Is Ethereum a Good Investment? A Practical Guide

So, is Ethereum a good investment? It's a question that goes way beyond just looking at its current price. While there's no simple "yes" or "no" answer, the simplest way to put it is this: Ethereum offers a shot at some serious growth, but it’s a bumpy ride packed with risk.

It's not just another cryptocurrency. Think of it less like digital money and more like a decentralized global computer. Developers who want to build and run new kinds of applications have to pay to use this computer's resources. This built-in utility gives Ethereum a real, functional value that isn't just about market hype. That’s what really sets it apart from so many other digital assets out there.

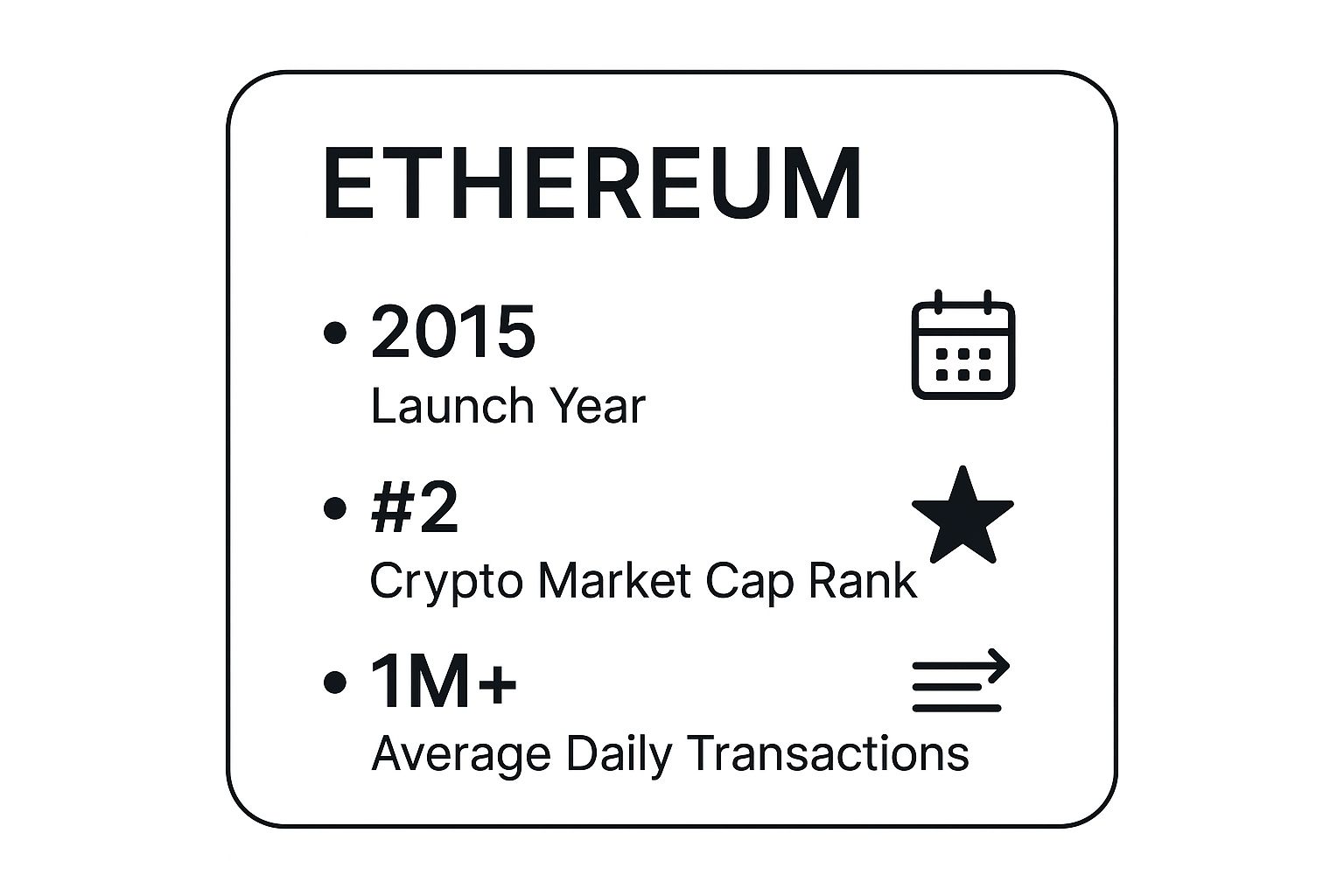

This infographic gives you a quick visual rundown of Ethereum's scale and a bit of its history.

What these numbers really tell us is that Ethereum isn't some fly-by-night project. It's an established powerhouse with a huge, active network—a critical sign of health for any potential investor.

Ethereum Investment Snapshot Pros vs Cons

Before we dive deeper, it helps to see the big picture. Investing in Ethereum means buying into both its incredible promise and its considerable risks. Here’s a quick summary of the main arguments for and against adding it to your portfolio.

| Investment Factor | Potential Upside (Pro) | Potential Downside (Con) |

|---|---|---|

| Technology | First-mover advantage with smart contracts and a massive developer ecosystem. | Network congestion can lead to high transaction fees during peak usage. |

| Market Position | Consistently the second-largest cryptocurrency by market capitalization. | Faces intense competition from newer, faster "Ethereum killer" blockchains. |

| Growth Potential | Its role in fast-growing sectors like DeFi and NFTs drives network demand. | Price is highly volatile and sensitive to market sentiment and news cycles. |

| Regulatory Risk | Growing institutional adoption and clearer regulatory pathways emerging. | Evolving global regulations could impose restrictions or impact its classification. |

This table lays out the core tensions you'll have to navigate. On one hand, you have a pioneering technology with massive adoption. On the other, you have technical hurdles, stiff competition, and the ever-present shadow of regulatory uncertainty.

A Look at Historical Performance and Growth

Ethereum's past performance is a big reason it's on so many investors' radars. It has a track record of significant price growth that's hard to ignore. For example, in 2025 alone, Ethereum delivered a year-to-date return of +41.9%, leaving Bitcoin's +32.3% in the dust.

Its market dominance has also been creeping up, growing from 21.4% in 2024 to 23.6% in 2025. This isn't just a number; it signals growing confidence from investors and wider use in the world of decentralized finance. For a closer look, you can always explore more data on Ethereum's historical performance to get a feel for these trends.

But here’s the catch: this growth comes hand-in-hand with some serious volatility. The asset’s volatility index was sitting at an average of 4.6% in early 2025, which is more than double Bitcoin’s 2.1%. So, while the potential for high returns is absolutely there, so is the risk of gut-wrenching price drops.

An investment in Ethereum is really a bet on the future of a new digital economy. Its value is directly tied to how much people want to use its network, which powers everything from digital art and collectibles to incredibly complex financial systems.

What Gives Ethereum Its Intrinsic Value

To figure out if Ethereum is a good investment, you have to look beyond the price charts. Its real value isn't just speculation; it's built on what you can do with it. Ethereum isn't simply digital money. A better way to think of it is as digital real estate for a new kind of internet.

Imagine the Ethereum network as a huge, decentralized city where anyone can build. Developers from all over the globe are constructing applications, financial systems, and marketplaces on this digital foundation. To run anything in this city—whether it's a simple program, a digital art piece, or a complex trade—they need to pay rent. That rent is paid in ETH, which creates a natural, ongoing demand for the asset.

Smart Contracts: The Engine of Utility

So, what are the building blocks of this digital city? They’re called smart contracts. These are the fundamental tools that let developers build on Ethereum in the first place. At its core, a smart contract is just an agreement that runs itself, with the terms written directly into its code.

Think of a vending machine. It's a perfect real-world analogy. You put in your money (the condition), and the machine automatically gives you a snack (the outcome). There's no cashier needed and no one to argue with. The rules are baked in, and it just works.

Smart contracts operate on the same principle but on the blockchain. They enforce rules and carry out agreements automatically once certain conditions are met, removing the need for two people to trust each other. This single capability powers the entire ecosystem built on Ethereum.

This self-executing feature is what makes the network so special. It allows for incredibly complex applications to run without any single person or company in charge, fostering a truly open environment for new ideas.

How Use Cases Create Real Economic Demand

The demand for ETH is directly tied to how much activity is happening on the network. Every single action requires a small fee, called "gas," which is paid in ETH. This is a brilliant mechanism: the more people use the network, the more valuable its native currency, ETH, becomes.

Here are the key activities that drive this demand:

- Decentralized Finance (DeFi): Every time you trade, lend, or borrow on a DeFi platform, you're using smart contracts that need ETH to process the transaction.

- Non-Fungible Tokens (NFTs): Minting, buying, or selling an NFT is a transaction on the Ethereum blockchain. Each one of those actions uses up a little bit of ETH.

- Decentralized Applications (dApps): From games to social networks, any app built on Ethereum requires users to spend ETH for pretty much any in-app activity.

So, when you ask, "is Ethereum a good investment?" you're really asking something much bigger. It's like asking if a plot of land in the middle of a booming city is a good buy. The value isn't just the land itself; it's about what people are building on it and how many others want to come and use those services.

When you invest in Ethereum, you’re not just buying a digital asset; you're betting on a technology that’s constantly getting better. The network isn't a finished product. It's undergoing a series of carefully planned upgrades designed to make it faster, more secure, and cheaper for everyone to use. For anyone asking "is Ethereum a good investment?" for the long haul, these improvements are the real story.

Think of the Ethereum network like a city's main highway. In the beginning, it was just a single, busy road. As more people started using it, traffic jams became common, and the tolls (or gas fees) shot up. The ongoing upgrades are a massive infrastructure project meant to solve these growing pains for good.

The Merge: A Landmark Shift

The biggest change so far was a massive event called “The Merge.” This wasn't just a minor patch; it was like swapping out the entire engine of a car while it was still running. Before The Merge, Ethereum relied on a system called Proof-of-Work, which was incredibly secure but also used an enormous amount of electricity.

The Merge moved the whole network over to a new system: Proof-of-Stake. This was a fundamental shift with huge implications for investors.

- Drastic Energy Savings: This one change slashed Ethereum's energy use by over 99%. It instantly addressed a major criticism about its environmental impact and positioned it as a more sustainable technology.

- Slowing Down New Supply: The new system also dramatically reduced how much new ETH gets created. This is a bit like a company doing a massive stock buyback. It makes the existing supply of ETH scarcer, which can support its value over time.

The switch to Proof-of-Stake completely rewrote Ethereum's economic rulebook. By putting the brakes on the creation of new coins, it introduced a deflationary element that could help drive up the price, especially as more people and apps start using the network.

Future Upgrades: Adding More Lanes to the Highway

The work didn't stop with The Merge. The next big thing on the roadmap is an upgrade known as sharding, which is designed to tackle the network's congestion problem head-on.

Sharding is like adding dozens of new lanes to that digital highway. Instead of all the traffic getting crammed into one lane, the network’s workload will be split across many parallel chains. The goal is to massively boost the number of transactions the network can handle, which in turn should lower fees and make everything faster. For an investor, a more scalable network means it can host more applications and attract more users, which directly fuels demand for ETH.

Ultimately, these technical improvements are a huge part of Ethereum's appeal. While Bitcoin's value is often linked to its digital scarcity, Ethereum's value is driven by its ever-expanding utility in fields like DeFi and NFTs. We’re already seeing this play out in the market, with Ethereum's share of the total crypto market cap projected to rise from 21.4% in 2024 to 23.6% in 2025.

Sure, this growth potential comes with more price swings—an average volatility of 4.6% compared to Bitcoin's 2.1%—but its powerful and growing ecosystem keeps pulling in serious interest. You can watch these dynamics yourself and see how technological improvements correlate with investor confidence on CoinMarketCap. This constant drive to improve is a clear sign of a commitment to long-term success, and it's something every potential Ethereum investor should be watching closely.

Real-World Use Cases Driving Demand

Theory is great, but an asset's real value comes down to how people actually use it. To figure out if Ethereum is a solid investment, you have to look past the price charts and see the bustling economy being built on top of it. This isn't just about people speculating on a token; it's about real services and products that need ETH to work, creating a constant and organic demand.

This economic activity is happening across a few key areas. Every single time someone uses an application on Ethereum, they have to pay a small transaction fee, known as "gas," using ETH. This creates a direct, tangible link between the network's usefulness and the token's value. The more people build and use things on Ethereum, the more valuable ETH becomes.

The Rise of Decentralized Finance (DeFi)

One of the biggest drivers of this demand is Decentralized Finance (DeFi). Picture a global, open-source financial system that operates without the need for traditional banks. DeFi applications use smart contracts on Ethereum to rebuild familiar financial tools—like lending, borrowing, and trading—on the blockchain.

This new system is open to anyone with an internet connection, cutting out the middlemen. When someone swaps tokens on a decentralized exchange or takes out a loan, their transaction is powered by ETH. This non-stop activity has led to billions of dollars worth of assets being locked into DeFi protocols, and every transaction adds to the network's strength.

DeFi’s core promise is to build a more transparent and accessible financial world. Every transaction in this new world adds to the economic engine of Ethereum, directly supporting its underlying value.

The Digital Ownership Economy of NFTs

Then you have Non-Fungible Tokens (NFTs). The easiest way to think of an NFT is as a unique, digital certificate of ownership. It can represent anything from digital art and collectibles to a concert ticket, all secured on a transparent ledger that proves who owns what. That ledger is Ethereum.

When an artist creates a new NFT (a process called "minting") or a collector sells a piece from their collection, these actions are all recorded on the Ethereum blockchain. Every step—from creation to sale to transfer—requires a little bit of ETH to pay for gas fees. This has sparked a multi-billion dollar market for digital goods that is completely dependent on Ethereum’s infrastructure.

Internet-Native Companies and DAOs

Finally, there are Decentralized Autonomous Organizations (DAOs). These are essentially internet-native companies that are collectively owned and managed by their members. Instead of a CEO and board of directors, the rules are coded into smart contracts, and decisions are made when members vote with special governance tokens.

DAOs are used for everything from managing investment funds to running creative studios. All their operations—paying contributors, executing proposals, managing a treasury—run on Ethereum. This adds yet another layer of real-world economic activity that requires ETH to function. As more organizations look to decentralized models, it's worth exploring how crypto is redefining ecommerce transactions.

This constant use across finance, digital ownership, and business governance is what forms the bedrock of Ethereum's long-term investment case.

Navigating the Inherent Risks of Ethereum

While it’s easy to get excited about Ethereum's potential, a smart investor always looks at the other side of the coin. No investment is a sure thing, and Ethereum comes with its own unique set of challenges you need to understand before jumping in.

The most obvious risk is volatility. The crypto market is famous for its dramatic price swings, and Ethereum is no exception. Think of it less like a steady climb and more like a rollercoaster. News headlines, shifting market moods, and even global economic changes can send its value soaring or plunging in a short time. You have to have the stomach for that kind of ride.

The Landscape of Competition and Regulation

Beyond the day-to-day price movements, Ethereum is in a constant battle to stay on top. It faces stiff competition from a wave of newer blockchains often dubbed "Ethereum killers." Platforms like Solana and Cardano were built from the ground up to be faster and cheaper, directly targeting Ethereum’s weaknesses. While Ethereum has a massive head start, this technological arms race is far from over.

There are also technical hurdles. The Ethereum network is an incredibly complex piece of machinery. Even with constant testing and development, there's always a risk of undiscovered bugs or vulnerabilities, especially when rolling out major network upgrades. High demand can also clog the network, causing transaction fees (or "gas fees") to skyrocket. This can make using the network frustratingly expensive, an issue you can see in action with increased blockchain fees for Ethereum ERC-20 transactions.

A core consideration for any investor is that Ethereum operates in a world with shifting rules. Regulatory uncertainty remains one of the biggest external risks, as governments worldwide are still deciding how to classify and oversee digital assets.

Finally, don't let past performance fool you. While the numbers are impressive, they aren't a crystal ball for the future. As of mid-2025, Ethereum has seen a 45.6% increase over the last year and an incredible 97.3% gain in just three months. Looking back three years, its value has jumped by over 110%. These figures show the massive opportunities, but they also underscore the volatility. If you want to dig deeper, you can discover more insights about Ethereum's performance data to get a clearer picture of these trends.

Smart Strategies for Investing in Ethereum

Alright, you've got the fundamentals down. Now comes the important part: building a smart plan to actually enter the market. Deciding if Ethereum is right for you isn't just about market charts; it's about creating a strategy that fits your personal financial goals and how much risk you're willing to take on.

One of the most battle-tested strategies for navigating crypto's legendary volatility is Dollar-Cost Averaging (DCA). Instead of trying to time the market perfectly with a lump sum—a nearly impossible task—DCA involves investing smaller, fixed amounts on a regular schedule.

Think of it this way: you're smoothing out the bumps. By investing consistently, you buy more ETH when the price is low and less when it's high, averaging out your cost over time. This takes the emotion out of the equation and turns investing into a disciplined habit.

Portfolio Allocation and Secure Storage

Knowing where Ethereum fits into your overall investment picture is crucial. Given its high-risk, high-reward nature, it’s best viewed as a speculative asset within a diversified portfolio. Many experienced investors only allocate a small percentage of their total portfolio to digital assets—an amount they would be comfortable losing.

For a deeper dive into this, you can explore the compelling reasons to invest in cryptocurrency and see how it complements a traditional investment approach.

A key piece of advice: always use reputable exchanges to buy your ETH. But purchasing it is just the first step. Securing your investment from theft is absolutely non-negotiable.

Here’s a quick breakdown of your main storage options:

- Hot Wallets: These are software-based wallets connected to the internet, like a mobile app or a browser extension. They're incredibly convenient for making frequent transactions, almost like a checking account or the cash in your pocket.

- Cold Wallets: These are physical hardware devices that keep your crypto completely offline. Think of a cold wallet as your personal bank vault—it offers the strongest protection against online hacks and is ideal for long-term holding.

Finally, a smart strategy always involves tracking your progress. To do this effectively, you need to know how to calculate your rate of return properly. Combining the right investment cadence with the right storage method is the foundation of a sound and secure crypto journey.

Common Questions About Investing in Ethereum

Even after getting a handle on the fundamentals, a few key questions always pop up. Let's walk through the big ones that most people wrestle with before deciding to add Ethereum to their portfolio.

Is It Too Late to Invest in Ethereum?

It’s a fair question. Have we already missed the boat? While the explosive, thousand-percent gains from its earliest days are probably behind us, the reason to invest has simply changed.

Investing in Ethereum today isn't about getting in on a wild, speculative bet. It's about investing in the long-term growth of a massive, functioning digital economy. The future value hinges on things like DeFi and NFTs continuing their march into the mainstream, plus the successful rollout of critical scaling upgrades. The risk profile is different now, but the potential for serious growth is still very much on the table as long as developers and users keep flocking to the network.

Should I Invest in Ethereum or Bitcoin?

This really comes down to what you’re trying to achieve as an investor. Think of Bitcoin as "digital gold." Its main appeal is its role as a store of value—a potential shield against things like inflation. The investment case is straightforward and built on pure scarcity.

Ethereum is a completely different animal. Investing in ETH is more like buying a stake in a foundational piece of the internet's future. Its value is directly tied to the success of the thousands of apps running on its back. Bitcoin is generally seen as the more stable, "safer" of the two crypto giants, while Ethereum presents higher growth potential, but that comes with more technological risk and volatility.

Many savvy investors don't see it as an either/or choice. They hold both, using Bitcoin for its relative stability and Ethereum for its utility and high-growth potential. It's a classic diversification play within the crypto space.

How Much of My Portfolio Should Go to Ethereum?

There's no magic number here, and this isn't financial advice. The golden rule for high-risk assets like cryptocurrency is to start small.

Most financial advisors recommend allocating no more than 1-5% of your entire investment portfolio to the entire crypto asset class. Since Ethereum can swing wildly in price, you should only invest an amount you'd be comfortable losing entirely. Ultimately, how much you allocate should be a personal decision based on your financial goals and how much risk you can stomach.

Ready to accept crypto payments for your business? BlockBee offers a secure, non-custodial payment gateway that simplifies crypto transactions. With support for over 70 cryptocurrencies and instant payouts, you can start accepting payments seamlessly. Learn more and get started at BlockBee.