Unlocking Blockchain Payment Processing

Ever tried sending money overseas? It feels a bit like your payment is on a world tour, stopping at several different banks along the way. Each stop costs you money and adds frustrating delays. Now, what if there was a direct, secure superhighway for your money, with no detours and no toll booths? That’s the simple idea behind blockchain payment processing. It uses a shared, unchangeable digital ledger to move value from point A to point B, efficiently and directly.

A New Highway for Digital Money

Think of today's typical payment systems as that winding country road. When you send money, especially across borders, it rarely goes straight to the recipient. Instead, it gets handed off between multiple intermediary banks and financial institutions. Every one of these handoffs introduces more fees, potential delays, and even points where things can go wrong.

Blockchain completely reimagines this process. It establishes a direct, peer-to-peer route for your transaction. Instead of a central gatekeeper like a bank verifying everything, a decentralized network of computers works together to confirm and record the payment. Each transaction gets bundled into a cryptographically secured "block" of data, which is then permanently linked to a "chain" of all previous transactions.

This shared ledger is both transparent and tamper-proof. Once a transaction is added to the blockchain, it’s there for good—it can't be changed or deleted. This creates an incredibly reliable record of every payment without ever needing a third party to vouch for it.

This isn't just a minor tweak to the old system. It’s a foundational shift that tackles some of the most persistent problems in finance head-on: steep fees, slow settlement times, and a frustrating lack of transparency. It’s more than a new way to pay; it’s a whole new infrastructure for moving value across the globe.

The Old Way vs The New Way

To really get a feel for the difference, it helps to see the two systems compared directly. We’re not talking about small, incremental gains here. The advantages in speed, cost, and security are game-changers for any business managing payments.

Here’s a quick breakdown to highlight just how different these two approaches are.

Traditional Payments vs Blockchain Payment Processing

| Feature | Traditional Payment Systems (e.g., Banks, Credit Cards) | Blockchain Payment Processing |

|---|---|---|

| Transaction Speed | Can take 2-5 business days, especially for international transfers. | Final settlement can happen in minutes, sometimes even seconds. |

| Transaction Cost | High fees from intermediaries, currency conversion, and wire transfers add up. | Drastically lower fees by cutting out most of the middlemen. |

| Security | Relies on centralized systems vulnerable to a single point of failure or attack. | Decentralized and cryptographically secured, making it highly resistant to fraud. |

| Transparency | An opaque process with little to no real-time visibility into a payment's status. | All authorized parties can view the transaction on a shared, immutable ledger. |

This table makes it clear: blockchain isn't just an alternative, it's a significant operational upgrade.

The diagram below gives you a simple visual of how a blockchain is structured. You can see how each individual block of data is linked securely and chronologically to the one before it.

It’s this chain-like structure—where each block contains a unique reference (a "hash") to the previous one—that creates an unbreakable record, guaranteeing the integrity of the entire ledger.

A Market on the Rise

This isn't just a fascinating theory; the numbers prove it's the real deal. The global blockchain market is seeing incredible growth, with projections showing it will skyrocket from $27.84 billion in 2024 to a staggering $825.93 billion by 2032.

Payments are the single biggest force behind this surge, making up 44% of global blockchain revenue back in 2022. You can explore the data behind this massive growth in blockchain payment adoption to see for yourself. This isn't just a trend; it's a clear signal that businesses everywhere are recognizing the profound value of building their financial operations on a faster, cheaper, and far more secure foundation.

How Blockchain Secures Your Transactions

In the familiar world of finance, security hinges on a central gatekeeper, like a bank, that we all agree to trust. Blockchain payment processing completely flips that model on its head. It doesn't ask you to trust a company; it asks you to trust math. Security isn't managed by a single entity but is woven into the very fabric of the network itself.

Think of it like a shared digital ledger that everyone in a group can see and hold a copy of. When someone makes a payment, that transaction is broadcast to everyone. Once enough people have seen and verified it, it’s added as a new, permanent entry. Crucially, these entries are linked together in a chain using complex cryptography. Trying to alter an old entry would break the chain, and everyone on the network would instantly see the tampering.

This shared, unchangeable ledger is the core of what makes blockchain so secure. Every transaction is transparently recorded and validated by the network's participants, creating a single, undisputed history of events.

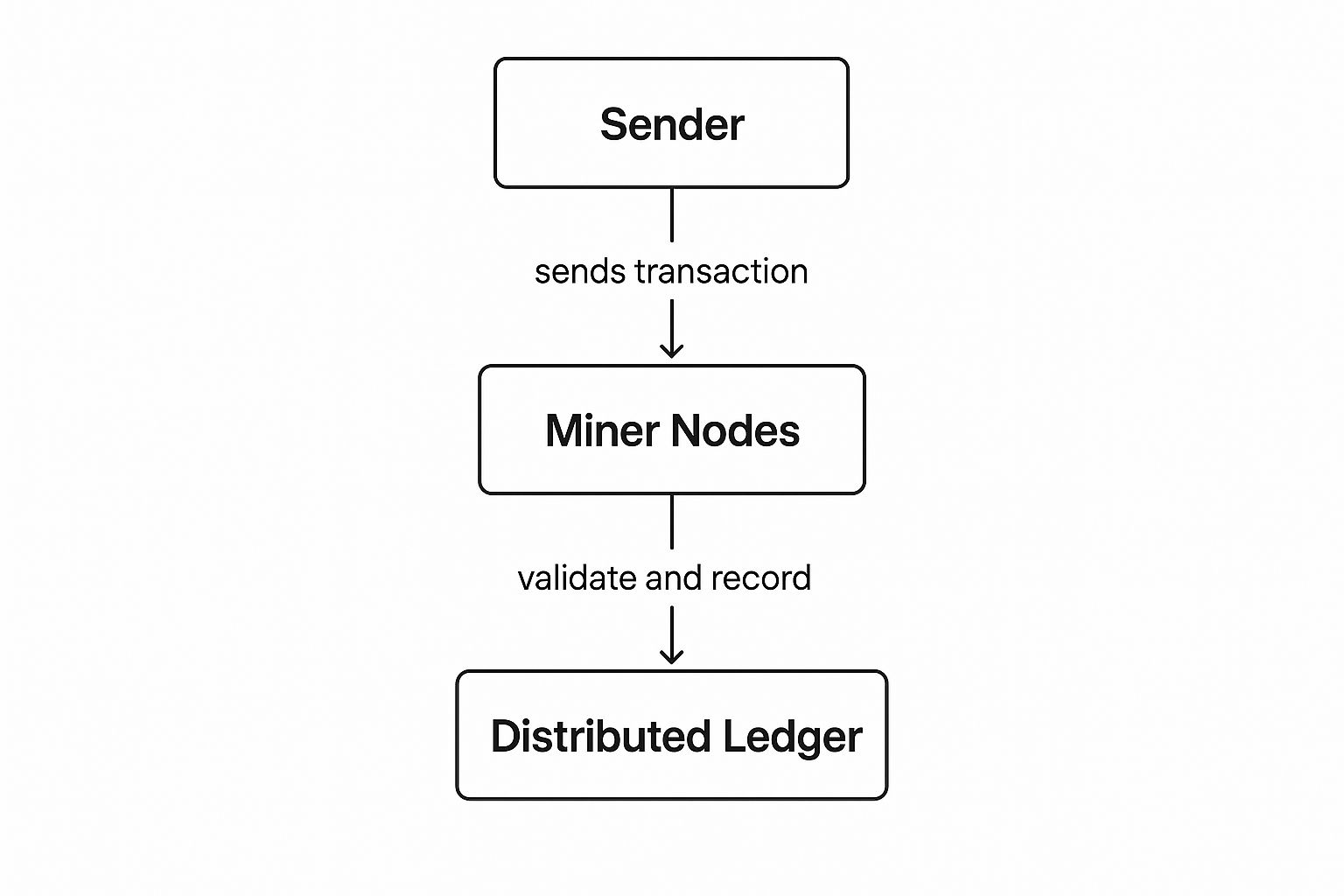

The image below shows how this works in practice, illustrating the journey of a transaction from sender to its final, locked-in place on the ledger.

As you can see, the payment sidesteps the usual middlemen, relying on the collective power of the network for validation and security.

The Role of Cryptography and Keys

So, how does the network know a transaction is legitimate and not a forgery? The magic is in cryptography, the art of secure communication. When you set up a digital wallet to send and receive crypto payments, you're given a unique pair of cryptographic keys.

You get two keys that work together:

- A public key, which acts like your account number. You can share this with anyone who needs to send you money, no problem.

- A private key, which is your secret password. You guard this with your life because it’s what you use to authorize—or digitally "sign"—any payments leaving your wallet.

When you decide to send funds, your private key creates a unique digital signature for that specific transaction. The network can then use your public key to confirm that the signature is authentic and that it could only have come from you. This elegant system makes it practically impossible for anyone to touch your funds without having your private key.

This cryptographic handshake proves ownership with mathematical certainty, removing the need for a bank to act as a verifier.

Building Consensus Across the Network

Before any transaction is officially added to the permanent ledger, the network has to agree that it's valid. This process of reaching an agreement is handled by a consensus mechanism. You can think of it as the entire network holding a vote on each new batch of transactions to ensure everything is above board.

There are two main ways networks achieve this today:

Proof-of-Work (PoW): This is the original model used by Bitcoin. It involves network participants, known as miners, racing to solve incredibly difficult math puzzles. The first one to find the solution gets to add the next "block" of transactions to the chain and earns a reward. The sheer amount of computing power required makes cheating prohibitively expensive.

Proof-of-Stake (PoS): This is a newer, far more energy-efficient method. Here, participants, called validators, lock up or "stake" some of their own cryptocurrency as collateral. The network then randomly chooses a validator to propose the next block. Their staked coins act as a security deposit; if they try to validate a fraudulent transaction, they lose their stake.

Both of these mechanisms are designed to make it incredibly difficult and costly for anyone to manipulate the transaction history. This decentralized validation is precisely what gives blockchain payments their strong resistance to fraud and censorship.

For any business exploring this technology, getting a handle on these security principles is step one. To see how these concepts translate into action, you might want to read the ultimate guide to accepting cryptocurrency payments for your business, which gets into the practical side of getting started.

The Real-World Benefits for Your Business

While the technology is fascinating, the real story is what it can do for your business. Moving to blockchain payment processing isn't about jumping on a trend; it's about solving some very old problems in how money moves. These aren't just minor tweaks—they're direct answers to the frustrations baked into traditional finance.

Think of it this way: every advantage, from iron-clad security to lower costs, gives you a competitive edge. You can run a leaner operation, reach new global customers with less hassle, and provide a genuinely better payment experience for everyone you do business with.

Radically Lower Transaction Costs

One of the first things you'll notice is the dramatic drop in transaction fees. Traditional payment systems, especially for international payments, are a mess of intermediary banks. Each one takes a cut, and those fees pile up fast, chipping away at your profits.

Blockchain cuts out most of those middlemen. It creates a direct line between the sender and the receiver, bypassing the correspondent banks and their fees. If you work with international suppliers, pay remote teams, or sell to a global audience, the savings are massive.

The numbers don't lie. In 2023, the value of blockchain payment transactions reached $15.9 billion, and it's projected to climb past $20 billion in 2024. A huge part of that growth comes from slashing cross-border fees—often by 60% to 70% compared to the old banking system. That’s not just a discount; it’s a game-changer for your bottom line.

Near-Instant Settlement Times

In any business, cash flow is everything. Waiting two to five business days for an international wire transfer to clear can tie up your capital and create real uncertainty.

Blockchain payments shrink that settlement window from days to minutes. Transactions are often confirmed and finalized across the network in less time than it takes to brew a pot of coffee.

This means your money isn't stuck in limbo. You get access to your funds almost immediately, which frees up your capital and allows you to be much more agile with your financial planning.

Imagine a freelance developer in Asia finishing a project for your company in the U.S. They can receive their payment almost instantly, instead of waiting a week for it to crawl through the SWIFT system. That kind of speed builds trust and makes you a far more appealing client or partner.

Unprecedented Security and Transparency

When it comes to payments, security is paramount. Blockchain's decentralized design and cryptographic foundation create an incredibly robust defense against fraud. Each transaction is locked into an immutable ledger, meaning once it's confirmed, no one can alter or reverse it. This design all but eliminates common issues like chargeback fraud.

At the same time, the system offers remarkable transparency. While personal identities are kept private, the flow of transactions is visible on the public ledger. This creates a perfect, auditable trail that everyone involved can see and verify, cutting down on disputes and making bookkeeping a breeze. It's like having a shared accounting book that can't be tampered with.

If you're thinking about how this could work for your own operations, figuring out how to accept crypto payments for your business is the logical next step.

Choosing Your Blockchain Payment Solution

Stepping into the world of blockchain payment processing can feel a lot like walking into a massive car dealership. You know you need a vehicle, but the options are overwhelming—sleek sports cars, rugged off-roaders, and practical family sedans. Each serves a different purpose, and the same is true for blockchain-based assets.

Not all digital assets are created equal, and the one you choose will have a real impact on everything from your accounting to your exposure to financial risk. To build a payment strategy that works, you first need to understand the fundamental differences between your main options.

Let's break down the three primary categories you'll encounter.

The Original Pioneers: Volatile Cryptocurrencies

When most people hear "blockchain payments," their minds jump to the classics: Bitcoin (BTC) or Ethereum (ETH). These are the original digital assets, built on decentralized networks that operate without a central authority dictating their value. Their biggest draw is their global, censorship-resistant nature.

But for a business, their defining trait is volatility. The price of these assets can swing wildly, sometimes in a matter of hours. This is great for traders, but it’s a huge risk for a merchant. A payment worth $1,000 one minute could be worth just $900 by the time you close your books for the day.

Because of this unpredictability, these cryptocurrencies are often best for niche businesses—think companies that cater to crypto enthusiasts or use a payment gateway that instantly converts the crypto to your local currency, sidestepping the price risk altogether.

The Stability Champions: Stablecoins

So what if you want the speed and low cost of blockchain without the constant price anxiety? Enter stablecoins. These digital currencies are specifically engineered to maintain a stable value because they are pegged to a real-world asset, most often the U.S. dollar.

Think of a stablecoin like USDC (USD Coin) or USDT (Tether) as a digital dollar. One USDC is designed to always be worth one U.S. dollar. This simple feature makes them perfect for everyday business transactions.

For businesses, stablecoins offer the best of both worlds: the efficiency of blockchain technology combined with the predictability of traditional currency. You get fast, cheap, global payments without worrying about the value of your funds changing overnight.

This stability has turned them into a workhorse for modern B2B finance, especially for cross-border payments. The numbers speak for themselves. In 2024, the total transaction volume for stablecoins is projected to hit approximately $5.7 trillion. Companies like BVNK, which process around $15 billion annually, report that about 50% of that volume comes from B2B payments. For more on this trend, check out this detailed FXC report on stablecoins.

The Government-Backed Future: Central Bank Digital Currencies

The third, and most forward-looking, category is Central Bank Digital Currencies (CBDCs). A CBDC is a digital version of a country's official currency, issued and backed directly by its central bank. It's essentially a "digital dollar" or "digital euro" that carries the full faith and credit of the government, just like physical cash.

Unlike cryptocurrencies, CBDCs are centralized by design. The goal isn't to replace the financial system but to modernize it, making payments more efficient, secure, and accessible for everyone in a country.

While most CBDCs are still in pilot programs or development stages, they represent where government-backed money is headed. For businesses, they promise a future of risk-free, highly regulated, and deeply integrated digital payments.

To help you visualize the differences, here’s a straightforward comparison.

Comparing Blockchain Payment Solution Types

Deciding between these options requires a clear look at their core traits. The table below outlines the main types of blockchain-based payment methods to help you see which solution might be the right fit for your needs.

| Payment Type | Key Characteristic | Primary Use Case | Volatility |

|---|---|---|---|

| Volatile Cryptos | Decentralized and permissionless, but with fluctuating value. | Niche markets, speculation, or payments with instant conversion. | High |

| Stablecoins | Price stability pegged to a fiat currency like the USD. | B2B payments, cross-border transfers, and everyday commerce. | Very Low |

| CBDCs | Government-issued digital currency, fully regulated. | Future domestic retail and wholesale payments. | None |

Ultimately, your choice boils down to your business model and how much risk you're willing to take on. For most merchants today who are looking for efficiency and predictability, stablecoins offer the most practical and powerful solution for everyday blockchain payment processing.

Integrating Blockchain Payments Into Your Business

So, you’re thinking about accepting crypto payments. That’s a big, strategic move, and while the upsides are compelling, getting there requires a solid plan. This isn't about flipping a switch; it's about thoughtfully meshing new technology with your existing business goals, staying on the right side of regulations, and making sure your customers have a great experience.

The first big question you'll face is whether to build your own payment system from the ground up or partner with an existing payment gateway. This "build vs. buy" choice is a fork in the road that really defines the journey ahead.

The Build vs. Buy Decision

Building your own custom blockchain payment solution gives you complete control. You can shape every single feature to fit your business like a glove, creating a system that’s truly your own. But let’s be realistic—that path is steep. It demands serious technical know-how, a hefty upfront investment, and a dedicated team for ongoing maintenance, security, and updates.

For most businesses, the much more practical route is to partner with a third-party gateway. Companies like BlockBee offer a ready-to-go infrastructure that handles the complex, technical heavy lifting for you. You get a secure, battle-tested platform without the massive cost and headache of starting from scratch.

Think of it this way: you could design and build your own delivery van, or you could lease a reliable one from a company that services it for you. Building it yourself offers ultimate customization, but leasing gets you on the road faster, cheaper, and with experts on call. For a closer look at this, you can learn more about integrating cryptocurrency into your business with BlockBee's approach.

Navigating Compliance and Custody

Once you've decided on your approach, your next focus is compliance. The world of digital assets has rules, and knowing your responsibilities isn't optional.

Two key areas you'll need to address are:

- Know Your Customer (KYC): This is all about verifying your customers' identities to prevent fraud and other illicit activities.

- Anti-Money Laundering (AML): These are the procedures you must have in place to stop your platform from being used to move illegal funds.

A good payment processor will manage most of this for you, but it’s still your job to understand the framework. Another critical piece of the puzzle is digital asset custody—how you’ll securely store your crypto. Will you hold the private keys yourself (self-custody) or use a service to manage them for you? Many prefer non-custodial solutions because they guarantee you always have full control over your funds.

A non-custodial approach means that even your payment provider cannot access your funds. This model significantly reduces counterparty risk and gives you true ownership of your money.

Your Actionable Integration Checklist

To make the transition as smooth as possible, it helps to have a clear roadmap. Here are the steps every business leader should follow when considering blockchain payments.

Define Your Goals: First, figure out why you're doing this. Are you trying to slash cross-border transaction fees? Tap into new global markets? Or maybe just give your customers another way to pay? Clear goals will be your North Star for every other decision.

Choose Your Partner Wisely: If you go the "buy" route, do your homework on potential payment gateways. Look for providers with a strong security track record, transparent pricing, great support, and simple APIs or plugins for your website. It's also smart to see how these new tools fit with what you already use, which might include integrating with traditional payment platforms like PayPal.

Start with a Pilot Program: Don't try to boil the ocean. Launch a small-scale pilot to test the waters first. You could enable crypto payments for just one product or in a specific country. This lets you gather real-world data, get customer feedback, and work out any kinks before a company-wide launch.

Train Your Team: Make sure everyone from finance to customer support is up to speed. They need to understand how the new payment option works, be ready to answer basic questions, and know the process for handling and reconciling crypto transactions.

By following this strategic plan, you can successfully bring blockchain payment processing into your business and unlock a whole new set of efficiencies and growth opportunities.

Frequently Asked Questions

As you start to explore blockchain payments, it's completely normal for questions and a bit of healthy skepticism to pop up. This isn't your standard financial system, after all. Let's cut through the jargon and tackle the real-world questions business owners and finance managers ask most often.

We’ll get straight to the point on the issues that matter when you're thinking about making the switch.

Are Blockchain Payments Actually Legal and Regulated?

This is usually the first—and most critical—question on everyone's mind. The short answer is yes, blockchain payments are legal in most places. But the regulatory landscape is a patchwork that changes from country to country. It’s no longer the "Wild West," as governments worldwide are actively building legal frameworks around digital assets.

Most of these new rules are built on familiar financial principles:

- Anti-Money Laundering (AML) checks to stop illegal financial activities.

- Know Your Customer (KYC) protocols to make sure users are who they say they are.

The good news? A reputable blockchain payment processing partner does the heavy lifting for you. They bake compliance right into their platforms, making sure your transactions tick all the necessary legal boxes. That said, it’s still smart for any business to have a basic grasp of the rules in the specific countries where you operate.

What Happens if a Cryptocurrency Price Drops?

A perfectly valid concern. The price of cryptocurrencies like Bitcoin can be a rollercoaster, and no business wants its revenue to be unpredictable. Getting a payment for $1,000 one minute, only to see it become $950 the next, just isn't a viable way to operate.

This is precisely why most businesses don't hold volatile crypto directly. Instead, they either accept stablecoins or use a payment processor that shields them from price swings. These services instantly convert the crypto payment into your local currency (like USD or EUR) the moment the transaction happens.

What this means for you is simple: you get the exact amount you charged, every single time. You tap into the speed and low cost of blockchain payments—think lower fees and faster settlements—without having to worry about the market's ups and downs. It's like using the new high-speed rail network without having to ride the rollercoaster to get to the station.

Is This Technology Too Technical for My Business?

It’s a common myth that you need a whole team of developers to touch anything with the word "blockchain" in it. The truth is, modern blockchain payment solutions are built for regular businesses, not crypto experts. The user experience is often surprisingly straightforward.

If your team has ever integrated a service like Stripe or PayPal, you already have all the skills you need.

Most providers offer simple ways to get started:

- Simple Plugins: For e-commerce sites on platforms like WooCommerce or Magento, it’s often as easy as installing a plugin.

- Clean APIs: For custom-built websites or apps, clear and well-documented APIs let your developers plug in the payment system with minimal fuss.

All the complicated stuff—the nodes, the ledgers, the cryptography—is handled behind the scenes by the payment provider. Your team gets a clean dashboard, and the money arrives in your wallet or bank account, just like any other payment method. The goal of these platforms is to make blockchain payment processing genuinely accessible.

Ready to unlock faster, cheaper, and more secure global payments? BlockBee offers a secure, non-custodial platform that makes it easy to accept over 70 cryptocurrencies. With low fees, instant payouts, and simple integration, we handle the complexity so you can focus on growing your business. Discover how BlockBee can transform your payment operations today.