Your Guide to Cryptocurrency Payment Solution Integration

At its core, a cryptocurrency payment solution is simply a service that lets businesses accept digital currencies like Bitcoin and Ethereum. Think of it as a digital version of a credit card terminal, but for crypto. These platforms handle all the messy technical details of blockchain transactions behind the scenes.

This means a smooth checkout for your customer and a straightforward way for you, the merchant, to get paid.

Why Businesses Are Adopting Crypto Payments Now

The chatter around cryptocurrency has moved from nerdy forums to company boardrooms. What was once seen as a fringe investment is quickly becoming a serious tool for commerce. Businesses are catching on that accepting crypto isn't a gimmick—it's a smart play to stay relevant and tap into a huge, tech-savvy global market.

It feels a lot like the early days of e-commerce. The businesses that built websites first didn't just look innovative; they captured a massive advantage by meeting customers where they were headed.

This shift isn't about chasing trends. It's driven by real-world business needs and the powerful tools a good cryptocurrency payment solution provides to solve old-school financial problems.

Tapping Into a New Global Audience

One of the biggest draws is the ability to instantly operate in a borderless marketplace. Cryptocurrencies don't care about national borders or traditional banking hours. They let you take payments from anyone, anywhere, without wrestling with currency conversions or the headaches of international banking rules.

This opens your doors to customers in places you might never have been able to serve before. Plus, the typical crypto user is digitally native and has real spending power. By offering their preferred payment method, you can attract a whole new segment of loyal customers who actively look for businesses that embrace the digital economy.

By removing the geographical and financial barriers of traditional payment systems, businesses can instantly expand their market reach, transforming a local shop into a global contender overnight.

Gaining a Competitive Edge

The numbers tell a compelling story, too. We all know that traditional payment fees, especially for credit cards, nibble away at profits. They typically hover somewhere between 2.5% to 3.5% per transaction. A modern cryptocurrency payment solution cuts those costs dramatically.

For example, a platform like BlockBee can bring transaction fees down to as low as 0.25%. That’s a huge saving that goes directly back to your bottom line.

This isn't a niche movement. The market for these solutions is projected to hit an incredible USD 4,240.80 billion by 2034, signaling that this is becoming a standard part of doing business. You can read the full research on the cryptocurrency payment solutions market to see how major players are making the switch. Ultimately, this is about more than just saving on fees; it's about building a more efficient, secure, and global financial engine for your company.

Understanding How a Crypto Payment Solution Works

At its core, a cryptocurrency payment solution is surprisingly simple. Think of it as a highly efficient, automated cashier for digital money. It creates a unique payment address for a customer, watches the blockchain for the incoming funds, verifies the payment, and then gives you the green light once it’s all confirmed.

The entire process is over in a matter of minutes. This is a world away from the sluggish, multi-day settlement times you see with international bank wires. The whole point is to make accepting a Bitcoin payment as seamless for a business as swiping a credit card.

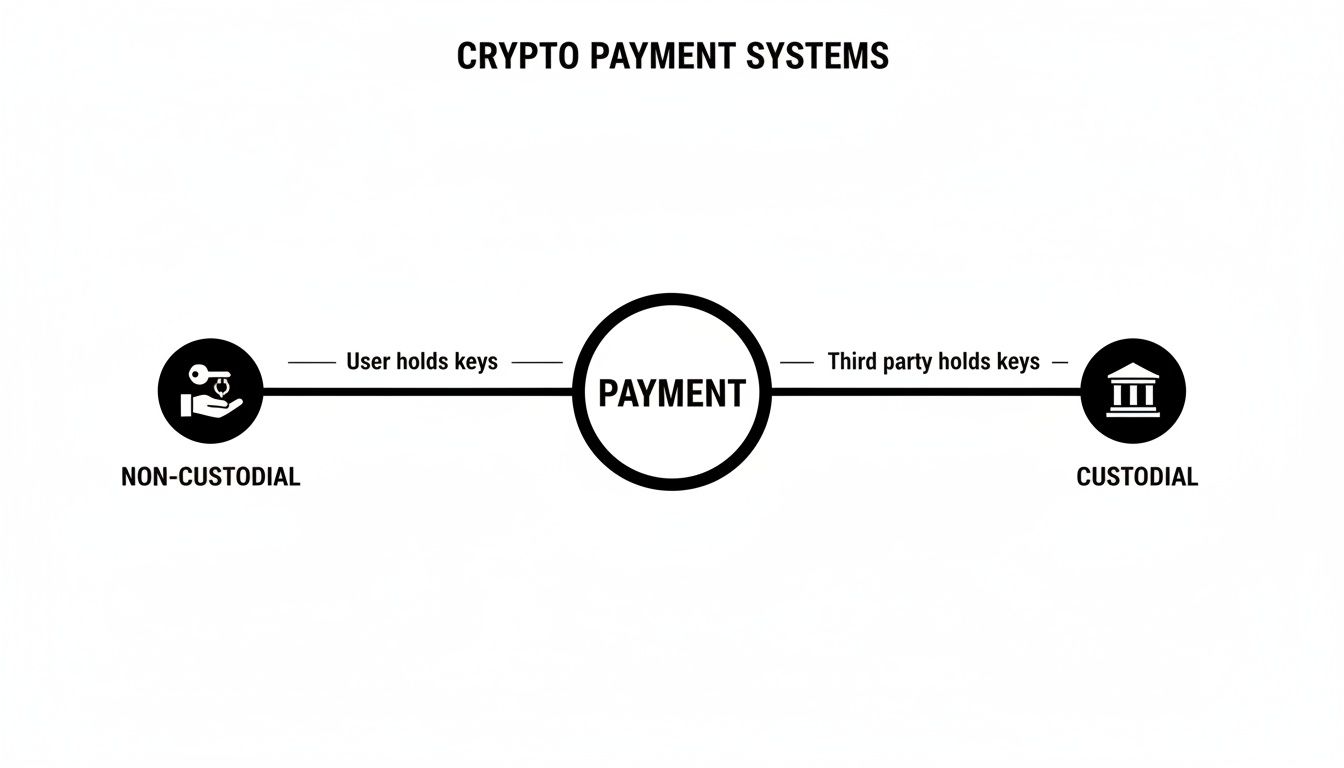

The Most Important Choice: Custodial vs. Non-Custodial

When you start exploring payment processors, you’ll hit a major fork in the road. It’s a decision that boils down to one critical question: who holds your money? This is the difference between a custodial and a non-custodial model, and it's a choice that directly impacts your security and control over your own revenue.

A custodial solution operates a lot like a bank. The service provider holds your private keys and, by extension, your funds. While this might feel familiar, it introduces what’s known as counterparty risk. If that company gets hacked, goes out of business, or runs into regulatory trouble, your funds could be stuck—or worse, gone forever. You're placing your trust entirely in their hands.

On the other hand, a non-custodial solution puts you firmly in control. When a customer pays you, the money goes straight into a digital wallet that only you can access. The payment provider, like BlockBee, acts as a facilitator for the transaction but never actually touches your funds. It’s the difference between giving your cash to someone else for safekeeping and putting it directly into your own vault.

For businesses, the non-custodial model offers superior security and sovereignty over company assets. It eliminates the middleman, ensuring that your revenue is always under your direct control, significantly reducing third-party risk.

This direct control is a cornerstone of why so many businesses are now leaning towards non-custodial platforms. It aligns perfectly with the crypto ethos of self-sovereignty.

To make this crystal clear, let's break down the key differences side-by-side.

Custodial vs. Non-Custodial Cryptocurrency Payment Solutions

| Feature | Custodial Solution (Third-Party Holds Funds) | Non-Custodial Solution (You Hold Funds) |

|---|---|---|

| Control of Funds | The payment provider holds your private keys and funds. | You hold your own private keys and have 100% control of your funds. |

| Security Risk | You are exposed to the provider's security. A breach on their end can result in lost funds. | Security is in your hands. You are not exposed to third-party hacks or insolvencies. |

| Payouts | Payouts are often batched and sent on a schedule (e.g., daily, weekly). | Funds arrive directly in your wallet as soon as the transaction is confirmed on the blockchain. |

| Complexity | Can be simpler for beginners, as the provider manages keys and wallets. | Requires you to manage your own wallet, which involves a slight learning curve. |

| Counterparty Risk | High. Your funds could be frozen or lost if the provider fails. | None. The provider cannot access or freeze your funds. |

| Best For | Businesses that prefer a hands-off, bank-like experience and accept the associated risks. | Businesses prioritizing security, autonomy, and immediate access to their revenue. |

Ultimately, the choice depends on your business's risk tolerance and how much control you want over your own money.

Core Features That Drive Business Value

Beyond the custodial-versus-non-custodial debate, a handful of core features really determine whether a crypto payment solution will be a genuine asset for your business. These are the nuts and bolts that affect your cash flow, customer experience, and bottom line.

Here’s what you should be looking at:

- Supported Coins: Does the gateway accept the currencies your customers actually use? Offering a broad mix, from heavy hitters like Bitcoin (BTC) and Ethereum (ETH) to popular stablecoins, opens your doors to a much wider audience.

- Transaction Fees: The fees can make or break the business case. You need to find a provider with a transparent and low-fee structure. Otherwise, high costs can easily cancel out the savings you were hoping to gain by accepting crypto.

- Payout Speed: How fast can you access your money? This is a huge advantage of non-custodial solutions. Funds land in your wallet almost immediately after the transaction is confirmed, which is a massive boost for your cash flow.

A solution that scores well on all three fronts is more than just a piece of tech—it's a tool that can actively help you grow.

Taming Volatility with Stablecoins

Let’s be honest: one of the biggest hesitations businesses have with crypto is volatility. A payment you receive for $1,000 in the morning could be worth $950 by the afternoon. That’s a risk most companies can’t afford to take. This is exactly where stablecoins come in.

Stablecoins are a special type of cryptocurrency pegged to a stable asset, usually the U.S. dollar. Think of currencies like USDC or USDT as digital dollars that run on the blockchain. When you accept payments in stablecoins, you lock in the value. A $1,000 payment arrives as $1,000 and stays that way.

This lets your business tap into all the powerful advantages of crypto—tiny fees, near-instant global payments, and zero chargebacks—but with the financial stability of traditional money. It’s the perfect bridge connecting the legacy financial system with the new digital economy.

The Real Business Benefits of Accepting Crypto

Let's cut through the noise. What does accepting crypto actually do for your business? This isn't just about looking tech-savvy; it's about solving real-world commerce problems and seeing tangible results on your balance sheet. The benefits, from slashing costs to getting paid faster, are concrete and immediate.

The most obvious win for most businesses is the massive cut in transaction fees. Think about it: traditional credit card processors skim 2.5% to 3.5% off every single sale you make. That’s a constant drain on your profit margins.

A modern crypto payment solution flips that script. A non-custodial provider like BlockBee, for instance, can handle payments for as little as 0.25%. If you're running a high-volume business, the math is simple. That difference adds up to thousands of dollars in savings every year—money you can put back into growing the business instead of handing it over to payment processors.

Say Goodbye to Chargebacks and Fraud

Chargebacks are the bane of every online merchant's existence. A customer can dispute a transaction weeks or even months down the line, and suddenly the burden is on you to prove everything was legitimate. It’s a time-consuming, expensive process, and you often get hit with fees even if you win the dispute.

Cryptocurrency transactions are, by their very design, final. Once a payment is confirmed on the blockchain, it’s settled. It cannot be reversed.

This single feature completely erases the threat of fraudulent chargebacks. For anyone selling digital products or operating in an industry considered "high-risk," this is a game-changer. It gives you a level of payment security and finality that traditional financial rails just can't match, safeguarding your revenue from disputes and bad actors.

By design, blockchain payments are irreversible. This provides businesses with final settlement, protecting them from the significant revenue loss and operational drag caused by fraudulent chargebacks.

This is where the difference between custodial and non-custodial solutions really matters. With a non-custodial gateway, you hold your own keys and control your funds, whereas a custodial service holds them for you.

Choosing a non-custodial path is what unlocks the biggest benefits, like getting your money right away without trusting a third party.

Get Paid Faster and Improve Your Cash Flow

If you do business internationally, you know how painfully slow money moves. Traditional cross-border payments like wire transfers can take 3-5 business days to finally land in your account. That lag creates a major cash flow problem, tying up working capital that you need for inventory and operations.

A crypto payment solution, on the other hand, runs on a global network that never sleeps.

Payments settle in minutes, not days, no matter where your customer is. This isn't just a minor improvement; it fundamentally changes how you manage your money:

- Better Cash Flow: Revenue from a sale is available almost instantly. This dramatically improves your company's liquidity and financial agility.

- Less Admin Headaches: Your finance team can stop chasing down delayed international payments or trying to navigate the maze of correspondent banks.

- A Smoother Customer Experience: Fast, seamless payments make for happy customers, building the kind of trust that brings people back.

In the end, accepting crypto lets you operate like a truly global company, tearing down the old financial walls that used to slow you down.

Integrating Crypto Payments Into Your Business

So, you're ready to start accepting crypto. The next logical question is, "How do I actually get this running on my website?" Getting a crypto payment solution up and running is far more straightforward than most people think. Businesses typically head down one of two paths, depending on their technical setup and resources.

Think of it like building with LEGOs. You can either use an API—a box of individual bricks that lets your developers build a completely custom checkout experience from the ground up—or you can use a pre-built plugin, which is like a ready-made LEGO castle that snaps into your existing platform with just a few clicks.

Choosing Your Integration Path

The right path for you really depends on your business. A tech company with a unique, custom-built platform will almost certainly need the creative freedom of an API to weave crypto payments seamlessly into its architecture. On the other hand, an online store built on a popular platform like WooCommerce or Magento can get started in minutes with a plug-and-play solution.

No matter which you choose, bringing any new payment system on board involves some common payment gateway API integration principles to make sure everything connects smoothly and securely.

The goal is accessibility. Modern crypto payment solutions are designed to accommodate everyone, from a solo entrepreneur running a small online shop to a large enterprise with a dedicated team of software engineers.

This dual approach ensures that no business is left on the sidelines, regardless of its technical skill level or size.

The Power of APIs for Custom Platforms

An API (Application Programming Interface) is essentially a toolkit for your developers. It provides a secure, standardized way for your website or app to talk directly to the payment gateway. It's like a universal translator that lets your system ask for a payment address, check on a transaction's status, and get confirmation, all without needing to know the nitty-gritty details of how a blockchain works.

This method gives you the ultimate in control and customization.

- Custom User Experience: You can design a checkout flow that perfectly matches your brand's look and feel. No clunky, out-of-place payment forms here.

- Deep Integration: APIs let you pipe payment data directly into your other business systems, like your accounting software or CRM, keeping everything in sync.

- Advanced Features: With an API, you can build out more sophisticated payment logic, like setting up recurring subscriptions or automating complex payout schedules.

For businesses that need this level of control, a well-documented and robust API is non-negotiable. If you want to get into the technical weeds, our guide on a crypto payment gateway API explains exactly how these connections are made.

The Simplicity of E-commerce Plugins

For the vast majority of online merchants, plugins are the fastest and easiest way to start accepting crypto. A plugin is a small piece of software that adds new functionality to an existing platform, such as WooCommerce, OpenCart, or PrestaShop.

There's absolutely no coding required. You just install the plugin from your platform's marketplace, paste in your API key from a provider like BlockBee, and tweak a few settings. Within minutes, a new crypto payment option appears on your checkout page. This approach makes integration incredibly accessible, letting you tap into the benefits of crypto payments without a huge budget or a long, drawn-out development cycle.

How Stablecoins Make Crypto Payments Practical

Let's be honest. While the idea of crypto payments is exciting, the thought of its notorious price swings can give any business owner heartburn. Accepting a payment that might drop 5% in value before it even hits your books is a gamble most aren't willing to take.

This is exactly where stablecoins come in. They were created to solve this one, massive problem, acting as a reliable bridge between the wild world of crypto and the predictable stability of traditional money.

Think of a stablecoin as a digital dollar that lives on the blockchain. Its value is pegged to a stable asset, usually the US Dollar. So, when a customer pays you $100 using a token like USDC or USDT, you get $100. Period. That value doesn't change, effectively shielding your transactions from market volatility.

This one feature—stability—is what turns a cryptocurrency payment solution from a niche experiment into a powerful, everyday business tool. You get all the best parts of crypto—lower fees, lightning-fast global payments, and zero chargebacks—without the financial risk.

The Sheer Scale of Stablecoin Transactions

Stablecoins are far from a small corner of the crypto market. They've become a powerhouse in digital finance, handling transaction volumes that are starting to dwarf some of the biggest names in payments. Their growth has been nothing short of explosive.

Projections show stablecoins are on track to process a mind-boggling $46 trillion in transaction volume in 2025, with the total supply rocketing past $229 billion.

Let that sink in. Stablecoin volumes are already more than 20 times larger than PayPal's and are closing in on 3 times the volume of Visa. If you want to dive deeper, you can discover more insights about stablecoin trends and see just how quickly they're catching up to major national payment systems.

This isn't just theory anymore. This massive scale proves that stablecoins are a tested, reliable, and incredibly liquid way to move money around the globe. They are quickly becoming the engine that makes the digital economy run.

It’s no surprise that major financial institutions are now paying close attention and investing heavily. They see the writing on the wall: stablecoins are poised to reshape everything from B2B supply chain payments to payroll for global teams.

Building the Future of Business Payments

The growing confidence in stablecoins is laying the groundwork for a new financial system built on tokenized assets and seamless business-to-business transactions. As this infrastructure matures, using a cryptocurrency payment solution will feel as normal as a bank transfer does today. For any company operating internationally, understanding the role of stablecoins in cross-border payments is becoming essential.

This shift is unlocking powerful new ways for businesses to operate:

- Supply Chain Payments: Settle invoices with international suppliers in minutes, not days. Forget about frustrating delays and expensive currency conversion fees.

- Mass Payouts: Pay hundreds of contractors, affiliates, or gig workers all at once, anywhere in the world, with almost no friction.

- Treasury Management: Keep a portion of your company's treasury in a stable digital asset that can be moved 24/7, without waiting for a bank to open.

By providing a stable and trustworthy medium of exchange, these digital dollars make crypto payments practical, dependable, and wildly efficient. You get the best of both worlds: the stability of traditional finance combined with the speed and efficiency of the blockchain.

Choosing the Right Cryptocurrency Payment Partner

Picking the right partner to handle your crypto transactions is a huge decision. It's not just a software choice; it’s a foundational piece of your financial stack. The right solution should feel like a natural part of your business—secure, smooth, and dependable. Get it wrong, and you could be dealing with frustrating delays, surprise costs, and security risks that completely defeat the purpose of accepting crypto in the first place.

You need a partner whose technology aligns with your goals. The whole point is to give you total control over your revenue while making things easy for your customers.

Your Essential Evaluation Checklist

To cut through the noise and make a smart choice, you need a solid checklist. Here are the non-negotiables that separate a top-tier provider from the rest.

- Security Model (Non-Custodial First): This is, without a doubt, the most important thing to look for. A non-custodial provider means payments go straight into a wallet that you control. You hold the keys, period. This setup completely removes the risk of a third party getting hacked or deciding to freeze your funds, giving you true ownership of your money.

- Variety of Supported Coins: Your customers will want to pay with more than just Bitcoin. Think Ethereum, popular stablecoins like USDC and USDT, and other altcoins. The more currencies a provider supports, the wider the net you can cast to attract a global audience.

- Fee Transparency: Hidden fees are a profit killer. Look for a partner with a straightforward, transparent fee structure. A great crypto payment solution won’t sting you with setup charges, monthly minimums, or confusing pricing tiers.

The crypto payments space is growing up fast, thanks in large part to serious institutional money flowing in. For instance, the launch of Bitcoin ETPs in the US has already sparked global crypto ETPs to accumulate net inflows of $87 billion. This isn't a niche market anymore. With practical uses like stablecoin-based cross-border payments becoming more common, a reliable partner is absolutely critical.

Technical Excellence and Support

Great core features are only half the battle. If a platform is a nightmare to integrate or you can’t get help when something goes wrong, it’s not the right fit.

For more general advice on picking payment providers, resources like payments-experts.com can offer a broader perspective. When you're looking specifically at crypto solutions, focus on these two areas:

- API Quality and E-commerce Plugins: Does your team need a powerful API for a custom integration, or do you just need a simple plugin for your Shopify or WooCommerce store? Either way, the tools need to be well-documented, flexible, and easy to work with. A developer-first approach is usually a great sign.

- Reliable Customer Support: When you’re dealing with money, waiting days for an email response is not an option. You need a partner with responsive, knowledgeable support that can help you solve problems quickly so you can get back to business.

A truly great partner doesn’t just provide technology; they provide peace of mind. They offer the tools, security, and support that empower you to focus on growing your business, confident that your payment infrastructure is in good hands.

If you want to go even deeper on this, check out our guide on finding the best crypto payment gateway.

When you lay these criteria over the current market, certain options stand out. A provider like BlockBee, for example, checks all these boxes. Its non-custodial model, wide range of supported coins, and developer-friendly tools make it a solid choice for any business ready to step into the future of payments.

Frequently Asked Questions

Jumping into the world of crypto payments can feel like a big step, and you probably have a few questions. Let's tackle some of the most common ones we hear from businesses just like yours.

How Do I Handle Cryptocurrency Price Volatility as a Merchant?

This is the big one, right? The key is to sidestep the volatility altogether. The best way to do this is by either accepting stablecoins (like USDC or USDT) or using a payment solution that instantly converts crypto into your local fiat currency.

Many payment gateways will automatically swap a customer's crypto payment into dollars, euros, or whatever you use, right at the moment of the transaction. This locks in the sale price, so you're never exposed to price swings.

If you’re using a non-custodial solution like BlockBee, you can simply choose to accept payments directly in stablecoins. Since their value is pegged to a currency like the U.S. dollar, it's just like getting paid in cash—the volatility risk is completely gone.

Is Integrating a Cryptocurrency Payment Solution Technically Difficult?

It really depends on your setup, but it’s probably easier than you think. If you run an e-commerce store on a popular platform like WooCommerce, Magento, or OpenCart, you can use a ready-made plugin. It's often as simple as installing an app—no coding needed, and you can be up and running in minutes.

For custom-built websites or more complex applications, you'll need to use an API. This does require a developer, but modern payment solutions come with excellent documentation, software development kits (SDKs), and customer support to make the integration as painless as possible.

The beauty is that there's a path for everyone, whether you're a small shop owner or a large enterprise with a dedicated dev team.

What Are the Key Security Differences Between Custodial and Non-Custodial Solutions?

This all comes down to a single, critical question: who holds your money?

With a custodial solution, a third-party company holds your private keys and your crypto. Think of it like a traditional bank. The big risk here is counterparty risk—if that company gets hacked or goes out of business, your funds could be in jeopardy.

A non-custodial solution is different. You hold your own private keys and your own wallet. Customer payments go directly from their wallet to yours, with no middleman holding the funds. This setup puts you in complete control, eliminates counterparty risk, and is fundamentally a more secure way to manage your assets.

How Do Crypto Transaction Fees Compare to Credit Card Fees?

Here’s where it gets really interesting for your bottom line. Credit card fees are notoriously high, typically hovering between 2.5% and 3.5% of every sale, not to mention extra fixed fees.

On the other hand, a cryptocurrency payment solution can slash those costs dramatically, with fees often starting as low as 0.25%. For any business, especially those with high sales volume or large ticket items, the savings add up fast. Plus, crypto payments get rid of chargebacks and their associated fees—a huge, often unpredictable expense for many merchants.

Ready to see what secure, low-cost global payments can do for your business? With BlockBee, you can integrate a non-custodial cryptocurrency payment solution in minutes. Start accepting crypto today and take full control of your revenue.