How to Accept Bitcoin Payments A Guide for Your Business

If you're looking to accept Bitcoin payments, you'll need three key things: a trustworthy payment processor, a digital wallet to hold your funds, and a straightforward way to plug it all into your website. The whole process is really about signing up for a service like BlockBee, getting your payout settings just right, and then connecting it to your e-commerce platform or custom-built site.

Why Your Business Should Accept Bitcoin Payments

Before we jump into the nuts and bolts of setting this up, let's talk about why it's a smart move. Once you get past the media hype, you'll find some solid, practical benefits to adding Bitcoin as a payment option. Digital currency isn't just a trend; it's a growing part of the financial world, and getting in early can set your business up for long-term success.

Reach a Global and Tech-Savvy Audience

The moment you start accepting Bitcoin, your business goes global. Seriously. You can take payments from anyone, anywhere on the planet, without getting tangled up in currency conversion headaches or the steep fees that come with international credit cards. This instantly connects you with a growing, tech-forward crowd that actively looks for businesses that fit their digital-first lifestyle.

The worldwide adoption of crypto has been exploding, which means there's a huge and growing pool of potential customers ready to spend their digital assets. By not offering a crypto payment option, you could be missing out on a large and often wealthy customer segment. These are typically early adopters who become incredibly loyal when they find a business that gets them.

Bitcoin vs Traditional Payments: A Quick Comparison

To really see the difference, it helps to put Bitcoin and traditional payments side-by-side. For a merchant, the advantages become clear pretty quickly, especially when it comes to the bottom line.

| Feature | Bitcoin Payments | Traditional Payments (Credit Cards) |

|---|---|---|

| Transaction Fees | Typically 1% or less | Usually 2% - 4% |

| Chargeback Risk | None; transactions are final | High; a common source of loss |

| Global Reach | Borderless, no conversion fees | Complex, high international fees |

| Settlement Time | Minutes to hours | Days |

| Customer Privacy | High; no sensitive data shared | Low; requires extensive personal info |

This table really highlights how Bitcoin can directly impact your revenue by cutting costs and eliminating common frustrations like chargebacks.

Reduce Transaction Costs and Eliminate Chargebacks

This is a big one. One of the most attractive reasons to accept Bitcoin is the dramatic drop in transaction fees. Credit cards will typically hit you with fees anywhere from 2% to 4% on every single sale. In contrast, Bitcoin payment processors like BlockBee often charge just 1% or less.

That difference adds up fast, turning into significant savings, especially if you're running a high-volume business or working with tight margins. Understanding the different ways a website can make and keep money—including by slashing costs with new payment tech—is key. For a broader perspective on this, you can learn more about how websites make money for businesses.

On top of that, Bitcoin transactions are irreversible. Once a payment is confirmed on the blockchain, it's final. This completely wipes out the risk of fraudulent chargebacks, a persistent and expensive headache for anyone selling online. For a deeper look into this, check out our guide on how to accept cryptocurrency payments on your website.

Enhance Customer Privacy and Security

Offering Bitcoin also resonates strongly with customers who value their privacy. Unlike credit card payments, which force customers to hand over a lot of sensitive personal information, Bitcoin transactions don't expose any of that private data. Customers pay you directly from their wallet, which dramatically cuts down the risk of data breaches and identity theft. Showing that you respect customer privacy is a powerful way to build trust and loyalty with your audience.

Choosing the Right Bitcoin Payment Processor

When you decide to accept Bitcoin, your payment processor is your most important partner. This isn't just about picking a piece of software; it’s about finding a service that fits your business like a glove, keeps your money safe, and makes your life easier. Get it right, and the whole process is a breeze. Get it wrong, and you're in for a world of headaches and risk.

The first thing you need to wrap your head around is the difference between custodial and non-custodial services. It's a critical distinction. A custodial service holds onto your crypto for you, kind of like a traditional bank. A non-custodial processor, on the other hand—which is what we do here at BlockBee—sends payments straight to a wallet that you control. This gives you complete ownership and authority over your funds. From my experience, most businesses are far better off with the non-custodial route for the sake of security and independence.

Key Factors for Your Evaluation

As you start comparing different processors, you’ll want to zero in on a few non-negotiable features. Think of these as the pillars that will support the reliability, cost, and overall usability of your new payment system.

- Security Measures: What are they doing to protect your money? Look for concrete features like multi-signature wallets and strong API security protocols. Your processor’s number one job should be shielding your transactions from any and all threats.

- Fee Transparency: The fee structure should be dead simple to understand. Dig into the transaction fees, any setup costs, and what they charge for withdrawing or converting your crypto. Hidden fees are a classic "gotcha" that can seriously erode your profit margins over time.

- Integration Options: How easily will this tool plug into what you’re already using? A top-tier processor will give you a well-documented API for custom work and ready-made plugins for major platforms like WooCommerce, Shopify, or Magento.

A lot of people forget about the customer's side of the equation. A clunky or confusing checkout page is a one-way ticket to abandoned carts. The payment process needs to feel intuitive, with clear instructions and real-time status updates to keep the customer in the loop.

Matching a Processor to Your Business Model

The perfect processor for a simple online store might not be the best fit for a subscription-based software company. You have to think about your specific needs. If you're selling physical products, a straightforward plugin could be all you need. But if you run a SaaS business, you’ll want a robust API that can manage recurring billing and more complex, automated payment flows.

To help you think through it, here’s a quick checklist I use when advising businesses:

| Feature to Check | E-commerce Store | Subscription Service | In-Person Sales |

|---|---|---|---|

| Instant Fiat Conversion | Essential to dodge price swings | Essential for predictable income | Helpful for daily bookkeeping |

| Plugin Availability | Critical for a fast setup | Helpful, but an API is more flexible | Not applicable (API is everything) |

| Non-Custodial Wallets | Highly Recommended for fund control | Highly Recommended | Essential for instant access |

| API Customization | Helpful for unique checkouts | Essential for billing logic | Essential for POS integration |

In the end, choosing how to accept Bitcoin payments really boils down to three things: control, cost, and convenience. A non-custodial processor like BlockBee sets you up for success by giving you direct ownership of your funds, clear and honest fees, and flexible integration tools that can adapt to just about any business model. This way, you can start accepting Bitcoin confidently and securely.

Getting Your BlockBee Account Ready for Payments

Alright, you've picked BlockBee as your payment processor. Great choice. Now comes the fun part: setting up your account so you can actually start accepting Bitcoin payments. This isn't just a box-ticking exercise; it's about laying a secure foundation for every single transaction that comes through your business.

Think of it like setting up a new digital cash register. Before you can ring up your first sale, you need to plug it in, set the security code, and make sure you know exactly where the money is going. The process is pretty straightforward, but getting these details right from the start will save you a world of headaches down the road.

One of the first things you'll notice is how clean the BlockBee dashboard is. It gives you a quick, clear overview of your balances and recent activity, so you can find what you need without getting bogged down in technical jargon.

Creating and Securing Your Account

First up, you’ll need to create your BlockBee account. It's a standard signup, but the most critical thing you'll do right after is enable two-factor authentication (2FA). This adds a serious layer of security, requiring a code from your phone to log in or approve important actions.

Honestly, skipping 2FA is like leaving your vault door wide open. Just don't do it. This one small step is non-negotiable for keeping your funds safe.

Generating Your First API Key

Your API key is essentially the secret handshake that lets your website communicate with your BlockBee account. It's the magic that allows your e-commerce store to generate payment addresses and verify transactions automatically.

You’ll generate this key right inside your BlockBee dashboard. From experience, I always recommend a few best practices:

- Create Specific Keys: Avoid the temptation to use one API key for everything. Make a unique key for each website or application. If one is ever compromised, you can just disable that single key without taking down your entire payment system.

- Set Limited Permissions: When you can, restrict what an API key can do. For a typical website integration, the key only needs permission to create payment requests, not to initiate payouts or change settings.

- Store It Securely: Treat your API key like a password. Never, ever share it publicly or commit it to a public code repository like GitHub.

Your API key is the bridge between your website and your wallet. Protecting it is just as important as protecting your login credentials. A compromised key can lead to serious operational and financial problems.

Configuring Your Payout Wallet Address

This is where you tell BlockBee where to send the money. Since BlockBee is non-custodial, it forwards every payment directly to a Bitcoin wallet that you control. In the settings, you'll need to input the receiving addresses for Bitcoin and any other cryptocurrencies you want to accept.

Be extra careful here. I can't stress this enough: triple-check these addresses. A single typo could send your funds to the wrong place forever. On the blockchain, there are no do-overs. The safest way is to copy and paste the address directly from your wallet app.

Getting this setup right is crucial, especially as consumer readiness to use Bitcoin grows. In fact, consumer confidence is climbing in key markets like the US, UK, and Singapore. You can discover more insights from the 2025 Global State of Crypto report to see just how big this trend is becoming.

Connecting BlockBee To Your Website

Alright, with your BlockBee account set up and ready to go, it's time for the exciting part: connecting it to your website. This is where you'll build the bridge that lets customers pay you directly with Bitcoin.

The great thing is, you've got options. Whether you're running a popular e-commerce store with no coding skills or you're a developer crafting a completely custom platform, there's a path for you. Your decision will really boil down to your existing setup, your technical confidence, and how much you want to customize the checkout experience.

Need Something Quick and Easy? Use an E-commerce Plugin

For the vast majority of online merchants, a plugin is the simplest and most direct route to accepting Bitcoin. I've seen countless store owners get this done in minutes. If you're on a major platform like WooCommerce, Shopify, or Magento, BlockBee has official plugins that handle all the heavy lifting for you.

Seriously, it requires absolutely no code.

Let’s say your shop runs on WooCommerce. Here’s how straightforward it is:

- First, you'll grab the BlockBee plugin from the WordPress directory.

- Then, you upload and activate it right from your WordPress dashboard—the same way you'd install any other plugin.

- Finally, you just navigate to its settings and paste in the API key you already generated.

Once you hit "save," that's it. A "Pay with Bitcoin" option will now be live on your checkout page. It’s a true set-it-and-forget-it solution that gets you operational almost instantly. For a deeper dive, our guide on how to add crypto payments to your website breaks down every detail.

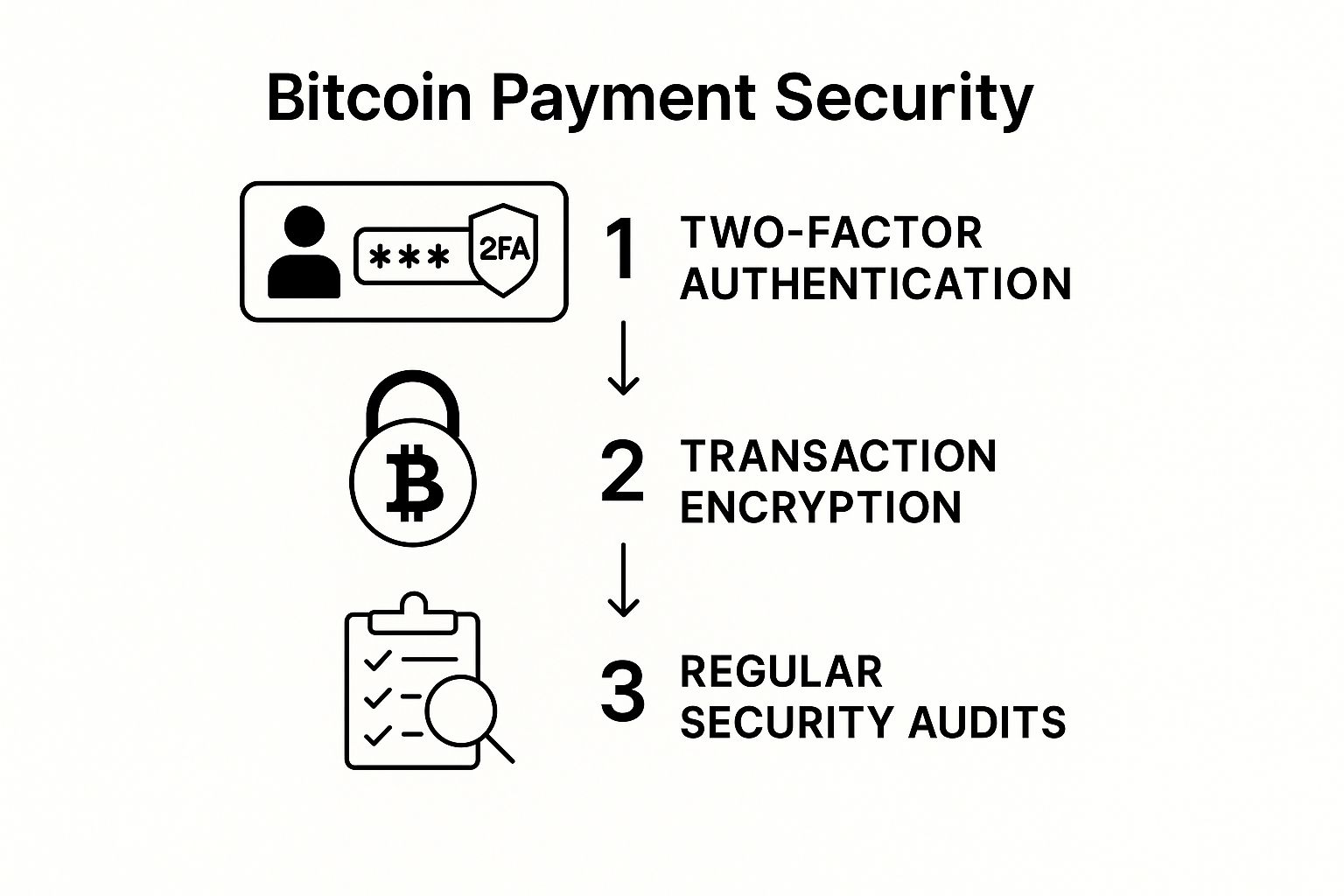

As you get started, always keep security top of mind. This isn't just about passwords; it involves multiple layers of protection.

The image above really drives home the point that solid security is a combination of things working together—from strong account-level features like 2FA to the encryption that protects every single transaction.

Want Full Control? Go with the Direct API

Now, if you're working with a custom-built website, a unique application, or you simply need more control over the payment flow, the API path is your best bet. This approach is built for developers who want to integrate Bitcoin payments seamlessly into their own code.

With the BlockBee API, you can programmatically do things like generate a unique payment address for every single order, check on the payment status in real-time, and get instant payment notifications (IPNs) the moment a transaction is confirmed. It’s incredibly powerful. For example, a developer could write a simple Python script to request a new Bitcoin address for a specific customer's cart, making the process entirely automated and invisible to the end-user.

The API isn't just for selling products online. I’ve seen it used to power everything from in-app purchases and recurring subscription billing to donation platforms for streamers and content creators. Its flexibility is its biggest asset.

Which Method Is Right For You?

Choosing between a plugin and the API is really a trade-off between speed and customization. One gets you started in minutes with zero fuss, while the other gives you the power to build anything you can imagine.

To help you decide, here’s a quick comparison of the two approaches.

Integration Methods: Plugin vs. API

| Factor | E-commerce Plugin | Direct API Integration |

|---|---|---|

| Technical Skill | None required | Requires programming knowledge |

| Setup Time | Minutes | Hours to days, depending on complexity |

| Customization | Limited to plugin settings | Fully customizable payment flow |

| Best For | Standard e-commerce (WooCommerce, Shopify) | Custom sites, SaaS, advanced applications |

Ultimately, both paths are secure and reliable ways to bring Bitcoin payments into your business. Whether you opt for the plug-and-play simplicity of a plugin or the endless potential of the API, BlockBee provides a solid foundation. This flexibility is key, opening up a whole new world of customers and opportunities for your business.

Testing and Managing Your Bitcoin Payments

Before you flip the switch and go live, you need to be absolutely confident that everything works. This final phase is all about ensuring a flawless launch where every transaction runs smoothly. It's not just about seeing the payment button show up; it's about walking through the entire customer journey from their first click to the final confirmation.

Don't even think about announcing your new payment option until you've done a full end-to-end test. This means simulating a real purchase—from a customer starting a transaction all the way to you seeing the confirmation in your BlockBee dashboard and the funds arriving in your wallet. Think of it as a final dress rehearsal.

Running a Full Payment Test Cycle

To do this right, you'll need a small amount of Bitcoin in a separate, personal wallet. Go to your own website and buy something just like a customer would. Pay close attention to every single detail.

- Checkout Clarity: Is the payment page clear and easy to understand? Does it plainly display the BTC amount and the QR code?

- Confirmation Speed: How fast did the system register the payment after you sent the Bitcoin?

- Notification Check: Did you get the right email confirmations, both as the merchant and as the (test) customer?

Going through this process helps you find any snags or confusing steps before your actual customers do. A smooth, intuitive checkout experience is everything when it comes to closing a sale.

Never go live without a test transaction. A single successful test gives you the confidence that your API keys are correct, your wallet addresses are properly configured, and your customer experience is seamless. It’s the best five minutes you can spend.

Managing Your Bitcoin Funds and Volatility

Once payments start coming in, you’ll need a plan for managing your newfound crypto assets. For many businesses, the biggest elephant in the room with Bitcoin is its well-known price volatility. A sale worth $100 today might be worth $90 or $110 tomorrow.

The most straightforward solution for most businesses is to turn on automatic fiat conversion. A service like BlockBee can instantly convert the Bitcoin you receive into your local currency (like USD or EUR) the moment the transaction happens. This locks in your revenue, shields you completely from price swings, and keeps your accounting clean and predictable. To get a better handle on the possibilities, our guide on crypto payments for business offers more context.

Handling Common Payment Issues

Even with the most polished setup, you might run into the occasional hiccup. Knowing how to handle these situations gracefully is what separates good customer service from bad.

- Underpayments: If a customer accidentally sends less than the required amount, BlockBee’s system is smart enough to keep the invoice open. It will then notify them of the remaining balance needed to complete the purchase.

- Overpayments: In the case of an overpayment, you can easily issue a refund for the extra amount right from your dashboard.

- Transaction Delays: The Bitcoin network can sometimes get congested, which slows things down. The payment gateway will keep an eye on the blockchain and confirm the payment as soon as it's secure, all while keeping the customer in the loop on the status page.

Tying Up Loose Ends: Common Questions About Accepting Bitcoin

Alright, you're almost ready to go. But before you flip the switch, it's completely normal to have a few last-minute questions bubbling up. Let's tackle the most common ones I hear from merchants so you can move forward with total confidence.

What About Bitcoin's Price Volatility?

This is usually the first question people ask, and it's a big one. Bitcoin's price can swing wildly, and you're running a business, not a trading desk. How do you protect your revenue?

The simplest, most effective strategy is to use a payment processor that offers instant fiat conversion. Here’s how it works: when a customer pays in Bitcoin, a service like BlockBee can immediately convert it into your local currency (like USD or EUR) at the exact market rate.

This one feature is a game-changer. It locks in your sale price and completely shields your business from the crypto market's ups and downs. While you could technically hold the Bitcoin, that's an investment decision, not a sales one. For day-to-day operations, instant conversion is the way to go.

Are Bitcoin Transactions Anonymous? What Are My Legal Obligations?

There's a common myth that Bitcoin is anonymous. It's actually pseudonymous.

Every single transaction is publicly and permanently recorded on the blockchain. While a wallet address isn't stamped with a name and social security number, the trail of funds is there for anyone to see.

From a business perspective, this means you treat Bitcoin revenue just like any other income. You absolutely must follow the tax and legal requirements of your country. A good habit is to keep meticulous records:

- The date and time of the transaction.

- The amount received in BTC.

- The fiat value at the moment of the transaction.

My advice? Don't guess. Talk to a tax professional who has experience with cryptocurrency. They'll give you the exact guidance you need to stay compliant and avoid any nasty surprises later on.

What Happens if a Customer Sends the Wrong Amount?

Mistakes happen. A customer might accidentally send too little or too much. Modern payment gateways are designed to handle these scenarios without causing a headache.

If a customer underpays, the system will typically flag it and notify both of you. It usually gives the customer a simple way to send the remaining balance to complete the order.

If they overpay, you can easily issue a refund for the extra amount right from your dashboard. These systems also manage things like network congestion, keeping the customer informed with a clear status on the payment page until the transaction is confirmed on the blockchain. It's all about making the process smooth for everyone involved.

Ready to give your customers a modern, secure way to pay? With BlockBee, you can start accepting Bitcoin and over 70 other cryptocurrencies, all with incredibly low fees and instant payouts. Get started with BlockBee today!