12 Best Treasury Management Software Solutions for 2025

In today's complex financial landscape, manual treasury processes are no longer sustainable for growing businesses. Relying on spreadsheets, multiple bank portals, and fragmented data introduces significant risks, breeds inefficiency, and leads to missed strategic opportunities. The right Treasury Management System (TMS) is essential for transforming this operational chaos into financial clarity.

A robust TMS centralizes global cash visibility, automates complex payment workflows, strengthens risk management protocols, and delivers accurate, data-driven forecasting. However, navigating the crowded marketplace to find the best treasury management software for your specific needs, whether you're a global enterprise, a SaaS business, or a FinTech startup, can be challenging.

This comprehensive guide is designed to cut through the noise. We provide a detailed breakdown of the top solutions available, analyzing their core functionalities from bank connectivity and in-house banking to debt and investment management. Each review includes key features, ideal use cases, screenshots, and direct links to help your finance team identify the platform that will elevate them from reactive administrators to strategic business partners. We'll help you find the system that best aligns with your company's scale, industry, and financial objectives.

1. Kyriba: The Enterprise Powerhouse for Unified Treasury

Kyriba is an enterprise-grade SaaS platform offering a unified solution for treasury, risk, and payments. It's a top contender for the best treasury management software for large, multinational corporations that require a single source of truth for all financial activities. The platform’s core strength is its immense connectivity, linking to over 9,900 banks worldwide, which provides unparalleled real-time visibility into global cash positions and liquidity.

This extensive network makes Kyriba ideal for organizations managing complex hedging strategies and intricate payment workflows across numerous entities and currencies. Its AI-powered forecasting helps teams proactively identify potential liquidity shortfalls and financial anomalies before they escalate.

Core Features & Limitations

Key Strengths:

- Deep Functionality: Provides a comprehensive suite covering payments, risk management, and hedge accounting, eliminating data silos.

- Extensive Connectivity: A vast library of open APIs ensures seamless integration with banks and ERP systems.

- Global Scalability: Built to support the complex needs of large, global enterprises with a strong customer base.

Potential Downsides:

- Complex Implementation: Rolling out Kyriba is a significant project that requires dedicated internal resources and careful planning.

- Premium Pricing: The cost reflects its enterprise focus and is on the higher end, making it less suitable for smaller businesses.

Pricing is quote-based, so you'll need to contact their sales team for a custom proposal.

Website: https://www.kyriba.com/solutions/treasury/

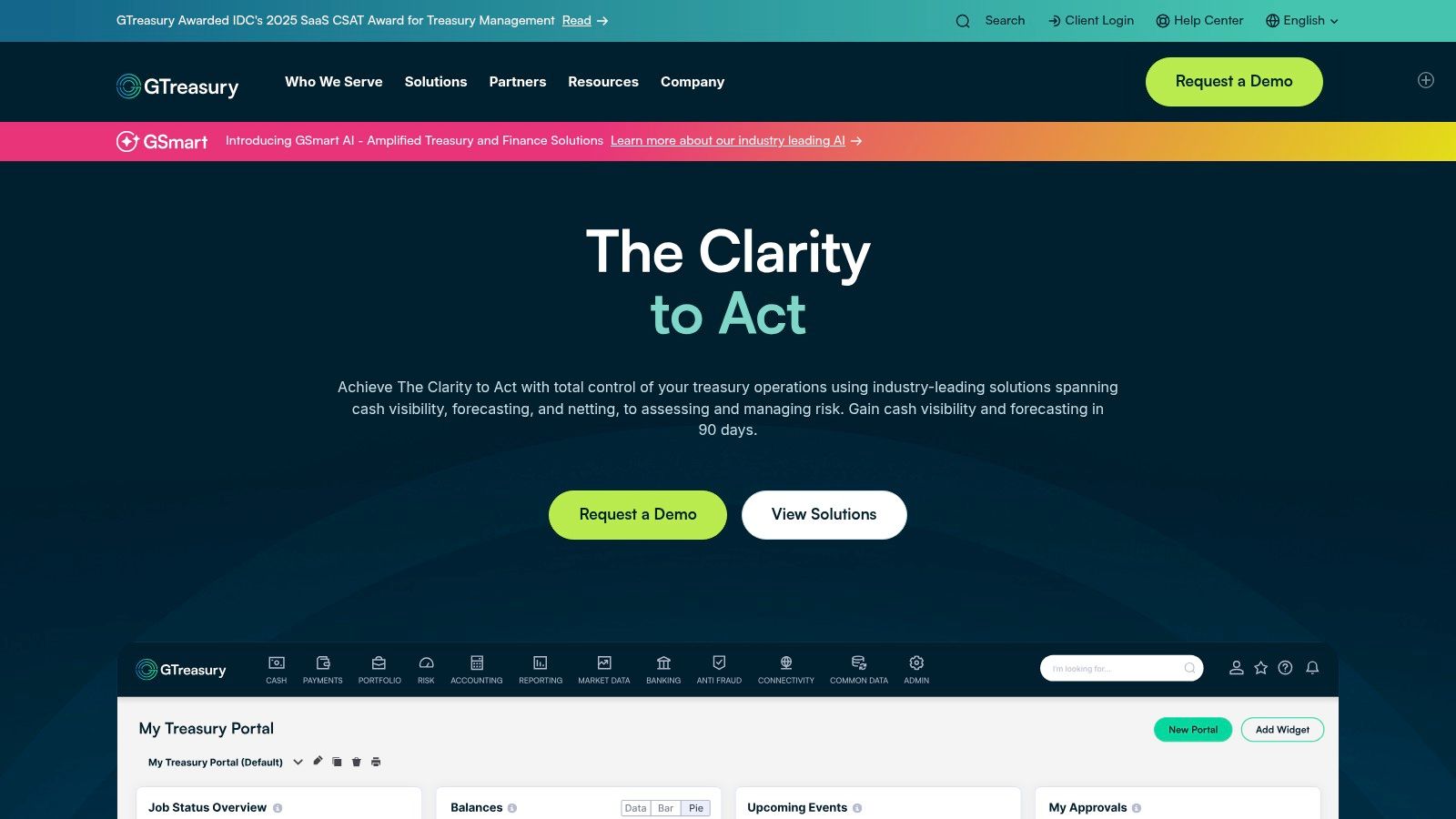

2. GTreasury: The Modular Solution for Targeted Treasury Needs

GTreasury is a modular SaaS platform that stands out for its flexibility, allowing organizations to select and implement only the treasury functions they need. This makes it an excellent choice for businesses seeking a tailored solution without the complexity of a full-scale enterprise system. It is a strong candidate for the best treasury management software for mid-market and growing companies that want to start with core functions like cash visibility and forecasting and add more capabilities over time.

The platform’s emphasis on accelerated implementation and strong customer support helps organizations achieve a faster time-to-value. GTreasury’s ClearConnect hub provides robust connectivity for banks, ERPs, and other financial systems, ensuring that even a modular deployment provides a centralized and accurate view of treasury operations.

Core Features & Limitations

Key Strengths:

- Flexible Modular Packaging: Buy only what you need, with options to add modules for risk, payments, netting, and debt management as your company grows.

- Focus on Time-to-Value: Implementation accelerators and dedicated success resources help ensure a quick and effective rollout.

- Strong Connectivity: The ClearConnect feature ensures seamless integration with your existing financial ecosystem.

Potential Downsides:

- Phased Rollout for Advanced Features: Implementing the full suite of advanced modules may require a more strategic, phased approach.

- Quote-Based Pricing: You must contact their sales team for a custom quote, as pricing is not publicly available.

Pricing is tailored to the specific modules you select, requiring a direct inquiry for a proposal.

Website: https://www.gtreasury.com/

3. FIS Treasury and Risk Manager – Integrity Edition

FIS Treasury and Risk Manager is a comprehensive, cloud-native suite from a long-standing financial technology leader. Its Integrity Edition is recognized as one of the best treasury management software options for organizations seeking a proven, enterprise-grade solution that covers the full spectrum of treasury operations, from cash management and forecasting to complex hedge accounting.

A standout feature is the embedded AI assistant, 'Treasury GPT,' which provides in-app guidance and support to help users navigate its extensive capabilities more efficiently. This makes the robust platform more accessible, reducing the learning curve often associated with feature-rich treasury systems and empowering teams to resolve queries instantly.

Core Features & Limitations

Key Strengths:

- Comprehensive Functionality: Provides an all-in-one platform covering cash, payments, FX, debt, and risk management.

- AI-Powered Support: The 'Treasury GPT' assistant accelerates user adoption and troubleshooting directly within the application.

- Proven Vendor: Backed by FIS, a global leader with deep industry expertise and a large partner ecosystem.

Potential Downsides:

- Potential Complexity: The sheer breadth of features may be overwhelming for smaller or less mature treasury departments.

- Opaque Pricing: Costs are not publicly listed and require direct engagement with the sales team for a custom quote.

Pricing is available upon request, tailored to your organization’s specific needs.

Website: https://www.fisglobal.com/products/fis-treasury-and-risk-manager-integrity-edition/

4. Coupa Treasury & Cash Management

Coupa Treasury is a powerful solution embedded within its broader Business Spend Management (BSM) platform. This makes it a standout contender for the best treasury management software for companies that want to unify treasury functions with procurement, invoicing, and payments. Its key advantage is the seamless flow of data from spend and accounts payable, offering treasurers exceptional visibility and control over enterprise-wide liquidity.

By integrating cash management directly with spend operations, Coupa helps organizations optimize working capital and mitigate payment fraud risks. The platform provides tools for cash visibility across all subsidiaries, in-house banking, intercompany netting, and risk management, all augmented by embedded AI for smarter decision-making.

Core Features & Limitations

Key Strengths:

- Unified Spend & Treasury: Provides a single platform for procurement, AP, and treasury, delivering unparalleled visibility into cash outflows.

- Strong Fraud Controls: Leverages data from the entire BSM ecosystem to identify and prevent fraudulent payments.

- Integrated AI: AI-powered insights help optimize liquidity, forecast cash flow, and manage risk more effectively.

Potential Downsides:

- Best for Existing Coupa Users: The greatest ROI is achieved when leveraging the full Coupa suite; it may be less ideal as a standalone solution.

- Opaque Pricing: Cost details are not publicly available and require direct engagement with their sales team.

Pricing is available upon request, tailored to your organization's specific needs.

Website: https://www.coupa.com/products/treasury-management

5. ION Treasury (Wallstreet Suite / IT2 / Reval / Openlink)

ION Treasury represents a family of specialized products, including Wallstreet Suite, IT2, Reval, and Openlink, designed to meet diverse and complex treasury needs. This makes it a contender for the best treasury management software for organizations with highly specific requirements, from large enterprises needing extensive asset-class coverage to commodity-intensive firms requiring sophisticated risk analytics. Each product in the suite targets a different market segment, offering tailored functionality for treasury, risk, and payments.

The platform's key differentiator is its modular approach, allowing corporations to choose a solution that precisely fits their operational complexity and scale. For instance, Wallstreet Suite excels in high-volume payments and complex financial instrument management, while Reval is a leader in hedge accounting and derivative valuation. This specialized focus ensures deep functional capabilities for intricate treasury environments.

Core Features & Limitations

Key Strengths:

- Multiple Tailored Products: Offers specialized solutions (e.g., Wallstreet Suite, Reval) for varying complexity levels and industries.

- Extensive Asset Coverage: Provides deep functionality for a wide range of financial instruments and sophisticated risk analytics.

- Industry Recognition: Commands a large, established customer base among global corporations and financial institutions.

Potential Downsides:

- Complex Product Selection: Navigating the different product offerings to find the right fit can be a challenging and lengthy process.

- Lengthy Sales Cycles: Implementation is often a major undertaking, requiring significant investment and planning.

Pricing is entirely quote-based, and engaging with their sales team is necessary to determine the best solution and associated costs.

Website: https://iongroup.com/products/treasury/wallstreet-suite/

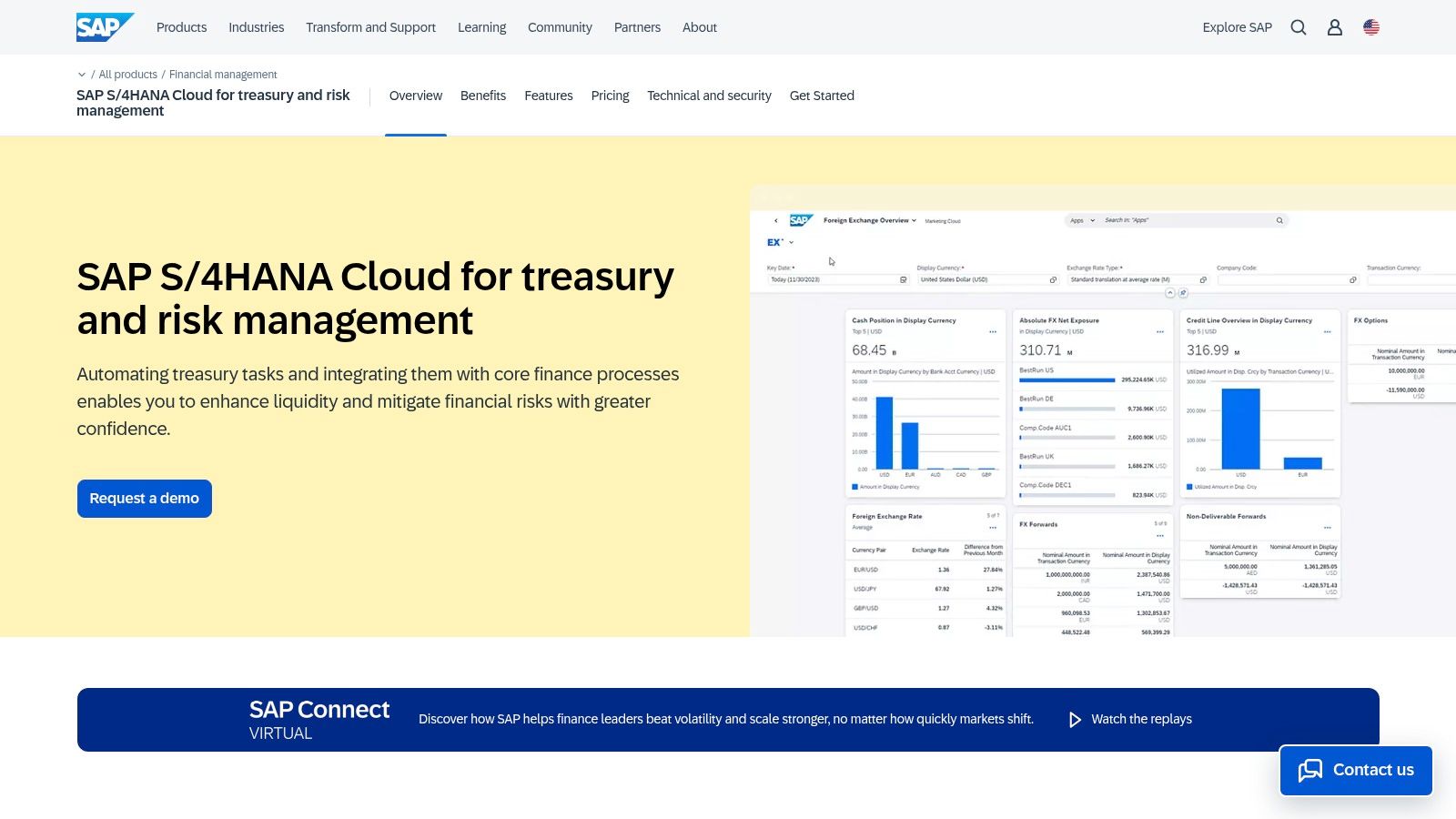

6. SAP S/4HANA Cloud for Treasury and Risk Management

For organizations already embedded in the SAP ecosystem, SAP S/4HANA Cloud for Treasury and Risk Management offers an unparalleled level of integration. This solution isn't a standalone system but a module built directly into the S/4HANA core, making it a strong contender for the best treasury management software for companies seeking end-to-end process control within a single ERP. Its key advantage is the seamless flow of data between treasury and other financial functions like accounting and controlling, eliminating the need for complex reconciliations.

This native integration allows for automated FX exposure capture directly from logistics and sales processes, feeding into its sophisticated hedge management and accounting tools. The inclusion of SAP Multi-Bank Connectivity streamlines bank communication, creating a truly unified environment for managing cash, liquidity, debt, investments, and financial risk from one platform.

Core Features & Limitations

Key Strengths:

- Deep SAP Integration: Provides a single source of truth by embedding treasury operations directly within the core S/4HANA finance system.

- End-to-End Process Control: Automates the entire treasury lifecycle, from exposure identification to hedge accounting and reporting (IFRS/US GAAP).

- Unified Connectivity: Integrates with trading platforms, market data sources, and banks via SAP Multi-Bank Connectivity for streamlined operations.

Potential Downsides:

- SAP-Centric: Delivers maximum value only for organizations committed to the SAP S/4HANA environment.

- Complex Implementation: Licensing and implementation can be complex and resource-intensive, often requiring specialized consultants.

Pricing is quote-based and integrated into the broader SAP S/4HANA licensing structure.

Website: https://www.sap.com/products/financial-management/treasury-risk-management.html

7. Oracle Treasury Management

For organizations already embedded in the Oracle ecosystem, Oracle Treasury Management offers a deeply integrated solution. It's a strong contender for the best treasury management software for enterprises seeking to centralize treasury functions within their existing Oracle financial framework, supporting both cloud and on-premises deployments. The platform’s key advantage is its seamless unification with other Oracle applications, creating a cohesive environment for managing multi-entity and multi-currency operations.

This native integration allows for highly configurable workflows and dashboards, providing finance teams with robust control over processes like cash positioning, debt and investment management, and financial risk. Its ability to leverage a shared data model across the enterprise simplifies reporting and enhances visibility without the need for complex third-party integrations.

Core Features & Limitations

Key Strengths:

- Flexible Deployment: Offers the choice between cloud or on-premises solutions to fit specific IT strategies.

- Enterprise Scalability: Built to handle the volume and complexity of large, global organizations.

- Strong Workflow Controls: Provides powerful, configurable tools for managing exceptions and enforcing internal policies.

Potential Downsides:

- Oracle-Centric: Delivers maximum value within the Oracle stack; may be less ideal for non-Oracle environments.

- Implementation Expertise: Optimizing the platform often requires specialized knowledge of Oracle systems.

Pricing is not publicly available and requires direct contact with the Oracle sales team for a customized quote.

Website: https://www.oracle.com/industries/financial-services/banking/treasury-management/

8. TIS (Treasury Intelligence Solutions): The Connectivity and Payments Specialist

TIS (Treasury Intelligence Solutions) is a cloud-based platform that excels in providing streamlined bank connectivity, payments, and cash visibility. It stands out as one of the best treasury management software choices for organizations operating in complex, multi-bank environments that need to consolidate account information and manage transactions efficiently. Its core value is simplifying global payment flows and providing a single, reliable source for cash management.

The platform integrates powerful business intelligence (BI) tools, offering robust reporting and executive dashboards right out of the box. This makes it particularly useful for companies that require detailed, FBAR-supporting reports and real-time insights into global liquidity without the need for extensive customization or separate analytics software.

Core Features & Limitations

Key Strengths:

- Strong Connectivity: Delivers proven, reliable connections to a vast network of banks, simplifying data aggregation.

- Robust Reporting: Embedded BI provides powerful dashboards and analytics for clear cash visibility and management.

- Payment Hub Focus: Excels at centralizing and standardizing outbound payments across the entire organization.

Potential Downsides:

- Narrower Treasury Scope: More focused on payments and cash visibility rather than the full suite of treasury functions like risk or debt management.

- Opaque Pricing: Cost is not publicly available, requiring direct engagement with their sales team for a custom quote.

Pricing is quote-based, so you'll need to contact the TIS sales team for details.

Website: https://tispayments.com/

9. Nomentia: Modular Treasury for Modernization

Nomentia is a highly flexible, cloud-native platform offering a modular approach to treasury, cash, and risk management. This solution is a strong contender for the best treasury management software for organizations seeking a gradual, step-by-step path to modernizing their treasury functions. Rather than forcing a complete system overhaul, Nomentia allows companies to implement specific modules like payments, cash visibility, or risk management as needed.

This mix-and-match capability is ideal for multinational corporations looking to build a centralized payments hub or improve global liquidity planning without replacing their entire tech stack at once. The platform is known for its robust integrations with banks, ERP systems, and various financial data providers, ensuring seamless connectivity and data flow.

Core Features & Limitations

Key Strengths:

- Flexible Adoption Path: The modular design allows for a phased implementation, reducing initial complexity and cost.

- Strong Support & Consulting: Nomentia is well-regarded for its hands-on support and expert consulting services.

- Built for Global Enterprises: The platform is widely used by large, global companies for complex payment and cash management needs.

Potential Downsides:

- European Roots: While a global provider, its origins are in Europe; US customers should confirm local bank API support and service-level agreements.

- Quote-Based Pricing: You must contact their sales team for a custom quote, as pricing is not publicly available.

Nomentia is an excellent choice for businesses that value flexibility and a partnership approach to treasury transformation.

Website: https://www.nomentia.com/

10. HighRadius: The AI Specialist for Cash Forecasting

HighRadius is an AI-driven platform that excels in providing highly accurate cash forecasting and visibility. It stands out as one of the best treasury management software choices for companies prioritizing precision in their liquidity planning. The platform leverages machine learning to analyze historical data and predict future cash flows with over 95% accuracy, giving finance teams a powerful tool for strategic decision-making and risk mitigation.

Its core value lies in its specialized AI, which can be integrated with HighRadius’s broader AR/AP solutions for even greater operational synergy. To understand the broader technological landscape impacting such solutions, it's helpful to explore how AI agents are accelerating software development. HighRadius is ideal for organizations looking to move beyond simple spreadsheet-based forecasting to a more dynamic, data-driven model.

Core Features & Limitations

Key Strengths:

- Strong AI/ML Technology: Proven AI capabilities deliver highly accurate, multi-horizon cash forecasts, reducing manual effort and improving reliability.

- Fast Time-to-Value: The solution is designed for rapid implementation, especially for cash forecasting use cases, allowing for quick wins.

- Real-time Visibility: Centralized dashboards provide a clear, real-time view of global cash positions across all bank accounts.

Potential Downsides:

- Niche Focus: Lacks some broader treasury functionalities found in enterprise suites, such as in-depth hedge accounting or debt management.

- Quote-Based Pricing: You must contact their sales team for a custom quote, as pricing is not publicly available.

This makes HighRadius a strong contender for businesses that need to solve cash forecasting challenges first and foremost.

Website: https://www.highradius.com/product/treasury-management-software/

11. Serrala: The SAP-Integrated Automation Expert

Serrala offers a suite of treasury solutions designed for organizations seeking deep automation and seamless integration, particularly those running on SAP. It stands out as a top choice for the best treasury management software for companies that want to centralize cash, liquidity, and risk management directly within their existing ERP landscape. The platform’s key differentiator is its SAP-embedded FS² Treasury option, which provides a single, unified environment for all treasury operations.

This tight integration enables real-time data exchange and streamlines processes like financial instrument management and intercompany netting, eliminating the need for separate interfaces or middleware. Serrala's focus on automation extends to bank connectivity, compliance controls, and reconciliation, helping finance teams reduce manual work and enhance operational efficiency.

Core Features & Limitations

Key Strengths:

- Deep SAP Integration: The FS² Treasury module is directly embedded in SAP, offering an unparalleled native experience for SAP-centric organizations.

- Strong Automation Focus: Excels at automating routine tasks, including payment processing, reconciliation, and compliance reporting.

- Centralized Management: Provides a single platform for managing cash, liquidity, payments, and risk across the enterprise.

Potential Downsides:

- Best Suited for SAP Environments: Non-SAP users may not leverage the full value proposition of its core integrated solutions.

- Complex Pricing: Costs are not publicly available and often involve implementation partner fees, requiring a custom quote.

Pricing is quote-based, so you will need to contact their sales team for a detailed proposal.

Website: https://www.serrala.com/treasury-management

12. G2 Treasury Management Systems Category: The Peer Review Hub

While not a software provider itself, G2’s Treasury Management Systems category is an indispensable resource for any team evaluating their options. It serves as an independent review and comparison platform, offering up-to-date listings and peer-driven user reviews for leading vendors. This makes it a crucial first stop for vendor shortlisting and validating marketing claims against real-world user satisfaction.

The platform’s strength lies in its aggregated data, which allows you to filter solutions by company size, industry, and feature set. This practical approach helps teams move from a long list of potential systems to a focused shortlist for demos, making it an essential tool for finding the best treasury management software for your specific needs.

Core Features & Limitations

Key Strengths:

- Independent User Feedback: Provides authentic user reviews and balanced pros/cons summaries to support better vendor validation.

- Comparison Grids: Allows for direct, side-by-side comparisons of features, ratings, and user sentiment.

- RFP & Shortlisting Resource: An effective tool for building a data-backed business case and aligning stakeholders.

Potential Downsides:

- Variable Review Quality: The depth and relevance of reviews can vary, so it should be used in conjunction with live demos.

- Gated Content: Some in-depth reports and buyer guides require contact information, functioning as a lead-generation tool for vendors.

Access to the platform's core review features is free.

Website: https://www.g2.com/categories/treasury-management-systems/enterprise

Top 12 Treasury Management Software Comparison

| Platform | Core Features / Functionality | User Experience & Quality ★★★★☆ | Value & Pricing 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| Kyriba | Cash visibility, forecasting, payments, risk, hedge accounting | Enterprise-grade, AI forecasting, strong resources 🏆 | Quote-based, enterprise pricing 💰 | Large enterprises, treasury teams 👥 | Unified treasury, risk, payments platform ✨ |

| GTreasury | Modular cash visibility, forecasting, netting, risk management | Flexible modular, strong support ★★★★☆ | Quote-based, modular pricing 💰 | Mid-large firms wanting modularity 👥 | Modular buy-only-needed feature packs ✨ |

| FIS Treasury and Risk Manager | Comprehensive TMS with AI assistant ("Treasury GPT") | Cloud-native, secure, AI-guided support ★★★★☆ | Private pricing 💰 | Enterprises needing global scale 👥 | Embedded AI assistant for user guidance ✨ |

| Coupa Treasury & Cash Management | Cash visibility, netting, in-house banking, mobile approvals | Integrated with Coupa spend, mobile-friendly ★★★★ | Pricing private 💰 | Coupa platform users, mid-large firms 👥 | Strong Coupa ecosystem integration ✨ |

| ION Treasury (Wallstreet Suite etc) | Multi-product, extensive risk analytics & payment hub | Highly functional for complex treasuries ★★★★☆ | Quote-based, longer cycles 💰 | Large/commodity-intensive enterprises 👥 | Deep, complex treasury & risk analytics ✨ |

| SAP S/4HANA Cloud Treasury | Embedded treasury/risk, automated hedging, SAP connectivity | SAP-native, end-to-end control, complex ★★★☆☆ | Quote-based, complex licensing 💰 | SAP-centric corporations 👥 | Native SAP integration and multi-bank support ✨ |

| Oracle Treasury Management | Flexible cloud/on-prem, configurable workflows | Oracle ecosystem aligned ★★★☆☆ | Private pricing 💰 | Oracle users, enterprise scale 👥 | Hybrid deployment and Oracle integration ✨ |

| TIS (Treasury Intelligence Solutions) | Bank connectivity, payments, BI reporting dashboards | Strong reporting, focused on cash mgmt ★★★★☆ | Not public 💰 | Multi-bank environments 👥 | Embedded BI & payments hub focus ✨ |

| Nomentia | Modular treasury, cash, risk, strong bank/ERP integration | Flexible adoption path, strong consulting ★★★★ | Quote-based 💰 | Multinational corporations 👥 | Mix-and-match modules for treasury modernization ✨ |

| HighRadius | AI-driven cash forecasting, real-time dashboards, automation | AI accuracy >95%, fast ROI ★★★★☆ | Quote-based 💰 | Firms focused on cash forecasting 👥 | Best-in-class AI cash forecasting ✨ |

| Serrala | Treasury & cash automation, SAP integration | Strong SAP focus, automation rich ★★★☆☆ | Not public, partner costs 💰 | SAP-heavy environments 👥 | High automation & SAP embedded option ✨ |

| G2 Treasury Management Systems | User reviews, vendor comparisons, buyer guides | User-rated insights, balanced pros/cons ★★★☆☆ | Free platform | Buyers, evaluators, procurement teams 👥 | Independent peer reviews & comparisons ✨ |

Making Your Final Decision: From Shortlist to Solution

Selecting the best treasury management software is far more than a simple procurement exercise; it's a strategic investment in your organization's financial future. The journey from evaluating options like the enterprise-grade powerhouses Kyriba and SAP to considering the focused, API-driven connectivity of TIS can feel complex. However, this process empowers your team to move beyond reactive cash management and become a proactive, data-driven partner to the business.

We have explored a wide array of solutions, from the comprehensive suites offered by Oracle and FIS to the specialized cash forecasting capabilities of HighRadius and Nomentia. The key takeaway is that there is no single "best" platform for everyone. The ideal choice hinges entirely on your unique operational landscape, strategic goals, and technical infrastructure. A global enterprise managing complex multi-currency hedging will have vastly different needs than a fast-growing e-commerce merchant focused on optimizing working capital and bank connectivity.

Your Actionable Path Forward

With your initial research complete, it's time to transition from analysis to action. Use this guide to create a shortlist of two to three vendors that align most closely with your core requirements.

- Request Personalized Demonstrations: Do not settle for a generic sales pitch. Insist on a customized demo that walks through your most critical daily, weekly, and monthly workflows. Provide the vendor with specific use-case scenarios, such as "Show us how we would consolidate cash positions from our five global banking partners" or "Demonstrate your system's process for executing a foreign exchange hedge."

- Engage with Reference Customers: Ask potential vendors to connect you with current clients who share a similar industry, company size, or specific challenge. This is your opportunity to ask candid questions about the implementation process, post-launch support, and any unexpected hurdles they encountered.

- Conduct a Rigorous ROI Analysis: Move beyond the sticker price. Calculate the total cost of ownership, including implementation fees, training, and ongoing maintenance. Weigh this against the quantifiable benefits, such as reduced borrowing costs, improved returns on excess cash, and time saved through automation.

Implementation and Future-Proofing

Remember that implementation is as critical as the software itself. A smooth rollout requires a dedicated internal project manager, clear communication across departments (especially IT and accounting), and a strong partnership with your chosen vendor's professional services team.

Finally, consider the evolving financial landscape. The rise of digital assets and alternative payment methods is no longer a distant concept. As you make your decision, evaluate a platform's roadmap and its ability to integrate with emerging technologies. Forward-thinking treasury departments are preparing for a future where managing both fiat and digital currencies is standard practice. Choosing a solution with a flexible, API-first architecture will ensure your investment remains valuable and relevant, allowing you to adapt to new payment rails and asset classes as they gain prominence. By taking these deliberate steps, you can confidently select the best treasury management software that not only solves today's challenges but also scales as a strategic asset for years to come.

As your business prepares for the future of finance, consider how you'll manage the growing demand for digital currency transactions. BlockBee provides a secure and streamlined crypto payment gateway, allowing you to easily accept, manage, and process payments in Bitcoin, Ethereum, and other major cryptocurrencies. Integrate with BlockBee to ensure your payment infrastructure is as forward-thinking as your treasury strategy.