooth handshake between your customer's payment and the cash hitting your bank.

The process starts by generating a unique payment address for every single transaction. When a customer decides to pay with Bitcoin, the BlockBee API instantly creates a fresh, one-time-use address just for their order. This is a huge deal for security and clean bookkeeping, as it eliminates any mix-ups and makes reconciling your accounts a breeze. All you need is a small code snippet from the BlockBee documentation to make the API call when a customer hits the checkout.

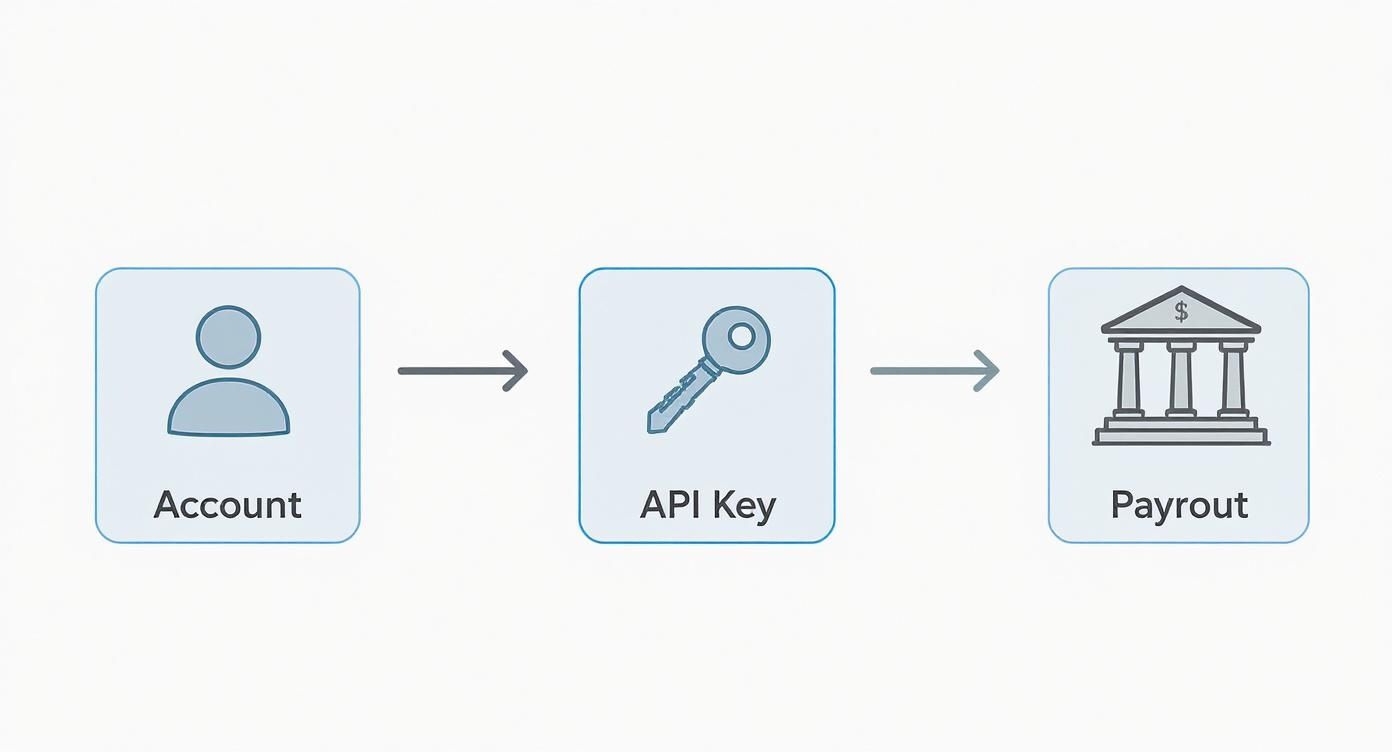

This handy visual shows the simple, three-part flow for getting your automated cash-out system up and running.

As you can see, your initial account setup, the API key, and your payout destination all work in concert to build a reliable conversion pipeline from crypto to cash.

Getting Real-Time Updates with Webhooks

Creating a payment address is just the first half of the equation. You also need a way for BlockBee to signal to your store that a payment has landed. That's where webhooks come in. Think of a webhook as an automated tap on the shoulder—an instant message sent from one app to another.

Instead of your store constantly having to check in with BlockBee ("Did they pay yet? How about now?"), the webhook lets BlockBee proactively tell your store the exact moment a payment is confirmed. This real-time ping is what kicks your order fulfillment into gear, marking the order as "paid" and telling your team it’s time to get that package out the door.

Getting your webhooks set up correctly is the secret sauce to genuine automation. It turns your payment gateway from a passive wallet into an active, intelligent part of your business that ensures no order ever gets stuck in limbo.

This setup does more than just make your life easier; it dramatically improves the customer experience. Buyers get instant confirmation that their payment went through, which builds a ton of trust and makes them feel confident shopping with you again.

Tying It All Together on Your E-commerce Platform

Most of us aren't building a custom e-commerce system from the ground up. The good news is that BlockBee already has plugins for the most popular platforms, making this whole integration incredibly straightforward.

- WooCommerce: The official BlockBee for WooCommerce plugin manages everything—address generation, payment monitoring, and webhook callbacks—automatically. You pretty much just install it and drop in your API key.

- Magento: Just like with WooCommerce, the Magento extension plugs right into your checkout flow and does the heavy lifting for you.

- Custom-Built Stores: If you have a bespoke platform, the API documentation is packed with clear examples to get your developers on the right track quickly.

By using these tools, you can build a rock-solid system where customer payments are instantly recognized, converted, and queued up for deposit. This hands-off workflow is the end goal, freeing you up to focus on what really matters: growing your business, not chasing down transactions.

Configuring Your Automated Fiat Payouts

Getting BlockBee integrated is the first win, but the real magic happens when that crypto turns into cash in your bank account. This is where you graduate from simply accepting Bitcoin to creating a smart financial pipeline for your business. Let's dial in your automated payout settings to make them work for you.

First things first, you need to connect your business bank account. Think of this as telling BlockBee the final destination for your money. It’s a one-time step that creates a secure link, ensuring your converted funds land right where you need them for payroll, inventory, or anything else.

Getting this right from the start saves a lot of potential headaches and payout delays down the road.

Fine-Tuning Your Payout Strategy

With your bank account linked, it’s time to set the rules for when and how you turn bitcoins to cash. This isn’t just a technical toggle; it’s a strategic choice that directly influences your cash flow and how much you pay in fees.

You have two main controls to play with:

- Payout Threshold: You can tell the system to cash out only when your balance hits a specific amount. For example, you could set it to automatically trigger a payout every time you accumulate $1,000. This is a fantastic way to batch transactions and cut down on bank fees.

- Payout Frequency: If you prefer a more predictable schedule, you can set up time-based payouts. A weekly or monthly withdrawal gives you a consistent cash-in day, which makes financial planning and forecasting so much easier.

The trick is to find the sweet spot between needing cash on hand and keeping transaction costs low. A startup might need smaller, more frequent payouts to stay liquid, while a larger company could set a higher threshold to save on fees.

Experiment with these settings to discover what rhythm fits your business best. You can dive deeper into all the options on the official BlockBee payouts page at https://blockbee.io/payouts. This flexibility is what allows you to truly sync your crypto revenue with your day-to-day financial operations, making the whole process feel effortless.

Smart Strategies for Managing Your Crypto Earnings

https://www.youtube.com/embed/hSpnLPWY2S8

Once you're set up, you'll need a smart approach to get the most value when you turn bitcoins to cash. The big question on every merchant's mind is this: should you convert 100% of your crypto earnings right away, or hold onto a small piece as an investment?

For most businesses, converting everything to fiat immediately is the simplest and safest path. You get predictable cash flow and completely sidestep the wild swings of the crypto market. It’s a clean, no-fuss way to manage your revenue.

However, some merchants I’ve worked with prefer a hybrid approach. They might earmark a small percentage—say, 5-10%—of their crypto earnings and move it to a separate wallet for the long term. This gives you a nice balance, locking in your operational cash while still keeping a little skin in the game for potential future growth.

Securing Your Setup and Assets

Of course, a great strategy means nothing without rock-solid security. A couple of things are absolutely non-negotiable here: protecting your API keys and turning on two-factor authentication (2FA).

Your API keys are literally the keys to your funds. Treat them like you would the keys to a bank vault—keep them somewhere incredibly secure and never expose them in your website's front-end code.

Think of your security settings as an insurance policy for your revenue. A few minutes spent enabling 2FA and safeguarding your API keys can prevent catastrophic losses down the line, ensuring your earnings are always protected.

The importance of having a clear cash-out plan became obvious after Bitcoin climbed above $100,000 for the first time in early 2025. Many savvy investors took advantage of the market highs by converting portions of their holdings.

While our guide is focused on crypto, understanding broader strategies for cashing out business assets can offer some really valuable insights. And if your business handles a high volume of payments, you'll definitely want to read up on efficient mass payout solutions. Mastering these practices is what separates the novices from the pros who confidently navigate the crypto space.

Common Questions About Cashing Out Bitcoin

It's completely normal to have a few questions when you start to turn bitcoins to cash, even with a simple process. Getting straight answers is the best way to feel confident and know what's happening with your money. Let's walk through some of the most frequent things merchants ask us.

How Long Until the Cash Reaches My Bank Account?

The whole journey has a few moving parts. First, the Bitcoin transaction has to get its confirmations on the blockchain, which usually takes somewhere between 10 and 60 minutes. The moment BlockBee gets the confirmation, we convert it to your chosen fiat currency right away.

The last leg of the trip is the bank transfer itself, like a SEPA or ACH payment. These typically land in your account within 1-3 business days. So, from start to finish, you should see the money in your bank in about 1-4 business days.

What Are the Fees for Converting Bitcoin to Cash?

We believe in a clear and simple fee structure—no hidden costs. You'll see a small processing fee for the crypto payment, a fair conversion rate, and a standard fee for the final bank withdrawal. That’s it.

We designed this automated system to be significantly cheaper than doing it all by hand. Think about it: you skip the separate fees you'd pay moving crypto from a wallet, then to an exchange, and finally to your bank.

Can I Set a Minimum Payout Amount?

Absolutely. Your BlockBee dashboard gives you full control over when you get paid. You can easily set a minimum balance that needs to be reached before a payout is triggered.

For example, you could set the system to hold your funds until your balance hits $500, then automatically start the conversion and transfer. This is a great way to manage your cash flow and cut down on the number of bank transactions, which can save you a good bit on banking fees over time.

Ready to put your crypto-to-cash process on autopilot? BlockBee gives you everything you need for smooth, secure, and quick conversions. Get started with BlockBee today and take full control of your crypto revenue.