Cryptocurrency Payment Solutions for Modern Business Success

So, what exactly is a cryptocurrency payment solution?

Think of it as a bridge. On one side, you have your customer with their digital wallet full of Bitcoin, Ethereum, or other cryptocurrencies. On the other side, you have your business's bank account or crypto wallet. The payment solution connects the two, acting much like a credit card terminal does for traditional money, but for the world of digital assets. It handles all the complex stuff behind the scenes, making it surprisingly simple for a customer to pay you with crypto.

Why Your Business Should Consider Crypto Payments

Looking past the hype, bringing crypto payment options into your business offers some very real, tangible benefits. This isn't just about adding another payment method; it's about making your business more efficient, reaching customers you couldn't before, and getting ready for the future of commerce. For a lot of businesses, making this move has been a genuine game-changer.

The trend is impossible to ignore. In 2023 alone, the use of crypto for payments shot up by a massive 55%. Businesses all over the globe are adding Bitcoin, Ethereum, and stablecoins to their checkout pages. In fact, roughly 40% of small and medium-sized enterprises (SMEs) started accepting crypto payments last year, which points to a huge shift in how we think about money.

Slashing Costs and Boosting Speed

One of the most powerful arguments for switching to crypto is the drastic cut in transaction fees. Your typical credit card processor will skim 2% to 4% off every single sale. That adds up, and it comes directly out of your profits. In contrast, cryptocurrency payment solutions usually charge fees well under 1%.

By running on decentralized networks, crypto payments cut out the middlemen—the banks, the card networks, and all the processors—that make traditional finance so expensive. It’s a more direct path from your customer to you, meaning more of each sale ends up in your pocket.

This efficiency isn't just about cost; it's also about speed. Forget waiting days for a bank transfer to land or a credit card payment to clear. Crypto transactions often settle in a matter of minutes. This instant access to your funds frees up cash flow, which is a massive advantage for any business, especially when dealing with international sales where bank delays are a common headache.

Unlocking Global Markets and Attracting New Customers

Cryptocurrency doesn't care about borders. For any business with international customers or aspirations, this is a huge deal. You can get paid by someone on the other side of the world just as easily as you can from someone down the street, all without worrying about currency conversion fees or painfully slow international wires.

This also opens your doors to a growing, tech-savvy group of people. The kind of customer who owns and uses crypto is often younger, has more disposable income, and actively looks to support forward-thinking businesses. Simply offering crypto as a payment option sends a powerful message that your company is innovative and in tune with where the world is headed.

If you’re ready to take the first step, our guide on how to accept crypto payments for your business is the perfect place to start.

It’s also smart to see how these new options fit alongside your existing payment structures. Understanding how crypto can complement the different types of payment terms you already offer can help you create a more complete and flexible payment strategy for all your customers.

Traditional Payments vs. Cryptocurrency Payments

To really grasp the difference, it helps to see a side-by-side comparison.

| Feature | Traditional Payment Systems (e.g., Credit Cards, Bank Transfers) | Cryptocurrency Payment Solutions |

|---|---|---|

| Transaction Fees | High (typically 2-4% + fixed fees) | Low (often below 1%) |

| Settlement Speed | Slow (2-5 business days) | Fast (minutes to a few hours) |

| Global Access | Limited by banking systems and currency conversion | Borderless, accessible anywhere with an internet connection |

| Security | Centralized; vulnerable to data breaches and fraud | Decentralized; secured by cryptography, reducing chargeback fraud |

| Intermediaries | Multiple (banks, card networks, processors) | Few to none (direct peer-to-peer or via a single gateway) |

| Accessibility | Requires a bank account | Only requires a digital wallet and internet access |

As you can see, the core advantages of crypto—lower costs, faster settlement, and true global reach—directly address the main pain points of traditional financial systems. This shift represents a fundamental improvement in how value is exchanged.

How Crypto Payments Actually Work

Getting into digital currency payments might seem intimidating at first, but for a business owner, the way modern cryptocurrency payment solutions operate is surprisingly straightforward. The whole system is built to feel as familiar as taking a credit card payment, just with more efficient technology running in the background.

Let's break down the journey, from the moment your customer decides to pay to the cash landing in your bank account.

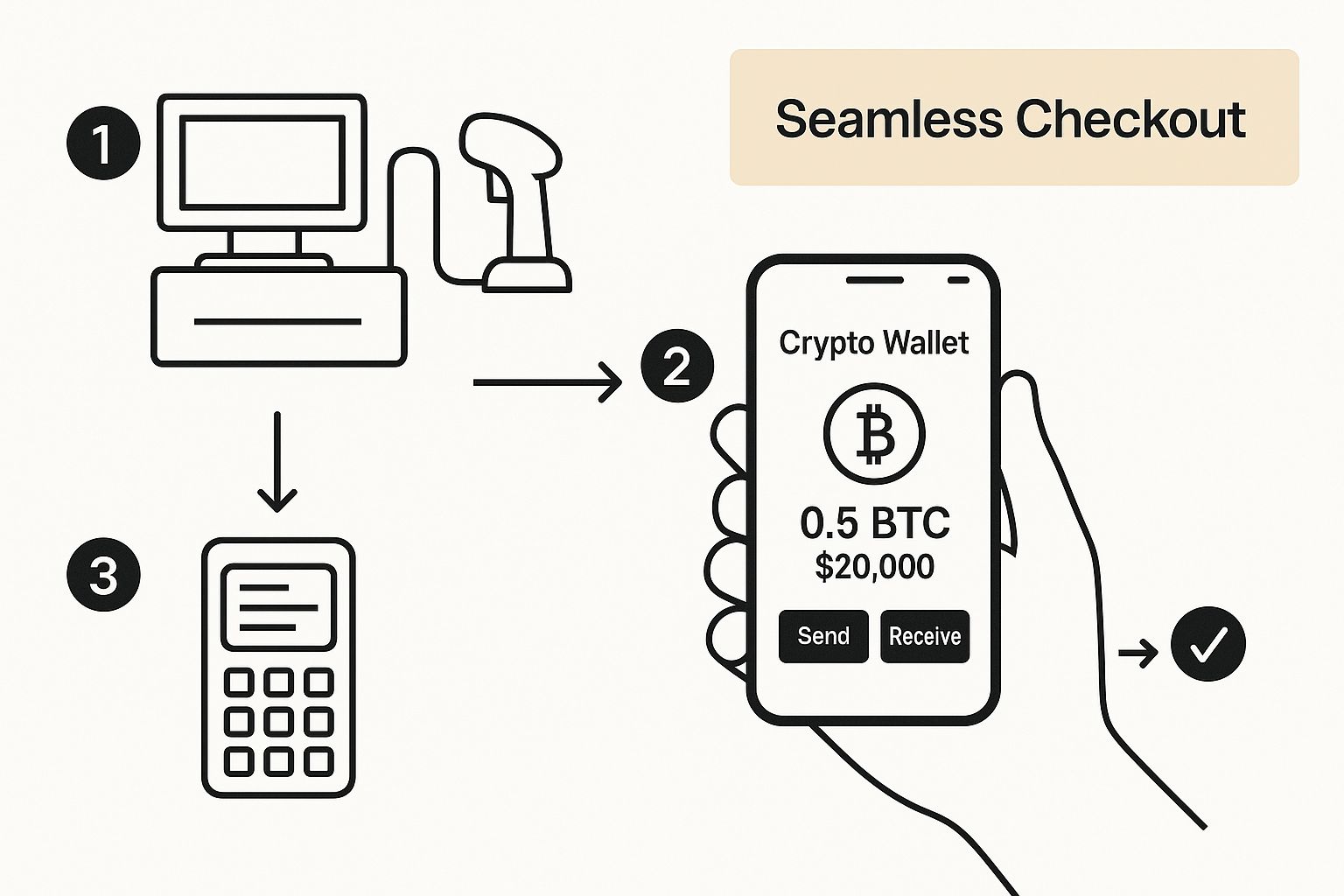

At its heart, a crypto transaction is just a digital transfer of value from one person to another. The good news is you don't have to get your hands dirty with the complex blockchain tech. A specialized payment gateway acts as your digital cashier, handling everything securely and smoothly.

The process often starts with a simple tap on a phone, kicking off a checkout flow that turns a customer's crypto into your revenue.

As you can see, the experience for the customer is clean and simple. All the heavy lifting—the verification and fund transfers—happens instantly behind the curtain.

The Customer's Checkout Experience

It all begins on your checkout page. Right next to the familiar "Pay with Card" or "PayPal" buttons, your customer will see a new option: "Pay with Crypto."

Once they choose it, the payment gateway takes the stage. It usually pops up a simple interface showing a QR code and a unique digital wallet address. Think of this address like a one-time-use invoice number created just for this sale. It's how the system knows to connect this specific payment to this specific order.

The customer simply opens their crypto wallet app, scans the QR code, and hits "confirm." It's no different from authorizing a payment with a banking app. Within a few seconds, their cryptocurrency is sent.

The Role of the Payment Gateway

This is where the real magic happens for your business. The payment gateway is the bridge that makes accepting crypto so easy.

- Payment Verification: The gateway keeps a constant watch on the blockchain. The moment the customer sends their payment, the gateway spots it and starts verifying that it's legitimate.

- Instant Confirmation: Forget about waiting around for the blockchain to slowly confirm the transaction. A good gateway gives you an instant "payment successful" notification, so you can ship the product or provide the service right away.

- Currency Conversion: For most businesses, this is the most critical feature. As soon as the payment is confirmed, the gateway can instantly convert the crypto (like Bitcoin) into your local currency (like USD or EUR) at the live market rate.

This automatic conversion is your shield against price volatility. You don't have to worry about the value of Bitcoin dropping after a sale. You receive the exact amount of the purchase in stable fiat currency, guaranteed.

Settlement and Your Funds

The final step is getting paid. After the crypto is converted, the funds are sent to the account you've designated. This is where modern crypto payment solutions offer fantastic flexibility.

You can have the money deposited directly into your business bank account, just like with any other payment processor. Or, if you want to keep some crypto, you can have the funds sent to your company's corporate wallet.

This whole cycle—from customer click to money in your account—is often much faster than the 2-5 business days it takes for traditional credit card settlements. In essence, you get all the perks of a fast, global, low-fee payment method without any of the risk of holding a volatile asset. It's the best of both worlds.

Choosing the Right Crypto Payment Platform

Picking the right partner to handle your crypto payments is a make-or-break decision. It’s one of the first and most critical steps you'll take. The market is crowded with options, and while they might look similar on the surface, they all have different strengths. Your job is to find a platform that not only gets the job done today but can also grow with you tomorrow.

Think of it like choosing the engine for a new car. You need something powerful and reliable, but also secure and efficient. The wrong choice means constant breakdowns and headaches, but the right one ensures a smooth ride for years.

So, let's break down the essential features that separate a truly great crypto payment platform from the rest.

Core Features You Cannot Overlook

When you start comparing different services, a few features are simply non-negotiable. These are the bedrock elements that guarantee a smooth experience for both you and your customers. Getting these right from the beginning will save you a world of hurt later on.

To keep things simple, focus on three key areas first: coin support, currency conversion, and how well it plays with your existing setup.

Multi-Coin Support: Your customers aren't all using the same digital assets. A platform that only accepts Bitcoin is already behind the times. You want a provider that supports the heavy hitters like Bitcoin (BTC) and Ethereum (ETH), plus popular stablecoins like USDT and USDC. The more choices you offer, the wider your net for potential customers.

Automatic Fiat Conversion: This is your shield against the notorious price swings of crypto. A coin's value can jump or drop in minutes. A platform with automatic conversion instantly swaps the crypto payment into your local currency (like USD or EUR) the second the transaction happens. This single feature guarantees you receive the full purchase price, completely removing the risk of losing money to a market dip.

Seamless E-commerce Integration: Your payment gateway should feel like it belongs on your website—not some clunky, bolted-on afterthought. Look for pre-built plugins and official integrations for major e-commerce platforms. For anyone running an online store, a solid integration is vital, and our guide on the best cryptocurrency payment gateway for WooCommerce dives deeper into what a great plugin actually looks like.

Security and Usability Are Paramount

Okay, so the platform can process payments. Great. But can you trust it with your money, and can you actually use it without pulling your hair out? Security and ease of use must be at the top of your list. A system that’s a fortress but impossible to navigate is just as bad as one that’s easy to use but has a flimsy lock on the door.

You need a platform that protects your assets without requiring a cybersecurity degree to operate it. Finding that balance is the key to getting your team on board and making this a long-term win.

Security in the crypto world isn't just a feature; it's the foundation of trust. Your chosen provider should employ multiple layers of defense, including industry-best practices like two-factor authentication (2FA) and cold storage solutions for securing funds offline, away from online threats.

This robust security should be paired with a clean, intuitive user experience. You should be able to log in and instantly understand what's going on. Look for a clear dashboard where you can track payments, review transaction history, and manage your funds without any guesswork. If you can't see your revenue at a glance, the tool isn't doing its job.

Evaluating Fees and Support

Last but not least, it all comes down to the bottom line and knowing someone has your back. The fee structure should be straightforward and transparent, with no nasty surprises that chip away at your profits. Most gateways take a small slice of each transaction, usually between 0.25% and 1%. Compare these rates, but don't let a slightly lower fee distract you from a platform's other weaknesses.

Here’s a final checklist to run through:

- Transparent Fee Structure: Are all costs laid out clearly? Avoid any provider with a confusing pricing page.

- No Hidden Charges: Be sure to ask about setup fees, monthly minimums, or withdrawal costs so you know the true price.

- Responsive Customer Support: What happens when you hit a snag? You want a provider with dedicated support—ideally 24/7—to get you back up and running fast.

Ultimately, choosing a payment platform is about finding a true partner for your business. By focusing on these essentials—coin support, fiat conversion, security, usability, and fair pricing—you can confidently pick a solution that will do more than just process payments; it will help your business thrive.

Tackling the Real-World Challenges and Risks

Let's be realistic. While the upside of accepting crypto is huge, it's not without its hurdles. Adopting any new payment method brings its own set of questions, and crypto is no different. By getting a handle on these potential issues from the start, you can find a platform that’s already solved them for you.

For most businesses, the concerns boil down to three things: wild price swings, confusing regulations, and, of course, security. The good news? The right payment provider isn't just aware of these problems; they're built specifically to shield you from them.

Taming Price Volatility

The first thing everyone asks about is volatility. It’s a fair question. The price of Bitcoin or Ethereum can jump up and down pretty dramatically in a single day. So, what if you sell a product for $100 in crypto, and by the time you see the money, it's only worth $90?

That's a risk you simply don't have to take. The solution is a feature called instant fiat conversion.

Think of it like a currency lock. The second a customer pays you, a good crypto payment platform instantly swaps the crypto for your local currency—be it USD, Euros, or whatever you use—at that exact moment's exchange rate. This completely sidesteps the volatility problem.

The sale price is locked in. You get your $100, guaranteed, no matter what the crypto markets do five minutes later. This one feature is a game-changer. It lets you tap into all the benefits of crypto—lower fees, faster payments, no borders—without turning you into a currency speculator overnight. Crypto becomes just another stable, efficient way to get paid.

Making Sense of Regulatory Compliance

The rulebook for crypto is still a work in progress, and it changes depending on where you are in the world. Trying to keep up with the shifting legal landscape can feel like a full-time job you didn't sign up for. This is another spot where a solid payment partner proves its worth.

A trustworthy provider takes compliance seriously. They have teams dedicated to navigating the maze of global regulations, ensuring every transaction on their platform is above board.

Here’s what that actually means for you:

- Know Your Customer (KYC): Expect to go through a standard identity check, just like you would with any bank. This is a good thing—it keeps fraudsters out and ensures everyone on the platform is who they say they are.

- Anti-Money Laundering (AML): The platform should be actively flagging suspicious transactions, following the same strict AML rules as traditional financial institutions.

- Clear Reporting: Come tax season, you'll need clear records. A great platform gives you detailed reports that make it easy for you and your accountant to treat crypto income just like any other sale.

When you pick a provider that has this covered, you’re essentially outsourcing a massive headache. They do the heavy lifting on compliance, so you can get back to what you do best.

Addressing Security Concerns Head-On

Security is, without a doubt, a huge deal for everyone involved. It’s not just about protecting your business; it's about making your customers feel safe, too. Consumer trust is still a work in progress here. In fact, even among people who already own crypto, 40% have safety concerns, and about one in five have had trouble accessing their own funds on certain platforms. You can dig deeper into these consumer trust challenges in crypto.

This really drives home how critical it is to choose a secure partner. A quality crypto payment solution is your first and best line of defense. They use sophisticated tools like multi-signature wallets (which require more than one person to approve a transfer) and two-factor authentication (2FA) to lock down your account.

Ultimately, your provider is your most important security decision. Their infrastructure and expertise are what stand between your business and bad actors, giving you the confidence to accept digital currencies without losing sleep at night.

Your Step-by-Step Integration Guide

Taking your business from crypto-curious to crypto-ready might seem like a huge leap, but it’s really just a series of manageable steps. The good news is that modern cryptocurrency payment solutions are built for quick and painless implementation. This guide breaks down the whole process into a simple roadmap, so you can start accepting digital currency with confidence.

Think of it like setting up any other online payment method, like Stripe or PayPal. You pick a provider, set up your account, connect it to your site, and run a quick test. Let's walk through it together.

Step 1: Choose Your Payment Gateway

Your first move is picking the right partner. Your payment gateway is the engine that will drive your entire crypto payment operation, so this decision really matters. Use the features we discussed earlier as a checklist to size up potential providers, paying close attention to security, which coins they support, and how easy the platform is to actually use.

A solid provider should offer:

- Simple Integrations: Look for ready-made plugins for popular e-commerce platforms like WooCommerce, Shopify, or Magento. This saves you from having to hire a developer for a complex custom build.

- Automatic Fiat Conversion: This is non-negotiable. It’s what protects your business from price swings. Make sure the platform can instantly settle payments in your local currency.

- Transparent Fees: The best platforms are upfront about their costs. Look for clear, low-cost fee structures, often around 0.25% to 1% per transaction, without any hidden monthly charges.

Step 2: Create and Verify Your Business Account

Once you've picked your gateway, it's time to sign up for a business account. The process will feel familiar—it’s a lot like opening an account with any other financial service. You'll need to provide standard business information and go through a verification process.

This process, often called Know Your Customer (KYC) or Know Your Business (KYB), is actually a great sign. It means the provider is serious about security and following regulations, creating a trustworthy environment for all its merchants. It usually just involves uploading some basic documents to prove your business is legitimate.

Step 3: Integrate With Your Website or Platform

Now for the "tech" part—which is often surprisingly simple. Thanks to pre-built plugins and well-documented APIs, you don’t need to be a blockchain wizard to get this done.

For most online stores, it boils down to three quick steps:

- Install the Plugin: Head over to your e-commerce platform’s app store or marketplace (like the WooCommerce Extensions store) and install your chosen provider's official plugin.

- Enter Your API Keys: Your payment gateway will give you a unique set of API keys in your dashboard. You’ll just copy and paste these into the plugin’s settings to securely link your website to your new gateway.

- Configure Your Settings: This is where you tailor the experience. You’ll decide which cryptocurrencies to accept (like Bitcoin, Ethereum, or USDC) and set your settlement preferences. For maximum stability, nearly all businesses choose to automatically convert payments into their main currency, like USD or EUR.

For example, an online clothing store using WooCommerce can have a crypto payment option live in minutes. After installing the plugin, they just paste in their API keys, select which coins to display at checkout, and set settlements to go directly to their business bank account in USD. The entire setup can be done in less than an hour.

Step 4: Test the Payment Flow

Before you announce it to the world, always run a test transaction. This final check ensures everything is working perfectly and that your customers will have a seamless checkout experience. Just create a small test product on your site and go through the entire payment process yourself.

Pay with a small amount of crypto from a personal wallet to see exactly what your customer will see. Confirm the payment goes through, the order is marked as "paid" in your system, and the funds land correctly in your account. This simple test is the best way to catch any small hiccups before your real customers do.

The Future of Digital Currency in Commerce

When we look past the immediate horizon, it's clear the world of digital payments is moving at a breakneck pace. The adoption of cryptocurrency payment solutions isn’t just some passing fad; we're witnessing the groundwork being laid for a massive shift in global commerce. For any business thinking about what's next, a few key developments are already taking shape.

The most practical and immediate evolution has been the incredible rise of stablecoins. Think of these as digital currencies tied directly to a stable asset, like the U.S. dollar. This simple peg strips away the price volatility that makes people nervous about cryptocurrencies like Bitcoin. For businesses, this is a huge deal.

Stablecoins give you the best of both worlds: the speed, low fees, and borderless reach of crypto, but with the predictable value of traditional money. They are quickly becoming the preferred tool for everyday business, whether you're sending an international invoice or paying a supplier. You get all the efficiency without the risk.

New Players and Expanding Markets

Looking a bit further out, Central Bank Digital Currencies (CBDCs) are preparing to make their entrance. A CBDC is essentially a digital version of a country's official currency, issued and backed by its central bank. While many governments are still in the research and testing phase, CBDCs could act as a vital bridge connecting the old-school financial system with the new decentralized world.

How CBDCs will work alongside existing crypto solutions is something we'll all be watching closely. It could lead to new hybrid payment systems that offer businesses security and efficiency on a scale we haven't seen before.

A huge piece of this future growth is coming from emerging economies. By paying attention to these trends, businesses can get a foothold in massive, underserved markets where digital currencies are already becoming a part of daily life.

On a global scale, about 12.4% of adults with internet access now own or use cryptocurrencies. Stablecoin use, in particular, has exploded, often driven by worries about inflation and the need for better remittance options in countries with high adoption rates, like Nigeria, Vietnam, and India.

What This Means for Your Business

This forward momentum isn't just noise—it's a clear opportunity. Putting a solid cryptocurrency payment solution in place today isn't just about grabbing a niche customer base; it’s about preparing your business for what's coming.

Doing so allows you to:

- Access High-Growth Regions: Connect with booming economies where crypto adoption is leapfrogging traditional banking.

- Reduce Cross-Border Friction: Use stablecoins to handle international business with much lower fees and instant settlement times.

- Attract a New Generation of Customers: Appeal to a global, tech-savvy audience that expects and prefers digital-native ways to pay.

As the world of commerce continues to evolve, it’s worth seeing how businesses are exploring Web3 technologies. Adopting these tools is quickly moving from a "nice-to-have" to a strategic imperative for staying competitive. You can also get a deeper look by reading our article on https://blockbee.io/blog/post/how-crypto-is-redefining-ecommerce-transactions. The future of commerce is being built on these new rails, and the businesses that get on board early will be in the best position to succeed.

Got Questions About Crypto Payments? We've Got Answers.

Stepping into the world of cryptocurrency payments naturally brings up a few questions. It’s a new frontier for many businesses, so it's smart to have concerns. Let's walk through some of the most common ones we hear from business owners just like you.

What if the Price of a Crypto Crashes Right After a Customer Pays?

This is easily the biggest worry for most merchants, and it's a completely valid one. The good news is that modern payment solutions have this figured out. The best platforms offer instant fiat conversion.

What does that mean? The moment a customer pays you in crypto, the platform immediately converts it into your preferred stable currency, like US Dollars or Euros.

It's like locking in the price at the exact second of the sale. You're guaranteed to receive the full, expected amount, completely shielding your business from crypto's famous price swings. You get all the upsides of accepting crypto without taking on the volatility risk.

Aren't Crypto Transactions Anonymous and Untraceable?

That’s a common misconception, largely fueled by early crypto narratives. While transactions are pseudonymous—meaning they aren't directly linked to your real-world identity on the public blockchain—they are absolutely not untraceable. In fact, every single transaction is permanently etched onto the blockchain, visible for anyone to review.

Beyond that, any legitimate crypto payment gateway will require your business to complete standard Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. This is the same compliance required for traditional banking, ensuring everything stays transparent, secure, and above board.

How in the World Do I Handle Taxes for Crypto Sales?

While tax regulations for crypto are still evolving globally, you don't have to navigate it alone. Today's crypto payment platforms are designed to make tax season surprisingly straightforward.

Most of them provide incredibly detailed transaction reports that you can export with a click. Many even integrate directly with the accounting software you already use, like QuickBooks or Xero. These tools give you—and your accountant—the clean, organized data needed to file your taxes correctly, treating the revenue just like any other sale.

Ready to offer your customers a secure, fast, and low-cost payment option? BlockBee provides a non-custodial cryptocurrency payment solution with instant settlement and easy integration. Get started with BlockBee today and see how simple digital currency payments can be.